Market Overview

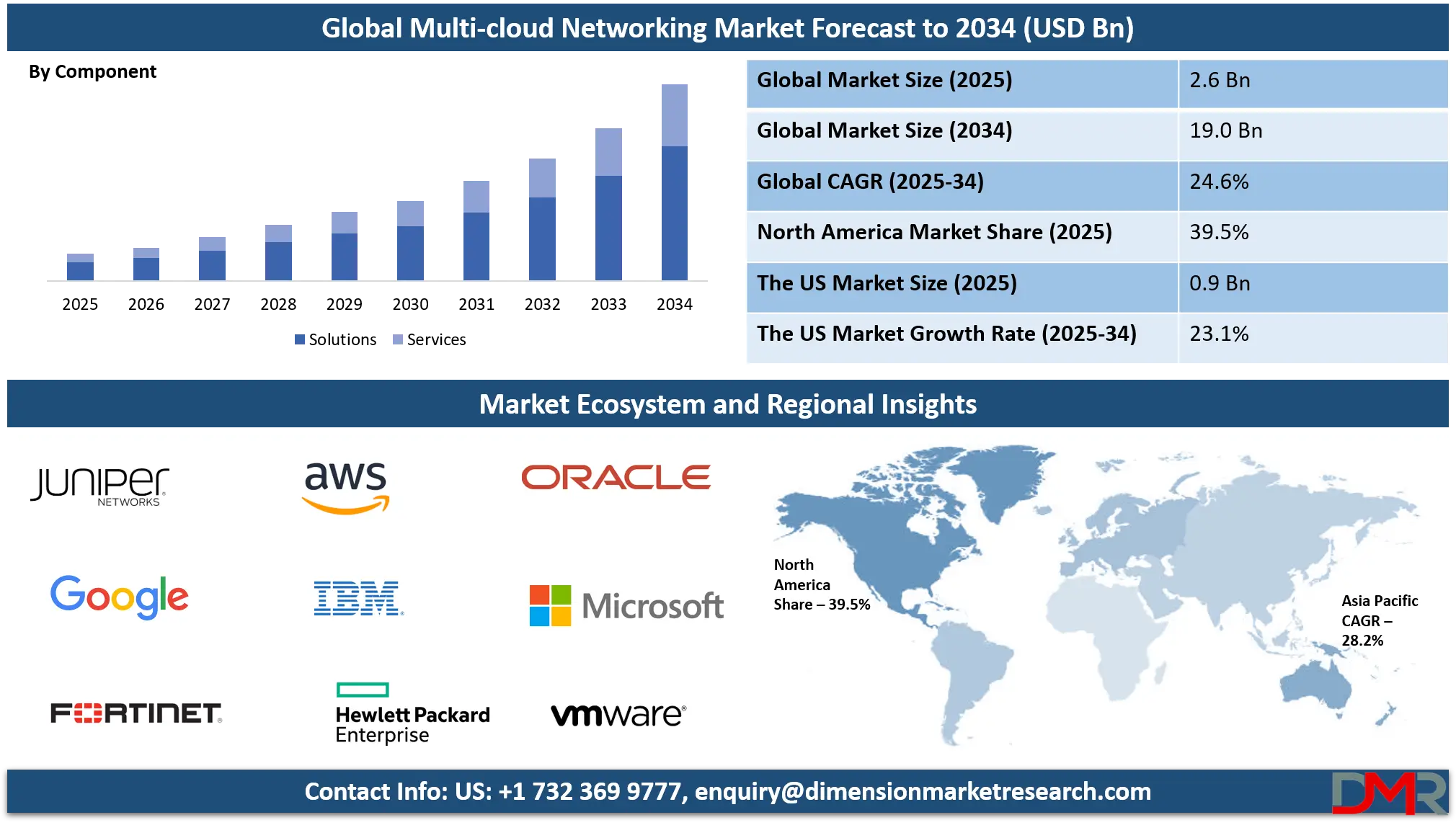

The Global Multi-Cloud Networking Market size is projected to reach USD 2.6 billion in 2025 and grow at a compound annual growth rate of 24.6% to reach a value of USD 19.0 billion in 2034.

The Multi-Cloud Networking Market refers to the infrastructure, platforms, and services that enable seamless connectivity, management, and security across multiple cloud environments—public, private, and hybrid. It forms the critical foundation for enterprises pursuing multi-cloud strategies to enhance agility, resilience, and cost optimization. Multi-cloud networking integrates data, workloads, and applications across various providers like AWS, Azure, and Google Cloud, ensuring consistent performance and unified network visibility.

In recent years, enterprises have increasingly adopted distributed architectures to avoid vendor lock-in and ensure business continuity. This trend has driven the need for advanced networking frameworks capable of secure inter-cloud communication. Key developments include the rise of SD-WAN, network virtualization, AI-based traffic routing, and zero-trust network access models.

Large organizations currently dominate the adoption landscape, but small and medium-sized enterprises (SMEs) are rapidly entering the market through managed and network-as-a-service (NaaS) offerings. Service providers are expanding cross-cloud connectivity and orchestration platforms to simplify operations for customers.

The market’s growth is also fueled by digital transformation, IoT integration, and cloud-native applications. Industry verticals such as BFSI, healthcare, manufacturing, and government increasingly rely on multi-cloud networking for compliance, uptime, and real-time data transfer. Overall, the market continues to evolve through innovations in automation, security, and intelligent network management, positioning itself as a cornerstone of the modern digital ecosystem.

The US Multi-Cloud Networking Market

The US Multi-Cloud Networking Market size is projected to reach USD 900 million in 2025 at a compound annual growth rate of 23.1% over its forecast period.

The U.S. market is expected to maintain its dominance through continuous investments in automation, AI-based network monitoring, and hybrid connectivity. Enterprises are focusing on integrating private data centers with multiple public clouds for resilience and compliance. The market exhibits consolidation as vendors merge to offer unified platforms combining visibility, orchestration, and threat prevention. Additionally, the push for zero-trust architectures and edge connectivity enhances the scope of adoption. With strong regulatory oversight and cloud maturity, the U.S. will continue to set global standards in multi-cloud networking technologies.

Europe Multi-Cloud Networking Market

Europe Multi-Cloud Networking Market size is projected to reach USD 650 million in 2025 at a compound annual growth rate of 24.1% over its forecast period.

European companies are adopting multi-cloud networking to ensure compliance, maintain business continuity, and optimize workloads across data centers and cloud regions. The growing focus on open-source cloud frameworks and sovereign cloud initiatives is fostering vendor-neutral solutions. Countries such as Germany, France, and the U.K. are investing in hybrid connectivity infrastructure and managed cloud services. Europe’s market growth is supported by collaborations between telecom operators and cloud vendors, encouraging innovation and standardized networking models across multi-cloud ecosystems.

Japan Multi-Cloud Networking Market

Japan Multi-Cloud Networking Market size is projected to reach USD 182 million in 2025 at a compound annual growth rate of 25.3% over its forecast period.

Japan’s highly digitized economy favors multi-cloud networking for efficient data exchange between local and global cloud providers. Companies emphasize reliability, low latency, and robust cybersecurity, aligning with the country’s strong regulatory standards. The rise of Industry 4.0, combined with Japan’s advanced edge infrastructure, is fueling investments in cloud-to-edge connectivity. Enterprises are also prioritizing disaster recovery and multi-region redundancy, making Japan a key regional contributor to Asia-Pacific’s overall growth in multi-cloud networking.

Multi-Cloud Networking Market: Key Takeaways

- Market Growth: The Multi-Cloud Networking Market size is expected to grow by USD 15.8 billion, at a CAGR of 24.6%, during the forecasted period of 2026 to 2034.

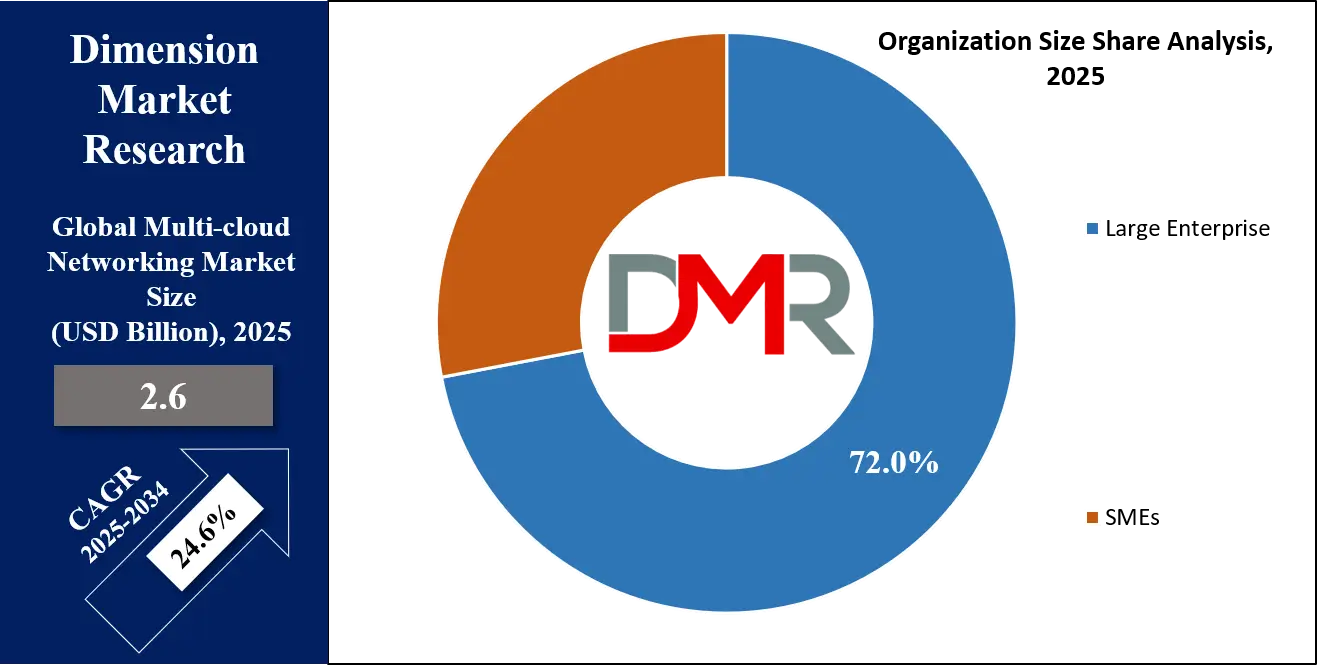

- By Organization Size: The large enterprise segment is anticipated to get the majority share of the Multi-Cloud Networking Market in 2025.

- By Component: The solution segment is expected to get the largest revenue share in 2025 in the Multi-Cloud Networking Market.

- Regional Insight: North America is expected to hold a 39.5% share of revenue in the Global Multi-Cloud Networking Market in 2025.

- Use Cases: Some of the use cases of Multi-Cloud Networking include disaster recovery, edge-to-cloud IoT integration, and more.

Multi-Cloud Networking Market: Use Cases

- Global Application Delivery: Connects applications across multiple cloud platforms for improved performance and scalability.

- Disaster Recovery: Ensures business continuity through redundancy across multiple cloud environments.

- Edge-to-Cloud IoT Integration: Links smart devices and edge systems to centralized multi-cloud networks.

- Regulatory Compliance & Data Sovereignty: Enables localized data routing while maintaining unified governance policies.

Market Dynamic

Driving Factors in the Multi-Cloud Networking Market

Rapid Cloud Adoption and Workload Distribution

As enterprises embrace hybrid and multi-cloud strategies, the need for seamless connectivity, performance consistency, and unified security across cloud platforms has surged. Multi-cloud networking enables data sharing, automation, and real-time analytics between clouds. It eliminates vendor lock-in, improves cost optimization, and enhances scalability—making it a key driver of enterprise digital transformation.

Advancements in Edge Computing and 5G

The expansion of edge infrastructure and 5G networks has amplified demand for distributed cloud environments. Multi-cloud networking integrates edge nodes with central cloud systems to enable ultra-low latency and secure data transmission. This trend supports next-generation use cases such as autonomous vehicles, smart factories, and AI-driven analytics.

Restraints in the Multi-Cloud Networking Market

Complexity of Integration and Management

Multi-cloud environments involve connecting diverse platforms, APIs, and protocols. Managing interoperability, latency, and security across clouds presents technical and operational challenges. Many organizations struggle with skill shortages, leading to misconfigurations, inconsistent policy enforcement, and increased costs.

Security and Compliance Concerns

Data transfer across multiple cloud environments raises compliance and privacy issues. Organizations face challenges ensuring encryption, identity management, and audit transparency across providers. Furthermore, cyber threats targeting inter-cloud links and misaligned security frameworks act as major restraints in the market.

Opportunities in the Multi-Cloud Networking Market

Growing SME Adoption

SMEs are highly leveraging managed multi-cloud networking solutions to streamline connectivity without high infrastructure investment. This segment provides significant opportunities for service providers offering subscription-based or pay-as-you-go models tailored for smaller enterprises.

Industry-Specific Customization

Verticals such as BFSI, healthcare, and manufacturing present vast potential for specialized multi-cloud networking applications. Industry-focused solutions that meet compliance, latency, and automation needs will create substantial new revenue streams.

Trends in the Multi-Cloud Networking Market

Rise of Network-as-a-Service (NaaS)

Organizations are shifting from traditional ownership models toward NaaS, where networking resources are delivered on demand. This trend simplifies operations and allows scalability in multi-cloud environments.

AI-Driven Automation and Analytics

Artificial intelligence and machine learning are increasingly integrated to automate traffic management, predict network bottlenecks, and optimize resource utilization across multiple clouds.

Impact of Artificial Intelligence in Multi-Cloud Networking Market

- AI-Based Routing Optimization: Enhances traffic flow between cloud providers using predictive analytics.

- Proactive Network Monitoring: Detects and resolves connectivity issues before service disruption occurs.

- Automated Security Enforcement: Applies consistent policies across multiple cloud environments.

- Cost Optimization through ML: Analyses bandwidth usage and recommends efficient routing paths.

- Enhanced User Experience: Delivers intelligent QoS adjustments based on application priorities.

Research Scope and Analysis

By Component Analysis

The Solutions segment dominates the multi-cloud networking market with a commanding 68.5% share in 2025. This leadership is primarily due to enterprises’ preference for comprehensive, integrated networking solutions that combine SD-WAN, WAN optimization, and zero-trust secure access. These solutions enable seamless interconnection between multiple cloud platforms, ensuring consistent performance, visibility, and policy enforcement.

Enterprises increasingly rely on these integrated platforms to reduce latency, enhance reliability, and gain unified control over their hybrid and multi-cloud infrastructures. The demand for SDN-based orchestration, automated routing, and intelligent traffic management further strengthens the position of the solutions segment.

The Services segment represents the fastest-growing component of the multi-cloud networking market, expanding rapidly as organizations seek specialized expertise and managed support. Enterprises are increasingly outsourcing network management, integration, and maintenance functions to professional service providers to overcome skill shortages and technical complexities.

These services include consulting, network design, integration of hybrid infrastructures, and continuous support and monitoring. As multi-cloud deployments become more intricate, enterprises are turning to managed services to maintain uptime, security, and compliance across platforms.

By Deployment Mode Analysis

The Public Cloud segment leads the market with an estimated 66.7% share in 2025. Its dominance is driven by the rapid expansion of hyperscale providers such as AWS, Microsoft Azure, and Google Cloud, offering scalable and cost-effective infrastructure solutions. Organizations favor the public cloud for its agility, global reach, and ability to support diverse workloads without extensive on-premise investment. Multi-cloud networking in the public environment allows enterprises to seamlessly connect across different providers, optimizing performance and ensuring redundancy.

The Public Cloud segment leads the market with an estimated 66.7% share in 2025. Its dominance is driven by the rapid expansion of hyperscale providers such as AWS, Microsoft Azure, and Google Cloud, offering scalable and cost-effective infrastructure solutions. Organizations favor the public cloud for its agility, global reach, and ability to support diverse workloads without extensive on-premise investment. Multi-cloud networking in the public environment allows enterprises to seamlessly connect across different providers, optimizing performance and ensuring redundancy.

By Organization Size Analysis

The Large Enterprises segment leads the multi-cloud networking market with about 72% share in 2025. These organizations possess the necessary capital, technical expertise, and global infrastructure to deploy large-scale, complex networking solutions. Multi-cloud networking enables them to manage diverse workloads across regions, ensuring scalability, redundancy, and compliance with international standards. Large enterprises, particularly in BFSI, manufacturing, and technology, leverage advanced automation tools and orchestration systems for centralized policy control.

The SMEs segment is emerging as the fastest-growing in the multi-cloud networking landscape. Although smaller in market share, SMEs are rapidly adopting managed cloud networking services due to their affordability, scalability, and ease of implementation. Multi-cloud networking allows these organizations to connect multiple cloud applications securely while minimizing infrastructure costs. With limited in-house expertise, SMEs rely on service providers to deliver automation, monitoring, and security across their cloud setups.

By Industrial Vertical Analysis

The Banking, Financial Services, and Insurance (BFSI) sector dominates the market with a 23.9% share in 2025, primarily due to its demand for secure, high-availability, and globally connected network infrastructures. Financial institutions use multi-cloud networking to ensure continuous service delivery, minimize latency in transactions, and meet regulatory compliance requirements. The ability to segment workloads between private and public clouds enhances security and optimizes resource utilization.

The Manufacturing/Industrial sector is the fastest-growing vertical, driven by Industry 4.0, smart factories, and industrial IoT applications. Manufacturers are increasingly connecting on-premise systems with cloud environments for predictive maintenance, process automation, and data-driven decision-making. Multi-cloud networking enables real-time data sharing between production facilities, suppliers, and logistics partners, optimizing efficiency and responsiveness.

The Multi-Cloud Networking Market Report is segmented on the basis of the following:

By Component

- Solutions

- SD-WAN / WAN Optimization

- Cloud Interconnect / Direct Connect / Cloud Exchange

- Cloud VPN & Secure Access (ZTNA)

- Network Orchestration & Automation (CNI, CNM, Controllers)

- Network Security (Microsegmentation, Firewall as a Service)

- Network Visibility / Monitoring / Analytics

- Services

- Professional Services (Integration, Consulting, Design)

- Managed Services

- Support & Maintenance

By Deployment Mode

- Public Cloud

- Private Cloud

- Hybrid Cloud / Multi-Cloud

By Organization Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By Industry Vertical

- IT & ITeS / Telecom

- BFSI (Banking, Financial Services & Insurance)

- Healthcare & Life Sciences

- Manufacturing / Industrial

- Retail & eCommerce

- Government & Public Sector

- Energy & Utilities

- Education

- Others

Regional Analysis

Leading Region in the Multi-Cloud Networking Market

North America leads the global market with about 35.9% share in 2025. The region benefits from mature cloud infrastructure, extensive vendor presence, and strong adoption among large enterprises. Continuous innovation in network automation, AI integration, and hybrid deployment models drives sustained growth. Regulatory compliance, cybersecurity frameworks, and high investment in IT modernization further reinforce its leadership position.

Fastest Growing Region in the Multi-Cloud Networking Market

Asia-Pacific represents the fastest-growing region, propelled by rapid digital transformation, expanding data centers, and increasing demand for hybrid cloud infrastructure. Countries such as India, China, and South Korea are deploying large-scale multi-cloud ecosystems to support manufacturing, telecommunications, and e-commerce sectors. The region’s growth is also fueled by government digital initiatives and the expansion of 5G connectivity.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The multi-cloud networking market is highly competitive, comprising established vendors and emerging startups offering innovative solutions for cloud connectivity, orchestration, and security. Key players include Cisco Systems, VMware, Juniper Networks, Microsoft, IBM, and Hewlett Packard Enterprise. Companies compete through product differentiation, AI integration, and strategic partnerships. Continuous mergers, acquisitions, and ecosystem collaborations are reshaping market dynamics toward unified network-as-a-service and intelligent automation models.

Some of the prominent players in the global Multi-Cloud Networking are:

- Cisco Systems

- VMware

- Amazon Web Services (AWS)

- Microsoft

- Google Cloud (Alphabet Inc.)

- IBM Corporation

- Hewlett Packard Enterprise (HPE)

- Oracle Corporation

- Arista Networks

- Juniper Networks

- Fortinet Inc.

- Palo Alto Networks

- Akamai Technologies

- Alkira Inc.

- Aryaka Networks

- Aviatrix Systems

- Cato Networks

- Cloudflare Inc.

- Dell Technologies

- Extreme Networks

- Other Key Players

Recent Developments

- In July 2025, Hewlett Packard Enterprise completed its USD 14 billion acquisition of Juniper Networks to strengthen its AI-native and multi-cloud networking portfolio, enhancing global market presence.

- In May 2025, Aviatrix introduced an AI-enabled network management agent integrating security automation and diagnostics, designed to improve reliability in enterprise multi-cloud environments.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 2.6 Bn |

| Forecast Value (2034) |

USD 19.0 Bn |

| CAGR (2025–2034) |

24.6% |

| The US Market Size (2025) |

USD 0.9 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Solutions and Services), By Deployment Mode (Public Cloud, Private Cloud, and Hybrid Cloud / Multi-Cloud), By Organization Size (Large Enterprises and Small & Medium Enterprises (SMEs)), By Industry Vertical (IT & ITeS / Telecom, BFSI (Banking, Financial Services & Insurance), Healthcare & Life Sciences, Manufacturing / Industrial, Retail & e-Commerce, Government & Public Sector, Energy & Utilities, Education, and Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Cisco Systems, VMware, Amazon Web Services (AWS), Microsoft, Google Cloud (Alphabet Inc.), IBM Corporation, Hewlett Packard Enterprise (HPE), Oracle Corporation, Arista Networks, Juniper Networks, Fortinet Inc., Palo Alto Networks, Akamai Technologies, Alkira Inc., Aryaka Networks, Aviatrix Systems, Cato Networks, Cloudflare Inc., Dell Technologies, Extreme Networks, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Multi-Cloud Networking Market size is expected to reach a value of USD 2.6 billion in 2025 and is expected to reach USD 19.0 billion by the end of 2034.

North America is expected to have the largest market share in the Global Multi-Cloud Networking Market, with a share of about 39.5% in 2025.

The Multi-Cloud Networking Market in the US is expected to reach USD 0.9 billion in 2025.

Some of the major key players in the Global Multi-Cloud Networking Market are IBM, Google, VMware, and others

What is the growth rate in the Global Multi-Cloud Networking Market?