Market Overview

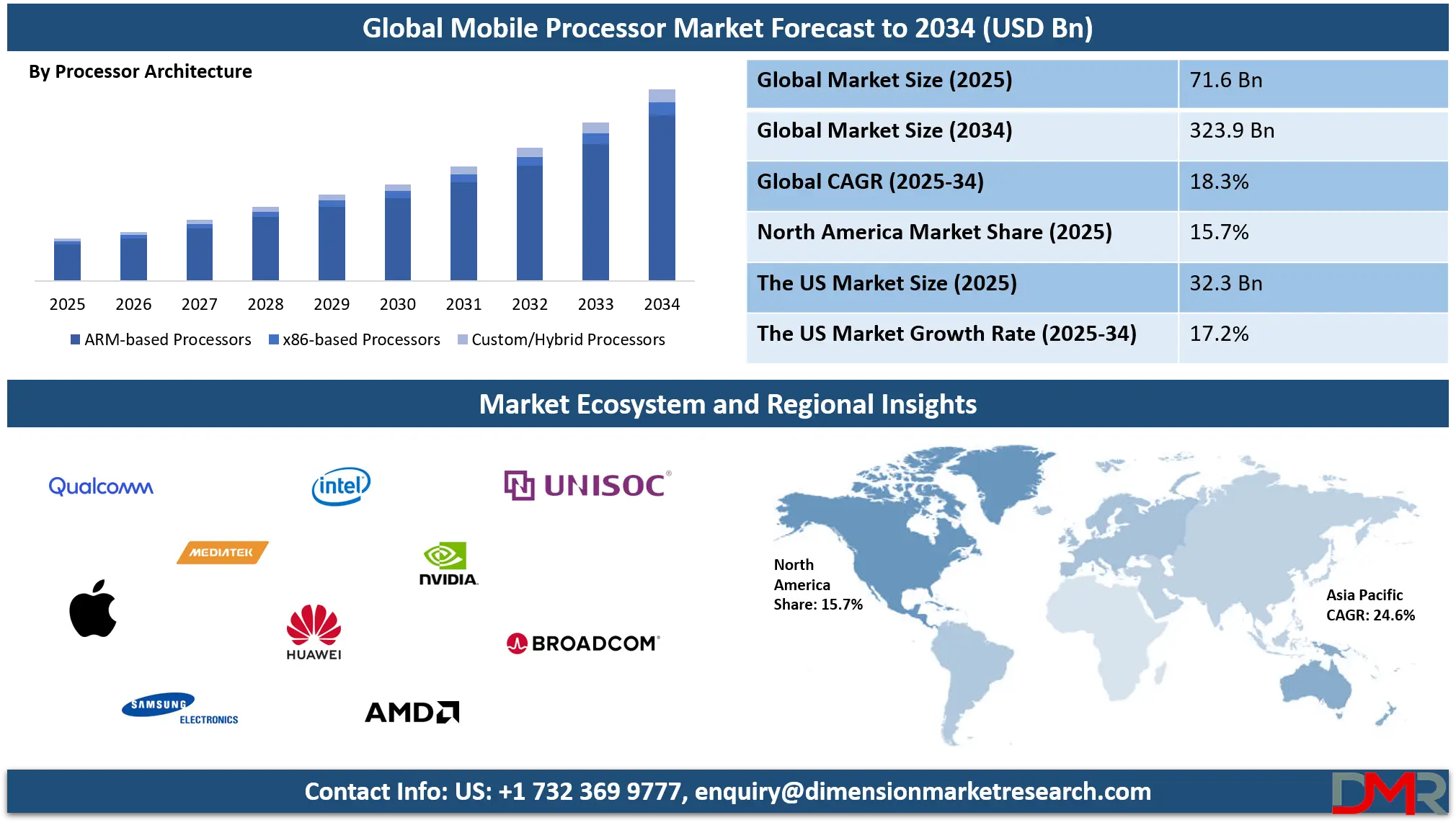

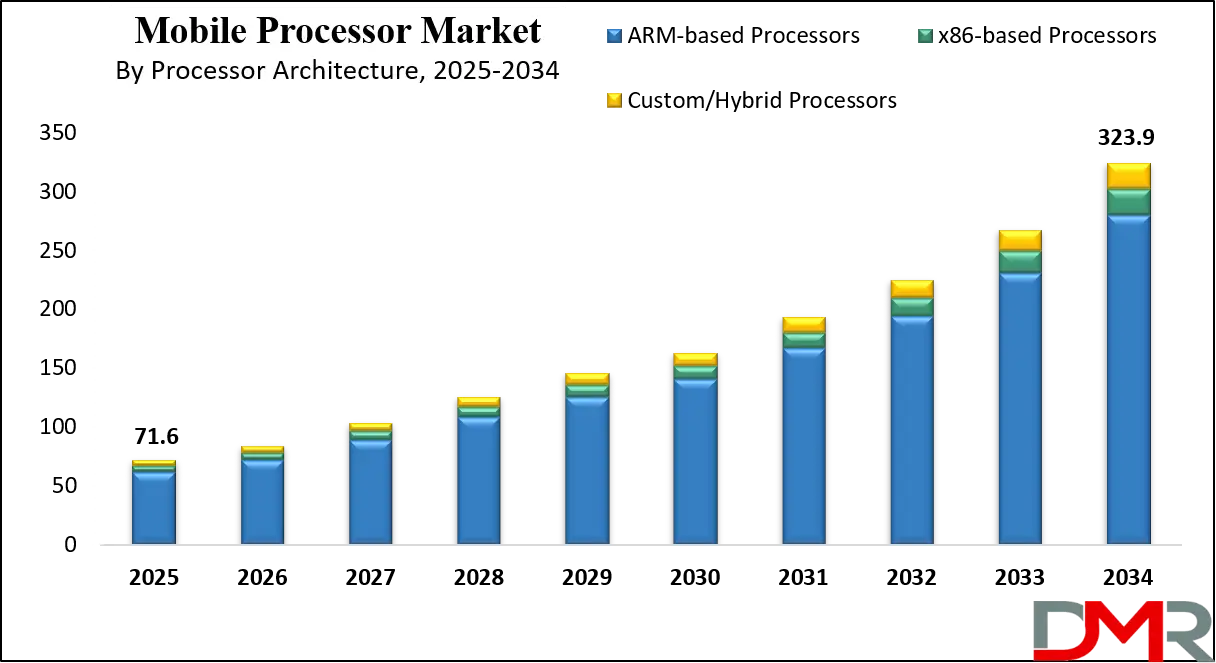

The global mobile processor market is projected to grow from USD 71.6 billion in 2025 to USD 323.9 billion by 2034, driven by rising demand for high-performance chipsets, AI integration, and 5G-enabled SoCs at a robust CAGR of 18.3%.

