Market Overview

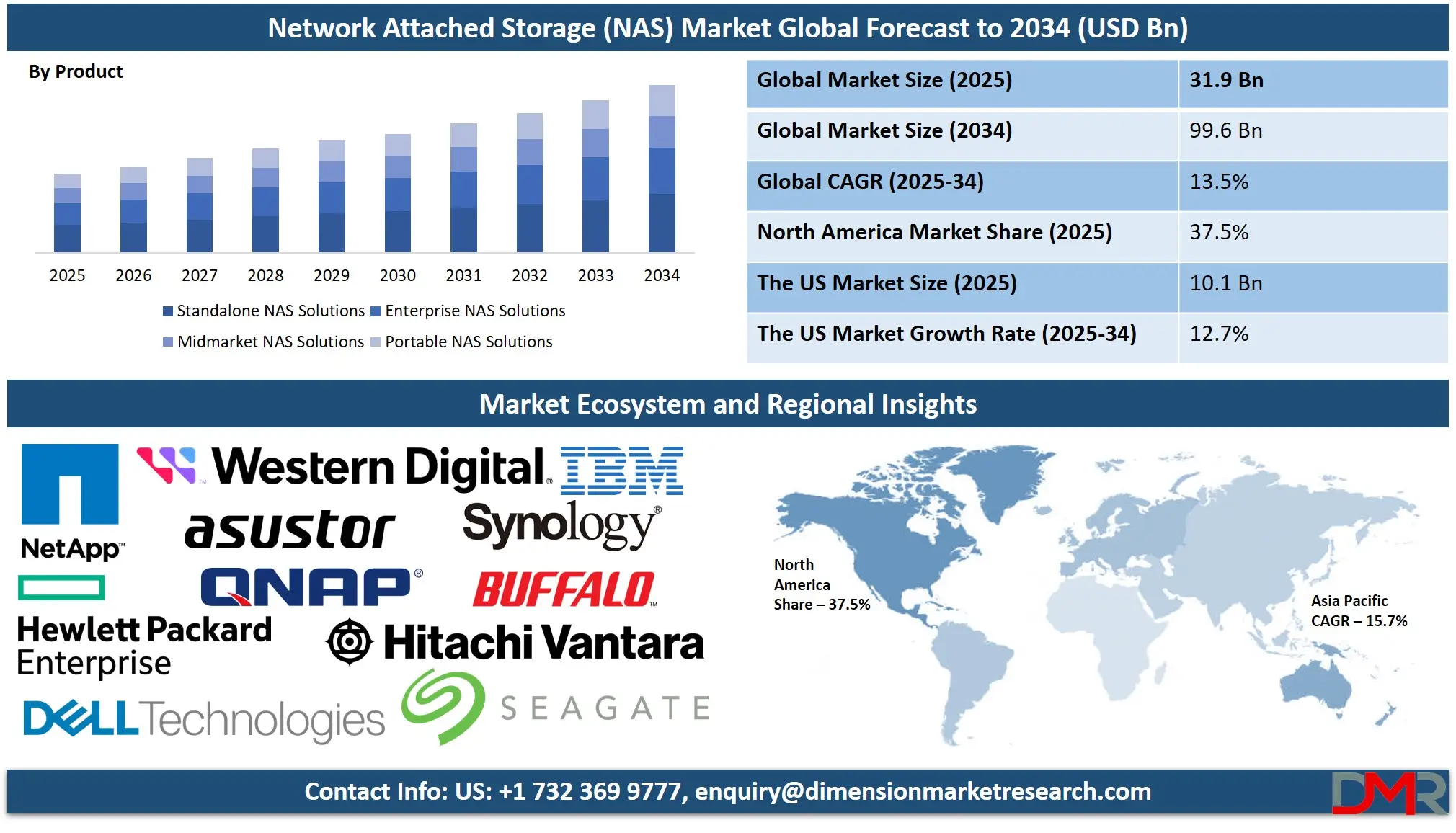

The Global Network Attached Storage Market is projected to reach USD 31.9 billion in 2025 and grow at a compound annual growth rate of 13.5% from there until 2034 to reach a value of USD 99.6 billion.

The market for global Network Attached Storage (NAS) is expanding rapidly due to the increasing demand for scalable low-cost storage. The rise in big data, cloud computing, and industrial digital transformation is driving the adoption. Organizations are becoming more interested in large-capacity storage that supports remote access, sharing, and backup easily, making NAS a top choice over other types of traditional storage.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The market is also benefitting from the rise in the use of NAS in small and medium businesses (SMEs), which are interested in efficient low-cost data storage. The global NAS market will expand at a robust CAGR throughout the forecast period to reach billions in valuation.

A top market trend is the integration of artificial intelligence (AI) and machine learning (ML) in NAS solutions. AI NAS enhances the handling of storage, boosts security, and automates the categorization of information, making it more efficient. The hybrid cloud NAS that provides the best qualities of both on-premises and cloud storage is also becoming increasingly popular as businesses are seeking flexibility and scalability. Better performance, reduced latency, and higher adoption are also being made possible through the innovation of solid-state drives (SSDs) and NVMe-based NAS.

