Mobile security involves protecting smartphones, tablets, and other portable devices from threats like malware, unauthorized access, and theft. As mobile device usage grows, so does the need for robust security solutions, making the mobile security market increasingly vital. The adoption of advanced mobile threat protection and enterprise mobility security solutions further strengthens this market’s significance.

Newcomers should focus on niche areas such as solutions for emerging threats like advanced phishing attacks or ransomware designed for mobile platforms. Specializing in these areas can help smaller companies establish a distinct market presence and compete with larger firms by offering innovative and tailored services. Forming strategic partnerships with hardware manufacturers and network providers can also help these new entrants grow quickly.

Several trends are shaping the mobile security market, including a rise in mobile malware, especially on Android devices. The 2024 Symantec Internet Security Threat Report highlights that Android accounted for 97% of mobile malware infections, indicating a significant need for targeted security measures for Android users.

Another trend is the increase in targeted attacks on enterprise mobile devices, with a notable rise in phishing sites specifically aiming at these devices. As reported by zLabs in their 2024 Global Mobile Threat Report, 82% of phishing sites now target enterprise mobile devices, highlighting the urgent need for businesses to adopt mobile security solutions that protect against such exploits.

The significant financial losses to fraud, as reported by the FTC, where consumers in the United States lost over $10 billion in 2023, a 14% increase from 2022, have prompted stricter security mandates. Companies are now more than ever required to adhere to stringent data protection laws, which in turn boosts demand for compliant mobile security solutions.

To effectively communicate and engage potential clients, it is crucial to support our conversations with concrete data. The alarming statistics reported by the FTC and the detailed findings from Symantec and zLabs serve as pivotal data points that not only highlight the growing challenge of mobile security but also validate the urgent need for comprehensive cybersecurity solutions.

By referencing these data points, we can better illustrate the critical nature of the threats and the importance of adopting robust mobile security measures. Mobile security is increasingly being implemented even in specialized areas such as

Mobile Clinics, where sensitive patient information must be protected during mobile operations.

Key Takeaways

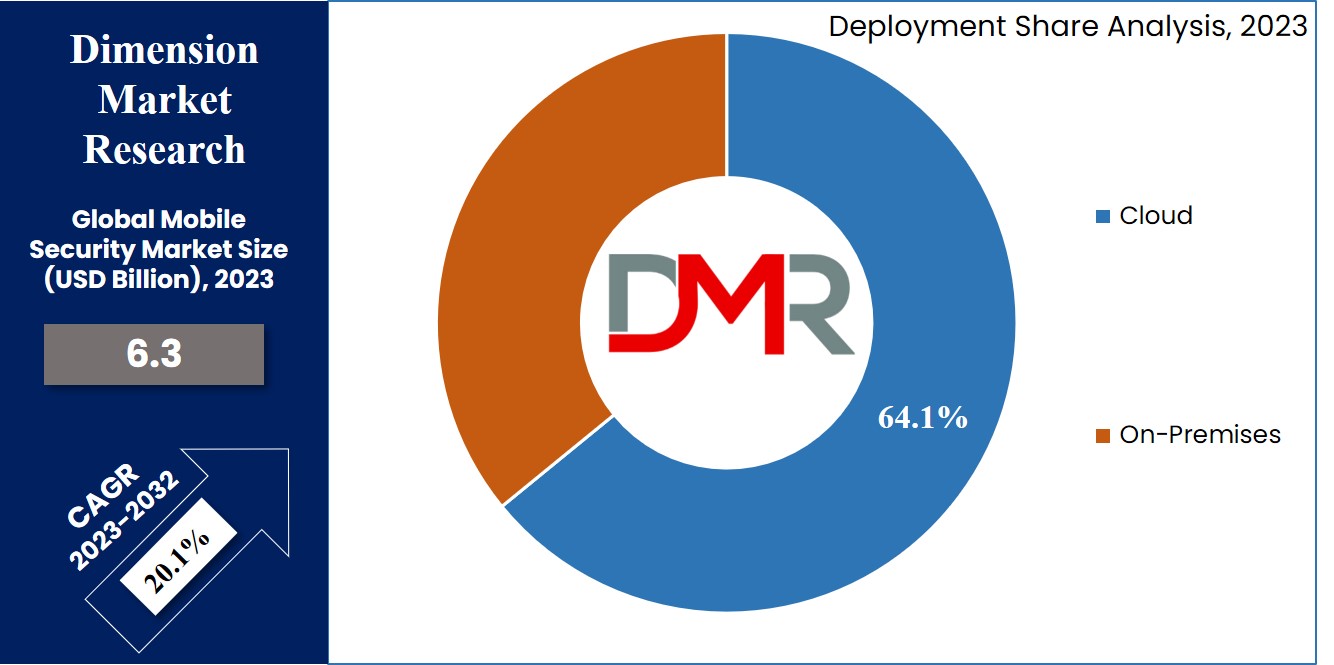

- The Global Mobile Security Market is expected to reach a value of USD 6.3 billion in 2023, and it is further anticipated to reach a market value of USD 32.7 billion by 2032 at a CAGR of 20.1%.

- In 2023, android is the major operating system driving the global security market and is expected to drive it in the future during the forecasted period. Mobile security for Android involves an extensive approach to safeguard devices.

- Cloud deployment has been a major segment driving the mobile security market in 2023.

- In 2023, enterprises have been a major driving force in the mobile security market, as enterprise mobile security is a smart plan for safeguarding business mobile devices, data, and actions.

- The banking, Financial Services, and Insurance (BFSI) sector contributes significantly to driving the global mobile security market in 2023, as it involves implementing strong measures to protect sensitive data & transactions on mobile devices.

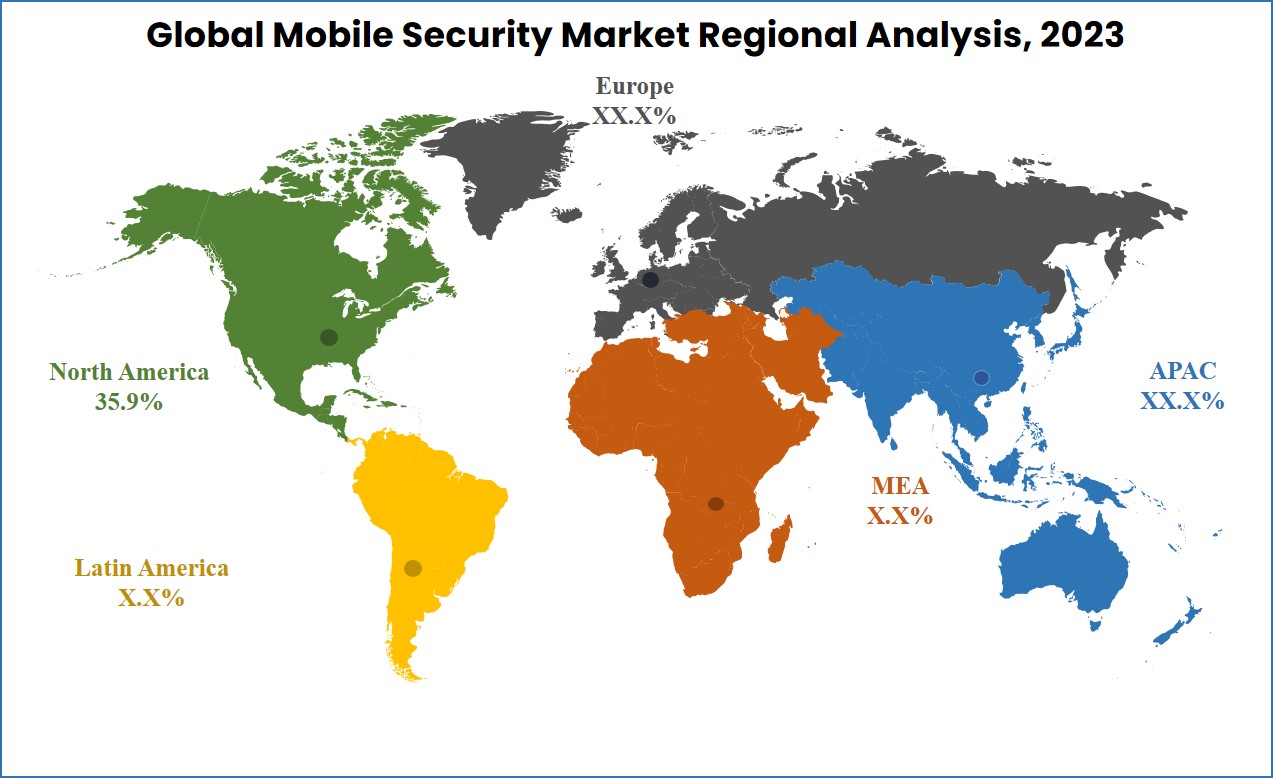

- In 2023, North America claims the largest market share in the Global Mobile Security Market, accounting for over 35.9% of total revenue.

Use Cases

- Android Device Protection: Safeguarding Android smartphones from malware, phishing, ransomware, and unauthorized access using antivirus, app management, encryption, and biometric authentication.

- Cloud-Based Security Deployment: Centralized management of mobile security across enterprises, enabling real-time threat detection, remote monitoring, and seamless integration with multiple devices.

- Enterprise Mobile Security: Securing business devices and sensitive data through mobile device management, app control, encryption, and employee training to ensure regulatory compliance.

- Industry-Specific Applications: BFSI, healthcare, and retail sectors implement specialized mobile security solutions to protect financial transactions, patient records, and operational data.

- Emerging Threat Mitigation: Startups and new entrants focus on AI-driven solutions, anti-phishing, and ransomware protection to address evolving mobile threats.

Market Dynamic

The global mobile security market is driven by the growth in online mobile payments and the increasing security demand stemming from the adoption of bring your own devices (BYOD) in workplaces. Moreover, the market growth is driven by the increased necessity to secure phone access to video streaming content.

However, the market faces challenges in the form of complex and costly security solution implementation. This complexity restraints adoption, particularly among resource-constrained businesses. The fast-paced evolution of mobile technologies requires ongoing updates, posing financial and operational challenges. Compatibility issues across diverse platforms and devices also disrupt seamless implementation. Addressing all these concerns and finding necessary innovative approaches to simplify deployment, along with providing better cost-efficiency, and ensuring uniform protection irrespective of the dynamic mobile security landscape.

Research Scope and Analysis

By Operating System

In 2023, android is the major operating system driving the global security market and is expected to drive it in the future as well during the forecasted period. Mobile security for Android involves an extensive approach to safeguard devices.

This includes using strong antivirus and anti-malware tools, regular software updates, managing app permissions, secure app installation from trusted sources such as Google Play Store, allowing device encryption, biometric authentication, safe browsing practices, & remote tracking and wiping capabilities in case of loss or theft. These steps protect personal data & sensitive information from cyberattacks and privacy breaches.

By Deployment

Cloud deployment has been a major segment driving the mobile security market in 2023, as cloud deployment for mobile security offers an efficient & scalable solution to protect devices. By using cloud-based platforms, organizations can centrally manage security measures such as antivirus, threat detection, and data encryption.

This approach provides real-time updates, seamless integration with mobile devices, and the ability to remotely monitor & respond to security threats. Cloud deployment improves flexibility, reduces the need for on-device resources, and ensures consistent protection along a diverse range of mobile devices & locations, and by virtue of this, it is anticipated to drive the future of the market as well.

By End User

In 2023, enterprises have been a major driving force in the mobile security market, as enterprise mobile security is a smart plan for safeguarding business mobile devices, data, and actions. It involves managing devices effectively, using strong security measures such as passwords or biometrics, encrypting data, spotting & dealing with threats in real-time, controlling apps, keeping personal & work data separate, regularly checking security, and teaching employees how to stay safe.

This all ensures that sensitive info stays protected and business keeps running smoothly on mobile devices. With future development and dependability on digitization of the enterprises, it is further anticipated to drive the future of the market.

By Industrial Vertical

The banking, Financial Services, and Insurance (BFSI) sector contributes significantly to driving the global mobile security market in 2023, as it involves implementing strong measures to protect sensitive data & transactions on mobile devices. This includes secure mobile app development, multi-factor authentication for account access, encryption of data during transmission and storage, real-time monitoring for suspicious activities, biometric authentication, remote device management, and compliance with industry regulations.

These measures secure the security of financial transactions, customer information, & overall data integrity, gaining trust and confidence in

mobile banking and financial services. Further, these trends and advancements in BFSI will further lead to drive & boost the future of the market.

The Global Mobile Security Market Report is segmented on the basis of the following

By Operating System

By Deployment

By End User

By Industrial Vertical

- BFSI

- Telecom & IT

- Healthcare

- Retail

- Government

- Others

Regional Analysis

In 2023, the North American region secures a considerable market share, accounting for

over 35.9% of total revenue for the Global Mobile Security Market. In addition, the adoption of mobile technologies by North American businesses is driven by factors such as technological advancements, affordability, societal trends, and economic benefits.

These businesses are acquiring mobile solutions due to advancing technology, cost-effectiveness, and the increasing use of mobile devices. Additionally, the competitive advantage & improved customer engagement offered by mobile technologies contribute to their integration into business operations.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The market players in the global mobile security market are constantly engaging in a range of strategic actions, including collaborations, partnerships, acquisitions, & geographic expansions, to improve business growth along with strengthening market positioning. Further, mergers and acquisitions remain a major form of strategy favored by a significant proportion of these market players.

In October 2022, RSA launched RSA Mobile Lock, a potent addition to mobile security. This solution addresses a critical weakness in organizational security, its users. RSA Mobile Lock identifies major threats on mobile devices & blocks compromised users from accessing secure corporate systems. By doing so, it prevents threats from spreading beyond & compromised device to protect other users, data, and crucial systems.

Some of the prominent players in the Global Mobile Security Market are:

- Microsoft Corp.

- Google

- IBM Corp.

- Apple

- Lookout Inc.

- Intel Corp.

- Broadcom Inc

- Blackberry Ltd.

- McAfee

- Verizon Communication

- Other Key Players

Recent Development

- In March 2024, London-based fintech company Nuke From Orbit successfully raised €585,000 in a pre-seed funding round to deliver smarter smartphone security solutions.

- In November 2024, the conference owned by Crosspoint Capital Partners declared that it would enforce a new funding requirement. Starting next year, each of the 10 finalists in the conference’s sandbox competition must secure a $5 million investment to qualify.

- In October 2024, Apono, a company specializing in AI-driven cybersecurity solutions, announced the successful closure of a $15.5 million Series A funding round.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 6.3 Bn |

| Forecast Value (2032) |

USD 32.7 Bn |

| CAGR (2023-2032) |

20.1% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Operating System (Android, iOS and Others), By

Deployment (Cloud and On-Premises), By End User

(Enterprises and Individual), By Industrial Vertical

(BFSI, Telecom & IT, Healthcare, Retail, Government

and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Microsoft Corp., Google, IBM Corp., Apple, Lookout

Inc., Intel Corp, Broadcom Inc., Blackberry Ltd.,

McAfee., Verizon Communication, and Other Key

Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |