Market Overview

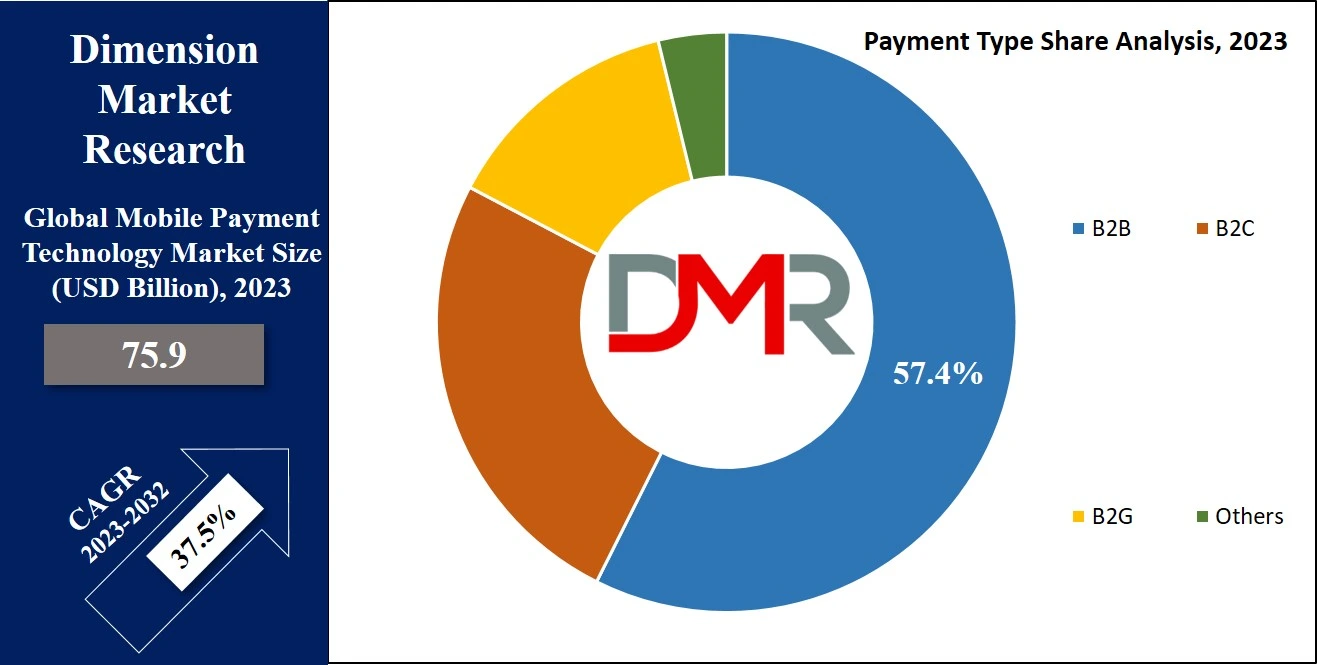

The Global Mobile Payment Technology Market is expected to reach a value of USD 75.9 billion in 2023, and it is further anticipated to reach a market value of USD 1,329.5 billion by 2032 at a CAGR of 37.5%. The market has seen significant growth over the past few years and is predicted to grow significantly during the forecasted period as well.

Mobile Payment Technology refers to the use of mobile devices such as smartphones and tablets to make electronic transactions. This technology allows users to pay for goods and services, transfer money, or even purchase products online through digital wallets or apps. It has gained significant traction in recent years due to the increasing use of smartphones and the growing need for convenient and secure payment methods.

The mobile payment technology market encompasses the development, integration, and use of mobile wallets, mobile point-of-sale (POS) systems, digital currencies, and other related technologies that enable seamless payment experiences. Key players in this market include giants like Apple Pay, Google Pay, and PayPal, as well as emerging startups focusing on niche market segments.

The mobile payment technology market is experiencing rapid growth, with a wide range of growth opportunities expected in 2024. For established players, there are immense prospects for expansion in untapped markets. The widespread adoption of mobile wallets like Apple Pay, Google Pay, and PayPal is already a norm, with 60% of all digital transactions worldwide being processed via mobile wallets.

However, opportunities remain for these companies to explore new regions and address the specific needs of diverse consumer groups. At the same time, new and entry-level businesses are poised to disrupt the market by introducing innovative solutions, especially in emerging economies where mobile payments are not yet as ubiquitous.

