Market Overview

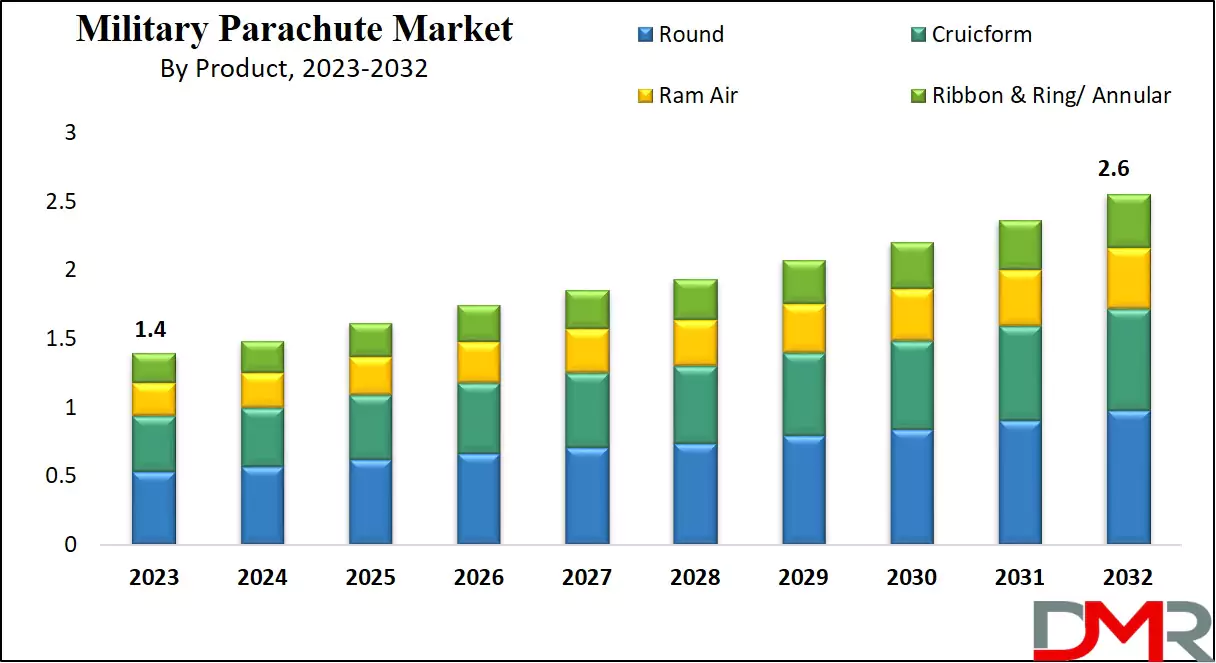

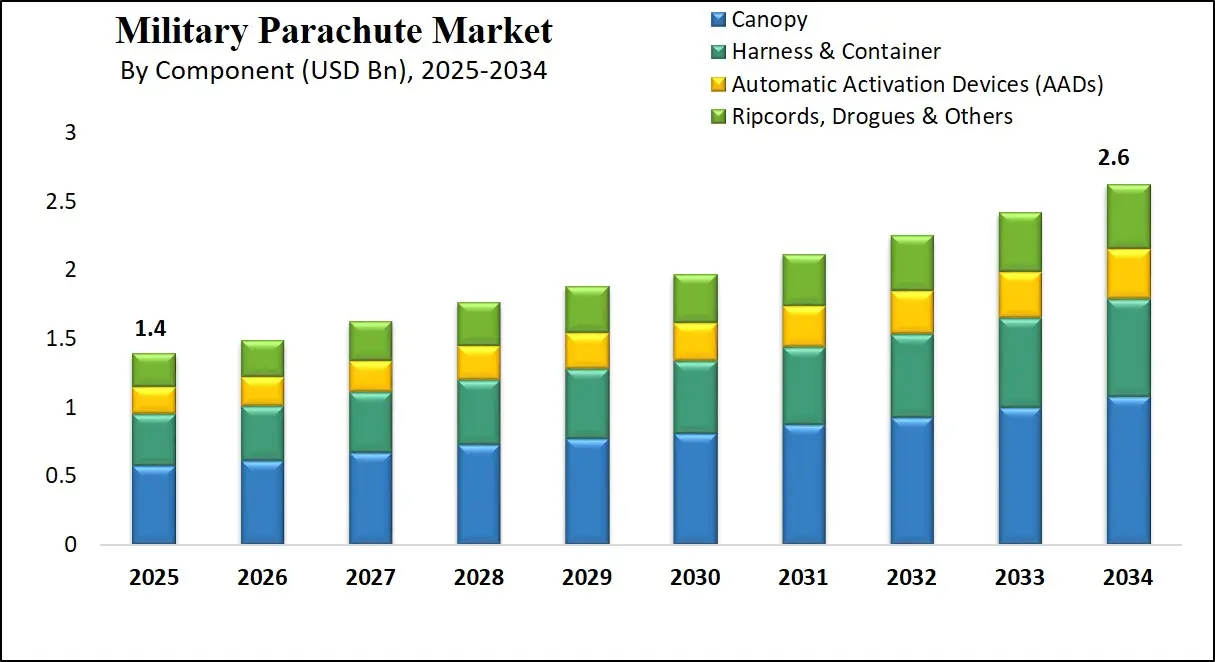

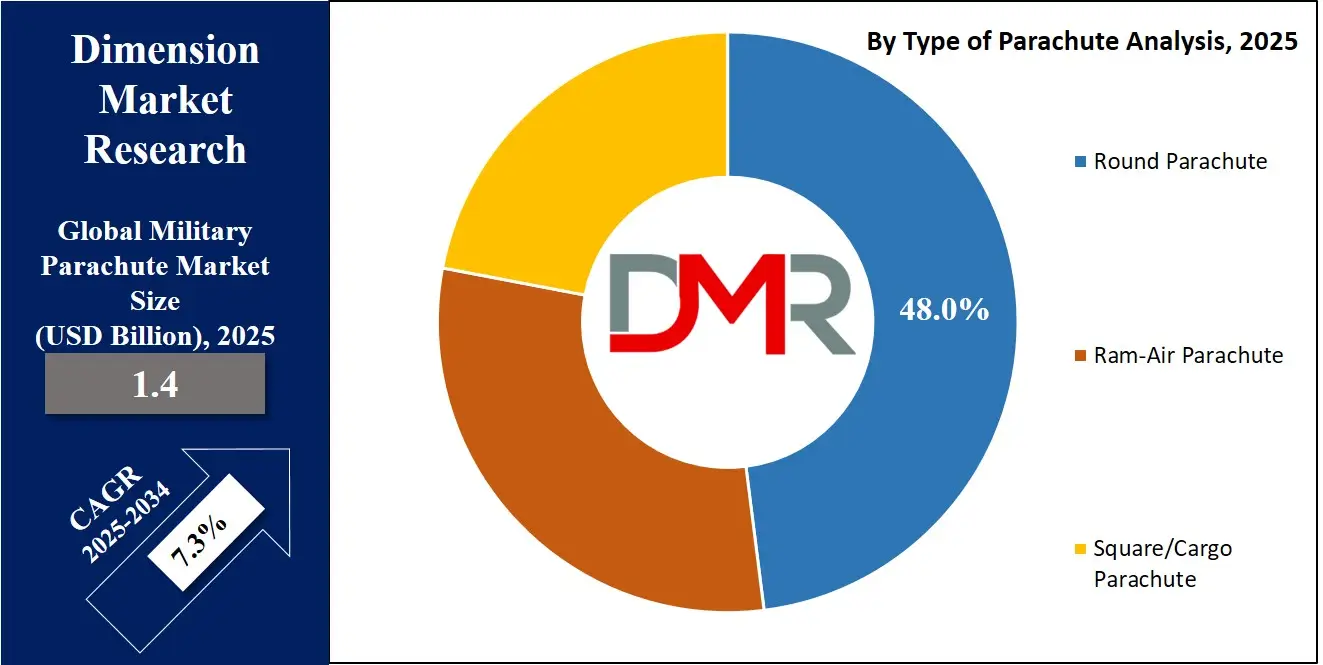

The global military parachute market is projected to reach USD 1.4 billion in 2025 and is expected to grow to USD 2.6 billion by 2034, expanding at a CAGR of 7.3%. Growth is driven by growing defense modernization, rising demand for tactical airborne systems, and advancements in personnel and cargo parachute technologies.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

A military parachute is a specialized aerial descent system designed for tactical use by armed forces to insert personnel, equipment, or supplies into designated zones, often in hostile or inaccessible environments. These parachutes are engineered with rugged, durable materials such as high-tenacity nylon or Kevlar to withstand extreme conditions and heavy loads. Military parachutes include various configurations like round, ram-air, and square canopies, each serving distinct purposes ranging from static line troop deployment to high-altitude precision drops.

Equipped with advanced components like harness systems, automatic activation devices, and deployment bags, they ensure safe and controlled descents in both combat and training scenarios. Used extensively in airborne operations, search and rescue missions, and rapid logistics deployment, military parachutes are a critical component of modern warfare mobility and strategic response.

The global military parachute market refers to the global industry focused on the development, production, and distribution of parachute systems specifically designed for defense applications. It encompasses a diverse range of products, including personnel parachutes, cargo delivery systems, and steerable tactical parachutes. With growing investments in defense modernization, rising cross-border tensions, and greater demand for rapid-response capabilities, nations across North America, Europe, Asia-Pacific, and the Middle East are enhancing their airborne insertion and resupply capacities.

The market is also influenced by technological innovations in lightweight fabrics, precision-guided airdrop systems, and autonomous parachute release mechanisms. Governments and defense agencies continue to collaborate with aerospace and tactical gear manufacturers to equip their forces with advanced aerial delivery solutions that ensure mission success under diverse terrain and weather conditions. Advancements in aerospace textiles and the increasing use of defense-grade materials highlight the role of innovation in reshaping future parachute performance.

In continuation, the growth of the global military parachute market is also being shaped by evolving warfare strategies that prioritize rapid mobility, stealth insertion, and support for special operations forces. As asymmetric threats and counterinsurgency operations increase, there is a greater emphasis on high-altitude low-opening (HALO) and high-altitude high-opening (HAHO) techniques, which require highly maneuverable and low-detection parachute systems.

Additionally, advancements in parachute design, such as modular harness systems, high-deployment accuracy, and reduced descent signatures, are gaining traction among elite airborne units. Integration of GPS-guided cargo parachutes and innovations in canopy aerodynamics are further enhancing mission efficiency and minimizing landing dispersion. As defense budgets rise globally and more countries aim to modernize their airborne forces, the demand for reliable, high-performance military parachutes is expected to continue its upward trajectory, supported by a strong pipeline of technological development and procurement initiatives.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The role of

Military Wearables and

Military Communication systems in conjunction with modern parachutes is also expanding, ensuring enhanced coordination, navigation, and soldier survivability during airborne missions. Similarly, developments in

Healthcare Fabrics for parachute harnesses and gear are improving comfort and durability, reflecting a convergence of defense and textile innovations.

The US Military Parachute Market

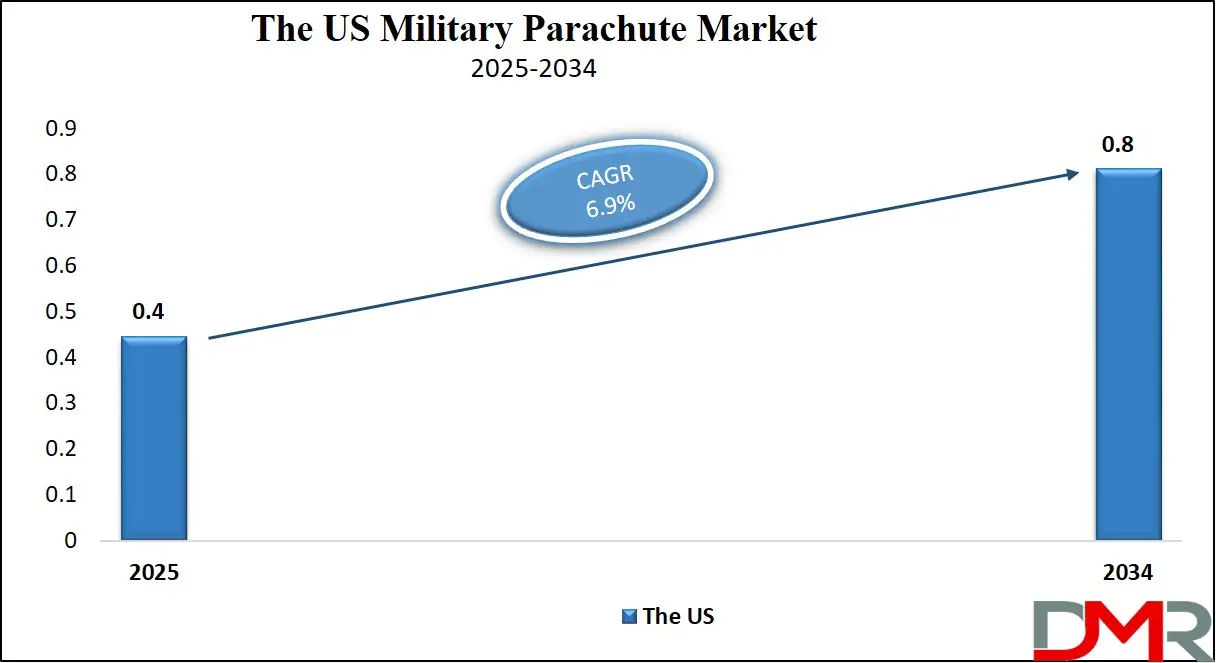

The U.S. Military Parachute Market size is projected to be valued at USD 400 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 800 million in 2034 at a CAGR of 6.9%.

The US military parachute market represents the most mature and technologically advanced segment within the global defense parachute industry. As the world's largest defense spender, the United States maintains a robust demand for next-generation parachute systems tailored for various mission profiles, including tactical troop insertion, high-altitude precision airdrops, and rapid cargo resupply.

The market benefits from strong government funding and consistent procurement cycles through defense programs managed by the Department of Defense (DoD), the US Army, and the United States Special Operations Command (USSOCOM). These programs focus on equipping airborne divisions and special forces with cutting-edge ram-air parachutes, static line systems, and steerable canopy designs. Enhanced safety systems such as automatic activation devices (AADs), GPS-guided cargo parachutes, and modular load-bearing harnesses are becoming standard in new acquisitions, emphasizing both operational efficiency and soldier survivability.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Innovation in the US military parachute sector is further fueled by collaboration with domestic aerospace and tactical gear manufacturers who prioritize materials science, aerodynamic stability, and weight optimization. Companies are integrating advanced textiles like ultra-high-molecular-weight polyethylene and heat-resistant Kevlar to create lighter yet more durable canopies capable of withstanding high-altitude environmental stress.

Moreover, the emphasis on multi-domain operations has led to a growing demand for low-visibility deployment systems used in covert operations, particularly by elite units like the Navy SEALs and Army Rangers. Ongoing R&D initiatives supported by DARPA and defense contractors are also contributing to the development of autonomous parachute release technologies and hybrid UAV-parachute systems for unmanned delivery. As military doctrines shift toward rapid deployment and expeditionary warfare, the US market is poised to remain a key driver of innovation and scale in the global military parachute landscape.

Europe Military Parachute Market

The Europe military parachute market is estimated to reach approximately USD 300 million in 2025. This strong position is supported by well-established defense industries, consistent government spending, and robust modernization efforts across major nations such as France, Germany, the United Kingdom, and Italy. These countries are investing heavily in enhancing their airborne infantry capabilities, including procurement of advanced personnel parachute systems, GPS-guided cargo delivery solutions, and specialized equipment for special operations forces. Europe’s involvement in NATO-led missions and rapid reaction forces also sustains demand for reliable, interoperable parachute technologies that align with collective defense standards.

With a projected CAGR of 6.5% from 2025 to 2034, the European market is poised for steady growth driven by cross-border collaboration, growing defense budgets, and rising geopolitical uncertainties. Countries in Eastern Europe, including Poland and the Baltic states, are also upgrading their tactical airborne systems in response to regional security concerns. The trend toward indigenizing military equipment production and the adoption of newer materials and deployment technologies are expected to further support market expansion. Additionally, ongoing investments in airborne troop training programs and joint exercises among EU and NATO allies continue to create favorable conditions for sustained procurement of high-performance military parachute systems across the region.

Japan Military Parachute Market

Japan’s military parachute market is projected to reach approximately USD 100 million in 2025, accounting for about 7% of the Asia-Pacific market and a growing share of the global total. This reflects Japan’s strategic shift toward strengthening its airborne and rapid deployment capabilities in response to evolving regional security challenges, particularly in the Indo-Pacific. The Japan Ground Self-Defense Force (JGSDF) has increased its focus on paratrooper units, airborne insertion exercises, and the procurement of advanced parachute systems for both personnel and cargo missions. This includes the integration of steerable ram-air canopies and static line systems for rapid and precise troop deployment, supporting Japan’s broader defense readiness posture.

With a forecasted CAGR of 8.2% from 2025 to 2034, Japan’s military parachute market is expected to grow at a pace above the global average. This is fueled by ongoing defense reforms, expanding military budgets, and the introduction of new technologies aligned with Japan’s strategy of proactive deterrence. Partnerships with domestic aerospace firms and increased investments in R&D for lightweight, high-durability materials are contributing to the development of indigenous parachute systems. Additionally, Japan's participation in joint military drills with allies such as the United States has led to greater standardization and demand for advanced airborne systems that meet international interoperability standards, further accelerating market momentum.

Global Military Parachute Market: Key Takeaways

- Market Value: The global military parachute market size is expected to reach a value of USD 2.6 billion by 2034 from a base value of USD 1.4 billion in 2025 at a CAGR of 7.3%.

- By Type of Parachute Segment Analysis: Round Parachutes are anticipated to dominate the type of parachute segment, capturing 48.0% of the total market share in 2025.

- By Component Segment Analysis: Canopies are poised to consolidate their dominance in the component segment, capturing 41.0% of the total market share in 2025.

- By Fabric Material Segment Analysis: Nylon will lead in the fabric material segment, capturing 62.0% of the market share in 2025.

- By Deployment Mechanism Segment Analysis: Static Line deployment mechanism is expected to maintain its dominance in the deployment mechanism segment, capturing 60.0% of the total market share in 2025.

- By Application Segment Analysis: Personnel Deployment applications will dominate the application segment, capturing 55.0% of the market share in 2025.

- By End-User Segment Analysis: The Army will lead the end-user segment, capturing 65.0% of the market share in 2025.

- Regional Analysis: North America is anticipated to lead the global military parachute market landscape with 38.0% of total global market revenue in 2025.

- Key Players: Some key players in the global military parachute market are Airborne Systems, Safran Electronics & Defense, FXC Corporation, Mills Manufacturing Corporation, Butler Parachute Systems, Spekon GmbH, Parachute Systems, BAE Systems, Ballenger International, Zodiac Aerospace, Cimsa Ingenieria de Sistemas, Parachute Industry Association (PIA) affiliated manufacturers, and Other Key Players.

Global Military Parachute Market: Use Cases

- Tactical Personnel Insertion in Combat Zones: Military parachutes are a critical component in deploying troops directly into active or contested areas where conventional transportation methods are unfeasible. In operations requiring rapid force projection, static line parachutes are used to drop large units of soldiers at low altitudes for fast ground engagement. In contrast, high-altitude high-opening (HAHO) and high-altitude low-opening (HALO) techniques enable special operations forces to infiltrate deep into enemy territories with minimal radar detection. These methods rely heavily on steerable ram-air parachutes for controlled descent, accuracy, and low-visibility approaches. The demand for advanced tactical parachute systems is growing as modern combat scenarios involve unpredictable, asymmetric warfare and rapid-response missions.

- Aerial Resupply and Cargo Airdrop Operations: Military parachutes are extensively used for logistics support through cargo airdrop systems, enabling the delivery of critical supplies such as food, ammunition, medical aid, and equipment to troops stationed in remote or combat-heavy zones. Using square or cruciform canopy systems, cargo parachutes are deployed from transport aircraft like the C-130 Hercules or C-17 Globemaster. Advanced airdrop technologies such as Joint Precision Airdrop System (JPADS), integrated with GPS and autonomous navigation, enhance drop accuracy while reducing dispersion radius. These solutions are vital for sustaining operations in mountainous terrain, desert environments, or disaster-affected regions where ground access is compromised.

- Search and Rescue (SAR) and Humanitarian Missions: Military parachutes also play an essential role in non-combat missions, particularly in search and rescue operations and humanitarian relief efforts. Parachute systems are deployed to insert SAR teams, medics, or life-saving equipment in inaccessible or disaster-struck areas. For example, during earthquake or flood emergencies, air-dropping rescue kits and medical supplies becomes crucial for survival until further aid arrives. Personnel parachutes used in these missions prioritize safety, ease of deployment, and low-opening altitude capability, often incorporating automatic activation devices to ensure deployment in emergency scenarios. The growing frequency of climate-related disasters is boosting demand for such versatile, dual-use parachute systems.

- Training and Simulation for Airborne Units: A consistent use case for military parachutes is in the training and simulation of airborne units, ensuring combat readiness and proficiency in parachuting operations. Armed forces around the world maintain rigorous jump training programs that include static line jumps, free-fall simulation, and night-time insertion exercises. These programs use high-durability training parachutes designed to withstand repetitive use while mimicking real combat conditions. Advanced training environments often integrate virtual reality systems with real parachute descents to simulate battlefield scenarios, wind conditions, and obstacle navigation. Investment in parachute-based training programs is essential to maintain elite readiness among paratroopers and special forces, reinforcing the ongoing need for reliable and safe parachuting equipment.

Impact of Artificial Intelligence on Military Parachute Market

- AI-Driven Materials Innovation and Lightweight Design: AI-enhanced materials science tools are enabling manufacturers to explore advanced fibers and fabric weaves for parachutes that balance strength, weight, and durability. Machine learning algorithms analyze performance data from composites, ripstop nylons, and specialized weaves to identify optimal material blends. This results in parachute canopies that maintain tensile strength while reducing weight, improving load capacity, maneuverability, and portability in military missions.

- Automated Quality Control and Defect Detection: Integrating AI and computer vision systems into production lines enables real-time detection of defects, such as stitching errors, fabric tears, or seam inconsistencies, that are often missed by manual inspection. High-resolution imaging systems, coupled with deep learning, can identify microscopic flaws and predict material wear. This automation enhances safety, reduces rework, and ensures consistent quality for military personnel relying on life-critical parachute equipment.

- Simulation-Based Deployment Optimization: AI-powered simulation platforms enable parachute engineers to model complex deployment scenarios, including high-wind jumps, high-altitude drops, and varying payload configurations. Reinforcement learning models help in tuning canopy aperture, suspension line configuration, and descent maneuver parameters. As a result, performance is optimized for accuracy, stability, and reduced oscillation in combat and emergency situations.

- Predictive Maintenance and Lifecycle Monitoring: Military parachutes require strict maintenance schedules to ensure reliability. AI systems process log data from deployments, including canopy usage, deployment frequency, descent dynamics, and environmental conditions, to forecast component fatigue, wear rates, and replacement intervals. Predictive insights allow logistics and maintenance teams to preemptively service or replace parts before failure, ensuring mission readiness and reducing logistics strain.

Global Military Parachute Market: Stats & Facts

-

United States – Department of Defense (DoD), GAO, FPDS, and Budget Documents

- In FY2024, the DoD awarded a contract to Complete Parachute Solutions, Inc. for military parachute systems.

- FY2023 saw a contract awarded to Paradigm Parachute & Defense Inc. for parachute procurement.

- The Army and Marine Corps planned to spend nearly USD 150 million to replace aging free-fall parachute systems.

- Free-fall parachutes in U.S. service typically have a 12–15 year service life.

- Both systems meet operational requirements for glide distance and payload.

- Parachute system replacement plans include thousands of units across both services.

- The Mil Free Fall Advanced Ram Parachute System is tracked via FPDS as of July 2024.

- JPADS integrates GPS, steerable parachutes, and onboard computers.

- T-11 parachute systems are actively used by both U.S. and Canadian military.

- T-11 main canopy is 30.6 ft, reserve canopy 24 ft, and full rig weight is 53 lbs.

- T-11 reduces descent speed to 19 ft/s, compared to 24 ft/s in earlier versions.

- T-11 systems reduce landing injuries by minimizing opening shock and oscillation.

- Relocating the U.S. parachute test range could save USD 2.6 million annually.

- Equipment relocation to a new test facility could save USD 1.7 million.

- FY2025 Army aircraft procurement budget: USD 3.2 billion.

- Navy aircraft procurement budget: USD 16.5 billion.

- Air Force aircraft procurement budget: USD 22.0 billion.

- Defense-Wide aircraft procurement: USD 5.7 billion.

- Total DoD procurement funding for FY2025: USD 176 billion.

- FY2023 NDAA includes funds for combat rescue systems and pararescue equipment.

- U.S. defense parachute procurement can be exempt from Buy-American rules under DFARS public interest clauses.

-

Belgium and Montenegro – Equipment Modernization Plans

- Montenegro and Belgian Armed Forces listed G-12 parachutes under their equipment modernization programs.

-

NATO – WMEAT and Allied Military Data

- NATO member defense personnel statistics include airborne capability funding across joint operations.

Global Military Parachute Market: Market Dynamics

Global Military Parachute Market: Driving Factors

Rising Global Defense Spending and Modernization Programs

As nations increase their defense budgets to address regional threats, insurgencies, and evolving warfare tactics, there is a strong push toward modernizing airborne assault and logistics capabilities. Countries like the US, China, India, and France are heavily investing in new-generation parachute systems to enhance rapid deployment forces. These investments include procurement of tactical airdrop systems, GPS-guided cargo parachutes, and advanced personnel insertion gear, creating sustained demand in the military parachute market.

Growing Demand for Special Operations and Covert Insertion Capabilities

Modern combat operations emphasize agility and stealth, leading to increased reliance on special operations forces that require HALO and HAHO capabilities. Ram-air parachutes and low-signature descent systems are crucial for these missions. As unconventional warfare and counterterrorism operations become more prevalent, militaries are prioritizing parachute systems that offer precision, mobility, and low detection, significantly driving market growth.

Global Military Parachute Market: Restraints

High Cost of Advanced Parachute Systems and Maintenance

While demand is strong, the cost of manufacturing advanced parachute systems, especially those integrated with navigation and automatic deployment features, is relatively high. Additionally, maintenance, repacking, and certification of military-grade parachutes require specialized personnel and infrastructure. These factors can hinder procurement in countries with limited defense budgets or inconsistent military spending.

Risk Factors and Safety Concerns in Combat Parachuting

Despite technological advancements, parachuting in military contexts carries inherent risks such as deployment failure, weather interference, or landing injuries. These concerns can lead to operational hesitation in certain regions or limit the adoption of airborne insertion tactics in non-elite units. Stringent safety testing and regulatory approvals can also delay market penetration of new systems.

Global Military Parachute Market: Opportunities

Integration of AI and Autonomous Systems in Airdrop Technologies

The integration of AI and autonomous controls in parachute deployment mechanisms presents a major growth opportunity. Intelligent systems can guide cargo or personnel to precise coordinates with minimal human input, reducing error rates and enhancing operational efficiency. This technology is especially valuable in denied or GPS-jammed environments, where real-time course correction is vital for mission success.

Expanding Use of Military Parachutes in Disaster Relief and Civil Emergencies

Beyond traditional combat roles, military parachutes are used in non-combat applications such as humanitarian aid delivery and emergency response. Governments and international organizations are deploying airborne logistics systems to deliver critical supplies in disaster-hit zones. This expansion of application beyond defense missions opens up new revenue streams and encourages cross-sector partnerships.

Global Military Parachute Market: Trends

Development of Ultralight and Modular Parachute Systems

Recent innovations are focused on reducing the weight and bulk of parachute systems without compromising on performance. Manufacturers are leveraging advanced synthetic fabrics and modular harness setups to create customizable solutions for various mission types. These ultralight systems are favored by special forces and rapid response units operating in diverse terrains.

Emphasis on Joint Military Training and Parachute Drills

Multinational military alliances such as NATO and Indo-Pacific partnerships are conducting joint airborne exercises and parachute drills. These cooperative efforts are driving the standardization of tactical parachute systems and boosting demand across allied nations. Moreover, training programs require a consistent supply of reliable parachutes, further stimulating production and innovation in the sector.

Global Military Parachute Market: Research Scope and Analysis

By Type of Parachute Analysis

In the type of parachute segment, round parachutes are projected to hold the leading position in the global military parachute market, accounting for approximately 48.0% of the total market share in 2025. This dominance is largely attributed to their widespread use in mass troop deployment and training exercises across conventional military forces. Round parachutes are known for their high-drag, stable descent, and simplicity in design, making them ideal for static line jumps from low altitudes.

They are cost-effective, easy to manufacture, and require minimal training for operation, which adds to their appeal, particularly for large-scale airborne infantry units and logistics operations in defense organizations with traditional jump doctrines.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

On the other hand, ram-air parachutes represent a growing and highly specialized segment within the market. These parachutes feature a rectangular, airfoil-shaped canopy that allows for greater maneuverability, glide control, and soft landings. Ram-air systems are primarily used by special operations forces and elite military units who conduct high-altitude missions such as HALO (high-altitude low-opening) and HAHO (high-altitude high-opening) jumps.

They enable precise navigation and silent insertion into hostile or remote territories, which is critical for covert missions. Although their market share is lower compared to round parachutes, ram-air systems are gaining traction due to growing demand for stealth, precision, and flexibility in modern warfare scenarios. Their adoption is expected to grow steadily as defense forces globally invest in advanced parachuting capabilities for both personnel and specialized equipment deployment.

By Component Analysis

In the component segment of the military parachute market, canopies are expected to maintain a dominant position, securing approximately 41.0% of the total market share in 2025. The canopy serves as the core functional element of any parachute system, responsible for creating the aerodynamic drag that enables safe and controlled descent.

Military canopies are designed using high-strength, lightweight fabrics such as ripstop nylon or advanced composites like Kevlar to ensure durability under extreme operational conditions. The evolution of canopy technology has led to the development of various configurations, including round, ram-air, and cruciform designs, each tailored for specific missions ranging from mass troop deployments to high-altitude precision jumps. Due to their critical role in performance, safety, and mission adaptability, canopies receive a significant portion of investment and innovation in parachute system development.

Alongside canopies, the harness and container segment plays an essential supporting role in the deployment and operational safety of military parachutes. The harness is the wearable structure that secures the parachutist to the canopy system, distributing load evenly during deployment and descent. The container houses the packed parachute and includes key deployment mechanisms such as pilot chutes, release handles, and, in some systems, automatic activation devices. These components are engineered for both comfort and operational reliability, especially in high-risk missions.

In recent years, modular and ergonomic harness designs have become important for special forces, allowing for better mobility, faster gear adjustments, and integration with additional tactical equipment. Although not as prominent as canopies in terms of market share, the harness and container systems are indispensable in ensuring deployment accuracy and reducing injury risk during military operations.

By Fabric Material Analysis

In the fabric material segment of the military parachute market, nylon is projected to lead significantly, accounting for 62.0% of the market share in 2025. Nylon has long been the preferred material for military parachutes due to its excellent combination of strength, flexibility, and resistance to environmental stress. It offers a high strength-to-weight ratio, which is crucial for ensuring safe descent without adding unnecessary bulk.

Nylon canopies are also relatively easy to manufacture, cost-effective, and perform well under various weather conditions, making them highly suitable for both personnel and cargo parachutes. Its ability to resist moisture, abrasions, and UV degradation has cemented its role as the dominant material used in round, ram-air, and cruciform parachute designs across global armed forces.

Kevlar, although used less widely than nylon, represents a high-performance material in the military parachute market, especially in applications where durability and heat resistance are critical. Known for its exceptional tensile strength and resistance to high temperatures, Kevlar is used in parachutes designed for more extreme or specialized missions.

