Market Overview

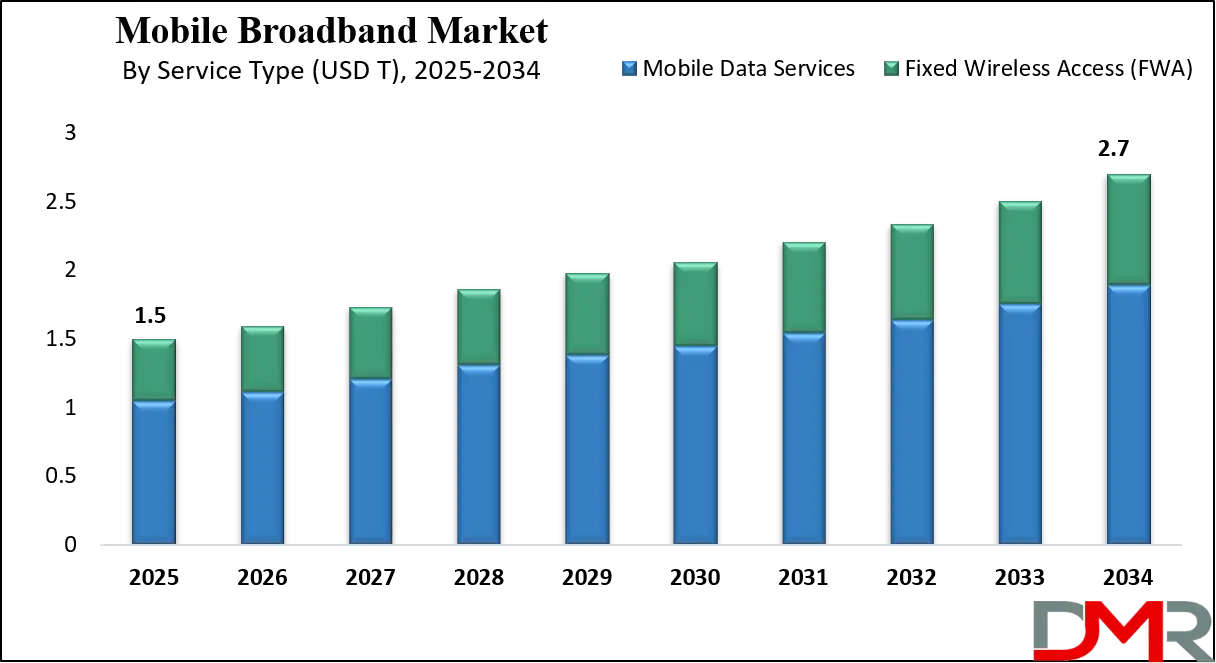

The global mobile broadband market is projected to grow from USD 1.5 trillion in 2025 to USD 2.7 trillion by 2034, registering a CAGR of 6.8%. Rising smartphone adoption, expanding 5G networks, and increasing demand for high-speed mobile data are driving market growth across consumer and enterprise segments globally.

Mobile broadband refers to high-speed wireless internet access delivered through mobile network technologies such as 4G LTE and 5G. It allows users to connect to the internet using smartphones, tablets, laptops, and other portable devices without relying on fixed-line connections. This form of connectivity supports seamless streaming, online gaming, video conferencing, cloud computing, and other data-intensive applications.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Mobile broadband networks utilize advanced radio frequency technologies, spectrum allocation, and network infrastructure to provide reliable and scalable internet access to both individual consumers and businesses. The evolution of mobile broadband has transformed digital communication by enabling anytime, anywhere connectivity and fostering the growth of mobile-dependent services and applications.

The global mobile broadband market encompasses the deployment, operation, and commercialization of wireless internet services globally. It includes various technology segments such as 4G LTE, 5G, and fixed wireless access, catering to different end-user needs across consumer and enterprise segments. The market is driven by increasing smartphone penetration, rising demand for high-speed data, growing adoption of Internet of Things devices, and the expansion of digital services across emerging and developed economies. Additionally, advancements in network infrastructure, spectrum management, and mobile edge computing have further accelerated market growth.

The market landscape is shaped by regional dynamics, regulatory frameworks, and competitive strategies of key telecom operators and technology providers. North America and Europe are characterized by mature networks with high adoption of 5G, while Asia-Pacific is witnessing rapid growth due to large populations and increasing mobile internet penetration.

Emerging markets in the Middle East, Africa, and Latin America are also contributing to global market expansion through investments in network infrastructure and government initiatives promoting digital connectivity. The market continues to evolve as operators introduce innovative service offerings, enhance network performance, and leverage next-generation technologies to meet the growing demand for reliable and fast mobile internet services.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Mobile Broadband Market

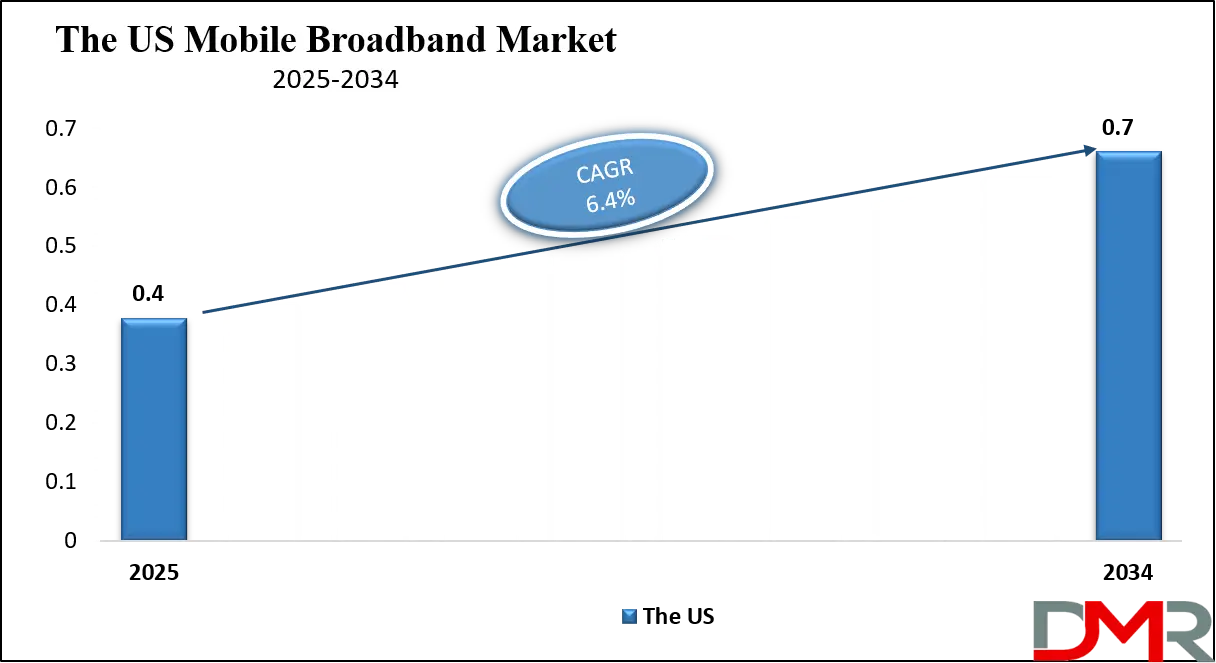

The U.S. Mobile Broadband market size is projected to be valued at USD 400 billion by 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 700 billion in 2034 at a CAGR of 6.4%.

The US mobile broadband market is one of the most advanced and competitive markets globally, driven by extensive 4G LTE coverage and rapid deployment of 5G networks. Major telecom operators are investing heavily in network infrastructure, including small cell technology, spectrum expansion, and fiber backhaul, to enhance connectivity and deliver ultra-fast internet services.

The market growth is supported by rising smartphone penetration, widespread adoption of IoT devices, and increasing demand for high-speed mobile data across urban and rural areas. Consumer demand for seamless video streaming, online gaming, cloud applications, and remote work solutions continues to propel mobile broadband adoption in both individual and business segments.

Enterprise adoption is a key driver of the US mobile broadband market as businesses increasingly rely on wireless connectivity for operations, remote workforce enablement, and digital transformation initiatives. Fixed wireless access solutions are gaining traction as an alternative to traditional wired broadband in underserved regions, providing reliable high-speed connectivity.

Regulatory support, government incentives, and spectrum auctions further enhance network expansion and service quality. Competitive dynamics among leading service providers encourage innovation in pricing, service bundles, and value-added solutions, reinforcing the US market’s position as a global leader in mobile broadband deployment and adoption.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Mobile Broadband Market

The Europe mobile broadband market is projected to reach approximately USD 225 billion in 2025, reflecting the region’s strong adoption of high-speed mobile networks and digital services. Growth in the market is driven by widespread 4G LTE coverage, rapid deployment of 5G infrastructure, and increasing demand for mobile data services among consumers and enterprises. Telecom operators are investing heavily in network upgrades, spectrum expansion, and edge computing solutions to deliver faster, low-latency connectivity, supporting applications such as video streaming, cloud computing, online gaming, and smart city initiatives across the region.

The market is further supported by regulatory frameworks that encourage investment in digital infrastructure and promote spectrum availability for mobile broadband expansion. Enterprise adoption is a significant contributor, with businesses increasingly relying on mobile broadband for remote work, IoT integration, and enterprise mobility solutions.

Additionally, the growing popularity of fixed wireless access services helps bridge connectivity gaps in rural and underserved areas, complementing traditional wired broadband. With a compound annual growth rate of 5.8%, the European market is expected to maintain steady growth, driven by technological advancements, increasing smartphone penetration, and the rising demand for high-speed mobile internet.

Japan Mobile Broadband Market

The Japan mobile broadband market is estimated to reach around USD 30 billion in 2025, reflecting steady growth driven by advanced network infrastructure and widespread adoption of high-speed mobile services. The market benefits from extensive 4G LTE coverage and a rapid rollout of 5G networks, which provide low-latency connectivity and high-speed data access for consumers and businesses alike. Rising smartphone penetration, increasing demand for streaming, gaming, and cloud-based applications, and the proliferation of connected devices are key factors supporting market expansion.

Enterprise demand also plays a crucial role in Japan’s mobile broadband market, with businesses leveraging wireless connectivity for remote work, IoT integration, and smart manufacturing solutions. Fixed wireless access and private 5G networks are being adopted to ensure reliable connectivity in areas with high population density or challenging geography. With a compound annual growth rate of 4.5%, the market is expected to maintain consistent growth, supported by technological innovation, government initiatives promoting digital infrastructure, and increasing consumer reliance on mobile data services for everyday activities.

Global Mobile Broadband Market: Key Takeaways

- Market Value: The global Mobile Broadband market size is expected to reach a value of USD 2.7 trillion by 2034 from a base value of USD 1.5 trillion in 2025 at a CAGR of 6.8%.

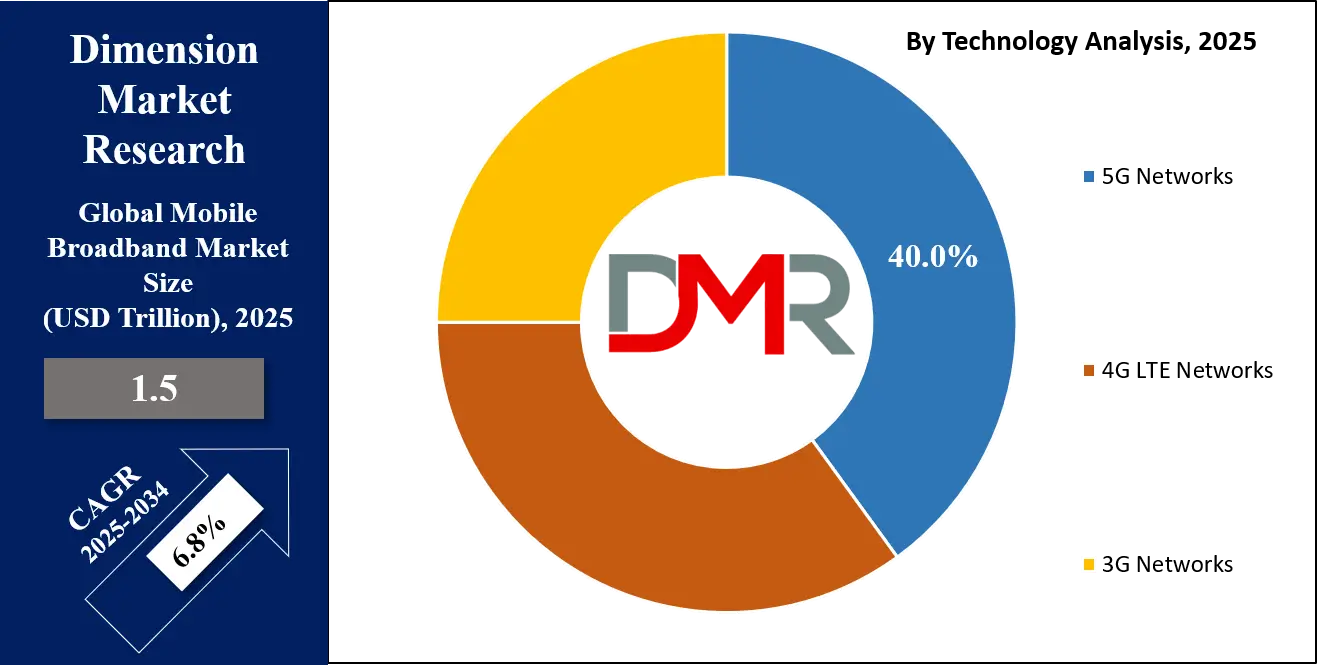

- By Technology Segment Analysis: 5G Networks are anticipated to dominate the technology segment, capturing 40.0% of the total market share in 2025.

- By Service Type Segment Analysis: Mobile Data Services are expected to maintain their dominance in the service type segment, capturing 50.0% of the total market share in 2025.

- By End-User Segment Analysis: Consumer Segment will dominate the end-user segment, capturing 60.0% of the market share in 2025.

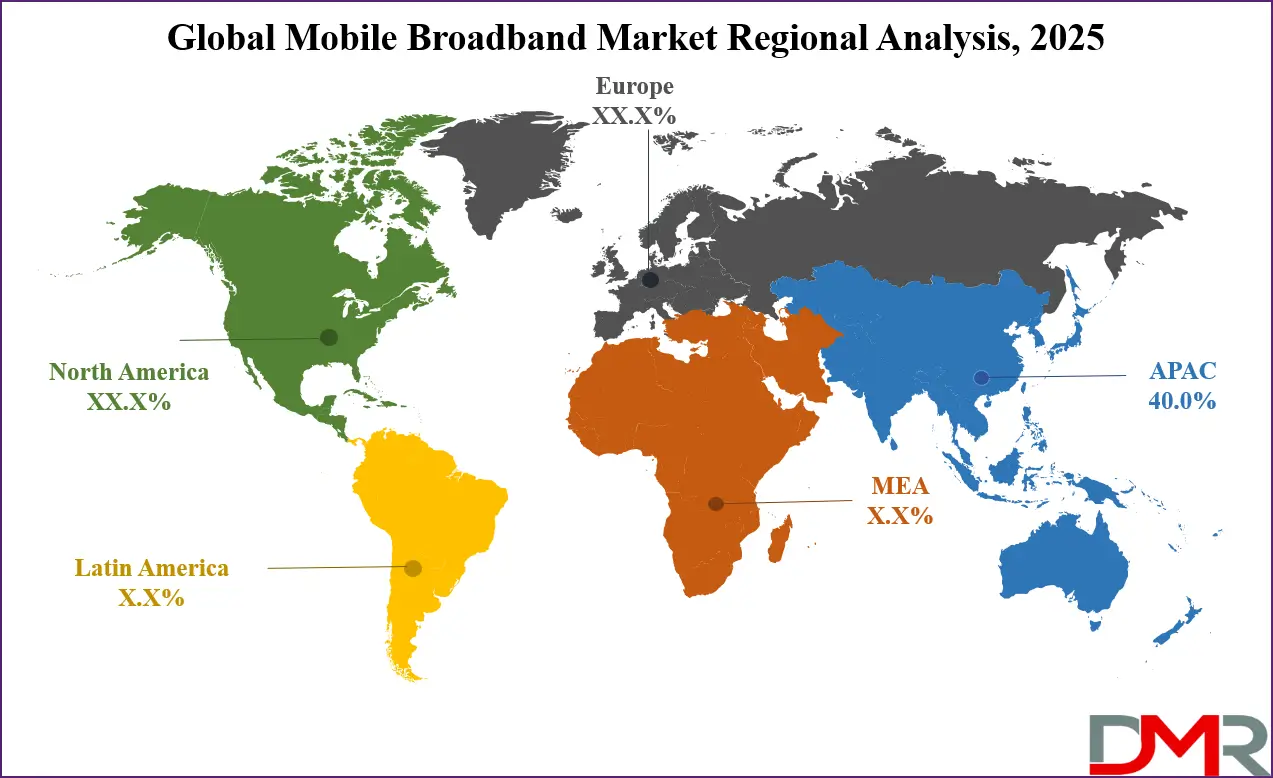

- Regional Analysis: Asia Pacific is anticipated to lead the global Mobile Broadband market landscape with 40.0% of total global market revenue in 2025.

- Key Players: Some key players in the global Mobile Broadband market include Jio, AT&T, Verizon Communications, T-Mobile US, China Mobile, Vodafone Group, Deutsche Telekom, NTT Group, Orange S.A., Telefónica S.A., América Móvil, SK Telecom, KT Corporation, Reliance Communications, Bharti Airtel, Telstra, Optus, Rogers Communications, and Others.

Global Mobile Broadband Market: Use Cases

- Consumer Internet Access and Entertainment: Mobile broadband enables seamless internet connectivity for individual users, supporting high-speed streaming, video calls, social media, and online gaming. With the expansion of 4G LTE and 5G networks, consumers experience low latency and faster download speeds, enhancing digital entertainment experiences. This connectivity also facilitates access to cloud services, e-commerce platforms, and mobile applications, driving higher smartphone and tablet usage globally.

- Enterprise Connectivity and Remote Work: Businesses increasingly rely on mobile broadband to support remote work, cloud computing, and enterprise mobility solutions. High-speed wireless networks allow employees to access corporate systems, collaborate via video conferencing, and use Software-as-a-Service platforms without relying on fixed-line connections. Fixed wireless access and private 5G networks further enhance operational efficiency, especially for organizations with distributed offices or field operations.

- Internet of Things (IoT) and Smart Devices: Mobile broadband serves as the backbone for IoT applications, connecting smart devices, wearables, and industrial sensors. High-speed mobile networks enable real-time data transmission, remote monitoring, and automation across sectors such as smart homes, healthcare, manufacturing, and logistics. The combination of 5G and edge computing ensures low latency and reliable connectivity, fostering innovation in IoT-driven services.

- Rural and Underserved Area Connectivity: Mobile broadband bridges the digital divide by delivering internet access to rural and underserved regions. Fixed wireless access and mobile network expansions provide high-speed connectivity where fiber or cable infrastructure is limited. This improves access to online education, telemedicine, e-commerce, and government services, driving socioeconomic development and digital inclusion globally.

Impact of Artificial Intelligence on the global Mobile Broadband market

Artificial Intelligence is significantly transforming the global mobile broadband market by optimizing network performance, enhancing service quality, and enabling predictive maintenance. AI-driven analytics help telecom operators manage traffic, reduce latency, and improve spectrum utilization across 4G and 5G networks. Intelligent automation supports dynamic bandwidth allocation, fraud detection, and customer experience management, while machine learning algorithms facilitate the deployment of self-optimizing networks. Additionally, AI accelerates the rollout of advanced services such as edge computing, IoT connectivity, and personalized digital applications, driving higher adoption of mobile broadband across consumer and enterprise segments globally.

Global Mobile Broadband Market: Stats & Facts

Press Information Bureau (PIB), India

- As of March 2024, India had 954.40 million internet subscribers, with 398.35 million in rural areas.

- By April 2024, 95.15% of Indian villages had 3G/4G mobile connectivity.

- The total number of internet subscribers increased from 251.59 million in March 2014 to 954.40 million in March 2024, at a CAGR of 14.26%.

- Broadband connections rose from 6.1 crore in March 2014 to 94.92 crore in August 2024, growing by 1452%.

- Out of 6,44,131 villages, 6,15,836 had 4G mobile connectivity as of December 2024.

- The median mobile broadband download speed increased from 10.71 Mbps in 2019 to 144.33 Mbps in February 2025.

- The median fixed broadband download speed increased from 29.25 Mbps in 2019 to 61.66 Mbps in February 2025.

- The number of broadband subscribers increased from 66 crores to 94.49 crores under the National Broadband Mission (NBM) 1.0.

- Per capita average monthly wireless data consumption increased from 10 GB to 21.10 GB.

- The number of 5G towers installed reached 4.74 lakh, covering 99.6% of districts.

Telecom Regulatory Authority of India (TRAI)

- The total number of internet subscribers in India increased from 96.91 crore at the end of March 2025 to 100.28 crore by June 2025, a growth of 3.48%.

- Of the total subscribers, 97.97 crore were broadband subscribers, and 2.31 crore were narrowband subscribers.

- Wireless internet services accounted for 95.81 crore subscribers, while wired internet services had 4.47 crore subscribers.

- The average revenue realization per subscriber per GB of wireless data reduced to Rs. 8.31 in June 2024 from Rs. 268.97 in December 2014, a reduction of more than 96.91%.

National Sample Survey (NSS) Office, India

- Around 86.3% of households in India had access to the internet within the household premises.

- In rural areas, approximately 79.2% of males and 75.6% of females aged 15 years and above owned a smartphone.

- In urban areas, approximately 89.4% of males and 86.2% of females in the same age group owned a smartphone.

- Approximately 73.4% of individuals aged 15-29 years owned a mobile phone.

- Around 94.3% of individuals aged 15-29 years used the internet at least once during the last three months.

- About 85.1% of individuals in the same age group reported sending messages with attached files using mobile or computer-like devices.

Ministry of Electronics and Information Technology (MeitY), India

- As of mid-2024, there were over 650 million smartphone users in India.

- Internet subscribers had surpassed 950 million by mid-2024.

- The digital economy contributed 11.74% to GDP in 2022–23, projected to reach 13.42% in 2024–25.

- BharatNet connected 2.18 lakh Gram Panchayats with high-speed internet.

Federal Communications Commission (FCC), USA

- The National Broadband Map provides information about internet services available to individual locations across the country.

- The Measuring Broadband America program collects data on broadband performance and availability.

United States Department of Agriculture (USDA)

- Enhancing digital agriculture technologies could create at least USD 47 billion each year in additional gross benefit for the U.S. economy.

- Rural broadband e-connectivity is the driver of more than one-third of that potential value, equal to USD 18 billion of annual economic improvements for the nation.

National Telecommunications and Information Administration (NTIA), USA

- The NTIA Internet Use Survey is conducted to collect data on internet usage patterns across the country.

- The Broadband Equity Access and Deployment (BEAD) Program supports government projects for broadband deployment, mapping, and adoption.

Global Mobile Broadband Market: Market Dynamics

Global Mobile Broadband Market: Driving Factors

Rapid 5G Network Deployment

The global rollout of 5G networks is accelerating mobile broadband adoption by providing ultra-high-speed connectivity, low latency, and massive device support. Telecom operators are investing in advanced network infrastructure, small cell installations, and spectrum expansion to meet growing consumer and enterprise demand for seamless internet access and high-speed data services.

Increasing Smartphone and IoT Device Penetration

Rising smartphone adoption and the proliferation of IoT devices are fueling the demand for mobile broadband services. Consumers and businesses increasingly rely on wireless connectivity for applications such as streaming, cloud computing, smart homes, and industrial automation, driving growth across both urban and rural regions.

Global Mobile Broadband Market: Restraints

High Infrastructure Deployment Costs

The expansion of mobile broadband networks, particularly 5G, requires substantial investment in spectrum licensing, small cell deployment, fiber backhaul, and network maintenance. High capital expenditure limits market penetration in developing regions and slows the rollout in less profitable areas.

Regulatory and Spectrum Challenges

Stringent regulations, spectrum allocation constraints, and complex licensing procedures can hinder mobile broadband network expansion. Delays in government approvals and fragmented policies across regions affect network deployment timelines and operational efficiency for telecom operators.

Global Mobile Broadband Market: Opportunities

Fixed Wireless Access (FWA) Expansion

Fixed wireless access presents a growing opportunity to provide high-speed internet in areas where fiber or cable infrastructure is limited. FWA solutions enable telecom operators to deliver reliable connectivity to rural and underserved markets, expanding the mobile broadband user base.

Integration with Cloud and Edge Computing

The integration of mobile broadband with cloud computing and edge networks offers opportunities for enhanced service delivery. Low-latency connections enable real-time data processing, IoT applications, and enterprise digital transformation, creating new revenue streams for service providers.

Global Mobile Broadband Market: Trends

AI-Driven Network Optimization

Telecom operators are increasingly leveraging artificial intelligence and machine learning to optimize network performance, predict traffic congestion, and enhance user experience. AI-powered tools enable self-optimizing networks and proactive maintenance, reducing operational costs and improving service quality.

Growth of Digital Services and OTT Applications

The rising demand for over-the-top applications, streaming services, online gaming, and mobile payment platforms is driving mobile broadband consumption. Telecom providers are offering bundled data plans and value-added services to cater to evolving digital lifestyles, supporting market expansion globally.

Global Mobile Broadband Market: Research Scope and Analysis

By Technology Analysis

In the technology segment of the global mobile broadband market, 5G networks are expected to lead, capturing around 40.0% of the total market share in 2025. The widespread adoption of 5G is driven by its ability to deliver ultra-high-speed connectivity, low latency, and support for a massive number of connected devices. This makes it ideal for advanced applications such as real-time streaming, cloud computing, IoT deployments, smart cities, and enterprise digital transformation. Telecom operators are heavily investing in 5G infrastructure, including small cell networks, spectrum expansion, and edge computing, to meet the growing demand for faster and more reliable mobile internet services across both consumer and business segments.

Meanwhile, 4G LTE networks continue to play a significant role in the mobile broadband market. Despite the rapid deployment of 5G, 4G LTE remains widely used, particularly in regions where 5G infrastructure is still being developed. It provides reliable high-speed internet access, enabling activities such as video streaming, online gaming, and mobile commerce. 4G LTE also serves as a critical foundation for operators to gradually upgrade to 5G, ensuring continuity of service and broad coverage in rural and underserved areas. The coexistence of 4G and 5G networks ensures that mobile broadband services remain accessible, efficient, and scalable across different geographies.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Service Type Analysis

In the service type segment of the global mobile broadband market, mobile data services are projected to maintain their leading position, accounting for approximately 50.0% of the total market share in 2025. The dominance of mobile data services is driven by the increasing reliance on smartphones, tablets, and other connected devices for internet access. Consumers and businesses are demanding faster and more reliable connectivity to support activities such as video streaming, online gaming, social media, cloud applications, and mobile commerce. The growth of mobile applications, digital services, and IoT devices further fuels the need for high-speed mobile data, making it the primary revenue generator for telecom operators across global markets.

Fixed Wireless Access (FWA) is emerging as a complementary service within the mobile broadband segment, providing high-speed internet to homes, businesses, and rural areas where fiber or cable infrastructure is limited. FWA leverages existing 4G and 5G networks to deliver reliable broadband connectivity without the need for extensive wired installations.

This service is particularly valuable in regions with challenging geography or underdeveloped broadband infrastructure, enabling access to online education, telemedicine, e-commerce, and other digital services. As operators continue to expand network coverage and improve technology, FWA is gaining traction as a cost-effective solution to bridge the digital divide and support broader adoption of mobile broadband globally.

By End-User Analysis

In the end-user segment of the global mobile broadband market, the consumer segment is expected to dominate, capturing around 60.0% of the market share in 2025. The strong presence of the consumer segment is fueled by the widespread adoption of smartphones, tablets, and wearable devices, which are increasingly used for high-speed internet access, social media, video streaming, online gaming, and mobile commerce.

Rising digital literacy, growing demand for entertainment and communication services, and the convenience of anytime-anywhere connectivity are driving consumer reliance on mobile broadband. Additionally, the expansion of 5G networks and improved coverage enhances the overall user experience, encouraging more individuals to adopt mobile data services for personal use.

The business segment also plays a significant role in the mobile broadband market, accounting for the remaining market share. Enterprises across industries are increasingly leveraging mobile broadband to support remote work, cloud computing, enterprise mobility solutions, and real-time communication. Fixed wireless access and private 5G networks enable businesses to maintain secure and high-speed connectivity, particularly for distributed offices, manufacturing units, and field operations.

The growing reliance on digital transformation initiatives, IoT integration, and smart solutions in sectors such as healthcare, logistics, and finance further drives demand for mobile broadband services among corporate users, making it a crucial contributor to overall market growth.

The Mobile Broadband Market Report is segmented on the basis of the following:

By Technology

- 5G Networks

- 4G LTE Networks

- 3G Networks

By Service Type

- Mobile Data Services

- Fixed Wireless Access (FWA)

By End-User

- Consumer Segment

- Business Segment

Global Mobile Broadband Market: Regional Analysis

Region with the Largest Revenue Share

The Asia Pacific region is expected to lead the global mobile broadband market in 2025, accounting for approximately 40.0% of total market revenue. This dominance is driven by rapidly growing smartphone adoption, expanding 4G and 5G network infrastructure, and increasing demand for high-speed mobile data across both urban and rural areas. Large populations in countries such as China and India, integrated with rising internet penetration and digital services adoption, fuel the region’s mobile broadband growth.

Additionally, government initiatives to enhance digital connectivity, along with investments by telecom operators in advanced network technologies and spectrum expansion, are further strengthening the Asia Pacific’s position as the largest and fastest-growing market for mobile broadband globally.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

The Middle East and Africa region is witnessing significant growth in the global mobile broadband market due to increasing investments in network infrastructure, rising smartphone penetration, and government initiatives promoting digital inclusion. Expanding 4G LTE coverage and the gradual rollout of 5G networks are enhancing connectivity in urban and semi-urban areas, while fixed wireless access solutions are bridging the digital divide in rural and underserved regions. Growing demand for mobile data services, online education, telemedicine, and e-commerce is driving adoption, making the Middle East and Africa one of the fastest-growing markets in the global mobile broadband landscape.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Mobile Broadband Market: Competitive Landscape

The global mobile broadband market is highly competitive, with leading telecom operators and technology providers continuously investing in network expansion, 5G deployment, and innovative service offerings to capture market share. Companies compete through strategies such as spectrum acquisition, infrastructure upgrades, bundled service plans, and value-added digital services to attract both consumer and enterprise segments.

Collaboration with technology vendors, adoption of AI-driven network optimization, and partnerships for fixed wireless access and IoT solutions further intensify competition. The dynamic landscape encourages continuous innovation, pricing strategies, and service differentiation, driving overall growth and enhancing connectivity across regions globally.

Some of the prominent players in the global Mobile Broadband market are:

- Jio

- AT&T

- Verizon Communications

- T-Mobile US

- China Mobile

- Vodafone Group

- Deutsche Telekom

- NTT Group

- Orange S.A.

- Telefónica S.A.

- América Móvil

- SK Telecom

- KT Corporation

- Reliance Communications

- Bharti Airtel

- Telstra

- Optus

- Rogers Communications

- Bell Canada

- Telus Corporation

- Other Key Players

Global Mobile Broadband Market: Recent Developments

- September 2025: iBASIS agreed to acquire wholesale voice, mobile, and messaging customer contracts from Telstra International, marking its entry into the Australian and New Zealand markets.

- December 2024: Antietam Broadband launched Flight Mobile, a national 5G phone service, exclusively for its internet customers.

- November 2024: T-Mobile introduced the TCL Linkport IK511, its first 5G RedCap USB modem, designed to enhance mobile broadband connectivity.

- November 2024: Sullivan County, NY, received a nearly USD 30 million state grant to expand high-speed broadband services.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 1.5 T |

| Forecast Value (2034) |

USD 2.7 T |

| CAGR (2025–2034) |

6.8% |

| The US Market Size (2025) |

USD 0.4 T |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Technology (5G Networks, 4G LTE Networks, 3G Networks), By Service Type (Mobile Data Services, Fixed Wireless Access), and By End-User (Consumer Segment, Business Segment) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Jio, AT&T, Verizon Communications, T-Mobile US, China Mobile, Vodafone Group, Deutsche Telekom, NTT Group, Orange S.A., Telefónica S.A., América Móvil, SK Telecom, KT Corporation, Reliance Communications, Bharti Airtel, Telstra, Optus, Rogers Communications, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global Mobile Broadband market?

▾ The global Mobile Broadband market size is estimated to have a value of USD 1.5 trillion in 2025 and is expected to reach USD 2.7 trillion by the end of 2034.

What is the size of the US Mobile Broadband market?

▾ The US Mobile Broadband market is projected to be valued at USD 400 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 700 billion in 2034 at a CAGR of 6.4%.

Which region accounted for the largest global Mobile Broadband market?

▾ Asia Pacific is expected to have the largest market share in the global Mobile Broadband market, with a share of about 40.0% in 2025.

Who are the key players in the global Mobile Broadband market?

▾ Who are the key players in the global Mobile Broadband market?

What is the growth rate of the global Mobile Broadband market?

▾ The market is growing at a CAGR of 6.8 percent over the forecasted period.