For instance, the surge in "Buy Now, Pay Later" (BNPL) services, which have grown by 400% in the last three years, presents a unique opportunity for both big players and new entrants to capitalize on consumer demand for flexible payment options. The trend is expected to further grow, allowing businesses to cater to consumers' evolving preferences for easy, budget-friendly payment methods.

Key trends in the mobile payment technology market are shaping its growth trajectory in 2024 and beyond. One of the most prominent trends is the continued adoption of mobile wallets and contactless payments. According to data, by 2026, 80% of smartphone users are expected to use mobile payments, indicating that the shift to cashless transactions is accelerating.

Moreover, the increase in mobile-based shopping, particularly in the U.S., where 31% of adults have already utilized mobile payments for online shopping, demonstrates the growing trust and comfort consumers have with digital transactions.

The BNPL service model also significantly impacts the market, as more consumers seek alternative payment options. This demand for flexible and installment-based payment solutions is driving innovation within the industry, with companies expanding their mobile payment platforms to integrate these services.

Key Takeaways

- The global mobile payment technology market is projected to reach USD 1,329.5 billion by 2032, growing at a CAGR of 37.5%.

- Mobile web payments are leading the technology segment due to their security, flexibility, and user-friendly features.

- The B2B segment is driving market growth, contributing 57.4% of revenue share in 2023.

- Remote payments gained significant traction post-COVID-19 due to the demand for contactless transactions.

- The BFSI sector dominates the market, with banks pushing for mobile payment adoption in 2023.

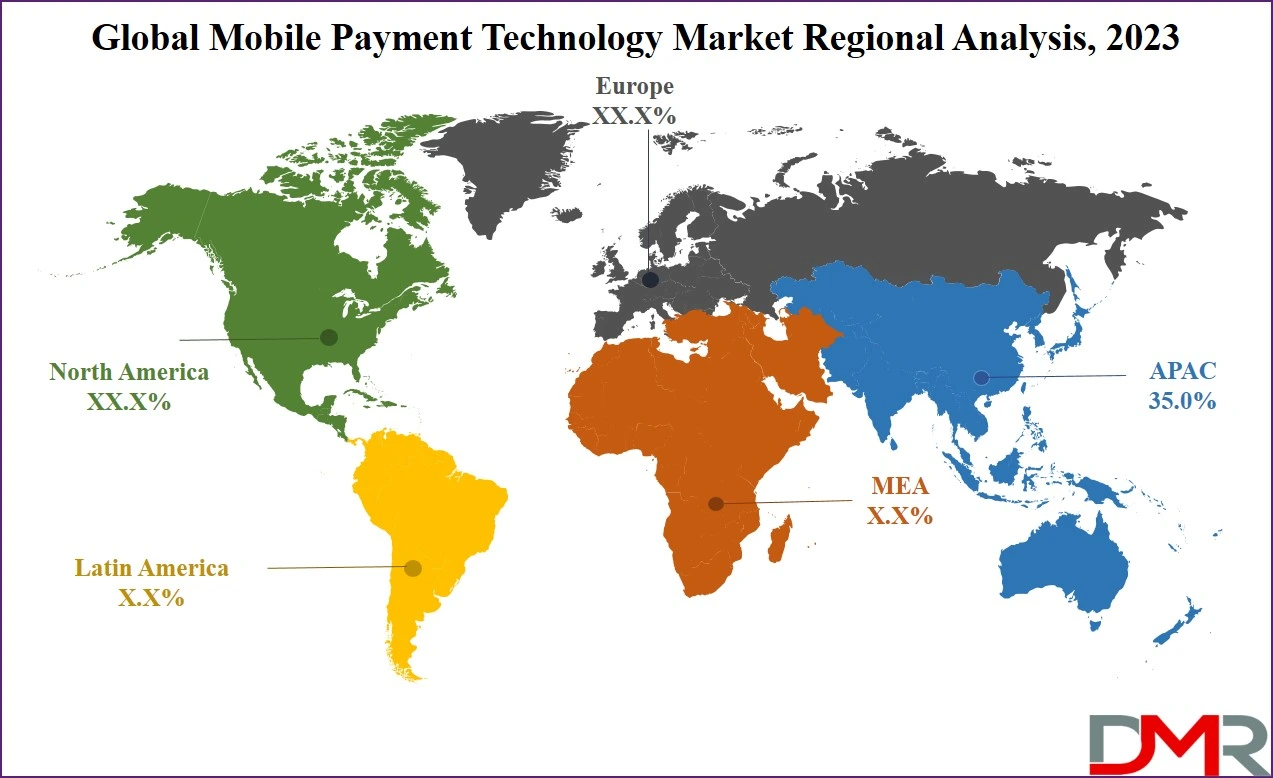

- Asia Pacific leads the global market with a 35.0% revenue share in 2023, driven by online retail trends and smartphone usage.

Use Cases

- Contactless retail payments allow customers to tap phones at checkout for quick, cashless transactions.

- Peer-to-peer money transfers enable instant funds sharing between friends or family members.

- In-app purchasing streamlines payment for digital goods, subscriptions, and services.

- Transportation fare collection lets commuters pay for transit with a smartphone scan.

- QR code payments link physical marketing materials to instant purchase options.

Market Dynamic

The global expansion of smartphones has played a major role in driving the mobile payment technologies market. With more people owning smartphones, the potential user base for mobile payment solutions has significantly expanded, resulting in a rise in the demand for these services.

The growth in e-commerce & m-commerce has further grown the need for mobile payment technologies. Moreover, a growing number of consumers are turning to their smartphones for online shopping, & mobile payments provide a convenient & secure way to complete these transactions, standing as a more reliable alternative to cash.

However, the large adoption of mobile payment technologies depends on the presence of strong & dependable telecommunications infrastructure. In areas with insufficient network coverage or slow internet speeds, many mobile payments may face obstacles. Security is also a major concern in mobile payments, as consumers must have confidence that their financial information remains protected. Any security breaches or instances of fraud can undermine consumer trust in mobile payment technologies, potentially limiting their adoption &usage.

Research Scope and Analysis

By Technology

In the technology segment, the mobile web payment segment emerged as the key segment, driven by the security & flexibility provided by these solutions. Mobile web payments are gaining traction owing to their reliability and the surging popularity of mobile commerce (m-commerce). These payment platforms come with a user-friendly URL, making it convenient for customers to bookmark and revisit websites, enhancing the user experience.

Also, the near-field communication (NFC) segment is expected to experience the highest growth in the forecast period. NFC technology enables businesses to easily integrate customer loyalty programs into their payment processes & allows customers to quickly redeem coupons using their mobile phones.

The rise in the number of e-commerce platforms & the ongoing integration of cutting-edge technologies in financial transactions will drive the growth of NFC-based payments. Factors like the growth in adoption of wearable payment devices & the booming trend of mobile commerce are expected to further boost the adoption of NFC-based payment solutions.

By Payment Type

The B2B (Business-to-Business) segment is a major driving factor, which also leads the way in terms of revenue share in 2023, as significant investments from private equity & venture capital firms in the B2B payments sector are creating the way for fresh growth opportunities. In addition, banks are highly embracing B2B mobile payment solutions to improve the experience for their business clients.

Further, the B2C (Business-to-Consumer) segment is expected to experience the highest growth throughout the forecast period, as B2C payments refer to transactions made by individual consumers when purchasing products or subscribing to services for personal use, as the segment is on the rise, owing to the growing number of mobile payments in the e-commerce industry.

Further, as per a recent report by SalesForce mobile users account for over 60% of the total e-commerce traffic worldwide. Thus, the increasing global adoption of digital wallets is anticipated to drive the growth of the B2C segment further in the coming years.

By Location

In 2023, the remote payment segment takes the lead in terms of revenue share. Remote payments have gained significant popularity, mainly due to the impact of the COVID-19 pandemic. The pandemic expanded the adoption of remote payments as they allow contactless transactions, removing the need for direct interaction during the payment process. Many companies have introduced remote payment apps to facilitate convenient & secure remote payments for their customers.

Further, the proximity payment segment is expected to experience the highest growth during the forecast period. Proximity payments include transactions between the payer & payee's devices using methods like QR codes, NFC, or Bluetooth connectivity, typically at physical point-of-sale (POS) terminals.

The use of proximity payments has grown in the post-pandemic era, as banks, fintech industries, & businesses look to enhance the digital experience for their customers & minimize operational costs, which reflects a growing desire for efficient & contactless payment options.

By End User

The BFSI (Banking, Financial Services, and Insurance) sector takes the lead with a substantial share of the market's revenue in 2023, as several banks are actively pushing for the adoption of mobile payment solutions, contributing highly to the segment's growth.

Furthermore, businesses within this sector are looking to embrace personalized & comprehensive payment solutions, which assist in tackling particular challenges across areas like wealth management, lending, & insurance. Mobile banking & payments provide banks a chance to improve convenience for their current customers & extend their services to a bigger population of unbanked individuals in developing nations.