These include high-speed deployments, operations involving drag chutes for aircraft recovery, or environments where additional strength and minimal stretch are required. Kevlar's high cost and relatively lower flexibility compared to nylon limit its usage to niche applications, often within special operations or aerospace recovery systems. However, its unmatched protective qualities make it a valuable material where mission success and survivability depend on superior parachute fabric performance.

By Deployment Mechanism Analysis

In the deployment mechanism segment of the military parachute market, the static line deployment method is anticipated to retain its dominance, accounting for 60.0% of the total market share in 2025. Static line parachuting is widely used by military forces for mass troop deployment, especially during low-altitude jumps from transport aircraft.

The system is designed so that the parachute is automatically deployed as the jumper exits the aircraft, eliminating the need for manual intervention. This ensures consistency, reduces training complexity, and allows for rapid insertion of large numbers of personnel in coordinated operations. Static line systems are typically paired with round canopies and are highly valued for their reliability and simplicity, making them a staple in airborne infantry and basic training programs globally.

In contrast, free-fall (manual) deployment mechanisms are employed in more advanced and specialized military operations. These systems require the parachutist to manually activate the parachute after exiting the aircraft, allowing for greater control over timing and descent path. Commonly used in high-altitude jumps such as HALO and HAHO operations, manual free-fall deployment is essential for missions that demand stealth, precision, and flexibility.

The technique is favored by special forces and reconnaissance units due to its capability to cover long distances during descent and avoid detection. While its adoption is more limited compared to static line deployments, the growing emphasis on unconventional warfare and covert insertion is driving growth in this segment, supported by advancements in automatic activation devices and steerable ram-air canopy systems.

By Application Analysis

In the application segment of the military parachute market, personnel deployment is projected to dominate with 55.0% of the total market share in 2025. This significant share is primarily driven by the continued reliance of armed forces on airborne troops for rapid-response missions, large-scale tactical insertions, and special operations.

Parachute systems used for personnel deployment include both static line and free fall types, depending on the mission profile. Round parachutes are typically used for standard low-altitude jumps, while ram-air canopies are favored by elite units for high-altitude, high-precision descents. The demand for safe, reliable, and maneuverable parachute systems is closely tied to military training programs, force readiness strategies, and the need to access remote or conflict-prone areas without conventional transport infrastructure.

Cargo deployment is another crucial application in the military parachute market, accounting for a substantial portion of the remaining share. It involves the airdrop of supplies, equipment, vehicles, and humanitarian aid using specialized cargo parachutes designed to handle heavy payloads and ensure controlled descent.

These systems are integral to supporting forward-operating bases, disaster relief missions, and wartime logistics where ground access is restricted or unsafe. Advances in precision airdrop technology, such as GPS-guided systems and autonomous release mechanisms, have significantly enhanced the accuracy and reliability of cargo delivery. As military logistics emphasize speed and flexibility, cargo parachutes play a vital role in sustaining operations across diverse terrains and combat scenarios.

By End-User Analysis

In the end-user segment of the military parachute market, the army is expected to dominate, capturing 65.0% of the total market share in 2025. This dominance is driven by the army’s extensive use of parachute systems for both routine training and operational deployments. Ground forces rely heavily on airborne capabilities to insert troops, deliver supplies, and support tactical maneuvers in diverse combat environments.

Large infantry units, airborne brigades, and special operations teams within the army regularly conduct static line jumps and HALO/HAHO missions using a range of parachute systems tailored to mission-specific needs. Additionally, armies across various countries are investing in modernizing their airborne equipment to support faster deployment, improved maneuverability, and enhanced soldier safety, which further contributes to the segment’s leading position.

The air force, while having a smaller market share in comparison, plays a crucial and specialized role in the military parachute ecosystem. Air forces primarily focus on aerial delivery operations, search and rescue missions, and the insertion of specialized units via high-altitude platforms. They are often responsible for the deployment of paratroopers from military transport aircraft and are also involved in dropping critical supplies to isolated or combat-intensive zones.

In addition, air force personnel such as pararescuemen and special tactics teams undergo advanced parachute training and utilize high-performance systems like ram-air parachutes for precision landings. With growing emphasis on multi-domain operations and rapid force projection, the Air Force continues to expand its use of specialized parachuting technologies to complement its broader strategic and tactical objectives.

The Military Parachute Market Report is segmented on the basis of the following

By Type of Parachute

- Round Parachute

- Ram-Air Parachute

- Square/Cargo Parachute

By Component

- Canopy

- Harness & Container

- Automatic Activation Devices (AADs)

- Ripcords, Drogues & Others

By Fabric Material

- Nylon

- Kevlar

- Polyester & Others

By Deployment Mechanism

- Static Line

- Free Fall (Manual)

By Application

- Personnel Deployment

- Cargo Deployment

- Training Purposes

By End-User

- Army

- Air Force

- Navy/Marines

Global Military Parachute Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to lead the global military parachute market in 2025, accounting for 38.0% of the total global market revenue. This dominance is largely driven by the United States, which allocates the highest defense budget globally and maintains a strong focus on modernizing its airborne forces.

The region benefits from a well-established defense industrial base, advanced R&D infrastructure, and active procurement programs through the Department of Defense. High demand for troop insertion systems, precision airdrop technologies, and specialized parachutes for special operations forces contributes to sustained market growth. Additionally, strategic collaborations between the military and domestic manufacturers in the U.S. and Canada ensure continuous innovation and supply chain resilience, reinforcing North America's leadership in this market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

The Asia-Pacific region is expected to register the highest CAGR in the global military parachute market during the forecast period, driven by growing defense expenditures, modernization initiatives, and expanding airborne capabilities among emerging economies. Countries such as China, India, South Korea, and Australia are significantly enhancing their special forces and rapid deployment units, fueling demand for advanced parachute systems, including steerable ram-air canopies and GPS-guided cargo delivery solutions.

The region’s focus on strengthening border security, participating in multinational defense exercises, and investing in indigenous production capabilities is accelerating the adoption of both personnel and cargo parachutes, positioning Asia-Pacific as the fastest-growing market in terms of both value and innovation.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Military Parachute Market: Competitive Landscape

The global competitive landscape of the military parachute market is characterized by a mix of established defense contractors and specialized airborne systems manufacturers competing across product innovation, customization, and defense partnerships. Leading players such as Airborne Systems, Safran Electronics & Defense, and BAE Systems dominate through large-scale defense contracts, comprehensive product portfolios, and long-standing ties with government agencies

Meanwhile, niche manufacturers like Mills Manufacturing, Butler Parachute Systems, and Precision Aerodynamics focus on high-performance solutions tailored for special operations, training, and cargo deployment. The market is marked by continuous R&D in lightweight materials, autonomous deployment technologies, and enhanced canopy designs. Strategic collaborations, military modernization programs, and growing emphasis on indigenous manufacturing across countries like the U.S., India, and China are intensifying competition, fostering regional supply chain development, and encouraging innovation in both legacy and emerging defense firms.

Some of the prominent players in the global military parachute market are

- Airborne Systems

- Safran Electronics & Defense

- FXC Corporation

- Mills Manufacturing Corporation

- Butler Parachute Systems

- Spekon GmbH

- Parachute Systems

- BAE Systems

- Ballenger International

- Zodiac Aerospace

- Cimsa Ingenieria de Sistemas

- Parachute Industry Association (PIA) affiliated manufacturers

- The Aerial Delivery Research and Development Establishment (ADRDE - DRDO, India)

- Skydiving Equipment LLC

- Performance Designs, Inc.

- National Parachute Industries, Inc.

- GALAXY GRS

- OMEGA Parachutes

- Strong Enterprises

- Precision Aerodynamics

- Other Key Players

Global Military Parachute Market: Recent Developments

- June 2025: ParaZero introduced its SafeAir M4 parachute recovery system, designed for DJI Matrice 4 drones, featuring automotive airbag‑inspired rapid deployment for improved UAV operational safety.

- March 2025: Safran Electronics & Defense secured a contract with France’s DGA to deliver its Multi‑Mission Parachute (PMM), a next‑generation two‑seat system enhancing airborne insertion capabilities.

- November 2023: SpaceX acquired Pioneer Aerospace’s assets, a supplier of drogue and recovery parachutes, for USD 2.2 million through a bankruptcy sale, strengthening its parachute production portfolio.

- May 2023: Paradigm Parachute & Defense expanded its operations by acquiring assets from ASR‑Pioneer, Airlift Technologies, and Strong Enterprises in a USD 2.25 million deal.

- June 2025: European defense tech startups, including dual‑use aerial delivery firms, attracted over USD 1 billion in VC investment in 2024, with renewed momentum from increased defense spending and EU funds.

- May 2024: Paradigm Parachute & Defense secured USD 1.75 million in senior secured notes from Carofin to boost production capacity and fulfill a growing contract backlog.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 1.4 Bn |

| Forecast Value (2034) |

USD 2.6 Bn |

| CAGR (2025–2034) |

7.3% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 0.4 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type of Parachute (Round Parachute, Ram-Air Parachute, Square/Cargo Parachute), By Component (Canopy, Harness & Container, Automatic Activation Devices (AADs), Ripcords, Drogues & Others), By Fabric Material (Nylon, Kevlar, Polyester & Others), By Deployment Mechanism (Static Line, Free Fall (Manual)), By Application (Personnel Deployment, Cargo Deployment, Training Purposes), and By End-User (Army, Air Force, Navy/Marines) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Airborne Systems, Safran Electronics & Defense, FXC Corporation, Mills Manufacturing Corporation, Butler Parachute Systems, Spekon GmbH, Parachute Systems, BAE Systems, Ballenger International, Zodiac Aerospace, Cimsa Ingenieria de Sistemas, Parachute Industry Association (PIA) affiliated manufacturers, and Other Key Players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global military parachute market?

▾ The global military parachute market size is estimated to have a value of USD 1.4 billion in 2025 and is expected to reach USD 2.6 billion by the end of 2034.

What is the size of the US military parachute market?

▾ The US military parachute market is projected to be valued at USD 0.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 0.8 billion in 2034 at a CAGR of 6.9%.

Which region accounted for the largest global military parachute market?

▾ North America is expected to have the largest market share in the global military parachute market, with a share of about 38.0% in 2025.

Who are the key players in the global military parachute market?

▾ Some of the major key players in the global military parachute market are Airborne Systems, Safran Electronics & Defense, FXC Corporation, Mills Manufacturing Corporation, Butler Parachute Systems, Spekon GmbH, Parachute Systems, BAE Systems, Ballenger International, Zodiac Aerospace, Cimsa Ingenieria de Sistemas, Parachute Industry Association (PIA) affiliated manufacturers, and Other Key Players.

What is the growth rate of the global military parachute market?

▾ The market is growing at a CAGR of 7.3 percent over the forecasted period.