Although the market has tremendous growth prospects, there are issues to be overcome, including the large capital investment in enterprise NAS solutions and issues regarding cybersecurity breaches and ransomware. Also, the complexity of NAS integration within existing IT infrastructures can prove to be a constraining factor in certain sectors. However, continuous tech innovation and the lowering of hardware costs are likely to balance the issues.

Opportunities within the NAS market are growing through the growing use of edge computing, IoT devices, and the use of high-definition video storage within the media and surveillance sectors. High-speed, consistent data access within geographically dispersed workforces is also driving the market. The region that dominates the market is North America, followed by the Asia-Pacific region where digitization and cloud usage are gaining momentum.

The US Network Attached Storage (NAS) Market

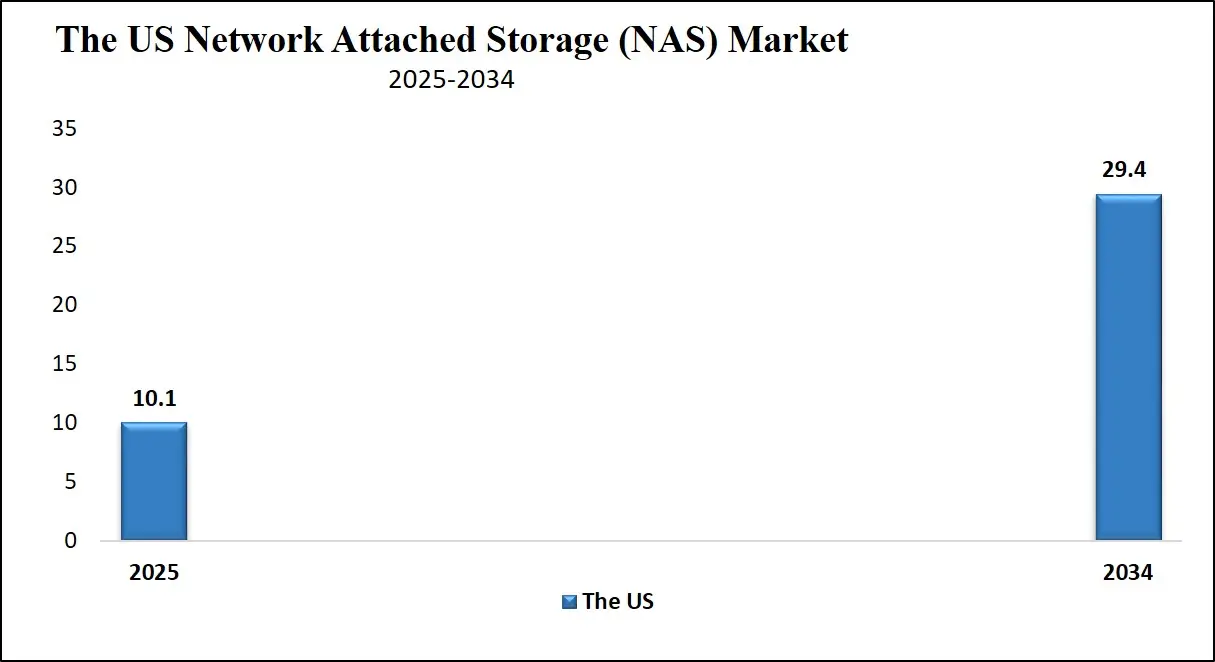

The US Network Attached Storage (NAS) Market is projected to reach USD 10.1 billion by the end of 2025 and grow substantially to an expected USD 29.4 billion market by 2034 at an anticipated CAGR of 12.7%.

The US NAS market is the market leader based on the region's sophisticated IT infrastructure, the large-scale use of cloud computing, and the presence of international tech majors. The need for high-performance NAS solutions comes from industries like IT & telecommunication, BFSI, healthcare, and the media sector where large amounts of data need to be stored, protected, and made easily accessible. With the growing amounts of unstructured information, the need has shifted to NAS solutions based on scalability and economics. The growth of remote work culture has further fueled the demand, where businesses need centralized, easily accessible NAS solutions to be used by dispersed teams.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

A robust demographic and economic landscape defines the US market, where there is a concentrated presence of businesses and start-ups that are implementing digital transformation. The country also has an evolved ecosystem that supports regulations regarding data security and privacy, making investment in NAS technology more desirable. The government initiatives that promote cloud computing along with AI-managed handling of data further aid the market. The convergence of NAS with hybrid cloud solutions gains pace, giving businesses greater flexibility and operational agility.

With businesses requiring seamless access to data and permanent storage solutions for data, NAS gains pace across industries. The presence of premium brands such as Dell Technologies, NetApp, and Western Digital gives continuous innovation, making the US a lead driver of global NAS market growth.

Key Takeaways

- Global Market Size Analysis: The Global Network Attached Storage (NAS) Market size is estimated to have a value of USD 31.9 billion in 2025 and is expected to reach USD 99.6 billion by the end of 2034.

- The US Market Size Analysis: The US Network Attached Storage (NAS) Market is projected to be valued at USD 10.1 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 29.4 billion in 2034 at a CAGR of 12.7%.

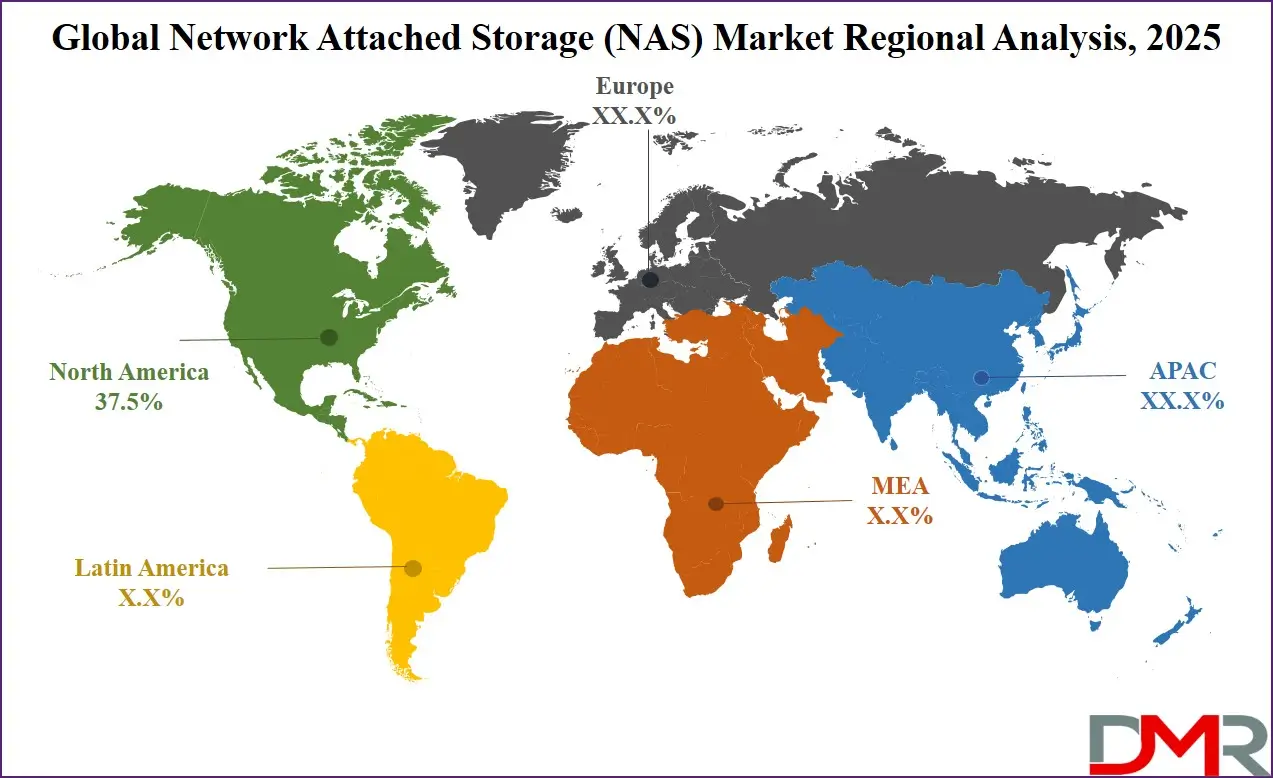

- Regional Insights: North America is expected to have the largest market share in the Global Network Attached Storage (NAS) Market with a share of about 37.5% in 2025.

- Key Players: Some of the major key players in the Global Network Attached Storage (NAS) Market are Dell Technologies Inc., Hewlett Packard Enterprise (HPE), NetApp, Inc., Western Digital Corporation, and many others.

- The Global Market Growth Rate: The market is growing at a CAGR of 13.5 percent over the forecasted period of 2025.

Use Cases

- Enterprise Data Backup & Recovery: NAS solutions enable companies to store and recover vital information effectively. Organizations use NAS to execute scheduled backups to ensure the integrity of the information and prevent downtime during hardware failure or cyberattacks.

- Media & Entertainment Storage: NAS is employed to store large volumes of high-definition video, graphics, and audio files by media companies. It offers fast access, efficient editing, and collaborative work during the production of the content.

- Healthcare Data Management: NAS is used in hospitals and research institutes to store patient records, medical images, and clinical trial data in a safe and secure manner to ensure regulatory compliance and easy availability to healthcare professionals.

- Retail & E-commerce Operations: NAS supports retailers to manage customer databases, transaction histories, and real-time stock tracking to provide enhanced customer satisfaction and operational efficiency.

- Surveillance & Security Systems: NAS is used to store the footage from the high-definition security cameras to ensure reliable data retention and easy access to allow monitoring and law enforcement.

Stats & Facts

- Widespread Adoption: Over 80% of large and midsize businesses use NAS to store data, outnumbering both Storage Area Networks (SAN) and Direct Attached Storage (DAS) in capacity, according to Gartner. Unstructured data growth, the adoption of scale-out NAS, and growing interest in software-defined NAS drive the market.

- Custom NAS Solutions: Leading providers such as Synology and NetApp are developing NAS solutions to address the scalability, security, and virtualization requirements of the enterprise. The solutions aim to transform NAS from being simply a storage system to becoming full-fledged data management platforms to allow businesses to streamline availability, automation, and multi-cloud compatibility to improve operational efficiency.

- Cloud integration: Enterprises are increasingly integrating on-premise NAS with cloud storage to be able to control the data, backup, and archiving more effectively. Vendors such as QNAP and Western Digital are implementing Amazon S3 along with hybrid cloud architecture to enable businesses to scale the storage capacity effectively along with ensuring availability and security.

- Performance benefits: NAS provides an economical large-capacity option that has performance advantages over both DAS and SAN based upon network traffic, device access characteristics, and storage protocol. Seagate indicates that NAS solutions enable seamless sharing of information, read/write speed improvement, and high availability, making them ideal to use within multi-user environments.

- Security Threats: QNAP fixed a critical security vulnerability (CVE-2021-28809) in its HBS 3 Hybrid Backup Sync software back in July 2021. The vulnerability discovered by TXOne Networks gave remote access and command execution to unauthorised users, leaving NAS devices open to potential breaches of data and underlining the need for robust cybersecurity.

- Usage Trends: 70.0% of businesses use NAS to back up and recover from disaster, 451 Research indicates. The healthcare industry ranks among the highest users because it has to comply with strict HIPAA regulations, while 60 percent of businesses are using hybrid cloud NAS to balance the use of both local and cloud.

- Technological Developments: NetApp and Dell EMC AI-powered NAS solutions are enhancing predictive analytics and automation. With the new NAS devices having 10GbE speed capability, Western Digital reports that the speed of transferring data has considerably enhanced. NAS based on SSD enhances read/write speed, power efficiency, and system lifespan.

- Competitive Landscape: Some of the top NAS providers are Synology, QNAP, NetApp, Western Digital, Buffalo, Seagate, Dell EMC, and HPE. Synology and QNAP lead the SME market, providing low-cost, consumer-friendly NAS solutions, whereas NetApp and Dell EMC are the leaders in the enterprise market, providing scalable, high-speed NAS solutions.

Market Dynamic

Driving Factors in the Global Network Attached Storage (NAS) Market

Proliferation of Big Data and IoT Applications

The rise of big data and the rapid expansion of the Internet of Things (IoT) are fueling the demand for NAS solutions. Organizations are generating large amounts of unstructured data in the form of high-definition videos, images, logs, and sensors from the IoT. NAS solutions provide an efficient, scalable method to store and manage this data to ensure ease of use and protection. With healthcare, finance, and retail sectors using data analytics more and more, NAS has an important role to play to manage large amounts of data and deliver high-speed read performance.

The rise of edge computing further enhances this demand, with the need to store real-time information near the edge. As the usage of IoT continues to expand further, industries require NAS solutions that are capable of storing, processing, and analyzing large amounts of information generated through connected devices. This growing usage of data-intensive applications is one of the key drivers of NAS market growth.

Increasing Demand for High-Performance Storage Solutions in SMEs

Small and medium-sized businesses (SMEs) are increasingly implementing NAS solutions to enhance operational efficiency, enhance data protection, and deliver remote work capability. SMEs traditionally employed external hard drives or limited on-premises storage that was causing scalability challenges and making the data inaccessible. NAS provides an affordable, fast-speed option to store the data that offers centralized access to the information, making it the ideal solution to expand the business.

The affordability of entry-level NAS devices along with the expanding options to integrate the cloud makes NAS very popular amongst SMEs. With the rise in cyberattacks, SMEs are realizing the necessity to safeguard themselves through safe automated backup options, making NAS an essential component of the SME's IT infrastructure. Most NAS providers are now offering SME-focused solutions that include simplified install, automated updates, and expandable storage. With SMEs accounting for the majority of global businesses, the expanding usage of SMEs reliant upon NAS solutions is a robust market driver.

Restraints in the Global Network Attached Storage (NAS) Market

High Initial Investment and Maintenance Costs

Despite the various advantages of NAS solutions, the capital-intensive nature of enterprise NAS systems raises an entry issue to most businesses. High-cost infrastructures such as high-speed storage drives, network upgrades, and protection mechanisms are required to implement NAS on a large scale. Ongoing maintenance and upgrading further add to the cost of ownership, making NAS adoption unaffordable to cost-sensitive organizations.

Even though cloud-based NAS solutions are more affordable, large-scale data storage requirements of businesses can be costly through the payment of cloud subscription fees and bandwidth. Besides, NAS integration with existing IT infrastructures often requires professional expertise, resulting in additional training and operational expenses. Small start-ups and businesses are hesitant to implement NAS solutions due to the unaffordability factor that can suppress market growth. Overcoming this restraint will be vital using low-cost, scalable NAS models to tackle the affordability issues.

Cybersecurity Risks and Data Breach Concerns

Cybersecurity is the primary concern regarding NAS adoption because NAS devices connected to the public network are vulnerable to cyberattacks, ransomware, and data breaches. Publicly connected NAS devices are prone to hackers targeting the weak links within the NAS system. The frequency of ransomware attacks on NAS devices is increasing each year, resulting in information loss and operational disruptions to the concerned businesses. Unauthorised access to information within NAS devices will also lead to breaches of regulations and reputations.

Most businesses lack robust cybersecurity measures to safeguard the NAS system from threats. Even though NAS providers are updating encryption, access control, and protection mechanisms regularly, businesses must use robust security measures to prevent risks. Cybersecurity concerns will temper NAS adoption, particularly in highly regulated industries such as healthcare and finance where information protection is highly important. Overcoming the risks through complex protection mechanisms and continuous updates is crucial to enable NAS providers to maintain customer trust and ensure continued market expansion.

Opportunities in the Global Network Attached Storage (NAS) Market

Expansion of NAS in Edge Computing and 5G Networks

The growing use of 5G technology and edge computing presents the NAS market with a major opportunity. The necessity to store data nearer to the source to reduce latency and support real-time analysis makes NAS the ideal choice to deal with edge-created information. Industries such as manufacturing, healthcare, and autonomous vehicles are applying edge NAS solutions to store and process information near the source.

The combination of NAS with 5G networks enhances the speed and reliability of information transfer, delivering low-latency information access to distributed environments. With the advent of smart cities and the use of IoT applications, edge-based NAS solutions will likely witness robust demand. The use of NAS will also be pursued by communications providers to support the delivery of content, video streaming, and cloud games. As the necessity to decentralize the operations of enterprises increases, NAS solutions that are edge-optimized will be a top market growth driver.

Growing Demand for High-Capacity NAS in Video Surveillance and Media Industry

Increased use of high-definition video monitoring in industries such as security, retail, and transportation is driving the demand for large-capacity NAS solutions. Surveillance networks generate large amounts of information that must be archived securely and easily retrieved to be used for monitoring and forensic analysis. NAS offers an efficient and cost-effective means of video archiving, recovery, and storage that makes it the best choice for large-scale surveillance networks.

The media and entertainment industry is also witnessing an exponential growth in the demand for information storage through the use of 4K and 8K video formats, gaming applications, and online streaming. NAS enables the media industry to store large multimedia files, automate workflow collaboration, and deliver seamless content. With the use of video content and security monitoring networks increasing worldwide, the demand for NAS solutions specifically to store large amounts of information will drive market growth.

Trends in the Global Network Attached Storage (NAS) Market

Adoption of AI-Integrated NAS for Intelligent Data Management

The intersection of artificial intelligence (AI) and machine learning (ML) within NAS solutions is revolutionizing the means through which data are managed. AI-powered NAS enhances the classification of data, automates the optimization of storage, and improves predictive maintenance through the detection of future failures. Such solutions scan data usage patterns to optimize the use of storage, dynamically allocating the use of resources based upon demand.

AI-powered NAS also improves cybersecurity through real-time anomaly identification and unauthorized access identification, significantly reducing the likelihood of breaches. AI-powered analytics also enable the extraction of valuable information from the stored information, optimizing operations and decision making within the organization.

The integration of AI within NAS solutions also reduces the need for human involvement, reducing operational costs and optimizing workflow automation. With the increasing reliance upon big data and analytics within the organization, AI-powered NAS will be an important part within modern infrastructures for the storage, driving market growth.

Rising Adoption of Hybrid Cloud NAS Solutions

Hybrid NAS gains traction as the demand for flexibility, scalability, and cost savings in the storage of data increases. With hybrid NAS, companies can store information that is accessed regularly onsite but use cloud storage to store information long term and back it up. This strategy enhances the availability of information but reduces the cost of disaster recovery and infrastructure. With hybrid NAS solutions, companies can reduce latency and be more in charge of sensitive information but maintain the scalability that comes with cloud storage.

The increased demand for remote work has further contributed to the use of hybrid NAS as companies need to be able to retrieve information easily and securely anywhere. Top NAS providers are introducing multi-cloud support to enable users to connect to various cloud providers to be more flexible. As more companies shift towards hybrid IT environments, hybrid NAS will be the standard for future data storage strategies.

Research Scope and Analysis

By Design

8–12 bays segment is projected to dominate the NAS market because it has the ideal combination of storage capacity, performance, and affordability. The NAS devices provide the ideal storage for medium to small businesses and power users requiring robust handling of the data but are unwilling to incur the complexity and cost of larger storage. 8–12 bay NAS solutions are the go-to option for businesses that deal with medium to large amounts of data because the devices can support various high-capacity hard drives or SSDs to enable efficient RAID configurations to provide robust data redundancy and protection.

Another important factor fueling adoption is scalability. As opposed to lower NAS solutions that eventually run out of capacity, 8–12 bay devices enable an organization to grow the storage to match growing data requirements, making them an investment that will last. Furthermore, the devices are equipped with superior processing and memory configurations to support sophisticated applications like virtualization, video editing, and big data backup operations.

Furthermore, mid-size NAS solutions provide enterprise features such as fast networks, encryption, and support for multiple users within an economically viable range, making them an attractive solution to administrators. As opposed to larger than 12-bay designs, 8–12 bay NAS devices take up a compact physical space that reduces the use of power and operational costs.

Along with this, the increased usage of hybrid workplaces and compute-intensive applications such as AI and IoT has generated an added need for scalable storage. With these advantages, 8–12 bay NAS solutions are the market leaders as the ideal choice for businesses that need an equilibrium of affordability, performance, and future scalability.

By Product

Standalone NAS solutions are the global market projected to lead this segment due to the flexibility, affordability, and convenience that define them. Compared to the sophisticated infrastructure and IT expertise that defines enterprise NAS solutions, the plug-and-play nature of the devices makes them deployable to businesses of every size. The fact that the devices can provide centralized file storage, secure backup, and seamless data sharing makes them the ideal solution for SMEs, remote offices, and individuals.

Cost savings are an important force behind dominance. Standalone NAS solutions avoid the use of costly storage area networks (SANs) or the need for specific IT staff, making them a viable option for budget-conscious companies. They also include support for various RAID levels, encryption, and automated backup to ensure that the data is safe and intact, but without breaking the bank.

They further strengthen their market position through scalability. Standalone NAS devices are currently equipped with hot-swappable drives and expandability to allow businesses to grow the capability to store based upon demand. They are also supported through cloud services to form hybrid storage that improves flexibility and remote access.

Another important criterion is performance. Standalone NAS devices are equipped to support fast connection options like 10GbE and NVMe caching to ensure seamless data transfer and multi-user access. This makes them appropriate for use in applications that are data-intensive like media creation, surveillance storage, and AI-powered analytics.

Thanks to the fact that they are easy to use, low-cost, scalable, and applicable to a wide range of uses, independent NAS solutions remain the market leaders, especially among SMEs and expanding businesses seeking robust, high-speed network storage.

By Storage Solution

Scale-up NAS solutions are anticipated to lead the NAS market because they are cost-effective, manage data centrally, and are easier to scale. Unlike the scale-out NAS that comes with the need to deploy individual independent nodes, the scale-up NAS provides the option to expand the storage within one system through additional hard drives or the upgrade of the current ones. This method minimizes the complexity of the infrastructure along with the overhead of managing it, making it the best option for growing enterprises.

One of the core explanations for its ascendancy is cost savings. Scale-up NAS allows companies to expand storage capability without buying extra NAS devices, keeping capital investment and operational costs to a minimum. This comes in especially handy for SMEs and financially-constrained enterprises, which are able to expand storage based on demand without having to undertake extensive hardware replacements.

Furthermore, scale-up NAS offers centralized data management that is essential to industries that deal with large volumes of structured and unstructured data. Data can be managed, backed up, and protected from a centralized interface by the IT administrators, making operations more efficient and lowering security risks.

Another benefit is performance optimization. High-speed connectivity, caching, and RAID configurations are supported by scale-up NAS systems to enable quick data recovery and protection from the possibility of drive failure. The NAS systems are also compatible with hybrid and multi-cloud environments, making them perfect for enterprises that are implementing cloud storage strategies.

Furthermore, the demand for AI, big data analytics, and IoT initiatives is fueling the adoption of scale-up NAS because the aforementioned workloads ought to be served by robust, high-capacity storage that has minimal downtime. Because it has lower costs, centralized control, and linear scalability, scale-up NAS remains the best choice for scalable but simple storage.

By Deployment Type

On-premises NAS is expected to dominate the market based on the benefits it enjoys over cloud solutions regarding data protection, control, and performance. Organizations handling sensitive information, such as finance, healthcare, and government sectors, opt to use on-premises NAS to be fully in charge of the storage system to ensure that there is no third-party dependence.

A key impetus to its leadership is higher security and compliance. NAS solutions installed on-premises consist of end-to-end encryption, role-based access control, and complex firewall setups that are best applicable to industries requiring strong protection of the information and regulatory compliance. As opposed to cloud NAS that is susceptible to third-party breaches and cybersecurity risks, on-premises NAS confines the information within the organization's ecosystem.

Furthermore, there is the aspect of performance optimization. Low-latency access to the data comes with on-premises NAS, supporting higher read/write speeds than cloud storage that relies on the internet. This makes it perfect for real-time data processing, video editing using high-definition media, and AI workloads that need to read the data at high speed. Another factor contributing to its ascendancy is cost predictability. Although cloud NAS solutions are based on ongoing subscription payments, on-premises NAS has a one-time upfront investment with predictable maintenance.

This is especially valuable to large businesses that need large amounts of storage with predictable bandwidth costs. Moreover, hybrid NAS deployments further solidified the place of on-premises NAS through the unification of local storage with cloud backup. With the security, speed, and predictable expense, on-premises NAS remains the best option for enterprises requiring control of the information, compliance, and high-speed storage options.

By Enterprise Size

Small to medium-sized businesses (SMEs) are projected to lead this segment due to the increasing digitization, cost sensitivity, and need for scalable storage. With the expanding volumes of information generated by the businesses, NAS provides an efficient but low-cost alternative to expensive data centers or cloud storage subscriptions.

Among the primary causes of this dominance is cost-effectiveness. SMEs often have limited budgets for IT, and NAS solutions offer an efficient low-cost method for data sharing, backup, and storage. Compared to the use of enterprise-level storage devices, NAS makes it possible for SMEs to expand the storage incrementally without having to make large capital investments.

Another critical factor is ease of deployment and management. Most SMEs lack dedicated IT teams, making plug-and-play NAS solutions ideal for hassle-free setup and operation. Modern NAS systems come with user-friendly dashboards, automated backups, and cloud integration, ensuring seamless data management without technical complexity.

Furthermore, SME NAS adoption has also been fueled by data security and compliance issues. As cyber threats escalate, SMEs need safe, on-premises storage that offers encryption and role-based access control to safeguard customer and financial information. NAS solutions enable SMEs to gain regulatory compliance without spending capital to implement complex security frameworks.

Furthermore, remote work and web collaboration have exploded, requiring safe and convenient data storage. NAS provides SMEs the capability to collaborate effectively through the sharing of files, remote access to data, and syncing to the cloud platform, enhancing productivity and business continuity. With these advantages, NAS solutions are the best option for SMEs that require low-cost, scalable, and secure handling of data.

By End-user Industry

The BFSI sector is projected to dominate the NAS market due to the sector's need for high-density data storage, regulatory requirements, and security. BFSI entities generate volumes of transaction information, customer information, and regulatory reports that demand robust NAS solutions to store them effectively and securely.

Compliance and data protection are two of the chief drivers of BFSI leadership. BFSI organizations handle very sensitive customer information that requires complex encryption, access control measures, and data redundancy. NAS solutions provide secure on-premises storage that adheres to strict regulations such as PCI-DSS, GDPR, and SOX to ensure that global finance regulations are complied with.

Another vital factor to be considered is disaster recovery and high availability. BFSI entities require zero downtime and real-time recovery of the data, making NAS solutions that encompass RAID protection, snapshot backup, and failover capability essential to guarantee continuous financial operations.

Furthermore, the rise of mobile banking and fintech has further accelerated the use of NAS. Insurance companies and banks are implementing big data analysis, AI-powered fraud protection measures, and online payment options, each requiring fast, scalable storage. NAS offers efficient, high-speed storage to meet these requirements.

Besides this, hybrid NAS solutions are picking up pace within BFSI to store crucial information on-premises along with integration with the cloud to maintain redundancy. With BFSI requiring high-security measures, big transactions, and regulatory obligations, NAS solutions are the best option for the storage infrastructure within global banks.

The Global Network Attached Storage (NAS) Market Report is segmented on the basis of the following

By Design

- 1–8 Bays

- 8–12 Bays

- 12–20 Bays

- More than 20 Bays

By Product

- Standalone NAS Solutions

- Enterprise NAS Solutions

- Midmarket NAS Solutions

- Portable NAS Solutions

By Storage Solution

- Scale-up NAS

- Scale-out NAS

By Deployment Type

By Enterprise Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By End-user Industry

- Banking, Financial Services, and Insurance (BFSI)

- Consumer Goods & Retail

- Telecommunications & ITES

- Healthcare

- Energy

- Government

- Education & Research

- Media & Entertainment

- Manufacturing

- Business & Consulting

- Other End Users

Regional Analysis

Region with the Highest Market Share

North America is projected to dominate the market for Network Attached Storage (NAS) as it is

poised to hold 37.5% of the market share in 2025, due to strong enterprise IT infrastructures, high cloud penetration ratios, and a proliferation of data-intensive enterprises. The region has an established ecosystem of tech leaders, banks, healthcare providers, and government agencies that are requiring strong storage mechanisms to enable big data analytics, AI use, and regulatory compliance.

The US has the highest market share globally in the NAS market due to extensive investment in data centers, digital transformation initiatives, and cyber-security solutions. The region has the highest SME and Fortune 500 company base that has generated a strong need for scalable and secure NAS solutions. The region's leadership is further bolstered through the availability of the best NAS vendors such as Dell Technologies, NetApp, and Hewlett Packard Enterprise (HPE).

Growing usage of hybrid and multi-cloud infrastructures has further accelerated the demand for NAS solutions to blend the on-premises storage with the cloud. The necessity to comply with regulations such as CCPA (California Consumer Privacy Act) and HIPAA (Health Insurance Portability and Accountability Act), which mandate robust data privacy measures, has also compelled businesses to deploy safe on-premises NAS.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with the Highest CAGR

Asia-Pacific is anticipated to expand at the highest CAGR within the NAS market due to the rapid pace of digitalization, the increasing consumption of data, and the growing investment in the IT infrastructure. The expanding SME sector, the use of the cloud, and government initiatives are the key drivers of the market's rapid growth.

China, Japan, South Korea, and India are experiencing a boom in investment in data center facilities that has generated a growing demand for scalable storage solutions. The region's growing BFSI, e-commerce, and IT industries require efficient NAS solutions to store and protect large amounts of transactional and customer data.

Moreover, 5G rollout and the growth of IoT have led to an unprecedented surge in data traffic, prompting enterprises to deploy high-speed NAS solutions to process real-time information. Also, government initiatives such as "Digital India" and China's "New Infrastructure Plan" are driving the adoption of enterprise storage. As the region's enterprises modernize their IT infrastructures, the region will witness the highest growth in NAS adoption.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global market for NAS is highly competitive with the leaders focusing on product innovation, strategic partnerships, and geographical expansion to gain market shares. The leaders are Dell Technologies, NetApp, Synology, Western Digital Corporation, Hewlett Packard Enterprise (HPE), QNAP Systems, and Buffalo Technology.

NetApp and Dell Technologies lead the enterprise NAS market via the latter's scalable, high-speed NAS solutions that are AI-infused and cloud-managed. Synology and QNAP cater to SME customers and home users via low-cost NAS devices that are hybrid cloud-supported and easily managed.

Market leaders are expanding their NAS product portfolios through the integration of AI-powered automation, NVMe storage, and multi-cloud compatibility. Vendors are focusing on software-defined NAS to optimize the efficiency of managing data.

The market is witnessing higher investment in R&D and cybersecurity enhancements, based on the increasing concern regarding protecting data and regulations. Strategic alliances and acquisitions are also contributing to market growth, with the companies collaborating to deploy edge computing, hybrid cloud, and AI-based storage analytics within NAS solutions.

Some of the prominent players in the Global Network Attached Storage (NAS) Market are:

- Dell Technologies Inc.

- Hewlett Packard Enterprise (HPE)

- NetApp, Inc.

- Western Digital Corporation

- Synology Inc.

- QNAP Systems, Inc.

- Seagate Technology Holdings PLC

- IBM Corporation

- Cisco Systems, Inc.

- Buffalo Americas, Inc.

- Hitachi Vantara (Hitachi, Ltd.)

- Asustor Inc.

- Other Key Players

Recent Developments

2025

- March 2025: Dell Technologies launched an AI-powered NAS system to optimize storage performance for hybrid cloud environments, enhancing data management, scalability, and efficiency in enterprise IT infrastructures.

- January 2025: Western Digital announced a $500 million investment to expand its NAS product line, introducing higher-capacity enterprise solutions to meet increasing data storage and security demands.

2024

- December 2024: Synology partnered with Google Cloud to enhance multi-cloud NAS integration, allowing businesses to streamline data access, synchronization, and security across hybrid cloud environments.

- October 2024: QNAP Systems introduced a high-speed NAS solution featuring NVMe SSD caching and 10GbE connectivity, optimized for AI workloads and high-performance computing.

- July 2024: NetApp acquired a cloud storage firm to strengthen its hybrid NAS offerings, improving data accessibility, backup solutions, and cloud integration.

- May 2024: The Global Storage Expo 2024 showcased next-gen NAS solutions, emphasizing AI-driven automation, cybersecurity advancements, and enhanced storage architectures.

2023

- November 2023: Buffalo Technology partnered with AWS to enable seamless NAS-cloud integration, offering improved scalability, security, and remote data management.

- September 2023: Hewlett Packard Enterprise (HPE) invested $300 million in edge-based NAS solutions for IoT applications, enhancing real-time data processing and device connectivity.

- June 2023: The Asia-Pacific NAS Conference 2023 highlighted emerging storage technologies, emphasizing the region’s rapid NAS market growth and innovation.

- April 2023: Western Digital launched an AI-integrated NAS system, enhancing real-time data processing, automation, and predictive analytics capabilities for enterprise storage solutions.

Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 31.9 Bn |

| Forecast Value (2033) |

USD 99.6 Bn |

| CAGR (2024-2033) |

13.5% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2024) |

USD 10.1 Bn |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Design (1–8 Bays, 8–12 Bays, 12–20 Bays, More than 20 Bays), By Product (Standalone NAS Solutions, Enterprise NAS Solutions, Midmarket NAS Solutions, Portable NAS Solutions), By Storage Solution (Scale-up NAS, Scale-out NAS), By Deployment Type (On-Premises, Cloud-Based), By Enterprise Size (Small and Medium Enterprises (SMEs), Large Enterprises), By End-user Industry (BFSI, Consumer Goods & Retail, Telecommunications & ITES, Healthcare, Energy, Government, Education & Research, Media & Entertainment, Manufacturing, Business & Consulting, Other End Users) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Dell Technologies Inc., Hewlett Packard Enterprise (HPE), NetApp, Inc., Western Digital Corporation, Synology Inc., QNAP Systems, Inc., Seagate Technology Holdings PLC, IBM Corporation, Cisco Systems, Inc., Buffalo Americas, Inc., Hitachi Vantara (Hitachi, Ltd.), Asustor Inc., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Network Attached Storage (NAS) Market?

▾ The Global Network Attached Storage (NAS) Market size is estimated to have a value of USD 31.9 billion in 2025 and is expected to reach USD 99.6 billion by the end of 2034.

What is the size of the US Network Attached Storage (NAS) Market?

▾ The US Network Attached Storage (NAS) Market is projected to be valued at USD 10.1 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 29.4 billion in 2034 at a CAGR of 12.7%.

Which region accounted for the largest Global Network Attached Storage (NAS) Market?

▾ North America is expected to have the largest market share in the Global Network Attached Storage (NAS) Market with a share of about 37.5% in 2025.

Who are the key players in the Global Network Attached Storage (NAS) Market?

▾ Some of the major key players in the Global Network Attached Storage (NAS) Market are Dell Technologies Inc., Hewlett Packard Enterprise (HPE), NetApp, Inc., Western Digital Corporation, and many others.

What is the growth rate in the Global Network Attached Storage (NAS) Market in 2025?

▾ The market is growing at a CAGR of 13.5 percent over the forecasted period of 2025.