Further, the retail & e-commerce sector is expected to notice the highest growth throughout the forecast period, with the growth driven by the rise in number of smartphone users, leading to a growth in mobile commerce sales. Smartphones have become the preferred choice for shopping, with mobile applications making the shopping experience more convenient & accessible to a larger audience.

The Mobile Payment Technology Market Report is segmented based on the following:

By Technology

- NFS

- Direct Mobile Billing

- SMS

- Mobile App

- Mobile Web Payment

- Interactive Voice Response System

- Others

By Payment Type

By Location

- Remote Payment

- Proximity Payment

By End User

- BFSI

- Healthcare

- IT & Telecom

- Transportation

- Retail & E-Commerce

- Media & Entertainment

- Others

Regional Analysis

Asia Pacific region is leading the market with a substantial

35.0% revenue share in 2023 globally, which is fueled by the changing lifestyles of people, the current trends in online retail, & the growing use of smartphones. As more governments in the Asia Pacific region promote cashless transactions, it's opening up growth opportunities.

The broad adoption of mobile technology in emerging countries is giving fintech companies & banks a new way to provide mobile banking solutions to those who are underserved & don't have access to traditional banking services in remote areas.

Further, North America is anticipated to have significant growth in the forecast period, which stands out with the presence of many key market players & a history of adopting advanced technologies, as several unmanned stores in the US are also pushing the adoption of mobile payments. Furthermore, the boom in the e-commerce industry is a key driver behind the large use of mobile payment solutions in North America.

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The mobile payments industry experiences a moderate level of competition with prominent companies consistently investing in the development of new products, forming partnerships, & acquiring other companies to expand their market presence. Their ongoing efforts in these areas are driven by the goal of capturing a bigger share of the mobile payments market and promoting growth & innovation within the industry.

In May 2023, Visa made a major change in India, as they removed the need for entering the CVV (Cardholder Verification Value) when making online purchases with domestically tokenized Visa cards, as the CVV2 requirement is now handled during the initial card tokenization process, making it easier & simpler for businesses & consumers, aiming to enhance the online shopping experience, ensuring smoother & more secure domestic internet transactions for Indian customers.

Some of the prominent players in the global Mobile Payment Technology Market are:

- PayPal

- Google

- Amazon

- Apple

- M Pesa

- Money Gram International

- Visa

- WeChat

- Alibaba Group

- Mastercard

- Other Key Players

Recent Development

- In January 2025, PayByCar announced a fundraising campaign aiming to secure $10 million in investment capital to expand its mobile payment services for in-vehicle transactions across additional markets and service categories.

- In February 2025, Corpay revealed plans to acquire an unnamed Brazilian mobile payments company to strengthen its position in Latin American markets and enhance its cross-border payment capabilities.

- In May 2023, Fabrick completed the acquisition of UK-based Judopay to enhance its payment orchestration capabilities in the United Kingdom, allowing the company to offer more comprehensive fintech solutions to its European clients.

- In August 2024, HPS (Hightech Payment Systems) finalized its acquisition of CR2 Limited, a banking software provider, to strengthen its digital banking and payment solutions portfolio and expand its global market reach.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 75.9 Bn |

| Forecast Value (2032) |

USD 1,329.5 Bn |

| CAGR (2023–2032) |

37.5% |

| Historical Data |

2017 – 2022 |

| Forecast Data |

2023 – 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Technology (NFS, Direct Mobile Billing, SMS, Mobile App, Mobile Web Payment, Interactive Voice Response System, and Others), By Payment Type (B2B, B2C, B2G, and Others), By Location (Remote Payment and Proximity Payment), By End User (BFSI, Healthcare, IT & Telecom, Transportation, Retail & E-Commerce, Media & Entertainment, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

PayPal, Google, Amazon, Apple, M Pesa, MoneyGram International, Visa, WeChat, Alibaba Group, Mastercard, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Mobile Payment Technology Market size is estimated to have a value of USD 75.9 billion in

2023 and is expected to reach USD 1,329.5 billion by the end of 2032.

Asia Pacific has the largest market share for the Global Mobile Payment Technology Market with a share

of about 35.0% in 2023.

Some of the major key players in the Global Mobile Payment Technology Market are PayPal, Visa,

Mastercard, and many others.

The market is growing at a CAGR of 37.5 percent over the forecasted period.