Market Overview

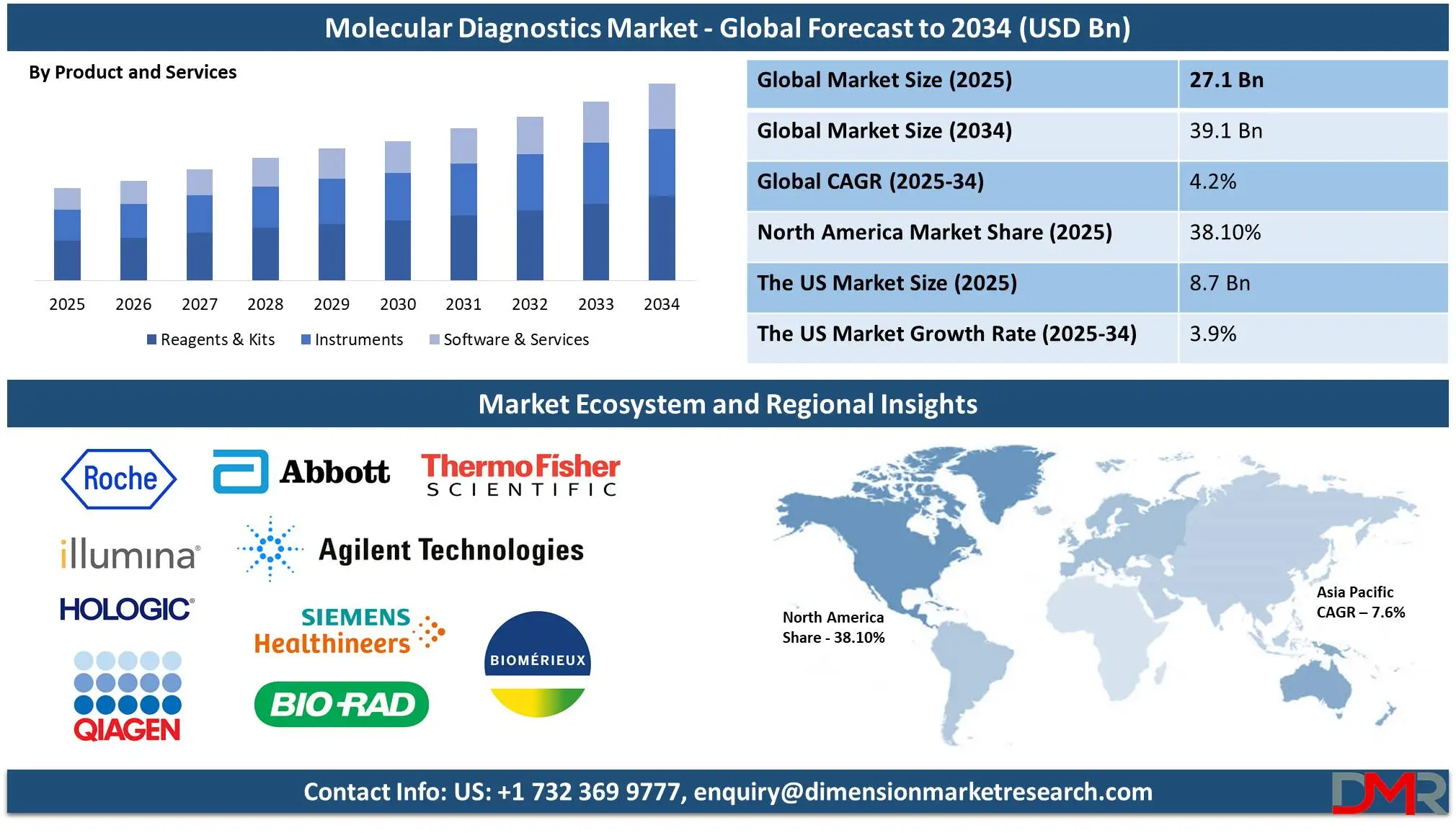

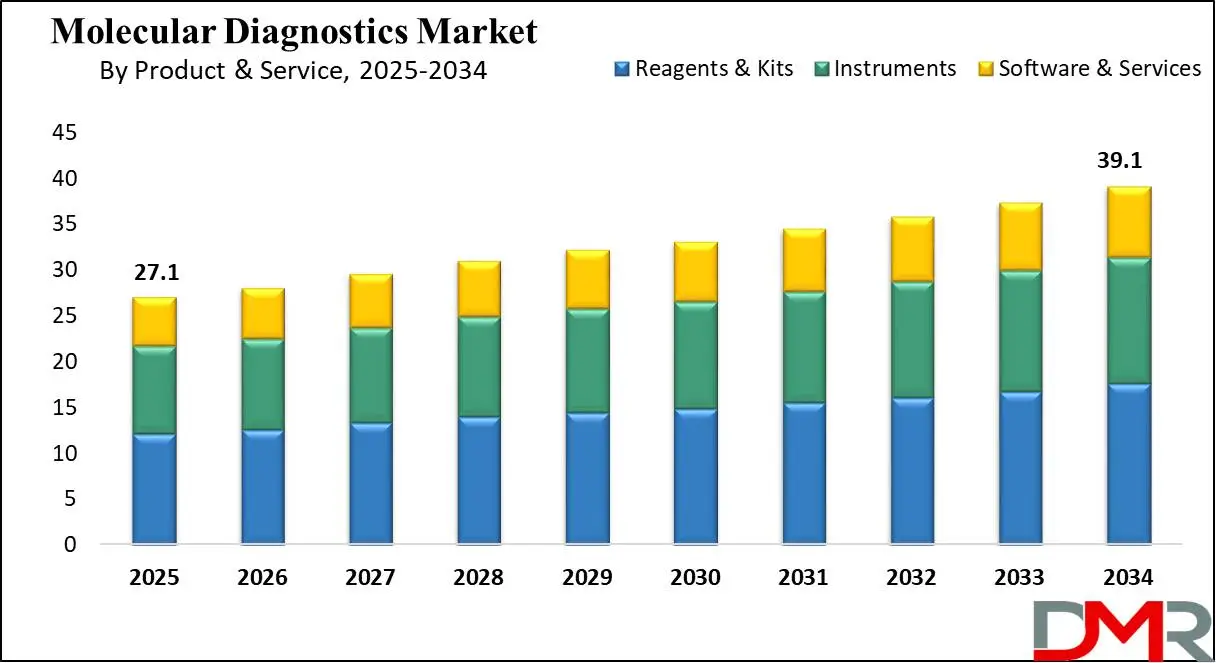

The Global Molecular Diagnostics Market is predicted to be valued at USD 27.1 billion in 2025 and is expected to grow to USD 39.1 billion by 2034, registering a compound annual growth rate (CAGR) of 4.2% from 2025 to 2034.

The global Molecular Diagnostics Market has experienced tremendous expansion, driven by advancements in orthopedic infection diagnosis. Conventional methods like blood tests and tissue cultures often lack sensitivity and turnaround time; molecular diagnostics is an ideal alternative. New techniques being pursued include PCR-based bacterial gene detection, metabolomics analysis and biomarker quantitation of synovial fluid. Proteomic analysis identified A-defensin, interleukins, and neutrophil elastase as significant biomarkers of periprosthetic joint infection (PJI). C-reactive protein (CRP) remains one of the most widely available tests, though its specificity remains contentious.

Molecular techniques have the advantage of providing more precise data while eliminating false negatives and low-virulence bacteria often found with culture-based tests. Molecular diagnostics is increasingly being seen as a key player in both point-of-care and personalized medicine, making molecular diagnostics one of the cornerstones of infection management in global orthopedics markets.

The global molecular diagnostics market is experiencing impressive growth rates due to rising precision medicine demand, an increase in infectious disease incidence rates, oncology research applications, genetic testing needs, and personalized treatment approaches being pursued by doctors. Molecular diagnostics enables early disease diagnosis with targeted treatment approaches; plus artificial intelligence-powered automation enhances accuracy and efficiency thereby supporting clinical decision-making processes.

An emerging opportunity in the market is its increasing emphasis on decentralized testing, including point-of-care and home molecular diagnostics. Rapid and accurate tests have become more in demand since the COVID-19 pandemic, fuelling investment in portable diagnostic devices. Next-generation sequencing (NGS) offers promising potential to perform whole genome profiling for personalized cancer therapy approaches; developing economies are witnessing increasing adoption of molecular diagnostics due to improving healthcare infrastructures and greater awareness of advanced diagnostic technologies.

Although its growth is impressive, the market still faces hurdles that impede mass adoption of molecular diagnostic testing, including high costs and rregulatory approval complexity. Reimbursement issues limit the usage of advanced diagnostics limiting market penetration.

Molecular diagnostics remains in high demand for oncology, infectious disease testing, and genetic screening applications. North America dominates this market due to a highly developed healthcare infrastructure with rapid adoption rates for new technologies; Asia-Pacific represents a high-growth market driven by increasing investments in healthcare and rising incidences of chronic diseases; these two markets will only expand further over time with biomarker discovery technologies like liquid biopsy playing a pivotal role.

The US Molecular Diagnostics Market

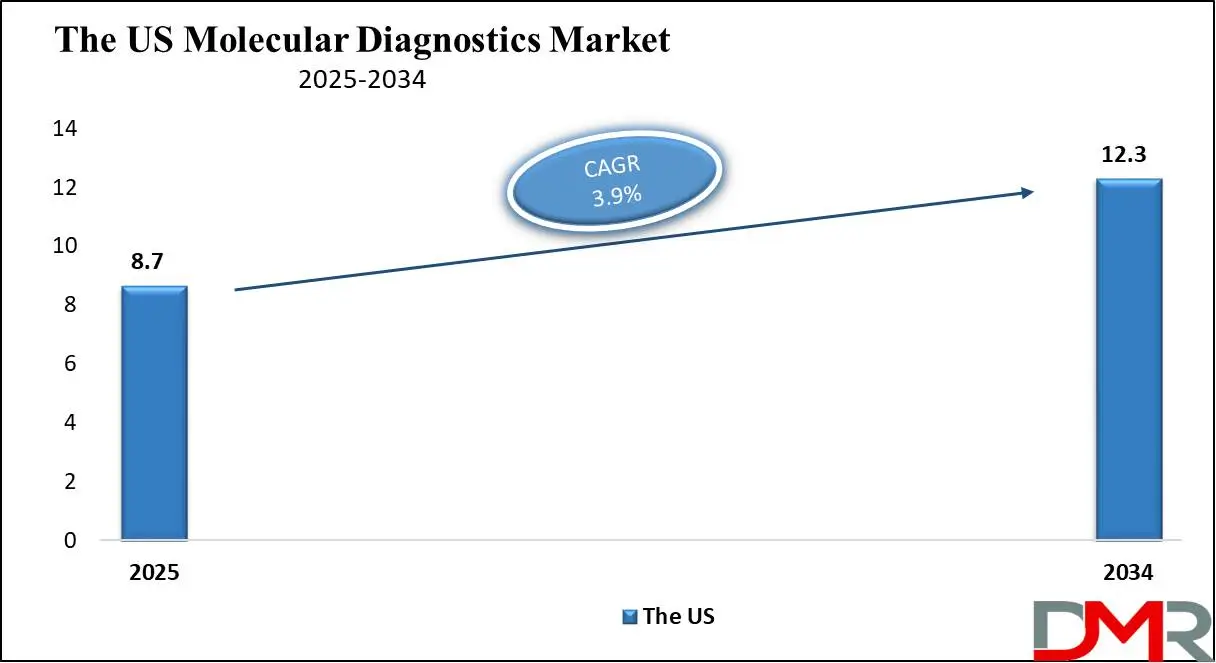

The US Molecular Diagnostics Market is projected to be valued at USD 8.7 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 12.3 billion in 2034 at a CAGR of 3.9%.

The US market for molecular diagnostics is the world leader, driven by advanced healthcare infrastructure, high prevalence rates of chronic conditions, and investments in diagnostic technologies. It is estimated to increase at a steady pace due to innovations in genomics and precision medicine. With cancer, cardiovascular conditions, and infectious diseases all on the rise globally as well as their increasing incidence rates driving adoption, hospitals, diagnostics centers, and research institutions are driving demand for these diagnostic technologies - leading to their increasing adoption.

One of the key strengths of the US market is its diverse population, which allows for large genetic studies and clinical trials. Key biotech firms and academic research centers further accelerate this technological progress with AI-powered diagnostic platforms and home testing products coming to market at a rapid rate. Furthermore, comprehensive insurance coverage with favorable reimbursement policies enables patients to access advanced molecular tests, further expanding market penetration.

Point-of-care molecular diagnostics have gained prominence in the US, especially within infectious disease testing and personalized medicine. There has been an unprecedented demand for rapid, decentralized testing solutions after COVID-19 which has driven portable and user-friendly diagnostic devices development. North America holds the highest penetration for next-generation sequencing and liquid biopsy technologies which are revolutionizing cancer diagnosis and treatment planning, and ongoing integration of molecular diagnostics into routine clinical practice and government investments into research activities further solidifies US position in global markets.

Key Takeaways

- The Global Market Size Insights: The Global Molecular Diagnostics Market size is estimated to have a value of USD 27.1 billion in 2025 and is expected to reach USD 39.1 billion by the end of 2034.

- The US Market Size Insights: The US Molecular Diagnostics Market is projected to be valued at USD 8.7 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 12.3 billion in 2034 at a CAGR of 3.9%.

- Regional Insights: North America is expected to have the largest market share in the Global Molecular Diagnostics Market with a share of about 38.10% in 2025.

- Key Players Insights: Some of the major key players in the Global Molecular Diagnostics Market are Roche Diagnostics, Abbott Laboratories, Thermo Fisher Scientific, Danaher Corporation, Illumina, Inc., Qiagen N.V., bioMérieux, Hologic, Inc., Siemens Healthineers, and many others.

- The Global Market Growth Rate: The market is growing at a CAGR of 4.2% over the forecasted period of 2025.

Use Cases

- Oncology Diagnostics: Molecular diagnostics play an integral part in identifying genetic mutations associated with various forms of cancer to enable targeted therapy and early identification. Liquid biopsies and NGS-based cancer panels can help pinpoint early stage malignancies as well as track their progression with high sensitivity, making these diagnostic tools essential tools in tracking disease development over time.

- Infectious Disease Testing: Modern molecular diagnostic techniques such as PCR and isothermal amplification allow for fast and accurate detection of infectious diseases like COVID-19, tuberculosis and hepatitis. Early detection enables effective outbreak control as well as therapeutic interventions which reduce mortality rates while increasing patient outcomes.

- Genetic and Hereditary Disorder Screening: Molecular diagnostics is widely utilized during prenatal and neonatal screening to detect genetic diseases like cystic fibrosis and sickle cell anemia through DNA sample analysis. Parents can utilize the screens as decision-making aids regarding treatment plans and genetic counseling, providing families with invaluable resources.

- Neurological Disease Diagnosis: Molecular diagnostics play an integral part in diagnosing neurodegenerative conditions like Alzheimer's and Parkinson's diseases by identifying genetic biomarkers for these diseases. Early identification allows proactive intervention strategies, drug discovery potential, and enhanced patient management for those at risk of cognitive decline.

- Pharmacogenomics and Personalized Medicine: Through molecular diagnostics, genetic variation analysis allows for personalized medicine solutions to optimize drug selection and dosage to reduce side effects and optimize therapeutic outcomes and safety. The approach has become popular in areas like oncology and cardiology where tailoring the patient experience to individual genetic profiles has enhanced outcomes and safety.

Stats & Facts

- Yale Medicine defines molecular diagnostics as DNA or RNA testing used to detect potential markers of disease such as infectious disease, hematopathology, genetics, and solid tumors. Molecular diagnostics tests can also detect genetic mutations which could inform treatment decisions and assist doctors.

- According to the American Cancer Society statistics for 2022 revealed that an estimated 1,918,030 new cancer cases were to occur in the United States alone, with breast cancer having an estimated 290,560 new cases, leukemia having 60,650 new cases, and lymphoma having 89,010 new cases.

- Yale Medicine offers molecular diagnostic testing for genetic disorders, such as cystic fibrosis (CF), and inherited cancers such as BRCA1/BRCA2 for breast cancer. It also does testing for acquired mutations, such as chronic myeloid leukemia (CML), and drug resistance testing, which is utilized to monitor diseases such as HIV for resistance to therapy.

- According to Canadian Cancer Statistics, approximately one out of every five Canadians will develop cancer during their lifetime - underscoring the urgent need for innovative diagnostic solutions.

- The National Institutes of Health (NIH) 2022 update indicated that significant investments have been made in research activities, with USD 212 million allocated for genetic testing and USD 4,666 million for emerging infectious diseases research in 2021.

Market Dynamic

Driving Factors in the Global Molecular Diagnostics Market

Rising Prevalence of Infectious Diseases and Cancer

Rising Cancer and Infectious Disease Rates Cancer and infectious disease cases continue to pose significant burdens worldwide, driving molecular diagnostics forward as an integral component. As infectious disease threats such as COVID-19, tuberculosis, hepatitis, and sexually transmitted diseases (STDs) become increasingly widespread, rapid and accurate diagnostic solutions must be available immediately to effectively respond. Real-time PCR, isothermal amplification, and CRISPR-based assays offer greater sensitivity and specificity, helping facilitate early pathogen detection.

Oncology diagnostics is also witnessing significant growth due to rising incidences of lung, breast, colorectal, and hematological cancers. Liquid biopsy, circulating tumor DNA analysis (ctDNA), and companion diagnostics are becoming cornerstones for personalized cancer treatments as governments and healthcare authorities place greater focus on early detection programs requiring high-accuracy molecular diagnostics - driving market expansion further.

Advancements in Genomic and Proteomic Research

Rapid advancements in genomics and proteomics research are driving expansion in molecular diagnostics. The Human Genome Project completion and subsequent evolution of WGS, transcriptomics, and proteomic profiling have opened new pathways for biomarker identification and disease description. Single-cell sequencing, digital droplet PCR (ddPCR), and metagenomics offer high throughput molecular testing of complex diseases including autoimmune conditions, neurological illnesses, and metabolic syndromes.

Multi-omics approaches combining genomic, transcriptomic, and metabolomic information have the power to further increase diagnostic precision. Public and private investments in precision medicine and next-generation molecular tests will continue to drive forward momentum of the industry forward, expanding beyond infectious disease into oncology, cardiology, and rare genetic disorders.

Restraints in the Global Molecular Diagnostics Market

High Cost and Limited Reimbursement Policies

Despite its technological advancements, molecular diagnostics is costly, which is posing as an impediment to their widespread adoption among low and middle-income countries (LMICs). NGS, microarrays, and automated PCR systems often face steep prices that prevent their adoption in undeveloped regions; reimbursement systems vary significantly by geography as well. Most health systems and insurance companies hesitate to reimburse expensive molecular assays due to their high costs and uncertain long-term value, hindering patient access.

Without harmonized reimbursement systems in place, access is severely limited for lifesaving molecular testing services thereby hindering market expansion. Creating value-based reimbursement models through differential price adjustments and price differential adjustments would significantly expand market penetration and enhance penetration into healthcare networks.

Regulatory Challenges and Stringent Approval Processes

Another major limitation faced by molecular diagnostics products is their stringent approval processes, creating numerous hurdles along their journey to market. Regulators such as the United States Food and Drug Administration, the European Medicines Agency (EMA), and China's National Medical Products Administration (NMPA) administer rigorous approval processes when reviewing new molecular tests.

Although these requirements ensure test accuracy, clinical validity, and patient safety; they often necessitate longer approval processes than expected. Molecular technologies are rapidly developing, necessitating frequent updates of regulatory standards that present diagnostic companies with compliance challenges. Furthermore, the lack of international harmonization of regulatory requirements compounds market entry obstacles for newcomers; eliminating regulatory hurdles and streamlining approval processes will be vital steps toward speeding the adoption of next-generation molecular diagnostics.

Opportunities in the Global Molecular Diagnostics Market

Expanding Role of Molecular Diagnostics in Personalized Medicine

Molecular Diagnostics' Improving Role in Personalized Medicine

Personalized medicine's increasing prominence presents new opportunities for molecular diagnostics companies to advance. Personalized medicine offers an alternative approach that tailors treatments directly to an individual's genetic makeup, biomarkers for disease, and metabolic profile. Pharmacogenomics testing, which measures genetic variations that influence drug response and metabolism, has rapidly gained ground across several medical fields including oncology, psychiatry, and cardiology.

Molecular diagnostics is increasingly utilized as part of targeted therapies by detecting certain genetic mutations or protein biomarkers that serve as targets. CDx usage within pharmaceutical drug development represents another robust growth opportunity in this market. As precision medicine initiatives gain steam worldwide, demand for advanced molecular testing solutions will only rise, driving market expansion.

Growing Demand for Non-Invasive and Liquid Biopsy Diagnostics

The need for non-invasive molecular diagnostics is increasing due to patient demand for minimally invasive interventions. Liquid biopsy is rapidly becoming a game-changer in cancer diagnosis, offering a less invasive alternative to traditional tissue biopsies. By analyzing circulating tumor DNA (ctDNA), circulating tumor cells (CTCs), and exosomes, liquid biopsy offers real-time monitoring of tumor progression, response to therapy, and minimal residual disease (MRD) detection.

Beyond oncology, non-invasive molecular diagnostics are being developed for prenatal screening, infectious disease, and neurodegenerative diseases. The ability to conduct frequent, real-time monitoring using liquid biopsy is expected to drive its adoption in clinical and research practice. With technology innovation enhancing test sensitivity and specificity, the non-invasive molecular diagnostics segment will be a prime growth driver in the market.

Trends in the Global Molecular Diagnostics Market

Rising Adoption of Point-of-Care (PoC) Molecular Diagnostics

Growing demand for on-site, rapid testing is driving the adoption of point-of-care (PoC) molecular diagnostics in various healthcare settings. Traditional molecular diagnostic techniques, such as polymerase chain reaction (PCR) and next-generation sequencing (NGS), have long been restricted to centralized laboratory settings. However, advances in microfluidics, lab-on-a-chip technology, and portable PCR devices enable the decentralization of molecular testing.

This trend is particularly strong in infectious disease diagnosis, where pathogen detection in emergency rooms, outpatient clinics, and home-care settings needs to be swift to enable timely intervention. Further, the COVID-19 pandemic accelerated innovation in PoC molecular diagnostics, expediting clinician and patient acceptance. Looking ahead, miniaturization of diagnostic platforms, automation, and cloud-based data integration will continue to shape the PoC molecular diagnostics landscape, enabling greater accessibility and efficiency worldwide.

Integration of Artificial Intelligence (AI) and Machine Learning (ML) in Molecular Diagnostics

The intersection of AI and ML algorithms with molecular diagnostics is revolutionizing disease detection, classification, and prognosis. AI-driven bioinformatics software is enhancing the analysis of genomic, proteomic, and metabolomic data for more precise and faster test results. In oncology, for example, AI-driven genomic sequencing detects actionable mutations for targeted therapy, facilitating personalized treatment regimens.

Similarly, in infectious disease diagnosis, ML-based algorithms analyze PCR and NGS data to more precisely differentiate between bacterial, viral, and fungal infections. In addition, AI-driven predictive modeling is facilitating early disease detection and risk assessment based on genetic predisposition. The increasing intersection of AI, cloud computing, and molecular diagnostics is set to standardize tests, reduce errors, and enhance patient outcomes, making AI a defining trend for the future of molecular diagnostics.

Research Scope and Analysis

By Product & Service

Reagents & kits are projected to dominate the Global Molecular Diagnostics Market with 44.9% of total revenue by the end of 2025 due to their irreplaceable application in diagnostic processes, frequent repeat orders, and constant demand across both clinical and research applications. Unlike instruments, which are one-time investments, reagents & kits are consumables that must be replenished regularly, thus providing consistent revenues to their manufacturers. They include PCR reagents, sequencing kits, nucleic acid extraction kits, and gene amplification enzymes, all of which are integral to molecular testing.

Increased application of real-time PCR, next-generation sequencing (NGS), and isothermal amplification have also increased the need for high-quality reagents that optimize test sensitivity and specificity. Additionally, the outbreak of infectious diseases, such as COVID-19, tuberculosis, and hepatitis, has increased the need for molecular diagnostic kits, leading to bulk procurement by hospitals, diagnostic laboratories, and government agencies.

Also, there are innovations in the design of reagents, such as multiplex PCR kits and CRISPR-based molecular assays that offer faster and more precise results, thus increasing their clinical utility. The majority of reagents companies offer customized solutions for specific applications, which further consolidates their market position.

The intense adoption of point-of-care (PoC) molecular tests also boosts the dominance of reagents & kits, as they are required for rapid, decentralized testing. Additionally, the development of automated and integrated molecular diagnostic systems has fueled increased demand for pre-packaged, ready-to-use reagent kits for convenience and standardization. As personalized medicine and molecular oncology diagnostics gain traction, demand for high-throughput reagents & kits will only increase, solidifying their leading market position.

By Test Location

Point-of-care (PoC) molecular diagnostics are anticipated to be at the forefront of the test location segment due to the increasing demand for rapid, decentralized, and on-site disease diagnosis. Traditional molecular diagnostic testing requires centralized laboratory infrastructure, which results in delayed test outcomes and prolonged clinical decision-making. PoC testing breaks these delays by enabling real-time, near-patient molecular testing, which significantly improves patient outcomes.

The dominance of PoC diagnostics is largely driven by infectious disease outbreaks, most recently COVID-19, which demanded the mass deployment of PoC PCR testing and isothermal amplification-based testing. PoC molecular systems, such as Cepheid GeneXpert, Abbott ID NOW, and BioFire FilmArray, have been used heavily in hospitals, clinics, pharmacies, airports, and even homes, which reflects the increased need for rapid molecular testing.

Technological advances have enabled miniaturization, automation, and ease of use of PoC molecular diagnostic platforms. These advances enable easy testing by non-specialist healthcare workers, thereby widening market access. Further, AI-powered PoC diagnostics that have a cloud-based analysis of results and remote monitoring further enhance their ease of use in rural and resource-scarce settings.

PoC molecular diagnostics find particular application in infectious disease monitoring, in which rapid turnaround times are most important for detection at an early stage and outbreak management. In addition, increasing occurrences of chronic disorders, such as cancer as well as genetic disorders, have spurred demand for PoC molecular oncology testing, further consolidating their dominance.

As the decentralization of healthcare continues and governments invest in pandemic preparedness and mobile health initiatives, the PoC molecular diagnostics market will see sustained growth, reaffirming its leadership position in the test location segment.

By Sample Type

Blood, serum, and plasma samples are anticipated to dominate the sample type segment in the molecular diagnostics industry, owing to their reliability, availability, and clinical usefulness in the detection of disease. They are the gold standard for molecular testing since they provide a full snapshot of a subject's genetic, proteomic, and metabolic status, enabling precise diagnosis of disease.

Molecular diagnostics for infectious disease, cancer, and genetic disorders are typically reliant upon circulating biomarkers such as nucleic acids (DNA/RNA), proteins, and metabolites, which are all readily separated from blood, serum, or plasma. Such advances as liquid biopsy, circulating tumor DNA (ctDNA) analysis, and real-time PCR-based viral load testing have served to further cement the leadership role of these sample types in molecular diagnostics.

Compared with tissue biopsies, blood-based sampling is minimally invasive, reducing patient discomfort and allowing frequent, real-time monitoring of disease course and response to therapy. Blood samples also facilitate early disease detection, as molecular changes in the circulation generally precede physiological symptoms.

The prevalence of blood, serum, and plasma also results from their standardization in laboratory workflows, and they are thus compatible with the majority of molecular diagnostic platforms, including PCR, NGS, and microarray-based assays. With the advancement of automated sample preparation and high-throughput sequencing, the efficiency of molecular diagnostics using blood-derived samples continues to improve, consolidating their position at the front line of clinical testing.

As the demand for personalized medicine, oncology testing, and infectious disease monitoring is increasing, the demand for molecular testing based on blood, serum, and plasma will continue to dominate the market globally.

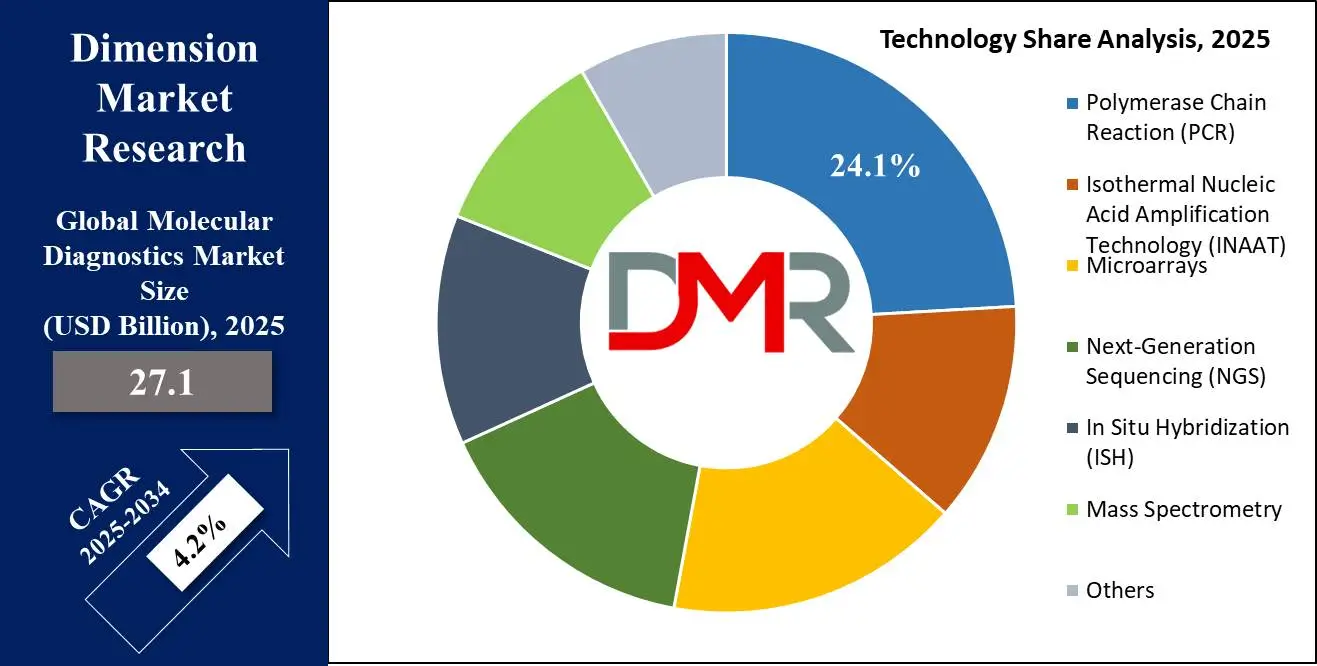

By Technology

Polymerase Chain Reaction (PCR) is the foremost molecular diagnostics technology due to its unmatched sensitivity, specificity, and versatility in the detection of nucleic acids. As a fundamental molecular diagnostics technology, PCR enables amplification and detection of DNA/RNA from minute biological samples and is thus a key tool for diagnosing infectious diseases, genetic disorders, and cancers.

The ubiquity of PCR is underpinned by its broad spectrum of applications across many disciplines, including clinical diagnostics, forensics, agriculture, and pharmaceutical research. It is the preferred technology for diagnosing viral and bacterial infections, including COVID-19, HIV, hepatitis, and tuberculosis, due to its high sensitivity and quick turnaround time compared to traditional culture-based methods.

Its analytical capability has been enhanced by the advent of real-time quantitative PCR (qPCR) and digital PCR (dPCR), wherein the precise quantitation of genetic material has been made feasible. Additionally, PCR automation platforms reduce the need for specialized expertise, making decentralized, point-of-care molecular diagnostics a reality.

PCR's cost-effectiveness compared to newer sequencing-based methods, such as Next-Generation Sequencing (NGS), also enables it to continue its leadership. Although NGS provides comprehensive genomic data, PCR remains the gold standard for routine diagnostic applications since it is affordable and provides rapid results.

Additionally, the innovation of multiplex PCR assays allows multiple pathogens to be detected in a single test, which streamlines diagnostic workflows and reduces expenses. The continued expansion of PCR-based liquid biopsy testing for cancer diagnosis and personalized medicine continues to solidify its position as a leader in molecular diagnostics.

With its widespread application, continuous innovation, and regulatory approval for new clinical applications, PCR will remain the premier molecular diagnostic technology for years to come.

By Application

Infectious disease diagnostics is projected to account for the biggest portion of the molecular diagnostics market due to the rising global burden of infectious diseases, rising antimicrobial resistance, and the increasing demand for quick and specific pathogen detection. The COVID-19 pandemic also demonstrated the importance of molecular diagnostics since PCR and rapid molecular tests played a critical role in mass screening and outbreak control.

Molecular diagnostics are more sensitive and specific than conventional methods, such as culture-based assays and serology. Molecular diagnostics can identify pathogens early, even in asymptomatic carriers, reduce transmission risks, and enable early treatment regimens. PCR, isothermal amplification, and NGS have become essential methods in diagnosing respiratory infections (COVID-19, influenza, tuberculosis), sexually transmitted infections (HIV, HPV, chlamydia), and hospital-acquired infections.

Infectious disease diagnostics leadership is also driven by government initiatives and funding for pandemic preparedness and disease surveillance. The World Health Organization (WHO) and Centers for Disease Control and Prevention (CDC) are some of the institutions that continue to drive molecular-based diagnostic techniques to combat emerging and re-emerging infectious threats.

Furthermore, the expansion of decentralized testing and point-of-care molecular platforms has enhanced access to rapid infectious disease diagnostics in remote and resource-limited settings. The growing utilization of multiplex molecular panels, which detect many pathogens simultaneously, has streamlined diagnostic workflows in hospitals, clinics, and reference laboratories.

With continued technology innovation, the growing prevalence of drug-resistant infections, and the need for rapid outbreak containment, molecular diagnostics for infectious diseases will retain their dominant market share.

By End User

Hospitals and clinics are projected to constitute the largest end-user segment in the market for molecular diagnostics due to their central role in patient care, high patient pool, and adoption of high-end diagnostic technologies for disease management. As the primary point of contact for the diagnosis of infectious diseases, genetic diseases, and oncology, hospitals, and clinics are the initial contact points, and thus molecular diagnostics is an integral component of their clinical workflows.

Demand for molecular diagnostics in hospitals is largely driven by the demand for rapid and reliable diagnostics in emergency care and inpatient settings. Potentially life-threatening conditions such as sepsis, respiratory infections, and cancer require precise molecular testing to guide prompt and effective treatment. Hospitals heavily invest in high-throughput molecular diagnostic systems that allow bulk testing, with the promise of rapid turnaround times for critical cases.

In addition, government and insurance reimbursements and payments lean towards hospitals and clinics, and thus they are the preferred setting for high-cost molecular diagnostic testing. Increasing focus on personalized medicine and companion diagnostics further increased the reliance of hospitals on molecular testing for targeted treatment, particularly in oncology and infectious disease management.

Another driver of hospital hegemony is the integration of molecular diagnostics with laboratory information systems (LISs) and electronic health records (EHRs). Such integration enhances the accuracy of data, workflow efficiency, and clinical decision support, making molecular diagnostics a necessity in hospital settings.

As there is a growing demand for precision medicine, growing regulatory approvals, and hospital labs are still in the process of adopting newer molecular technologies, hospitals, and clinics will remain the largest end-user segment in the molecular diagnostics market.

The Global Molecular Diagnostics Market Report is segmented on the basis of the following

By Product & Service

- Reagents & Kits

- Instruments

- Software & Services

By Test Location

- Point of care

- Self-test or OTC

- Central laboratories

By Sample Type

- Blood, Serum and Plasma

- Urine

- Other Sample Type

By Technology

- Polymerase Chain Reaction (PCR)

- Real-time PCR (qPCR)

- Digital PCR

- Isothermal Nucleic Acid Amplification Technology (INAAT)

- Microarrays

- Next-Generation Sequencing (NGS)

- In Situ Hybridization (ISH)

- Mass Spectrometry

- Others

By Application

- Infectious Disease Diagnostics

- Respiratory Infections

- COVID-19

- Influenza

- Tuberculosis

- Bloodborne Infections

- HIV

- Hepatitis

- Hepatitis B

- Hepatitis C

- Sexually Transmitted Infections

- Gastrointestinal Infections

- Others

- Oncology Testing

- Breast Cancer

- Solid Tumor Testing

- Liquid Biopsy

- Genetic Cancer Testing

- Genetic Testing

- Carrier Screening

- Newborn Screening

- Pharmacogenomics

- Neurological Disease

- Cardiovascular Disease

- Blood Screening

- Other Applications

By End User

- Hospitals & Clinics

- Diagnostic Laboratories

- Research & Academic Institutes

- Pharmaceutical & Biotechnology Companies

- Other End Users

Regional Analysis

Region with Highest Market Share of the Global Molecular Diagnostics Market

North America is projected to be the largest market for molecular diagnostics globally as it commands over 38.10% of the total revenue in 2025 due to its strong healthcare infrastructure, high adoption rate of advanced diagnostic technologies, and high government backing for precision medicine initiatives. The region has the benefit of highly developed reimbursement policies and high R&D investments by key industry players such as Thermo Fisher Scientific, Abbott, and Roche Diagnostics.

The United States possesses the largest share, driven by the wide usage of polymerase chain reaction (PCR), next-generation sequencing (NGS), and point-of-care molecular testing in hospitals and clinical labs. The leadership in the market is also facilitated by the existence of regulatory bodies like the FDA and CDC that allow rapid approval and adoption of molecular tests.

Moreover, the high prevalence of infectious diseases, cancer, and genetic disorders, and a growing focus on companion diagnostics and personalized medicine propel the demand for molecular diagnostic products. The rapid adoption of automated and multiplex molecular testing platforms in North American healthcare facilities enhances diagnostic productivity, strengthening the region's leadership in this market.

Region with the Highest CAGR in the Global Molecular Diagnostics Market

The Asia-Pacific region is expected to grow at the highest compound annual growth rate (CAGR) in the molecular diagnostics market worldwide because of the growing healthcare spending, higher incidence of infectious diseases, and wider availability of sophisticated diagnostic technologies. China, India, and Japan are some of the countries investing significantly in genomics research and biotechnology, leading to the market growing at a rapid rate.

The rising aging population in the region and the high burden of chronic conditions like tuberculosis, hepatitis, and cancer necessitate the adoption of molecular diagnostic solutions for early detection and treatment. In addition, governmental initiatives to expand diagnostic services, improve healthcare infrastructure, and apply regulatory policies also boost the growth of the market.

Expanding diagnostic laboratories, partnerships between local and global companies, and the affordability of molecular testing products also contribute to market growth. Point-of-care testing (POCT) and home-based molecular diagnostics use in remote areas have also boosted demand. Asia-Pacific will lead the molecular diagnostics market in terms of growth with more investments in precision medicine and a growing biotechnology sector.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global molecular diagnostics market is highly competitive with key players focusing on technological innovation, strategic partnership, and geographical diversification to strengthen their market shares. The key players include Roche Diagnostics, Abbott, Thermo Fisher Scientific, Qiagen, Bio-Rad Laboratories, and Danaher Corporation, and all of them continually invest in R&D and innovation to increase their molecular testing menus.

Roche Diagnostics has a stronghold with its market-dominating PCR and NGS-based systems, and Abbott holds the top spot for point-of-care molecular diagnostics. Thermo Fisher Scientific is leveraging its wide portfolio of reagents and kits to serve the growing demand for high-throughput molecular diagnostics.

Collaborations between biotech companies and diagnostic players in the form of strategic alliances are shaping market trends. For example, deals such as those between Illumina and Qiagen are expanding NGS-based diagnostic solutions. Additionally, the entry of startups and regional players in the Asia-Pacific region is increasing competition, particularly in the infectious disease and personalized medicine segments.

With increasing regulatory approvals, mergers, and acquisitions, competition is expected to become even fiercer, driving continued innovation and expansion in the molecular diagnostics sector globally.

Some of the prominent players in the Global Molecular Diagnostics Market are:

- Roche Diagnostics

- Abbott Laboratories

- Thermo Fisher Scientific

- Danaher Corporation

- Illumina, Inc.

- Qiagen N.V.

- bioMérieux

- Hologic, Inc.

- Siemens Healthineers

- Agilent Technologies

- Cepheid

- Exact Sciences

- Myriad Genetics

- Genomic Health

- Bio-Rad Laboratories

- PerkinElmer

- Luminex Corporation

- Guardant Health

- Natera, Inc.

- Oxford Nanopore Technologies

- Other Key Players

Recent Developments

2024

- March 2024: Abbott introduced a next-generation multiplex molecular testing platform designed for rapid detection of infectious diseases, enhancing diagnostic accuracy and turnaround time. This innovation aims to improve early disease detection and patient management across global healthcare settings.

- February 2024: Thermo Fisher Scientific announced a $400 million investment to expand its molecular diagnostics manufacturing capabilities in North America. This initiative strengthens supply chain resilience and supports the growing demand for high-throughput molecular testing solutions.

- January 2024: Roche Diagnostics formed a strategic collaboration with an AI-driven molecular diagnostics firm to enhance automation in genomic testing. The partnership integrates artificial intelligence with molecular diagnostics to advance precision medicine and personalized treatment approaches.

2023

- December 2023: Qiagen acquired a molecular diagnostics startup specializing in ultra-sensitive PCR technology, aiming to enhance its portfolio of high-precision diagnostic solutions. The acquisition strengthens Qiagen’s position in infectious disease and oncology testing.

- November 2023: Bio-Rad Laboratories introduced its high-throughput digital PCR system at the Global Molecular Diagnostics Expo 2023, showcasing advancements in quantitative genetic analysis and molecular testing for clinical and research applications.

- October 2023: The Asia-Pacific Molecular Diagnostics Conference 2023 highlighted advancements in point-of-care molecular testing and AI-driven diagnostics, addressing challenges in early disease detection, affordability, and scalability in emerging markets.

- September 2023: Danaher Corporation expanded into molecular oncology diagnostics through a strategic partnership with a biotechnology firm, focusing on cancer biomarker detection and precision medicine solutions to enhance personalized treatment approaches.

- August 2023: The North American Precision Medicine and Molecular Diagnostics Summit emphasized NGS and CRISPR-based diagnostics, showcasing innovations in genetic testing, personalized medicine, and real-time molecular surveillance of infectious diseases.

Report Details

|

Report Characteristics

|

| Market Size (2025) |

USD 27.1 Bn |

| Forecast Value (2034) |

USD 39.1 Bn |

| CAGR (2025-2034) |

4.2% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 8.7 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product & Service (Reagents & Kits, Instruments, Software & Services), By Test Location (Point of care, Self-test or OTC, Central laboratories), By Sample Type (Blood, Serum and Plasma, Urine, Other Sample Type), By Technology (Polymerase Chain Reaction (PCR), Isothermal Nucleic Acid Amplification Technology (INAAT), Microarrays, Next-Generation Sequencing (NGS), In Situ Hybridization (ISH), Mass Spectrometry, Others), By Application (Infectious Disease Diagnostics, Oncology Testing, Genetic Testing, Neurological Disease, Cardiovascular Disease, Blood Screening, Other Applications), By End User (Hospitals & Clinics, Diagnostic Laboratories, Research & Academic Institutes, Pharmaceutical & Biotechnology Companies, Other End Users) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Roche Diagnostics, Abbott Laboratories, Thermo Fisher Scientific, Danaher Corporation, Illumina, Inc., Qiagen N.V., bioMérieux, Hologic, Inc., Siemens Healthineers, Agilent Technologies, Cepheid, Exact Sciences, Myriad Genetics, Genomic Health, Bio-Rad Laboratories, PerkinElmer, Luminex Corporation, Guardant Health, Natera, Inc., Oxford Nanopore Technologies, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Molecular Diagnostics Market size is estimated to have a value of USD 27.1 billion in 2025 and is expected to reach USD 39.1 billion by the end of 2034.

The US Molecular Diagnostics Market is projected to be valued at USD 8.7 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 12.3 billion in 2034 at a CAGR of 3.9%.

North America is expected to have the largest market share in the Global Molecular Diagnostics Market with a share of about 38.10% in 2025.

Some of the major key players in the Global Molecular Diagnostics Market are Roche Diagnostics, Abbott Laboratories, Thermo Fisher Scientific, Danaher Corporation, Illumina, Inc., Qiagen N.V., bioMérieux, Hologic, Inc., Siemens Healthineers, and many others.

The market is growing at a CAGR of 4.2% over the forecasted period of 2025.