Multi-layer Ceramic Capacitor Market Overview

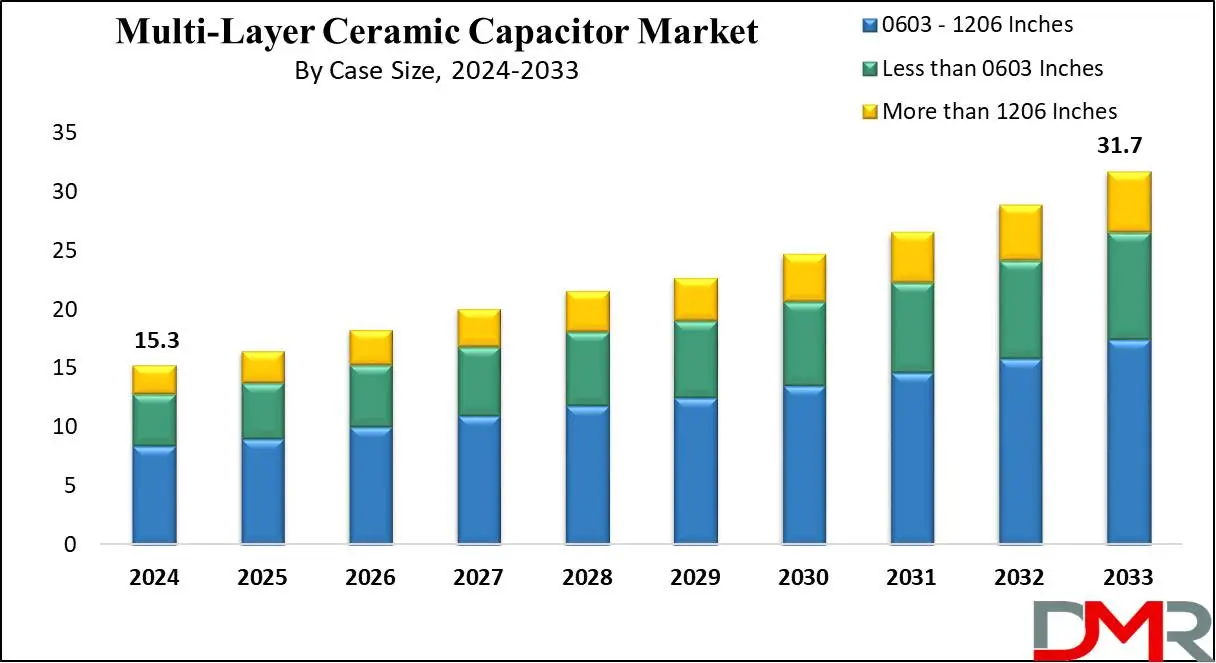

The Global Multi-layer Ceramic Capacitor Market is expected to reach a value of USD 15.3 billion by the end of 2024, and it is further anticipated to reach a market value of USD 31.7 billion by 2033 at a CAGR of 8.4%.

Multilayer Ceramic Capacitor or MLCC is a form of capacitor that works as a 'dam' which temporarily charges & discharges electricity. It regulates the current's flow in a circuit and avoids electromagnetic interference between components, due to the thickness of a single dielectric and the number of stacked layers being related to the capacity of electricity, technology for thinning a single layer and stacking more layers is important.

Key Takeaways

- The Global Multi-layer Ceramic Capacitor Market is expected to grow by 16.4 billion, at a CAGR of 8.4% during the forecasted period.

- By Case Size, the 0603-1206 inches segment is expected to lead in 2024 & is anticipated to dominate throughout the forecasted period.

- By Type, General capacitors are expected to have a lead throughout the forecasted period.

- By End User, the electronic segment is expected to be the dominant driver of the growth of the market in forecasted years.

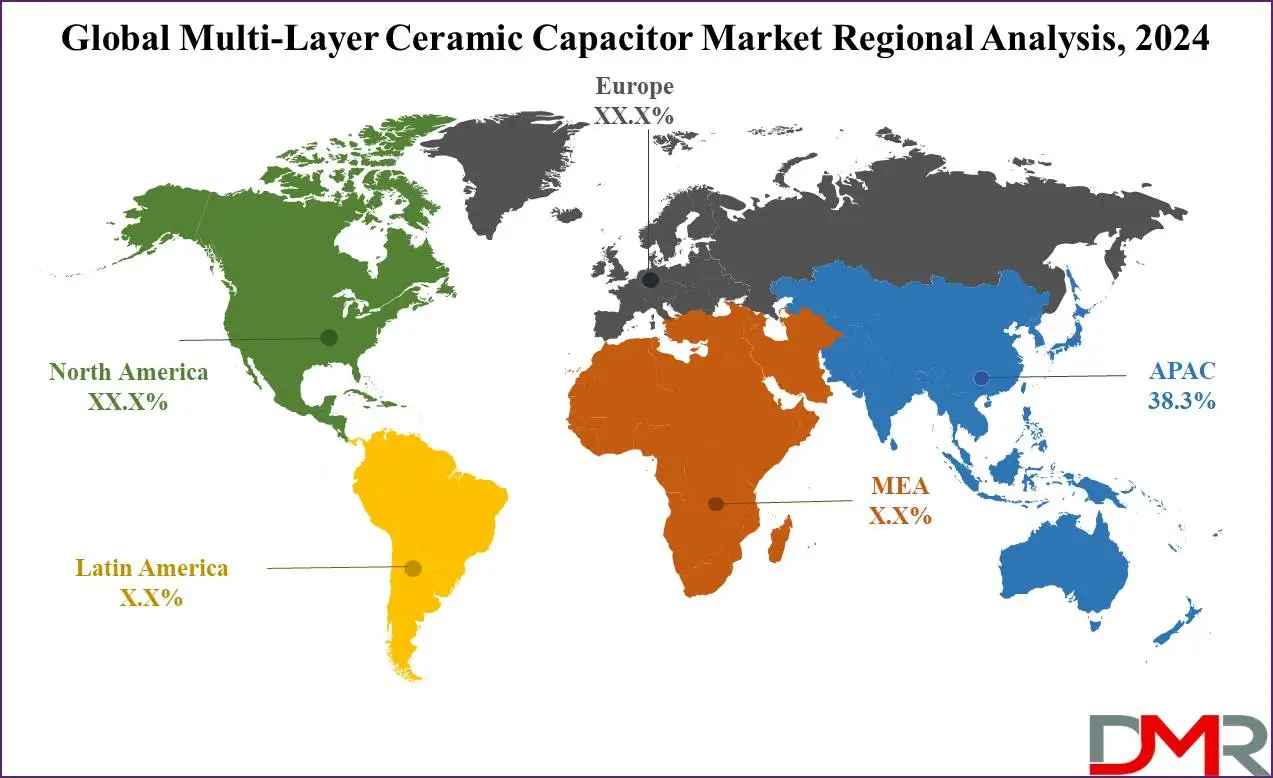

- Asia Pacific is expected to hold a 38.3% share of revenue in the Global Multi-layer Ceramic Capacitor Market in 2024.

- Some of the use cases of the multi-layer ceramic capacitor market include consumer electronics, industrial equipment, and more.

Use Cases

- Consumer Electronics: MLCCs are largely used in consumer electronics like smartphones, tablets, laptops, & digital cameras for separating, filtering, and voltage regulation purposes. They provide stable performance & help in minimizing electromagnetic interference (EMI), ensuring the smooth operation of electronic devices.

- Automotive Electronics: In the automotive industry, they are critical components in advanced driver assistance systems (ADAS), infotainment systems, engine control units (ECUs), & onboard chargers for Electric Vehicles. They contribute to the shrinkage of electronic modules while providing high capacitance values & excellent temperature stability, vital for harsh automotive environments.

- Industrial Equipment: These are integral to many industrial applications like power supplies, motor drives, inverters, & PLCs (Programmable Logic Controllers). They assist in voltage regulation, noise suppression, & filtering, making it the reliable operation of industrial equipment in demanding environments with temperature variations & high vibration levels, supporting Industrial Automation.

- Telecommunications Infrastructure: MLCCs are important in telecommunications infrastructure, like base stations, routers, switches, & optical networking equipment. They support signal conditioning, obstruct matching, and noise filtering, improving the performance & reliability of communication networks while coping with strict requirements for size, weight, & power consumption.

Multilayer Ceramic Capacitor Market Dynamics

Multi-layer ceramic capacitor (MLCCs) play an important role in various consumer electronics like wearables, computers, tablets, & smartphones, driven by the growth in disposable incomes & technological developments. The growing demand for electronic gadgets drives the MLCC market growth. In addition, the automotive sector shows a fast growth in MLCC usage due to the ongoing electrification & integration of modern electronics in vehicles.

Also, EVs depend on MLCCs for components, entertainment systems, safety features, & engine control units. Moreover, they are also vital components in telecommunications infrastructure, assisting base stations, routers, switches, & other equipment during the rollout of 5G networks & growing demands for connectivity. Further, industrial sectors, like manufacturing, energy, and transportation, drive MLCC demand due to the adoption of automation technologies in control systems, robotics, & power electronics.

However, the MLCC market experiences challenges due to its dependency on consistent raw material supplies, like metals & ceramic powders. Factors like fluctuating raw material prices, geopolitical conflicts disrupting trade, or natural disasters impacting production facilities can limit its availability & induce price volatility. Such variations, along with macroeconomic factors, create challenges in planning, budgeting, & maintaining stable pricing.

Moreover, ensuring excellent quality & reliability is paramount, given its critical role in electronic systems. Issues like duplicate parts, performance discrepancies, & reliability failures can reduce trust, potentially leading to safety concerns, product recalls, and damage to reputations.

Multilayer Ceramic Capacitor Market Research Scope and Analysis

By Case Size

The 0603-1206 inch case size segment is anticipated to dominate revenue in 2024 for the global multi-layer ceramic capacitor market due to growing demand for smaller components providing better performance & compatibility with automated manufacturing. These MLCCs provide a compact form factor, higher capacitance values, lesser equivalent series resistance (ESR), and simplified assembly, meeting space-constrained applications & gaining market favor.

Further, the less than 0603-inch case size MLCC segment is expected to show the fastest growth in coming years due to developments in miniaturization, an increase in demand for compact components, the proliferation of portable & Wearable Technology, and the growth in Internet of Things and smart device adoption. These smaller MLCCs support the development of sleeker, lighter electronic devices while maintaining optimal performance, making them as preferred choices across many applications within the electronics industry.

By Type

The general capacitor segment is expected to lead the multi-layer ceramic capacitor market in revenue in 2024 due to its high demand across various applications like cell phones, DC-DC converters, gaming devices, and TVs. General Capacitors play an important role in removing electronic circuit noise and are favored for their compact size, supporting easy installation in electronic gadgets.

MLCC arrays, using passive technology by combining multiple capacitor elements into one structure, are gaining traction for their efficiency, affordability, and reduced placement costs in products like game consoles, computers, automotive systems, & telecommunications equipment.

Further, the mega-cap MLCC segment is experiencing fast growth, due to the high demand for advanced capacitance in electronic devices, also development in technologies like 5G and IoT, the current trend of miniaturization, and advancement in manufacturing processes. These capacitors, with their better energy storage, improved performance, and compact designs, meet the evolving needs of various industries.

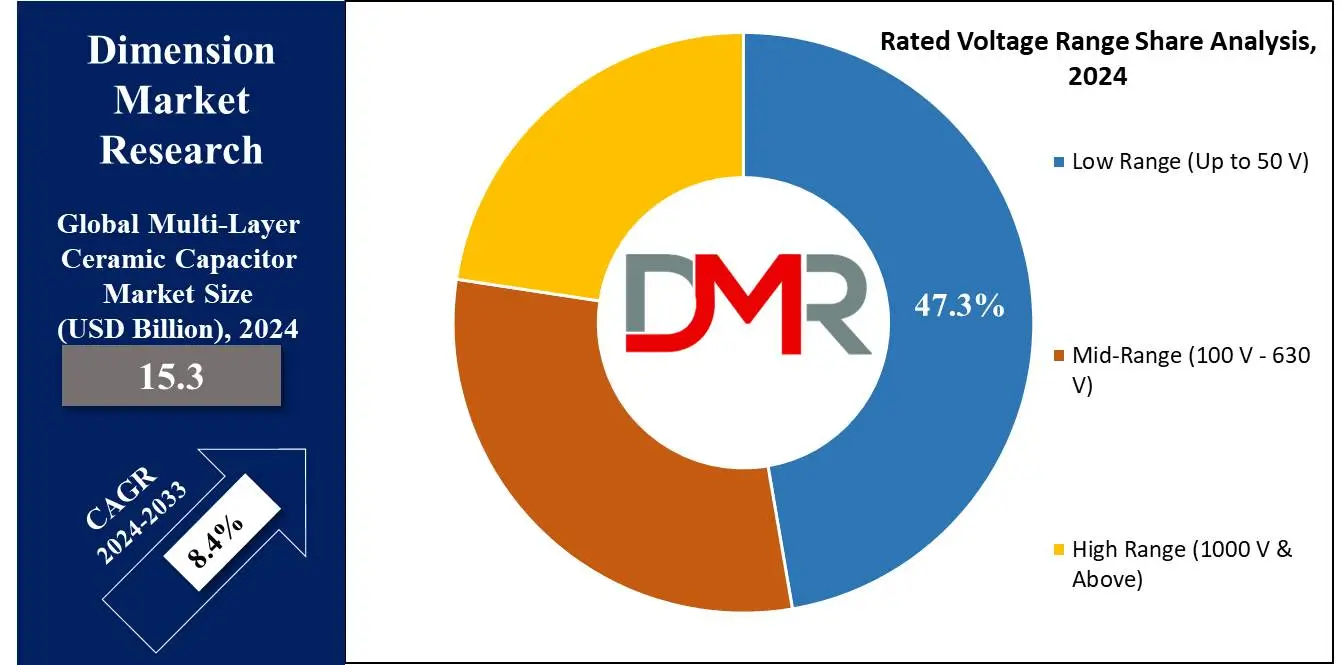

By Related Voltage Range

In terms of related voltage range, the low-range voltage segment, including capacitors with voltages up to 50V, will hold the largest market share in 2024. These capacitors are largely used across consumer electronics, automotive, industrial, & telecommunications sectors due to their flexibility, compact size, higher capacitance range, and competitive pricing.

Developments in manufacturing processes have further supported the production of low-range MLCCs, contributing to their dominance in the market. Further, the high-range voltage segment (1000V & above) is expected to be the fastest-growing segment in coming years, using multi-layering technologies & advanced ceramic dielectric layers to provide high capacitance & voltage to electronic devices.

These capacitors find applications in lighting ballasts, high-voltage coupling, power supply devices, & inverter circuits. In addition, mid-range voltage MLCCs (100V to 630V) support favorable characteristics like a good capacitance-to-volume ratio, low cost, no polarity, low leakage, higher mechanical strength, & lower Equivalent Series Inductance (ESL)/Equivalent Series Resistance (ESR), making them active choices across various electronic devices.

By Dielectric Type

The Global Multi-layer ceramic capacitor market is expected to be led by the X7R segment in revenue in 2024, driven by its high operating temperature & temperature stability, making it ideal for frequency-discriminating circuits, bypass, decoupling, filtering, & transient voltage suppression applications. Further, the Y5V dielectric segment is experiencing quick growth due to its miniature size, broader capacitance range, availability for vapor & wave solder, and suitability for decoupling applications with limited temperature requirements.

These dielectric capacitors are easy to handle, support inventory control, & are recyclable, contributing to their higher popularity. With their distinct advantages & applicability in many electronic applications, both X7R & Y5V dielectric MLCCs play important roles in meeting the changing demands of the market, meeting various needs while ensuring reliable performance.

By End Use

The electronic segment is predicted to have a major revenue share of the multi-layer ceramic capacitor market in 2024, primarily driven by the higher usage of multilayer ceramic capacitors (MLCCs) in automotive applications, like powertrains, vehicle frames, & infotainment systems, which has allowed manufacturers to create MLCCs customized for automotive needs, using various voltage options, case sizes, & capacitance values. In addition, they are gaining traction in EVs due to their resilience to high temperatures prevalent in control circuits.

The automotive sector is expected to come out as the fastest-growing segment, driven by the growth in the adoption of electric vehicles & the integration of Advanced Driver Assistance Systems (ADAS) and infotainment features. Further, MLCCs are finding large applications across telecom, military, medical, & industrial equipment sectors, like military communications systems, telecom base stations, & high-frequency RF applications, due to their ease of mounting, assembly efficiency, and ability to reduce circuit tracks' inductance.

The Multi-layer Ceramic Capacitor Market Report is segmented on the basis of the following:

By Case Size

- Less than 0603 Inches

- 0603 – 1206 Inches

- More than 1206 Inches

By Type

- General Capacitor

- Array

- Serial Construction

- Mega Cap

- Others

By Rated Voltage Range

- Low Range (Up to 50 V)

- Mid-Range (100 V – 630 V)

- High Range (1000 V & Above)

By Dielectric Type

By End Use

- Electronics

- Automotive

- Industrial

- Telecommunication

- Data Transmission

- Others

Multilayer Ceramic Capacitor Market Regional Analysis

Asia Pacific is expected to lead with a

38.3% revenue share of the global multi-layer ceramic capacitor market in 2024, due to its status as a major manufacturing hub for electronic devices. The region gains from the presence of MLCC manufacturers in countries like South Korea, Japan, Taiwan, & India, reviving growth in the coming years. In addition, Asia Pacific is also anticipated to witness quick growth, due to high demand from various industries because of higher capacitance levels of MLCCs and the trend towards capacitor miniaturization. In addition, to stay competitive, regional MLCC manufacturers are using advanced technologies.

Moreover, the current consumer electronics demand in developing nations like China and India further drives the regional consumption of multilayer ceramic capacitors. Further, In Europe, major growth is anticipated, mainly due to the region's major automotive industry presence. MLCCs find high use in automobiles, covering a range of working voltages, capacitance values, & case sizes, which encourages many MLCC manufacturers to create and supply capacitors for automotive applications, promoting their integration into the automotive sector. Also, MLCCs are indispensable in many industrial applications, like high-frequency, high-voltage, soft termination, & general-purpose applications, thereby helping the expansion in the European market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Multilayer Ceramic Capacitor Market Competitive Landscape

The global multi-layer ceramic capacitor market has strong competition among key players competing for market share. Companies aim for product innovation, technological development, and strategic collaborations to get a competitive edge. In addition, market players give importance in expanding their geographical presence & improving production capacities to meet the rising demand for MLCCs across many industries. Price competitiveness & quality assurance remain critical factors influencing consumer preferences & shaping the competitive landscape.

Some of the prominent players in the global Multi-layer Ceramic Capacitor Market are

- Samsung Electronics

- YAGEO Group

- Murata Manufacturing Co Ltd

- KYOCERA Corporation

- TDK Corp

- Future Electronics

- Vishay Intertechnology

- TAIYO YUDEN

- Walsin Technology Corp

- Maruwa Co Ltd

- Other Key Players

Recent Developments

- In September 2023, TDK Corporation expanded its CN series of multilayer ceramic capacitors (MLCCs) with a new design. Unlike traditional soft termination MLCCs, the new design has resin layers providing only one side, minimizing electrical resistance, available in CNA & CNC series, provides larger capacitances & smaller sizes, addressing market needs while avoiding short circuits in power & battery lines.

- In July 2023, KEMET, a part of the YAGEO Group introduced the new X7R high voltage VW80808 series automotive grade MLCCs. Available in case sizes ranging from EIA 0603 to 1210, these capacitors provide capacitances from 100pF to 0.1uF and DC voltages from 500V to 1kV. Designed with flexible termination (FT-CAP) in X7R dielectric, they create a reliable performance in harsh automotive environments, meeting AEC-Q200 and VW80808 specifications.

- In May 2023, Murata launched its new Multi-Layer Ceramic Capacitors developed for portable devices, meeting the growing need for compact components with better capacitance and improved temperature performance. With capacitance values up to 10µF & a 0201inch/0603M package size, they provide high space savings and cost benefits.

- In April 2023, Kyocera Corporation introduced its' Electronic Components Division and developed a new capacitor (MLCC) with EIA 0201 size (0.6 mm x 0.3 mm) along with the industry's highest*1 capacitance of 10 microfarads.

- In October 2022, Vishay Intertechnology, Inc. launched a new series of surface-mount multilayer ceramic chip capacitors (MLCC) customized for DC-blocking applications. These devices are the industry's first to cover frequency bands from 3 MHz to 18 GHz, simplifying component selection for designers. Manufactured utilizing reliable noble metal electrode (NME) technology, they excel in many applications like RF, Bluetooth, 5G, and powerline communication circuits, providing efficient AC signal transmission with minimal insertion loss.

Multilayer Ceramic Capacitor Market Report Details

| Report Characteristics |

| Market Size (2024) |

USD 15.3 Bn |

| Forecast Value (2033) |

USD 31.7 Bn |

| CAGR (2023-2032) |

8.4% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Case Size (Less than 0603 Inches, 0603 – 1206 Inches, and More than 1206 Inches), By Type (General Capacitor, Array, Serial Construction, Mega Cap, and Others), By Rated Voltage Range (Low Range (Up to 50 V), Mid-Range (100 V – 630 V), and High Range (1000 V & Above)), By Dielectric Type (X7R, X5R, C0G, Y5V, and Others), By End Use (Electronics, Automotive, Industrial, Telecommunication, Data Transmission, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Samsung Electronics, YAGEO Group, Murata Manufacturing Co Ltd, KYOCERA Corporation, TDK Corp, Future Electronics, Vishay Intertechnology, TAIYO YUDEN, Walsin Technology Corp, Maruwa Co Ltd, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Multi-layer Ceramic Capacitor Market size is estimated to have a value of USD 15.3 billion in 2024 and is expected to reach USD 31.7 billion by the end of 2033.

Asia Pacific is expected to have the largest market share in the Global Multi-layer Ceramic Capacitor Market with a share of about 38.3% in 2024.

Some of the major key players in the Global Multi-layer Ceramic Capacitor Market are Samsung Electronics, YAGEO Group, Murata Manufacturing Co Ltd, and many others.

The market is growing at a CAGR of 8.4 percent over the forecasted period.