Market Overview

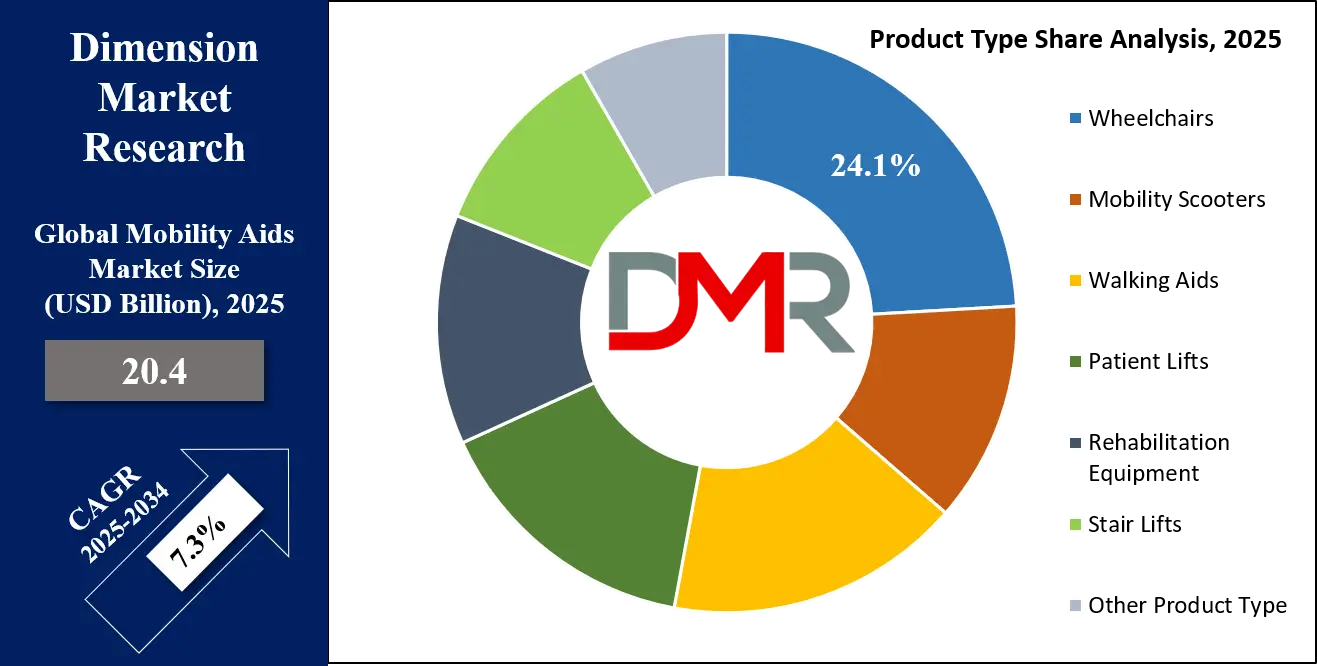

The Global Mobility Aids Market is projected to reach USD 20.4 billion by 2025 and is anticipated to expand at a CAGR of 7.3% from 2025 to 2034, ultimately attaining a valuation of USD 38.4 billion.

The market growth is driven by rising incidences of mobility impairments, orthopedic disorders, arthritis, and disabilities among the aging population, alongside increasing adoption of assistive devices such as wheelchairs, walking aids, scooters, and crutches. Moreover, technological advancements in powered wheelchairs, smart mobility scooters, ergonomic walking sticks, and patient transfer solutions are accelerating demand. Supportive healthcare infrastructure, reimbursement policies, and growing awareness about rehabilitation equipment, physical therapy aids, and accessibility solutions are further boosting market expansion globally.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global mobility aids market is witnessing significant expansion, driven by rising awareness of mobility challenges and increasing prevalence of disabilities and age-related mobility impairments worldwide. Growing geriatric populations, especially in developed and emerging economies, contribute heavily to demand for assistive devices such as wheelchairs, scooters, and walking aids.

Advances in technology, including the integration of smart features and IoT-enabled devices, are enhancing product functionality and user experience, enabling better mobility, safety, and independence for users. The market also benefits from government initiatives and healthcare programs aimed at improving the quality of life for people with disabilities and elderly individuals. Increasing investments in rehabilitation centers and home care facilities further stimulate market growth. However, high product costs, lack of awareness in rural areas, and regulatory challenges in certain regions restrain widespread adoption.

Additionally, supply chain disruptions and fluctuating raw material prices create operational challenges for manufacturers. Nevertheless, growing urbanization, expanding healthcare infrastructure, and a surge in chronic diseases such as arthritis and neurological disorders offer substantial growth opportunities. Furthermore, innovative product developments in lightweight materials and customizable designs enhance market appeal.

Statistically, the market is expected to maintain a robust CAGR, reflecting steady demand across multiple applications, including hospitals, nursing homes, and home care. The increasing focus on enhancing accessibility in public spaces and transportation also fuels the need for advanced mobility aids. The market’s future trajectory is promising due to ongoing R&D, technological advancements, and favorable demographic trends worldwide, indicating sustainable expansion and broader user adoption.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

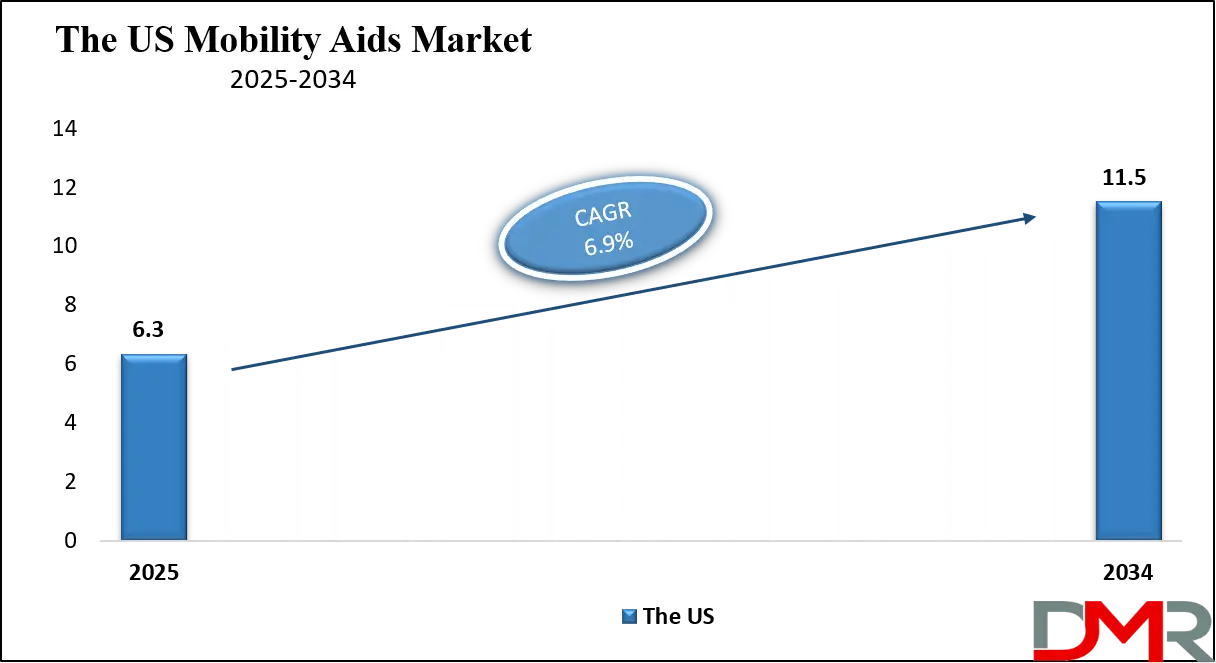

The US Mobility Aids Market

The US Mobility Aids Market is projected to reach USD 6.3 billion in 2025 at a compound annual growth rate of 6.9% over its forecast period.

The United States mobility aids market benefits from a favorable demographic landscape characterized by an aging population and a significant number of individuals living with disabilities. According to the U.S. Census Bureau, the elderly population (65 years and above) is projected to increase sharply in coming decades, creating an ever-growing demand for mobility assistance devices such as wheelchairs, powered scooters, and walking aids.

Furthermore, the Centers for Disease Control and Prevention (CDC) highlights that millions of Americans live with mobility impairments resulting from chronic conditions like arthritis, stroke, and neurological disorders, amplifying the need for effective mobility solutions. The U.S. government actively supports this market through healthcare policies like Medicare and Medicaid, which often cover costs related to mobility aids for eligible patients, improving accessibility and affordability.

Rehabilitation services funded by government bodies and insurance providers also drive demand within clinical and home care settings. Additionally, awareness campaigns led by organizations such as the National Council on Aging (NCOA) promote the use of mobility aids, empowering elderly individuals to maintain independence. Technological innovation thrives in the U.S. market, with numerous manufacturers headquartered domestically investing in powered wheelchairs, smart mobility devices, and ergonomic designs tailored to user needs.

Urban infrastructure improvements, such as increased ADA-compliant public spaces, further support market growth by facilitating easier mobility for users. These demographic and institutional factors collectively position the U.S. as one of the most significant and rapidly evolving markets globally for mobility aids.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Europe Mobility Aids Market

The Europe Mobility Aids Market is estimated to be valued at USD 3.0 billion in 2025 and is further anticipated to reach USD 5.1 billion by 2034 at a CAGR of 6.0%.

Europe’s mobility aids market is strongly influenced by demographic trends, including a rapidly aging population and rising life expectancy across member countries. Data from Eurostat shows that the proportion of people aged 65 and above is steadily increasing, intensifying demand for mobility products such as manual and powered wheelchairs, walking frames, and stair lifts.

Governments and healthcare systems in Europe emphasize social inclusion and independence for elderly and disabled citizens, which encourages investments in assistive technologies and accessibility solutions. The European Disability Strategy and related policies promote equal access to healthcare and assistive devices, supporting market penetration. Countries like Germany, France, and the UK have well-established healthcare infrastructures that provide reimbursement schemes for mobility aids, enhancing affordability for users.

Additionally, the European Commission supports research and innovation in healthcare technology, fostering advancements in smart and connected mobility devices that improve user convenience and safety. Public health organizations across Europe, such as the European Centre for Disease Prevention and Control (ECDC), report increased incidences of chronic diseases that impair mobility, further driving market demand.

Efforts to improve public transport accessibility and home care services contribute to the market’s expansion, as mobility aids become integral to daily living. The focus on patient-centric care models and home-based rehabilitation also fuels demand for portable and user-friendly devices. Thus, the European market is marked by progressive regulations, aging demographics, and strong healthcare support, making it a key region for mobility aids growth and innovation.

The Japan Mobility Aids Market

The Japan Mobility Aids Market is projected to be valued at USD 1.2 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 2.0 billion in 2034 at a CAGR of 6.1%.

Japan’s mobility aids market is shaped by one of the world’s most rapidly aging populations, with over 28% of its citizens aged 65 or older, according to the Ministry of Internal Affairs and Communications. This demographic reality propels demand for various mobility solutions, including wheelchairs, scooters, and walking aids, designed to support independence among elderly and disabled individuals. The government of Japan promotes active aging policies and invests heavily in healthcare infrastructure, with reimbursement programs and long-term care insurance covering a significant portion of mobility aid costs.

The Ministry of Health, Labour and Welfare advocates for accessible healthcare and rehabilitation services, strengthening the demand for advanced mobility aids. Japan’s emphasis on robotics and smart technologies translates into a growing market for innovative, powered, and connected mobility devices that improve safety and usability. Rehabilitation centers and home care services are expanding, supported by governmental and local initiatives aimed at reducing institutionalization and promoting home-based care.

Additionally, social awareness campaigns and community support networks encourage early adoption of mobility aids to maintain quality of life. Urban planning in Japan also integrates accessibility features that accommodate mobility aid users, facilitating smoother mobility in public and private spaces. While the aging population drives market growth, cultural preferences for independence and dignity influence product design and acceptance. The combination of demographic pressures, robust healthcare policies, and technological advancements positions Japan as a dynamic and evolving market for mobility aids.

Global Mobility Aids Market: Key Takeaways

- Global Market Size Insights: The Global Mobility Aids Market size is estimated to have a value of USD 20.4 billion in 2025 and is expected to reach USD 38.4 billion by the end of 2034.

- The Global Market Growth Rate: The market is growing at a CAGR of 7.3 percent over the forecasted period of 2025.

- The US Market Size Insights: The US Mobility Aids Market is projected to be valued at USD 6.3 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 11.5 billion in 2034 at a CAGR of 6.9%.

- Regional Insights: North America is expected to have the largest market share in the Global Mobility Aids Market with a share of about 37.0% in 2025.

- Key Players: Some of the major key players in the Global Mobility Aids Market are Invacare Corporation, Sunrise Medical, Pride Mobility Products Corp., Drive DeVilbiss Healthcare, Permobil AB, Ottobock SE & Co. KGaA, Medline Industries, Inc., Graham-Field Health Products, Inc., and many others.

Global Mobility Aids Market: Use Cases

- Elderly Home Care: Mobility aids such as powered wheelchairs and walkers enable elderly individuals to maintain independence while performing daily activities, reducing fall risks and enhancing quality of life in home settings.

- Post-Surgery Rehabilitation: Patients recovering from surgeries utilize walking aids and manual wheelchairs to regain mobility during physical therapy, facilitating faster recovery and preventing complications.

- Disabled Access in Public Spaces: Wheelchairs and mobility scooters allow physically disabled individuals to navigate public areas, transportation, and workplaces with ease, promoting inclusivity.

- Nursing Home Mobility Support: Assisted living and nursing facilities employ patient lifts and stair lifts to safely assist residents with mobility challenges, ensuring comfort and safety.

- Sports and Recreation: Specialized mobility aids, including all-terrain wheelchairs, provide opportunities for disabled individuals to participate in recreational and adaptive sports, promoting physical and mental well-being.

Global Mobility Aids Market: Stats & Facts

U.S. Centers for Disease Control and Prevention (CDC)

- About 13.7% of adults in the U.S. report mobility difficulties.

- Mobility limitations increase with age: nearly 50% of adults aged 65+ report mobility issues.

- Approximately 6.8 million adults use mobility aids such as canes, walkers, or wheelchairs.

- Falls are the leading cause of injury among older adults; proper mobility aids reduce fall risk by up to 30%.

- Arthritis affects 23% of all adults and is a leading cause of mobility impairment.

U.S. Census Bureau

- The U.S. population aged 65 and over is projected to double by 2060, from 52 million to 95 million.

- Among people aged 75+, about 40% experience mobility disabilities.

- 19% of non-institutionalized adults report some form of disability, with mobility being the most common.

World Health Organization (WHO)

- Over 1 billion people worldwide experience some form of disability; mobility impairments are among the most common.

- The global population aged 60 years or over is expected to reach 2.1 billion by 2050, driving demand for mobility aids.

- Approximately 15% of the world’s population lives with some form of disability.

- Falls among older adults are the second leading cause of accidental injury deaths globally.

Eurostat (European Statistical Office)

- Nearly 30% of Europeans aged 65+ report limitations in mobility.

- Life expectancy in the EU is rising, increasing the elderly population needing mobility assistance.

- Approximately 17% of EU citizens have a long-standing health problem or disability affecting mobility.

- Home care services usage by elderly Europeans has increased by 15% in the past decade, driving mobility aid demand.

Ministry of Health, Labour and Welfare, Japan

- Over 28% of Japan’s population is aged 65 or older.

- The long-term care insurance system covers approximately 5.7 million people requiring mobility assistance.

- 70% of elderly care facility residents use some form of mobility aid regularly.

- Japan’s government invests heavily in assistive robotics and mobility technologies to address demographic challenges.

National Institute on Aging (NIA), USA

- 42% of adults aged 65+ report difficulty walking or climbing stairs.

- Mobility impairments increase the risk of social isolation and depression in the elderly.

- Use of mobility aids is linked to a 25% increase in independent living among seniors.

National Council on Aging (NCOA), USA

- Falls result in over 3 million emergency department visits annually for older adults.

- 1 in 4 Americans aged 65+ falls each year; mobility aids are critical for fall prevention.

European Centre for Disease Prevention and Control (ECDC)

- Chronic diseases affecting mobility, such as arthritis and stroke, affect 50 million Europeans.

- Mobility disability prevalence increases from 10% in adults aged 55-64 to 40% in those aged 85+.

United Nations Department of Economic and Social Affairs (UNDESA)

- The number of persons aged 60 years or over worldwide is projected to increase from 1 billion in 2020 to 1.4 billion in 2030.

- Disability rates increase significantly with age, with mobility difficulties being the most reported limitation.

Australian Institute of Health and Welfare (AIHW)

- Nearly 18% of Australians aged 65 and over report mobility difficulties.

- Over 1 million Australians use some form of mobility aid.

- Hospital admissions due to falls among elderly Australians have increased by 25% over the last decade.

National Health Service (NHS), UK

- Approximately 17% of people in England report a long-term mobility disability.

- Demand for mobility aids through the NHS has increased by 20% in the past 5 years.

- Over 1 million people in the UK use wheelchairs or scooters for mobility support.

Canada Statistics

- About 20% of Canadians aged 65 and older report mobility challenges.

- Nearly 2 million Canadians use assistive devices including mobility aids.

- Aging population expected to double by 2040, increasing demand for mobility solutions.

Occupational Safety and Health Administration (OSHA), USA

- Work-related injuries causing mobility impairments affect approximately 1 million workers annually.

- Mobility aids are increasingly used in workplace rehabilitation programs.

Global Mobility Aids Market: Market Dynamic

Driving Factors in the Global Mobility Aids Market

Rapidly Aging Global Population and Increasing Disability Prevalence

The foremost growth driver of the mobility aids market is the demographic shift toward an aging global population. According to the World Health Organization, the number of people aged 60 years and older is expected to reach 2.1 billion by 2050. Aging is associated with declining mobility, increased incidence of chronic diseases like arthritis, osteoporosis, and neurological disorders, and higher risk of falls and injuries. As a result, the demand for assistive mobility devices such as wheelchairs, scooters, walkers, and stair lifts is growing steadily.

Additionally, the rise in life expectancy has led to longer periods of disability or limited mobility, increasing the need for durable and adaptive mobility aids. Similarly, an increasing number of individuals with physical disabilities, whether congenital or acquired through accidents or illnesses, fuels market growth. Governments and healthcare organizations are intensifying efforts to improve accessibility and quality of life for these populations by subsidizing mobility aids and enhancing healthcare infrastructure.

Expansion of Healthcare Infrastructure and Rehabilitation Services

The expansion and modernization of healthcare infrastructure globally act as a crucial growth driver for the mobility aids market. Increasing investments in hospitals, rehabilitation centers, nursing homes, and home healthcare services necessitate a broad array of mobility products tailored to diverse clinical and non-clinical needs.

Rehabilitation services for post-surgical patients and those recovering from strokes or injuries are expanding rapidly, encouraging demand for specialized mobility aids like patient lifts, crutches, and advanced wheelchairs. Government programs supporting disability welfare and long-term care insurance schemes provide financial assistance to patients, enhancing device affordability and accessibility. Additionally, the rise of outpatient and ambulatory care centers emphasizes short-term mobility aids to facilitate quick recovery and reduce hospital stays.

Restraints in the Global Mobility Aids Market

High Cost and Limited Affordability of Advanced Mobility Aids

One of the significant restraints for the mobility aids market is the high cost associated with powered and smart mobility devices. Advanced wheelchairs, scooters, and stair lifts equipped with sophisticated features such as AI, connectivity, and robotics often come with prohibitive price tags, limiting their accessibility to low- and middle-income users, especially in developing countries.

Even manual devices with ergonomic designs and premium materials can be expensive relative to average incomes in certain regions. Many insurance schemes and government subsidies do not cover the full cost or have strict eligibility criteria, creating financial barriers.

Additionally, maintenance and repair costs for powered and connected devices are higher than traditional aids, deterring adoption among cost-sensitive consumers. This economic limitation narrows the potential market size and slows penetration in price-sensitive demographics. Affordability challenges are compounded by a lack of standardized reimbursement policies globally and disparities in healthcare funding.

Regulatory Challenges and Lack of Awareness in Developing Regions

Regulatory hurdles and low awareness represent substantial barriers in many regions, particularly in emerging markets. Mobility aids are subject to rigorous safety and quality standards in developed countries, but inconsistent regulatory frameworks elsewhere create challenges for manufacturers and distributors in ensuring compliance and market access. This regulatory fragmentation can delay product launches and increase costs.

Furthermore, in rural and underserved areas, there is limited awareness about the availability and benefits of mobility aids, leading to underutilization. Cultural stigmas related to disability and mobility challenges may discourage users from adopting assistive devices. Healthcare professionals and caregivers often lack adequate training on mobility aid selection and use, resulting in suboptimal recommendations. Additionally, supply chain inefficiencies and lack of service centers hinder timely access to devices and maintenance.

Opportunities in the Global Mobility Aids Market

Emerging Markets with Expanding Healthcare Access and Increasing Awareness

Emerging economies, particularly in Asia-Pacific, Latin America, and parts of Africa, present significant growth opportunities for the mobility aids market. These regions are witnessing rapid urbanization, increased healthcare spending, and rising awareness of disability rights and elderly care. Many countries are expanding healthcare infrastructure and launching social welfare programs targeting aging populations and disabled individuals, thereby increasing the accessibility and affordability of mobility aids.

Moreover, increasing penetration of e-commerce and online retail platforms enables manufacturers to reach underserved rural and semi-urban populations cost-effectively. The shift toward smart and powered mobility devices is also gaining traction as disposable incomes rise. In addition, the World Health Organization and other international bodies actively support initiatives to improve mobility and accessibility in developing countries, opening doors for partnerships and product adaptations that cater to local needs and economic conditions.

Technological Innovation and Integration of AI and IoT

Technological advancement remains a pivotal growth opportunity for the mobility aids market. The integration of artificial intelligence (AI), machine learning, and the Internet of Things (IoT) into mobility devices opens new frontiers in product capabilities and user experience. AI-powered devices can analyze user movement patterns, provide fall prevention alerts, and even predict health complications, allowing for proactive care. IoT connectivity enables remote monitoring by caregivers and healthcare professionals, improving safety and enabling personalized rehabilitation programs. Wearable sensors and voice recognition further enhance accessibility for users with limited dexterity or cognitive challenges.

Additionally, advancements in battery technology, lightweight materials, and ergonomic designs improve device portability and comfort, addressing longstanding user pain points. Robotics and exoskeleton integration offer promising prospects for severely impaired patients. The growing consumer demand for smart healthcare devices and the increasing availability of mobile applications complement these technological trends. Companies that invest in R&D and collaborate with tech firms to innovate smart mobility solutions are well-positioned to capture this growing market segment, thus driving sustained competitive advantage.

Trends in the Global Mobility Aids Market

Increasing Adoption of Smart and Connected Mobility Aids

The mobility aids market is witnessing a significant shift toward smart and connected devices integrated with IoT technology, sensors, and AI capabilities. These advanced mobility aids offer real-time health monitoring, GPS tracking, and fall detection, significantly improving user safety and independence. Devices like powered wheelchairs and walkers now come equipped with automated navigation and obstacle avoidance features, making them user-friendly for elderly and physically disabled individuals.

This trend aligns with the broader healthcare digitization movement, emphasizing remote monitoring and telehealth services. Moreover, manufacturers are focusing on ergonomic designs and lightweight materials such as carbon fiber to enhance comfort and portability. The trend is fueled by increasing consumer awareness about the benefits of smart mobility aids and government initiatives promoting assistive technologies for aging populations.

Growing Focus on Aging in Place and Home Care Solutions

Another major trend shaping the mobility aids market is the increasing preference among elderly individuals to age in place, i.e., to live independently in their own homes rather than moving to assisted living or nursing facilities. This shift has propelled demand for mobility aids tailored to home environments, including stair lifts, portable wheelchairs, and user-friendly walking aids.

Governments and healthcare providers are endorsing home-based care models as cost-effective and better aligned with patient preferences, encouraging innovation in products designed for domestic use. The integration of mobility aids with smart home technologies, such as voice control and automated lighting, further supports this trend. It presents opportunities for product differentiation and service expansion, fueling competitive dynamics and expanding market reach globally.

Global Mobility Aids Market: Research Scope and Analysis

By Product Type Analysis

Manual wheelchairs are projected to dominate the global market in terms of volume, especially in developing countries. Their affordability, durability, and ease of maintenance make them accessible to a larger portion of the population with mobility impairments. Many users in low- and middle-income regions rely on manual wheelchairs because they require no battery or complex technology, making them practical where electricity and technical service infrastructure might be limited.

In contrast, powered wheelchairs dominate in developed countries with higher disposable incomes, where users seek greater comfort, autonomy, and enhanced mobility options. Powered wheelchairs are preferred by users with severe disabilities or limited upper body strength, as these devices require minimal physical effort and allow for longer distances and outdoor use. The availability of advanced features such as joystick controls, adjustable seating, and customizable designs in powered wheelchairs further attracts consumers in wealthier markets.

Additionally, government subsidies and insurance reimbursement schemes in developed countries support the uptake of powered wheelchairs, encouraging adoption. This bifurcation creates a dual market structure where manual wheelchairs serve as essential, cost-effective aids globally, while powered wheelchairs represent premium, technologically advanced solutions predominantly in affluent regions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Technology Analysis

Manual mobility aids, including canes, crutches, walkers, and manual wheelchairs, are the most prevalent technologies in emerging markets and among low-income user groups worldwide. Their dominance is driven primarily by cost considerations and the relative simplicity of manufacturing and maintenance. In many developing regions, healthcare infrastructure and patient affordability limit the availability and distribution of powered or technologically enhanced mobility devices. Manual aids provide reliable and immediate mobility support without dependence on electricity or sophisticated servicing.

Additionally, many manual mobility aids are designed to be lightweight, foldable, and easy to transport, which fits well with the lifestyle and resource constraints of users in these regions. Furthermore, manual aids are often the first line of mobility assistance for temporary users such as post-surgery patients or those recovering from injuries, before transitioning to powered aids if needed.

The market for manual aids also benefits from strong community-based rehabilitation programs and NGOs working in underserved areas, which prioritize low-cost, durable solutions to address wide-ranging mobility needs. However, the limitations of manual aids for users with severe mobility impairments maintain demand for powered alternatives where feasible.

By Patient Type Analysis

The elderly population’s centrality in the mobility aids market is underpinned by the multifaceted challenges aging presents. Beyond musculoskeletal decline, many seniors face comorbidities such as cardiovascular disease, diabetes, and cognitive impairments that compound mobility issues. Consequently, mobility aids designed for geriatric users often incorporate features targeting these specific needs, such as easy-to-use brakes, intuitive controls, and fall prevention mechanisms.

The psychological impact of mobility loss also drives demand for aesthetically pleasing and socially acceptable devices that reduce stigma and encourage regular use. Assisted living and elder care facilities frequently recommend or provide these aids as part of comprehensive care plans that prioritize independence and social engagement.

Moreover, emerging smart technologies like voice-activated controls and fall detection sensors are gaining traction among tech-savvy elderly users and their caregivers. Public health policies in many countries increasingly emphasize “aging in place,” which promotes the use of mobility aids to support independent living and reduce healthcare system burdens. Globally, the geriatric segment represents a significant growth opportunity as increasing life expectancy and declining birth rates shift demographic balances, encouraging manufacturers to invest in product innovations, service models, and outreach tailored specifically for older adults.

By Distribution Channel Analysis

The surge in online retail for mobility aids is poised to be part of a broader digital transformation reshaping healthcare product distribution. E-commerce platforms not only provide unparalleled convenience and product variety but also facilitate personalized shopping experiences through virtual try-ons, expert consultations, and tailored recommendations based on user profiles. The rise of mobile commerce and app-based platforms further extends accessibility to users who may lack traditional internet access but possess smartphones.

Importantly, online retail helps dismantle traditional geographic and socioeconomic barriers by delivering specialized or customized products directly to consumers’ homes, including those in rural or underserved areas. This channel also supports flexible purchasing options such as installment plans, rentals, and trial periods, making expensive powered aids more financially accessible. Integration with telehealth services allows users to receive professional assessments remotely, ensuring better product fit and reducing post-purchase returns.

However, challenges remain, such as the need for reliable last-mile delivery networks capable of handling bulky and sensitive medical devices, and the provision of after-sales support and maintenance in remote locations. Partnerships between e-commerce platforms, local distributors, and healthcare providers are becoming increasingly critical to address these issues and enhance the customer journey, making online retail a cornerstone of the evolving mobility aids market ecosystem.

By End-User Analysis

Hospitals and clinics are projected to be the key hubs of mobility aids utilization due to their comprehensive role in patient diagnosis, treatment, rehabilitation, and discharge planning. The demand from these institutions is multifaceted, encompassing acute care needs, chronic disease management, and post-surgical rehabilitation. Mobility aids in clinical settings support early mobilization protocols, which are proven to reduce complications, shorten hospital stays, and improve long-term functional outcomes.

The clinical environment demands devices that are not only effective but also reliable, hygienic, and easy to sanitize to prevent hospital-acquired infections. Increasingly, hospitals are adopting smart mobility aids equipped with sensors and remote monitoring capabilities, enabling healthcare providers to track patient mobility, adherence to therapy, and detect fall risks in real time. Multidisciplinary rehabilitation teams rely on these devices to customize therapy plans and enhance patient engagement.

Additionally, hospitals influence the broader consumer market through their recommendations and prescriptions, as many patients continue using similar aids at home. Procurement strategies in hospitals are evolving towards value-based purchasing models, which prioritize devices that demonstrate clinical efficacy and cost-effectiveness over their lifecycle. As global healthcare infrastructure expands, especially in emerging economies, hospitals and clinics will continue to be major consumers and influencers in the mobility aids market, driving demand for both basic and advanced assistive technologies.

The Global Mobility Aids Market Report is segmented on the basis of the following:

By Product Type

- Wheelchairs

- Manual Wheelchairs

- Powered Wheelchairs

- Mobility Scooters

- Boot Scooter

- Midsize Scooter

- Road Scooter

- Walking Aids

- Patient Lifts

- Rehabilitation Equipment

- Stair Lifts

- Other Product Type

By Technology

- Manual Mobility Aids

- Powered Mobility Aids

- Smart Mobility Aids/Connected Devices

By Patient Type

- Geriatric Patients

- Physically Disabled Individuals

- Post-Surgery Patients

- Patients with Chronic Diseases

By Distribution Channel

- Online Retail

- Medical Supply Stores

- Pharmacies

- Direct Sales

- Hospitals & Healthcare Facilities

By End-User

- Hospitals & Clinics

- Nursing Homes

- Assisted Living Facilities / Elderly Care Facilities

- Rehabilitation Centers

- Ambulatory Surgical Centers

- Home Care Settings

- Healthcare Professionals

Impact of Artificial Intelligence in the Global Mobility Aids Market

- Enhanced Smart Mobility Devices: AI integration enables mobility aids like powered wheelchairs and scooters to incorporate advanced navigation systems, obstacle detection, and autonomous movement features, improving safety and ease of use for users with limited control or cognitive impairments.

- Personalized User Experience: AI algorithms analyze user behavior, movement patterns, and physical needs to customize device settings such as speed, seat adjustments, and control sensitivity leading to more comfortable, efficient, and adaptive mobility solutions tailored to individual requirements.

- Predictive Maintenance and Diagnostics: AI-powered sensors embedded in mobility aids monitor device health in real time, predicting maintenance needs before failures occur. This reduces downtime, extends device lifespan, and lowers repair costs, enhancing overall user satisfaction and reliability.

- Remote Monitoring and Tele-rehabilitation: AI facilitates remote tracking of users’ mobility and rehabilitation progress through connected devices. Healthcare professionals can monitor patient adherence, detect anomalies, and adjust therapy plans remotely, improving clinical outcomes and reducing hospital visits.

- Voice and Gesture Control Interfaces: AI-driven natural language processing and computer vision enable hands-free control of mobility aids via voice commands or gestures, making devices more accessible to users with severe physical limitations and enhancing independence and autonomy.

Global Mobility Aids Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to lead the global mobility aids market with 37.0% of market share in 2025, due to a combination of demographic, economic, technological, and healthcare infrastructure factors. The region has one of the highest proportions of elderly populations, particularly in the United States and Canada, which drives strong demand for mobility aids like wheelchairs, scooters, and walkers. Aging populations experience higher incidences of chronic diseases such as arthritis, osteoporosis, and neurological disorders, increasing reliance on assistive devices to maintain independence and quality of life.

The presence of well-established healthcare infrastructure and comprehensive insurance coverage, including Medicare and Medicaid in the U.S., significantly boosts mobility aids adoption by reducing financial barriers for end users. Government programs and subsidies further support access to advanced powered and smart mobility devices, accelerating market penetration. Additionally, North America is a hub for innovation, with leading manufacturers and research institutions developing state-of-the-art products that integrate artificial intelligence, IoT, and ergonomic designs to enhance usability and patient outcomes.

Awareness about mobility aids and disability rights is high, supported by advocacy organizations and regulatory frameworks like the Americans with Disabilities Act (ADA), which promote accessibility and inclusivity. This results in increased consumer confidence and adoption of mobility solutions. Moreover, established distribution channels, including specialized healthcare providers, hospitals, and growing online retail platforms, facilitate easy availability and after-sales support.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with the Highest CAGR

Asia Pacific is witnessing the highest compound annual growth rate (CAGR) in the mobility aids market, driven by rapid demographic, economic, and healthcare transformations. The region is experiencing a significant rise in its elderly population due to increasing life expectancy and declining birth rates, especially in countries like China, Japan, India, and South Korea. This demographic shift fuels growing demand for mobility aids as the prevalence of age-related mobility impairments and chronic diseases escalates.

Economic growth and expanding middle-class populations are improving purchasing power and access to healthcare, enabling more individuals to afford mobility aids previously considered luxury items. Governments across the region are investing heavily in healthcare infrastructure, rehabilitation programs, and social welfare schemes aimed at improving the quality of life for elderly and disabled populations. Initiatives like Japan’s long-term care insurance system and China’s Healthy Aging policies support increased access to assistive devices.

Technological adoption is also rising rapidly, with local manufacturers collaborating with global companies to produce affordable yet advanced mobility aids tailored to regional needs. E-commerce penetration is enhancing product availability even in rural and semi-urban areas, breaking down previous accessibility barriers.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Mobility Aids Market: Competitive Landscape

The global mobility aids market is highly competitive and characterized by the presence of established multinational corporations, regional manufacturers, and emerging innovative startups. Key players such as Invacare Corporation, Sunrise Medical, Pride Mobility Products Corp., Permobil AB, and Ottobock SE dominate through extensive product portfolios spanning manual wheelchairs, powered wheelchairs, mobility scooters, patient lifts, and smart mobility solutions.

These companies leverage advanced research and development to introduce cutting-edge technologies, including AI-powered navigation, IoT-enabled device monitoring, and ergonomic designs that enhance user comfort and safety. Strategic partnerships and collaborations with healthcare providers and distributors enable them to strengthen market presence and expand their reach across developed and emerging markets.

Competitive strategies include product innovation, mergers and acquisitions, and geographic expansion. For example, acquisitions of smaller specialized firms help larger companies diversify product offerings and enter niche segments such as pediatric mobility aids or rehabilitation robotics. Additionally, expanding manufacturing footprints closer to high-growth regions like Asia Pacific reduces costs and shortens supply chains.

Mid-sized and regional players focus on affordability and customization to capture underserved markets, particularly in emerging economies. The rise of online retail platforms has intensified competition, allowing new entrants to access global markets more easily while challenging traditional distribution models.

Some of the prominent players in the Global Mobility Aids Market are:

- Invacare Corporation

- Sunrise Medical

- Pride Mobility Products Corp.

- Drive DeVilbiss Healthcare

- Permobil AB

- Ottobock SE & Co. KGaA

- Medline Industries, Inc.

- Graham-Field Health Products, Inc.

- Arjo AB

- Hoveround Corporation

- Tzora Active Systems

- Kuschall AG

- HoverTech International

- Convaid

- Rollz International BV

- Magic Mobility

- Meyra GmbH

- Pride Mobility Products Group, Inc.

- Vermeiren Group

- Other Key Players

Recent Developments in the Global Mobility Aids Market

August 2025

- New State Capital Partners completed a majority investment in The Expo Group, a leading provider of critical services to the trade show and live event industry across North America. This strategic move aims to enhance The Expo Group's capabilities in organizing and managing events, potentially impacting the mobility aids market by improving the logistics and execution of industry-related expos and conferences.

July 2025

- The 2025 M&A Source Spring Conference & Deal Market was announced, focusing on mergers and acquisitions within the medical equipment sector. This conference provides a platform for industry professionals to discuss and explore potential M&A opportunities, which could influence the strategic directions of companies in the mobility aids market.

June 2025

- The Shanghai International Advanced Air Mobility Expo was held, showcasing innovations in air mobility. While primarily focused on aerial technologies, the expo highlighted advancements in mobility solutions that could intersect with ground-based mobility aids, offering insights into future integrated mobility ecosystems.

May 2025

- The New Mobility Congress 2025 took place, bringing together experts to discuss the future of mobility. Topics included the integration of AI in mobility aids, smart city infrastructure, and inclusive design, reflecting the growing importance of technological advancements in the mobility aids sector.

April 2025

- A significant investment was made in a startup specializing in AI-driven mobility aids. This funding aims to accelerate the development of smart wheelchairs and scooters, incorporating features like obstacle detection and autonomous navigation, marking a step forward in the evolution of mobility aids.

March 2025

- The Schaeffler Group and Vitesco Technologies completed their merger, forming a leading motion technology company. This merger combines their expertise in mobility solutions, potentially impacting the mobility aids market by introducing new technologies and products.

February 2025

- A collaboration was announced between a leading mobility aids manufacturer and a tech company specializing in AI to develop smart mobility solutions. This partnership aims to integrate advanced AI algorithms into mobility aids, enhancing user experience and accessibility.

January 2025

The Medtec China 2025 Expo was scheduled at the Shanghai World Expo Exhibition & Convention Center. The event focused on medical device innovations, including mobility

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 20.4 Bn |

| Forecast Value (2034) |

USD 38.4 Bn |

| CAGR (2025–2034) |

7.3% |

| The US Market Size (2025) |

USD 6.3 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Wheelchairs, Mobility Scooters, Boot Scooters, Walking Aids, Patient Lifts, Rehabilitation Equipment, Stair Lifts, and Other Product Types), By Technology (Manual Mobility Aids, Powered Mobility Aids, and Smart Mobility Aids/Connected Devices), By Patient Type (Geriatric Patients, Physically Disabled Individuals, Post-Surgery Patients, and Patients with Chronic Diseases), By Distribution Channel (Online Retail, Medical Supply Stores, Pharmacies, Direct Sales, Hospitals & Healthcare Facilities), By End-User (Hospitals & Clinics, Nursing Homes, Assisted Living Facilities / Elderly Care Facilities, Rehabilitation Centers, Ambulatory Surgical Centers, Home Care Settings, and Healthcare Professionals) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Invacare Corporation, Sunrise Medical, Pride Mobility Products Corp., Drive DeVilbiss Healthcare, Permobil AB, Ottobock SE & Co. KGaA, Medline Industries, Inc., Graham-Field Health Products, Inc., Arjo AB, Hoveround Corporation, Tzora Active Systems, Kuschall AG, HoverTech International, Convaid, Rollz International BV, Magic Mobility, Meyra GmbH, Pride Mobility Products Group, Inc., Vermeiren Group., and Other Key Players

|

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |