Market Overview

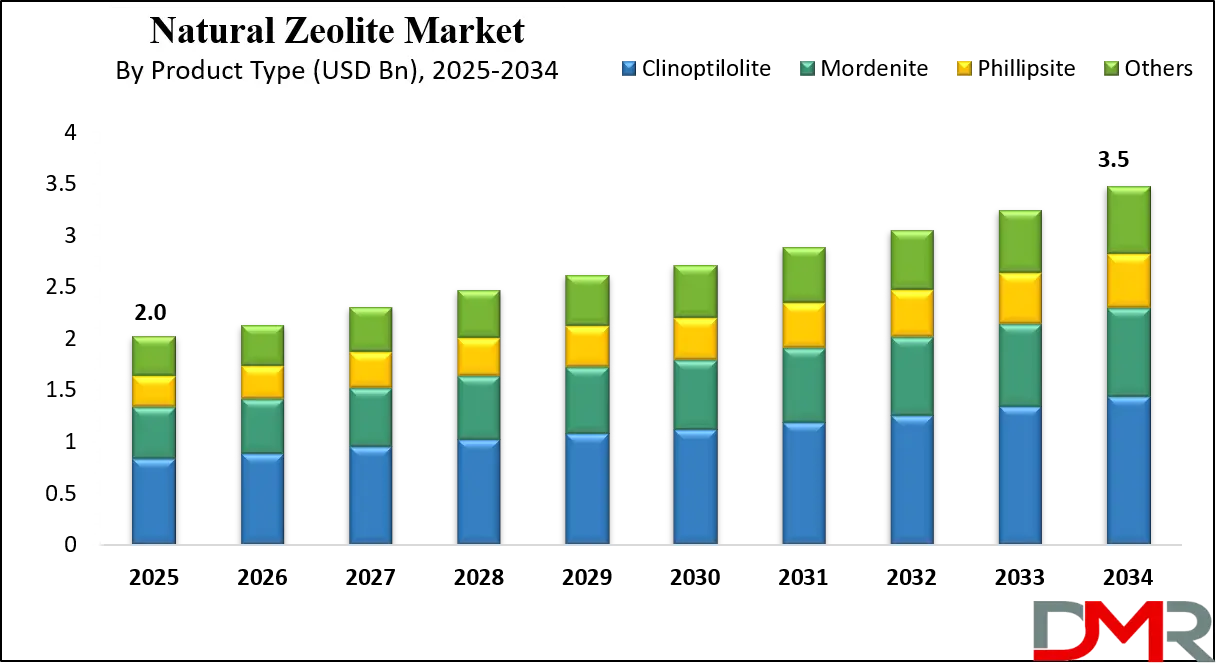

The global natural zeolite market is projected to grow from USD 2.0 billion in 2025 to USD 3.5 billion by 2034, expanding at a CAGR of 6.2%, driven by growing applications in water treatment, agriculture, animal feed, and construction industries.

Natural zeolite is a naturally occurring crystalline mineral belonging to the aluminosilicate family, formed over time through the alteration of volcanic ash and rocks in the presence of alkaline groundwater. Its highly porous structure allows it to selectively adsorb and exchange ions, making it effective in removing impurities from water and soil. With a composition primarily of silicon, aluminum, and oxygen, natural zeolites exhibit thermal stability, chemical inertness, and high cation-exchange capacity, which makes them suitable for a variety of industrial applications including agriculture, Water and Wastewater Treatment, and animal nutrition.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global natural zeolite market encompasses the production, processing, and commercialization of these minerals to meet diverse industrial demands. Zeolites are widely employed in agriculture to enhance soil quality and nutrient retention, while in water treatment they help eliminate heavy metals and ammonia. Industries also utilize natural zeolites as catalysts, adsorbents, and construction additives, reflecting their versatility and growing importance in sustainable practices and eco-friendly solutions.

The market growth is supported by the rising adoption of natural zeolites in environmental management, livestock feed, and renewable material applications. Manufacturers are increasingly exploring innovative processing techniques and high-purity grades to cater to specialized industrial needs. Additionally, the awareness of natural zeolites’ role in reducing environmental contamination and improving operational efficiency has propelled their demand across regions globally, creating opportunities for expansion in both emerging and developed markets.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Natural Zeolite Market

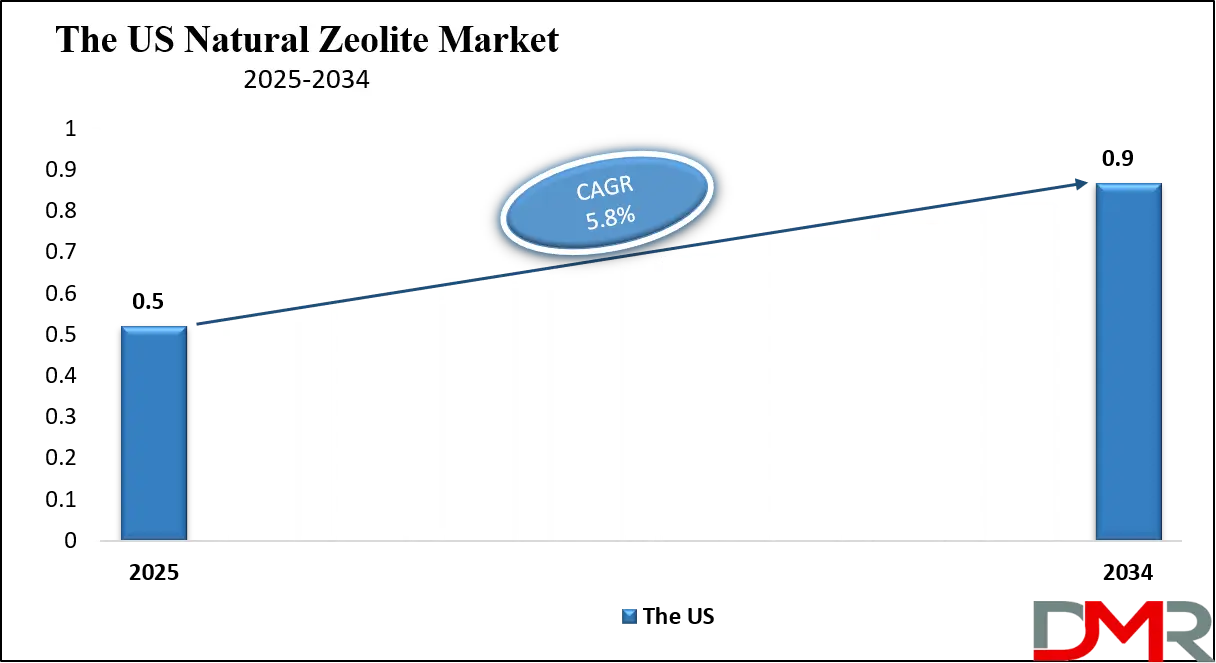

The U.S. Natural Zeolite market size is projected to be valued at USD 500 million by 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 900 million in 2034 at a CAGR of 5.8%.

The United States natural zeolite market has witnessed steady growth due to rising demand from diverse industrial applications. Natural zeolites are extensively utilized in water purification and wastewater treatment to remove heavy metals, ammonia, and other contaminants, supporting environmental sustainability initiatives. In agriculture, zeolites are applied as soil conditioners and fertilizers to enhance nutrient retention and improve crop yields, while in livestock farming, they are incorporated as feed additives to promote animal health and productivity. The versatility of natural zeolites in adsorption, ion exchange, and catalysis has further driven their adoption across chemical processing, construction, and industrial manufacturing sectors in the U.S.

Market expansion is also supported by the growing focus on eco-friendly construction materials, where natural zeolites are employed as lightweight aggregates and pozzolanic additives in concrete production to enhance durability and thermal stability. The U.S. market benefits from well-established mining and processing infrastructure, alongside growing research and development initiatives aimed at producing high-purity grades tailored for specialized applications.

Furthermore, regulatory emphasis on water treatment standards, sustainable agriculture, and environmental protection has accelerated the integration of natural zeolites across industries, positioning the United States as a significant contributor to the North American market landscape.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Natural Zeolite Market

The Europe natural zeolite market is projected to reach a market value of approximately USD 700 million in 2025, reflecting its strong presence in the global landscape. The market’s growth is largely driven by growing industrial and environmental applications of natural zeolites across the region. Countries such as Germany, France, and Italy are investing significantly in wastewater treatment infrastructure, sustainable agriculture, and eco-friendly construction materials, which has propelled the demand for zeolites.

Their excellent ion-exchange and adsorption properties make them highly effective in removing heavy metals and ammonia from water, improving soil fertility, and enhancing crop yields. Additionally, the adoption of natural zeolites in livestock feed to improve digestion and reduce ammonia emissions further strengthens their market position in Europe.

The market is expected to grow at a compound annual growth rate of 7.2% over the coming years, driven by technological advancements and growing awareness of sustainable solutions. Manufacturers are focusing on producing high-purity and specialized zeolite grades tailored for specific industrial, agricultural, and environmental applications.

The demand for eco-friendly construction materials, such as lightweight aggregates and pozzolanic additives, is also rising, as governments emphasize green building practices and energy efficiency. Furthermore, the strategic initiatives of key regional and multinational players, including partnerships, capacity expansions, and product innovations, are contributing to the robust growth trajectory of the Europe natural zeolite market.

Japan Natural Zeolite Market

Japan natural zeolite market is projected to reach approximately USD 20 million in 2025, reflecting a growing adoption of zeolites across industrial, agricultural, and environmental applications. The market growth is driven by the growing need for sustainable water treatment solutions, where natural zeolites are used to remove heavy metals, ammonium, and other contaminants from municipal and industrial wastewater.

In agriculture, zeolites are applied as soil conditioners and slow-release fertilizers, enhancing nutrient retention and improving crop yields. Additionally, their use in livestock feed helps improve animal digestion and reduce ammonia emissions, supporting environmental sustainability and regulatory compliance in the country.

The market in Japan is expected to grow at a compound annual growth rate of 7.9% over the coming years, fueled by technological advancements and rising environmental awareness. Manufacturers are focusing on high-purity and specialized zeolite grades tailored for chemical processing, industrial filtration, and environmental remediation.

The country’s emphasis on eco-friendly and energy-efficient construction materials has also contributed to increased demand, with zeolites being used as lightweight aggregates and pozzolanic additives in concrete. Strategic initiatives by regional and international players, including collaborations, capacity expansions, and product innovations, are further enhancing Japan’s market growth and strengthening its position in the global natural zeolite industry.

Global Natural Zeolite Market: Key Takeaways

- Market Value: The global Natural Zeolite market size is expected to reach a value of USD 3.5 billion by 2034 from a base value of USD 2.0 billion in 2025 at a CAGR of 6.2%.

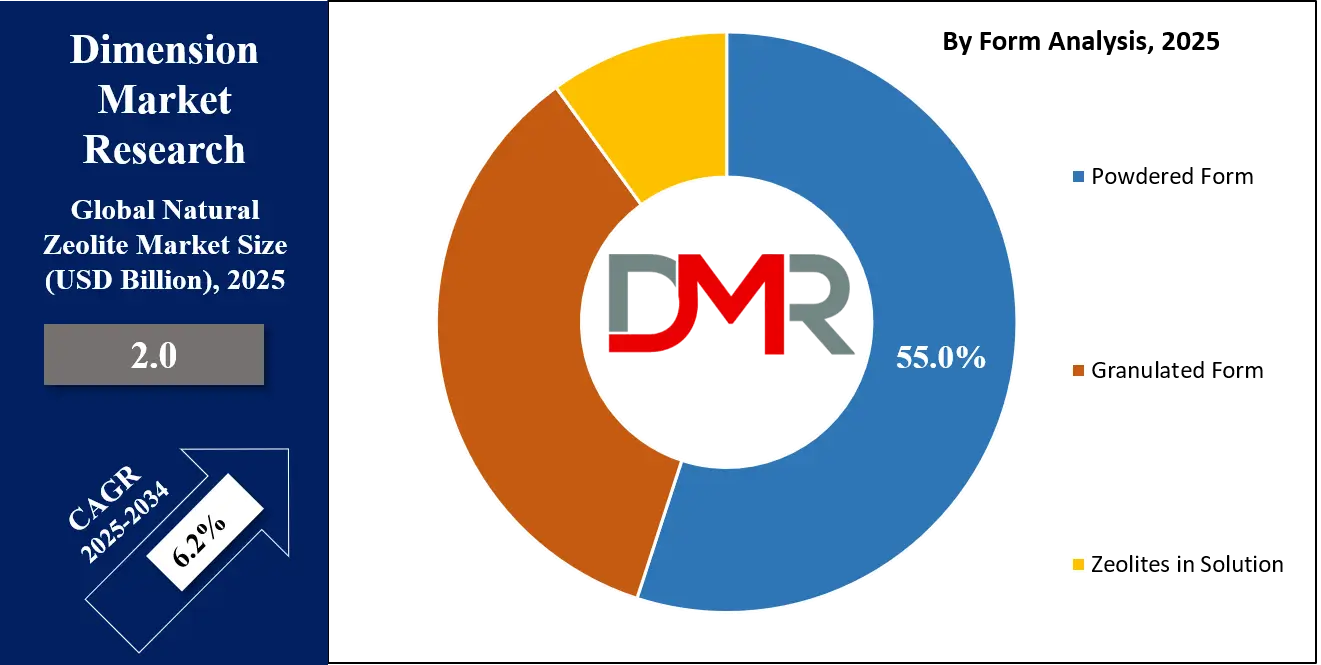

- By Form Segment Analysis: Powdered Form is anticipated to dominate the form segment, capturing 55.0% of the total market share in 2025.

- By Grade Segment Analysis: Chemical Grade is expected to maintain its dominance in the grade segment, capturing 40.0% of the total market share in 2025.

- By Granule Size Segment Analysis: Other sizes (0–1 mm, 3–5 mm, etc.) will dominate the granule size segment, capturing 65.0% of the market share in 2025.

- By Product Type Segment Analysis: Clinoptilolite will account for the maximum share in the product type segment, capturing 41.0% of the total market value.

- By Application Segment Analysis: Wastewater Treatment applications capture the maximum share in the application segment, capturing 31.0% of the market share in 2025.

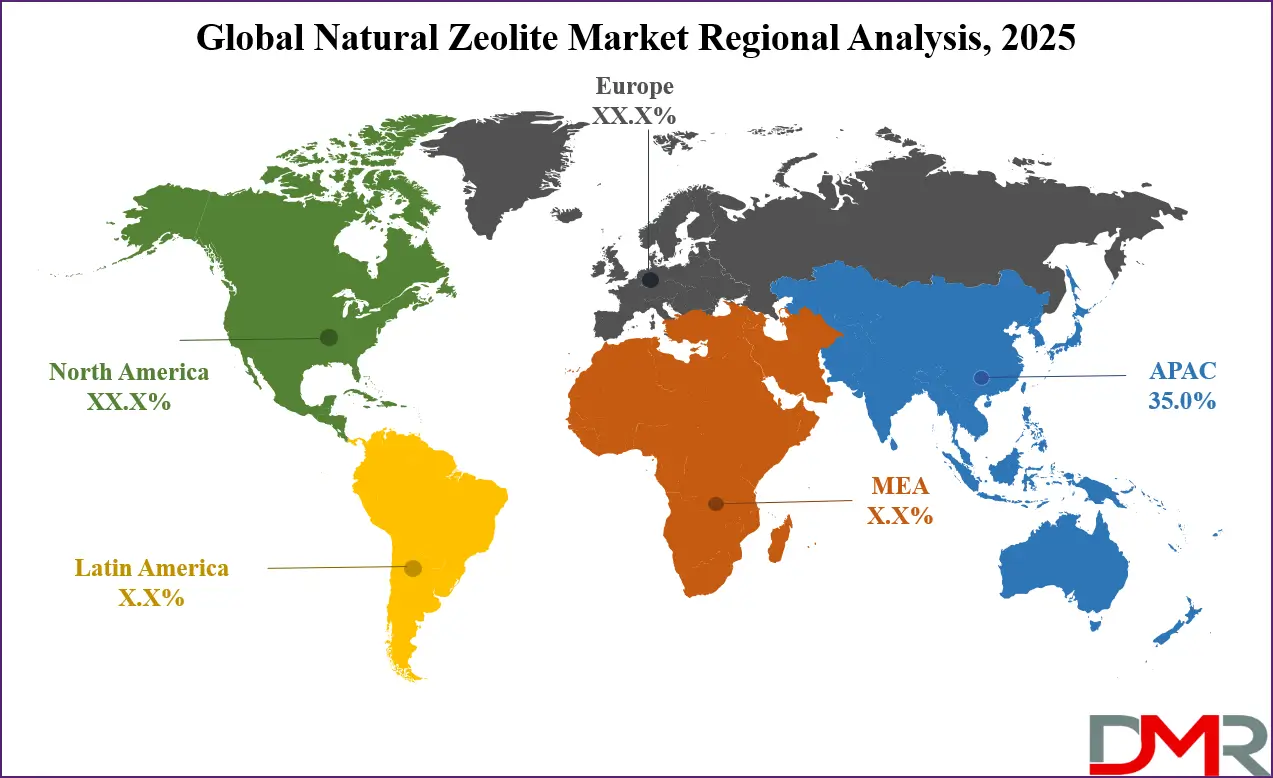

- Regional Analysis: Asia Pacific is anticipated to lead the global Natural Zeolite market landscape with 35.0% of total global market revenue in 2025.

- Key Players: Some key players in the global Natural Zeolite market include Akzo Nobel N.V., Albemarle Corporation, Asahi Kasei Corporation, Imerys, KMI Zeolite Inc., ZEOCEM s.r.o., Zeotech Corporation, International Zeolite Corp., Bear River Zeolite Co., United States Antimony Corporation, ROTA MINING CORPORATION, St. Cloud Mining, Maruti Mineral Industries, Apostolico e Tanagro, Blue Pacific Minerals, and Others.

Global Natural Zeolite Market: Use Cases

- Water and Wastewater Treatment: Natural zeolites are widely applied in water purification and wastewater treatment due to their high cation-exchange capacity and adsorption properties. They efficiently remove heavy metals, ammonium ions, and other contaminants from municipal and industrial effluents, supporting environmental sustainability. Industries increasingly use zeolites in filtration systems and water softening processes to comply with regulatory standards and improve water quality in agricultural, chemical, and manufacturing sectors.

- Agricultural Soil Enhancement: In agriculture, natural zeolites serve as soil conditioners and slow-release fertilizers. Their porous structure helps retain moisture and essential nutrients in the soil, improving crop productivity and reducing the need for chemical fertilizers. Zeolites also prevent nutrient leaching, promote healthy root development, and maintain soil pH balance, making them an eco-friendly solution for sustainable farming practices.

- Animal Feed Additives: Natural zeolites are used as feed additives to improve livestock health and productivity. They reduce ammonia emissions in animal housing, enhance nutrient absorption, and support digestion. By stabilizing pH levels in the digestive system and binding toxins, zeolites improve feed efficiency and animal growth performance, benefiting poultry, cattle, and swine farming operations.

- Construction and Industrial Applications: In construction, zeolites are used as pozzolanic materials and lightweight aggregates in concrete and cement, enhancing durability, thermal stability, and strength. Industrially, they act as catalysts, adsorbents, and molecular sieves in chemical processing, petrochemical, and gas purification applications. Their ability to improve structural performance while supporting sustainable construction practices drives adoption across the building and industrial sectors.

Impact of Artificial Intelligence on the global Natural Zeolite market

Artificial intelligence is increasingly influencing the global natural zeolite market by optimizing mining, processing, and quality control operations. Machine learning algorithms and predictive analytics help identify high-purity zeolite deposits, improve extraction efficiency, and reduce operational costs. In processing plants, AI-driven automation enhances particle size classification, purity testing, and production yield, while smart monitoring systems enable real-time tracking of chemical composition and performance parameters.

Additionally, AI applications in supply chain management and demand forecasting allow manufacturers to better align production with market needs, ultimately supporting innovation, sustainability, and competitive advantage across industrial, agricultural, and environmental applications of natural zeolites.

Global Natural Zeolite Market: Stats & Facts

U.S. Geological Survey (USGS) – Mineral Commodity Summaries

- In 2024, seven companies operated nine zeolite mines across six U.S. states, producing an estimated 81,000 tons of natural zeolites.

- In 2023, the U.S. produced approximately 78,000 tons of natural zeolites.

- Exports of natural zeolites from the U.S. have seen a gradual increase.

- Imports of natural zeolites remain limited, with most domestic consumption met through local production.

- The primary domestic applications include agriculture, water treatment, and industrial uses.

- Prices for natural zeolites have remained stable, with slight increases due to demand in environmental applications.

- Environmental regulations continue to influence mining practices and production volumes.

- Advancements in mining technology have led to more efficient extraction processes.

- Natural zeolite resources in the U.S. are considered abundant, supporting sustained production.

- U.S. zeolite production is concentrated in states such as Arizona, Nevada, California, Idaho, Montana, and Utah.

U.S. Department of the Interior – Data.gov

- The Department provides comprehensive datasets on natural zeolite production and trade.

- These datasets are publicly accessible, promoting transparency and research.

- Regular updates ensure the information reflects current production and trade conditions.

- Researchers and policymakers utilize this data for analysis and decision-making.

- The Department collaborates with other agencies to enhance data accuracy.

- The platform offers educational materials to help users interpret the data.

- Feedback mechanisms are in place to improve data quality and usability.

- Information is available in various formats, including XML and CSV, for ease of use.

- Data encompasses all U.S. states with zeolite mining activities.

- The data provides insights into regional applications and consumption patterns.

U.S. Geological Survey – Mineral Commodity Summaries 2023

- From 1993 through 2023, production and sales of natural zeolites more than doubled.

- Key applications include animal feed, water purification, and soil enhancement.

- The U.S. supply chain remains robust, with domestic production meeting most national needs.

- Zeolites are widely used in environmental remediation due to their chemical properties.

- Industries increasingly use natural zeolites for sustainable and eco-friendly applications.

- Government policies support the use of natural zeolites in environmental and agricultural applications.

- Ongoing research focuses on improving the efficiency and applications of natural zeolites.

- International trade in zeolites is balanced, with exports and imports aligning closely.

- Domestic consumption includes water treatment facilities, agriculture, and industrial processes.

- High-purity zeolite grades are produced to meet the needs of specialized chemical and environmental applications.

Global Natural Zeolite Market: Market Dynamics

Global Natural Zeolite Market: Driving Factors

Rising Demand for Water Treatment Solutions

The growing need for clean and safe water is a major driver for the natural zeolite market. Natural zeolites’ ion-exchange and adsorption capabilities make them highly effective in removing heavy metals, ammonia, and other contaminants from municipal and industrial wastewater. Regulatory pressure on water quality and sustainability initiatives across the globe further boosts their adoption in water treatment and filtration systems.

Expansion in Agricultural Applications

Increasing emphasis on sustainable farming practices is driving the demand for natural zeolites as soil conditioners and slow-release fertilizers. Their ability to retain nutrients, improve soil fertility, and enhance crop yields positions them as a preferred alternative to conventional chemical fertilizers. This, integrated with their use in livestock feed to enhance digestion and reduce ammonia emissions, reinforces market growth in the agricultural sector.

Global Natural Zeolite Market: Restraints

Environmental Concerns Related to Mining

The extraction of natural zeolites can lead to environmental challenges, including landscape disruption, dust generation, and water resource depletion. Stringent environmental regulations and high compliance costs in certain regions can limit the growth potential of mining operations and affect overall supply availability.

Competition from Synthetic Zeolites

Synthetic zeolites, which can be tailored for specific pore sizes and adsorption properties, pose a significant challenge to the natural zeolite market. Their customizable nature and consistent quality often make them preferable in high-precision industrial and chemical applications, limiting the market penetration of naturally occurring zeolites in certain sectors.

Global Natural Zeolite Market: Opportunities

Growth in Eco-Friendly Construction Materials

Natural zeolites are increasingly used in construction as pozzolanic additives and lightweight aggregates to enhance concrete durability, thermal stability, and structural strength. Rising demand for sustainable and energy-efficient building materials creates a significant opportunity for manufacturers to expand their product offerings in the construction industry.

Advancements in High-Purity Zeolite Production

Innovations in processing technologies enable the production of high-purity and specialized natural zeolite grades for niche applications in pharmaceuticals, chemical processing, and environmental remediation. These advancements open avenues for premium product development and higher-value industrial applications.

Global Natural Zeolite Market: Trends

Adoption of Digital and AI-Driven Mining Solutions

The integration of digital technologies and artificial intelligence in mining and processing operations is gaining momentum. AI-based predictive analytics and automation enhance deposit identification, extraction efficiency, and quality control, reducing operational costs and boosting overall productivity.

Increasing Focus on Environmental Sustainability

Sustainability-driven trends are pushing industries to adopt natural zeolites in agriculture, water treatment, and industrial processes to reduce chemical usage and environmental impact. Their eco-friendly properties and ability to support circular economy practices make them a preferred choice in green initiatives.

Global Natural Zeolite Market: Research Scope and Analysis

By Form Analysis

In the global natural zeolite market, the powdered form is anticipated to dominate the form segment, capturing 55.0% of the total market share in 2025. This dominance can be attributed to its exceptional versatility and ease of application across a wide range of industries. The fine particle size of powdered zeolites facilitates rapid ion exchange and efficient adsorption of impurities, making it ideal for water purification and wastewater treatment processes.

In agriculture, powdered zeolites enhance soil fertility and nutrient retention, allowing crops to absorb essential minerals more effectively. They are also incorporated into animal feed to improve digestion and reduce harmful ammonia emissions. Furthermore, the powdered form can be easily blended and customized for specific industrial applications, such as chemical processing and environmental remediation, making it the preferred choice for manufacturers and end-users seeking optimal performance and operational efficiency.

Granulated zeolites, while occupying a smaller share of the market, play a critical role in applications that require controlled release and structural stability. This form is particularly suitable for wastewater treatment beds, where the larger particle size ensures longer operational life and consistent contaminant removal over time. In agriculture, granulated zeolites are used as slow-release fertilizers that gradually provide essential nutrients to the soil, preventing leaching and improving crop yield sustainably.

They are also utilized in livestock feed systems to support prolonged interaction with feed, enhancing nutrient absorption and animal growth. The granulated form’s durability and ability to maintain performance under varying environmental conditions make it an essential complement to powdered zeolites, ensuring that diverse industrial and environmental needs are effectively addressed.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Grade Analysis

In the global natural zeolite market, chemical grade zeolites are expected to maintain their dominance in the grade segment, capturing 40.0% of the total market share in 2025. Chemical grade zeolites are characterized by high purity and consistent composition, making them highly suitable for applications that demand precise chemical performance. They are extensively used in water treatment to remove heavy metals and ammonia, in chemical processing as catalysts or adsorbents, and in industrial manufacturing processes that require stable ion-exchange properties.

Their uniform quality and superior adsorption efficiency allow manufacturers to achieve reliable results in environmental remediation, wastewater purification, and chemical synthesis. The versatility and high-performance characteristics of chemical grade zeolites continue to drive their preference among industries that require stringent quality standards and efficient operational outcomes.

Industrial grade zeolites, while slightly lower in market share, are widely used in construction, agriculture, and general industrial applications. They are incorporated as pozzolanic additives in cement and concrete to improve strength, durability, and thermal stability.

In agriculture, industrial grade zeolites act as soil conditioners and slow-release nutrient carriers, enhancing soil quality and crop yield. They are also applied in livestock feed to improve digestion and reduce ammonia emissions in animal housing. Industrial grade zeolites are valued for their robustness, cost-effectiveness, and ability to perform efficiently in large-scale operations, making them a key component of various industrial and environmental applications.

By Granule Size Analysis

In the global natural zeolite market, granules of other sizes, including 0–1 mm and 3–5 mm, are expected to dominate the granule size segment, capturing 65.0% of the market share in 2025. These varied sizes offer flexibility across multiple applications, allowing industries to select the most suitable particle dimensions for specific processes. Smaller granules, such as 0–1 mm, are highly effective in water treatment and filtration systems where rapid adsorption of impurities is required, while larger granules, such as 3–5 mm, are preferred in applications like slow-release fertilizers and livestock feed where gradual interaction with the medium is necessary. The availability of multiple granule sizes ensures that natural zeolites can meet diverse industrial, agricultural, and environmental demands, making this segment highly versatile and widely adopted across regions.

Granules in the 1–3 mm range also hold significant importance in the market, particularly for applications that require a balance between surface area and structural stability. This size range is ideal for wastewater treatment beds, where it provides adequate adsorption efficiency while maintaining durability and resistance to abrasion.

In agriculture, 1–3 mm granules serve as effective soil conditioners and nutrient carriers, gradually releasing minerals to improve soil fertility and support healthy crop growth. Their intermediate size also makes them suitable for use in animal feed, ensuring controlled interaction with feed while maintaining ease of handling and consistent performance. The 1–3 mm granule size offers a practical solution for industries seeking efficiency, reliability, and operational flexibility in their natural zeolite applications.

By Product Size Analysis

In the global natural zeolite market, clinoptilolite is expected to account for the maximum share in the product type segment, capturing 41.0% of the total market value. Clinoptilolite is highly favored due to its superior cation-exchange capacity, high adsorption efficiency, and thermal stability, which make it suitable for a wide range of industrial, agricultural, and environmental applications. It is extensively used in water purification and wastewater treatment to remove heavy metals, ammonium ions, and other contaminants, supporting sustainable water management practices.

In agriculture, clinoptilolite enhances soil fertility, improves nutrient retention, and serves as a slow-release fertilizer, while in livestock feed, it promotes digestion and reduces harmful ammonia emissions. Its versatility, consistent performance, and cost-effectiveness have established clinoptilolite as the leading choice among natural zeolite types in the market.

Mordenite, while accounting for a smaller share compared to clinoptilolite, is recognized for its high thermal and chemical stability, making it ideal for specialized industrial applications. It is commonly used as a catalyst in petrochemical processes, adsorption medium in gas purification, and as an additive in chemical processing industries.

Mordenite’s crystalline structure allows it to selectively adsorb specific molecules, which enhances its efficiency in environmental remediation and industrial filtration systems. Its robustness under high-temperature conditions and ability to perform in demanding chemical environments make mordenite an important product type in the natural zeolite market, complementing the broader applications of clinoptilolite.

By Application Analysis

In the global natural zeolite market, wastewater treatment applications are expected to capture the maximum share in the application segment, accounting for 31.0% of the market share in 2025. Natural zeolites are widely used in municipal and industrial wastewater treatment due to their excellent ion-exchange and adsorption properties.

They efficiently remove heavy metals, ammonium, and other harmful contaminants, ensuring compliance with environmental regulations and improving water quality. Zeolites are employed in filtration beds, water softening systems, and industrial effluent treatment plants, providing sustainable solutions for water purification. Their chemical stability, high cation-exchange capacity, and reusability make them cost-effective and highly reliable for large-scale wastewater management applications.

In agriculture, natural zeolites are utilized to improve soil health, nutrient retention, and crop productivity. They act as slow-release fertilizers, retaining essential minerals and preventing nutrient leaching, which enhances soil fertility over time. Zeolites also improve water retention in soils, supporting drought resistance and healthier root development.

In addition, they are incorporated into livestock feed to promote digestion, reduce ammonia emissions, and enhance overall animal health. The agricultural application of natural zeolites is gaining traction due to the growing focus on sustainable farming practices, eco-friendly soil management, and efficient use of fertilizers, making it a vital segment of the market.

The Natural Zeolite Market Report is segmented on the basis of the following:

By Form

- Powdered Form

- Granulated Form

- Zeolites in Solution

By Grade

- Chemical Grade

- Industrial Grade

- Food Grade

- Pharmaceutical Grade

By Granule Size

By Product Type

- Clinoptilolite

- Mordenite

- Phillipsite

- Others

By Application

- Wastewater Treatment

- Agriculture

- Animal Feed Additives

- Construction Materials

- Soil Remediation

- Industrial Applications

- Others

Global Natural Zeolite Market: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is anticipated to lead the global natural zeolite market landscape, capturing 35.0% of the total global market revenue in 2025. The region’s dominance is driven by the presence of abundant natural zeolite reserves, integrated with growing industrialization and growing demand from key end-use sectors such as agriculture, water treatment, and construction. Countries in the region are investing heavily in sustainable farming practices, wastewater management, and eco-friendly building materials, which has accelerated the adoption of natural zeolites.

Additionally, the expanding livestock industry and rising awareness about environmental conservation further contribute to the market growth, positioning Asia Pacific as a major hub for both production and consumption of natural zeolites in the global market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

The Middle East and Africa region is expected to witness significant growth in the global natural zeolite market over the coming years. This growth is fueled by growing investments in water treatment infrastructure, agricultural modernization, and industrial development across key countries. The region’s arid climate and water scarcity issues have driven the adoption of natural zeolites in wastewater treatment and irrigation systems to improve water efficiency and soil quality.

Additionally, expanding livestock farming and the demand for eco-friendly construction materials present new opportunities for market players, making the Middle East and Africa a high-potential region for natural zeolite applications and revenue growth.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Natural Zeolite Market: Competitive Landscape

The global natural zeolite market is characterized by a competitive landscape featuring a mix of established multinational corporations and specialized regional players. Leading global companies such as Imerys, BASF SE, Honeywell International Inc., Clariant, and Arkema Group have a significant presence, leveraging their extensive resources and technological expertise to dominate the market. These industry giants focus on product innovation, strategic partnerships, and expanding their global footprint to maintain a competitive edge.

In addition to these multinationals, regional players like International Zeolite Corp., ZEOCEM s.r.o., KMI Zeolite Inc., Zeotech Corporation, and Maruti Mineral Industries contribute to the market's dynamism. These companies often capitalize on local resource availability, cost-effective production methods, and tailored solutions to meet specific regional demands. The market's competitiveness is further intensified by the growing adoption of natural zeolites across various applications, including agriculture, water treatment, and construction, prompting both global and regional players to innovate and expand their market presence.

Some of the prominent players in the global Natural Zeolite market are:

- Akzo Nobel N.V.

- Albemarle Corporation

- Asahi Kasei Corporation

- Imerys

- KMI Zeolite Inc.

- ZEOCEM s.r.o.

- Zeotech Corporation

- International Zeolite Corp.

- Bear River Zeolite Co.

- United States Antimony Corporation

- ROTA MINING CORPORATION

- St. Cloud Mining

- Maruti Mineral Industries

- Apostolico e Tanagro

- Blue Pacific Minerals

- Castle Mountain Zeolites

- Gordes Zeolite

- Grupo Coypus

- Zeogroup

- Qemetica

- Other Key Players

Global Natural Zeolite Market: Recent Developments

- December 2024: Researchers unveiled a new aluminosilicate zeolite, ZMQ-1, featuring a unique intersecting meso-microporous channel system. This breakthrough is expected to enhance catalytic processes in the petrochemical industry, offering improved efficiency and selectivity.

- October 2024: Mother Nature Supplements launched a new zeolite-based detox supplement, Zeolite 500 mg – Clinoptilolite Mineral Powder, in vegan capsule form. This product targets consumers seeking natural detoxification options and aligns with the growing trend towards plant-based supplements.

- August 2024: United States Antimony Corporation announced the acquisition of new mining claims in Montana to enhance its resource base and increase production capabilities in antimony. This acquisition supports the company's growth strategy by providing opportunities for exploration and development, ensuring a stable supply of antimony for its customers.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 2.0 Bn |

| Forecast Value (2034) |

USD 3.5 Bn |

| CAGR (2025–2034) |

6.2% |

| The US Market Size (2025) |

USD 0.5 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Form (Powdered Form, Granulated Form, Zeolites in Solution), By Grade (Chemical Grade, Industrial Grade, Food Grade, Pharmaceutical Grade), By Granule Size (1-3 mm, Others), By Product Type (Clinoptilolite, Mordenite, Phillipsite, Others), and By Application (Wastewater Treatment, Agriculture, Animal Feed Additives, Construction Materials, Soil Remediation, Industrial Applications, Others)

|

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Akzo Nobel N.V., Albemarle Corporation, Asahi Kasei Corporation, Imerys, KMI Zeolite Inc., ZEOCEM s.r.o., Zeotech Corporation, International Zeolite Corp., Bear River Zeolite Co., United States Antimony Corporation, ROTA MINING CORPORATION, St. Cloud Mining, Maruti Mineral Industries, Apostolico e Tanagro, Blue Pacific Minerals, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |