To efficiently counter these multifaceted threats, new armed forces need advanced communication capabilities. During growing conflicts, these systems play a major role in creating secure communication channels, allowing commanders to quickly issue orders & troops to share vital information.

Situational awareness, is critical for military effectiveness, depending heavily on live data transmission, with better communication systems made possible. Further, interoperability, mainly within different alliances, becomes a strategic necessity, as advanced military communication systems provide standardized protocols & compatibility, facilitating seamless collaboration among allied forces, which enhances collective defense efforts & bolsters deterrence strategies. In addition, emerging technologies like

Artificial Intelligence, satellite communication, & advanced encryption are important components of modern military communication.

However, military communication systems are important for contemporary defense operations, their initial costs can be challenging for governments & military organizations. The R&D, and procurement of enhanced military communication systems need high investments in advanced technology, which must undergo strict testing, integration, & customization to meet particular military needs.

Creating secure & highly robust communication networks can strain defense budgets. The fast speed of technological progress means that military organizations have to constantly invest in enhancing their communication infrastructure to remain relevant & effective, which can be financially challenging, mainly for governments facing budget constraints or competing defense priorities.

Research Scope and Analysis

By Component

Within the military communication market, the hardware segment takes the lead with the biggest market share in 2023 focusing on hardware encryption devices that safeguard sensitive information from unauthorized access & interception.

It includes different hardware tools utilized for military communication, like switches, antennas, satellite communication terminals, routers, radios, & network infrastructure. These devices are particularly designed to facilitate voice, data, & video communication, both in the field & within command centers.

In addition, the software component is anticipated for the fastest growth during the forecasted period. Military communication software contains applications & protocols customized for secure & efficient data transmission.

These software solutions often integrate authentication, encryption, & network management features to guarantee the confidentiality & reliability of communication. They allow military personnel to work efficiently, even when geographically dispersed, offering secure messaging platforms & unified communication tools that assist live communication & information sharing.

By Technology

In the military communication market, SATCOM takes the lead as a leading in terms of revenue share in 2023. SATCOM, or satellite communication, focuses on using satellites for long-distance communication & data transfer in military operations.

It creates global coverage, proving important for remote & mobile military missions. SATCOM systems deliver high bandwidth capabilities, accommodating a wide range of communication needs, from voice & data to video & secure military networks.

Moreover, data link technology is expected to experience significant growth in the coming future. Data links include different systems & protocols designed for secure & effective data exchange among military platforms, like aircraft, ships, & ground vehicles. Data links enable the real-time transmission of crucial tactical data, targeting data, sensor data, & more, allowing seamless coordination & swift decision-making during military operations.

By Platform

As a platform, the ground holds the largest market share in 2023 within the military communication market. Communication systems designed for ground platforms play a major role in providing & delivering voice & data communication, improving situational awareness, promoting coordination among military units, & building links with major command levels.

Further, the airborne platform segment is expected to have the most rapid growth in the coming future. Communication systems on airborne platforms are essential for critical tasks like air-to-ground, reconnaissance, & air-to-air communication, command & control, surveillance, & data transmission, which includes a wide range of military aircraft, like transport planes, helicopters, fighter jets, & unmanned aerial vehicles (UAVs), showcasing their significance in modern military operations.

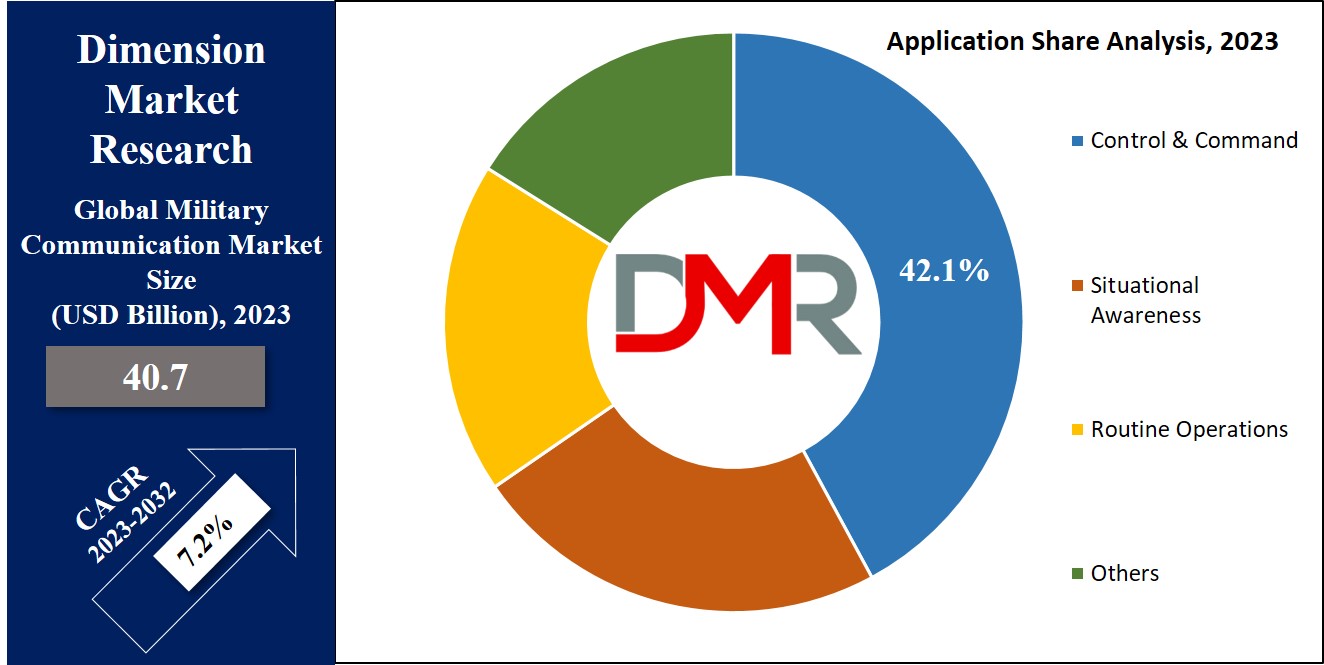

By Application

In the military communication market, the "command and control" application is a major driving factor to the growth of the market accounting for the major share of the market in 2023. Command and control, often referred to as C2, represent the essential communication systems & tools utilized by military leaders & decision-makers to oversee & guide military operations.

These systems play a major role in tactical data, transmitting orders, & strategic instructions, and ensuring well-coordinated & efficient responses to a range of threats & scenarios.

Further, the command-and-control application serves as the nerve center, allowing military authorities to make informed decisions, communicate critical directives, & adapt the actions of their forces for a unified and effective response to a variety of challenges and missions.

The Military Communication Market Report is segmented based on the following:

By Component

By Technology

- SATCOM

- HF Communication

- VHF/UHF/L-Band

- Data Link

By Platform

- Ground

- Airborne

- Naval

- Space

By Application

- Control & Command

- Situational Awareness

- Routine Operations

- Others

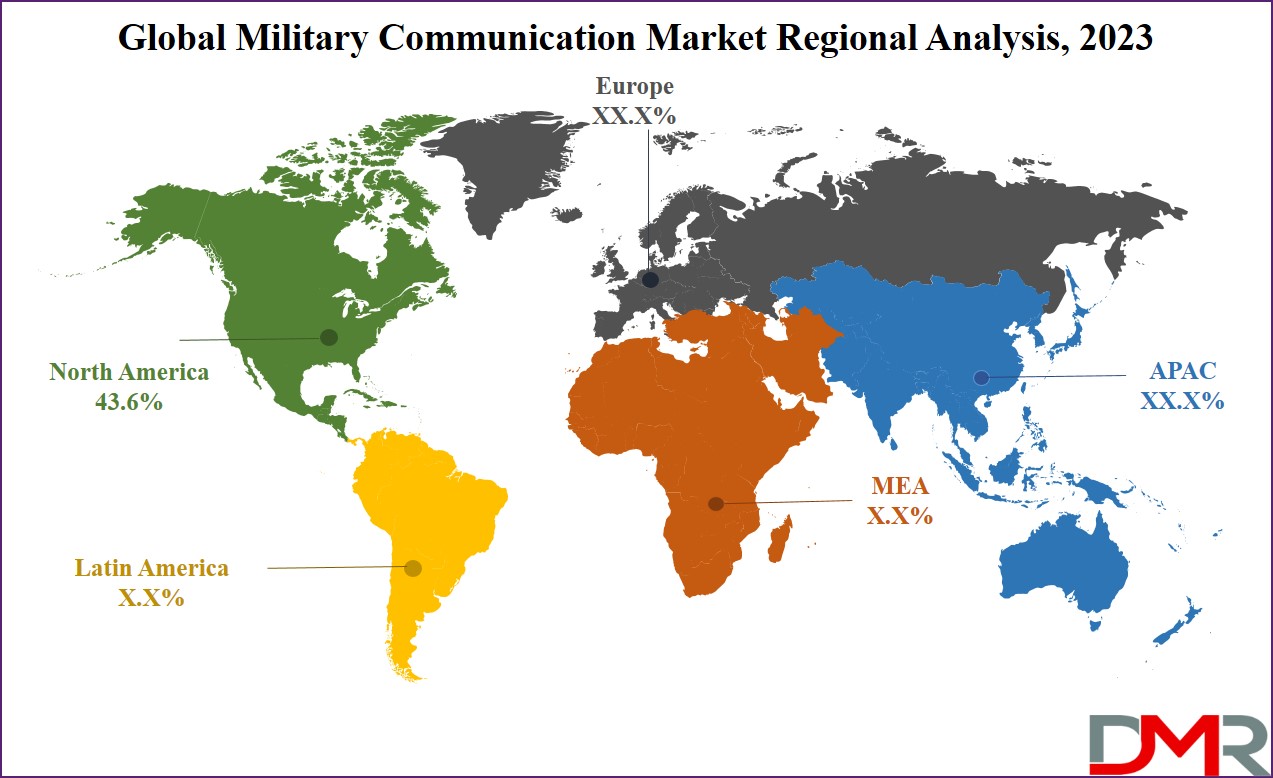

Regional Analysis

North America leads the military communication market with a dominant

43.6% share in 2023, due to the region's higher defense spending & the increasing use of technology in the defense sector. In addition, North America benefits from having a large number of communication equipment & system manufacturers, which further drives the growth of the military communication market in the region.

In addition, Europe is expected to witness notable growth in the military communication market, mainly because it hosts several naval and airborne communication solution manufacturers. These factors contribute to the region's expanding presence in the global military communication market during the forecast period.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The military communication market is quite concentrated, with a few big companies working hard to meet the rising demand for better communication systems and spending a lot on technology improvements. They also look to investments that will lead to more people using their products & their products becoming more highly used in the market, ultimately helping them expand their presence across the globe.

Like, in August 2022, BAE Systems introduced their latest deployable networking solution called NetVIPR, an advanced system designed to create smart & secure military communication networks that connect various devices, like drones, combat vehicles, fighter jets, & military command centers. It ensures seamless & safe information sharing across a broad range of military equipment, improving the overall effectiveness of communication within the armed forces.

Some of the prominent players in the global Military Communication Market are:

- General Dynamics

- BAE System PLC

- Northrop Grumman

- Thales Group

- Saab AB

- Honeywell International Inc

- Elbit Systems

- Aselsan A S

- Leonardo

- Cobham Ltd

- Other Key Players

COVID-19 Pandemic & Recession: Impact on the Global Military Communication Market:

The COVID-19 pandemic & its subsequent recession had a mixed impact on the global military communication market, as on one side governments faced economic challenges, leading to budget constraints, which affected military spending, and resulted in some delays in procurement & modernization efforts. On the other hand, the pandemic highlighted the importance of resilient & secure communication systems for military operations & disaster response.

As a result, there was a continuous investment in advanced communication technologies to improve the effectiveness of the armed forces. In the long term, while economic pressures pose challenges, the growing recognition of communication's important role in national security is expected to drive ongoing development & innovation in military communication systems.

| Report Characteristics |

| Market Size (2023) |

USD 40.7 Bn |

| Forecast Value (2032) |

USD 75.9 Bn |

| CAGR (2023-2032) |

7.2% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Component (Hardware and Software), By

Technology (SATCOM, HF Communication,

VHF/UHF/L-Band, and Data Link), By Platform

(Ground, Airborne, Naval, and Space), By Application

(Control & Command, Situational Awareness, Routine

Operations, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

General Dynamics, BAE System PLC, Northrop

Grumman, Thales Group, Saab AB, Honeywell

International Inc, Elbit Systems, Aselsan A S,

Leonardo, Cobham Ltd, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |