Market Overview

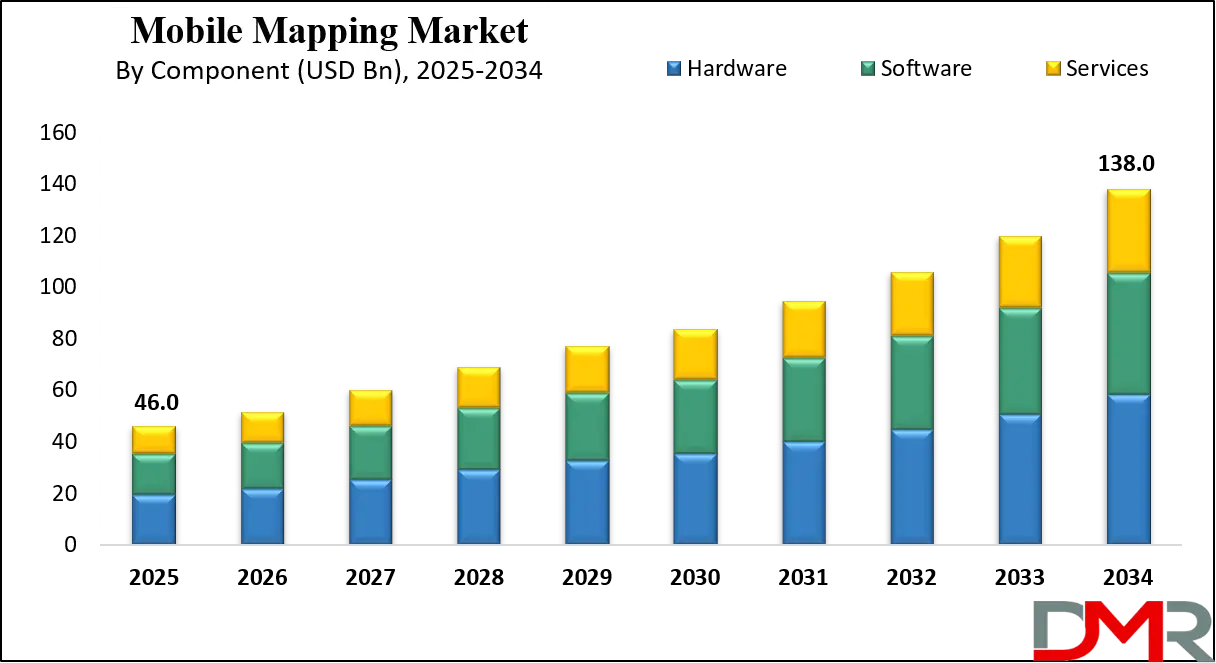

The Global Mobile Mapping Market size is projected to reach USD 46.0 billion in 2025 and grow at a compound annual growth rate of 13.0% to reach a value of USD 138.0 billion in 2034.

The Mobile Mapping Market refers to the ecosystem of technologies, systems, and services used to capture geospatial data through mobile platforms such as vehicles, UAVs, backpacks, marine vessels, and rail systems. It integrates hardware (LiDAR, GNSS/INS, IMUs, sensors, cameras), software (data processing, 3D modeling, cloud platforms), and services (surveying, integration, and maintenance). Over the past decade, this market has transitioned from conventional static surveying to dynamic, high-accuracy spatial intelligence for industries including construction, transportation, and urban planning.

Key developments include the integration of AI and

cloud computing into mapping workflows, the expansion of drone-based mapping, and the adoption of 3D/4D mapping for digital twins. Governments are liberalizing data policies to promote private participation—such as India’s 2021 geospatial reform, which removed licensing barriers for mapping data collection.

Technological convergence of LiDAR, photogrammetry, GNSS/INS, and radar has transformed the mapping landscape, enabling precise, real-time data availability for smart cities, infrastructure monitoring, and environmental management.

Overall, the Mobile Mapping Market is evolving from data collection to decision intelligence, where real-time geospatial data fuels predictive analytics, operational efficiency, and automation.

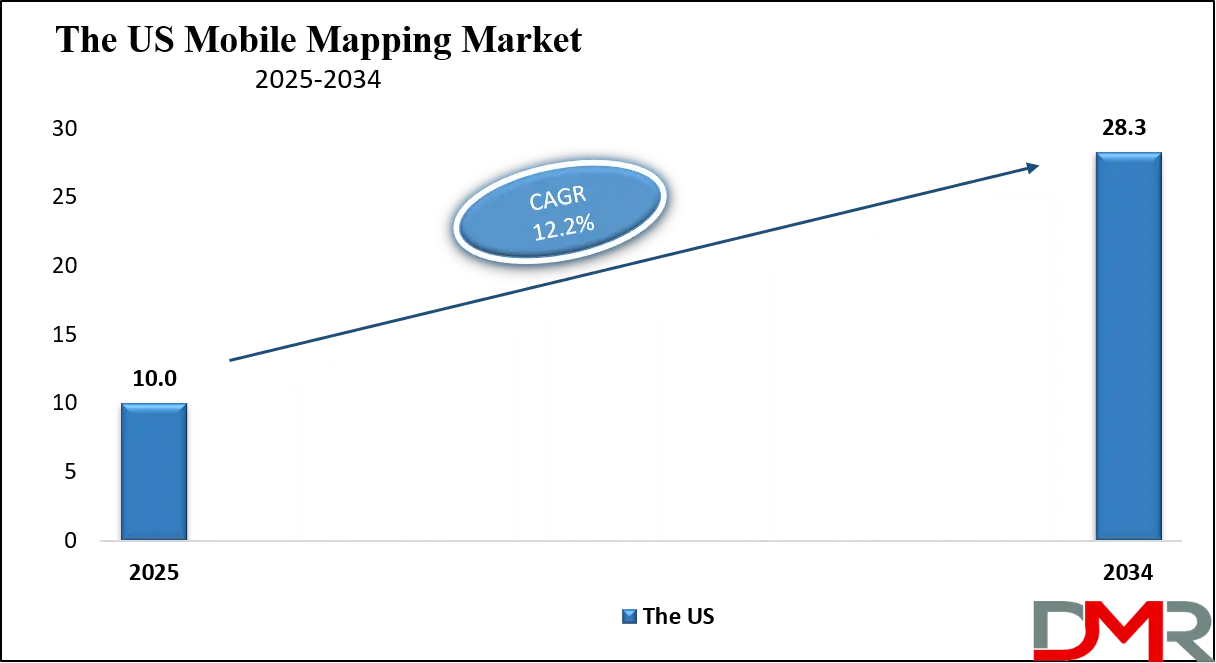

The US Mobile Mapping Market

The US Mobile Mapping Market size is projected to reach USD 10.0 billion in 2025 at a compound annual growth rate of 12.2% over its forecast period.

The U.S. mobile mapping market remains the largest globally, supported by major players in autonomous driving, smart infrastructure, and geospatial analytics. Federal agencies such as the Federal Geographic Data Committee (FGDC) ensure standardization and interoperability across mapping systems, while private sector investment fuels innovation in vehicle-mounted LiDAR and AI-powered data platforms. Integration with intelligent transportation systems and logistics optimization tools further drives adoption.

The market benefits from strong infrastructure investments, regulatory clarity, and mature geospatial frameworks. High adoption across transportation, construction, and defense underpins its leadership. The combination of advanced LiDAR manufacturing, software innovation, and venture funding accelerates development. However, data privacy regulations and the high cost of LiDAR and mobile mapping sensors remain challenges.

Europe Mobile Mapping Market

Europe Mobile Mapping Market size is projected to reach USD 9.5 billion in 2025 at a compound annual growth rate of 12.7% over its forecast period.

Europe’s mobile mapping market is propelled by cross-border transport projects, open-data policies, and sustainability mandates. The European Spatial Data Infrastructure (INSPIRE Directive) ensures unified geospatial data standards across the EU. Governments and private firms increasingly rely on mapping data for smart-city design, rail modernization, and environmental monitoring.

Europe’s market follows the institutional theory of technology adoption, emphasizing standardization, compliance, and interoperability. The EU’s open-data policy fosters collaboration across nations and industries. However, fragmented governance, strict privacy laws, and slower adoption rates in smaller economies can limit scaling. The continent’s long-term focus on sustainable development, digital twins, and precision mapping supports steady but structured growth, favoring high-accuracy, and regulated deployments over fast, disruptive adoption models.

Japan Mobile Mapping Market

Japan Mobile Mapping Market size is projected to reach USD 3.2 billion in 2025 at a compound annual growth rate of 13.1% over its forecast period.

Japan’s market is defined by precision engineering, dense urban infrastructure, and technological sophistication. Government initiatives through the Geospatial Information Authority of Japan (GSI) promote open access to land-use and urban spatial data. The country uses mobile mapping in rail, utilities, and disaster management applications.

Japan’s market aligns with innovation-systems theory, emphasizing ecosystem collaboration between academia, industry, and government. Precision mapping supports national priorities such as urban resilience, infrastructure inspection, and autonomous transportation. Constraints include high operational costs and a limited number of large-scale new infrastructure projects.

Mobile Mapping Market: Key Takeaways

- Market Growth: The Mobile Mapping Market size is expected to grow by USD 86.6 billion, at a CAGR of 13.0%, during the forecasted period of 2026 to 2034.

- By Deployment: The on-premises segment is anticipated to get the majority share of the Mobile Mapping Market in 2025.

- By Component: The hardware segment is expected to get the largest revenue share in 2025 in the Mobile Mapping Market.

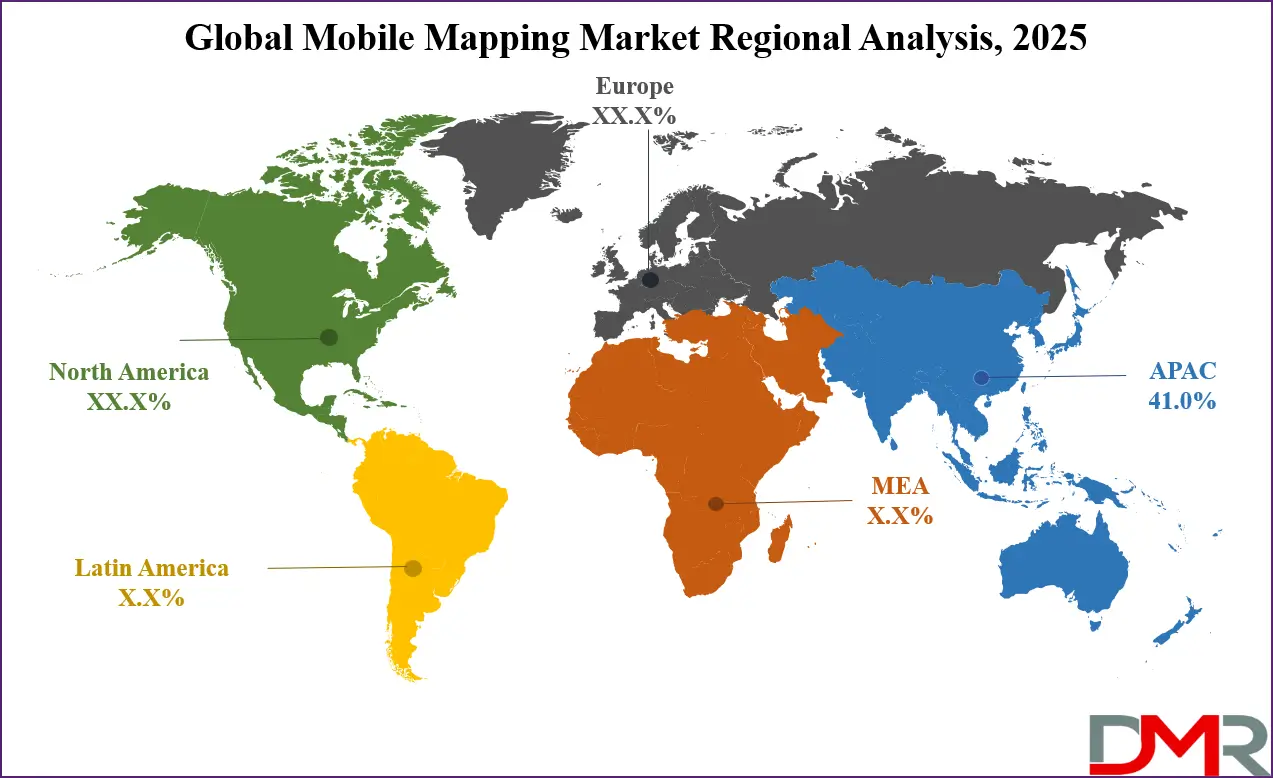

- Regional Insight: Asia Pacific is expected to hold a 41.0% share of revenue in the Global Mobile Mapping Market in 2025.

- Use Cases: Some of the use cases of Mobile Mapping include mining & oil gas, construction & infrastructure, and more.

Mobile Mapping Market: Use Cases:

- Transportation & Logistics: Enables real-time route optimization, road inspection, and fleet navigation accuracy.

- Construction & Infrastructure: Supports 3D modeling, digital twins, and progress monitoring of large infrastructure projects.

- Mining & Oil & Gas: Enhances resource mapping, safety monitoring, and terrain modeling for exploration.

- Public Safety & Emergency Response: Provides rapid situational mapping of disaster zones and critical areas for emergency response.

Stats & Facts

- Japan’s GSI mandates public access to national geospatial data for urban and disaster management.

- U.S. Geological Survey (USGS) oversees over 7 million square miles of high-resolution LiDAR coverage through the 3D Elevation Program.

- The European Commission INSPIRE Directive governs standardized data infrastructure across 27 EU member states.

Market Dynamic

Driving Factors in the Mobile Mapping Market

Smart Infrastructure Development and Urbanization

The growing pace of smart-city initiatives and infrastructure expansion across the world has significantly accelerated the adoption of mobile mapping solutions. Governments and urban planners are deploying vehicle-based, UAV, and backpack mapping systems to capture high-precision, real-time spatial data for roads, bridges, railways, and underground utilities.

As cities expand, the need for accurate geospatial data for asset management, predictive maintenance, and environmental planning becomes more critical. The integration of mobile mapping technologies into urban governance ensures cost-efficient planning, resource optimization, and improved public services, making it a cornerstone of sustainable urban development and modern infrastructure management.

Governmental Policy Support and Open-Data Initiatives

Supportive regulatory frameworks and government-led open-data initiatives are key growth catalysts for the global mobile mapping market. Reforms such as India’s 2021 geospatial liberalization policy and the EU’s INSPIRE Directive have opened access to mapping data, encouraging private investment and innovation.

These initiatives have reduced entry barriers, enabling startups and SMEs to contribute to mapping and spatial analytics. By promoting public-private collaborations, governments are fostering a competitive ecosystem that drives research and technology development. This liberalization of geospatial data is unlocking new applications in agriculture, telecom, construction, and logistics, ultimately accelerating digital transformation across multiple industry sectors.

Restraints in the Mobile Mapping Market

High Equipment and Deployment Costs

The high capital investment required for mobile mapping technology continues to restrict its widespread adoption, particularly among small and medium enterprises and in developing economies. Mobile mapping units involve expensive LiDAR scanners, GNSS/INS systems, high-resolution cameras, and complex data-processing software.

Additionally, trained personnel are needed to operate, calibrate, and maintain these systems, further increasing costs. The operational and maintenance expenses associated with large-scale data collection and processing often deter organizations from early adoption. As a result, cost optimization through equipment sharing, software-as-a-service (SaaS) models, and modular mapping systems is emerging as a crucial solution for market expansion.

Data Privacy and Standardization Challenges

Data security and lack of global standardization represent major obstacles to the growth of the mobile mapping market. The collection of high-resolution spatial data often includes imagery of private or restricted areas, leading to privacy concerns and regulatory restrictions. Varying legal frameworks—such as Europe’s GDPR, U.S. state-level data protection laws, and regional mapping policies—create complexities for cross-border operations.

Moreover, the absence of uniform data standards complicates interoperability between platforms and systems, reducing operational efficiency. Addressing these concerns requires international collaboration, policy harmonization, and the implementation of strong encryption and anonymization protocols to ensure compliant and secure data usage.

Opportunities in the Mobile Mapping Market

Emerging Economies and Infrastructure Gaps

Developing regions across Africa, Southeast Asia, and Latin America offer immense untapped opportunities for mobile mapping solutions. Rapid urbanization, infrastructure expansion, and limited legacy mapping data in these areas are driving demand for accurate and scalable spatial data collection technologies.

Governments are increasingly investing in digital infrastructure, transportation planning, and resource management using cost-effective UAV and vehicle-based mapping systems. International collaborations and technology transfers are further supporting the adoption of modern mapping tools. These emerging markets are projected to experience the fastest growth as they prioritize digital transformation, sustainable development, and smart urban planning initiatives.

Integration with AI and Cloud Ecosystems

The convergence of artificial intelligence and cloud computing presents transformative opportunities for the mobile mapping market. AI-driven automation enhances feature extraction, object recognition, and predictive analytics, reducing manual data-processing time. Cloud-based platforms enable large-scale data storage, collaboration, and real-time access to mapping outputs from multiple devices and locations.

These technologies are expanding applications beyond traditional surveying into digital twins, autonomous navigation, and infrastructure monitoring. As organizations increasingly seek agile, data-driven solutions, the integration of AI and cloud services is set to redefine mapping efficiency, scalability, and intelligence, making geospatial data a critical business enabler.

Trends in the Mobile Mapping Market

Transition from 2D to 4D Mapping and Advanced Visualization

A major trend transforming the mobile mapping industry is the evolution from traditional 2D cartography to sophisticated 3D and 4D dynamic mapping. This shift enables users to visualize environments in greater depth, incorporating both spatial and temporal data for real-time change detection.

Sectors such as construction, urban planning, and public safety increasingly rely on these models for digital twin creation, infrastructure inspection, and environmental monitoring. With advancements in LiDAR and imaging technologies, 4D mapping delivers high-resolution accuracy and temporal intelligence, supporting predictive maintenance, simulation-based planning, and immersive visualization through AR and VR applications.

Hybrid Sensor Integration and Multi-Platform Deployments

The growing integration of hybrid sensor technologies represents another key trend in the mobile mapping market. Modern mapping systems increasingly combine LiDAR, photogrammetry, GNSS/INS, radar, and camera-based imaging to enhance precision and coverage in diverse environments.

Multi-platform deployments—ranging from vehicle-mounted and UAV-based systems to backpack and marine configurations—enable seamless data collection in urban, remote, and hazardous locations. This hybrid approach improves mapping efficiency, minimizes operational constraints, and allows for continuous data acquisition across varied terrains. As a result, hybrid and multi-sensor mapping solutions are becoming the standard for organizations seeking scalable, accurate, and cost-efficient mapping capabilities.

Impact of Artificial Intelligence in Mobile Mapping Market

- Automated Object Detection: AI algorithms identify features like roads and structures from LiDAR data.

- Predictive Analysis: Machine learning predicts infrastructure wear and anomalies.

- Optimized Mapping Routes: AI enhances path planning for drones and vehicles.

- Data Fusion: AI integrates multisensor datasets for richer mapping accuracy.

- Smart Decision Systems: Enables digital twins and real-time monitoring dashboards.

Research Scope and Analysis

By Component Analysis

The hardware segment dominates the mobile mapping market, accounting for approximately 42% in 2025. Growth is driven by increasing adoption of high-precision LiDAR scanners, GNSS receivers, IMUs, and advanced sensors integrated into vehicle, UAV, and backpack mapping platforms. Governments and private organizations are investing heavily in modern mapping equipment to support infrastructure and transportation projects.

The hardware segment remains critical to the market ecosystem as it provides the foundational technology required for accurate data capture and spatial referencing. Continuous innovations in sensor miniaturization, cost reduction, and multi-sensor integration are further strengthening hardware’s leadership across all mapping applications.

The software segment is projected to register the fastest growth rate in the mobile mapping market during the forecast period. Cloud-based data processing, 3D visualization, and AI-enabled modeling tools are revolutionizing the management and analysis of geospatial data. Enterprises are increasingly adopting software platforms for real-time collaboration, automated feature extraction, and the creation of digital twins.

Mapping software now supports end-to-end workflows—from data capture to intelligent analysis—making it indispensable for large-scale infrastructure and smart-city projects. The growing shift toward subscription-based software-as-a-service (SaaS) models is also fueling recurring revenue streams and expanding accessibility across small and medium enterprises worldwide.

By Deployment Mode Analysis

The on-premises deployment segment leads the mobile mapping market with a share of approximately 48% in 2025. This dominance is attributed to the preference of government agencies, defense organizations, and large infrastructure firms for data security, sovereignty, and control over sensitive mapping information. On-premises systems allow integration with legacy GIS and enterprise data centers, ensuring compliance with national geospatial standards.

Despite higher setup and maintenance costs, the reliability, customization capabilities, and superior data confidentiality offered by on-premises deployments continue to make them the preferred choice for high-stakes applications, particularly in government and defense sectors.

The cloud-based deployment segment is expected to grow at the fastest pace as enterprises increasingly adopt scalable SaaS mapping solutions. Cloud infrastructure supports distributed data processing, remote collaboration, and real-time map updates, significantly enhancing operational agility.

The growing use of mobile mapping in construction, logistics, and environmental monitoring has accelerated the demand for flexible, easily deployable cloud platforms. By reducing infrastructure overhead and improving accessibility, cloud solutions are enabling organizations of all sizes to leverage high-quality mapping data. The trend toward digital twins and AI-driven analytics further reinforces cloud-based systems as the backbone of next-generation mapping workflows.

By Technology Analysis

LiDAR-based mapping remains the dominant technology, holding around 44% in 2025 of the total mobile mapping market. LiDAR offers unparalleled accuracy, speed, and depth in 3D data capture, making it essential for applications such as road mapping, topographic surveys, and infrastructure inspection. The technology’s ability to generate detailed point clouds under varied lighting and weather conditions enhances its reliability.

Ongoing advancements in solid-state LiDAR, lightweight sensors, and real-time point cloud processing have made LiDAR more efficient and affordable, ensuring its continued dominance across automotive, construction, and public safety applications.

Hybrid systems—integrating LiDAR, photogrammetry, GNSS/INS, and radar—represent the fastest-growing technology segment. Their ability to combine multiple data sources delivers improved spatial accuracy and contextual richness. These systems overcome environmental and lighting limitations associated with single-sensor setups, enabling precise mapping in urban canyons, forests, and subterranean settings.

Organizations are rapidly adopting hybrid mapping for complex infrastructure, disaster response, and smart-city projects. The convergence of diverse sensor technologies, combined with AI-enhanced data fusion, is positioning hybrid systems as the future of comprehensive and adaptive mobile mapping solutions across industries.

By Mapping Type Analysis

Vehicle-based mapping holds the largest market share, accounting for approximately 46% in 2025. These systems are widely used in road and highway surveys, transportation planning, and asset management. Their ability to collect high-resolution geospatial data efficiently over large areas has made them indispensable for government and private infrastructure projects.

The automotive sector’s push toward autonomous driving and advanced navigation systems further strengthens the demand for vehicle-mounted LiDAR and camera systems. Consistent investments in roadway digitalization and national mapping programs continue to secure this segment’s leadership position in the global market.

UAV or drone-based mapping is the fastest-growing segment due to its versatility, cost-effectiveness, and ability to access remote or hazardous terrains. Drones equipped with LiDAR, GNSS, and high-definition cameras enable rapid surveying and 3D modeling across industries such as agriculture, mining, and construction.

They provide faster data acquisition and lower operational costs compared to traditional vehicle-based systems. With advances in battery life, flight automation, and regulatory support, drone mapping is increasingly becoming the preferred choice for high-precision, short-duration mapping projects worldwide, and particularly in emerging markets.

By Application Analysis

The transportation and logistics sector leads the mobile mapping market with an estimated 40% share in 2025. Governments and private operators rely on mobile mapping for road maintenance, traffic management, and infrastructure modernization. These systems enable detailed asset inventories, route optimization, and integration with navigation technologies for autonomous vehicles.

Mobile mapping enhances safety and operational efficiency by providing real-time spatial data to support decision-making. With growing investments in smart mobility and intelligent transport networks, this segment continues to be the largest contributor to the global mobile mapping market.

The real estate sector is emerging as the fastest-growing application segment, driven by the rising adoption of 3D mapping and digital twins in property development and urban planning. Developers use mobile mapping to create detailed spatial visualizations for site assessment, building design, and infrastructure integration.

The use of photogrammetry and LiDAR-based models allows for accurate volumetric analysis and progress tracking. As cities embrace smart infrastructure, real estate companies are leveraging geospatial data for zoning, valuation, and environmental compliance, transforming property management through enhanced visualization and spatial intelligence.

The Mobile Mapping Market Report is segmented on the basis of the following:

By Component

- Hardware

- Cameras

- LiDAR Scanners

- GNSS Systems

- IMUs

- Sensors

- Control Units

- Software

- Data Processing Software

- 3D Modeling Software

- Image Processing Software

- Cloud Platforms

- Services

- Data Acquisition Services

- Mapping & Surveying Services

- Consulting & Integration Services

- Maintenance & Support Services

By Deployment Mode

- Cloud-based

- On-premises

- Hybrid

By Technology

- LiDAR-based Mapping

- Photogrammetry-based Mapping

- GNSS/INS-based Mapping

- Radar-based Mapping

- Hybrid Systems

By Mapping Type

- Vehicle-based Mapping

- UAV/Drone-based Mapping

- Portable/Backpack Mapping

- Marine-based Mapping

- Rail-based Mapping

By Application

- Transportation & Logistics

- Construction & Infrastructure

- Mining & Oil & Gas

- Telecommunications

- Agriculture

- Public Safety & Emergency Response

- Tourism & Cultural Heritage

- Environmental Monitoring

- Real Estate

Regional Analysis

Leading Region in the Mobile Mapping Market

Asia-Pacific dominates the global mobile mapping market, capturing about 41% of total revenue in 2025. This leadership stems from large-scale infrastructure investments, rapid urbanization, and expanding smart-city initiatives across countries like China, India, Japan, and South Korea. Government policies encouraging private participation and local manufacturing of LiDAR and GNSS systems have accelerated adoption.

Furthermore, regional emphasis on construction automation, environmental monitoring, and public safety has expanded the use of mobile mapping systems. Continuous investment in digital infrastructure and geospatial data modernization ensures that Asia-Pacific maintains its leading position in the global market landscape.

Fastest Growing Region in the Mobile Mapping Market

Latin America is projected to be the fastest-growing region in the mobile mapping market over the forecast period. Countries such as Brazil, Mexico, and Chile are witnessing rapid infrastructure development, urban expansion, and increased adoption of drone-based mapping technologies.

Governments are investing in road modernization, mining exploration, and environmental monitoring projects that rely heavily on accurate spatial data. The region’s growing focus on digital transformation, coupled with collaborations between international mapping firms and local authorities, is accelerating market growth. As costs decline and awareness rises, Latin America is poised to become a dynamic and lucrative market for mobile mapping solutions.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Mobile Mapping Market is moderately consolidated with leading players offering integrated hardware, software, and services. Key companies include Topcon, Trimble, Hexagon AB, Teledyne Technologies, and Leica Geosystems. Strategic alliances, mergers, and cloud-platform launches are shaping competition. Vendors focus on hybrid sensing technologies and AI-based analytics to strengthen end-to-end mapping capabilities. Competition is also intensifying among drone-mapping providers and SaaS-based mapping startups targeting cost-sensitive markets.

Some of the prominent players in the global Mobile Mapping are:

- Trimble Inc.

- Hexagon AB

- Leica Geosystems AG (part of Hexagon)

- Topcon Corporation

- Teledyne Technologies Incorporated

- RIEGL Laser Measurement Systems GmbH

- FARO Technologies, Inc.

- GeoSLAM Ltd.

- NavVis GmbH

- Cyclomedia Technology B.V.

- iM Ajing SAS

- Hi‑Target Surveying Instrument Co., Ltd.

- GreenValley International

- Klau Geomatics Pty Ltd.

- Genesys International Corporation Limited

- ALLIED IMAGING

- Apple Inc.

- Google LLC (Alphabet)

- Microsoft Corporation

- TomTom International B.V.

- Other Key Players

Recent Developments

- In June 2025, Leica Geosystems launched a next-generation mobile mapping system integrating LiDAR, cameras, and GNSS with AI-powered cloud analytics for real-time urban asset management.

- In March 2025, Trimble announced the acquisition of a drone-LiDAR technology startup to expand its aerial and mobile mapping capabilities for construction and infrastructure monitoring.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 46.0 Bn |

| Forecast Value (2034) |

USD 138.0 Bn |

| CAGR (2025–2034) |

8.3% |

| The US Market Size (2025) |

USD 10.0 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Hardware, Software, and Services), By Deployment Mode (Cloud-based, On-premises, and Hybrid) By Technology (LiDAR-based Mapping, Photogrammetry-based Mapping, GNSS/INS-based Mapping, Radar-based Mapping, and Hybrid Systems), By Mapping Type (Vehicle-based Mapping, UAV/Drone-based Mapping, Portable/Backpack Mapping, Marine-based Mapping, and Rail-based Mapping), By Application (Transportation & Logistics, Construction & Infrastructure, Mining & Oil & Gas, Telecommunications, Agriculture, Public Safety & Emergency Response, Tourism & Cultural Heritage, Environmental Monitoring, and Real Estate) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Trimble Inc., Hexagon AB, Leica Geosystems AG (part of Hexagon), Topcon Corporation, Teledyne Technologies Incorporated, RIEGL Laser Measurement Systems GmbH, FARO Technologies, Inc., GeoSLAM Ltd., NavVis GmbH, Cyclomedia Technology B.V., iM Ajing SAS, i‑Target Surveying Instrument Co., Ltd., GreenValley International, Klau Geomatics Pty Ltd., Genesys International Corporation Limited, ALLIED IMAGING, Apple Inc., Google LLC (Alphabet), Microsoft Corporation, TomTom International B.V. , and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Mobile Mapping Market size is expected to reach a value of USD 46.0 billion in 2025 and is expected to reach USD 138.0 billion by the end of 2034.

Asia Pacific is expected to have the largest market share in the Global Mobile Mapping Market, with a share of about 41.0% in 2025.

The Mobile Mapping Market in the US is expected to reach USD 10.0 billion in 2025.

Some of the major key players in the Global Mobile Mapping Market are Apple, Google, Trimble, and others

The market is growing at a CAGR of 13.0 percent over the forecasted period.