Market Overview

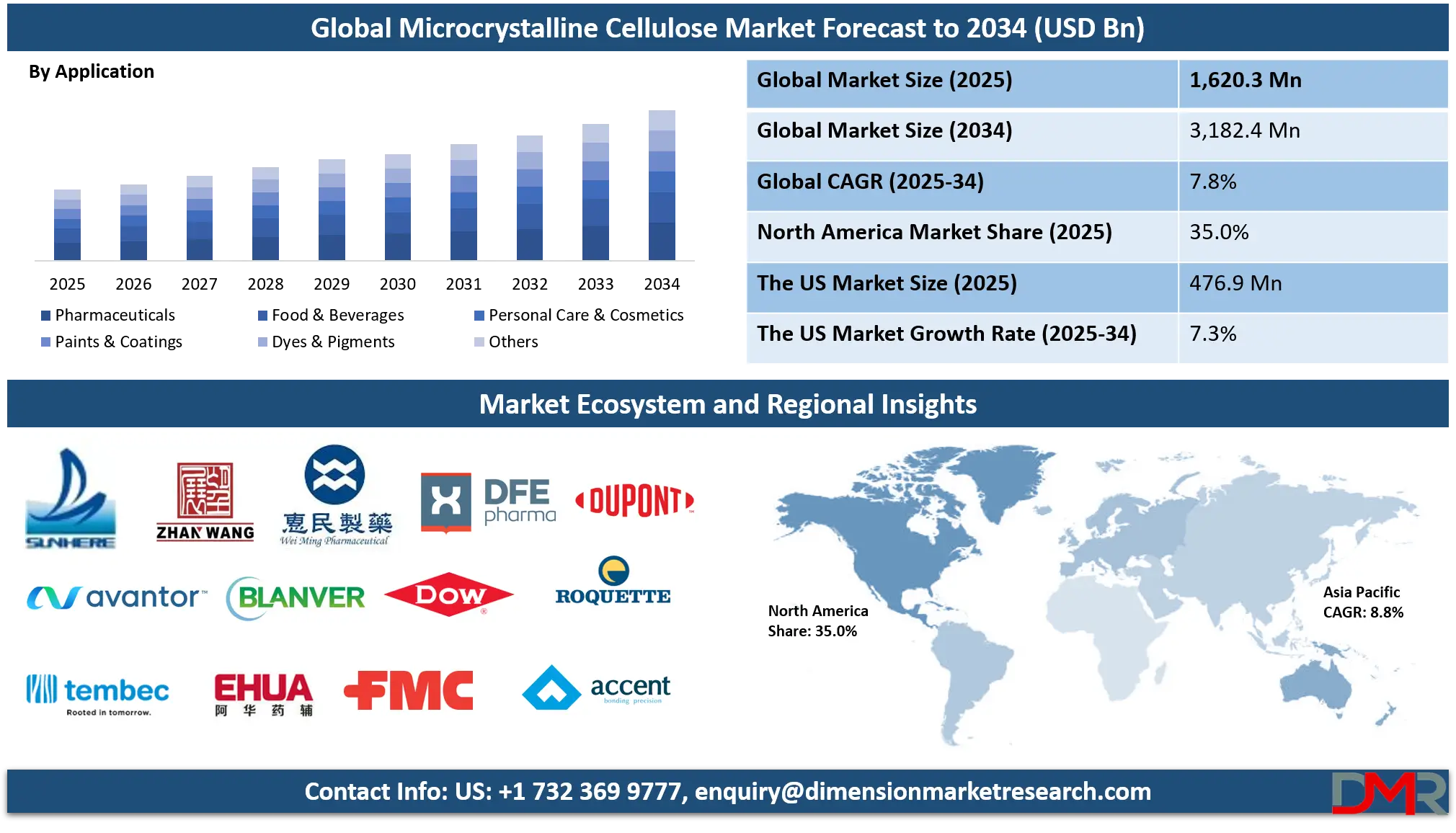

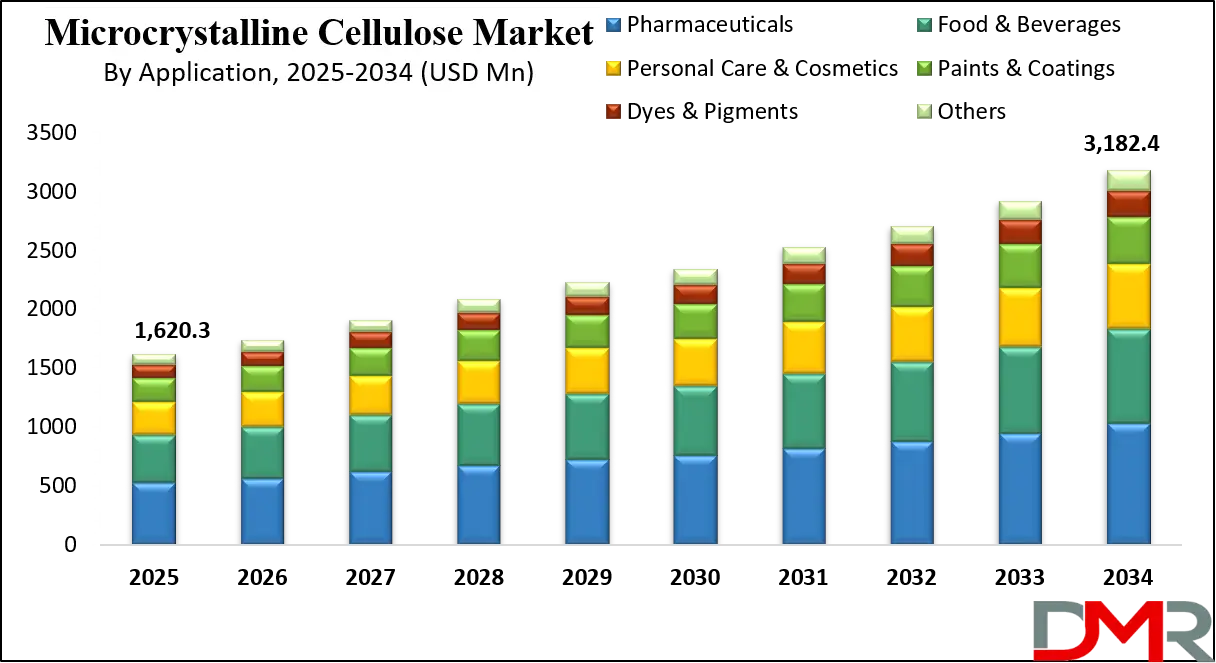

The Global Microcrystalline Cellulose Market is projected to reach USD 1,620.3 million in 2025 and grow at a compound annual growth rate of 7.8% from there until 2034 to reach a value of USD 3,182.4 million.