A mobile processor, often referred to as a system-on-chip or SoC, is the central computing unit within a mobile device responsible for executing tasks, managing system performance, and enabling communication between various hardware components. These processors are specifically engineered for energy efficiency, compactness, and high-speed processing to meet the demands of portable devices such as smartphones, tablets, wearables, and other connected technologies.

Equipped with multiple cores and often integrated with graphics units, AI accelerators, and modem capabilities, modern mobile processors play a crucial role in delivering seamless user experiences in real-time applications, gaming, imaging, connectivity, and artificial intelligence. Their architectural sophistication ensures optimal balance between power consumption and performance, making them the brain of every mobile digital experience.

The global mobile processor market represents a dynamic ecosystem characterized by rapid innovation cycles, intense competition, and growing customization by device manufacturers. As consumer preferences shift toward high-performance devices with advanced features, the demand for powerful yet energy-efficient processors has surged. Players in this space are pushing boundaries with smaller nanometer fabrication technologies, enhancing performance per watt and enabling faster speeds with lower heat generation. These processors are being developed to support integrated 5G, AI computing, and advanced GPU functions, reflecting the convergence of mobile computing and intelligent connectivity.

Mobile processors are not only powering traditional smartphones but are also driving the growth of new device categories, including foldable phones, AR/VR headsets, and smart home technologies. As the global push for digital transformation accelerates, particularly in emerging markets, mobile processors are becoming a core enabler of mobile-first economies. Companies are tailoring chipsets for regional needs, balancing cost efficiency with feature-rich capabilities to expand reach across mid-tier and budget devices. This approach is widening the user base and intensifying the competition among established players and new entrants alike.

Furthermore, the global mobile processor market is witnessing a growing emphasis on localized manufacturing, strategic partnerships, and AI-centric design. With governments incentivizing semiconductor production and R&D, companies are investing heavily in chip innovation to reduce supply chain vulnerabilities and dependency on third-party fabricators. The market's trajectory is being shaped by continuous technological evolution, cross-industry applications, and a sharp focus on integrating security, sustainability, and performance into the chip design process, which collectively defines the future of mobility in the digital age.

The US Mobile Processor Market

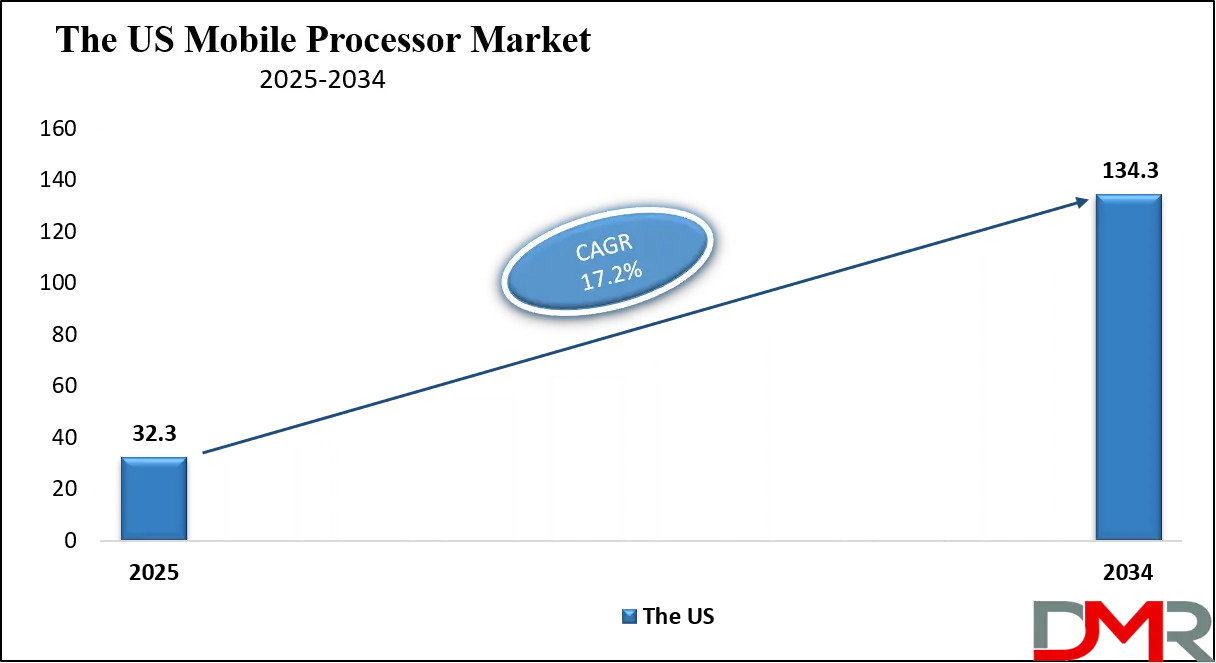

The U.S. mobile processor market size is projected to be valued at USD 32.3 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 134.3 billion in 2034 at a CAGR of 17.2%.

The U.S. mobile processor market is a highly advanced and innovation-driven segment, significantly influenced by leading semiconductor giants, consumer technology trends, and early adoption of cutting-edge mobile technologies. With a strong presence of companies focused on research and development, the region serves as a hub for next-generation chip design and fabrication processes. Demand in the U.S. is largely steered by the premium smartphone market, expanding use of 5G-enabled devices, and a growing reliance on edge computing and AI-driven mobile applications. The region also benefits from a robust ecosystem of tech companies, chipset integrators, and software developers who collaboratively shape processor performance and functionality to suit a digitally connected lifestyle.

The adoption of mobile processors in the U.S. is further catalyzed by growing consumer expectations for speed, multitasking, gaming, and immersive content consumption on mobile platforms.

Additionally, sectors such as autonomous vehicles, smart wearables, and enterprise mobility solutions are contributing to diversification in processor use cases. As sustainability and supply chain resilience become strategic priorities, U.S.-based manufacturers are ramping up domestic production and embracing energy-efficient architectures to meet regulatory and environmental standards. This convergence of technology, infrastructure, and innovation continues to position the U.S. as a key contributor and trendsetter in the global mobile processor landscape.

The Europe Mobile Processor Market

The Europe mobile processor market is projected to be valued at USD 13.6 billion in 2025, reflecting its rising importance in the global semiconductor landscape. This growth is being fueled by the region's strong push toward digital autonomy, growing investment in chip manufacturing, and an expanding ecosystem of connected devices and smart technologies. Countries like Germany and France are at the forefront, leveraging initiatives like the EU Chips Act to boost domestic production and reduce reliance on external supply chains. The integration of mobile processors into smartphones, IoT devices, and consumer electronics is accelerating, further strengthening Europe's position as a technology leader.

Moreover, the market is anticipated to grow at a CAGR of 23.5%, underpinned by advancements in 5G connectivity, the rise of AI-enabled mobile applications, and the growing demand for energy-efficient and high-performance chipsets. The automotive sector is also a major driver, as the shift toward electric and autonomous vehicles continues to demand sophisticated mobile processing capabilities. This convergence of industries and technologies, along with policy-driven support for semiconductor development, is expected to significantly elevate Europe’s share in the global mobile processor market over the next decade.

The Japan Mobile Processor Market

The Japan mobile processor market is projected to reach USD 2.2 billion in 2025, marking its steady ascent in the global semiconductor ecosystem. Japan’s legacy in advanced manufacturing, precision engineering, and consumer electronics has laid a solid foundation for the mobile processor industry. Major domestic players, integrated with global collaborations, are focusing on integrating cutting-edge processor technologies into smartphones, tablets, and wearable devices. Additionally, Japan's emphasis on quality, miniaturization, and energy efficiency continues to shape its processor development strategies, catering to a tech-savvy population with a high appetite for innovation in mobile computing.

With an expected CAGR of 20.8%, Japan’s growth in this market is significantly influenced by its strategic pivot toward AI-enabled devices, 5G infrastructure rollout, and growing demand for mobile devices in healthcare, education, and enterprise applications. The country is also investing in semiconductor self-sufficiency and regional supply chain resilience, making it an attractive destination for joint ventures and R&D initiatives in processor design. As industries converge on mobile and edge computing capabilities, Japan’s ecosystem, bolstered by policy support and deep-tech innovation, is poised to become a vital node in the global mobile processor value chain.

Global Mobile Processor Market: Key Takeaways

- Market Value: The global mobile processor market size is expected to reach a value of USD 323.9 billion by 2034 from a base value of USD 71.6 billion in 2025 at a CAGR of 18.3%.

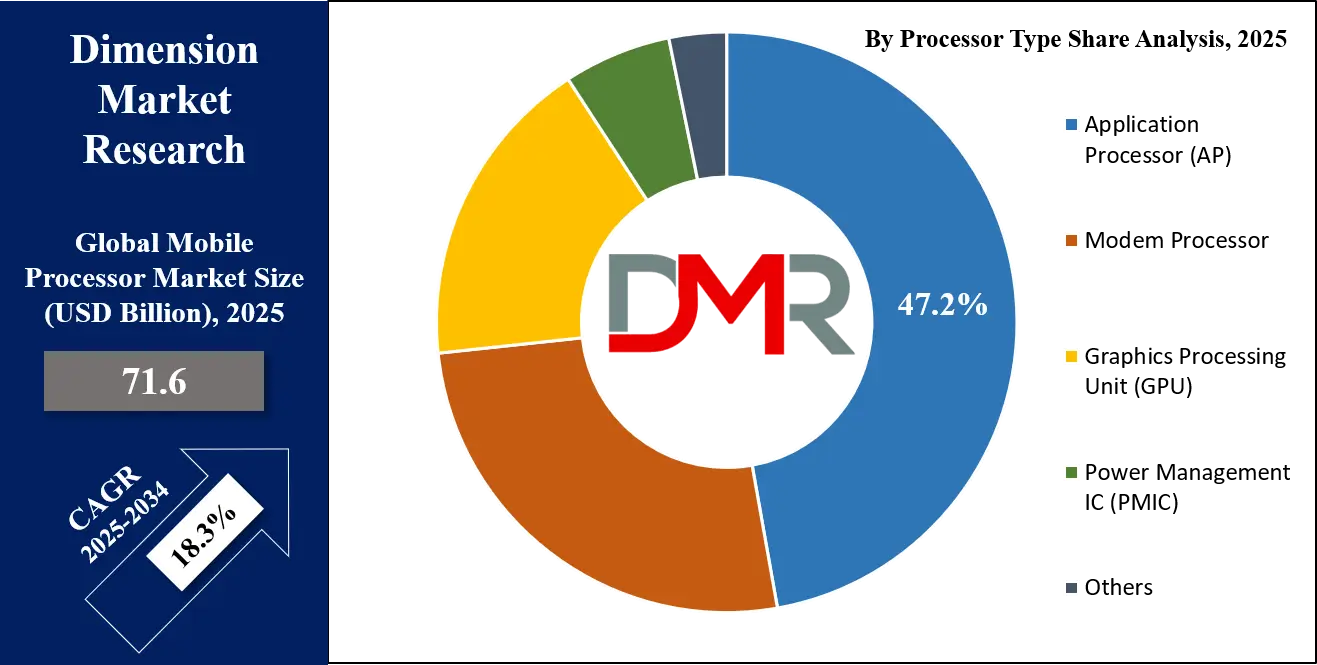

- By Processor Type Segment Analysis: Application Processor (AP) is expected to maintain its dominance in the processor type segment, capturing 47.2% of the total market share in 2025.

- By Processor Architecture Segment Analysis: ARM-based Processors architecture is poised to consolidate its dominance in the processor architecture segment, capturing 86.3% of the total market share in 2025.

- By Technology Segment Analysis: 5G Integrated Processors are expected to maintain their dominance in the technology segment, capturing 57.8% of the market share in 2025.

- By Price Range Segment Analysis: Premium Processors (> USD 500) are anticipated to capture the larger segment of the market in the price range segment, with 26.4% of the market share in 2025.

- By Processor Speed Segment Analysis: 2.5 GHz - 3.0 GHz speed processors are expected to maintain their dominance in the processor speed segment, capturing 55.1% of the market share in 2025.

- By Manufacturing Process Technology Segment Analysis: 5nm Process Technology is projected to dominate in the manufacturing process technology segment, with a market share of 43.6% in 2025.

- By Application Segment Analysis: Smartphones are anticipated to consolidate their market position in the application segment, capturing 76.9% of the market share in 2025.

- By End-Use Industry Segment Analysis: Consumer Electronics will hold the largest market share in the end-use industry segment, with a share percentage of 67.4% in 2025.

- Regional Analysis: Asia Pacific is anticipated to lead the global mobile processor market landscape with 53.6% of total global market revenue in 2025.

- Key Players: Some key players in the global mobile processor market are Qualcomm, MediaTek, Apple, Samsung Electronics, Intel, Huawei, AMD, NVIDIA, UNISOC, Broadcom, Texas Instruments, Marvell Technology, NXP Semiconductors, STMicroelectronics, Renesas Electronics, IBM, Rockchip, Allwinner Technology, VIA Technologies, ARM Holdings, and Other key players.

Global Mobile Processor Market: Use Cases

- Enhanced Smartphone Performance: Mobile processors play a pivotal role in enhancing the performance of smartphones, enabling them to handle complex tasks such as high-resolution gaming, multitasking, and video editing. With advancements in processor architecture, smartphones equipped with the latest processors can provide seamless user experiences, faster app launches, and smoother transitions between tasks. Processors like Qualcomm's Snapdragon and Apple's A-series chips have become instrumental in enabling features such as 5G connectivity, AI processing for camera enhancements, and immersive AR applications. These processors power high-end smartphones, ensuring that users experience top-tier performance for both everyday tasks and resource-intensive applications.

- AI and Machine Learning Integration: In the rapidly evolving landscape of mobile technology, processors are becoming integrated with artificial intelligence capabilities. On-device AI processing is revolutionizing how smartphones perform tasks like image recognition, predictive text, and voice assistants. Processors from companies like MediaTek and Qualcomm have built-in AI engines that allow smartphones to perform machine learning tasks locally, reducing latency and improving battery efficiency. These AI-enhanced mobile processors support features like facial recognition, real-time language translation, and personalized recommendations, offering consumers smarter devices that adapt to their habits and preferences.

- Automotive and Connected Vehicles: The integration of mobile processors into the automotive sector is expanding rapidly as the need for smart, connected vehicles grows. Modern vehicles rely on processors for various systems, including infotainment, autonomous driving, and vehicle-to-everything (V2X) communications. Mobile processors in automotive applications are designed to handle tasks such as real-time data processing, navigation, and vehicle diagnostics. As manufacturers develop intelligent and autonomous vehicles, processors from companies like NVIDIA and Qualcomm are enabling enhanced safety features, real-time traffic analysis, and intelligent route planning, thus shaping the future of mobility.

- Wearables and Smart Devices: Mobile processors are crucial in the development of wearables and other connected devices, enabling them to deliver high functionality in a small form factor. From smartwatches to fitness trackers, these processors are designed to provide users with real-time data processing, health monitoring, and seamless integration with other smart devices. Low power consumption is a critical feature of these processors, as wearables often need to operate for extended periods without frequent recharging. Companies like ARM and MediaTek design chips that are optimized for energy efficiency and are embedded in devices that track heart rate, monitor sleep patterns, and provide real-time notifications, all while maintaining a compact and lightweight design.

Global Mobile Processor Market: Stats & Facts

U.S. Department of Commerce (CHIPS and Science Act)

- CHIPS Act Funding

- The CHIPS and Science Act authorizes USD 280 billion in funding to boost U.S. semiconductor research and manufacturing.

- USD 52.7 billion has been allocated for semiconductor manufacturing, and USD 13 billion is dedicated to semiconductor research and workforce development.

- Private Sector Investments

- By March 2024, the act incentivized 25-50 projects with investments between USD 160 billion to USD 200 billion and the creation of 25,000–45,000 jobs.

- Metrology and Technology Initiatives

- USD 32.8 billion from the CHIPS Act’s fund was allocated by May 2024, supporting USD 75 billion in loans and tax credits for the semiconductor industry.

- USD 100 million in grants were awarded to 29 advanced metrology projects by February 2024.

- Workforce and Research Initiatives

- USD 174 billion was invested in public sector research programs for fields like quantum computing, artificial intelligence, and biotechnology.

- The National Science Foundation awarded more than 2,455 grants and signed 25 contracts in 2024 to advance chip technology.

- Global Supply Chain Resilience

- The U.S. allocated USD 500 million to strengthen semiconductor supply chain security in collaboration with foreign governments.

European Union (EU - Digital Strategy & Digital Compass Plan)

- Digital Infrastructure and Semiconductor Production

- The EU’s Digital Strategy is expected to boost semiconductor production within Europe, with the goal to produce 20% of global semiconductor output by 2030.

- €1 billion in funding was committed under the Digital Compass Plan to establish European microprocessor research hubs.

- Research & Innovation Funding

- €7 billion has been allocated for advancing high-performance computing and semiconductor manufacturing as part of Horizon Europe 2021-2027.

- The European Investment Bank (EIB) supports the creation of 3 semiconductor manufacturing plants in the EU, enabling access to €10 billion in funds for research institutions.

- Talent Development and Employment

- The EU is investing €3.5 billion to build a skilled workforce focused on chip design, nanotechnology, and cybersecurity.

Government of Japan (Ministry of Economy, Trade, and Industry - METI)

- Semiconductor Industry Investment

- Japan’s government has dedicated ¥70 billion ($640 million) to support semiconductor manufacturing facilities under its “Semiconductor Manufacturing Promotion Law”.

- The government is aiming to reduce Japan’s reliance on foreign semiconductor suppliers, focusing on improving domestic production capacity.

- Technology Hubs and International Collaboration

- ¥100 billion ($900 million) is allocated for semiconductor R&D collaborations with countries like the U.S. and Taiwan, focused on cutting-edge processor technologies.

- Japan has proposed a 10-year strategy to increase its semiconductor market share from 10% to 20% globally by 2030.

- Smart Devices and AI Integration

- The Japanese government is investing ¥200 billion ($1.8 billion) into the development of AI-integrated mobile processors to cater to rising consumer demand for 5G-enabled devices.

South Korean Government (Korean Ministry of Trade, Industry, and Energy)

- National Semiconductor Strategy

- The South Korean government has announced a USD 450 billion investment plan to become a leader in semiconductor research and manufacturing by 2030, targeting advanced mobile processor technologies like 5G.

- USD 16 billion in incentives are being provided to local firms like Samsung and SK Hynix to advance production capacity for mobile processors and AI chips.

- Research and Development Focus

- South Korea’s government has invested USD 2.3 billion in AI semiconductor development, focusing on creating chips with superior processing speeds for mobile and automotive applications.

- USD 350 million has been allocated for the development of 5G and AI-enhanced mobile processors in partnership with local universities and global tech firms.

- Public-Private Partnerships

- The South Korean government established 3 new public-private innovation centers aimed at enhancing mobile processor development for use in IoT devices and smart cars.

Chinese Government (National Development and Reform Commission)

- Focus on Semiconductor Self-Sufficiency

- China has committed USD 50 billion to developing the domestic semiconductor industry, focusing on mobile processors, to reduce dependence on foreign technology.

- The Chinese government has established 20 new semiconductor manufacturing plants over the next decade with a focus on 28nm and 14nm chips.

- International Expansion of Semiconductor Industry

- China’s National Development and Reform Commission (NDRC) is investing USD 10 billion to create joint ventures with countries like Brazil and Russia to establish mobile processor manufacturing plants.

- AI and Mobile Chip Research

- The Chinese government has set up a USD 4 billion fund for AI processor R&D, targeting the production of chips specifically for AI-powered mobile devices by 2025.

Taiwan Government (Ministry of Economic Affairs)

- Semiconductor Leadership in Asia

- Taiwan remains the world leader in semiconductor production, with TSMC contributing over 60% of the global foundry market.

- Taiwan’s government has announced USD 2 billion in funding to advance its semiconductor industry, particularly for mobile processors and 5G-enabled devices.

- Industry Expansion & Workforce Investment

- Taiwan is investing USD 1 billion to develop a skilled workforce in semiconductor fabrication and design by growing training programs and university collaborations.

- The Taiwanese government has committed to making the island the largest mobile processor manufacturing hub in Asia by 2030.

- Smartphone and Automotive Processor Integration

- Taiwan’s Ministry of Economic Affairs (MOEA) is prioritizing mobile processors for smartphones and electric vehicles with a focus on energy-efficient chip technologies.

Global Mobile Processor Market: Market Dynamics

Global Mobile Processor Market: Driving Factors

Increasing Demand for High-Performance Mobile Devices

The global demand for mobile processors is significantly driven by the growing need for high-performance smartphones and mobile devices. Consumers are expecting faster processors to support data-heavy applications, immersive gaming experiences, seamless multitasking, and high-quality video streaming.

Mobile processors that integrate cutting-edge technologies such as 5G connectivity, artificial intelligence, and enhanced graphics are in high demand. As mobile devices become more powerful, processors have evolved to offer superior performance while maintaining energy efficiency. This push for more advanced capabilities in smartphones, tablets, and other mobile devices is one of the key driving forces behind the growth of the mobile processor market.

Advancement in AI and 5G Technologies

The integration of artificial intelligence and the rollout of 5G networks are creating significant demand for advanced mobile processors. AI-powered applications such as voice recognition, facial recognition, and predictive analytics require more powerful processors capable of handling complex algorithms and real-time data processing.

Additionally, with 5G enabling ultra-fast internet speeds and low latency, mobile processors are being designed to support next-gen mobile networks, enhancing connectivity and performance. The ability of mobile processors to handle AI tasks and 5G communication simultaneously is transforming the mobile ecosystem, driving the market towards greater innovation and growth.

Global Mobile Processor Market: Restraints

High Manufacturing Costs

The production of mobile processors, especially those designed with advanced features like AI, 5G, and high-performance computing, requires significant investment in research, development, and manufacturing infrastructure. The complexity of designing custom chipsets and the advanced semiconductor fabrication processes drive up the overall costs. Smaller or emerging players in the market face challenges in matching the production capabilities and financial resources of larger players like Qualcomm and Apple. These high costs are a restraint for market expansion, particularly for manufacturers targeting budget-conscious consumers in developing regions.

Supply Chain and Component Shortages

The global semiconductor supply chain has faced significant disruptions in recent years due to various geopolitical factors, including trade tensions and the COVID-19 pandemic. Shortages of critical components such as chips, raw materials, and manufacturing capacity have hindered the timely production of mobile processors. These disruptions can lead to delays in product launches, reduced product availability, and increased prices, which negatively affect both manufacturers and consumers. As the demand for mobile processors continues to rise, supply chain constraints remain a significant challenge for the global market.

Global Mobile Processor Market: Opportunities

Emerging Markets for Budget Smartphones

As mobile technology becomes more accessible, there is a growing opportunity to cater to emerging markets, particularly in regions like Southeast Asia, Africa, and Latin America. These regions have seen rapid smartphone adoption, and budget-friendly mobile processors designed for affordable smartphones are in high demand. Manufacturers can take advantage of this trend by focusing on providing affordable processors that still offer essential features like 4G connectivity, basic AI integration, and improved battery life. By offering affordable yet powerful processors, companies can tap into a massive untapped market with significant growth potential.

Growth of Wearables and IoT Devices

The rising popularity of wearable devices, such as smartwatches, fitness trackers, and AR glasses, offers a significant opportunity for mobile processors. As the demand for connected, always-on devices increases, the need for specialized processors to power these gadgets grows. Low-power processors that provide efficient performance without compromising on features like health monitoring, communication, and real-time data processing are in high demand. The expansion of the Internet of Things (IoT) further opens opportunities for processors to be embedded in a wide range of devices beyond traditional smartphones, including home automation systems, healthcare equipment, and industrial IoT applications.

Global Mobile Processor Market: Trends

Integration of 5G and AI into Mobile Processors

The convergence of 5G and AI technologies is one of the most significant trends in the mobile processor market. As the world transitions to 5G networks, mobile processors must be equipped to handle the demands of faster data speeds, ultra-low latency, and high-density connectivity. AI capabilities are also being integrated into mobile processors to enable smarter devices that can adapt to user behavior, provide real-time recommendations, and improve system efficiency. The integration of both 5G and AI into a single processor platform is enhancing the overall mobile experience, and this trend is expected to continue as devices become more intelligent and connected.

Shift toward Energy-Efficient Processors

As mobile devices become more feature-rich and demand for extended battery life increases, there is a growing trend towards the development of energy-efficient mobile processors. The need to balance power consumption with performance is driving the development of processors that use less power while still delivering high levels of processing capability. Technologies like 7nm and 5nm fabrication processes are helping achieve these efficiency gains by reducing power consumption without compromising on performance. The trend toward energy-efficient mobile processors is essential not only for improving battery life but also for addressing sustainability concerns, as energy-efficient processors contribute to reducing the environmental impact of mobile device production and use.

Global Mobile Processor Market: Research Scope and Analysis

By Processor Type Analysis

The Application Processor (AP) segment is expected to maintain its dominance in the global mobile processor market, holding a substantial share of 47.2% in 2025. This dominance can be attributed to the central role that APs play in the performance of smartphones and other mobile devices.

Application processors are responsible for executing the majority of tasks in a device, including handling user interfaces, enabling multimedia features, supporting connectivity functions, and running applications. With advancements in mobile technology, the capabilities of APs have evolved to integrate not only the CPU and GPU but also specialized units such as AI processing cores, image signal processors (ISPs), and even 5G modems, making them the cornerstone of high-performance mobile computing. As mobile devices require greater processing power to support complex applications like gaming, augmented reality, and artificial intelligence, the demand for advanced application processors continues to rise.

On the other hand, modem processors are specialized chips that handle wireless communications, including 4G, 5G, and Wi-Fi connectivity. While modem processors may not carry the same level of processing power as application processors, they are nonetheless integral to ensuring mobile devices stay connected to the internet and other networks. In the era of 5G, modem processors are becoming more important than ever, as they enable faster, more reliable mobile connections, reduced latency, and enhanced network efficiency.

These processors are responsible for tasks such as managing data transmission between the mobile device and the cellular network, facilitating seamless calls, and maintaining a stable internet connection in high-speed environments. As the rollout of 5G networks continues globally, modem processors are expected to see growing demand, and their evolution will be key in ensuring that mobile devices can harness the full potential of next-generation wireless technologies.

By Processor Architecture Analysis

The ARM-based processor architecture is set to solidify its dominant position in the global mobile processor market, capturing 86.3% of the total market share in 2025. This architecture has become the backbone of the mobile device industry due to its power-efficient design, compact form factor, and ability to integrate multiple cores in a single chip.

ARM processors are designed to offer a high performance-to-power ratio, making them ideal for smartphones, tablets, wearables, and other mobile devices where battery life and portability are critical. Their scalability allows manufacturers to build devices across a broad range of price points, from budget smartphones to high-end flagships, without compromising on performance.

Additionally, the widespread adoption of ARM-based chips is supported by the extensive ecosystem of development tools, software compatibility, and licensing models, which makes it easier for manufacturers to design and customize chips for various applications. With the growing demand for energy-efficient, multi-core processors capable of supporting demanding tasks such as AI, 5G, and advanced imaging, ARM-based processors are expected to maintain their leading share in the mobile processor market for the foreseeable future.

On the other hand, x86-based processors, traditionally known for their strong presence in desktop and laptop computing, are making inroads into the mobile processor market, albeit with a smaller share. X86 processors are built for higher computational tasks and are typically associated with more power-hungry systems. While they are less efficient than ARM processors in terms of energy consumption, they still offer powerful performance, particularly in terms of raw computing power.

In mobile devices, x86-based processors are used primarily in high-performance laptops, ultra-thin notebooks, and certain Windows-based tablets. Intel, one of the most prominent players in the x86 architecture, has been working to optimize its chips for mobile use, including the development of energy-efficient versions that can compete with ARM in terms of battery life.

However, due to the relatively higher power consumption and larger physical size of x86 chips, their presence in the smartphone and wearable segments remains limited compared to ARM-based processors. Nevertheless, with ongoing improvements in power efficiency and the demand for more powerful devices, x86 processors could find a niche in high-end mobile devices that require maximum computing power, such as gaming phones or professional-grade mobile workstations.

By Technology Analysis

The dominance of 5G integrated processors in the global mobile processor market is projected to continue, capturing 57.8% of the market share in 2025. This trend is primarily driven by the global rollout of 5G networks, which promise faster data speeds, lower latency, and enhanced network efficiency. 5G integrated processors combine the processing power required for high-performance applications with the advanced networking capabilities needed to handle 5G connectivity. By integrating 5G modems directly into the processor, manufacturers can create more compact and efficient chips that enable devices to seamlessly transition between 5G, 4G, and Wi-Fi networks, ensuring optimal connectivity in various environments.

As more mobile devices adopt 5G capabilities to meet the growing demand for high-speed internet, ultra-low latency gaming, and real-time AI processing, the demand for 5G integrated processors is expected to rise significantly. These processors are expected to power flagship smartphones, high-end tablets, and other connected devices, offering enhanced performance and future-proofing mobile technology for years to come.

In contrast, 4G LTE processors are still relevant in the market, particularly for budget-conscious consumers and regions where 5G coverage is limited or still being deployed. 4G LTE processors are optimized for handling LTE (Long-Term Evolution) networks, which offer reliable and fast mobile data, though not at the speeds provided by 5G.

These processors are typically used in mid-range and entry-level smartphones, providing sufficient performance for day-to-day tasks like web browsing, social media, video streaming, and light gaming. While 4G LTE processors are more energy-efficient compared to their 5G counterparts, they cannot support the high-speed data demands required by emerging technologies such as augmented reality, real-time 4K video streaming, and ultra-low latency applications. However, in markets with slower 5G adoption or for users who do not prioritize the latest connectivity standards, 4G LTE processors continue to be a cost-effective option, maintaining a substantial share in the mobile processor market.

By Price Range Analysis

Premium processors, priced above USD 500, are expected to capture a significant portion of the global mobile processor market, accounting for 26.4% of the market share in 2025. This dominance can be attributed to the growing demand for high-performance mobile devices that feature cutting-edge technology and advanced functionalities, such as AI integration, high-speed 5G connectivity, and enhanced graphics capabilities.

Premium processors are typically integrated into flagship smartphones and high-end tablets, providing the raw processing power necessary to handle demanding applications, including advanced gaming, AR/VR experiences, and real-time video editing. With the ongoing trend of consumers seeking faster, more powerful, and more feature-rich devices, the demand for premium processors continues to rise. As manufacturers focus on delivering next-gen devices with exceptional performance, long-lasting battery life, and improved efficiency, the market for premium processors is expected to grow, catering to consumers who prioritize top-tier performance and cutting-edge features.

On the other hand, mid-range processors, priced between USD 200 and USD 500, cater to a large segment of the mobile processor market. These processors offer a balance between performance and affordability, making them ideal for mid-tier smartphones that provide a premium user experience without the high price tag of flagship devices. Mid-range processors are designed to handle a variety of tasks, such as smooth multitasking, gaming at moderate settings, streaming high-definition content, and supporting AI features like facial recognition and voice assistants.

While these processors may not match the sheer power of premium options, they strike a perfect balance for consumers looking for solid performance at a more accessible price point. The growing demand for affordable yet capable smartphones, especially in emerging markets where price sensitivity is a critical factor, positions mid-range processors as a crucial component in driving mobile device sales across the globe. These processors are expected to maintain a robust market presence as consumers continue to seek value-driven options that provide a satisfactory experience without overspending.

By Processor Speed Analysis

Processors with speeds between 2.5 GHz and 3.0 GHz are anticipated to dominate the global mobile processor market, capturing 55.1% of the market share in 2025. This processor speed range is particularly well-suited for handling the demanding applications and multitasking requirements of modern smartphones and other mobile devices. With a processing speed within this range, devices can deliver smooth performance for tasks such as gaming, high-definition video streaming, and resource-intensive applications like augmented reality (AR) and artificial intelligence (AI).

The 2.5 GHz - 3.0 GHz processors strike an optimal balance between energy efficiency and high-performance capabilities, making them the preferred choice for mid-to-high-end smartphones that aim to deliver an excellent user experience while managing battery consumption effectively. This speed range is also favored by mobile manufacturers because it supports advanced connectivity features such as 5G integration, which is essential in today’s devices.

On the other hand, processors with speeds exceeding 3.0 GHz are designed for premium devices that require maximum performance for cutting-edge applications. These high-speed processors are typically used in flagship smartphones, gaming phones, and professional-grade mobile devices that demand intensive computing power. With speeds greater than 3.0 GHz, these processors are capable of executing complex operations such as high-definition gaming, real-time video rendering, and AI-driven applications that require significant processing capabilities. Devices equipped with processors that exceed 3.0 GHz can handle multitasking more effectively and provide smoother experiences for users engaged in high-performance tasks.

However, this increased processing speed often comes with a trade-off in terms of higher power consumption and thermal management challenges, which is why these processors are generally reserved for high-end devices where performance outweighs power efficiency concerns. As the mobile industry continues to innovate, processors with speeds above 3.0 GHz are likely to become more prevalent in premium and gaming-focused smartphones, catering to consumers who demand the highest level of performance and responsiveness.

By Manufacturing Process Technology Analysis

The 5nm process technology is expected to lead the global mobile processor market, capturing 43.6% of the market share in 2025. This is primarily due to the ongoing trend toward miniaturization and efficiency improvements in mobile processors. The 5nm manufacturing process allows for a higher density of transistors within the same chip size, resulting in enhanced performance and power efficiency. T

hese processors offer faster processing speeds, lower power consumption, and improved thermal management, all of which are critical factors in delivering the high-performance experience that modern smartphones demand. The 5nm process technology also supports the integration of more advanced features, such as AI processing, 5G connectivity, and high-definition graphics, which are becoming standard in flagship devices. As mobile devices evolve and require even more powerful and energy-efficient processors, the 5nm technology is positioned to drive the next generation of smartphones, tablets, and other mobile devices, offering substantial improvements over older technologies.

On the other hand, 7nm process technology continues to play an important role in the mobile processor market, particularly in mid-range and some high-end smartphones. While not as advanced as the 5nm process, the 7nm technology still provides a significant performance boost over older manufacturing processes, delivering efficient power consumption and higher transistor density. Devices powered by 7nm processors can handle demanding tasks such as gaming, video streaming, and multitasking with relative ease, making them ideal for mid-range to premium smartphones.

The 7nm technology is also seen as a bridge for many manufacturers transitioning to more advanced process nodes like 5nm and beyond. Although processors based on the 7nm node may not offer the same power efficiency or raw processing power as 5nm chips, they still provide an excellent balance between cost, performance, and battery life, making them a popular choice for devices that do not require the absolute cutting-edge performance of 5nm processors. The 7nm process is expected to remain relevant for a wide range of devices as it continues to offer a cost-effective solution for high-quality mobile performance.

By Application Analysis

Smartphones are projected to maintain their dominant position in the application segment of the mobile processor market, capturing 76.9% of the market share in 2025. This is largely due to the widespread adoption of smartphones across the globe, with these devices becoming central to daily activities such as communication, entertainment, social media, gaming, and business. The growing demand for smartphones with advanced capabilities, such as 5G connectivity, AI integration, high-resolution cameras, and long battery life, has made them the primary driver of innovation in the mobile processor industry.

As smartphone manufacturers continue to focus on enhancing user experience and pushing the boundaries of mobile technology, mobile processors designed specifically for smartphones are evolving to meet these ever-growing demands. With the advent of new technologies, such as augmented reality, virtual reality, and more immersive gaming, the role of smartphones in the digital ecosystem will continue to expand, ensuring their dominance in the mobile processor market for the foreseeable future.

In contrast, tablets, while occupying a smaller share of the market, still represent an important segment. Although tablets generally do not match the volume of smartphones in terms of global sales, they have a dedicated user base that values their larger screens and versatility. Tablets are used for productivity tasks, such as working on documents, watching high-definition videos, gaming, and running business applications. The mobile processor requirements for tablets are somewhat different from those of smartphones, as these devices need to balance power efficiency with the ability to handle tasks that benefit from larger displays and more powerful processing, such as multitasking and content creation.

Tablets are also seeing an uptick in use for educational purposes, especially in regions where digital learning is becoming more widespread. As mobile processors for tablets continue to evolve, manufacturers are integrating more powerful and efficient chips to cater to these needs, offering performance that is competitive with laptops while maintaining the portability of a tablet. Although tablets will not surpass smartphones in market share, their growing role in work, education, and entertainment makes them a significant segment in the broader mobile processor landscape.

By End-Use Industry Analysis

Consumer electronics are projected to dominate the end-use industry segment of the mobile processor market, capturing 67.4% of the market share in 2025. This segment includes a wide range of devices, such as smartphones, tablets, laptops, wearables, and other smart gadgets, all of which rely heavily on advanced mobile processors for their operation. With the ongoing proliferation of smart devices in homes and businesses, the demand for high-performance processors has surged.

As consumer electronics evolve, with new features such as AI integration, high-definition displays, 5G connectivity, and seamless cross-device synchronization, processors have become the heart of these devices, driving their functionality. Consumer electronics are being equipped with processors that can support complex tasks like gaming, multimedia content creation, real-time communication, and more, further solidifying the dominance of this segment. With the rise of the Internet of Things (IoT), smart home devices, and wearable technology, the consumer electronics market is expected to continue expanding, making it the largest segment for mobile processors, as more consumers demand smarter, faster, and more capable devices.

In contrast, the automotive industry is becoming an important player in the mobile processor market. With the rapid adoption of advanced technologies in vehicles, such as autonomous driving, infotainment systems, and connected car solutions, automotive applications are driving a significant demand for mobile processors. These processors are essential for managing real-time data processing, complex algorithms for self-driving cars, and high-performance infotainment systems.

Modern vehicles are becoming highly integrated with sensors, cameras, and other electronic components that require advanced computing power to function seamlessly. In particular, automotive processors are expected to handle navigation, driver assistance systems, entertainment, and vehicle communication technologies, all of which rely on powerful and energy-efficient processors to deliver optimal performance.

The shift towards electric vehicles (EVs) and autonomous vehicles is further accelerating the need for specialized mobile processors customized for automotive applications. As the automotive industry continues to embrace digital transformation, the demand for high-performance processors to manage the growing complexity of vehicle systems will continue to grow, making automotive applications an important and expanding segment in the global mobile processor market.

The Mobile Processor Market Report is segmented on the basis of the following:

By Processor Type

- Application Processor (AP)

- Modem Processor

- Graphics Processing Unit (GPU)

- Power Management IC (PMIC)

- Others

By Processor Architecture

- ARM-based Processors

- X86-based Processors

- Custom/Hybrid Processors

By Technology

- 5G Integrated Processors

- 4G LTE Processors

- Other Networks

By Price Range

- Premium Processors (> USD 500)

- Mid-Range Processors (USD 200-500)

- Budget Processors (< USD 200)

By Processor Speed

- 2.5 GHz- 3.0 GHz

- >3.0 GHz

- <2.5 GHz

By Manufacturing Process Technology

- 5nm Process Technology

- 7nm Process Technology

- 10nm and Above

By Application

- Smartphones

- Tablets

- Wearables

- Other Consumer Electronics

By End-Use Industry

- Consumer Electronics

- Automotive

- Healthcare

- Industrial Automation

Global Mobile Processor Market: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is poised to dominate the global mobile processor market, projected to account for 53.6% of the total revenue in 2025, driven by the region’s robust manufacturing ecosystem, rapidly growing smartphone user base, and the presence of major semiconductor and electronics hubs such as China, South Korea, Taiwan, and India. This region benefits from a strong concentration of mobile device manufacturers and chip design companies, fostering innovation and cost-efficiency across the supply chain.

Additionally, the accelerating demand for 5G-enabled smartphones, AI-powered devices, and affordable mobile technology across both urban and rural populations is fueling large-scale adoption of advanced mobile processors. Government support in semiconductor development, integrated with rising tech-savvy consumers and digital transformation initiatives, further cements Asia Pacific’s leadership in shaping the future of mobile processing technology.

Region with significant growth

Asia Pacific is expected to record the highest compound annual growth rate (CAGR) in the global mobile processor market due to a confluence of dynamic economic, technological, and demographic factors. The region is undergoing rapid digitization, with billions of users relying on mobile devices for everything from communication and entertainment to payments and education.

This surge in mobile usage is creating a strong demand for high-performance, energy-efficient processors that can power next-generation smartphones, tablets, and wearable devices. Emerging economies within the region, such as India, Indonesia, and Vietnam, are experiencing an unprecedented rise in smartphone adoption, supported by affordable internet access and government-led digital inclusion programs. These developments are prompting both global and local tech companies to expand their operations and R&D facilities in the region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Mobile Processor Market: Competitive Landscape

The global competitive landscape of the mobile processor market is characterized by intense rivalry among key semiconductor giants, each striving to innovate and capture market share through performance, efficiency, and integration. Companies like Qualcomm, MediaTek, Apple, and Samsung dominate with their advanced chipsets, which power a vast majority of smartphones and smart devices globally. These players continuously invest in R&D to develop cutting-edge processors that support AI computing, 5G connectivity, and enhanced energy efficiency. The competition is further intensified by the entry of niche players and regional manufacturers such as UNISOC and Huawei, who focus on localized demand and budget segments.

Meanwhile, established firms like Intel, AMD, and NVIDIA are also expanding their footprint in mobile and edge applications, aiming to diversify beyond traditional computing domains. As mobile processors become critical enablers of immersive experiences, autonomous capabilities, and cloud-to-edge computing, strategic partnerships, custom silicon development, and vertical integration are shaping a fast-evolving and highly competitive global landscape.

Some of the prominent players in the global Mobile Processor market are:

- Qualcomm

- MediaTek

- Apple

- Samsung Electronics

- Intel

- Huawei

- AMD

- NVIDIA

- UNISOC

- Broadcom

- Texas Instruments

- Marvell Technology

- NXP Semiconductors

- STMicroelectronics

- Renesas Electronics

- IBM

- Rockchip

- Allwinner Technology

- VIA Technologies

- ARM Holdings

- Other Key Players

Global Mobile Processor Market: Recent Developments

- September 2024: Qualcomm initiated discussions to acquire Intel, aiming to merge Qualcomm's mobile Snapdragon line with Intel's PC and server chip divisions, potentially creating a semiconductor powerhouse.

- August 2024: AMD acquired ZT Systems for USD 4.9 billion to strengthen its position in AI infrastructure and expand its data center processor capabilities.

- August 2024: Renesas completed the acquisition of Altium for USD 5.9 billion to integrate printed circuit board design tools into its electronics development ecosystem and accelerate innovation.

- July 2024: AMD acquired Silo AI, Europe’s largest private AI lab, for USD 665 million to enhance its AI software capabilities and broaden its reach in the European AI market.

- June 2024: Renesas finalized its acquisition of Transphorm, a gallium nitride-chip maker, to expand its power semiconductor offerings for high-efficiency applications.

- May 2024: Amphenol Corporation completed the acquisition of Carlisle Interconnect Technologies to diversify its portfolio in high-performance connectivity solutions across harsh environments.

- April 2024: IBM acquired HashiCorp for USD 6.4 billion to integrate HashiCorp’s infrastructure automation tools with IBM’s hybrid cloud and AI platforms, strengthening its enterprise software stack.

- March 2024: Keysight Technologies announced the acquisition of Spirent Communications for USD 1.46 billion to expand its testing and validation offerings for next-gen communication technologies.

- February 2024: Renesas announced a USD 5.9 billion agreement to acquire Altium, further solidifying its strategic focus on embedded design and development.

- January 2024: Renesas agreed to acquire Transphorm for USD 339 million to reinforce its commitment to gallium nitride power solutions for electric vehicles and industrial applications.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 71.6 Bn |

| Forecast Value (2034) |

USD 323.9 Bn |

| CAGR (2025–2034) |

18.3% |

| The US Market Size (2025) |

USD 32.3 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Processor Type (Application Processor, Modem Processor, Graphics Processing Unit, Power Management IC, Others), By Processor Architecture (ARM-based Processors, X86-based Processors, Custom/Hybrid Processors), By Technology (5G Integrated Processors, 4G LTE Processors, Other Networks), By Price Range (Premium Processors, Mid-Range Processors, Budget Processors), By Processor Speed (2.5 GHz- 3.0 GHz, >3.0 GHz, <2.5 GHz), By Manufacturing Process Technology (5nm Process Technology, 7nm Process Technology, 10nm and Above), By Application (Smartphones, Tablets, Wearables, Other Consumer Electronics), By End-Use Industry (Consumer Electronics, Automotive, Healthcare, Industrial Automation). |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Qualcomm, MediaTek, Apple, Samsung Electronics, Intel, Huawei, AMD, NVIDIA, UNISOC, Broadcom, Texas Instruments, Marvell Technology, NXP Semiconductors, STMicroelectronics, Renesas Electronics, IBM, Rockchip, Allwinner Technology, VIA Technologies, ARM Holdings, and Other key players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The global mobile processor market size is estimated to have a value of USD 71.6 billion in 2025 and is expected to reach USD 323.9 billion by the end of 2034.

The US mobile processor market is projected to be valued at USD 32.3 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 134.3 billion in 2034 at a CAGR of 17.2%.

Asia Pacific is expected to have the largest market share in the global mobile processor market, with a share of about 53.6% in 2025.

Some of the major key players in the global mobile processor market are Qualcomm, MediaTek, Apple, Samsung Electronics, Intel, Huawei, AMD, NVIDIA, UNISOC, Broadcom, Texas Instruments, Marvell Technology, NXP Semiconductors, STMicroelectronics, Renesas Electronics, IBM, Rockchip, Allwinner Technology, VIA Technologies, ARM Holdings, and Other key players.

The market is growing at a CAGR of 18.3 percent over the forecasted period.