Market Overview

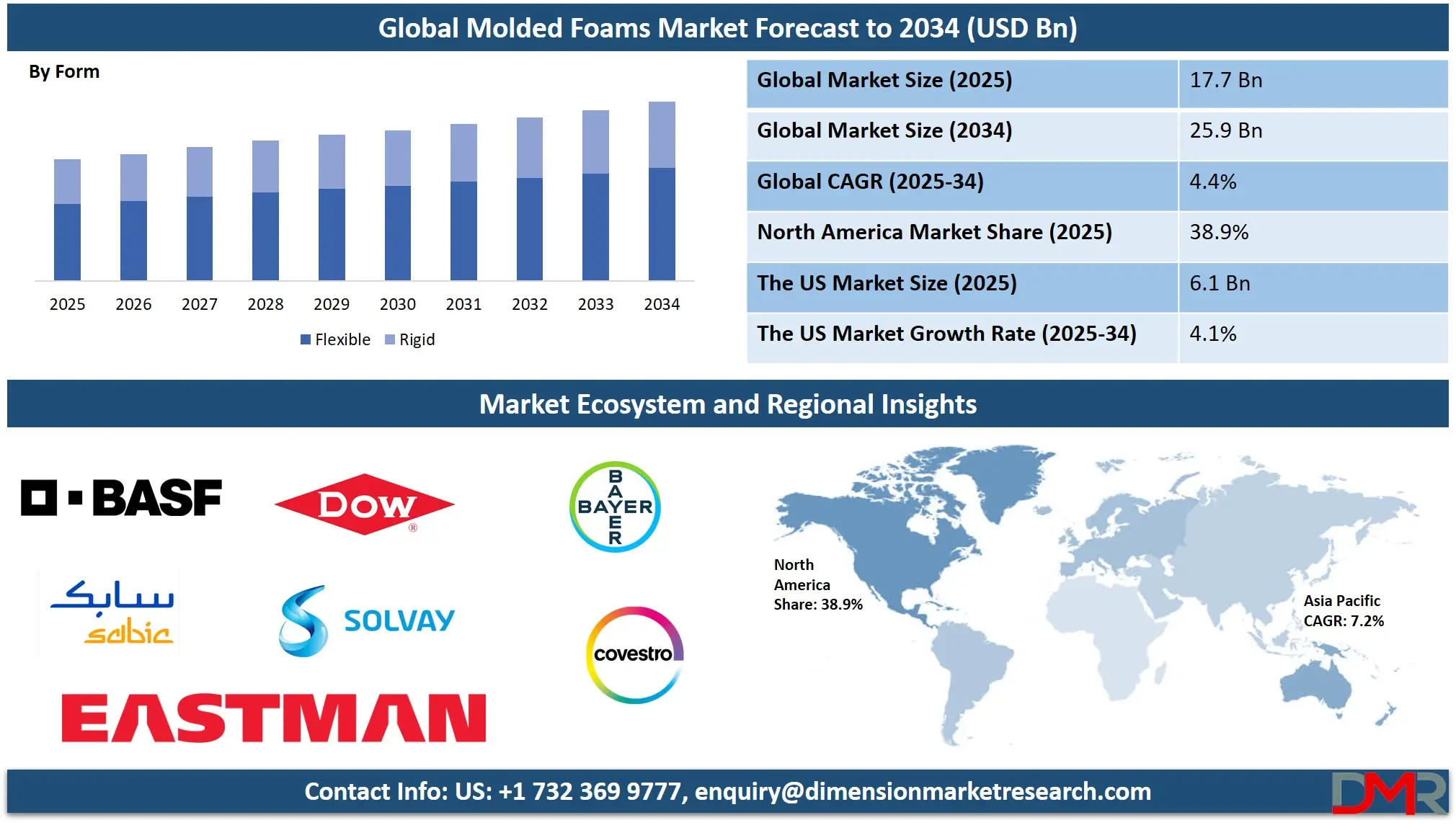

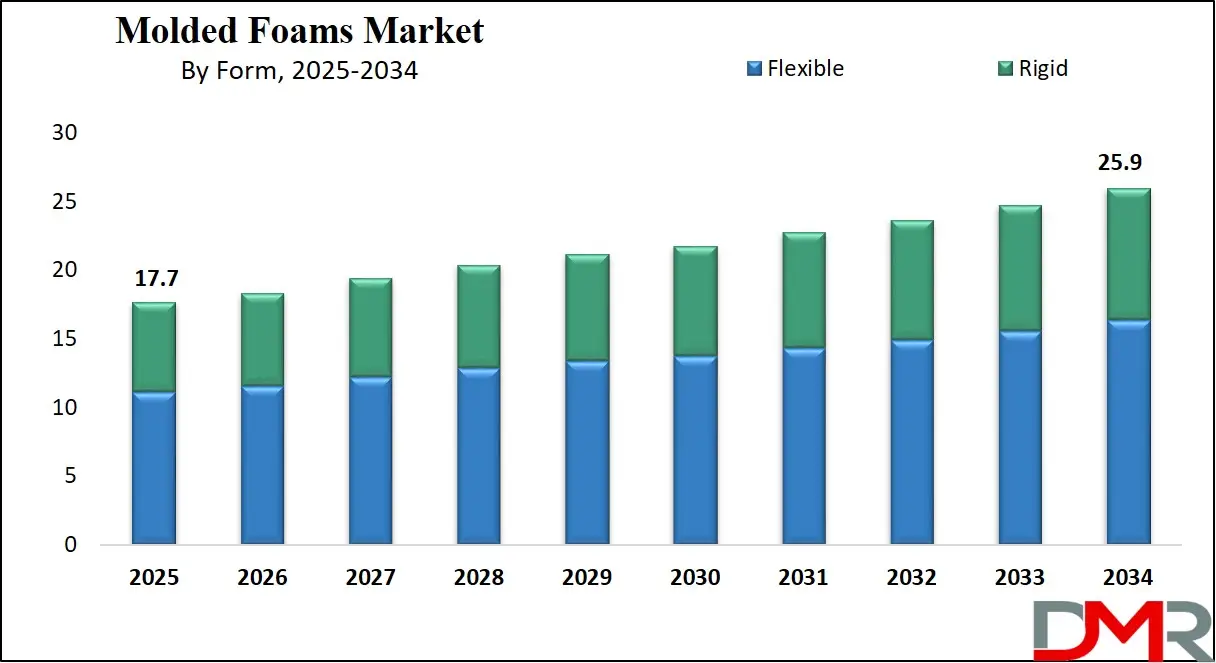

The Global Molded Foams Market is projected to reach

USD 17.7 billion in 2025 and grow at a compound annual growth rate of

4.4% from there until 2034 to reach a value of

USD 25.9 billion.

Molded foams are polyurethane foams that are made into specific forms during their manufacturing process. Molded foams have become an indispensable material in automotive seating, furniture upholstery, packaging, and insulation owing to their ability to provide comfort, durability, and shock absorption.

While slabstock foams are cut from large blocks of foam, molded foams are formed by injecting liquid polyurethane into molds where it solidifies to form desired shapes with enhanced design flexibility and precision, making molded foams invaluable in industries requiring ergonomic materials like automotive seating or high-performance materials like automotive seating and packaging materials.

Further, steady increase in demand for molded foams across industries like automotive and furniture manufacturing, mainly the automotive sector.

Automotive applications of molded foam-like seats, armrests and noise-reducing components are producing increased amounts as car manufacturing recovers from supply chain disruptions. Also, EV manufacturers have also driven innovation within foam production by creating materials to improve fuel efficiency and passenger comfort, further driving innovation across production processes across these industries.

Trends in the molded foam market reveal an emphasis on sustainability and advanced material technologies. More manufacturers are producing bio-based and recycled polyurethane foams to lessen environmental impact; smart foams with temperature regulation or pressure sensitivities are being investigated for mattresses, car seats and medical applications; while online shopping has driven an increased demand for protective packaging foams that prevent damage during shipping and transportation.

Various major events have affected the molded foam industry in recent years. The pandemic initially caused factory shutdowns and supply chain disruptions that minimized production. But after industries recovered, demand began rising again, mainly for automotive and furniture applications. Meanwhile, Ukraine's war and fluctuating raw material costs created challenges, prompting companies to search for alternative sources or more efficient production methods; consumer expectations regarding comfort and durability also motivated manufacturers to innovate new foam formulations.

Also, government and environmental agencies have had a major influence on the molded foam industry through regulatory pressure. Stricter regulations on volatile organic compounds (VOCs) and emissions from foam production have made manufacturers adopt greener production methods and create low-emission foams, while circular economy principles allow recycling initiatives leading to less industrial waste production overall. All these changes are shaping material selection processes across the industry.

As demand for molded foam grows in the automotive, furniture, and packaging industries, its market will likely expand accordingly. Innovations of lightweight, high-performance foams as well as, sustainable production practices will play a vital role in shaping its future; comfort, durability and environmental responsibility remain top priorities of modern manufacturing; thus, keeping molded foam at the heart of modern production practices.

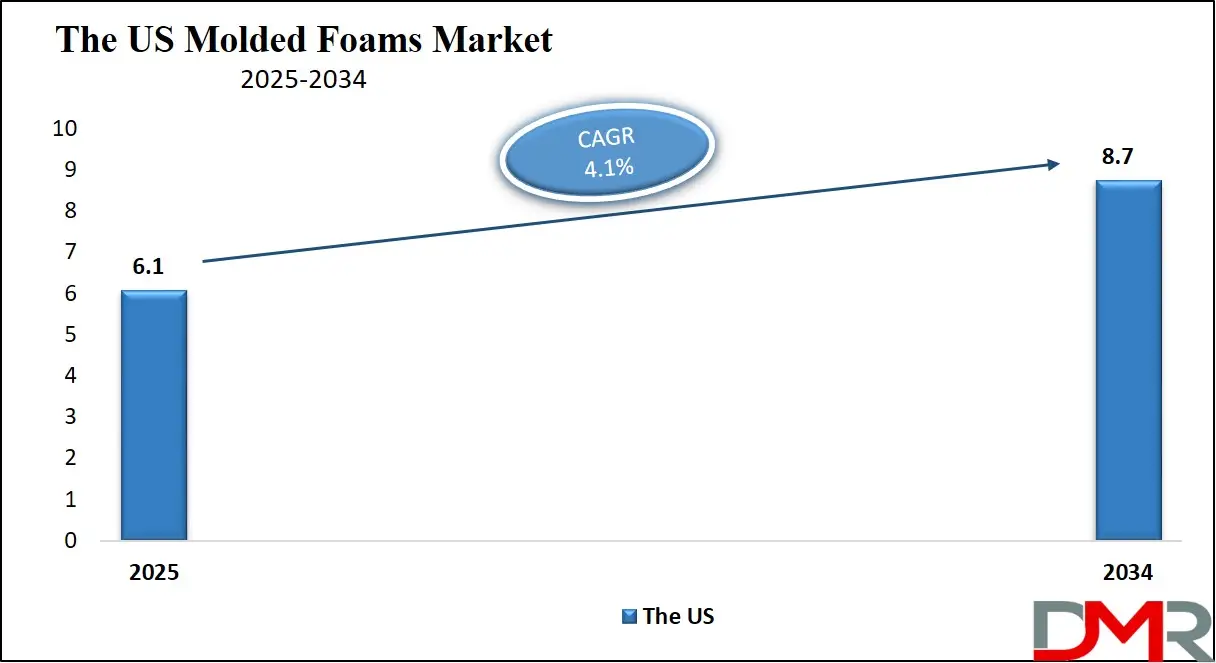

The US Molded Foams Market

The US Molded Foams Market is projected to reach USD 6.1 billion in 2025 at a compound annual growth rate of 4.1% over its forecast period.

The molded foams market in the US provides growth prospects across the automotive, bedding, furniture, packaging, and packaging industries. Rising demand for lightweight, energy-efficient materials along with eco-friendly products is driving market expansion, as is a focus on comfort and durability with consumer products and innovations in foam technology both of which boost growth prospects for the US molded foams market growth prospects.

Further, the market growth is driven by consumer demand for lightweight materials in the automotive and furniture industries, along with technological innovations for the production of foams. However, market participants face challenges such as rising raw material costs and supply chain disruptions, which impede production efficiency, along with environmental concerns related to disposal and sustainability challenges that manufacturers must overcome in the coming years.

Molded Foams Market: Key Takeaways

- Market Growth: The Molded Foams Market size is expected to grow by USD 7.6 billion, at a CAGR of 4.4% during the forecasted period of 2026 to 2034.

- By Form: The flexible segment is anticipated to get the majority share of the Molded Foams Market in 2025.

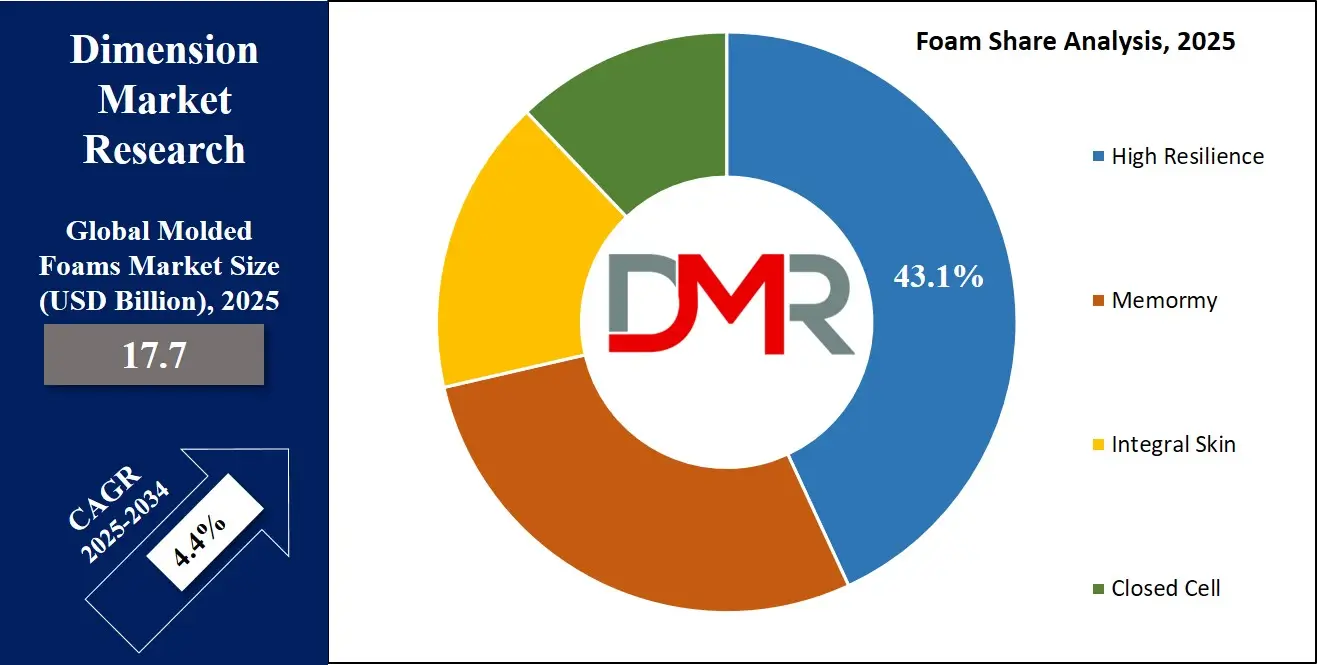

- By Foam: The high-resilience segment is expected to get the largest revenue share in 2025 in the Molded Foams Market.

- Regional Insight: North America is expected to hold a 38.9% share of revenue in the Global Molded Foams Market in 2025.

- Use Cases: Some of the use cases of Molded Foams include the automotive industry, protective packaging, and more.

Molded Foams Market: Use Cases

- Automotive Industry: Molded foams are mainly used in car seats, armrests, headrests, and noise-reducing components. Their durability, comfort, and impact absorption make them vital for enhancing passenger safety and vehicle performance.

- Furniture & Bedding: These foams are used in office chairs, sofas, mattresses, and ergonomic cushions. They provide superior comfort, shape retention, and support, making them ideal for high-quality seating & bedding products.

- Protective Packaging: Molded foams are used in packaging for fragile items like electronics, medical devices, and industrial equipment. Their shock-absorbing properties assist in preventing damage during transportation and storage.

- Medical & Healthcare: Molded foams are utilized in hospital mattresses, wheelchair cushions, and prosthetic padding. Their pressure-relieving and antibacterial properties make them ideal for patient comfort and healthcare applications.

Stats & Facts

- According to Europur, 172 factories in wider Europe (including Russia and Turkey) produce around 1.35 million tonnes of flexible polyurethane slabstock foam annually, with 109 plants in the European Economic Area, Switzerland, and the UK contributing about 900,000 tonnes per annum. Most of this foam is polyether, while polyester foam accounts for just 50,000 tonnes.

- In addition, Türkiye, Poland, and the “DACH” region (Germany, Switzerland, Austria) are the top three PU foam-producing regions in Europe, collectively generating 40% of the continent’s total output. Around 50% of the flexible slab stock PU foam in Europe is used in bedding applications, 35% in upholstered furniture, 7% in transportation, and the rest in various other products like kitchen sponges and clothing.

- CSIL (Choice in Support for Independent Living) estimates that Europe produces approximately 50 million mattresses annually, with nearly 90% containing 2 to 30 kg of polyurethane foam. Innerspring mattresses account for about 50% of production, foam mattresses 40%, and latex mattresses 7%, with PU core mattresses steadily increasing in share due to the popularity of "bed in a box" models.

- Further, Europur reports that Europe (including Central-Eastern Europe outside the EU) produces 23% of the world’s upholstered furniture. The EU furniture sector employs over 1.1 million people across 127,500 enterprises and generates products worth 87 billion EUR. Poland, Italy, Germany, the UK, and France contribute 85% of total European furniture production.

- According to Europur, e-commerce accounts for about 8% of furniture sales in Europe, with the UK and Germany leading in online sales. Meanwhile, the automotive sector uses between 22 kg and 28 kg of polyurethane per car, with most of it in molded foam for seats, while slabstock foam is used in applications like headliners, averaging about 2.5 kg per vehicle.

- Further, the European Automobile Manufacturers Association (ACEA) states that passenger vehicle production in Europe grew by nearly 14% in 2023, surpassing 17 million light vehicles. However, despite this rebound, production levels remain below pre-pandemic figures.

- According to Urethanes Technology International, total EMEA production of PU flexible foam was just over 1.98 million tonnes in 2023, marking a 1.7% decline from the previous year due to reduced consumer demand for comfort foams and prior overstocking, despite growth in automotive production.

- In addition, Western Europe remains the largest producer in the mature EMEA flexible foam market. While Germany’s production dropped slightly by 0.2%, the Nordic region saw a sharper decline of 12.2%. Türkiye, Poland, Germany, and Italy continue to be key producers due to their strong furniture and automotive industries.

- Also, North and West Africa lead foam production in their respective regions, while the GCC countries—particularly Saudi Arabia, Qatar, UAE, and Oman—are experiencing growth in flexible foam manufacturing.

- According to Urethanes Technology International, polyurethane flexible slabstock foam production declined by 6.8% in Western Europe and 3.5% across the entire EMEA region in 2023. Factors such as supply shortages, rising raw material costs, and lower demand contributed to this decline, with Poland seeing the largest contraction in Central and Eastern Europe at 2.4%.

- Moreover, Türkiye’s slabstock PU foam production increased significantly due to growing mattress demand, while the Middle East saw a 5.4% rise in slabstock PU foam production, driven by growth in the furniture and mattress industries. Also, EMEA production of PU molded foam increased by 4.6% in 2023, with Germany and France leading production. The Central and Eastern European region saw a 5% increase, with Türkiye as the largest producer in this category.

- Further, automotive seating foam was the largest segment of PU molded foam production in EMEA, followed by noise, vibration, and harshness (NVH) foams. In Western Europe, transport-related PU foams performed better than comfort foams, with higher production in auto and commercial vehicle seating foam, NVH foam, integral skin, and semi-rigid foams.

- Also, molded transport foams saw strong growth, with automotive seating foam increasing by 6.9% and commercial vehicle seating foam rising by 7.2% in 2023. In the Middle East and Africa, molded PU foam segments outperformed slabstock foam segments, reflecting stronger regional demand.

Market Dynamic

Driving Factors in the Molded Foams Market

Rising Demand in Automotive & Furniture Industries

The growth in the production of automobiles and the rise in focus on passenger comfort are major drivers of the molded foams market. Automakers are utilizing lightweight, high-performance foams to enhance fuel-efficiency, mainly in electric vehicles (EVs). Similarly, the furniture industry is experiencing higher demand for ergonomic seating and premium mattresses, driving the adoption of molded foams. As consumer preferences transform towards comfort and durability, manufacturers are innovating with advanced materials, further fueling market growth.

Sustainability & Technological Advancements

The rise in environmental concerns and stricter regulations on emissions have allowed the development of eco-friendly molded foams. Manufacturers are investing in bio-based and recycled polyurethane foams to minimize carbon footprints. Innovations in smart foams with temperature-regulating, pressure-sensitive, and antimicrobial properties are also gaining traction in automotive, healthcare, and bedding applications. These developments, along with the push for sustainable materials, are driving the expansion of the molded foams market globally.

Restraints in the Molded Foams Market

Volatile Raw Material Prices & Supply Chain Disruptions

The molded foams market is highly dependent on petrochemical-derived raw materials like polyurethane. Changes in crude oil prices, supply shortages, and geopolitical tensions have led to large production costs. Disruptions in the supply chain, like those seen during the COVID-19 pandemic and the Russia-Ukraine conflict, have further impacted material availability. These challenges have made manufacturers explore alternative sourcing, but price volatility remains a significant restraint for market growth.

Environmental Regulations & Sustainability Challenges

Stricter government regulations on volatile organic compound (VOC) emissions & non-biodegradable waste disposal are putting pressure on molded foam manufacturers. While companies are developing greener alternatives, the transition to bio-based or recycled foams comes with higher costs &production challenges. In addition, concerns about polyurethane foam’s recyclability and long-term environmental impact have led some industries to look for alternative materials, potentially slowing the market’s expansion.

Opportunities in the Molded Foams Market

Growth in Electric Vehicles & Advanced Automotive Applications

The growth in the adoption of electric vehicles (EVs) provides a significant opportunity for the molded foams market. Automakers are aiming for lightweight, high-performance materials to improve energy efficiency and passenger comfort. Molded foams are being highly used in EV seating, noise reduction, and impact absorption applications. In addition, developments in smart foams with temperature regulation and pressure sensitivity provide new possibilities for better driving experiences, making this a key growth area.

Expansion of Sustainable & Bio-Based Foam Solutions

The rise in consumer preference for eco-friendly products and strict environmental regulations is driving demand for sustainable molded foams. Manufacturers are investing in bio-based polyurethane foams and recycled materials to minimize carbon footprints and meet green standards. Innovations in biodegradable foams and closed-loop recycling systems are developing new business opportunities. As industries like furniture, bedding, and healthcare prioritize sustainability, the need for eco-friendly molded foams is expected to rise significantly.

Trends in the Molded Foams Market

Shift Towards Sustainable & Eco-Friendly Foams

The molded foams market is experiencing a strong push toward sustainability, driven by regulatory pressures and growth in consumer awareness. Manufacturers are emphasizing bio-based polyurethane foams, recycled materials, and low-VOC formulations to minimize environmental impact. Companies are also investing in closed-loop recycling technologies to enhance foam reusability. The need for greener alternatives is mainly high in the automotive and furniture industries, where brands are prioritizing eco-friendly materials, which is expected to accelerate as industries move toward circular economy practices.

Advancements in Smart & High-Performance Foams

The need for innovative molded foams with better properties is growing across various industries. Smart foams with temperature regulation, pressure sensitivity, and antibacterial coatings are gaining popularity in automotive, healthcare, and bedding applications. In the automotive sector, advanced molded foams are being created for better impact absorption and noise reduction, enhancing passenger safety and comfort. In addition, self-healing and shape-memory foams are emerging, providing greater durability and long-term performance. These developments are reshaping the industry, making molded foams more versatile and functional.

Research Scope and Analysis

By Foam

High-resilience (HR) foams have long been an engine of growth in the global molded foams market due to their superior durability, comfort, and support features. HR foams are mainly used in furniture, bedding, and automotive seating applications where long-term performance and ergonomic benefits are key considerations. HR foams provide superior rebound and elasticity, making them less likely to sag over time and wear out quickly.

In the automotive industry, they enhance passenger comfort along with impact absorption and noise reduction. HR foams' ability to maintain shape & firmness makes them ideal for mattresses, office chairs, and high-end sofas, while consumers and industries demand better quality and comfort from these materials. HR foams' popularity continues to expand owing to developments in foam technology and growth within furniture and bedding markets, making high-resilience foams an essential part of market expansion efforts.

Further, memory foams are expected to grow significantly in the global molded foams market in coming years due to their pressure-relieving and body-contouring qualities, making them popularly used in bedding, mattresses, pillows, and medical applications where comfort and support are crucial. They're often chosen over conventional mattress materials due to better sleep quality and reduced joint pain and can even be found used in automotive seating or footwear, further contributing to growth within this market segment. With rising consumer demand for ergonomic and high-performance products like memory foam, it continues to gain ground, helping expand it globally as part of larger market expansions in molded foam markets.

By Form

Flexible forms are projected to play an instrumental role in driving molded foams market expansion in 2025 by leading in terms of market share due to their adaptability, comfort, and durability. Used widely across automotive seats, furniture, bedding, and packaging applications, flexible molded foams remain indispensable across numerous industries. Flexible foams have long been considered one of the best cushioning materials on the market due to their superior cushioning properties, shock absorption abilities, and long-term resilience, qualities that make them popular with car manufacturers along with mattress and furniture producers alike.

The higher demand for lightweight yet high-performance materials integrated with furniture and mattress sales is driving this market segment forward. Flexible foams offer cushioning properties like shock absorption resilience along with being one of the key materials manufacturers look for when manufacturing products. As consumers highly demand comfortable and ergonomic products, flexible molded foams continue to gain in popularity. Their adaptability allows for customized applications, further expanding the market.

Further, rigid forms play an integral part in market growth for molded foams and are expected to experience substantial expansion during the forecast period by providing strength, insulation, and durability across various industries. They are highly used in construction, refrigeration, automotive, and industrial applications due to their excellent thermal resistance and structural stability in buildings, they help improve energy efficiency by reducing heat loss, while automotive applications utilize them as lightweight components that make vehicles more fuel-efficient. With the growing demand for insulation materials and durable products, rigid molded foams are expected to lead to market expansion across various sectors

By Material

Polyurethane foam (PU foam) is predicted to lead the global molded foam market in 2025 due to its versatility, durability, and variety of uses. Polyurethane is widely utilized across industries like automotive, furniture, bedding, and packaging, where its comforting capabilities such as support, insulation, and lightweight flexibility make it invaluable. Furthermore, advances in sustainable production techniques are increasing its appeal further and demand for comfortable energy efficient materials increases polyurethane foam will remain a popular material on the market.

Expanded Polyethylene (EPE) is expected to be one of the fastest-growing materials in molded foams over the forecast period. Recognized for its lightweight, shock-absorbing, and water-resistance properties, EPE finds large applications in packaging, protective gear, automotive applications, and eco-friendly recycling, making it popular as more industries focus on sustainability initiatives and demand protective packaging from e-commerce platforms; thermal insulation applications along with sports equipment usage are fueling its rise. EPE is rapidly gaining market share in molded foam applications as more industries seek cost-effective yet reliable materials. EPE is quickly expanding its market shares!

By Application

Seat and Furniture applications are projected to lead the molded foams market in 2025 due to an growth in demand for comfortable, durable, ergonomic seating solutions. Molded foams have quickly become an indispensable element of high-end furniture for homes, offices, and commercial settings due to their comfort, resilience, and shape retention capabilities. Premium sofas, office chairs and ergonomic furniture have increased demand for flexible, high-resilience foams that offer superior support and comfort. Furthermore, as more consumers opt for eco-friendly, long-lasting furniture options that utilize flexible foams like these molded foams are in high demand, driven further by increased online sales of seating products driving the growth of this market segment of molded foams in general.

Footwear is anticipated to be one of the fastest-growing applications of molded foams during this forecast period, as memory and high-resilience foams offer great comfort, support, and shock absorption properties that make them suitable for footwear applications. Consumer demand is driving this trend as consumers look for improved foot comfort and performance from athletic shoes, casual footwear, orthopedic shoes, and orthopedic orthoses additional factors like increased sports/fitness activities as well as ergonomic designs all contribute to the rapid expansion of molded foams within footwear as a sector growth segment within this market segment.

The Molded Foams Market Report is segmented on the basis of the following:

By Foam

- Closed Cell

- High Resilience

- Integral Skins

- Memory

By Form

By Material

- Expanded Polystyrene

- Polyurethane Foam

- Expanded Polyethylene

- Expanded Polypropylene

By Application

- Seat & Furniture

- Automotive Interior

- Bedding & Mattresses

- Footwear

Regional Analysis

Leading Region in the Molder Foams Market

North America is expected to lead the molded foams market with

38.9% in 2025 due to its dominant automotive, furniture, and bedding industries. Due to high demand for comfortable yet durable products like mattresses, sofas, and car seats made with molded foams in North America. Automotive industries across North America constantly experience steady expansion, developing greater demand for lightweight yet high-resilience foams that increase fuel efficiency while simultaneously enhancing passenger comfort. Memory and high-resilience foams have seen higher demand as e-commerce and direct-to-consumer mattress brands increase in popularity, as have technological developments for manufacturing, like eco-friendly recycled foams that shape market trends.

Fastest Growing Region in the Molded Foams Market

Asia Pacific is anticipated to experience rapid industrialization, urbanization and consumer demand during the forecast period for molded foams market expansion. Countries like China, India, and Japan have experienced strong automotive, furniture, bedding, and bedding industry growth that increases foam usage; construction sector activity and online marketplace expansion drive increased foam packaging and insulation needs, as do rising middle-class populations and rising disposable incomes that increase comfort product sales. Furthermore, increased manufacturing capacities and technological advances will continue to propel expansion across this region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global and regional manufacturers competing in the molded foams market can be divided into two groups: global players and regional manufacturers. Businesses focus on innovative foam technologies and sustainable solutions that meet growing consumer demand for eco-friendly products, investing in research and development efforts to enhance properties such as comfort, durability, and resilience in applications like automotive, furniture, bedding, and packaging applications. New entrants offer cost-effective solutions and customized products, while strategic partnerships and mergers between firms often occur to expand reach and technological capacities.

Some of the prominent players in the Global Molded Foams are:

- BASF

- DOW

- Primex

- Sumitomo Chemical

- Covestro

- Eastman Chemical

- Arkema

- Solvay

- Bayer

- SABIC

- Other Key Players

Recent Developments

- In October 2024, Engineered Foam Products Ltd. acquired Springvale EPS Ltd., creating the largest expanded polystyrene (EPS) and expanded polypropylene (EPP) manufacturer in the UK. The company is the largest expanded polystyrene (EPS) block molder in the UK. With over 50 years in the business, they provide numerous product portfolios within the construction sector with well-known brands including Beamshield, Floorshield®, and Groundshield®.

- In September 2024, L&L Products launched its proprietary InsituCore foaming materials for lightweight composite manufacturing. These new materials allow easy production processes that result in a final lightweight net-shape part or performance with targeted density and strength. InsituCore Foaming Core Technology is a family of one-component, heat-activated foaming materials that generate internal pressure to develop net shape, 3D parts that are both lightweight and strong in a simple, clean, and cost-effective process.

- In June 2024, Moldex3D and Xnovo Technology announced a partnership for fiber parameters based on scan experiments, empowering users to conduct reliable and accurate simulations. By building on our proven expertise in 3D imaging and analysis, the company can provide 3D fiber orientation characterization with unparalleled time-to-result and superior quality, which allows users to conduct simulations of 3D fiber orientation using calibrated fiber parameters, which is mainly valuable for defining the anisotropic mechanical strength and controlling molding shrinkage in fiber-reinforced components.

- In April 2024, Huntsman launched a series of new lightweight, durable polyurethane foam technologies to the company’s battery solutions portfolio that have been developed for the potting and fixation of cells mounted in electric vehicle (EV) batteries. The new series also has products that can be used as a moldable encapsulant in battery modules or packs. The new SHOKLESSTM foam systems can provide a flexible choice for assisting in safeguarding the structural integrity of EV batteries in case of impact or a thermal event.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 17.7 Bn |

| Forecast Value (2034) |

USD 25.9 Bn |

| CAGR (2025–2034) |

4.4% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 6.1 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Foam (Closed Cell, High Resilience, Integral Skins, and Memory), By Form (Rigid and Flexible), By Material (Expanded Polystyrene, Polyurethane Foam, Expanded Polyethylene, and Expanded Polypropylene), By Application (Seat & Furniture, Automotive Interior, Bedding & Mattresses, and Footwear |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

BASF, DOW, Primex, Sumitomo Chemical, Covestro, Eastman Chemical, Arkema, Solvay, Bayer, SABIC, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

The Global Molded Foams Market size is expected to reach a value of USD 17.7 billion in 2025 and is expected to reach USD 25.9 billion by the end of 2034.

North America is expected to have the largest market share in the Global Molded Foams Market with a share of about 38.9% in 2025.

The Molded Foams Market in the US is expected to reach USD 6.1 billion in 2025.

Some of the major key players in the Global Molded Foams Market are BASF, DOW, Primex, and others

The market is growing at a CAGR of 4.4 percent over the forecasted period.