Needle-free injectors are devices specifically designed to administer medications and vaccines without using traditional injection techniques. Utilizing high-pressure technology, needle-free injectors use liquid streams that penetrate skin directly, dispensing medication into underlying tissue. In addition to medical use, this technology is increasingly being explored for the precise delivery of

skin care products, supporting non-invasive cosmetic treatments and enhanced absorption of topical formulations. Growing adoption across the broader needle-free drug delivery market has further accelerated interest in these systems.

This method helps alleviate pain, reduces needle-stick injuries, and eliminates needle waste, making it ideal for many medical uses such as insulin delivery, vaccinations, and administering growth hormones. It has become widely utilized within this sector.

Needle-free drug delivery technology is an innovative concept that encompasses various medication delivery devices that recently hit the market, with widespread global adoption of such advanced solutions aiding market expansion.

Needle-free injectors have seen tremendous growth due to consumer preference for pain-free injections. Utilizing high-pressure technology for administering medication via skin injection, these injectors have become an attractive solution for individuals who either fear needles or require frequent shots. This uptake is also reflected in the increasing popularity of needleless injection systems designed to improve safety and patient comfort.

As chronic diseases like diabetes continue to rise in prevalence and prevalence rates, needle-free injectors are being widely adopted both clinically as well as within home healthcare environments as more comfortable ways to administer treatments are adopted by both.

Recent technological innovations are making needle-free injectors more accurate and intuitive to use than ever. Thanks to jet injectors and micro-needle patches, patients now enjoy improved experiences while receiving effective drug delivery solutions – this should boost market appeal among healthcare professionals as well as patients alike. These advancements are also fueling expansion across the global jet injector market.

As more pharmaceutical companies integrate needle-free injectors into their product offerings, opportunities in this market have grown substantially. Furthermore, an increasing interest in self-administered treatments - specifically vaccines and biologics - makes needle-free injectors an integral component of patient centered care that could pave the way for new product launches or partnerships.

The needle-free injector market is experiencing rapid expansion due to advances in drug delivery technology. Over 20% of global population suffers from chronic conditions like diabetes that require injections at regular intervals; needle-free injectors offer an alternative for 10 million U.S. residents alone -- helping reduce needle related anxiety while improving patient adherence.

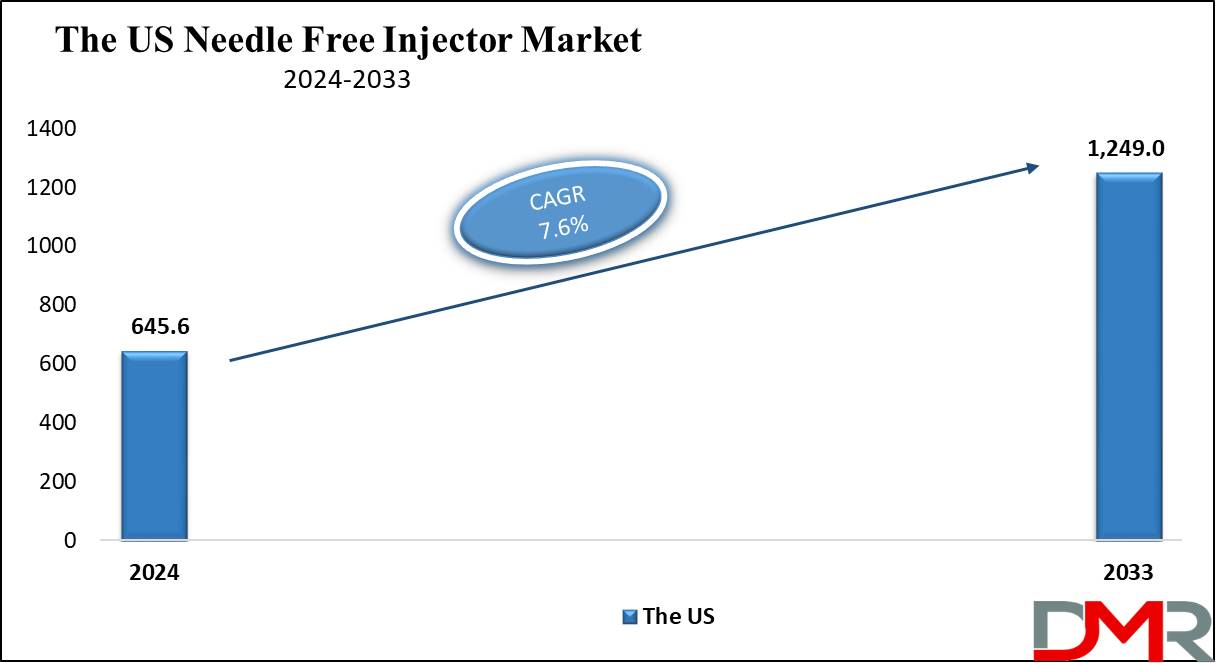

The US Needle-free Injectors Market

The

US Needle-Free Injectors Market is expected to reach

USD 645.6 million by the end of 2024 and is projected to grow significantly to an estimated

USD 1,249.0 million by 2033, with a

CAGR of 7.6%.

Diabetes and cancer, both on the rise in prevalence rates, require painless yet efficient drug delivery methods which drive demand for needle-free injectors in the US. A strong regulatory environment supporting innovative

medical devices in the US also aids needle-free injector adoption.

As healthcare costs decrease and convenience increases, more individuals are opting for self-administration of medications at home. Advanced needle-free injectors are being created which increase patient appeal as well as healthcare provider adoption rates due to technological innovations. Moreover, the integration of

healthcare CRM solutions is enhancing patient engagement and adherence by improving communication, monitoring, and personalized care coordination around these self-administration technologies.

Key Takeaways

- Market Growth: The global needle-free injectors market is expected to grow by USD 1,394.7 million, at a CAGR of 7.8 %, during the forecasted period i.e. from 2025 to 2033.

- Market Definition: Needle-free injectors are bio-medical devices that deliver medication without using a needle.

- Product Analysis: In terms of product, Fillable injectors are predicted to lead the global market with a high revenue share in 2024.

- Technology Analysis: Based on the technology, Gas-powered is expected to dominate the global market with a high revenue share of 36.0 % in 2024.

- Usability Analysis: The reusable segment is projected to lead the needle-free injector market with a substantial market share in 2024.

- Injector Type Analysis: Liquid-based injectors are expected to command the highest revenue share in the global needle-free injector market in 2024.

- Application Analysis: Vaccine delivery is forecasted to be one of the leading application segments in the global needle-free injectors market in 2024.

- Delivery Site Analysis: Subcutaneous delivery sites are dominating the needle-free injector market with the highest revenue share of 50.9% in 2024.

- End User Analysis: Hospitals are projected to lead the global needle-free injectors market in terms of revenue, with a 47.9% market share in 2024.

- Regional Analysis: North America is predicted to dominate the global needle-free injectors market with the highest market share of 51.3 % in 2024.

Use Cases

- Vaccine Programs: Vaccines delivered by needle-free injection are employed in mass vaccination campaigns to improve patient compliance and reduce the risk of needle-stick injuries as these are useful for administering vaccines in large populations quickly and efficiently.

- Diabetes Management: The use of needle-free injection systems offers a pain-free alternative for insulin delivery for diabetic patients as these can reduce the psychological burden associated with needle use.

- Allergy Treatment: These injectors are used for administering allergy shots to provide a convenient and less painful option for patients who require regular injections to manage their allergies.

- Cosmetic Procedure: Needle-free injectors are used for the delivery of various substances, such as fillers and botulinum toxin, to reduce wrinkles and enhance facial aesthetics.

Market Dynamic

Drivers

Benefits of Needle-Free Injector

The needle-free injector market offers a convenient and painless alternative to traditional needle-based methods for administering medications. They are used for treating many conditions and are expected to see market growth due to the rising prevalence of chronic diseases like osteoporosis & diabetes. The market is anticipated to expand over the forecast period as these innovative devices provide a way to deliver medications without piercing the skin.

High Emphasis on Patient Comfort

Needle-free injectors offer a pain-free alternative to traditional needle-based injections, which is especially advantageous for patients who fear needles or experience discomfort during injections. More patients are opting for this painless drug delivery system which increases the growth of the market.

Opportunities

Government initiatives

The global healthcare industry is transforming rapidly which influences public health and economic activity. Government initiatives aimed at advancing healthcare systems are driving the demand for needle-free injector industry. These initiatives are focused on increasing the adoption of needle-free injectors in households, hospitals, and independent laboratories, which provides an opportunity for the growth of the market.

Investment in Research and Development

Investment in R&D is expected to be a significant driver of growth in the needle-free injectors market, with both developed and emerging economies contributing to this trend. The continuous advancement in medical device technology and innovation in product design are pivotal in fueling market expansion.

Trends

Expanding Uses across Various Sectors

Needle-free injection technology has evolved beyond traditional hospital settings and is now being applied in veterinary medicine and cosmetic procedures. This broader range of applications has led to a significant rise in demand for needle-free injectors within the healthcare, cosmetic, and veterinary industries.

Growing adoption of diabetes Management

Increasing prevalence of diabetes and the need for more patient-friendly administration methods are driving the adoption of needle-free injectors. It improves compliance and reduces needle phobia among diabetic patients.

Restraints

Limited Awareness and Acceptance

Emerging technology in needle-free injectors remains relatively novel and is not as familiar or widely embraced as traditional needle injections. Both healthcare providers and patients are unsure about how well these devices work, their safety, and their reliability, which could slow down their wider acceptance among healthcare professionals.

High Cost of Products

Needle-free injector devices often come with a higher price tag compared to conventional needle-based systems. The initial investment and ongoing maintenance costs associated with these devices could restrict their use, especially in low-income areas or healthcare settings with limited budgets, which obstruct the growth of this market.

Research Scope and Analysis

By Product

Fillable injectors are expected to dominate the needle-free injector market with the highest revenue share in 2024, due to their flexibility and adaptability across many applications. It allows users to load different types of medications, accommodating a wider range of therapeutic needs.

This versatility makes fillable injectors particularly valuable in settings where different drugs or doses are required. The global presence of established manufacturing infrastructure for fillable injectors has contributed to their high adoption rates. They are preferred in environments where customization and cost-effectiveness are critical, like in large-scale medical facilities and emergency settings.

The widespread adoption of fillable needle-free injectors is also driven by their cost benefits and user convenience. These devices often have lower initial costs compared to prefilled needle-free injectors, as they do not come preloaded with medication, reducing manufacturing and storage expenses.

Furthermore, healthcare providers value the ability to refill these devices with many medications, making them suitable for a broader range of applications and improving their overall utility. This combination of adaptability, cost-effectiveness, and widespread availability positions fillable needle-free injectors as a dominant force in the market, catering to diverse medical requirements and improving their appeal in global healthcare settings.

By Technology

Gas-powered technology is predicted to dominate the needle-free injector market with a market share of 36.0% in 2024 as they are versatile and suitable for transdermal, subcutaneous, or intramuscular use.

This technology is getting popular due to its improved dosage accuracy, rapid drug administration, quicker patient response rates, and improved drug diffusion into tissues. The dominance of these injectors is due to their ability to deliver medications quickly & efficiently, which is crucial in both routine and emergency medical situations.

The precision offered by these injectors allows patients to receive the exact amount of medication needed, minimizing the risk of errors. These kinds of injectors are important for drugs requiring exact dosages, such as insulin or vaccines.

Rapid administration and better tissue diffusion offered by gas-powered injectors lead to faster relief and more effective treatment outcomes for patients. The strong reliability of these injectors makes them a preferred choice in various healthcare settings. They are often designed to be durable and easy to use, reducing the training burden on healthcare providers and ensuring consistent performance.

Meanwhile, laser-powered needle-free injectors also held a significant market share due to their ongoing advancements and innovations in this technology which enhance the precision and effectiveness of laser injectors, potentially challenging the current dominance of gas-powered options.

By Usability

The reusable segment is predicted to lead the needle-free injector market with a significant market share in 2024. Healthcare professionals and doctors frequently recommend reusable needle-free injectors to minimize the risk of infections and other health complications. These injectors are known for their exceptional durability, as they are crafted from high-quality, precision-engineered materials, allowing them to be used multiple times.

It is also preferred due to its long-term cost-effectiveness and sustainability. Reusable needle-free injectors are perfectly able to be used repeatedly making them more economical over time, especially in settings with high patient turnover. These features are particularly important in hospitals and clinics where budget constraints are a concern. These injectors are manufactured with high-quality materials which ensure they maintain their effectiveness and safety over multiple uses.

Healthcare industries can significantly reduce the volume of single-use plastic waste by using durable long-lasting injectors that align with sustainability goals as they are environment friendly. Meanwhile, the disposable segment is presenting notable growth due to its ease of use in administering many low-volume injections or varying doses.

By Type

Liquid-based injectors are anticipated to dominate the global needle-free injector market with a high revenue share in 2024. This dominance is due to its ability to efficiently deliver medications without compromising the integrity of the drug molecule. These injectors use a high-speed liquid jet that penetrates the skin and underlying fat layer, ensuring precise and painless delivery of the medication.

It addresses the common concerns associated with traditional needles, like needle phobia, risk of needle-stick injuries, & potential for infection. Growing cases of diseases like diabetes & rheumatoid arthritis, which require frequent and long-term medication administration, have driven the demand for more patient-friendly and efficient drug delivery systems. These injectors offer an attractive alternative by improving patient compliance and reducing discomfort, thereby improving the overall treatment experience.

There is a growing focus on self-administrated medication, particularly in home healthcare settings, which also contributes to the dominance of liquid-based needle-free injectors. Their convenience, along with the ability to deliver a wide range of medications, including vaccines, hormones, & biologics, makes them a preferred choice in the market.

By Application

Vaccine delivery is among the leading application segments in the global needle-free injectors market in 2024. Immunizing against various medical conditions has become an increasing global focus, driving greater immunization coverage across different age groups more quickly and creating demand for efficient, safe, patient-centric delivery methods that offer fast service delivery.

Needle-free injectors help eliminate fear and discomfort associated with traditional needle injections to increase patient compliance - particularly among children or needle-phobic individuals.

Furthermore, this technology mitigates needle-stick injuries and cross-contamination risks during vaccine administration in healthcare environments, essential in upholding safety standards for their safe administration. Furthermore, its precise delivery ensures the optimal efficacy of vaccines. These injectors can be especially advantageous during mass immunization campaigns and in regions with limited healthcare infrastructure, as their ease of use does not necessitate highly trained personnel.

Insulin delivery is one of the key drivers behind the needle-free injector market's expansion after vaccine delivery, due to increasing instances of diabetes worldwide and continued demand for more effective insulin administration methods.

By Delivery Site

Subcutaneous delivery sites are expected to dominate the needle-free injector market with an estimated revenue share of 50.9% in 2024. Subcutaneous tissue's high vascularization enables quick absorption and onset of action for medications like insulin, vaccines, and therapeutic agents requiring fast absorption that makes subcutaneous injections an ideal method of administering large volumes more rapidly compared to intradermal ones while increasing needle-free technology's range of applications given the ever-increasing demands of biologics and vaccines treatments.

Intramuscular delivery site is dominating after subcutaneous as needle free injectors are used to deliver medications deep into the muscles, where they are absorbed into the bloodstream. It is mainly employed for vaccines, hormone treatments, and certain medications that require a rapid onset of action.

By End User

Hospitals are projected to lead the global needle-free injectors market in revenue in 2024 with a 47.9% market share as it manages a high volume of patients requiring various injections, including vaccines, insulin, and other medications. The requirement of these injectors in hospitals is high due to their potential to reduce needle-stick injuries, minimize pain, and enhance patient comfort, thereby improving the overall patient experience.

The use of these needle-free injectors in hospitals improves safety protocols and infection control measures. It cut down the chances of cross-contamination associated with traditional needles, a critical concern in hospital environments. The increasing rate of hospitalizations, along with the rising number of hospitals globally, is anticipated to drive market growth during the forecast period.

Home care settings are emerging as the dominant force in the needle-free injectors market, due to increasing cases of diabetes and arthritis necessitating frequent administration of medications, which are more convenient to manage at home. The demand for needle-free injections is increasing due to the growing emphasis on patient comfort and the desire to reduce hospital visits and associated costs has fueled the adoption of home-based treatments.

The Needle Free Injectors Market Report is segmented based on the following

By Product

By Technology

- Spring-based Injectors

- Gas-powered Injectors

- Laser-powered Injectors

- Vibration-based Injectors

By Usability

By Type

- Liquid-based Needle Free Injectors

- Powder-based Needle Free Injectors

- Projectile/depot-based Needle Free Injectors

By Application

- Vaccine Delivery

- Insulin Delivery

- Pain Management

- Others

By Delivery Site

- Subcutaneous

- Intramuscular

- Intradermal

By End User

- Hospitals

- Clinics

- Home Care Settings

- Research Laboratories

- Others

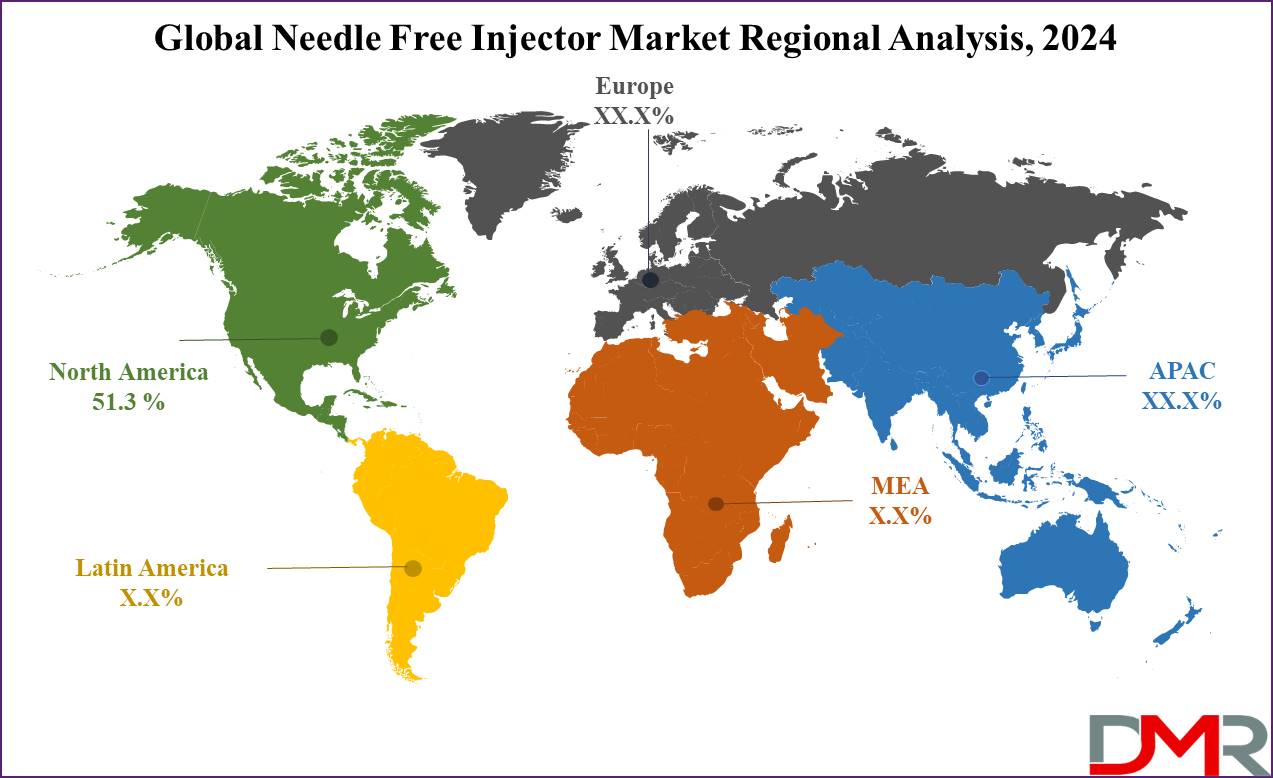

Regional Analysis

North America is expected to dominate the global needle-free Injectors market with a revenue

share of 51.3% in 2024, due to the presence of major market players in the U.S., and the rising prevalence of chronic & lifestyle-related diseases. There is a growing trend in the U.S. and Canada towards self-administration of medications, which is expected to further drive the growth of this region.

Well-established healthcare infrastructure, characterized by advanced medical facilities and a high level of healthcare expenditure offered by this region, drives the growth. This stable infrastructure supports the global adoption of innovative medical technologies, including needle-free injectors. Some conditions like diabetes and autoimmune disorders often require regular injections, making needle-free injectors an attractive alternative due to their ability to reduce pain and discomfort.

Moreover, the adoption of emerging needle-free technology among healthcare providers and patients contributes to the market's growth. The presence of regulatory support and favorable reimbursement policies also play a significant role in the dominance of North America in this market.

After North America, Asia-Pacific is projected to experience the highest CAGR during the forecast period driven by several factors, including the rapidly developing healthcare industries in China & India, an aging population, increasing life expectancy, rising per capita income, and significant investments from key market players.

The dominance of this region is also due to the expansion of private-sector hospitals and clinics into rural areas, the availability of low-cost labor for manufacturing, a favorable regulatory environment, and the growing demand for self-injectable device testing.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Major players operating in the market are adopting strategies such as innovating their products and services and engaging in mergers and acquisitions to expand the functionality of their product portfolios and maintain competitiveness. Key players in the needle-free injectors market are Gerresheimer AG, Pfizer Inc., Halozyme, CSL Limited (Seqirus UK Limited), Crossject, Portal Instruments, Ferring Pharmaceuticals, PharmaJet Inc., and PenJet Corporation.

Market players are focusing on the expansion of their brands in emerging regions and manufacturing the newly revised product. Manufacturers are also adopting a slew of expansion strategies such as acquisitions, new product launches and approvals, agreements, partnerships, and collaborations to strengthen their market presence.

Some of the prominent players in the global needle-free injectors market are

- PharmaJet

- Crossject

- Portal Instruments

- NuGen Medical Devices

- Inovio Pharmaceuticals

- Antares Pharma, Inc

- Aijex Pharma International Inc.

- Ferring B.V.

- Penjet Corporation

- Medical International Technology Inc.

- Other Key Players

Recent Development

- In September 2023, PharmaJet, a company specializing in precision delivery systems, reported positive results from Scancell's Phase 2 clinical study, which used PharmaJet's Stratis System for needle-free injections to treat patients with unresectable advanced melanoma. This method was preferred by patients.

- In September 2023, the Indian government introduced GEMCOVAC-OM, an mRNA-based COVID-19 booster vaccine tailored for Omicron variants. Administered intradermally using a needle-free injector, this thermostable vaccine elicited stronger immune responses in study participants.

- In August 2023, Pulse NeedleFree Systems launched the first-ever range of disposable needle-free vaccination equipment for animals, offering pig farmers health and food safety benefits at a cost comparable to traditional syringes and needles.

- In June 2023, PharmaJet partnered with Zydus Lifesciences to deliver the world's first plasmid DNA COVID-19 vaccine using its Tropis system, which has been shown to enhance immune response and clinical effectiveness.

- In March 2022, NovaXS Biotech received investor support for its patented needle-free injector. The device possesses a cloud-based platform that collects patient information for physicians. Information such as injection time, frequency, dosage volume, and medication temperature are expected to help physicians understand the effects of the dosage on the patient.