Market Overview

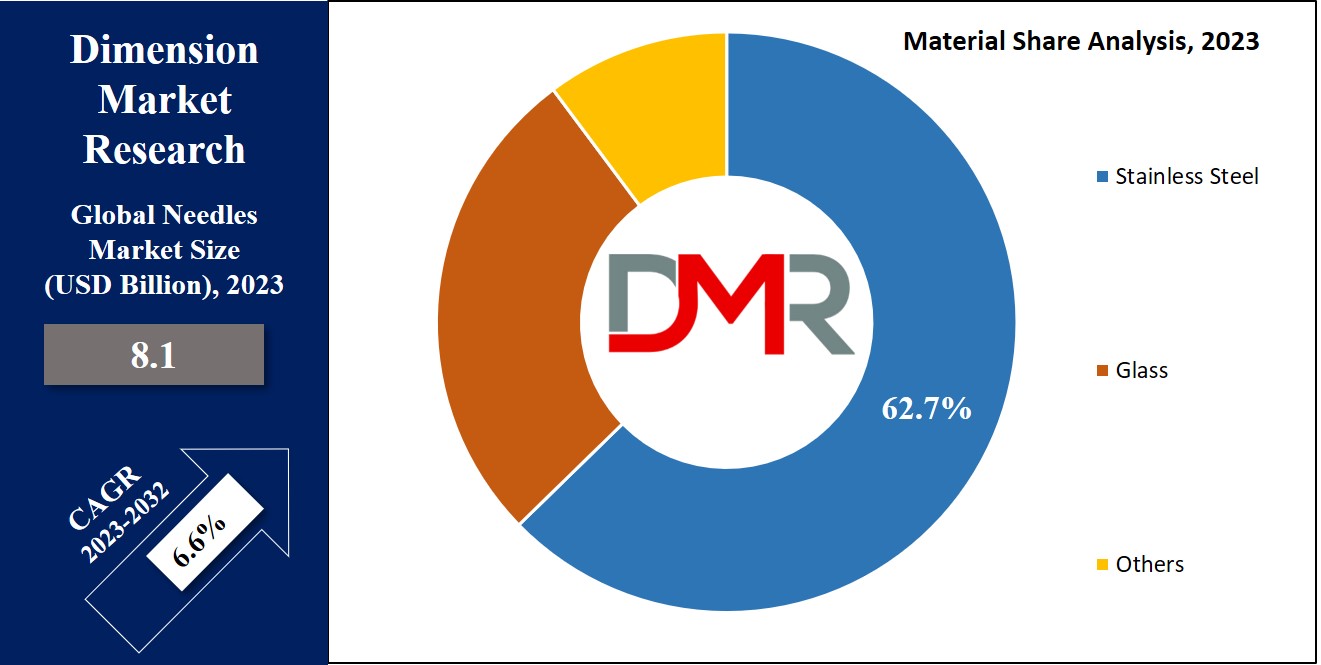

The Global Needles Market is expected to reach a value of USD 8.1 billion in 2023, and it is further anticipated to reach a market value of USD 14.5 billion by 2032 at a CAGR of 6.6%. The market has seen significant growth over the past few years and is predicted to grow significantly during the forecasted period as well.

Needles are slender and utilized in conjunction with syringes to administer medications, collect samples, & deliver pharmaceutical drugs into the body through injections.

The Needles Market is driven by critical health concerns linked to intravenous drug use. According to the Northridge Addiction Treatment Center, an estimated 11 million people globally inject drugs, with 40% of them contracting the hepatitis C virus. Additionally, 1.4 million people living with HIV globally are intravenous drug users, contributing to 10% of newly reported HIV cases.

In the United States, the Centers for Disease Control (CDC) estimates 1.18 million people living with HIV, with approximately 36,000 new diagnoses annually. Of these new cases, 21% are among individuals aged 13 to 24. This highlights the market's crucial role in addressing public health challenges.

The latest event in Needles, CA, was the Veterans Day ceremony held on November 9, 2024, at Santa Fe Park, honoring military veterans. It featured a keynote by retired Special Forces member Noah Claypool. The city's Chamber of Commerce is gearing up for the Lucky Greens Golf Tournament in February 2024.

Key Takeaways

- Market Growth: The global needles market is projected to grow from USD 8.1 billion in 2023 to USD 14.5 billion by 2032, at a compound annual growth rate (CAGR) of 6.6%.

- Health Drivers: Increased prevalence of chronic diseases, cancer, and pet health conditions drives needle demand, alongside rising investments in advanced medical devices and healthcare R&D.

- Safety Innovations: Safety needles are experiencing rapid growth due to higher awareness and regulatory focus on protecting healthcare workers from needlestick injuries and infections.

- Product Segmentation: Pen needles lead the product market in 2023, fueled by the global rise in diabetes and advancements in smaller, more comfortable pen needles.

- Material Dominance: Stainless steel remains the top raw material for needles because of its strength, durability, and rust resistance, enabling wide medical applications and long product life.

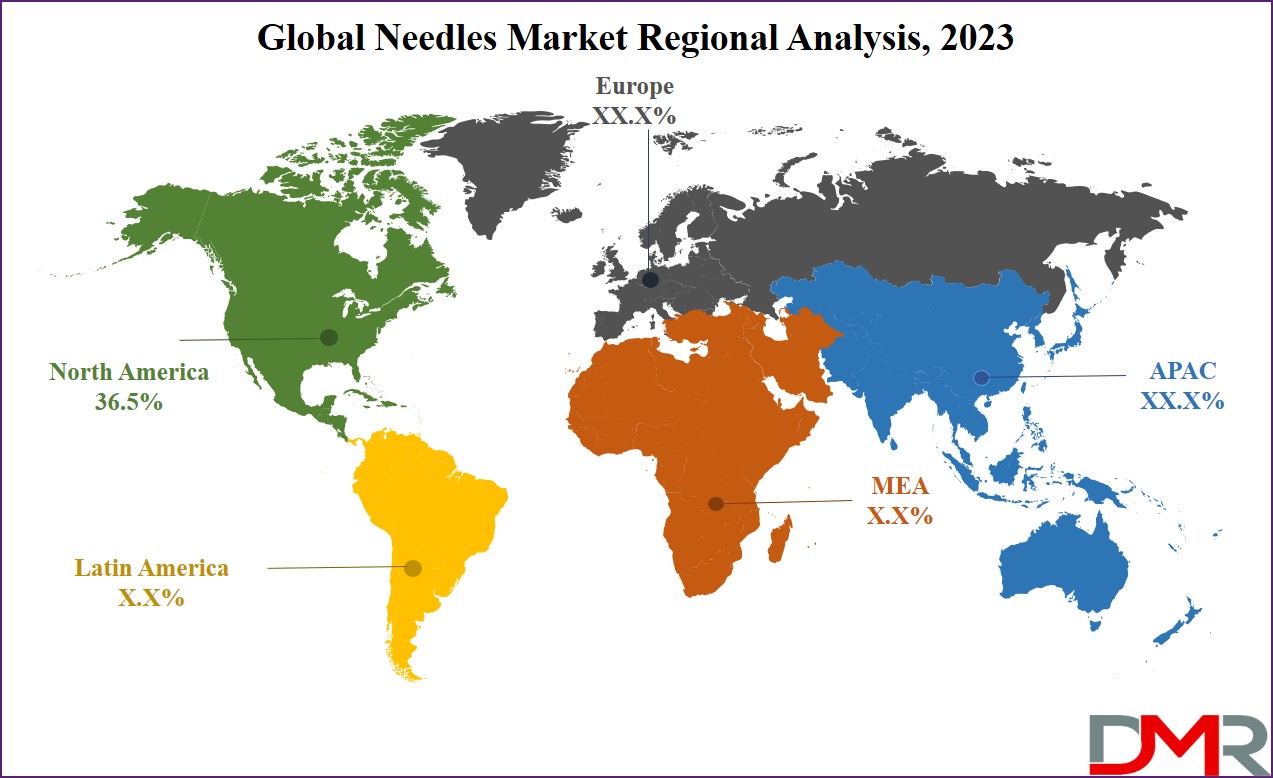

- Regional Leaders: North America captured the largest market share (36.5% in 2023), benefiting from advanced healthcare systems, high chronic disease rates, and strong innovation; Asia-Pacific is fast-growing due to healthcare expansion and increased demand.

- Competitive Landscape: The market is highly competitive with major players investing in research, while smaller companies in Asia-Pacific are emerging as awareness spreads, intensifying industry competition.

Use Cases

- Insulin Management: Widely used for diabetes care, pen needles enable safe, self-administered insulin injections, improving compliance and comfort for chronic patients in home or clinical settings.

- Blood Sampling: Medical laboratories and hospitals use blood collection needles for routine diagnostic tests, helping monitor health conditions and aid in timely disease detection.

- Surgical Suturing: Surgical and outpatient clinics utilize suture needles for wound closure and surgical procedures, supporting patient recovery and reducing infection risks.

- Dental Procedures: Dental clinics employ specialized dental needles for administering anesthesia during extractions, fillings, and other oral procedures, enhancing patient safety and precision.

- IV Therapy Delivery: Hospitals and emergency care centers rely on intravenous needles for efficient medication delivery, fluid administration, and sample extraction, crucial for critical care and rapid intervention.

Market Dynamic

The global needles market is experiencing growth due to the rise in the prevalence of cancer & a rise in chronic & acute diseases across the globe, along with a growing number of diseases in pets, which is further fueled by increased investments in R&D, particularly in developed & developing economies, aiming at medical instruments and devices. Advanced technology integration in healthcare facilities & infectious disease detection research is also contributing to market expansion.

However, challenges to market growth include the high costs associated with research & development, limited infrastructure, & strict regulations on needle sales by pharmacies. Challenges also grow from unfavorable reimbursement scenarios, limited technology adoption in developing economies, growing needlestick injuries, a shift toward alternative drug delivery methods, & a shortage of skilled professionals for diagnostic tests in low- & middle-income countries.

Research Scope and Analysis

By Type

The global needles market is categorized into conventional & safety needles. Safety needles are expected to see the most rapid growth during the forecasted period due to growth in awareness of needlestick injuries & infections among

healthcare workers, leading to a high focus on needle safety.

Healthcare facilities are highly turning to safety-engineered devices, including safety needles, to protect their staff & reduce workplace injuries, driven by regulatory efforts promoting safety devices in medical settings. Advances in safety needle technology, featuring retractable & passive safety features, further contribute to this growth, as healthcare providers prioritize the safety of both patients & staff.

By Product

The global needle market is divided into product categories, like sutures, pens, blood collection,

dental, & ophthalmic needles. Pen needles hold the top position in driving the global market in 2023, due to factors like the rise in prevalence of diabetes, & they are anticipated to exhibit higher growth in the coming years. Insulin pen needles come in various lengths & sizes. In the past, these needles used to be long & sharp, but with advancements in technology, smaller, thinner, & more comfortable needles are now broadly accessible worldwide, contributing to the segment's rapid growth

By Delivery Mode

The hypodermic needles segment takes the lead in growing the global needles market in 2023. This growth is mainly due to the growing prevalence of chronic conditions like diabetes & the development of needles compatible with high-pressure injectable technology.

Also, the intravenous segment is anticipated to experience rapid growth in the near future, as these needles, which are hollow & used with IV syringes for sample extraction & injections, help minimize contamination when working with sterile substances. The growing per capita healthcare spending is expected to boost this segment's expansion.

By Raw Material

The global needles market is categorized by the materials used into stainless steel, glass, & other materials segments. Stainless steel needles dominate this market because they provide excellent strength, durability, & resistance to rust, making them ideal for several medical uses & extending their product life. Their broad adoption in medical procedures like injections, blood tests, & surgeries has fueled the demand for stainless steel needles, making them the largest segment in the industry.

The Needles Market Report is segmented on the basis of the following

By Type

By Product

- Pen

- Blood Collection

- Suture

- Dental

- Ophthalmic

- Others

By Delivery Mode

- Intravenous

- Hypodermic

- Intramuscular

- Others

By Raw Material

- Glass

- Stainless Steel

- Others

Regional Analysis

In the global needles market, the North American region is the most prominent region driving the growth of the market by having a major

market share of 36.5% in 2023. North America leads the market due to its advanced healthcare system & high demand for medical devices like needles., also the aging population & rising chronic diseases in the region drive the need for medical procedures dependent on needles.

Major pharmaceutical & device companies in North America support innovation & advanced needle technology. Strict regulations allow the safety & quality of medical devices, improving consumer trust in needles for healthcare.

Further, Asia-Pacific is anticipated to have significant growth in the needle market in the coming years, as the growing population in the region builds a substantial patient base, in rising demand for medical procedures requiring needles. With the enhancement in the healthcare infrastructure & growing chronic diseases, the need for diagnostic and therapeutic procedures involving needles is expected to grow, making Asia-Pacific a promising market for needle products.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Most of the needles in the open market are made by big players in the market. These players have enough money for research & a better way to get their products to customers. In addition, many small companies in Asia-Pacific are starting to make needles because people there are getting educated more about them, which is making the needle market bigger in such regions.

In addition, the market for needles is divided into many parts, creating an intense competitive landscape for the market.

For instance, in June 2022, Wuxi Biologics, a global company that does R&D, & manufacturing for drugs, started its GMP operations at a new facility called DP5 in Wuxi, China, which offers a variety of options for delivering different amounts of medicine in pre-filled syringes (PFS).

Some of the prominent players in the global Needles Market are:

- Boston Scientific Corp

- Smiths Medical

- Medtronic PLC

- Cook Medical LLC

- Terumo Corp

- Johnson & Johnson

- Becton

- Dickinson & Company

- Stryker Corp

- The Hamilton Company

- Other Key Players

Recent Developments

- In January 2025, Terumo announced the global launch of the Terumo Injection Filter Needle, designed for intravitreal and hypodermic injections.

- In July 2024, Becton, Dickinson and Company (BD) acquired a biotech startup to strengthen its advanced needle technology pipeline for improved safety and performance.

- In October 2024, Novo Nordisk A/S expanded its diabetic care portfolio by launching a new pen needle series globally to enhance patient comfort and injection precision.

- In March 2025, Embecta Corp. raised funding to accelerate the development of innovative pen needle solutions for global diabetes management.

- In May 2025, MTD Medical Technology and Devices S.p.A. completed a strategic merger with a European manufacturer to expand its product range and European distribution channel.

- In September 2024, B. Braun SE increased its investment with a new facility dedicated to smart needle production, focusing on digital integration and minimally invasive care.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 8.1 Bn |

| Forecast Value (2032) |

USD 14.5 Bn |

| CAGR (2023-2032) |

6.6% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Conventional and Safety), By Product (Pen, Blood Collection, Suture, Dental, Ophthalmic, and Others), By Delivery Mode (Intravenous, Hypodermic, Intramuscular, and Others), By Raw Material (Glass, Stainless Steel, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Boston Scientific Corp, Smiths Medical, Medtronic PLC, Cook Medical LLC, Terumo Corp, Johnson & Johnson, Becton, Dickinson & Company, Stryker Corp, The Hamilton Company, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Needles Market size is estimated to have a value of USD 8.1 billion in 2023 and is expected to

reach USD 14.5 billion by the end of 2032.

North America dominates the Global Needles Market with a share of 36.5% in 2023.

Some of the key players in the Global Needles Market are Johnson & Johnson, Becton, Smiths Medical,

and many others.

The market is growing at a CAGR of 6.6 % over the forecasted period.