Market Overview

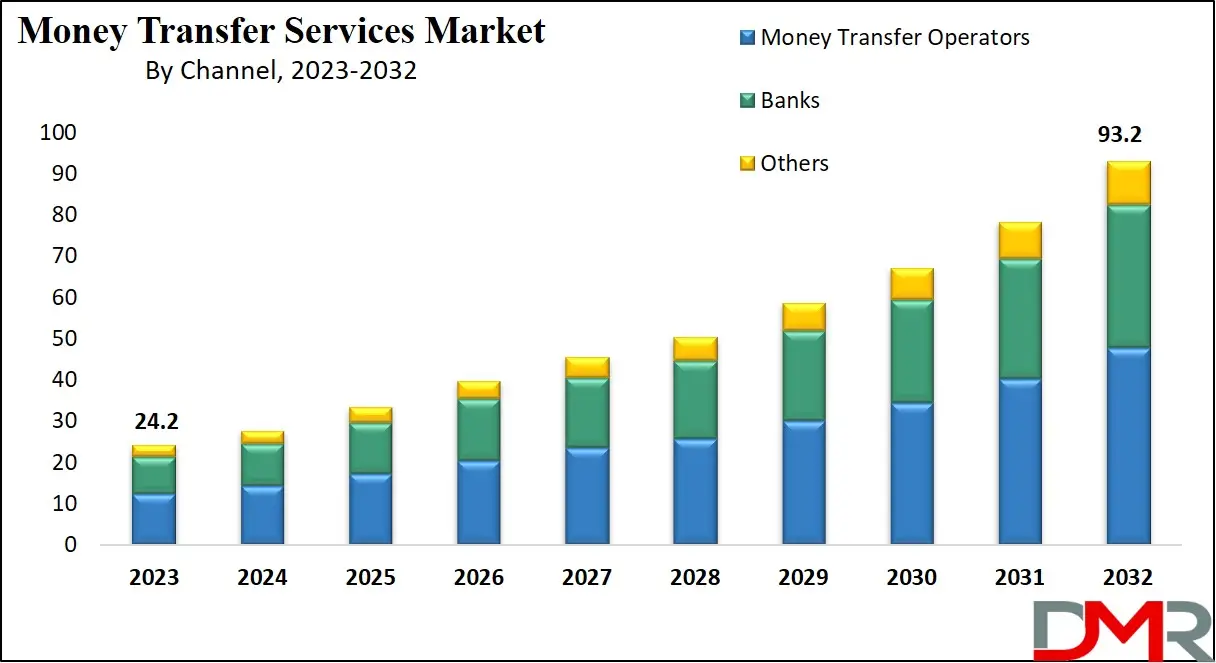

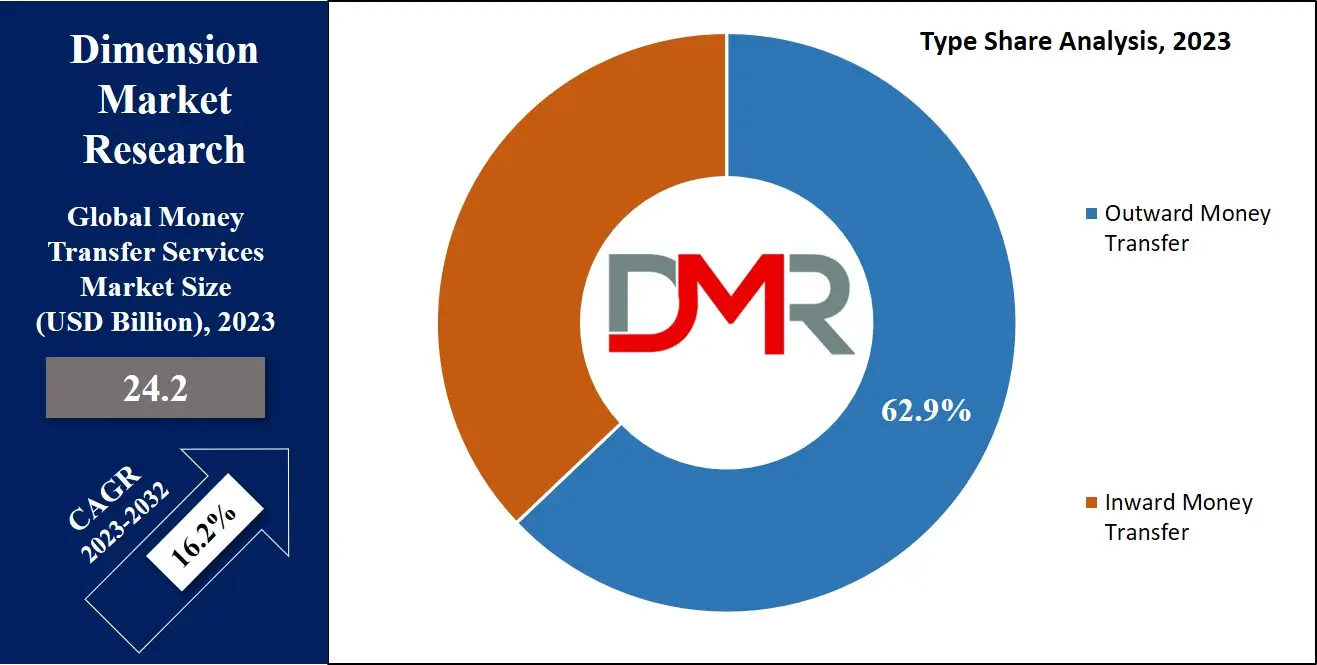

The Global Money Transfer Services Market is expected to reach a value of USD 24.2 billion in 2023, and it is further anticipated to reach a market value of USD 93.2 billion by 2032 at a CAGR of 16.2%. The market has seen significant growth over the past few years and is predicted to grow significantly during the forecasted period as well.

A money transfer, money service, or remittance enterprise includes providing a service that gathers funds from the sender & delivers them to the rightful recipient. This can include local transactions within a single country or extend to cross-border or international transfers connecting two or more nations. The rise of digital remittances and innovative payment technologies has been central to reshaping the money transfer industry.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

In addition, with the globalization of businesses & individuals relocating abroad for work & education, the need for cross-border payments has increased. This growth in demand has consequently driven a growing demand for money transfer services, and further expansion within the industry.

According to recent market analysis, the Money Transfer Services Market is experiencing significant growth, driven by increasing globalization and migrant populations. Major players like Western Union and MoneyGram dominate the market, with Western Union alone handling an estimated annual volume of approximately $150 billion.

The non-bank money transfer market has also reached a substantial size of around $600 billion, highlighting growing competition beyond traditional banks. In terms of cost, banks remain the most expensive channel for sending remittances, with an average fee of 12% in 2023, while Mobile Banking operators offer a more affordable option, with fees averaging only 4.4%.

The money transfer services sector is experiencing significant changes with major mergers and partnerships shaping the landscape. Notably, DolEx Dollar Express and Barri Financial Group announced a merger in 2022, creating a major player in the U.S. consumer financial services market. MoneyGram, meanwhile, completed its merger with Madison Dearborn Partners in mid-2023.

Meanwhile, fintech companies like Remitly and Payoneer saw surging transaction volumes, reflecting growth in cross-border payments. As the industry embraces technological innovation, partnerships, such as between Alviere and new clients for cross-border remittance services, highlight the ongoing evolution of money transfer services.

Market Dynamic

The integration of leading digital technologies such as mobile devices & the Internet has mainly streamlined the money transfer process, improving its accessibility. The emergence of digital platforms & mobile applications has allowed quick fund transfers, with these technological strides being major in driving the growth of the money transfer market.

However, the global money transfer services market sees several challenges, as financial institutions mostly require customer identity confirmation prior to authorizing money transfers. This process includes collecting personal details, like government-issued identification, passports, or utility bills. These verification protocols are developed to prevent fraudulent activities & validate the authority of transferred funds, ensuring they are not linked to illegal activities.

Research Scope and Analysis

By Type

The outward digital transfer sector emerges as the major driver within the global money transfer services market. This dominance can be said due to the practice of individuals residing abroad sending financial aid to their families back home. Facilitating this venture, financial institutions & banks have accelerated secure & quick cross-border money transfers.

Major international banks & financial entities have prioritized the execution of competitive fee structures & broad customer reach. Mainly, the execution of international outbound transfers is safeguarded via secure banking networks, which strongly reduces the risk of financial vulnerabilities & fraudulent activities for both the sender & the recipient.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Channel

The money transfer operators or MTOs segment maintained its dominance in the revenue distribution of the Global Money Transfer Services Market in 2023. Across the global landscape, MTOs, classified as non-bank financial organizations, have shown a keen focus on delivering comprehensive money transfer solutions.

Their service includes a range of offerings, like cash-to-cash transfers, bank transactions, & mobile money transfers. Primarily, MTOs serve individuals who lack access to conventional banking services, a demographic that includes immigrants & rural residents. This trend is projected to fuel the segment's growth during the anticipated forecast period.

By End User

The personal segment emerges as a major driving force for the growth of the global money transfer services market revenue during the recent years. This is fueled by the development of new & enhanced products & services, making it easier for people to manage their financial accounts. At the same time, the rising trend of global migration led to growth in the adoption of digital payment services by individuals who wanted to send money back to their homeland.

This trend is further boosted by the wide use of smartphones & the internet, which contributes to the ongoing growth of the personal segment throughout the forecast period. Additionally, innovative solutions are altering how money transfers are done, making them more convenient and cost-effective for both senders & receivers.

This segment mainly serves personal financial demands such as paying bills, supporting family members, & making purchases. Alongside this, the small businesses segment is also anticipated to secure high growth during the forecasted period. Moreover, the role of Education & Learning Analytics is emerging, as data-driven insights help service providers better understand user behavior and improve personalized financial solutions.

The Global Money Transfer Services Market Report is segmented on the basis of the following

By Type

- Inward money transfer

- Outward money transfer

By Channel

- Banks

- Money Transfer Operators

- Other Channels

By End User

- Personal

- Small Business

- Others

Regional Analysis

In 2023, the North American region secures a significant market share, accounting for about 28.8% of the total revenue for the global money transfer services market. The North American region consists of notable financial service & communication firms like Continental Exchange Solutions, Inc., Western Union Holdings, Inc., & MoneyGram. Various individuals relocate to North America for enhanced educational prospects, job opportunities, & entrepreneurial ventures.

The growing immigrant population in the region is projected to open the path for digital payment service providers. Additionally, the North American region has seen the rapid adoption of quick money transfers due to the introduction of numerous payment applications.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The market shows moderate fragmentation, as the key players look into diverse approaches such as innovating products, creating partnerships & collaborations, conducting research & development projects, engaging in mergers & acquisitions, establishing strategic joint ventures, & expanding geographical presence.

Money transfer software serves as a tool for fund transfers both among enterprises & between businesses & their clients. This type of software, along with payment solutions, finds primary utility among B2B clients & financial experts for conducting secure online payments.

For instance, in November 2022, India & Singapore successfully completed the technical preparations to connect their fast payment systems, UPI & PayNow. This connection facilitates instant & low-cost fund transfers between the two countries, majorly benefiting migrant workers. The integration efforts, led by the Reserve Bank of India (RBI) & Singapore's Monetary Authority of Singapore (MAS), have created a path for this enhanced cross-border payment service.

Some of the prominent players in the Global Money Transfer Services Market are

- MoneyGram

- Western Union Holdings

- Bank of America

- XOOM

- TransferGo

- TransferWise

- UAE Exchange

- Wells Fargo

- JPMorgan Chase and Co

- Citigroup Inc

- Other Key Players

Recent Developments

- August 2025: Wise Platform teamed up with Google to launch a new remittance feature for U.S. users. Now, customers searching for dollar transfers to destinations like India, the Philippines, Brazil, and Mexico will see real-time cost comparisons among providers directly in Google Search. This integration aims to boost transparency and efficiency in cross-border transfers.

- August 2025: Western Union announced a major acquisition of International Money Express (Intermex) for approximately $500 million in cash. The deal is expected to expand Western Union's reach in Latin America and strengthen its retail presence in the U.S., with projected cost synergies of around $30 million annually and a mid-2026 closing target.

- August 2025: Stablecoin-focused fintech Rain raised $58 million in a Series B round led by Sapphire Ventures. The company, which issues Visa-linked stablecoin payment cards and APIs, aims to expand its multi-chain issuer support across Solana, Tron, and Stellar networks.

- June 2025: Aspora, a London-based fintech serving the Indian diaspora, secured $53 million in a funding round co-led by Sequoia and Greylock. Serving 250,000 users and processing over $2 billion in volume, Aspora primarily operates in the UAE, UK, and EU, and plans to expand to the U.S., Canada, Australia, and Singapore.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 24.2 Bn |

| Forecast Value (2032) |

USD 93.2 Bn |

| CAGR (2023-2032) |

16.2% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Inward Money Transfer and Outward Money Transfer), By Channel (Banks, Money Transfer Operators and Other Channels), By End User (Personal, Small Business and Others) |

| Regional Coverage |

North America - The US and Canada; Europe - Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific - China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America - Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa - Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

MoneyGram, Western Union Holdings, Bank of America, XOOM, TransferGo, TransferWise, J.P. Morgan Chase ad Co, UAE Exchange, Wells Fargo, Citigroup Inc, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Money Transfer Services Market?

▾ The Global Money Transfer Services Market size is estimated to have a value of USD 24.2 billion in 2023

and is expected to reach a value of USD 93.2 billion by the end of 2032.

Which region accounted for the largest Global Money Transfer Services Market?

▾ North America dominates the Global Money Transfer Services Market with a share of 28.8% in 2023.

Who are the key players in the Global Money Transfer Services Market?

▾ Some of the major key players in the Global Money Transfer Services Market are MoneyGram, Bank of

America, Western Union, and many others.

What is the growth rate in the Global Money Transfer Services Market?

▾ The market is growing at a CAGR of 16.2 percent over the forecasted period.