The global microcrystalline cellulose (MCC) market is experiencing transformative growth, driven by evolving industrial applications and shifting consumer preferences. As a versatile pharmaceutical excipient, MCC has become indispensable in modern drug formulation, particularly in direct compression tablet manufacturing, where it enhances compressibility and improves disintegration properties. The market is witnessing a paradigm shift toward multifunctional excipient systems, with MCC increasingly being co-processed with other compounds to create superior performance materials that reduce tablet defects and improve production efficiency.

Technological advancements are reshaping production methodologies, with emerging processes enabling more efficient hydrolysis of cellulose sources and improved particle size control. The development of specialized MCC grades with enhanced flow properties and binding capacities is addressing formulation challenges in high-speed tablet production lines. Furthermore, the integration of

artificial intelligence in manufacturing processes is optimizing quality control and reducing batch-to-batch variability.

Environmental considerations are becoming increasingly pivotal in market dynamics. The industry is moving toward closed-loop production systems that minimize water usage and chemical waste. Sustainable sourcing initiatives are gaining momentum, with leading manufacturers establishing traceability programs for wood pulp and cotton linter supplies. The emergence of agricultural waste-derived MCC presents both an opportunity for circular economy practices and a challenge in maintaining consistent quality standards.

Regulatory landscapes continue to evolve, with harmonization efforts between major pharmacopeias (USP, EP, JP) streamlining global trade. However, regional variations in food additive approvals create complexities for multinational manufacturers. The recent inclusion of MCC in more pharmacopeial monographs underscores its growing therapeutic importance while raising the bar for quality compliance.

Market expansion faces headwinds from alternative excipients such as modified starches and synthetic polymers that compete on price and functionality. The development of direct compression aids with superior properties in certain applications poses a competitive threat. Additionally, fluctuations in wood pulp prices and potential supply chain disruptions remain persistent concerns for industry stakeholders.

The US Microcrystalline Cellulose Market

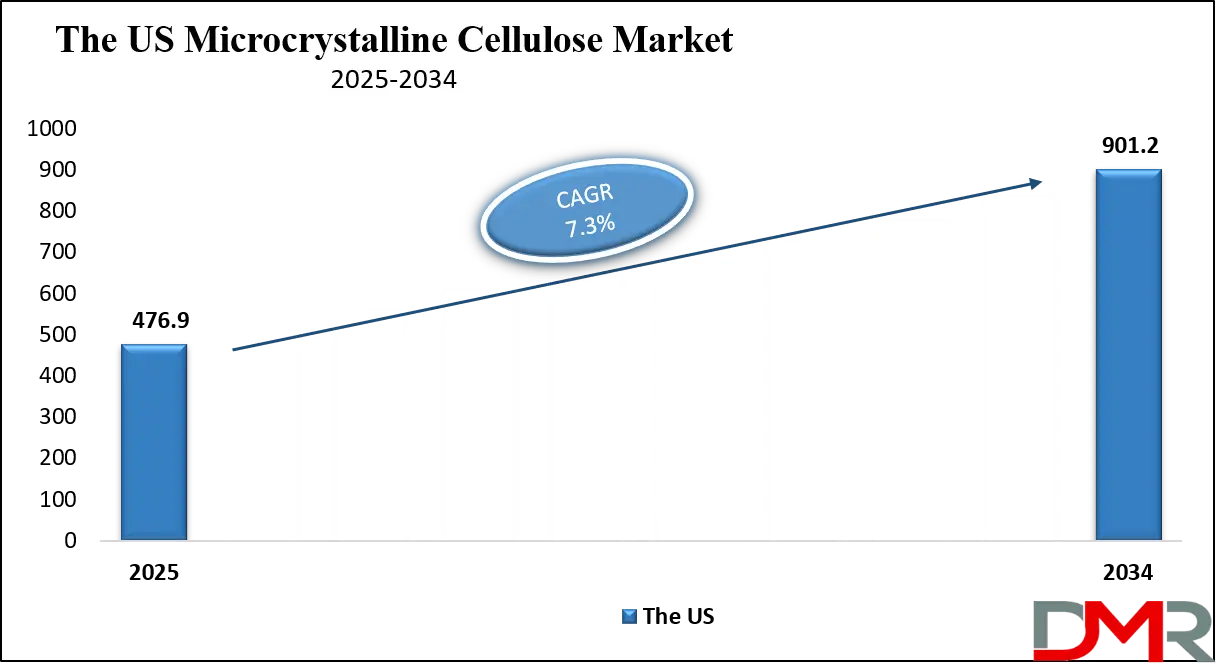

The US Microcrystalline Cellulose Market is projected to reach USD 476.9 million in 2025 at a compound annual growth rate of 7.3% over its forecast period.

The US microcrystalline cellulose market benefits from a unique convergence of regulatory support, demographic trends, and technological leadership that sustains its global dominance. With the FDA's GRAS designation facilitating widespread adoption, MCC has become deeply embedded in both pharmaceutical and food manufacturing value chains. The country's healthcare landscape, where CDC data shows chronic diseases affecting nearly half of adults, creates sustained demand for MCC in solid dose medications.

This demand is further amplified by Census Bureau projections of rapid senior population growth, with older Americans consuming prescription drugs at three times the rate of younger demographics. Beyond healthcare applications, the USDA actively promotes MCC's role in functional foods, particularly in fiber fortification and reduced-calorie products that align with national dietary guidelines.

The EPA's focus on sustainable biomaterials has spurred innovation in closed-loop production systems, while NIST's material science research continues to push the boundaries of MCC performance characteristics. This comprehensive ecosystem of supportive policies, combined with America's world-leading pharmaceutical R&D expenditure (exceeding $100 billion annually according to NIH estimates), ensures the US market will maintain its innovation edge in MCC applications ranging from advanced drug delivery to sustainable packaging solutions.

The European Microcrystalline Cellulose Market

The European Microcrystalline Cellulose Market is estimated to be valued at USD 243.0 million in 2025 and is further anticipated to reach USD 410.6 million by 2034 at a CAGR of 6.0%.

Europe's microcrystalline cellulose market operates within the world's most comprehensive regulatory framework for excipients, creating both challenges and competitive advantages for regional players. The EMA's stringent quality requirements have made European pharmaceutical-grade MCC the global benchmark, with manufacturers investing heavily in advanced purification technologies to meet pharmacopeial standards.

EFSA's rigorous safety evaluations have simultaneously expanded approved food applications while implementing stricter purity specifications. The region's demographic time bomb - with Eurostat projecting the 65+ population growing by 1 million annually - drives continuous innovation in senior-friendly dosage forms where MCC plays a pivotal role. The European Commission's Circular Economy Package has transformed sourcing practices, with over 60% of regional MCC now derived from FSC-certified sustainable forestry operations.

Horizon Europe funding has catalyzed breakthroughs in nanocellulose applications, particularly in controlled-release pharmaceuticals and biodegradable composites. The cosmetics sector's shift toward natural ingredients, supported by COSMOS certification standards, has opened new avenues for ultra-pure MCC grades in premium skincare lines. These factors combine to create a market that prioritizes quality and sustainability over price competition, with European MCC manufacturers commanding premium pricing in global markets. The region's leadership in green chemistry initiatives further positions it as the testing ground for next-generation sustainable MCC production methods.

The Japan Microcrystalline Cellulose Market

The Japan Microcrystalline Cellulose Market is projected to be valued at USD 97.2 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 160.1 million in 2034 at a CAGR of 5.7%.

Japan's microcrystalline cellulose market reflects the nation's unique position as a technology leader facing acute demographic challenges. The MHLW's exacting pharmaceutical standards have driven the development of specialized MCC grades that meet Japan's unparalleled quality requirements, particularly for moisture-sensitive formulations in the country's humid climate. With the Statistics Bureau reporting record-low birth rates and unprecedented longevity, the demand for easy-to-swallow medications and senior-specific nutraceuticals has spawned innovative MCC applications in orally disintegrating tablets and functional foods.

Japan's FSCJ maintains some of Asia's strictest food additive regulations, yet has approved expanding MCC uses in traditional foods like mochi and modern functional products. The government's Bioeconomy Strategy has successfully reduced import dependence through technological innovations in domestic wood pulp processing, achieving 45% self-sufficiency in pharmaceutical-grade MCC production.

JCIA-certified cosmetics manufacturers have pioneered MCC applications in oil-control formulations tailored to Japanese skincare preferences. RIKEN's nanocellulose research represents perhaps the most ambitious MCC innovation program globally, exploring applications ranging from artificial skin to targeted cancer therapies. This combination of demographic imperative and technological capability makes Japan both a sophisticated early-adopter market and a global innovation hub for high-value MCC applications that often later diffuse to other developed markets.

Global Microcrystalline Cellulose Market: Key Takeaways

- Global Market Size Insights: The Global Microcrystalline Cellulose Market size is estimated to have a value of USD 1,620.3 million in 2025 and is expected to reach USD 3,182.4 million by the end of 2034.

- The US Market Size Insights: The US Microcrystalline Cellulose Market is projected to be valued at USD 476.9 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 901.2 million in 2034 at a CAGR of 7.3%.

- Regional Insights: North America is expected to have the largest market share in the Global Microcrystalline Cellulose Market with a share of about 35.0% in 2025.

- Key Players: Some of the major key players in the Global Microcrystalline Cellulose Market are DuPont de Nemours, Inc., J. Rettenmaier & Söhne GmbH + Co KG (JRS Pharma), DFE Pharma GmbH & Co. KG, Asahi Kasei Corporation, Roquette Frères SA, Mingtai Chemical Co., Ltd., Accent Microcell Pvt. Ltd., FMC Corporation, The Dow Chemical Company, and many others.

- The Global Market Growth Rate: The market is growing at a CAGR of 7.8 percent over the forecasted period of 2025.

Global Microcrystalline Cellulose Market: Use Cases

- Orally Disintegrating Tablets (ODTs): MCC's unique combination of binding and disintegrating properties makes it ideal for ODT formulations, particularly for pediatric and geriatric medications. Its ability to provide adequate mechanical strength while ensuring rapid mouth dissolution addresses critical formulation challenges. Recent advancements in silicified MCC grades have further enhanced performance in this sensitive application category.

- Plant-Based Meat Analogues: In the rapidly growing alternative protein sector, MCC serves as a crucial texture modifier and water-binding agent. Its capacity to mimic the fibrous structure of meat while improving freeze-thaw stability has made it invaluable in next-generation meat substitutes. Food technologists are leveraging MCC's ability to create anisotropic structures that closely resemble animal muscle tissue.

- Controlled-Release Matrix Systems: Pharmaceutical scientists are utilizing MCC's modified forms to develop sophisticated drug delivery platforms. By combining MCC with rate-controlling polymers, formulators can create robust matrix systems that provide precise release profiles. This application is particularly valuable for once-daily dosage forms and combination products requiring differential release rates.

- Cosmetic Color Cosmetics: In makeup formulations, MCC has emerged as a superior alternative to talc in powder foundations and blushes. Its oil-absorbing capacity, combined with smooth spreadability, enhances product performance while meeting demands for natural ingredients. MCC's light-diffusing properties contribute to improved optical effects in premium cosmetic products.

- Bio-Based Composite Materials: Advanced material science applications are employing MCC as a reinforcing agent in biodegradable composites. Its high crystallinity and aspect ratio improve mechanical properties in sustainable packaging materials and automotive components. Researchers are exploring surface-modified MCC for enhanced interfacial adhesion in polymer matrices, opening new possibilities in green material development.

Global Microcrystalline Cellulose Market: Stats & Facts

- Microcrystalline cellulose (MCC) is embedded in over 2,500 approved drug products, as documented in the FDA’s Orange Book, solidifying its role as a critical pharmaceutical excipient.

- The USDA recognizes MCC as a dietary fiber offering 2.5–3.0 kcal/g, commonly used in fortified and functional foods.

- According to the CDC’s 2023 National Health Report, 60% of U.S. adults are affected by chronic diseases, further increasing demand for MCC-containing medications.

- Projections from the U.S. Census Bureau indicate that by 2030, 1 in 5 Americans will be aged 65 or older, boosting pharmaceutical demand for MCC in geriatric treatments.

- The EPA reports a 35% reduction in water usage in cellulose production facilities since 2010, reflecting improved sustainability in MCC manufacturing.

- As per the European Medicines Agency (EMA), 89% of solid oral dosage forms in the EU use MCC, as stated in the 2023 European Pharmacopoeia.

- The Eurostat data shows that the pharmaceutical sector in the EU has grown 4.2% annually since 2018, with 30% of the EU population projected to be over 65 by 2050, both of which signal rising MCC consumption.

- The European Food Safety Authority (EFSA) approved 12 new MCC (E460) food applications in 2022–2023.

- Under the European Commission’s Circular Economy Plan, a 50% reduction in cellulose waste is targeted by 2030, while the Horizon Europe program has allocated €280 million to nanocellulose R&D through 2027.

- The Japanese Ministry of Health, Labour and Welfare (MHLW) notes that 92% of OTC medications in Japan contain MCC, with 15 new MCC-based excipient grades approved in 2023.

- The Statistics Bureau of Japan confirms that 29.1% of the population was over 65 in 2023, alongside a 7.8% year-over-year growth in pharmaceutical exports.

- According to Japan’s Ministry of Agriculture, Forestry and Fisheries (MAFF), domestic wood pulp production essential for MCC has increased by 12% under the Bioeconomy Strategy.

- The World Health Organization (WHO) includes MCC in 78% of drugs listed in its Model Formulary, underscoring its essential status globally.

- The Food and Agriculture Organization (FAO) reports that global cellulose production reached 250 million metric tons in 2022. The OECD states that green chemistry patents involving cellulose rose 40% from 2018 to 2022, and 18 of its member countries have implemented specific MCC regulations.

- In 2022, Health Canada approved 342 new MCC-based pharmaceutical products. The UK Medicines and Healthcare Products Regulatory Agency (MHRA) reports that MCC appears in 82% of newly registered generic drugs. The Australian Therapeutic Goods Administration (TGA) processed an average of 45 MCC-related regulatory submissions per month in 2023.

- The Indian Central Drugs Standard Control Organization (CDSCO) observed an 18% annual increase in MCC imports to support domestic generics. Meanwhile, the China National Medical Products Administration (NMPA) added three new MCC monographs in its 2025 Pharmacopoeia.

- The U.S. International Trade Commission (ITC) valued pharmaceutical-grade MCC exports at $420 million in 2022, supported by a 15% tariff cut since 2020 on medical-grade cellulose.

- The EU Trade Commission recorded 680,000 metric tons of intra-EU MCC trade in 2023. Japan Customs valued MCC imports at ¥38 billion in 2022, with most sourced from North America.

- The UN Environment Programme (UNEP) indicates that cellulose production contributes to 2.1% of total global industrial water usage. According to the U.S. Department of Energy (DOE), bioenergy improvements have reduced MCC production energy use by 25% since 2015.

- The European Chemicals Agency (ECHA) registered 14 new sustainable MCC production techniques in 2023, including solvent-free and eco-friendly alternatives.

- The U.S. National Institutes of Health (NIH) supported 68 cellulose-related projects worth $120 million in 2022, focusing on drug delivery and biomedical use.

- The European Patent Office issued 214 nanocellulose patents in 2023, up 22% from the previous year. Japan’s Patent Office reports a 15% annual increase in MCC-related formulations between 2018 and 2023. Lastly, the World Intellectual Property Organization (WIPO) states that 38% of all international cellulose-related patents now target pharmaceutical applications.

Global Microcrystalline Cellulose Market: Market Dynamics

Driving Factors in the Global Microcrystalline Cellulose Market

Expansion of Pharmaceutical Manufacturing in Emerging Markets

Emerging economies such as India, China, and Brazil are experiencing a surge in domestic pharmaceutical manufacturing, fueled by expanding healthcare infrastructure, rising public health expenditure, and policy-driven incentives. Governments are actively promoting local API and excipient production to reduce import dependencies and secure national drug supply chains. For example, India’s Production Linked Incentive (PLI) Scheme is bolstering domestic manufacturing of critical raw materials, including MCC.

Microcrystalline cellulose, widely used in oral solid dosage forms, is benefiting from this localization trend. As global players expand manufacturing capacities in these regions, MCC producers are establishing strategic partnerships and localized facilities to meet the growing demand. The scalability and low toxicity profile of MCC further support its position as a vital excipient in the rapidly growing generics and over-the-counter medicine segments.

Rising Demand for Functional Ingredients in the Food and Beverage Sector

The evolving consumer focus on health, nutrition, and food functionality is propelling demand for microcrystalline cellulose as a dietary fiber and texture modifier. It is being widely adopted in gluten-free, low-calorie, and plant-based food formulations. As consumers increasingly seek products with cleaner labels, enhanced texture, and higher fiber content, food manufacturers are replacing synthetic additives with MCC to align with market expectations. Regulatory approvals from agencies like the FDA (U.S.), EFSA (EU), and FSSAI (India) support its inclusion across a broad range of food categories.

Additionally, MCC’s stabilizing and anti-caking properties allow food brands to reduce fat content without compromising product integrity. This is especially valuable in bakery, dairy, and convenience food segments where product performance is critical. The growing focus on sustainable and natural food components further elevates MCC's value proposition as a multifunctional ingredient.

Restraints in the Global Microcrystalline Cellulose Market

High Production Costs and Price Volatility of Raw Materials

Despite its widespread use, the production of microcrystalline cellulose involves intensive processing, including hydrolysis, purification, drying, and grinding, all of which contribute to higher energy consumption and operating costs. Fluctuating prices of wood pulp and cotton linters, key raw materials for MCC, can significantly impact manufacturing economics.

In regions with inconsistent wood supply or environmental restrictions on deforestation, input costs become even more volatile. Moreover, compliance with environmental norms and effluent treatment regulations adds to operational overhead. This high-cost structure often leads to elevated market prices, making MCC less competitive against synthetic alternatives in cost-sensitive markets. Smaller producers also face challenges scaling operations efficiently, limiting market entry, and pricing flexibility.

Stringent Regulatory Approvals and Quality Standards

MCC, especially when used in pharmaceuticals and food products, must meet strict regulatory requirements laid down by authorities such as the U.S. FDA, EFSA, and WHO. These regulations pertain to purity, microbial limits, heavy metal content, and consistency in functional performance. Obtaining these certifications involves extensive testing, documentation, and periodic audits, increasing time-to-market and compliance costs. Any variation in source material or processing method may necessitate revalidation of safety and efficacy, which can deter innovation. Moreover, differences in international standards often complicate global market entry, especially for SMEs. Regulatory stringency, while essential for public safety, can become a bottleneck for market expansion and product diversification in less mature economies.

Opportunities in the Global Microcrystalline Cellulose Market

Technological Advancements in MCC Processing and Customization

Innovations in cellulose extraction, purification, and co-processing technologies are opening new avenues for customized MCC grades tailored for specific end-use applications. Co-processed MCC with lactose, starch, or silicon dioxide is enabling superior compressibility, flowability, and disintegration in pharmaceuticals. Similarly, tailored particle sizes and functional blends are expanding MCC’s usability across food, cosmetics, and industrial formulations.

Companies are investing in R&D to develop high-performance MCC variants that meet stringent quality specifications of high-end applications, including controlled-release formulations and functional foods. The development of nanocellulose derivatives and hybrid cellulose-based materials also represents a frontier of value-added applications. These innovations are improving process efficiency, enhancing formulation performance, and reducing dependency on synthetic additives, thus expanding MCC’s market scope.

Expanding Role in Sustainable and Green Manufacturing

The global push toward sustainability is driving industries to adopt bio-based, renewable, and biodegradable raw materials. Microcrystalline cellulose, derived from natural sources like wood pulp and cotton linters, fits perfectly into circular economy goals and green chemistry frameworks. MCC’s renewability, low carbon footprint, and non-toxic nature make it highly attractive for eco-conscious manufacturers in pharmaceuticals, food, and personal care. Its use is especially relevant in biodegradable packaging, sustainable food emulsions, and clean-label cosmetics.

Moreover, government regulations encouraging the reduction of petrochemical-based ingredients are creating strong tailwinds for MCC-based product development. With increased consumer awareness and industry alignment toward ESG (Environmental, Social, and Governance) goals, MCC is well-positioned to benefit from the global transition to sustainable production and consumption.

Trends in the Global Microcrystalline Cellulose Market

Rise in Natural and Plant-Based Excipients in Pharmaceuticals

The global shift toward sustainable and biocompatible excipients is driving the increased demand for plant-derived microcrystalline cellulose in pharmaceutical formulations. As regulatory scrutiny heightens, particularly from bodies such as the U.S. FDA and EMA, manufacturers are moving away from synthetic binders and embracing excipients like MCC due to its inert, non-toxic, and biodegradable nature.

This trend is particularly strong in tablet and capsule formulations, where MCC is widely used as a filler, binder, and disintegrant. As the clean-label movement gains momentum, pharmaceutical companies are leveraging MCC’s natural origin to enhance product acceptance and regulatory compliance, particularly in regulated markets such as the U.S., EU, and Japan. Furthermore, advancements in microcrystalline cellulose grades, including co-processed and multifunctional variants, are enabling more efficient tableting and improved drug delivery performance.

Integration of MCC in High-Performance Food Formulations

In the food and beverage industry, microcrystalline cellulose is gaining traction as a fat replacer, texturizing agent, and stabilizer in products aiming for improved mouthfeel and reduced calories. This aligns with the growing consumer demand for functional and low-fat foods without compromising taste or texture.

MCC’s water-binding properties and ability to mimic fat in dairy, baked goods, and meat analogs are making it an ingredient of choice for health-conscious formulations. With increased focus on food safety and nutritional transparency, MCC meets the demand for GRAS-certified, plant-derived additives.

Additionally, food manufacturers are utilizing MCC to improve shelf-life stability, reduce product syneresis, and enhance structural integrity, particularly in processed foods. The convergence of clean label trends and innovative product development continues to solidify MCC’s role in next-gen food technologies.

Global Microcrystalline Cellulose Market: Research Scope and Analysis

By Source Type Analysis

Wood-based microcrystalline cellulose (MCC) is projected to dominate the global MCC market due to its widespread availability, process efficiency, and superior quality. Derived primarily from hardwood and softwood pulps, wood-based MCC is favored because of its consistent chemical composition and higher cellulose content, ensuring uniformity in end-product quality. This source type undergoes efficient acid hydrolysis to isolate α-cellulose, which yields MCC of pharmaceutical and food-grade purity. Additionally, the mature and established wood pulp supply chain, especially in North America, Europe, and Japan, provides cost-effective and scalable raw material procurement, reinforcing its market dominance.

The wood-based MCC segment is also technologically supported. Decades of R&D have optimized conversion techniques like spray and bulk drying, bleaching, and hydrolysis tailored specifically for wood pulp.

Moreover, regulatory approvals from bodies such as the FDA, EMA, and JECFA primarily reference wood-based MCC grades, making it the default standard for pharmaceuticals and nutraceuticals globally. Environmental advances, such as FSC-certified wood sourcing and reduced water/chemical usage during processing, have improved sustainability, addressing growing ecological concerns without compromising performance.

In comparison, non-wood-based MCC, derived from cotton linters, wheat straw, or sugarcane bagasse, still faces variability in fiber consistency, limited processing infrastructure, and slower global regulatory uptake. While non-wood alternatives are gaining traction in regions with less forest cover, wood-based MCC continues to dominate in volume and revenue due to its superior processing compatibility, higher demand in regulated sectors, and alignment with industrial sustainability goals.

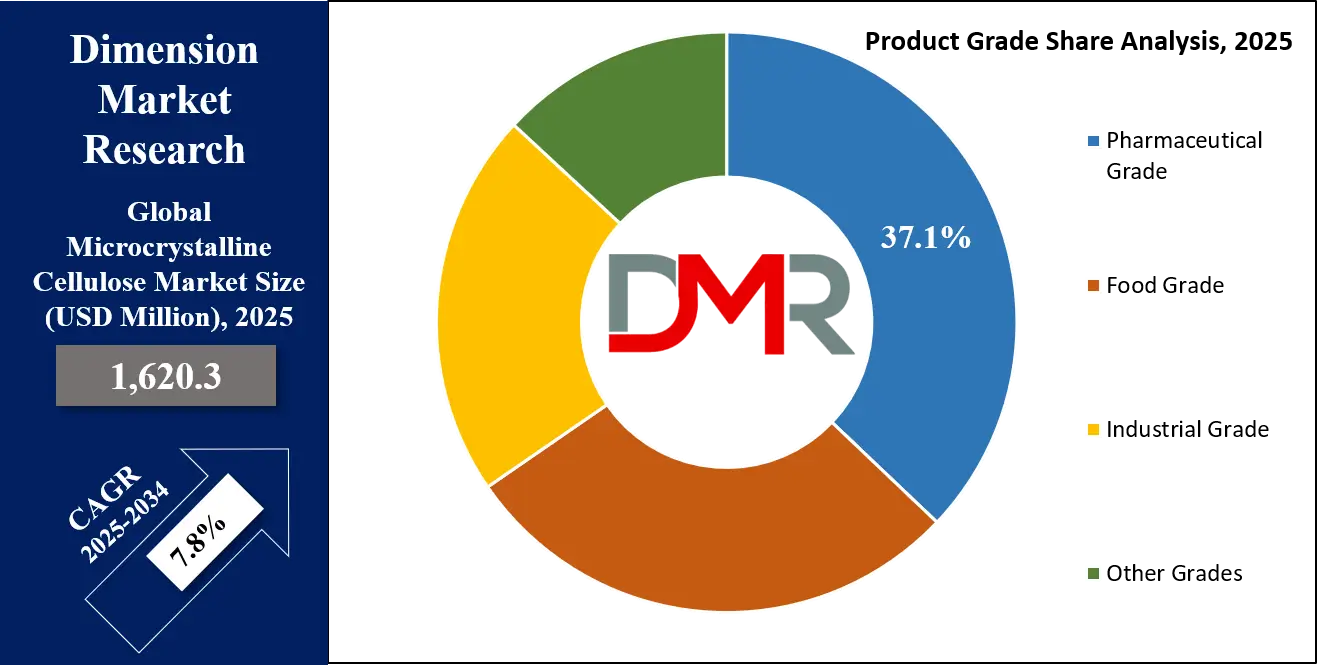

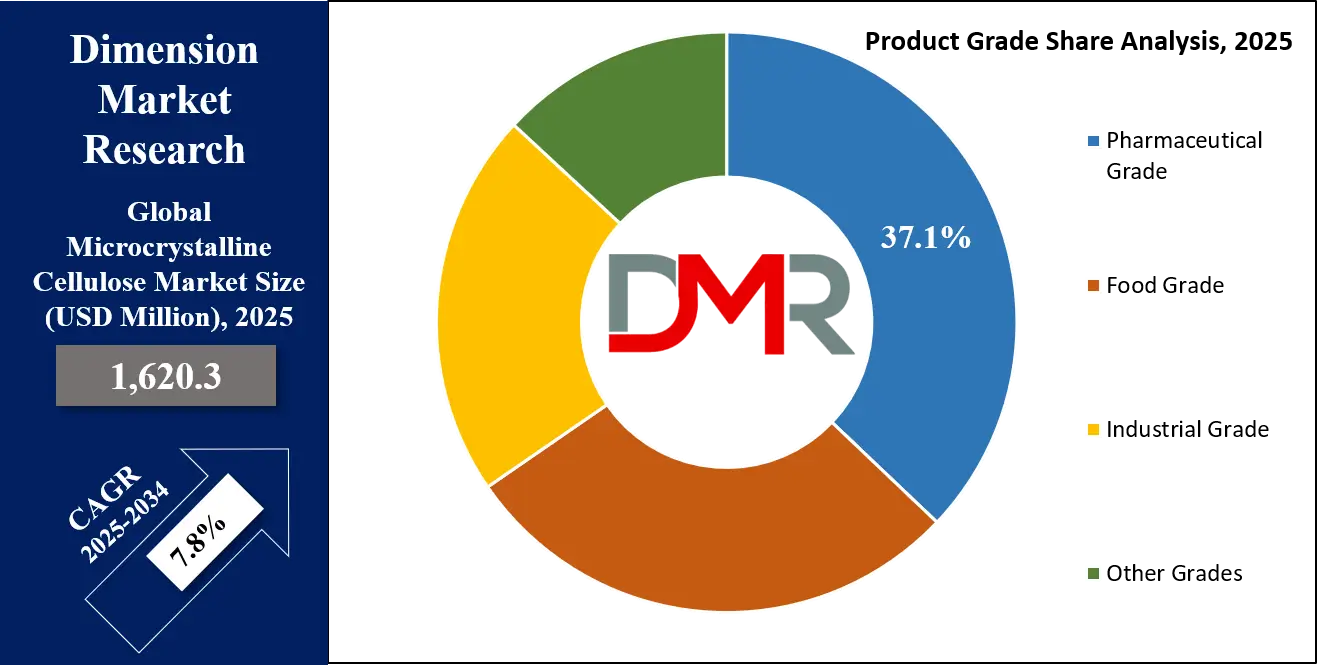

By Product Grade Analysis

Pharmaceutical-grade MCC is expected to dominate the global microcrystalline cellulose market owing to its crucial role as an excipient in oral solid dosage forms such as tablets and capsules. With excellent compressibility, binding capacity, and flow characteristics, pharmaceutical-grade MCC is integral to the formulation of controlled-release and immediate-release drug systems. The FDA, EMA, and WHO recognize MCC as a safe and inert excipient used in over 2,500 approved medications. This grade’s purity and particle uniformity meet stringent pharmacopoeial standards (USP, EP, JP), allowing global formulators to rely on its consistency for safe drug delivery.

Pharmaceutical-grade MCC demand is further amplified by demographic trends. Aging populations in the U.S., Europe, and Japan are leading to increased prescriptions, particularly in Chronic Disease Management segments such as diabetes, cardiovascular, and neurological disorders. The U.S. Census Bureau projects that by 2030, 20% of Americans will be 65 or older. This aging demographic necessitates high-volume production of oral medications, in which MCC is a key structural ingredient.

Moreover, innovations in drug delivery systems such as orally disintegrating tablets (ODTs), effervescent tablets, and chewables continue to drive MCC consumption in pharmaceutical applications. These formulations require excipients like MCC that offer rapid disintegration, non-reactivity, and stability.

Unlike industrial or food grades, pharmaceutical-grade MCC commands a premium price due to tighter quality control, documentation, and validation protocols. The vertical integration of MCC production with pharmaceutical supply chains in countries like the U.S., Germany, and Japan ensures a steady and regulatory-compliant supply, further entrenching pharmaceutical-grade MCC’s dominance in the global market.

By Form Analysis

The powder form of microcrystalline cellulose is poised to hold the largest share in the global MCC market due to its adaptability, ease of integration, and suitability for precision formulation. Powdered MCC is the most commonly used form across pharmaceutical, food, and personal care industries, largely because of its exceptional compressibility, fine particle size distribution, and high surface area that enhances binding, stabilization, and disintegration performance.

In pharmaceuticals, powdered MCC is indispensable in direct compression tablet manufacturing. It ensures excellent tablet hardness, flow properties, and low friability, making it a preferred choice for high-speed automated production. The cost-effectiveness of powdered MCC and its high compatibility with both hydrophilic and hydrophobic drugs further boost its appeal. Nearly 90% of MCC used in drug manufacturing is in powder form due to its technical suitability and regulatory familiarity.

Food and beverage manufacturers use powdered MCC as a stabilizer, anti-caking agent, bulking agent, and fat replacer, especially in baked goods, dairy alternatives, and low-calorie products. Its powder form allows uniform dispersion and seamless integration without altering taste or texture. The U.S. FDA and EFSA list powdered MCC as Generally Recognized As Safe (GRAS), cementing its regulatory advantage in functional foods.

Liquid MCC, while emerging in niche cosmetic and bioadhesive applications, has limited scalability, shelf stability issues, and a shorter history of usage. Powdered MCC’s lower transportation and storage costs, combined with its high versatility and broader application base, continue to position it as the dominant form in global MCC consumption across sectors.

By Drying Process Analysis

Bulk drying is anticipated to be the dominant drying process in the microcrystalline cellulose market due to its scalability, energy efficiency, and suitability for producing pharmaceutical- and food-grade MCC at large volumes. This method involves the acid hydrolysis of cellulose followed by neutralization, washing, and drying using controlled heat transfer systems. Bulk drying enables the production of MCC with uniform particle size and low moisture content, crucial for high-performance applications.

Pharmaceutical manufacturers prefer bulk-dried MCC because it supports consistent batch quality, optimal compressibility, and low microbial load attributes vital for regulatory compliance and shelf stability. With increasing demand for oral dosage forms, particularly in chronic disease treatment, bulk drying offers high-throughput capability while maintaining product integrity, making it indispensable to high-volume production facilities.

Moreover, bulk drying is cost-effective compared to spray drying. It consumes less energy per unit of production and operates efficiently in standard industrial setups, eliminating the need for specialized atomization equipment. The technique is particularly dominant in countries with established MCC manufacturing infrastructure, such as the U.S., Germany, and Japan, where legacy facilities are optimized for bulk drying operations.

While spray drying offers advantages for certain specialty applications that require ultra-fine particles or higher dispersion rates, its higher operational costs and technical complexity make it less prevalent. In contrast, bulk drying's operational simplicity, robust throughput, and widespread industrial adoption make it the preferred drying method for mass-market MCC production. Its alignment with pharmaceutical GMP standards further solidifies its leading position in the global MCC market.

By Application Analysis

Pharmaceutical applications are anticipated to dominate the global microcrystalline cellulose (MCC) market due to MCC’s fundamental role in drug formulation as a binder, filler, and disintegrant in oral solid dosage forms. The pharmaceutical industry accounts for the largest share of MCC usage, with over 89% of solid oral drugs in the EU and 78% in WHO’s Model Formulary utilizing MCC, according to official sources such as the EMA and WHO. Its non-reactivity, chemical stability, and compatibility with a wide range of active pharmaceutical ingredients (APIs) make MCC a versatile excipient.

The surge in chronic conditions like cardiovascular diseases, diabetes, and neurodegenerative disorders globally fuels pharmaceutical demand, especially in aging populations. According to the CDC and Japan’s Statistics Bureau, aging adults (65+) make up 20% of the U.S. and nearly 30% of Japan’s population, leading to a rise in tablet and capsule consumption. MCC’s excellent compressibility and disintegration properties make it crucial in manufacturing tablets that are easy to swallow and stable during storage.

Furthermore, with the expansion of generic drug production in India and China, MCC is increasingly adopted due to its affordability and regulatory acceptance. It also plays a key role in emerging delivery systems such as chewables, ODTs (orally disintegrating tablets), and modified-release formulations. Due to its high performance, regulatory familiarity, and widespread applicability in drug delivery systems, pharmaceutical remains the most dominant and revenue-generating segment in the MCC market.

The Global Microcrystalline Cellulose Market Report is segmented on the basis of the following:

By Source Type

- Wood-Based

- Non-Wood Based

- Cotton Linters

- Hemp

- Sugar Beet Pulp

- Others

By Product Grade

- Pharmaceutical Grade

- Grade 101

- Grade 102

- Grade 105

- Food Grade

- Industrial Grade

- Other Grades

By Form

By Drying Process

By Application

- Pharmaceuticals

- Food & Beverages

- Dairy Products

- Bakery & Confectionery

- Meat & Poultry

- Personal Care & Cosmetics

- Skincare Products

- Oral Care

- Paints & Coatings

- Dyes & Pigments

- Others

Global Microcrystalline Cellulose Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to dominate the global microcrystalline cellulose (MCC) market as it holds 35.0% of the total market share by the end of 2025, due to its well-established pharmaceutical and nutraceutical industries, advanced food processing sector, and robust regulatory infrastructure. The U.S. Food and Drug Administration (FDA) has approved MCC in over 2,500 drug formulations, making it a standard excipient in tablets, capsules, and oral dosage forms. The region's aging population, with projections from the U.S. Census Bureau indicating that 1 in 5 Americans will be over 65 by 2030, has led to increased demand for chronic disease treatments, thereby driving MCC consumption in drug manufacturing.

Additionally, North America has a strong presence of major MCC producers with vertically integrated operations and direct partnerships with pharmaceutical giants. The U.S. Department of Energy reports that advancements in bio-based technologies have also improved MCC production sustainability by reducing energy consumption by 25% since 2015. Furthermore, consumer trends in clean-label foods and high-fiber diets boost MCC demand as a fat replacer and texture enhancer in low-calorie foods. With high R&D investment, regulatory clarity, and a mature manufacturing base, North America continues to lead the MCC market in both volume and revenue.

Region with the Highest CAGR

Asia Pacific is projected to register the highest compound annual growth rate (CAGR) in the microcrystalline cellulose (MCC) market due to rapid industrialization, pharmaceutical expansion, and evolving food and cosmetic industries. Emerging economies such as India, China, and Southeast Asian nations are witnessing rising demand for MCC in generic drug manufacturing and functional food production. According to India's CDSCO, MCC imports have grown by 18% year-over-year to support domestic pharmaceutical production.

China’s National Medical Products Administration (NMPA) has added new MCC monographs in its 2025 Pharmacopoeia, reflecting its increasing role in regulatory harmonization. The region's abundant availability of non-wood raw materials like bamboo, bagasse, and cotton linters has also opened new avenues for sustainable MCC sourcing.

Rising disposable income, dietary changes, and consumer preferences for processed food are contributing to MCC usage in the food sector. Simultaneously, increasing cosmetic consumption, particularly in South Korea and Japan, supports MCC use in skin-care and cosmetic powders. Strong government support for biotech and pharmaceutical growth makes Asia Pacific the fastest-growing MCC market globally.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Microcrystalline Cellulose Market: Competitive Landscape

The global microcrystalline cellulose market is moderately consolidated, with several multinational corporations and regional manufacturers competing based on product purity, application versatility, pricing, and regulatory compliance. Key players include DuPont de Nemours Inc., FMC Corporation, Asahi Kasei Corporation, JRS Pharma (J. Rettenmaier & Söhne), DFE Pharma, Roquette Frères, Sigachi Industries Ltd., Huzhou City Linghu Xinwang Chemical Co. Ltd., Mingtai Chemical Co. Ltd., and Wei Ming Pharmaceutical Co. Ltd.

These companies primarily focus on expanding their product portfolios through innovation and strategic investments in research and development. For instance, Roquette has invested in nanocellulose development for high-performance pharmaceutical applications, while Asahi Kasei has enhanced its excipient grades to meet Japanese and global regulatory requirements. Vertical integration and backward sourcing of raw materials (especially from wood pulp and non-wood biomass) help these firms maintain quality and cost efficiency.

Collaborations, geographic expansions, and acquisitions are common growth strategies. Sigachi Industries, for example, continues to expand its export footprint to North America and Europe. Furthermore, regulatory certifications like USP-NF, EP, JP, and WHO-GMP are essential competitive differentiators, as global clients demand excipients that comply with international standards. Sustainability and green manufacturing practices are emerging as new frontiers in competitive positioning.

Some of the prominent players in the Global Microcrystalline Cellulose Market are:

- DuPont de Nemours, Inc.

- JRS Pharma (J. Rettenmaier & Söhne GmbH + Co KG)

- DFE Pharma

- Asahi Kasei Corporation

- Roquette Frères

- Mingtai Chemical Co., Ltd.

- Accent Microcell Pvt. Ltd.

- FMC Corporation (now part of DuPont)

- The Dow Chemical Company

- Shandong Liaocheng E Hua Pharmaceutical Co., Ltd.

- Wei Ming Pharmaceutical Mfg Co., Ltd.

- Huzhou Zhanwang Pharmaceutical Co., Ltd.

- Blanver Farmoquímica Ltda.

- Sigachi Industries Ltd.

- Libraw Pharma

- Qufu Tianli Medical Products Co., Ltd.

- Juku Orchem Private Limited

- Anhui Sunhere Pharmaceutical Excipients Co., Ltd.

- Avantor, Inc.

- Tembec Inc. (now part of Rayonier Advanced Materials)

- Other Key Players

Recent Developments in the Global Microcrystalline Cellulose Market

June 2024

- Investment: The U.S. Department of Energy (DOE) announced a $25M grant to develop sustainable MCC production from agricultural waste, focusing on reducing reliance on wood pulp.

- Collaboration: DuPont (U.S.) and Roquette (France) partnered to co-develop next-generation MCC excipients for mRNA vaccine stabilization.

May 2024

- Conference: CPHI North America (Philadelphia) featured a dedicated session on MCC innovations in solid-dose pharmaceuticals, with presentations from FDA, USP, and major MCC suppliers.

- Merger: DFE Pharma (Germany) acquired a Brazilian MCC producer to expand its Latin American footprint in excipients.

April 2024

- Expo: Interphex 2024 (New York) showcased new MCC grades for continuous manufacturing, with Ashland, JRS Pharma, and Mingtai Chemical exhibiting.

- Investment: India’s Ministry of Chemicals & Fertilizers allocated ₹150 Cr (~$18M) to boost domestic MCC production under the Pharma Vision 2030 plan.

March 2024

- Collaboration: Japan’s RIKEN Institute and Shin-Etsu Chemical launched a joint research project on nanocrystalline MCC for regenerative medicine.

- Government Policy: The EU Commission updated REACH guidelines for sustainable cellulose sourcing, impacting MCC manufacturers.

February 2024

- Merger: IFF Health & Biosciences (U.S.) merged with Avantor’s excipient division, consolidating MCC supply chains for biopharma.

- Conference: Arab Health 2024 (Dubai) highlighted MCC’s role in Middle Eastern generic drug expansion, with the Saudi FDA announcing new excipient regulations.

January 2024

- Investment: China’s NMPA approved $50M in subsidies for local MCC producers to reduce import dependency.

- Expo: CES 2024 (Las Vegas) featured MCC-based biodegradable packaging startups, including CelluComp (UK) and Borregaard (Norway).

December 2023

- Collaboration: BASF (Germany) and Cargill (U.S.) partnered to develop MCC from corn stover for food and pharma applications.

- Government Grant: Canada’s NRC awarded $12M to CelluForce for nanocellulose commercialization, including MCC derivatives.

November 2023

- Conference: AAPS PharmSci 360 (Orlando) discussed MCC’s role in pediatric and geriatric formulations, with FDA participation.

- Merger: DOW Chemical acquired FMC’s excipient business, including MCC production assets.

October 2023

- Expo: CPhI Worldwide (Barcelona) saw JRS Pharma unveil Vivapur® MCC grades for high-speed tableting.

- Investment: Thailand’s Board of Investment (BOI) granted tax breaks to MCC producers to support ASEAN drug manufacturing.

September 2023

- Government Initiative: Brazil’s ANVISA fast-tracked approvals for local MCC suppliers to reduce drug production costs.

- Collaboration: Sigachi Industries (India) partnered with the University of Helsinki on MCC for nutraceutical applications.

August 2023

- Conference: IPEC-Americas Annual Meeting focused on MCC supply chain resilience, with USP and FDA speakers.

- Investment: Asahi Kasei (Japan) expanded MCC production capacity by 20% to meet Asia-Pacific demand.

July 2023

- Merger: Merck KGaA acquired Blanver Farmoquimica (Brazil), strengthening its MCC portfolio for generics.

- Expo: In-Cosmetics Asia (Bangkok) featured MCC in natural cosmetics, with Evonik and Ashland showcasing new grades.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 1,620.3 Mn |

| Forecast Value (2034) |

USD 3,182.4 Mn |

| CAGR (2025–2034) |

7.8% |

| The US Market Size (2025) |

USD 476.9 Mn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Source Type (Wood-Based, Non-Wood Based), By Product Grade (Pharmaceutical Grade, Food Grade, Industrial Grade, Other Grades), By Form (Powder, Liquid), By Drying Process (Bulk Drying, Spray Drying), By Application (Pharmaceuticals, Food & Beverages, Personal Care & Cosmetics, Paints & Coatings, Dyes & Pigments, Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

DuPont de Nemours, Inc., J. Rettenmaier & Söhne GmbH + Co KG (JRS Pharma), DFE Pharma GmbH & Co. KG, Asahi Kasei Corporation, Roquette Frères SA, Mingtai Chemical Co., Ltd., Accent Microcell Pvt. Ltd., FMC Corporation, The Dow Chemical Company, Shandong Liaocheng E Hua Pharmaceutical Co., Ltd., Wei Ming Pharmaceutical Manufacturing Co., Ltd., Huzhou Zhanwang Pharmaceutical Co., Ltd., Blanver Farmoquímica Ltda., Sigachi Industries Limited, Libraw Pharma, Qufu Tianli Medical Products Co., Ltd., Juku Orchem Private Limited, Anhui Sunhere Pharmaceutical Excipients Co., Ltd., Avantor, Inc., Tembec Inc. (a subsidiary of Rayonier Advanced Materials)., and Other Key Players

|

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Microcrystalline Cellulose Market size is estimated to have a value of USD 1,620.3 million in 2025 and is expected to reach USD 3,182.4 million by the end of 2034.

The US Microcrystalline Cellulose Market is projected to be valued at USD 476.9 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 901.2 million in 2034 at a CAGR of 7.3%.

North America is expected to have the largest market share in the Global Microcrystalline Cellulose Market with a share of about 35.0% in 2025.

Some of the major key players in the Global Microcrystalline Cellulose Market are DuPont de Nemours, Inc., J. Rettenmaier & Söhne GmbH + Co KG (JRS Pharma), DFE Pharma GmbH & Co. KG, Asahi Kasei Corporation, Roquette Frères SA, Mingtai Chemical Co., Ltd., Accent Microcell Pvt. Ltd., FMC Corporation, The Dow Chemical Company, and many others.

The market is growing at a CAGR of 7.8 percent over the forecasted period of 2025.