Mobility as a service or MaaS moves around providing transportation options customized to consumer needs. It entails integrating various modes like car &bike sharing, taxis, and rentals/leases through digital platforms, allowing users to plan, book, & pay for diverse mobility services. Further, the core concept of MaaS is to provide travelers with convenient &customized mobility solutions that align with their specific travel needs.

Connectivity is fundamental for Mobility as a Service (MaaS), which relies on internet enabled platforms. According to the International Telecommunication Union, 64.4% of the global population—approximately 5.16 billion people—were estimated to use the internet by the end of 2023.

Smartphones play a critical role in modern mobility solutions, as services like ride sharing depend on mobile applications and reliable connectivity. Over recent years, smartphone adoption has surged globally, with developed nations leading the trend, boasting approximately 80% smartphone ownership. This widespread use of smartphones and improved internet access provide a strong foundation for the growth and adoption of MaaS platforms.

Key Takeaways

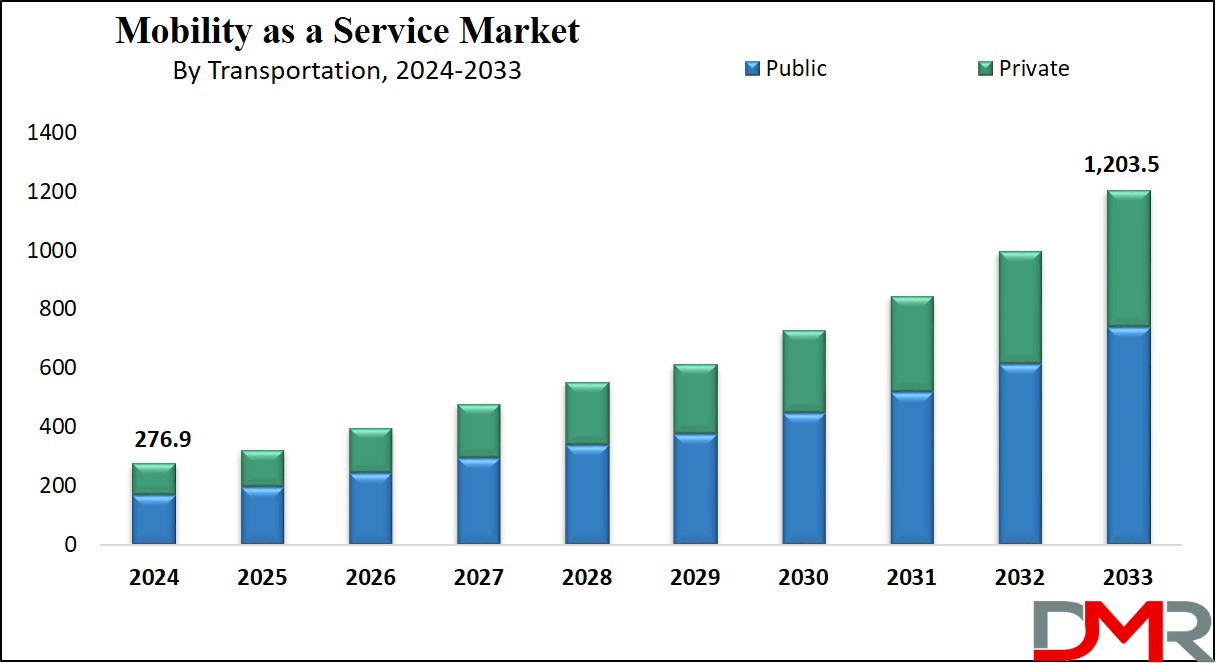

- The Global Mobility as a Service Market is expected to grow by 926.6 billion, at a CAGR of 17.7% during the forecasted period.

- By Operating System, the Android segment is expected to lead in 2024 & is anticipated to dominate throughout the forecasted period.

- By Propulsion, the ICE vehicle segment is expected to have a lead throughout the forecasted period.

- By End User, the automotive sector is expected to come out as a dominant force during the forecasted period.

- Europe is expected to hold a 31.0% share of revenue in the Global Mobility as a Service Market in 2024.

- Some of the use cases of Mobility as a Service include mobile financial service, IOT Connectivity, and more.

Use Cases

- Enterprise Mobility Solutions: Businesses can leverage MaaS to streamline their mobile operations, which includes delivering employees with access to company applications, data, & services on their mobile devices. With MaaS, enterprises can implement mobile device management (MDM) solutions, allowing security, compliance, & centralized control over corporate-owned or BYOD environments.

- Consumer Entertainment and Media: It can provide subscription-based access to a variety of entertainment & media content, like music streaming, video-on-demand, gaming, & e-books. Users can enjoy smooth access to their favorite content across many devices, with the flexibility to switch between services or cancel subscriptions as needed.

- IoT (Internet of Things) Connectivity: It can support the connectivity & management of IoT devices, like smart home appliances, wearables, and industrial sensors. By providing a unified platform for IoT connectivity, it allows users to monitor & control their devices remotely, receive on-spot notifications, and analyze data for insights & optimization.

- Mobile Financial Services: It also acts as a platform for delivering mobile banking, payment, & financial management services to consumers and businesses Users can access their bank accounts, make payments, transfer funds, & manage investments securely through mobile apps, assisted by backend infrastructure & integration with financial institutions.

Market Dynamic

Governments around the globe are backing the development & introduction of electric passenger vehicles, like buses, along with establishing charging infrastructure to improve transportation options, with joint efforts that have led to higher advancements in modes of transportation like bike sharing, car-sharing, ride-sharing, & trains.

The integration of wireless connections, like 5G,

5G service & 4G LTE, has further driven the Mobility as a Service (MaaS) market, allowing smooth communication between passengers & drivers through smartphones & ensuring high-speed internet connectivity. However, the market participants experience challenges in meeting regulatory standards across different countries, which can hinder growth.

Moreover, there's a need for a better understanding of the lifetime costs associated with private vehicles compared to MaaS solutions, presenting a major restraint for market growth. Yet, the increasing number of transportation options, along with solutions for traffic & parking management, emission reduction, and low cost, are driving the MaaS market towards the development of greener & smarter cities with better mobility solutions.

Driving Factors

Rising urban populations and traffic congestion are major forces propelling MaaS market development. Cities worldwide face issues related to rising vehicle ownership that increase commute times, pollute the environment, and lead to inefficiencies and ineffective operations. MaaS platforms integrate various transportation modes public transit, ridesharing and micromobility seamlessly together to offer solutions to urban mobility issues.

Governments and city planners are turning to MaaS to increase sustainable

transportation service options, reduce traffic congestion and enhance commuter convenience. Digitalization and smartphone use accelerate MaaS adoption, making it simpler for users to access multiple forms of transport through one user friendly platform.

Trending Factors

Artificial intelligence (AI) and IoT integration is a major trend in MaaS market, as its algorithms use AI driven solutions to optimize routes, predict travel demand and tailor user experiences. IoT technology enables real time tracking of vehicles, dynamic pricing and effective fleet management. Meanwhile, advanced data analytics provide insight into user behavior and system efficiency allowing service providers to refine their offerings and increase profit.

Additionally, connected vehicles and smart infrastructure are revolutionizing urban mobility ecosystems. Their combination enables MaaS providers to offer predictive, efficient, and tailored transportation solutions, thus contributing to the expansion and modernization of urban transit systems.

Restraining Factors

Operators platforms often involve sharing user data across platforms, raising security and privacy issues that limit growth of this market. Stringent regulations regarding data protection, especially in regions like Europe with GDPR, create additional obstacles for service providers. Furthermore, lack of standard policies across jurisdictions compromises implementation and scaling abilities.

Resistance from traditional transportation operatorss and limited collaboration among stakeholders further hinder progress. To overcome these hurdles, robust data security frameworks, regulatory alignment, and effective partnerships among public and private sectors must be in place.

Opportunities

Emerging markets present MaaS providers with immense growth opportunities due to rapid urbanization, growing smartphone penetration rates and inadequate public transportation infrastructure. Asia Pacific, Latin America, and Africa are experiencing an upsurge in demand for efficient, cost effective and eco friendly mobility solutions.

Governments in these areas are investing in smart city initiatives and digital infrastructure projects that support MaaS adoption. MaaS providers can also tap into the surge in interest for electric vehicles (EVs) and micromobility solutions by tailoring services specifically to local needs, such as affordability and connectivity, to unlock untapped potential in fast growing regions.

Research Scope and Analysis

By Solution

The application technology solutions segment is expected to lead in the market in 2024, which is majorly driven by mobility as a service application, which uses various technology solutions to smoothly integrate transportation modes and services.

For instance, APIs play a major role in connecting different transportation providers, allowing smooth data sharing & integration of services within the mobility as a service framework. In addition, cloud-based platforms effectively manage the vast data generated by mobility as a service application, ensuring scalability & better data security measures.

Further, the payment solutions segment is expected to have significant growth, as users can conveniently make payments within mobility as a service application, removing the demand to switch between multiple platforms for different transportation services. These payment solutions are developed with multi-currency support, supporting tourists & travelers from many regions.

By Service

The ride-hailing services segment is expected to be a leader in the mobility as a service market in 2024, as these address the growing demand for transportation, providing users with convenient options for last-mile connectivity, as users enjoy the flexibility to schedule their travel time, choose routes, & select preferred vehicle types.

Further, integrating ride-hailing services within mobility as a service platform provides users with a complete array of transportation choices, enabling them to find the more suitable mode of travel through a single application.

Further, the ride-sharing services segment is anticipated to experience significant growth. By optimizing vehicle occupancy, ride-sharing services contribute to lower single-occupancy vehicles on the road, leading to growing carbon emissions.

Also, established companies like UBER TECHNOLOGIES, INC. and Lyft, Inc. enjoy strong brand recognition, supporting the introduction & acceptance of shared services. In addition, the low cost of ride-sharing appeals to users, further driving the segment's growth in the forecast period.

By Propulsion

The Internal Combustion Engine (ICE) vehicle segment is expected to lead the market in 2024, commanding a majority share, as it serves an important role in meeting changing transportation demands, mainly in developing economies with sizable populations earning below median wages. For Mobility as a Service (MaaS) providers, using mixed fleets like ICE vehicles remains pertinent until the adoption of electric vehicles becomes widespread.

Further, the

Electric Vehicle (EV) segment is expected to significantly expand, which is driven by the growth in demand for sustainable & environmentally friendly transportation options. In addition, offering EVs as part of their mobility solutions resonates well with environmentally conscious consumers, positioning themselves as responsible entities. In addition, EVs have lower fuel & maintenance costs in comparison to traditional ICE vehicles, rendering them a low cost choice for transportation services.

By Operating System

The Android segment is expected to lead in the market in 2024, securing a major revenue share, as the growth in the adoption of mobility as a service among Android users is driven by its user-friendly interface & smooth integration with the Android platform. Customized mobility as a service applications for Android devices provide a smooth & accessible experience, tapping into the broad popularity of Android smartphones, mainly in emerging markets.

In addition, the iOS segment is expected to major growth, as mobility as a service application developed for iOS devices provides users with an inbuilt & streamlined experience, capitalizing on the vast usage of iOS devices like iPhones & iPads, which reflects the preference of iOS users for booking, effective travel planning, & payment features, contributing to the growth in popularity of MaaS within the iOS ecosystem. As these applications evolve on the iOS platform, they play an important role in reshaping urban mobility, improving convenience, and revolutionizing transportation services.

By End User

The automotive segment is predicted to have a lead in the market in 2024, by adapting to changing consumer preferences, showcasing access over ownership, and delivering integrated transportation experiences. MaaS offerings in the automotive sector include a range of services, like ride-sharing, one-day rentals, and access to public transit and micro-mobility options, allowing automotive companies to position themselves as providers of complete mobility solutions.

Further, the government segment is expected to major growth, as they use mobility as a service as a strategic tool to improve urban mobility, tackle transportation challenges, & enhance citizens' quality of life. By partnering with MaaS, governments can integrate many transport modes, providing citizens with a smooth travel experience. In addition, customized mobility solutions serve the demands of citizens with disabilities, allowing equitable access to effective transport options.

By Transportation Type

The public transportation segment is expected to lead the market in 2024, driven by the major advantages of Mobility as a Service (MaaS) offering to public transit systems, as it enhances operational efficiency by supporting data insights on user preferences, travel behaviors, & need, thereby allowing better resource allocation & route optimization. Through simplified user experiences & smooth multi-modal options, MaaS can promote public transportation, potentially leading to increased ridership.

Further, the private transportation segment is expected to major growth, as it facilitates on-demand access to private vehicles, preserving the convenience & familiarity of personal transportation. Users can easily book private vehicles to meet specific travel requirements, mainly for destinations underserved by public transit, which is further driven by the preferences of younger demographics who may prioritize the flexibility & privacy offered by private transportation options.

By Payment Type

The on-demand segment is predicted to be leading the market in 2024, capturing a majority share, due to its ability to meet the convenience, flexibility, &immediate transportation needs of city dwellers. Further, it as a service smoothly integrates many services like ride-hailing, bike-sharing, and scooter-sharing, providing users with numerous transportation options at their fingertips. The expansion of smartphone applications further enhances the popularity of on-demand mobility, reshaping urban transportation dynamics.

Moreover, the subscription-based segment is expected to have significant growth, which allows users to consolidate numerous transportation modes, like public transit & ride-sharing, into a single monthly payment.

Subscriptions appeal to commuters looking for predictable expenses, streamlined transactions, & the flexibility to use different modes without hassle. Through subscription-based mobility as a service, users enjoy an integrated travel experience, access too many modes at a fixed rate, & potential cost savings in comparison to individual payments.

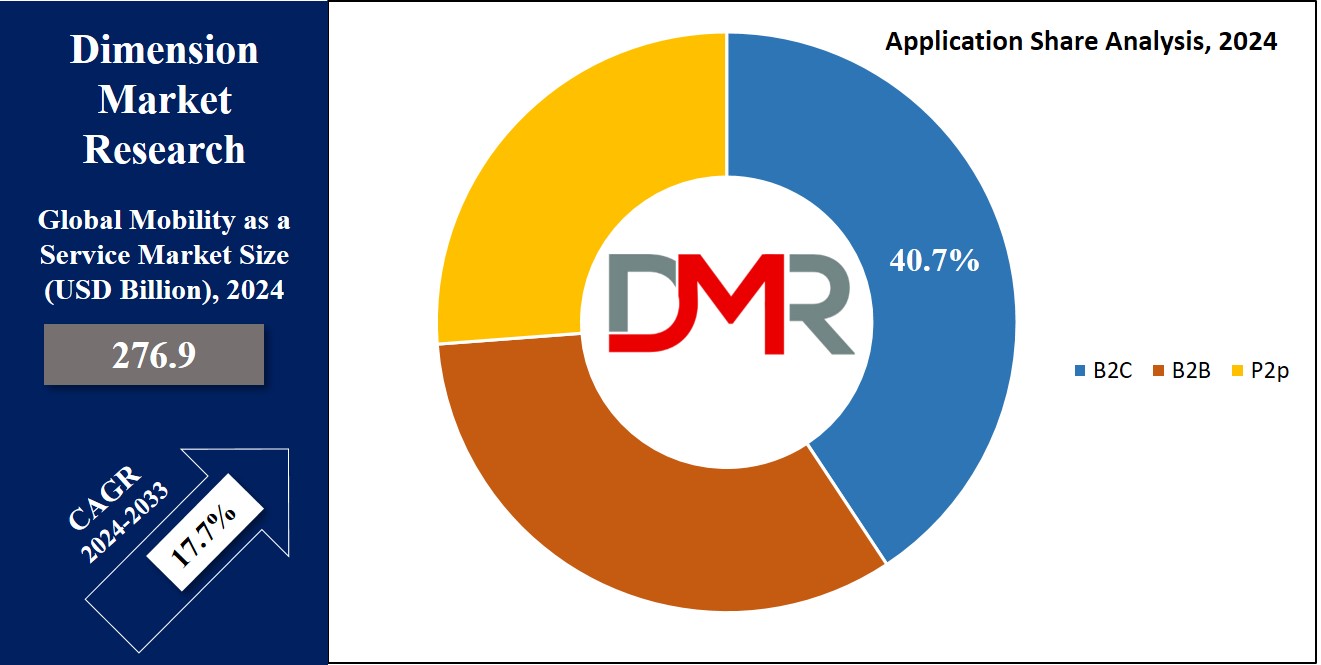

By Application

Business-to-Consumer (B2C) segment is expected to be the leader in the market in 2024, capturing a major revenue share, as it includes providing complete transportation solutions directly to individual consumers by service providers, which is driven by the convenience & ease provided by mobility services in comparisons to self-driving options. In addition, in densely populated cities, mobility services alleviate concerns about limited parking space, allowing users to access transportation without worrying about parking availability.

Further, the Business-to-Business (B2B) segment is anticipated for considerable expansion. The growth in demand for streamlined transportation solutions for corporations & institutions drives the growth of B2B mobility solutions. Enterprises look for effective travel options to improve workforce productivity during business trips, and it provides a smooth gateway to diverse transportation modes, enabling travelers to maximize their time.

