Market Overview

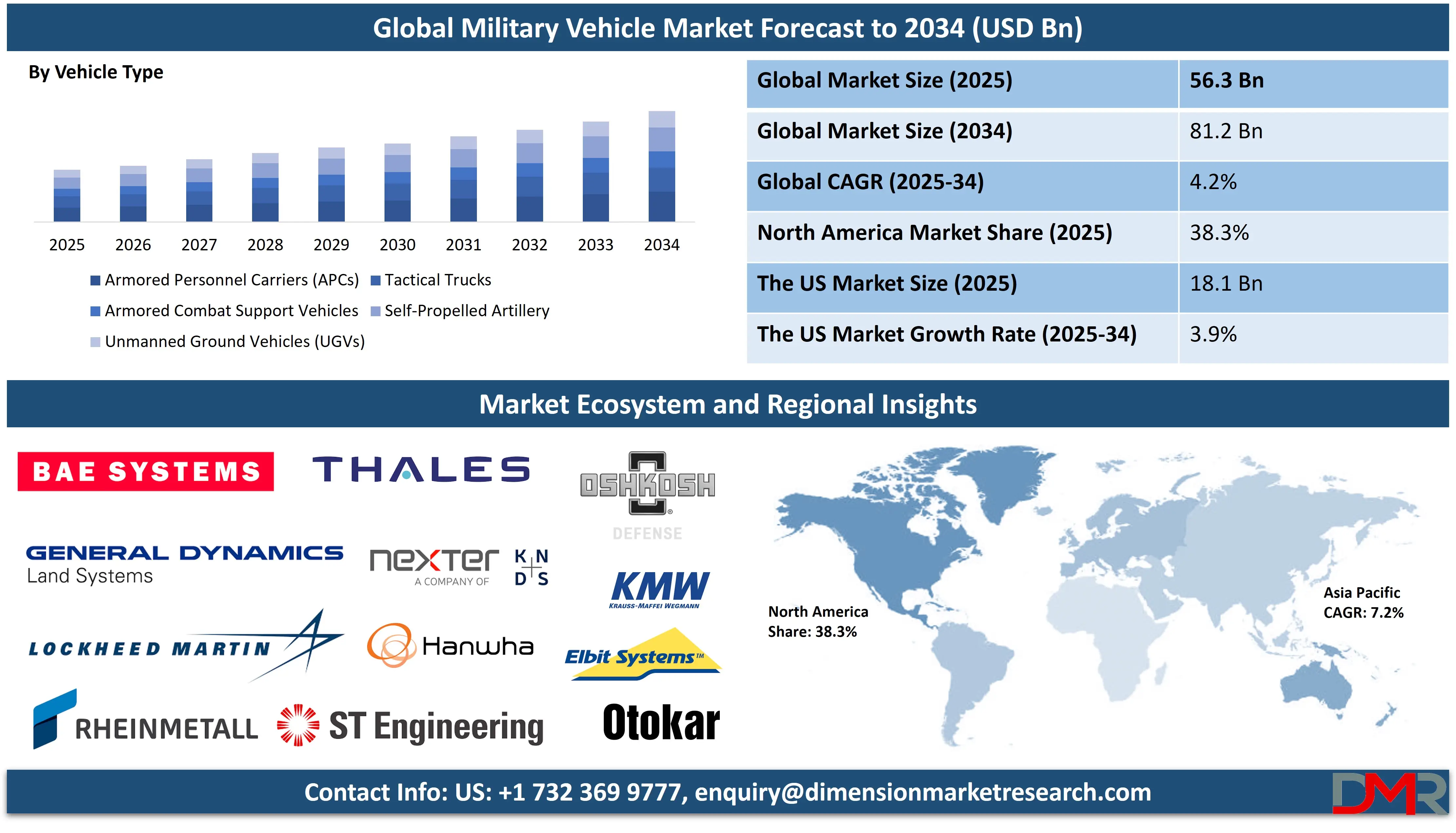

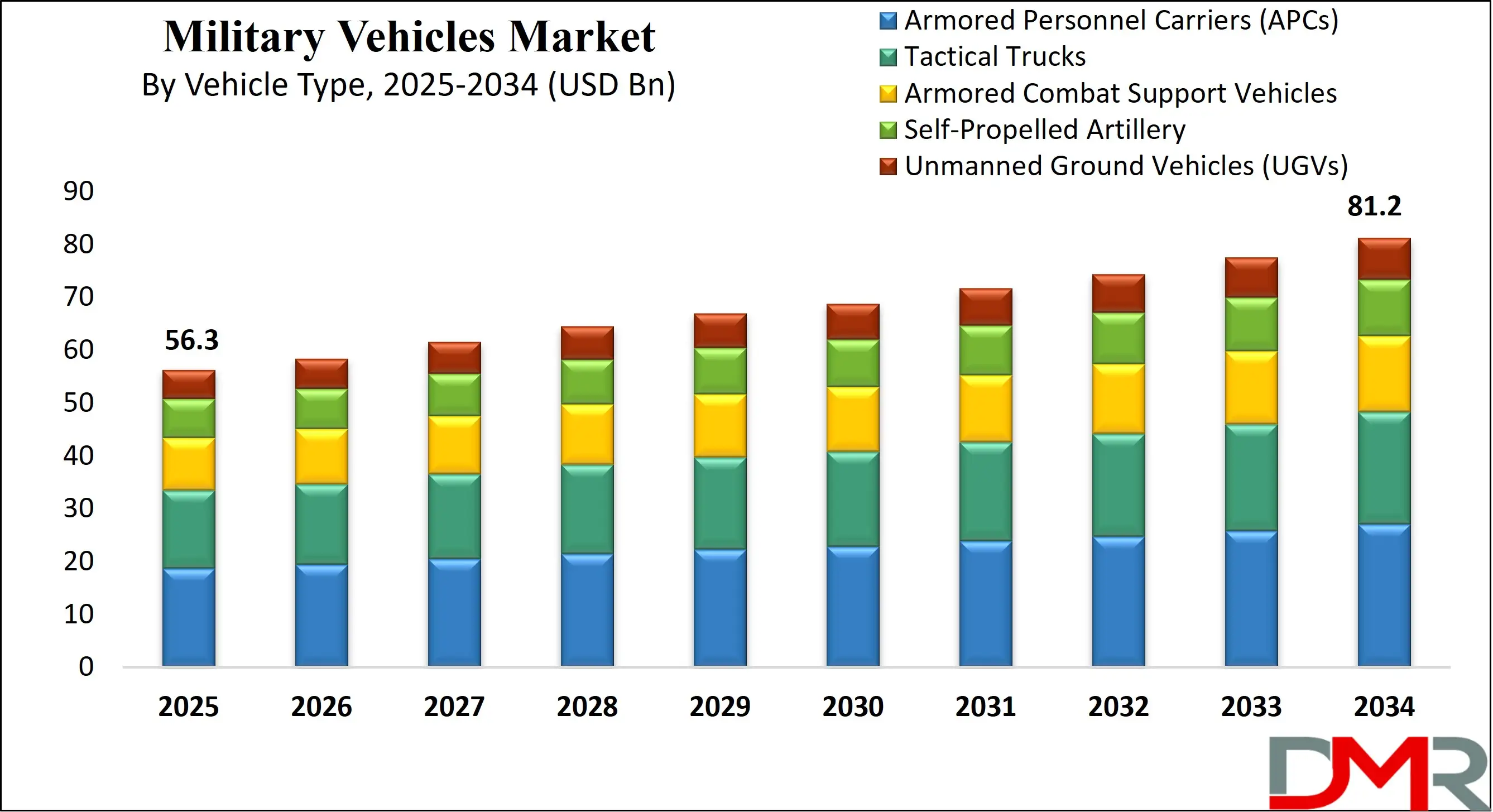

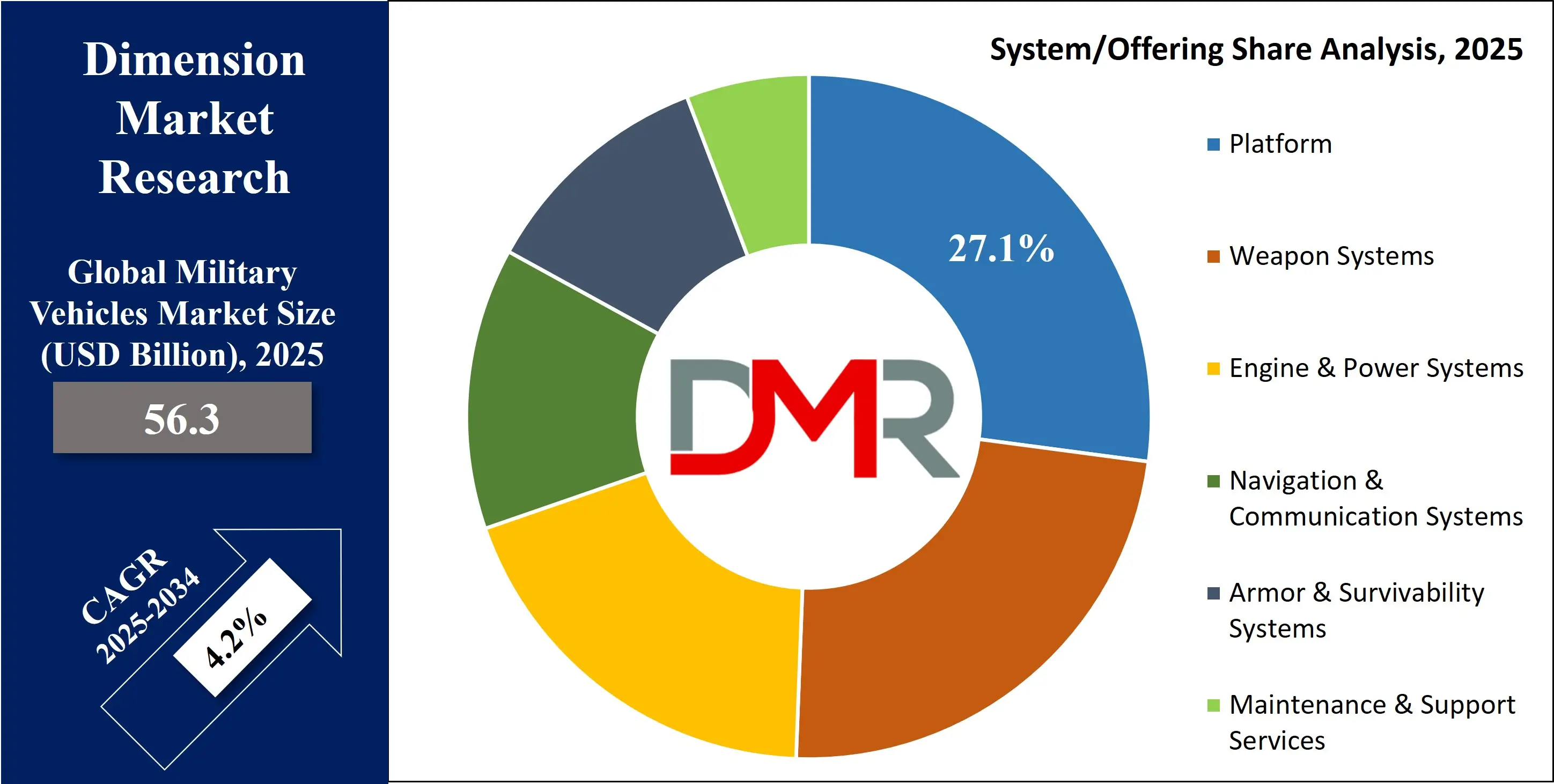

The Global Military Vehicles Market size is projected to be estimated at USD 56.3 billion in 2025 and is expected to reach USD 81.2 billion by 2034 at a CAGR of 4.2%.

The global military vehicles market is undergoing a significant transformation, shaped by evolving geopolitical tensions and rapid technological advancement. A prominent trend is the integration of advanced technologies such as artificial intelligence, autonomous driving systems, and electric powertrains. Nations are actively developing next-generation combat vehicles that can operate with reduced crews or even unmanned, enhancing soldier safety and operational effectiveness in complex battlespaces. This shift is not limited to combat vehicles; logistics and support vehicles are also being modernized with hybrid-electric systems to improve fuel efficiency and silent watch capabilities, directly addressing the logistical challenges of modern warfare.

A significant opportunity lies in the modernization of existing vehicle fleets and the development of lightweight, air-transportable platforms. Many allied nations are replacing aging Cold War-era equipment with more versatile, networked, and protected vehicles. This is particularly relevant for rapid deployment forces that require mobility and firepower that can be quickly projected across the globe. The demand for Mine-Resistant Ambush Protected (MRAP) and protected mobility vehicles remains steady for counter-insurgency and peacekeeping missions, while there is a parallel surge in investment for high-intensity conflict systems designed to peer-adversary threats, creating diverse avenues for market growth.

Despite the positive outlook, the market faces considerable restraints, primarily the immense research, development, and acquisition costs associated with sophisticated military vehicle programs. The incorporation of cutting-edge armor, active protection systems, and complex electronics drives unit costs upward, often leading to program delays and reduced procurement quantities. Furthermore, stringent and often fragmented regulatory and export control frameworks across different countries can complicate international collaboration and foreign military sales, potentially limiting the market reach for manufacturers and creating interoperability challenges for allied forces.

The US Military Vehicles Market

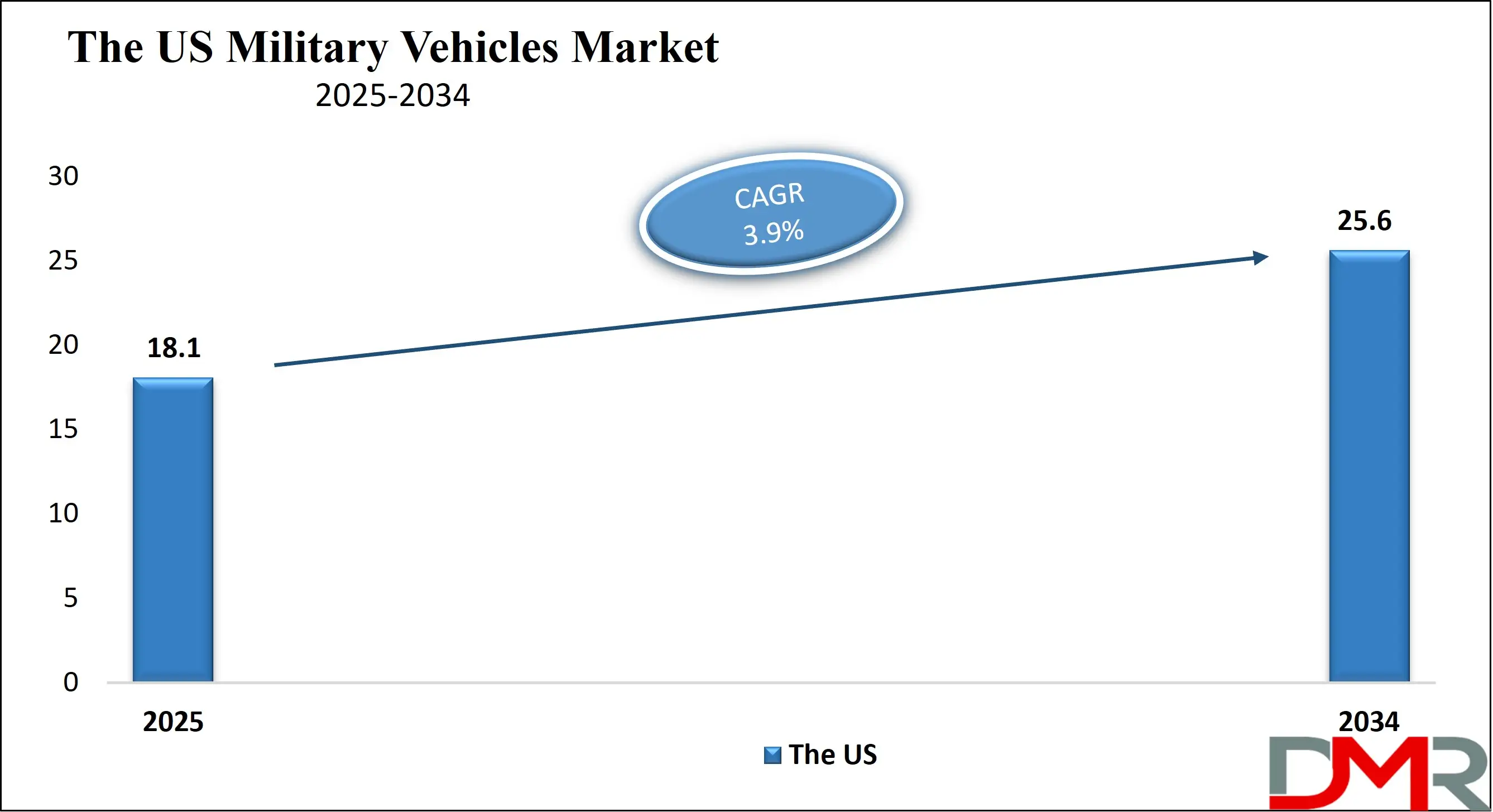

The US Military Vehicles Market is expected to be valued at USD 18.1 billion in 2025 and is expected to reach USD 25.6 billion by 2034 at a CAGR of 3.9%.

The United States military vehicle industrial base is a cornerstone of national defense strategy, directly supported by substantial and sustained Congressional appropriations. The Department of Defense (DoD) budget requests consistently allocate billions of dollars to modernize the Army and Marine Corps vehicle fleets, reflecting strategic priorities outlined in documents like the National Defense Strategy. This funding supports a multi-faceted approach, encompassing the development of next-generation systems like the Optionally Manned Fighting Vehicle (OMFV) to replace the Bradley, while simultaneously upgrading the enduring Abrams tank and Stryker vehicle fleets to maintain overmatch against pacing challenges.

A key demographic and strategic advantage for the U.S. market is the scale and integration of its domestic industrial manufacturing capacity with a professional all-volunteer force. The nation's extensive network of prime contractors, subcontractors, and specialized technology firms enables the design, production, and sustainment of a diverse range of military vehicles, from heavy main battle tanks to light tactical trucks. This robust infrastructure is deemed critical for national security, ensuring the capability to surge production in times of crisis. The DoD’s research ecosystem, including entities like the Army Futures Command, continuously drives innovation in vehicle survivability, mobility, and lethality, ensuring technological superiority.

The Europe Military Vehicles Market

The Europe Military Vehicles Market is estimated to be valued at USD 14.7 billion in 2025, driven by escalating regional security concerns, strengthened NATO defense commitments, and expanding modernization programs across major economies such as Germany, France, the UK, and Italy. The region is actively upgrading its fleets with advanced armored vehicles, hybrid propulsion platforms, and improved C4ISR-integrated mobility systems. The market is expected to grow steadily and reach USD 20.4 billion by 2034, registering a CAGR of 3.8%. Growing investment in wheeled armored vehicles, self-propelled artillery, and enhanced reconnaissance platforms remains a key driver throughout the forecast period.

The European military vehicle landscape is characterized by a concerted push towards strategic autonomy and enhanced interoperability among member states, driven by initiatives from the European Defence Agency (EDA) and NATO. In the wake of heightened security concerns, nations are significantly increasing defense budgets, with a clear focus on replenishing and modernizing land forces. Collaborative programs are paramount, exemplified by the Main Ground Combat System (MGCS) jointly developed by France and Germany, which aims to create a future armored vehicle family, and the multinational procurement of armored multi-purpose vehicles to replace aging M113 variants.

The Japan Military Vehicles Market

The Japan Military Vehicles Market is projected to hold a value of USD 6.2 billion in 2025, supported by rising defense expenditure and strategic efforts to strengthen homeland security and rapid-response capabilities. Japan continues to invest heavily in high-mobility armored vehicles, next-generation combat support systems, and unmanned ground vehicles to reinforce its defense posture in the Indo-Pacific region. By 2034, the market is expected to reach USD 8.1 billion, growing at a CAGR of 3.0%. Increased focus on hybrid-electric propulsion, improved survivability systems, and indigenous manufacturing initiatives further amplify market expansion during the forecast period.

Japan's military vehicle market is undergoing a profound shift, shaped by a deteriorating regional security environment and a fundamental reinterpretation of its national self-defense policies. The Japanese government, through its Ministry of Defense (MoD), has committed to a substantial and sustained increase in defense spending, as outlined in its National Defense Program Guidelines (NDPG). This strategic pivot is directly translating into accelerated procurement and development programs for the Japan Ground Self-Defense Force (JGSDF), with a focus on enhancing mobility, amphibious, and air-deployable capabilities, particularly for its newly established Amphibious Rapid Deployment Brigade.

Global Military Vehicles Market: Key Takeaways

- Global Military Vehicles Market Insights: The Global Military Vehicles Market is expected to be valued at USD 56.3 billion in 2025 and is projected to reach USD 81.2 billion by 2034, driven by modernization programs, rising defense budgets, and sustained global investments in advanced armored platforms.

- Global Market Growth Rate Insights: The market records a steady CAGR of 4.2% during the 2025–2034 period, reflecting increasing demand for next-generation combat vehicles, autonomous ground systems, hybrid propulsion technologies, and enhanced survivability solutions across military forces worldwide.

- US Military Vehicles Market Outlook: The US Military Vehicles Market is anticipated to be valued at USD 18.1 billion in 2025 and will reach USD 25.6 billion by 2034 at a CAGR of 3.9%, supported by fleet modernization, large-scale procurement programs, and unmanned ground vehicle adoption.

- North America Market Insights: North America is projected to dominate the Global Military Vehicles Market with a 38.3% share in 2025, driven by significant defense spending, rapid modernization of tactical and combat fleets, integration of advanced digital systems, and strong presence of leading industry manufacturers.

- Key Companies in the Market: Major companies in the Global Military Vehicles Market include BAE Systems, General Dynamics Land Systems, Rheinmetall AG, Oshkosh Defense, Lockheed Martin, Thales Group, Nexter Systems, and Hanwha Defense, collectively shaping innovation, production, and global armored vehicle capability development.

Global Military Vehicles Market: Use Cases

- Rapid Deployment & Airborne Operations: Military vehicles like the Light Tactical Vehicle and air-droppable armored platforms are essential for airborne brigades and rapid reaction forces. Their high mobility and lightweight design allow for swift insertion via airlift, enabling forces to establish a foothold, conduct reconnaissance, and engage threats immediately upon landing in contested environments, ensuring operational tempo from the outset.

- Counter-Insurgency & Urban Patrol: Mine-Resistant Ambush Protected (MRAP) vehicles and armored personnel carriers are critical for security patrols in asymmetric warfare settings. Their V-hulled designs deflect blast energy, and heavy armor protects occupants from improvised explosive devices (IEDs) and small-arms fire, providing a secure platform for moving troops through high-risk urban and rural terrain during peacekeeping and stability operations.

- Peer-State Armored Warfare: Main Battle Tanks and Infantry Fighting Vehicles form the core of combined arms maneuver in high-intensity conflict. These heavily armored and powerfully armed platforms are designed to engage enemy armor, suppress fortifications, and transport infantry directly onto objectives, working in concert with artillery and air support to achieve dominance on the conventional battlefield.

- Long-Range Logistics Convoys: Heavy-duty tactical trucks and logistics support vehicles are the lifeline of deployed forces. They transport essential supplies, including fuel, ammunition, food, and water, over vast and often treacherous supply routes. Their reliability and off-road capability are paramount for sustaining forward-operating bases and ensuring the continuity of extended military campaigns.

- Command, Control, and Communications (C3): Specialized command post vehicles and communication trucks provide mobile, shielded headquarters. Equipped with advanced satellite and radio systems, data links, and planning facilities, they enable commanders to direct operations, maintain situational awareness, and coordinate complex multi-unit maneuvers from a protected, mobile position near the front lines.

Global Military Vehicles Market: Stats & Facts

U.S. Department of Defense (DoD)

- The FY 2024 Presidential Budget Request for the Army included over $5 billion for ground combat vehicle modernization.

- The M1 Abrams tank modernization program (M1A2 SEPv4) is a multi-billion-dollar effort to upgrade the existing fleet.

- The Army's procurement objective for the Joint Light Tactical Vehicle (JLTV) is over 49,000 units to replace a significant portion of the HMMWV fleet.

- The Optionally Manned Fighting Vehicle (OMFV) program is planned to acquire a replacement for the M2 Bradley Infantry Fighting Vehicle.

U.S. Government Accountability Office (GAO)

- A GAO report found that major defense acquisition programs, including vehicle programs, often experience cost growth and schedule delays.

- The GAO has highlighted challenges in the DoD's management of its tactical wheeled vehicle fleet, including aging systems and maintenance burdens.

U.S. Army

- The Army's Long-Range Precision Fires cross-functional team is developing technologies that will impact future combat vehicle operations.

- The Integrated Visual Augmentation System (IVAS) program, based on Microsoft technology, is being developed to enhance soldier situational awareness in ground vehicles.

NATO

- NATO's guideline for members is to spend a minimum of 2% of GDP on defense; several European members have now met or exceeded this target.

- The NATO Support and Procurement Agency (NSPA) manages the logistics and support for multinational vehicle fleets like the AWACS fleet and various armored vehicles.

- The NATO Enhanced Forward Presence battlegroups in the Baltic states and Poland are equipped with a variety of national armored vehicles.

European Defence Agency (EDA)

- The EDA's Overarching Strategic Research Agenda (OSRA) identifies key activities for collaborative research, including ground vehicle technologies.

- The EDA manages the Collaborative Land Vehicles package of activities, which includes working groups on hybrid powerpacks and armor materials.

United Nations (UN)

- The UN Department of Peace Operations routinely contracts for thousands of armored vehicles for its global peacekeeping missions.

- The UN Logistics Support Division manages a global fleet of vehicles for its various missions and agencies.

United Kingdom Ministry of Defence (UK MoD)

- The UK's Army Warfighting Experiment (AWE) frequently trials new robotic and autonomous systems for military logistics and reconnaissance vehicles.

- The UK has committed to upgrading its Warrior Infantry Fighting Vehicle fleet and procuring the Ajax armored vehicle family.

Government of Canada

- Canada's Department of National Defence is undertaking the Light Forces Enhancement project to modernize its light forces vehicle fleet.

- Canada is a partner in the U.S. JLTV program and has procured its own fleet of these vehicles.

Australian Department of Defence

- Australia's Land 400 Phase 2 program is acquiring hundreds of new Combat Reconnaissance Vehicles.

- The Land 121 Phase 5B project is modernizing the Australian Army's medium and heavy vehicle fleet.

Japan Ministry of Defense (MoD)

- Japan's FY2023 defense budget saw a significant increase, with substantial funding allocated for the procurement of new mobile combat vehicles.

- The JGSDF operates over 600 Type 10 main battle tanks and is continuously upgrading its fleet.

French Ministry of the Armed Forces

- France's SCORPION program is a multi-billion euro effort to modernize its armored forces, including the Griffon and Jaguar vehicles.

- The French Army's EBRC Jaguar reconnaissance vehicle is equipped with a 40mm cannon and missile systems.

German Federal Ministry of Defence

- Germany is leading the multinational effort to provide Ukraine with Leopard 2 main battle tanks from its stocks and those of partner nations.

- The German Army's "Schwerer Waffenträger Infanterie" project aims to acquire a new heavy weapon carrier for infantry units.

Republic of Korea Armed Forces

- The Republic of Korea Army operates one of the largest armored vehicle fleets in Asia, including the K2 Black Panther main battle tank.

- South Korea's Defense Acquisition Program Administration oversees the development of indigenous vehicles like the K21 Infantry Fighting Vehicle.

Stockholm International Peace Research Institute (SIPRI)

- SIPRI data shows that the volume of international transfers of major arms in 2018-22 was stable compared to the previous five-year period.

- The United States and countries in Europe are the largest suppliers of major arms, including tanks and armored vehicles.

Global Military Vehicles Market: Market Dynamic

Driving Factors in the Global Military Vehicles Market

Geopolitical Instability and Modernization of Aging Fleets

The primary catalyst for market growth is the deteriorating global security environment, characterized by resurgent state-level competition and rising regional conflicts. Nations are responding to these escalating threats by significantly increasing their defense budgets, with substantial funding directed toward land force modernization and enhanced Military Communication capabilities. Many allied militaries continue to rely on vehicle fleets that are decades old, originally designed for post–Cold War peacekeeping and counter-insurgency missions. These legacy platforms are ill-suited for the high-intensity, peer-level conflicts envisioned in modern national defense strategies. As a result, there is a large, synchronized push to replace or extensively upgrade outdated systems such as infantry fighting vehicles, main battle tanks, tactical trucks, and the communication architectures that support them.

Technological Obsolescence and the Demand for Network-Centric Warfare Capabilities

The relentless pace of technological innovation is itself a powerful driver for new vehicle procurement and upgrades. Legacy platforms often lack the digital architecture and physical space to host the sophisticated command, control, communications, computers, intelligence, surveillance, and reconnaissance (C4ISR) systems that define modern network-centric warfare. The contemporary battlespace requires every vehicle to be a connected node, sharing real-time data across the force. This necessitates new designs with inherent vetronics (vehicle electronics) standards, such as the U.S. Army's Vehicular Integration for C4ISR/EW Interoperability (VICTORY) standard, and ample power generation and cooling capacity for advanced computing and sensor systems.

Restraints in the Global Military Vehicles Market

Exorbitant Research, Development, and Acquisition Costs

The most significant restraint on the military vehicle market is the extraordinary and escalating cost associated with developing and procuring new platforms. The incorporation of cutting-edge technologies such as composite and active armor, unmanned turrets, AI-driven threat detection, hybrid-electric drivetrains, and complex vetronics drives unit costs to unprecedented levels. A single modern main battle tank or infantry fighting vehicle can cost tens of millions of dollars. This economic reality creates severe fiscal challenges for defense departments, often resulting in program delays, reductions in procurement quantities, and political scrutiny. The shrinking number of units procured, in turn, increases the per-unit cost further due to the loss of economies of scale, creating a negative feedback loop.

Stringent International Arms Regulations and Interoperability Challenges

The global nature of the defense market is heavily constrained by a complex web of international arms trafficking regulations and stringent export control policies. Frameworks like the United States' International Traffic in Arms Regulations (ITAR) and various multinational arms embargoes create significant legal and administrative hurdles for the export of military vehicles and their sensitive technologies. Compliance is costly and time-consuming, and the potential for political denial can stifle international collaboration and limit the addressable market for manufacturers. Furthermore, even among allied nations, differing technical standards, operational requirements, and national industrial protection policies can hinder interoperability.

Opportunities in the Global Military Vehicles Market

Extensive Legacy Fleet Modernization and Mid-Life Upgrade Programs

While new platform development captures headlines, a substantial and reliable growth avenue lies in the extensive modernization of existing vehicle inventories. Given the immense cost and long development cycles of clean-sheet designs, many armed forces are opting for comprehensive mid-life upgrade programs to extend service life and enhance combat capability cost-effectively. These programs involve retrofitting vehicles with modern armor suites, new powerpacks and transmission systems, advanced fire control and situational awareness systems, and updated communication hardware. From upgrading M1 Abrams tanks to new System Enhancement Package (SEP) versions to modernizing M113 derivatives across Europe, these programs ensure that legacy systems remain relevant and lethal, providing a continuous revenue stream for the defense industry and delaying the need for fiscally challenging wholesale replacements.

Expansion in C4ISR and Electronic Warfare Integration Roles

The digitalization of the battlefield presents a critical growth opportunity for specialized vehicle variants and integration services. Modern military operations depend on a web of connected systems, creating high demand for vehicles specifically designed or modified as mobile hubs for C4ISR and electronic warfare (EW). This includes command post vehicles, electronic warfare jamming platforms, signals intelligence (SIGINT) collectors, and mobile communication nodes. These specialized platforms require unique integration of sensitive antennas, powerful computing servers, and extensive power management systems into a rugged, mobile, and protected chassis. The development, production, and continuous upgrade of these highly specialized vehicle types represent a high-value, technology-intensive niche within the broader market, attracting both traditional vehicle manufacturers.

Trends in the Global Military Vehicles Market

Proliferation of Unmanned and Autonomous Systems

The integration of unmanned ground vehicles (UGVs) is fundamentally reshaping military doctrines and vehicle acquisition strategies. This evolution extends beyond small reconnaissance drones to include large, sophisticated platforms for logistics, surveillance, and direct combat—often supported by advanced Surveillance Radar Systems that enhance situational awareness and target detection.

Robotic mules now accompany infantry squads to carry heavy loads, while large autonomous convoys execute high-risk logistics missions without endangering personnel. Armed UGVs are being developed to deliver remote fire support and breach fortified enemy positions, forming a new layer within combined arms warfare. This transformation is driven by the imperative to reduce human casualties and enhance soldier effectiveness, paving the way for a future battlespace where manned and unmanned platforms, enabled by integrated Surveillance Radar Systems, operate seamlessly together.

Electrification and Hybrid Powerpack Integration

A significant technological trend is the rapid development and incorporation of electric and hybrid-electric drivetrains into military vehicle design. This transition is motivated by more than just environmental concerns; it offers decisive tactical advantages. Hybrid systems enable "silent watch" capability, where a vehicle can power its advanced sensors, communications suite, and defensive systems for extended periods with its main engine off, drastically reducing its acoustic and thermal signature. Furthermore, electrification provides inherent exportable power, turning the vehicle into a mobile generator for forward operating bases or energy-intensive systems like directed energy weapons.

Global Military Vehicles Market: Research Scope and Analysis

By Vehicle Type Analysis

Within the vehicle-type segment, Armored Personnel Carriers (APCs) are projected to remain the dominant sub-segment due to their versatility, cost-effectiveness, and wide adoption across global armed forces. Unlike tanks or infantry fighting vehicles, APCs deliver a balanced capability across protection, mobility, and affordability, making them suitable for both developing and advanced militaries. Their multi-mission nature, transporting troops, executing patrol missions, supporting peacekeeping operations, and operating in urban warfare environments significantly boosts their demand.

APCs are also easier to manufacture, maintain, and deploy compared to heavier tracked platforms. Modern armies prefer wheeled APCs (such as 6×6 or 8×8 variants) because they offer fast mobility on roads and rugged terrain, making them ideal for rapid response units. Additionally, global conflicts and peacekeeping missions have increased procurement of APCs due to their ability to protect soldiers from small-arms fire, mines, and improvised explosive devices.

Unlike Main Battle Tanks, APCs require lower operational costs and can be upgraded with modular armor, remote weapon stations, surveillance systems, and communication equipment, giving them long service life and adaptability. With rising geopolitical tensions and modernization programs in the Asia-Pacific, Middle East, and Europe, APC acquisition continues to expand. The shift toward network-enabled warfare further enhances their demand, as APCs support digital command-and-control integration. Their blend of survivability, mobility, and cost advantage firmly establishes them as the largest and most influential sub-segment in the global military vehicles market.

By System / Offering Analysis

In the system or offering segment, the Platform is expected to be the dominant sub-segment, representing the core of military vehicle procurement. Nations prioritise acquiring physical armored vehicles, APCs, tanks, tactical trucks, MRAPs, and IFVs because platforms form the foundation for force mobility, troop protection, and combat readiness. Without the platform, additional systems such as weapons, sensors, and communication equipment cannot be integrated. As a result, most defense budgets allocate the highest expenditure toward acquiring new vehicles rather than auxiliary subsystems.

Platform procurement reflects major modernization cycles, where militaries replace outdated fleets or expand operational capabilities in response to geopolitical threats. These programs often involve large multi-year contracts, significantly increasing the platform sub-segment’s market share. Furthermore, platforms are the most expensive component of the entire offering ecosystem due to advanced engineering, armor technology, propulsion systems, and manufacturing complexity.

Even upgrade programs typically revolve around extending the life of the platform, making it central to long-term defense strategies. While weapon systems, communication suites, and survivability modules are critical, they are usually purchased as add-ons or integrated into existing vehicles. Emerging technologies such as unmanned ground vehicles and hybrid-powered vehicles still rely on the platform as their primary structural and functional unit. Additionally, many countries develop local manufacturing capability for platforms, further boosting their financial share within the market. Because military platforms are irreplaceable, high-value assets with long service life and strategic importance, they continue to dominate the systems/offerings segment globally.

By Mobility Analysis

In the mobility segment, wheeled military vehicles are expected to dominate the global market, driven by their operational flexibility, lower lifecycle cost, and widespread applicability across missions. Wheeled vehicles are preferred by most armies for patrol, reconnaissance, logistics transport, troop movement, and peacekeeping operations. Compared to tracked platforms, wheeled vehicles offer faster on-road performance, easier maneuverability in urban environments, and reduced maintenance requirements.

Their fuel efficiency and lower operating cost make them attractive for nations undergoing fleet modernization but facing budget constraints. Wheeled vehicles also support a broad range of configurations from light protected vehicles and MRAPs to heavy 8×8 infantry carriers, making them adaptable for diverse mission profiles. Modern improvements in suspension systems, run-flat tires, drivetrain technology, and modular armor have significantly enhanced wheeled vehicles’ survivability and off-road capabilities, narrowing the gap with tracked platforms.

Globally, peacekeeping missions, border security operations, and counter-insurgency activities further expand demand for wheeled designs due to their speed and deployment agility. For emerging economies, the cost advantage and ease of local assembly make wheeled vehicles more accessible. Even advanced militaries continue investing heavily in next-generation wheeled platforms with digital battlefield integration, remote weapon stations, and hybrid propulsion. While tracked vehicles retain relevance for heavy combat roles, wheeled vehicles dominate because they serve the widest operational needs with superior cost-benefit performance. Their balance of mobility, versatility, and modernization potential firmly establishes wheeled systems as the leading mobility sub-segment in the global market.

By Propulsion Analysis

Within the propulsion segment, diesel-powered military vehicles are poised to continue dominating the global market due to their unmatched reliability, fuel efficiency, and the high power output required for defense operations. Modern Diesel Power Engine technologies deliver superior torque, making them ideal for armored vehicles and heavy-duty off-road performance. Their proven ability to operate in harsh climates—including extreme heat, cold, dust, and rugged terrain solidifies their position as the standard choice for global militaries.

Diesel fuel is also less flammable than gasoline, improving survivability and safety in combat environments. Most existing global fleets, including APCs, MRAPs, tactical trucks, and tanks, rely on diesel propulsion, creating a strong installed base supported by established logistics and maintenance networks. This extensive legacy infrastructure further reinforces diesel’s dominance, as defense forces prefer platforms that seamlessly integrate with their existing fuel supply chains and Diesel Power Engine support systems.

Although hybrid and electric propulsion systems are gaining attention, especially for silent operation and reduced thermal signatures, their adoption remains limited due to high costs, battery limitations, and dependence on advanced charging infrastructure often impractical in real combat environments.

Diesel engines, on the other hand, are easy to repair, widely available, and proven under battlefield conditions. Modern advancements, such as improved fuel injection systems, turbocharging, and digitized engine controls, further enhance diesel vehicles’ efficiency and survivability. Additionally, nations upgrading existing fleets often opt for diesel-powered variants to maintain interoperability. Despite future shifts toward hybrid systems in specialized missions, diesel propulsion remains the dominant sub-segment because it combines endurance, affordability, durability, and battlefield readiness unmatched by other technologies today.

By Application Analysis

In the application segment, the Defense (combat and tactical operations) is projected to overwhelmingly dominate the global military vehicles market. Defense forces account for the largest share of procurement because military vehicles are primarily designed to support national security, battlefield operations, and force mobility. Governments worldwide invest heavily in modernizing ground fleets to strengthen combat preparedness, enhance troop protection, and improve tactical mobility.

Combat-oriented vehicles such as APCs, IFVs, MRAPs, tanks, and tactical trucks form the backbone of land forces, making defense applications the primary driver of demand. Rising geopolitical tensions, border conflicts, counter-terrorism missions, and modernization cycles in Asia-Pacific, Europe, and the Middle East fuel continuous procurement. Defense use also encompasses reconnaissance, battlefield surveillance, rapid troop deployment, and armored response missions, further expanding the requirement for diverse vehicle categories.

Unlike homeland security or logistics roles, defense missions require high-endurance, heavily armored platforms with advanced weapon systems, communication suites, and survivability technologies, resulting in larger budgets and higher acquisition volumes. Joint operations, digitized warfare strategies, and the shift toward network-centric combat systems also increase demand for modern combat vehicles with integrated AI, sensors, and remote weapon stations. Governments globally allocate a significant share of defense budgets toward land vehicle upgrades, life-cycle support, and replacement programs, keeping defense as the most dominant application area. As armies expand capabilities and replace aging fleets, the defense sub-segment will continue to lead the market, driven by strategic necessity and sustained long-term investment.

The Global Military Vehicles Market Report is segmented on the basis of the following:

By Vehicle Type

- Armored Personnel Carriers (APCs)

- Infantry Fighting Vehicles (IFVs)

- Armored Personnel Carriers (APCs)

- Main Battle Tanks (MBTs)

- Mine-Resistant Ambush Protected Vehicles (MRAPs)

- Light Protected Vehicles

- Tactical Trucks

- Armored Combat Support Vehicles

- Armored Supply Trucks

- Repair And Recovery Vehicles

- Medical Evacuation Vehicles

- Self-Propelled Artillery

- Unmanned Ground Vehicles (UGVs)

By System / Offering

- Platform

- Vehicle Chassis

- Vehicle Body

- Weapon Systems

- Machine Guns

- Missile Launchers

- Remote Weapon Stations

- Engine & Power Systems

- Diesel Engines

- Hybrid/Electric Power Units

- Navigation & Communication Systems

- GPS Systems

- Battlefield Management Systems

- Communication Radios

- Armor & Survivability Systems

- Composite Armor

- Reactive Armor

- Mine Protection Kits

- Maintenance & Support Services

- Repair & Overhaul

- Lifecycle Management

- Training Services

By Mobility

By Propulsion

- Diesel

- Hybrid

- Electric

- Gasoline

By Application

- Defense

- Combat Missions

- Border Security

- Military Patrol

- Homeland Security

- Riot Control

- Urban Security

- Logistics & Support

- Cargo Transport

- Personnel Transport

- Reconnaissance

- Surveillance Vehicles

- Scout Vehicles

- Combat Operations

- Offensive Combat Vehicles

- Special Operations Vehicles

Impact of Artificial Intelligence in the Global Military Vehicles Market

- Autonomous Operations: AI enables fully autonomous convoys and unmanned ground vehicles (UGVs) for logistics, reconnaissance, and high-risk attack missions. This reduces human crew exposure to danger and allows for sustained operations in contested or hazardous environments.

- Predictive Maintenance: By analyzing real-time sensor data, AI algorithms predict mechanical failures before they occur. This maximizes vehicle fleet availability, reduces unexpected downtime, and optimizes maintenance schedules and supply chains for parts and repairs.

- Enhanced Survivability: AI-powered active protection systems (APS) automatically detect, track, and intercept incoming projectiles like anti-tank missiles. This provides a reactive electronic shield, drastically improving vehicle and crew survivability against modern threats.

- Advanced Threat Detection: AI processes data from multiple sensors to automatically identify, classify, and prioritize potential threats—often faster than a human operator. This accelerates critical decision-making and shortens the sensor-to-shooter timeline.

- Swarming Tactics: AI allows multiple unmanned vehicles to coordinate as an intelligent swarm. These units can overwhelm enemy defenses, conduct distributed surveillance, or execute complex, synchronized attacks, presenting adversaries with multifaceted challenges.

Global Military Vehicles Market: Regional Analysis

Region with the Largest Revenue Share

North America, led by the United States, is projected to command 38.3% of the market share of the global military vehicles market by the end of 2025, due to a confluence of strategic, financial, and industrial factors. The region's preeminence is fundamentally anchored in the United States' status as a global military power with extensive international security commitments, necessitating a vast, diverse, and technologically advanced fleet of land systems. This demand is backed by the world's largest defense budget, which consistently allocates billions of dollars to ground vehicle modernization, research, and sustainment.

Programs like the Next Generation Combat Vehicle (NGCV) family, including the Optionally Manned Fighting Vehicle (OMFV) and the Armored Multi-Purpose Vehicle (AMPV), along with the massive Joint Light Tactical Vehicle (JLTV) procurement, create a sustained and unparalleled demand pipeline. Furthermore, the region boasts a deeply entrenched and innovative industrial base, featuring prime contractors like General Dynamics, Oshkosh Defense, and BAE Systems, which possess decades of experience and cutting-edge R&D capabilities. This combination of strategic necessity, unparalleled financial investment, and a mature, technologically superior defense industrial complex ensures North America's continued dominance in market share.

Region with the Highest CAGR

The Asia Pacific region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) in the military vehicles market, driven by escalating geopolitical tensions, intense regional arms races, and robust economic growth. Nations are significantly boosting defense expenditures in direct response to security challenges, including territorial disputes in the South China Sea and the persistent threat from North Korea. China's rapid military modernization and its growing assertiveness have triggered a massive wave of indigenous vehicle production and procurement, while also compelling neighboring countries like India, Japan, South Korea, and Australia to accelerate their own land force modernization initiatives.

India, for instance, is pursuing programs like the Future Ready Combat Vehicle (FRCV) and increasing its domestic manufacturing under the "Make in India" policy. Japan is breaking from its post-war pacifist stance, substantially increasing its defense budget to acquire new mobile combat vehicles and enhance its amphibious capabilities. This region's growth is not merely about replacing old equipment but about rapidly expanding and technologically leapfrogging existing capabilities, fueled by a combination of strategic necessity, economic capacity, and a strong push for defense industrial self-reliance.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Military Vehicles Market: Competitive Landscape

The global military vehicles market is characterized by intense competition among a mix of established defense primes and specialized manufacturers. Key players include General Dynamics Corporation, BAE Systems plc, Oshkosh Corporation, Rheinmetall AG, and Hanwha Aerospace, who leverage deep engineering expertise and long-standing relationships with national militaries. The landscape is increasingly shaped by two key strategies: consolidation and strategic partnerships. Larger firms acquire smaller, innovative companies to gain access to critical technologies, particularly in the domains of autonomy, electrification, and active protection systems.

Simultaneously, cross-border collaborations and joint ventures are becoming commonplace to share soaring R&D costs, access new markets, and develop specialized platforms, as seen in the European Main Ground Combat System (MGCS) shared by France and Germany. Competition revolves not just around platform manufacturing but also through lucrative long-term contracts for maintenance, training, and comprehensive through-life support. Furthermore, the rapid integration of AI and unmanned systems is creating new competitive frontiers, with traditional vehicle manufacturers partnering with software and robotics firms to maintain their technological edge and offer integrated solutions to modern armed forces.

Some of the prominent players in the Global Military Vehicles Market are

- BAE Systems

- General Dynamics Land Systems

- Rheinmetall AG

- Oshkosh Defense

- Lockheed Martin

- Thales Group

- Nexter Systems (KNDS)

- Hanwha Defense

- Krauss-Maffei Wegmann (KMW)

- Otokar

- ST Engineering

- Elbit Systems

- Iveco Defence Vehicles

- Patria Land Oy

- Tatra Defence Vehicle

- FNSS Defence Systems

- AM General

- Kongsberg Defence & Aerospace

- Ashok Leyland Defence

- Arquus

- Other Key Players

Recent Developments in the Global Military Vehicles Market

- May 2024: The U.S. Army awarded a contract to Oshkosh Defense for the next batch of Joint Light Tactical Vehicles (JLTVs), continuing the multi-year procurement program.

- April 2024: Rheinmetall announced the opening of a new Lynx Infantry Fighting Vehicle production facility in Hungary, marking a significant expansion of its footprint in Eastern Europe.

- March 2024: General Dynamics Land Systems and BAE Systems each received contracts from the U.S. Army to continue prototyping and technology demonstration for the Optionally Manned Fighting Vehicle (OMFV) program.

- February 2024: Hanwha Aerospace signed a major deal with Poland to supply hundreds of K9 Thunder self-propelled howitzers and K10 ammunition resupply vehicles, further solidifying its global market presence.

- January 2024: The British Army confirmed the acceptance of the first production units of the Ajax armored vehicle family from General Dynamics UK, following extensive trials.

- November 2023: BAE Systems completed the acquisition of Ball Aerospace, a move aimed at bolstering its space and advanced technology portfolios, which have applications in military vehicle sensor and C4ISR systems.

- October 2023: The Modern Day Marine exposition in Washington, D.C., featured new variants of amphibious combat vehicles and light tactical vehicles, highlighting the focus on maritime deployment capabilities.

- September 2023: At the DSEI 2023 defense exhibition in London, several manufacturers, including Rheinmetall and Lockheed Martin, showcased new concepts for hybrid-electric drivetrains and integrated unmanned turrets for next-generation armored vehicles.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 56.3 Bn |

| Forecast Value (2034) |

USD 81.2 Bn |

| CAGR (2025–2034) |

4.2% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 18.1 Bn |

| Forecast Data |

2025 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Vehicle Type (Armored Personnel Carriers (APCs), Tactical Trucks, Armored Combat Support Vehicles, Self-Propelled Artillery, Unmanned Ground Vehicles (UGVs)), By System / Offering (Platform, Weapon Systems, Engine & Power Systems, Navigation & Communication Systems, Armor & Survivability Systems, Maintenance & Support Services), By Mobility (Wheeled, Tracked), By Propulsion (Diesel, Hybrid, Electric, Gasoline), By Application (Defense, Homeland Security, Logistics & Support, Reconnaissance, Combat Operations) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

BAE Systems, General Dynamics Land Systems, Rheinmetall AG, Oshkosh Defense, Lockheed Martin, Thales Group, Nexter Systems (KNDS), Hanwha Defense, Krauss-Maffei Wegmann (KMW), Otokar, ST Engineering, Elbit Systems, Iveco Defence Vehicles, Patria Land Oy, Tatra Defence Vehicle, FNSS Defence Systems, AM General, Kongsberg Defence & Aerospace, Ashok Leyland Defence, Arquus, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Military Vehicles Market size is estimated to have a value of USD 56.3 billion in 2025 and is expected to reach USD 81.2 billion by the end of 2034.

The market is growing at a CAGR of 4.2 percent over the forecasted period of 2025.

The US Military Vehicles Market is projected to be valued at USD 18.1 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 25.6 billion in 2034 at a CAGR of 3.9%.

North America is expected to have the largest market share in the Global Military Vehicles Market with a share of about 38.3% in 2025.

Some of the major key players in the Global Military Vehicles Market are BAE Systems, General Dynamics Land Systems, Rheinmetall AG, Oshkosh Defense, Lockheed Martin, Thales Group, Nexter Systems (KNDS), Hanwha Defense, and many others.