Market Overview

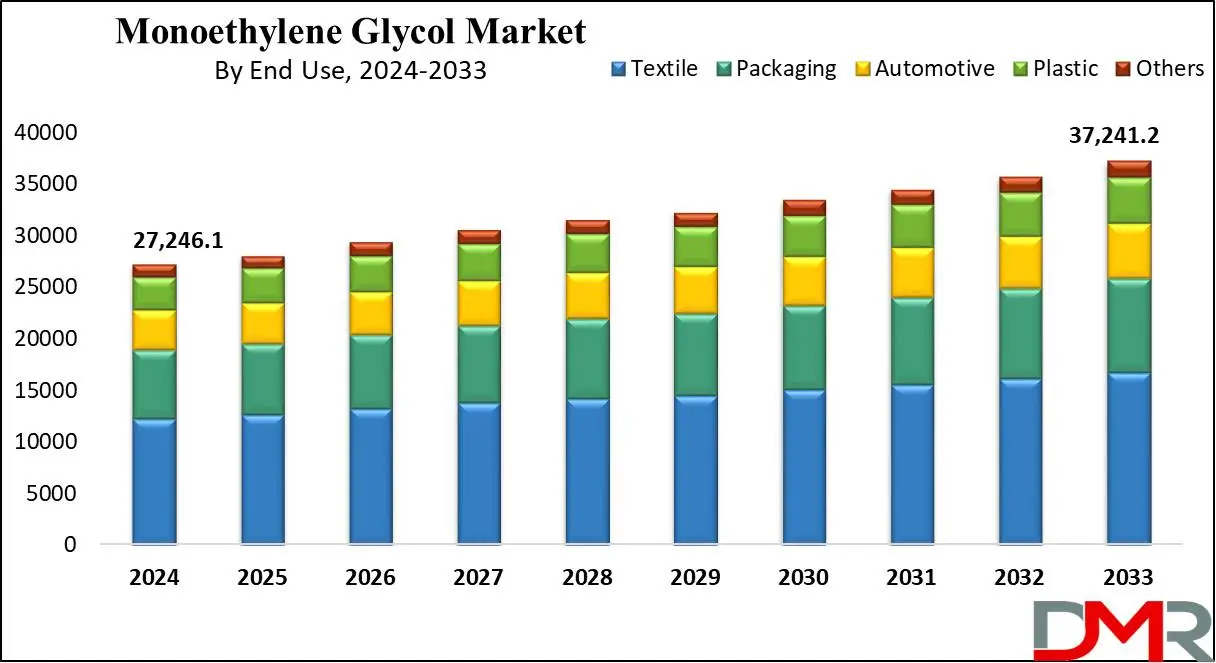

The Global Monoethylene Glycol Market was valued at USD 26,290.3 million in 2023, and it is anticipated to grow with a CAGR of 3.5% during the forecasted period and is expected to reach USD 37,241.2 million by 2033.

Monoethylene Glycol (MEG) is an organic compound represented by the formula (CH2OH)2, which is an odorless, colorless, & thick liquid that exhibits excellent miscibility with water & many organic solvents, making it highly versatile in various applications. MEG finds broad use in manufacturing polyester fibers, brake fluids,

antifreeze, & numerous other products.

The production of MEG includes a catalytic hydration process using copper or silver catalysts under higher temperatures & pressure. After the reaction, a mixture of Monoethylene Glycol & water is obtained and then separated through the distillation process. Being non-flammable, environmentally friendly, & biodegradable, MEG provides a safe & sustainable chemical solution for various sectors & products. Its wide range of applications further highlights its value as a valuable & eco-friendly compound in the market.

The textile industry is a key end user of monoethylene glycol as its derivatives are integral in synthesizing polyester fibers. By 2021, global production had reached 113,600 thousand metric tons reflecting a 4.8% rise from 2020's 108,300 thousand tons with major textile producing nations like India, China and the US playing key roles in driving this growth. With increased investments and infrastructure improvements projected over this timeframe, its sector should contribute a higher compound annual compound annual growth rate over its lifespan.

According to India Brand Equity Foundation (IBEF), India's exports of textiles and apparel, including handicrafts, totaled USD 29.8 billion between April and December 2021 representing a 41% rise compared to USD 21.2 billion during the same period in 2021. Favorable demographics and growing consumer preference for branded products should further fuel demand in textile sector and benefit monoethylene glycol market growth.

The United States stands out as a prominent exporter in textilerelated exports. In 2021, U.S. fiber, textiles and apparel exports reached USD 28.4 billion while National Council of Textile Organizations reported that textile and apparel shipment values reached USD 65.2 billion; all these factors combined have had a profoundly positive effect on market growth during this forecast period.

Key Takeaways

- Market Growth: The Monoethylene Glycol Market size is expected to grow by 9,060.6 million, at a CAGR of 3.5% during the forecasted period of 2025 to 2033.

- By Application: The PET (Polyethylene Terephthalate) segment as an application is expected to lead in 2024 with a major & is anticipated to dominate throughout the forecasted period.

- By End Use: The textile segment is expected to get the largest revenue share in 2024 in the Monoethylene Glycol market.

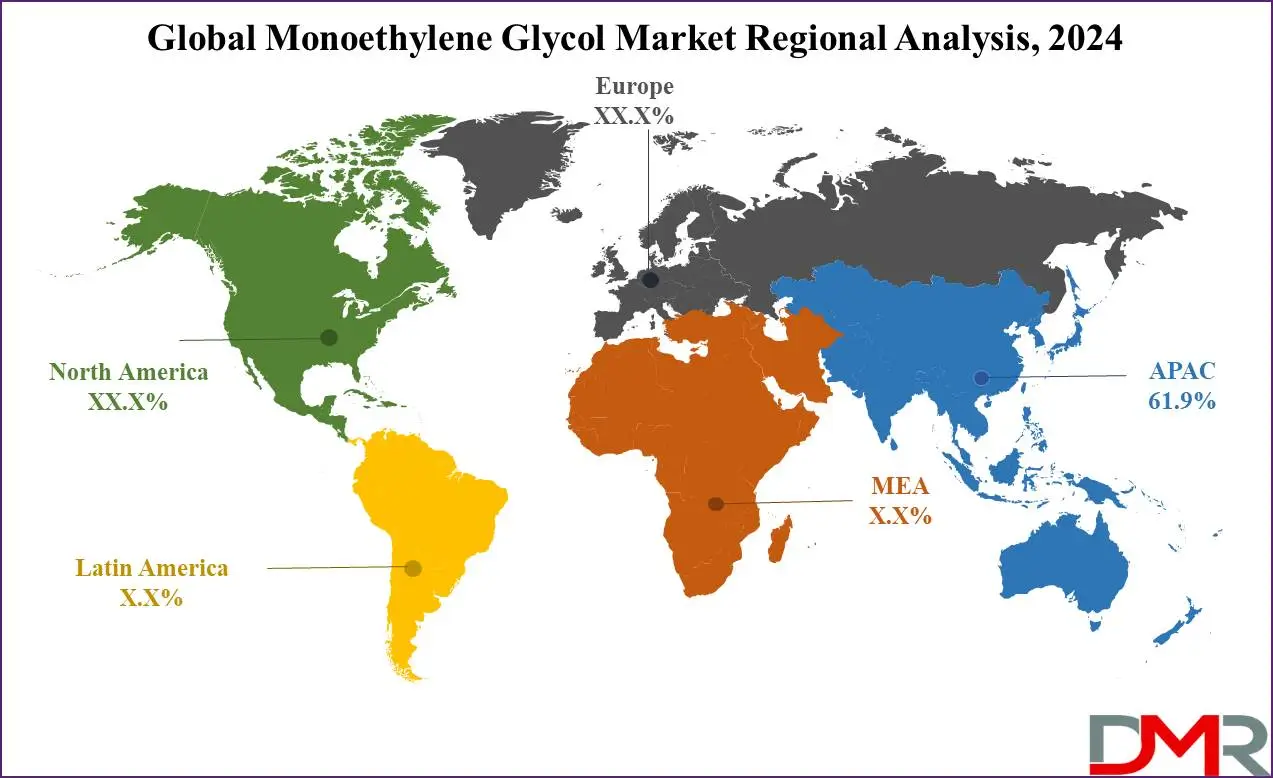

- Regional Insight: Asia Pacific is expected to hold a 61.9% share of revenue in the Global Monoethylene Glycol Market in 2024.

- Use Cases: Some of the use cases of Monoethylene Glycol include antifreeze & coolant, de-icing fluids, and more.

Use Cases

- Antifreeze and Coolants: MEG is a major component in antifreeze formulations for automotive engines. It lowers the freezing point and raises the boiling point of the coolant, preventing the engine from freezing in cold weather and overheating in hot weather.

- Polyester Fiber Production: MEG is a major raw material in the manufacture of polyethylene terephthalate (PET), which is used to develop polyester fibers. These fibers are broadly used in textiles, clothing, and home furnishings.

- Plastic Bottles and Packaging: MEG is used to develop PET resin, which is then used to make plastic bottles & packaging materials. PET is known for its strength, transparency, and recyclability, making it ideal for beverage containers & food packaging.

- De-icing Fluids: MEG is used in the production of de-icing solutions for aircraft & runways. These fluids help prevent the mixing of ice, ensuring safety and operational efficiency in cold weather conditions.

Market Dynamics

Driving Factors

Rising Demand for PET Products

The high use of polyethylene terephthalate (PET) in packaging, mainly for beverages and food items, is a major growth driver. PET's desirable properties, like strength, lightweight, and recyclability, are driving its demand, thereby expanding the MEG market.

Expanding Automotive Industry

The automotive industry's growth, mainly in emerging markets, drives the demand for antifreeze and coolant products containing MEG. As vehicle production & sales increase, the need for effective engine cooling solutions constantly grows, supporting the MEG market's expansion.

Restraints

Rising Demand for PET Products

The high usage of polyethylene terephthalate (PET) in packaging, primarily for beverages

and food items, is a major growth driver. PET's desirable properties, like strength, lightweight, and recyclability, are driving its need, thereby expanding the MEG market.

Expanding Automotive Industry

The automotive industry's growth, mainly in emerging markets, drives the demand for antifreeze and coolant products containing MEG. As vehicle production & sales grow, the need for effective engine cooling solutions constantly increases, supporting the MEG market's expansion.

Opportunities

Growth in Renewable MEG Production

The development and adoption of bio-based MEG, derived from renewable sources like bio-ethanol, provides many opportunities, as a shift towards sustainable production methods can attract environmentally conscious consumers and companies, opening new market segments and reducing dependency on fossil fuels.

Expanding Textile Industry in Emerging Markets

The expanding textile and apparel industry in emerging markets, mainly in Asia-Pacific, provides major growth potential. Higher demand for polyester fibers, which need MEG for their production, can drive market expansion as these regions continue to industrialize and urbanize.

Trends

Shift Towards Sustainability

There is a major trend towards the development & use of bio-based MEG, driven by high environmental awareness and regulatory pressures. Companies are investing in research & production of MEG from renewable resources, focused on reducing their carbon footprint and meeting consumer demand for sustainable products.

Technological Advancements in Production

Innovations in production technologies are improving the efficiency and cost-effectiveness of MEG manufacturing. Developments like catalytic processes and improved purification methods are optimizing yield and quality, causing more competitive pricing and expanded applications in various industries.

Monoethylene Glycol (MEG) Market Research Scope and Analysis

By Application

The PET (Polyethylene Terephthalate) segment will lead the monoethylene glycol market in 2024 by holding a substantial share of the market, which can be due to the superior properties of MEG in comparison to other products, making it an ideal choice for PET production.

MEG exhibits favorable characteristics like thermal stability, compatibility, reactivity, transparency, & clarity, and blockade properties. As a key ingredient in polyester fiber production, MEG reacts with terephthalic acid to create DMT (Dimethyl Terephthalate) which is further polymerized to create polyester resin.

Further, the polyester resin is then processed into fibers through methods like wet spinning & melt spinning. MEG's usage in polyester fiber production provides many benefits, including its affordability & eco-friendly nature. In addition, MEG serves as an important component in antifreeze, effectively lowering the freezing point of water.

Through hydrogen bonding with water molecules, MEG protects water from freezing, making it an essential ingredient in antifreeze to ensure engine coolant remains unfrozen, even in extremely cold conditions.

By End Use

The textile segment is expected to dominate the monoethylene glycol market in 2024, holding a major share in terms of revenue for the market, which can be credited to the broad usage of monoethylene glycol in the textile sector, like dyeing, textile printing, polyester fiber production, textile processing & finishing. Moreover, in the

plastic industry, MEG acts as a vital raw material in the formation of polyester resins & finds use in several plastic processing sectors, like, blow molding, injection molding & extrusion.

Furthermore, MEG plays a major role in the packaging industry, where it is used to produce polyester resins for creating a wide range of packaging materials like food packaging, bottles & films. It also works as a solvent in adhesive production, effectively dissolving adhesive components & improving bonding & flow properties.

Monoethylene Glycol-based adhesives are largely used in multiple packaging applications, like label application, food packaging, & carton sealing. As the global need for plastic products with better quality & properties constantly rises, the demand for monoethylene glycol in the plastic industry is expected to grow substantially over the forecast period.

The Monoethylene Glycol Market Report is segmented on the basis of the following

By Application

- Polyethylene Terephthalate (PET)

- Polyester Fibers

- Anti-Freeze

- Others

By End-Use

- Textile

- Packaging

- Automotive

- Plastics

- Others

Regional Analysis

The Asia Pacific region is set dominate the global monoethylene glycol market, with a substantial

share of 61.9%, which can be accredited to the growing demand for monoethylene glycol from key industries in the region, like packaging, textiles & electronics. The textile sector is a major user in this region, using Monoethylene Glycol in the production of polyester fibers for many textile products like carpets, clothing, & furniture, which is expected to fuel the regional market's growth.

Additionally, North America has seen high investments from major manufacturing groups, further driving the regional market. Also, in Europe, the electronics sector acts as a major user, using Monoethylene Glycol in the manufacturing of electronic components like batteries & capacitors.

The growing demand for electronic components from many industries, including automotive, consumer electronics, & industrial, is anticipated to drive the Monoethylene Glycol market in this region. These developments across different regions highlight the growing importance & versatility of monoethylene glycol in several sectors worldwide.

By Region

North America

Europe

- Germany

- The U.K.

- France

- • Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global monoethylene glycol market is characterized by intense competition, with key players in different regions actively expanding their product portfolios & global presence. These companies are focusing on expanding their distribution networks and geographical reach. Additionally, significant investments are being made in research and development activities to enhance production plant capacity and meet the increasing product demand.

Moreover, industry participants are strategically pursuing mergers and acquisitions to fortify their position in the global market. These measures collectively highlight the dynamic nature of the industry and the continuous efforts made by companies to thrive in the highly competitive landscape.

Some of the prominent players in the global Monoethylene Glycol Market are:

- Royal Dutch Shell PLC

- Mitsubishi Chemical Corporation

- China Petroleum and Chemical Corporation

- MEGlobal

- India Glycols, Ltd

- Ishtar Company, LLC

- Arham Petrochem Pvt. Ltd.

- Pon Pure Chemicals Group

- Indian Oil Corporation Ltd.

- Raha Group

- Euro Industrial Chemicals

- UPM Biochemicals

- Other Key Players

Recent Developments

- In January 2024, MEGlobal, a prominent player in the global production of monoethylene glycol (MEG) and diethylene glycol, has announced an increase in the February contract price for MEG in the Asian market at USD 850 per tonne, which is a slight increment of USD 10 per tonne in compared to the January pricing, which also reflects the company's strategic response to the evolving dynamics within the market.

- In January 2024, Saudi Eastern Petrochemical Company (SHARQ), a leading petrochemical producer in Saudi, is coming up to recommence production at its No. 4 monoethylene glycol (MEG) line in Al-Jubail, Saudi Arabia, during the second half of January, which comes in the aftermath of scheduled maintenance that temporarily halted operations on the MEG line.

- In September 2023, UPM Biochemicals announced that the company selected Brenntag SE as the sole distributor of its sustainable bio-monoethylene glycol (BioMEG) UPM BioPura in Europe, as it will bring UPM BioPura to market, unlocking new commercial opportunities, while expanding the introduction of sustainable forest-sourced materials into the chemical sector.

- In October 2022, Saudi Basic Industries Corp. (SABIC) started commercial operations at United Ethylene Glycol Plant 3, with an annual production capacity is 700,000 metric tons of monoethylene glycol (MEG), and this project’s financial impact is expected to be seen in the fourth quarter of 2022.

- In March 2022, Braskem and Japan's Sojitz planned for a joint venture producing biobased ethylene glycol and propylene glycol, where monosaccharides will be converted into glycolaldehyde before conversion to glycols using the Mosaik technology Braskem and the engineering firm Haldor Topsoe devised over five years. Braskem and Sojitz have also planned three industrial units, with the first being by 2025.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 27,246.1 Mn |

| Forecast Value (2033) |

USD 37,241.2 Mn |

| CAGR (2024–2033) |

3.5% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Application (PET, Polyester Fibers, Anti-Freeze, and Others), By End-Use (Textiles, Packaging, Automotive, Plastics, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Royal Dutch Shell PLC, Mitsubishi Chemical Corporation, China Petroleum and Chemical Corporation, ME Global, India Glycols, Ltd, Ishtar Company, LLC, Arham Petrochem Pvt. Ltd., Pon Pure Chemicals Group, Indian Oil Corporation Ltd., Raha Group, Euro Industrial Chemicals, UPM Biochemicals, and Other Key Players. |

| Purchase Options |

Physio-Control Inc., Schiller, Medtronic, Abbott, Boston Scientific Corporation, Koninklijke Philips N.V., Zoll Medical Corporation, BIOTRONIK, Progetti Srl, LivaNova Plc, and Other Key Players |

Frequently Asked Questions

The Global Monoethylene Glycol Market reached a value of USD 26,290.3 million in 2023.

The Global Monoethylene Glycol Market is expected to register a compound annual growth rate (CAGR) of 3.5% during the forecast period.

The Asia Pacific region will dominate the Global Monoethylene Glycol Market, securing a substantial revenue share of 61.9% in 2024.

Some of the prominent players in the Global Monoethylene Glycol Market include Royal Dutch Shell PLC, Mitsubishi Chemical Corporation, China Petroleum and Chemical Corporation, ME Global, etc.