The Mobility as a Service Market Report is segmented on the basis of the following

By Solution

- Journey Planning & Management Solutions

- Payment Solutions

- Booking & Ticketing Solutions

- Application Technology Solutions

- Others

By Service

- Ride-hailing Services

- Ride-sharing Services

- Micro-mobility Services

- Public Transport Services

- Others

By Propulsion

- Internal Combustion Engine (ICE) Vehicle

- Electric Vehicle (EV)

- CNG / LPG Vehicle

By Operating System

By End User

- Automotive

- Government

- Healthcare

- Retail

- Entertainment

- Others

By Transportation Type

By Payment Type

- On-demand

- Subscription-based

By Application

- Business-to-Business (B2B)

- Business-to-Consumer (B2C)

- Peer-to-Peer (P2P)

Regional Analysis

Europe is expected to lead the way in the Mobility as a Service market in 2024, capturing over

31% of the revenue, which is driven by Europe's strong commitment to sustainability. By using electric vehicles, bike-sharing, and public transit options in MaaS platforms, the region is constantly working to minimize emissions & promote eco-friendly transportation.

In addition, Europe's supportive regulatory environment, which allows open data sharing, fair competition, & integration of public transportation, further enhances the strength of its MaaS market.

Further, the Asia Pacific region is expected to be the fastest-growing market for the MaaS market, with a tech-savvy population & successful adoption of shared mobility services like ride-hailing & bike-sharing, as countries like China & India are leading the way. Also, it aligns perfectly with the needs of highly populated cities in Asia Pacific, providing a complete transportation solution that integrates several modes of transport & assists people navigate urban areas with ease.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

In the competitive landscape of the global Mobility as a Service (MaaS) market, as traditional transportation providers such as public transit agencies also compete for market share. In addition, technology giants like Google and Amazon are entering the market with integrated MaaS platforms, to enhance the competition.

Some of the prominent players in the global Mobility as a Service Market are

- MaaS Global

- SkedGo Pty Ltd

- Moovel Group

- Lyft Inc

- Moovit Inc

- Fluidtime

- BlaBlaCar

- UBER Technologies Inc

- Cubic Transportation Systems Inc

- Citymapper

- Other Key Players

Recent Developments

- In January 2024, Athens announced its commitment to implementing a pilot project for mobility as a service, which includes modernizing the entire public transport system of the city. Further, the initiative majorly focuses on simplifying the daily life of city dwellers & tourists, aiming at improving efficiency & interconnectivity.

- In January 2024, Caocao Mobility & Cango unveiled a strategic partnership in smart mobility to explore areas like new car sales, used car transactions, financing services, & mobility offerings, as the companies aim to strengthen a next-generation smart mobility ecosystem by completely holding their respective advantages & resources and adopting their synergies.

- In December 2023, May Mobility launched its first driverless service named May Mobility's rider-only vehicles for riders on public roads in Sun City, Arizona, which uses its proprietary Multi-Policy Decision Making technology and would operate daily throughout the week without an operator sitting in the driver's seat.

- In August 2023, Yulu unveiled a business program for established business entities & young entrepreneurs, as they get the opportunity to launch the company’s mobility service in their respective cities with end-to-end support from the company. Further, it aims to allow its local partners to launch over 10,000 of its electric two-wheelers in the coming year.

- In June 2023, BillionElectric announced its expansion into the Indian market, having USD 10 million in a seed round of equity & asset lease funding, which will be strategically allocated to two key initiatives: firstly, the installation of electric tarmac buses at the Bengaluru International Airport; and secondly, the development of a mid-mile heavy EV trucks platform.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 276.9 Bn |

| Forecast Value (2033) |

USD 1,203.5 Bn |

| CAGR (2024-2033) |

17.7% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Solution (Journey Planning & Management Solutions, Payment Solutions, Booking & Ticketing Solutions, Application Technology Solutions, and Others), By Service (Ride-hailing Services, Ride- sharing Services, Micro-mobility Services, Public Transport Services, and Others), By Propulsion (Internal Combustion Engine (ICE) Vehicle, Electric Vehicle (EV), and CNG / LPG Vehicle) By Operating System (Android, iOS, Others), By End User (Automotive, Government, Healthcare, Retail, Entertainment, and Others), By Transportation Type (Public and Private), By Payment Type (On-demand and Subscription-based), By Application (Business-to- Business (B2B), Business-to-Consumer (B2C), and Peer-to-Peer (P2P)) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

MaaS Global, SkedGo Pty Ltd, Moovel Group, Lyft Inc, Moovit Inc, Fluidtime, BlaBlaCar, UBER Technologies Inc, Cubic Transportation Systems Inc, Citymapper, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |