Microbial fermentation includes microorganisms like fungi generating secondary metabolites. As under favorable conditions, these microbes can convert affordable carbon & nitrogen sources into critical intermediates or APIs. These products are vital in different sectors, like biotechnology & the medical industry, and are produced with the assistance of microorganisms, mainly bacteria &fungi.

The microbial fermentation technology market demonstrated resilience during the COVID-19 pandemic, experiencing relatively minimal disruptions. The heightened demand for biologics, particularly vaccines, brought microbial

biotechnology into greater focus. Companies involved in COVID-19 vaccine production utilized microbial expression systems extensively. For example, the Pfizer-BioNTech vaccine leveraged bacterial fermentation to produce DNA plasmids critical for vaccine manufacturing.

Additionally, the rising demand for microbial contract manufacturing services is expected to drive market expansion. Over 115 companies currently offer microbial fermentation services, creating a highly fragmented market. Prominent players like AbbVie Contract Manufacturing and Lonza lead the sector, fostering innovation and competition, thereby fueling future growth.

Microbial Fermentation Technology Market Key Takeaways

- By Product, Alcoholic Beverages lead in 2023 & is anticipated to dominate throughout the forecasted period.

- In addition, the Antibiotics application is expected to have significant growth over the forecasted period.

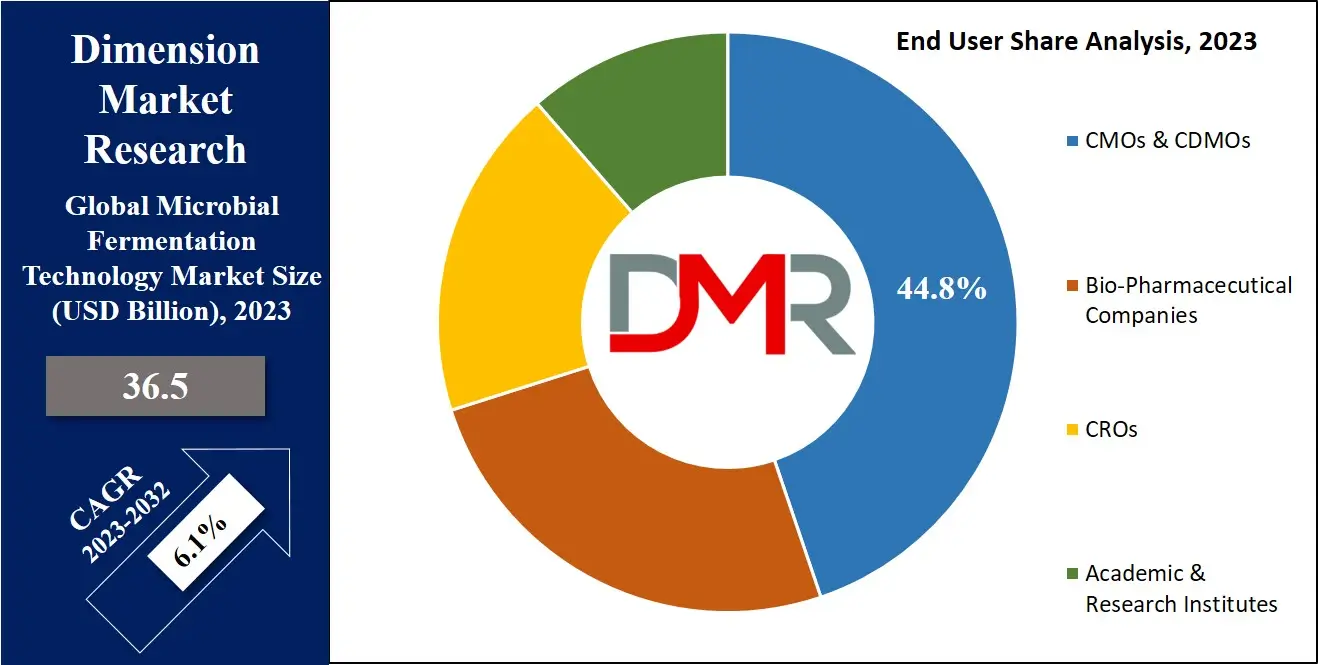

- By End User, CMOs & CDMOs takes the lead & drive the market in 2023

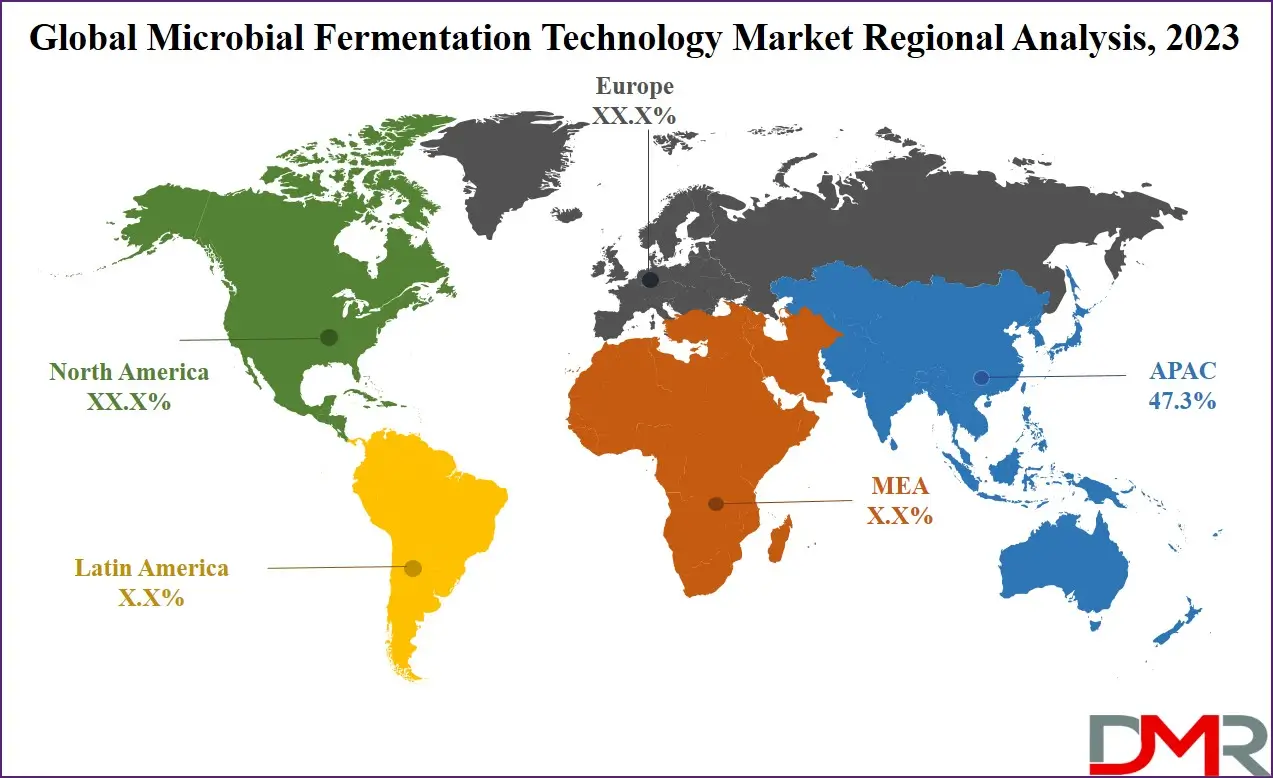

- Asia Pacific has a 47.3% share of revenue in the Global Microbial Fermentation Technology Market in 2023

Microbial Fermentation Technology Market Use Cases

- Pharmaceuticals & Antibiotic Production: Used to produce antibiotics, vaccines, and biologics like insulin and monoclonal antibodies.

- Food & Beverage Industry: Essential for fermenting yogurt, cheese, beer, wine, and probiotics, improving taste, texture, and nutritional value.

- Biofuel & Biochemical Production: Microbial fermentation converts biomass into bioethanol, biodiesel, and bioplastics, promoting sustainable energy solutions.

- Enzyme & Protein Production: Enables large-scale production of industrial enzymes and therapeutic proteins used in various industries.

- Agriculture & Animal Feed: Fermentation enhances animal feed supplements, probiotics, and biofertilizers, improving livestock health and crop yields.

- Waste Management & Bioremediation: Microbes help break down organic waste and pollutants, contributing to environmental sustainability and waste-to-energy solutions.

Microbial Fermentation Technology Market Dynamic

Microbial fermentation technology finds a variety of applications in

clinical, food, and

pharmaceutical sectors, contributing to the production of antibiotics, vaccines, & fermented foods. After the pandemic, there has been a major growth in research, mainly in vaccine & drug development, driven by the urgent requirement for innovative solutions in the aftermath of COVID-19.

Further, the growing number of infections,

chronic diseases, & rare conditions intensifies the need for research in new drugs & medicines, which is evident in growing clinical trials, small biomolecule production, & biologics development, together supporting the growth of the microbial fermentation technology market.

However, the expenses associated with experimentation, raw materials, equipment, & technology in pharmaceutical and biopharmaceutical research are quite high. Further, economic, political, & social factors contribute to the high costs, mainly in fermentation techniques.

Moreover, the conventional nature of microbial fermentation technology often leads to higher expenses, allowing many pharmaceutical companies to outsource these processes to CROs & CDMOs, with reduced cost of microbial fermentation technology serves as a potential barrier to the market's growth in the development & research of new therapeutics.

Driver

Rising demand for biopharmaceuticals such as vaccines, monoclonal antibodies and biosimilars is driving growth of the global microbial fermentation technology market. Microbial fermentation technology plays a vital role in producing high-quality yet cost-efficient biologics efficiently. Growing healthcare needs and advances in precision medicine are driving investments in microbial fermentation processes.

Furthermore, global efforts against infectious diseases and cancer have further expanded microbial fermentation's use in drug development processes. Microbial systems' ability to produce complex biomolecules with high specificity and yield makes them indispensable in both pharmaceutical and biotech industries and fuel market growth.

Trend

Synthetic biology has quickly emerged as an innovative trend within microbial fermentation technology market. By engineering specific strains of bacteria, researchers can optimize fermentation processes more effectively so as to produce bio-based chemicals, fuels, and pharmaceuticals more cost effectively.

Advanced gene-editing technologies like CRISPR-Cas9 are making possible the creation of customized microbial platforms tailored for specific applications, satisfying increasing demands for sustainable production methods and bio-based alternatives to petroleum-derived products. Industries are turning to synthetic biology as an enabler to innovate fermentation processes, lower costs and increase yields, signaling an industry shift toward precision fermentation technologies across numerous sectors.

Restraints

The market for microbial fermentation technology faces significant initial investment costs. Establishing ferment facilities require significant financial resources for infrastructure, equipment and skilled workforce training programs. Microbial processes often necessitate stringent regulatory compliance and quality control measures that add costs.

Small and medium enterprises may find it challenging to cover these expenses, thus inhibiting market entry. Scalability issues associated with commercial microbial fermentation systems may also prove prohibitive to widespread adoption, particularly for cost-conscious industries and developing regions with limited financial and technical capacities.

Opportunity

With the increasing focus on sustainability comes an opening for microbial fermentation technology to produce bio-based products. Industries are rapidly adopting fermentation processes to produce biofuels, bioplastics and bio-based chemicals as eco-friendly replacements for traditional petrochemicals. Rising consumer consciousness of environmental issues and government initiatives to reduce carbon footprints are at the root of this shift.

Innovations in microbial strain engineering and fermentation optimization further enhance economic viability of bio-based products; as well as expanding applications like probiotics and functional ingredients in food and beverage production that highlight potential for microbial fermentation to meet diverse market demands and accelerate adoption.

Microbial Fermentation Technology Market Research Scope and Analysis

By Product

The Global Microbial Fermentation Technology Market is categorized into Medical Products, Industrial Products, Alcohol Beverages, and Food and Feed Products. The leading product in this market segment is anticipated to be alcoholic beverages during the forecast period, which is attributed to the large popularity of alcoholic beverages, mainly among adolescents & millennials. Further, the market's growth is fueled by factors like the expanding urban population, ongoing technological development, new product launches, & a rise in the number of lounges and bars.

Even after future challenges posed by strict regulations on alcoholic drink advertising & increasing awareness about the adverse effects of excessive alcohol consumption, the segment's market share is highly sustained by consumers' inclination to explore new flavors. Also, the introduction of new alcoholic beverages featuring different flavors, focused on attracting customers & boosting sales, is expected to drive the need for microbial fermentation within the alcoholic beverages sector.

By Application

In the forecasted period, the antibiotics segment is expected to have significant growth, driven by higher investments in R&D by pharmaceutical companies. The growth in infections globally, along with the rise in antibiotic consumption in both developed &low-middle-income countries owing to improved lifestyles & affordability for healthcare, further fuels this growth. Even though the market is driven by the rise in infectious diseases, the challenge of antibiotic resistance hampers its expansion. However, the introduction of alternative novel therapies serves to counteract this hindrance and expand the market.

Moreover, microbial fermentation technology plays a major role in the large-scale production of antibiotics, which ensures cost-effectiveness, quality assurance, & high production volumes, particularly for drugs produced in bulk. With other methods being more complex & expensive, microbial fermentation remains the most suitable approach for the majority of antibiotics & drugs. As the need for antibiotic production continues to rise, the microbial fermentation market is expected to witness a corresponding increase in growth.

By End User

The market was largely dominated by the CMOs and CDMOs segment, holding the highest share in 2023, attributed to the growing popularity among biotherapeutics manufacturers for outsourcing, driven by the fact that smaller firms, mostly the innovators in the bioprocess space, experience limitations in capacity, skilled workforce, & resources for commercialization. The quick growth of the clinical pipeline for biologics further fuels the growth of this segment.

Further Outsourcing to contract manufacturing & research service providers, like Thermo Fisher Scientific & more, have become a popular choice, as these companies provide commercial-scale production capabilities & vast global presence, allowing rapid market penetration for products. Also, the competitive expertise & experience provided by these service providers make them major partners for biotherapeutics manufacturers navigating the challenges of innovation, production, & market entry.

The Microbial Fermentation Technology Market Report is segmented on the basis of the following:

By Product

- Medical

- Industrial

- Alcohol Beverages

- Food & Feed

By Application

- Enzymes

- Probiotics Supplements

- Monoclonal Antibodies

- Biosimilars

- Antibiotics

- Vaccines

- Recombinant Proteins

- Small Molecules

By End User

- Bio-Pharmaceutical Companies

- CMOs & CDMOs

- Contract Research Organizations (CROs)

- Academic & Research Institutes

How Does Artificial Intelligence Contribute To Improve Microbial Fermentation Technology Market ?

- Process Optimization: AI analyzes real-time fermentation data to adjust temperature, pH, and nutrient levels, maximizing microbial productivity.

- Predictive Maintenance: AI detects equipment wear and potential failures in fermentation systems, reducing downtime and maintenance costs.

- Strain Development & Genetic Engineering: AI accelerates the discovery and optimization of microbial strains for higher yield and better product quality.

- Automated Quality Control: AI-driven monitoring systems detect impurities and deviations, ensuring consistent and high-quality fermentation products.

- Supply Chain & Resource Management: AI predicts raw material demand, optimizes logistics, and reduces waste in fermentation-based industries.

- Bioprocess Modeling & Simulation: AI models fermentation processes to simulate different conditions, improving efficiency before large-scale production.

Microbial Fermentation Technology Market Regional Analysis

Asia Pacific region takes the lead in market dominance, capturing the highest revenue

share at 47.3% in 2023, which is attributed to the region being recognized as a key hub for biopharmaceutical outsourcing, as both domestic & international companies in Asia, like major players, are expected to contribute to nearly half of the new bioprocessing facilities across the globe. Moreover, China is set to witness the construction of different bioprocessing facilities to meet the growing domestic demand, reflecting the region's growing dependency on microbial fermentation technology.

Further, North America anticipates significant growth, driven by a rise in engagement in research & product development in biologics. Also, the region holds a substantial presence of contract development organizations, & a higher regulatory framework, mainly through the efforts of the US FDA. Furthermore, the US, a key revenue contributor, benefits from an advancing biologics manufacturing landscape, growing funding for biopharmaceutical R&D, & the adoption of innovative manufacturing technologies, contributing to the overall growth of the market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Microbial Fermentation Technology Market Competitive Landscape

The Global Microbial Fermentation Technology Market experiences a dynamic competitive landscape marked by a growth in innovative solutions, as different companies, both established & emerging, are investing in R&D, driving development in bioprocessing techniques. The market is characterized by strategic partnerships, collaborations, and the introduction of new technologies, reflecting the industry's commitment to supporting growth & addressing growing challenges.

In April 2023, Toray Industries, Inc. & Mitsui DM Sugar Co., Ltd. together showcased a foundational technology for producing sugar from non-edible biomass, like surplus bagasse & cassava pulp, whose economy efforts, aim to integrate biomass-based polymers for different applications. The demonstration in Thailand, supported by NEDO, aimed at separating, purifying, & concentrating cellulose-derived sugars using a membrane-based bioprocess, highly reducing carbon dioxide emissions in comparison to conventional methods.

Some of the prominent players in the global Microbial Fermentation Technology Market are:

- Lonza

- Biocon Ltd

- Danone UK

- BIOZEEN

- ABPDU

- Biocatalysts

- BioVectra Inc

- United Breweries Ltd

- Osprey Biotechnics

- AGC Biologics

- Other Key Players

COVID-19 Pandemic & Recession: Impact on the Global Microbial Fermentation Technology Market

The COVID-19 pandemic & the subsequent economic recession have left a discernible impact on the Global Microbial Fermentation Technology Market. The biopharmaceutical industry, a major consumer of microbial fermentation technology, faced interruptions in supply chains, production, & clinical trials, delaying projects and impacting market growth. Further, with a switch in focus towards pandemic-related research, the need for microbial fermentation technology in non-COVID therapeutic areas experienced fluctuations.

The recession-induced financial restraints led to strategic budget reassessments, impacting investments in R&D. However, as the world adapts to the 'new normal,' growing awareness of bioprocessing's essential role in vaccine & drug development has renewed interest. Also, the market is expected to rebound as economies recover, but the ongoing unpredictive nature highlights the importance of resilient strategies & innovation in navigating the post-pandemic landscape.

Microbial Fermentation Technology Market Recent Developments

- In October 2023, MycoTechnology, a foodtech startup specializing in fungi-based products, introduced its Fermentation as a Service (FaaS) platform, which accesses fermentation capacity in a competitive market, enabling them to optimize assets & generate extra revenue. Also, it features fermentation vessels of different sizes, meeting different needs, mainly those requiring low oxygen transfer rates. Further, the company aims to explore diverse bioproduct possibilities & opportunities through this innovative platform, supporting a decade of experience in flexible & successful ingredient production.

- In July 2023, Japan's leading chemical company, Sumitomo Chemical Co., Ltd, & Ginkgo Bioworks, a leader in cell programming and biosecurity, announced a collaborative initiative, which aims to create functional chemicals utilizing synthetic biology, extending their current biomanufacturing partnership, which signifies a strategic move towards advancing capabilities in developing innovative chemical solutions through the integration of synthetic biology techniques.

- In October 2023, ScaleUp Bio, an advanced CDMO provider based in Singapore, introduced its inaugural customer roster, signaling broader global interest in its distinctive offerings. The company enhanced a collaboration agreement with Australia's Nourish Ingredients as part of its Asian growth strategy. In addition, letters of intent were signed with C16 Biosciences in the USA, Ultimate in Malaysia, & Allium Bio in Singapore, focused on to explore sustainable ingredient development for the Asian market.

Microbial Fermentation Technology Market Report Details

| Report Characteristics |

| Market Size (2023) |

USD 36.5 Bn |

| Forecast Value (2032) |

USD 62.3 Bn |

| CAGR (2023-2032) |

6.1% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Medical, Industrial, Alcohol Beverages,

and Food & Feed), By Application (Enzymes,

Probiotics Supplements, Monoclonal Antibodies,

Biosimilars, Antibiotics, Vaccines, Recombinant

Proteins, and Small Molecules), By End User (Bio-

Pharmaceutical Companies, CMOs & CDMOs,

Contract Research Organizations (CROs), and

Academic & Research Institutes) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Lonza, Biocon Ltd, Danone UK, BIOZEEN, ABPDU,

Biocatalysts, BioVectra Inc, United Breweries Ltd,

Osprey Biotechnics, AGC Biologics, and Other Key

Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |