Market Overview

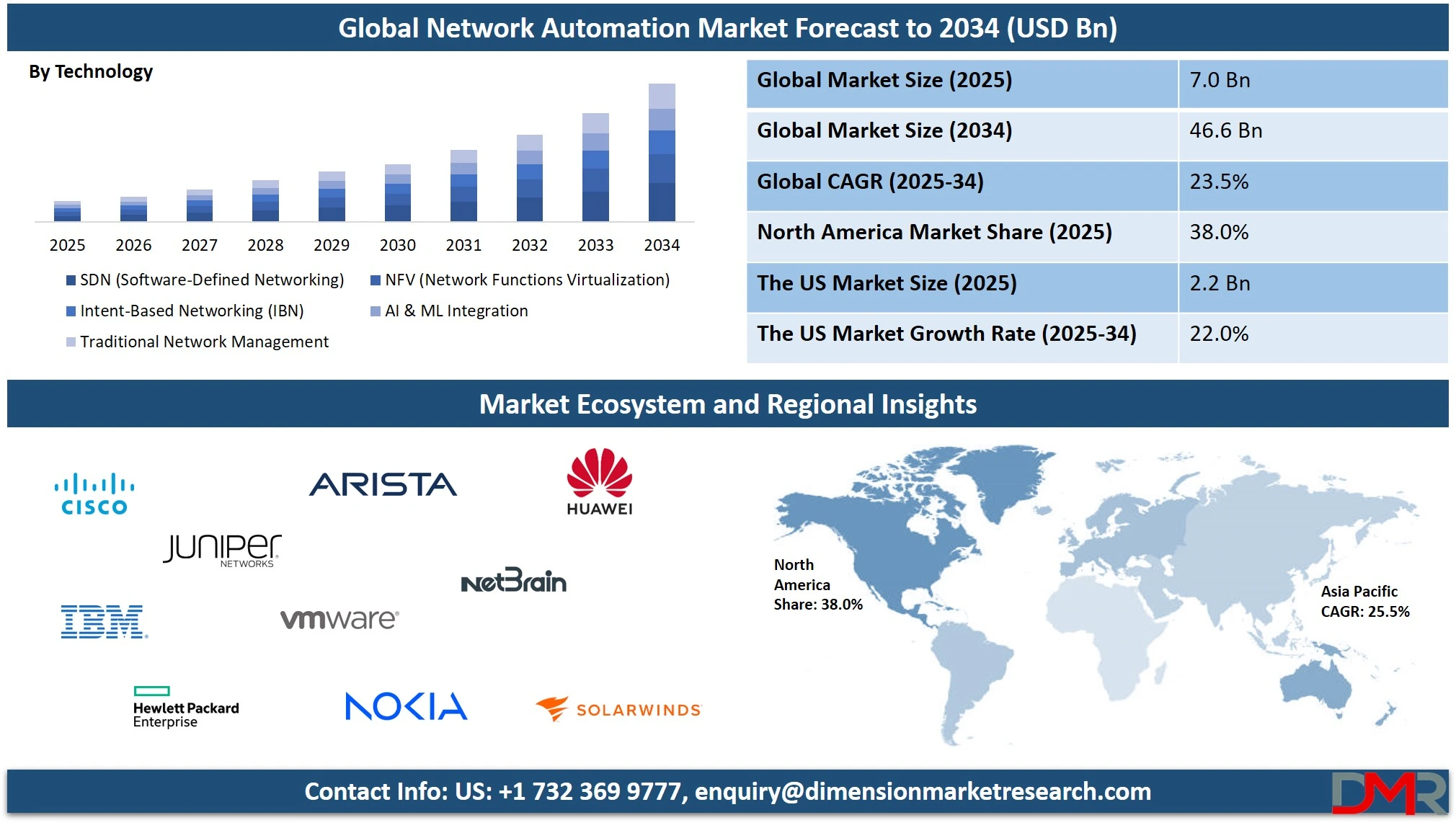

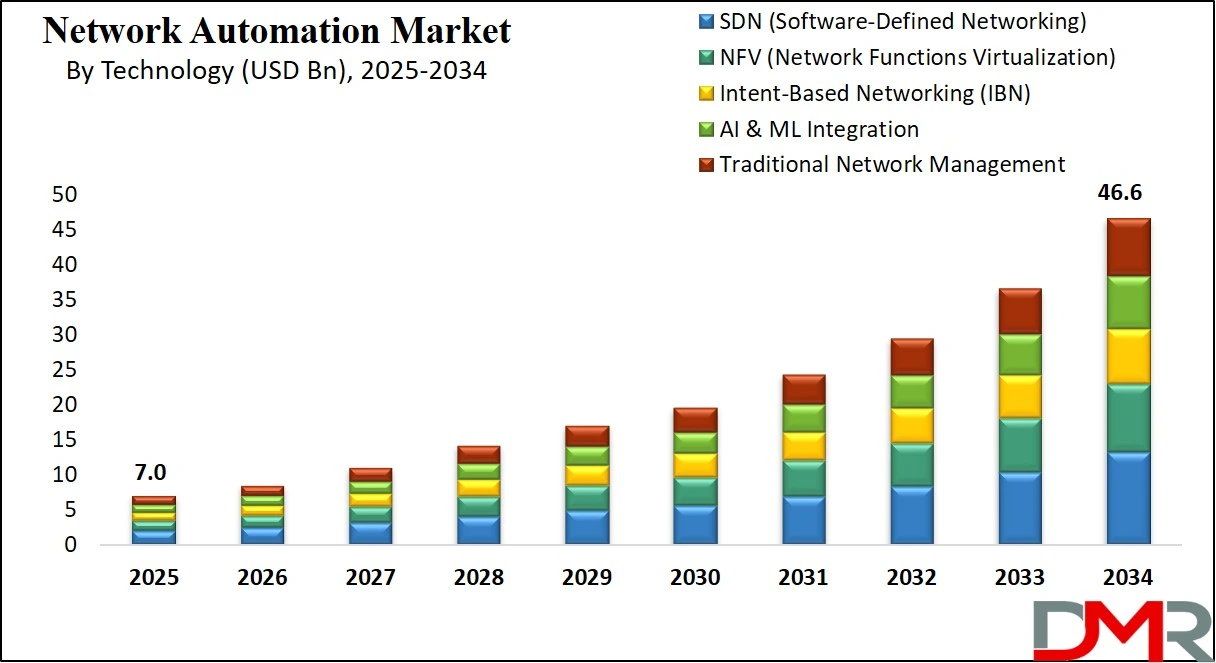

The global network automation market is projected to grow from USD 7.0 billion in 2025 to USD 46.6 billion by 2034, expanding at a robust CAGR of 23.5%. This growth is driven by rising adoption of AI-driven networking, intent-based automation, and demand for scalable, secure, and agile network infrastructure across enterprises and service providers..

Network automation refers to the process of automating the configuration, management, testing, deployment, and operation of physical and virtual devices within a network. By leveraging software and programmable processes, network automation reduces manual interventions, minimizes human error, enhances network efficiency, and accelerates service delivery.

It plays a vital role in modern IT environments by enabling dynamic responses to network events, seamless policy enforcement, and intelligent traffic management. As organizations increasingly adopt technologies such as intent-based networking, software-defined networking, and machine learning, automation has become integral to achieving scalability, reliability, and cost-effective network operations.

The global network automation market has emerged as a transformative force across industries as businesses shift toward digital-first models and increasingly complex network infrastructures. This market includes solutions that enable centralized control, automated provisioning, self-healing networks, and real-time performance optimization.

Rising adoption of cloud computing, growing demand for robust cybersecurity frameworks, and the proliferation of IoT and 5G technologies are pushing enterprises and service providers to implement scalable automation platforms. Automation is no longer seen as a luxury but a necessity for managing high-performance, multi-vendor, and hybrid networks.

As enterprises grapple with growing data volumes and real-time connectivity needs, network automation is becoming a strategic asset for ensuring uptime and agility. The market is witnessing a surge in AI-powered network intelligence, policy-based orchestration, and zero-touch provisioning across sectors like telecom, BFSI, and healthcare.

With operational cost savings and improved compliance as key drivers, both large enterprises and small-to-medium businesses are investing in network automation tools that provide visibility, resilience, and predictive maintenance. As the demand for secure, flexible, and autonomous network operations rises, the global network automation market is positioned for sustained and accelerated growth.

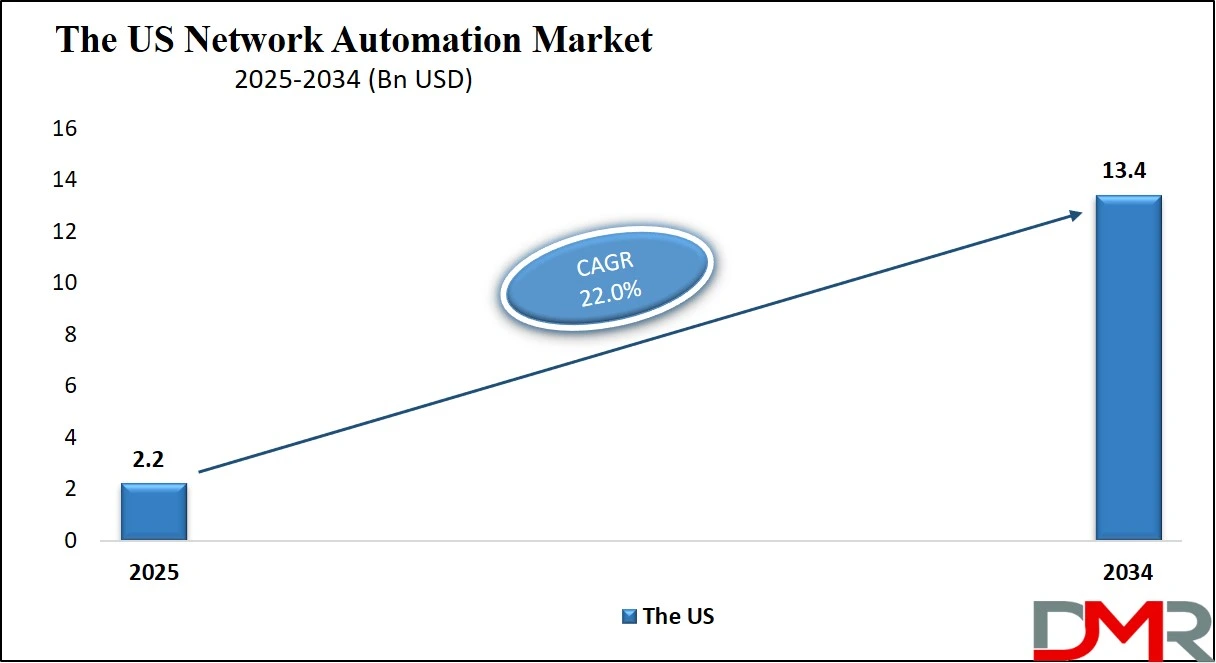

The US Network Automation Market

The U.S. Network Automation Market size is projected to be valued at USD 2.2 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 13.4 billion in 2034 at a CAGR of 22.0%.

The United States network automation market stands as a frontrunner globally, driven by rapid digital transformation, widespread adoption of cloud-native architectures, and the increasing need for intelligent, scalable networking solutions.

Enterprises across industries, including telecom, banking, healthcare, and manufacturing, are investing heavily in automation tools to streamline network operations, reduce downtime, and enhance security posture. With the proliferation of connected devices, 5G rollout, and the shift toward edge computing, there is a growing demand for AI-powered network orchestration, zero-touch provisioning, and policy-driven automation platforms.

U.S.-based tech giants and cloud service providers are also accelerating the deployment of software-defined networking (SDN) and network function virtualization (NFV), further reinforcing the region’s leadership in network automation technologies.

The U.S. market is also witnessing a strong focus on hybrid IT environments, where enterprises are integrating on-premise infrastructure with public and private cloud networks. This trend has amplified the need for unified network visibility, automated compliance management, and predictive network analytics.

Vendors in the region are offering intent-based networking solutions, self-healing networks, and intelligent monitoring tools to meet the growing complexity of enterprise IT ecosystems.

Moreover, regulatory compliance, cybersecurity challenges, and operational cost pressures are prompting organizations to adopt programmable network infrastructure that supports agility, resilience, and seamless service delivery. With advanced R&D capabilities, a strong presence of key market players, and a high adoption rate of emerging technologies, the U.S. network automation market is poised for sustained and high-impact growth.

Europe Network Automation Market

The Europe network automation market is projected to be valued at approximately USD 1.7 billion in 2025, accounting for a significant portion of global adoption. This growth is primarily driven by the region's rapid digital transformation across key industries such as telecommunications, manufacturing, and government services.

Countries like Germany, the United Kingdom, and France are investing heavily in 5G infrastructure, cloud migration, and AI-integrated networks, all of which require highly automated and scalable network environments. The rising need to reduce network complexity, enhance service agility, and ensure regulatory compliance is pushing enterprises and service providers toward adopting intelligent, software-defined, and intent-based networking frameworks.

With a robust projected CAGR of 22.4% from 2025 to 2034, Europe’s network automation market is set for strong and sustained growth. Strategic initiatives by the European Union focusing on digital sovereignty, data security, and green IT infrastructure are further propelling demand for automation platforms that are secure, energy-efficient, and compliant with strict governance protocols.

Additionally, the increasing deployment of IoT and edge computing across smart cities and industrial zones is creating new demand for real-time, automated network operations. These factors combined are positioning Europe as a technologically progressive and regulation-conscious region that is likely to remain at the forefront of network automation adoption throughout the forecast period.

Japan Network Automation Market

The Japan network automation market is estimated to be worth USD 350 million in 2025, reflecting a growing demand for intelligent and adaptive networking solutions across the country’s highly digitized economy. This growth is being propelled by Japan’s strong focus on automation-led infrastructure modernization, particularly within the telecommunications, automotive, financial services, and smart manufacturing sectors.

As Japanese enterprises accelerate their adoption of AI, cloud computing, and edge technologies, there is a pressing need for network architectures that are scalable, resilient, and capable of autonomous operation. The government’s initiatives under “Society 5.0” and nationwide 5G deployment further amplify the demand for advanced network orchestration and zero-touch provisioning systems.

With a projected CAGR of 20.6% between 2025 and 2034, Japan’s network automation market is poised for steady expansion. Companies are increasingly deploying software-defined networking (SDN), network functions virtualization (NFV), and intent-based networking (IBN) to reduce operational costs and improve efficiency across distributed IT environments.

Japan’s technological sophistication, combined with a high standard for reliability and security, makes it an ideal environment for the adoption of AI-powered automation platforms. The market is also benefiting from the collaboration between local system integrators and global network automation vendors, enabling the rollout of customized solutions that meet Japan’s unique regulatory and performance standards.

Global Network Automation Market: Key Takeaways

- Market Value: The global network automation market size is expected to reach a value of USD 46.6 billion by 2034 from a base value of USD 7.0 billion in 2025 at a CAGR of 23.5%.

- By component segment analysis, solutions are anticipated to dominate the market, capturing 63.0% of the total market share in 2025.

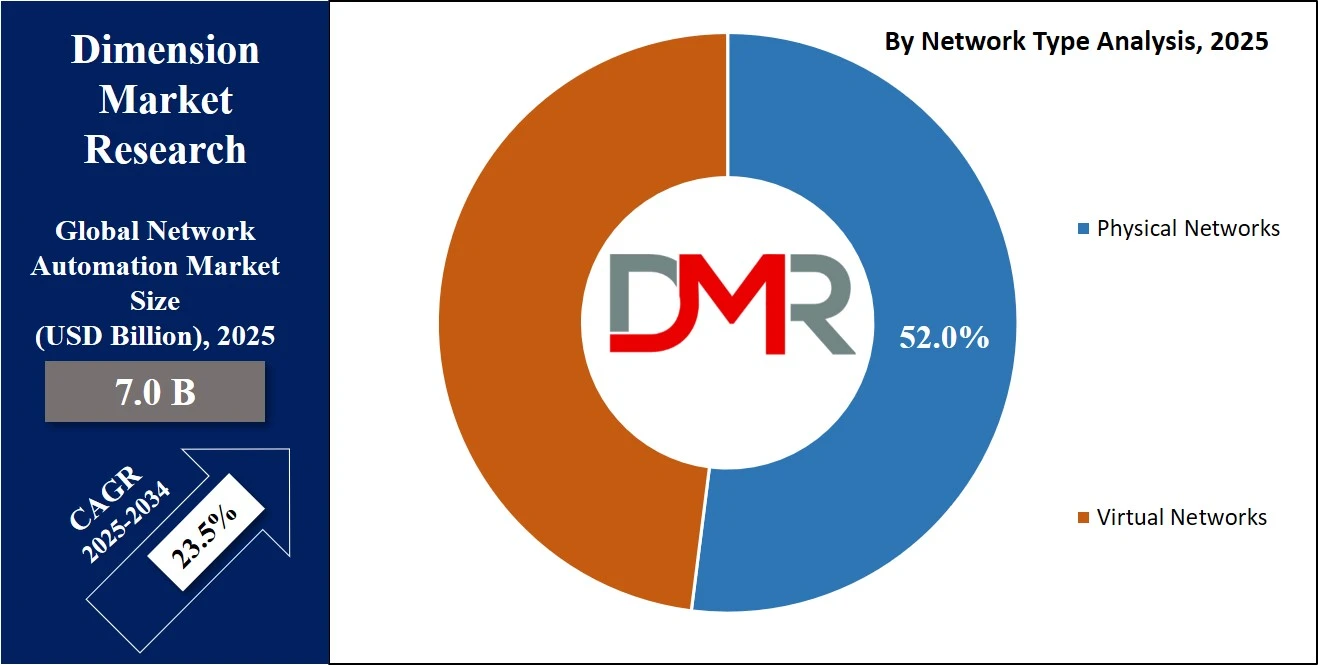

- By Network Type Segment Analysis: Physical Networks are expected to maintain their dominance in the network type segment, capturing 52.0% of the total market share in 2025.

- By Deployment Mode Segment Analysis: On-Premise mode will dominate the deployment mode segment, capturing 44.0% of the market share in 2025.

- By Network Infrastructure Segment Analysis: Wireless Networks are expected to consolidate their position in the network infrastructure segment, capturing 59.0% of the market share in 2025.

- By Technology Segment Analysis: SDN (Software-Defined Networking) technologies are poised to consolidate their dominance in the technology segment, capturing 28.0% of the total market share in 2025.

- By Application Segment Analysis: Network Provisioning applications will account for the maximum share in the application segment, capturing 22.0% of the total market value.

- By Industry Vertical Segment Analysis: The IT & Telecom is expected to consolidate its dominance in the industry vertical segment, capturing 38.0% of the market share in 2025.

- Regional Analysis: North America is anticipated to lead the global network automation market landscape with 38.0% of total global market revenue in 2025.

- Key Players: Some key players in the global network automation market are Cisco Systems, Juniper Networks, IBM Corporation, Hewlett-Packard Enterprise, Arista Networks, VMware, Nokia, Huawei Technologies, NetBrain Technologies, SolarWinds, Apstra, Red Hat, BlueCat Networks, Forward Networks, Riverbed Technology, Itential, and Others.

Global Network Automation Market: Use Cases

- Telecom Network Optimization with AI-Driven Automation: Telecommunications providers are among the top adopters of network automation technologies, using them to optimize performance, reduce latency, and ensure service continuity in large-scale networks. With the rise of 5G infrastructure, network slicing, and the expansion of mobile broadband, operators are implementing AI-driven automation to handle complex traffic patterns and real-time provisioning. Through intent-based networking and closed-loop automation, telecom networks can self-adjust routing paths, balance loads intelligently, and automatically isolate faults, minimizing service disruptions. Zero-touch provisioning enables fast deployment of base stations and core network elements, particularly in rural and underserved regions. These capabilities significantly reduce operational expenditure (OPEX), accelerate service delivery, and enhance customer experience in highly competitive markets.

- Enterprise IT Infrastructure Management in Hybrid Cloud Environments: Large enterprises operating hybrid and multi-cloud environments use network automation to manage increasingly complex IT infrastructures. As business operations become more distributed and data-intensive, organizations require seamless connectivity across on-premise data centers, private clouds, and public cloud providers. Network automation tools enable policy-based configuration management, real-time network visibility, and proactive threat detection, all from a centralized dashboard. Automated network segmentation and compliance monitoring ensure that regulatory requirements, such as GDPR, HIPAA, and SOX, are consistently enforced across all environments. Enterprises also leverage automation to integrate SD-WAN solutions, dynamically adjust bandwidth, and support high-performance workloads in cloud-native applications. This leads to improved network agility, scalability, and secure data exchange across distributed teams and resources.

- Financial Institutions Ensuring Secure and Compliant Network Operations: In the banking, financial services, and insurance (BFSI) sector, network automation plays a crucial role in ensuring uptime, data security, and compliance with global regulatory standards. Financial institutions deal with high volumes of sensitive transactions and must maintain low-latency, high-availability network environments. With automation, they can continuously monitor network traffic, automate security policy enforcement, and quickly respond to potential threats or anomalies using AI-based analytics. Automated failover systems and disaster recovery protocols also ensure business continuity in the event of unexpected outages. In addition, automation helps these institutions perform seamless network audits, log management, and remediation processes with minimal human intervention, supporting both operational efficiency and regulatory compliance.

- Smart Manufacturing with Industrial IoT and Predictive Networking: In network automation environments, network automation enables the integration and management of Industrial IoT (IIoT) devices, robotics, and real-time analytics platforms. Factory floors are increasingly equipped with sensors, cameras, and connected machines that require consistent, low-latency communication across industrial control systems. Network automation provides predictive maintenance capabilities by analyzing network data to anticipate potential failures or bottlenecks. It also automates the segmentation of production zones to isolate faults and enhance security. Through self-configuring and self-optimizing networks, manufacturers can reduce downtime, boost productivity, and support just-in-time operations. Integration with edge computing further allows processing of time-sensitive data locally, reducing dependency on central data centers and enabling faster decision-making in mission-critical processes.

Impact of Artificial Intelligence on Network Automation Market

Artificial Intelligence (AI) is revolutionizing the network automation market by introducing intelligence, adaptability, and predictive capabilities into traditionally static network infrastructures. AI-powered network automation enables real-time decision-making, anomaly detection, and self-healing mechanisms that significantly reduce manual intervention and improve network performance.

As enterprise and service provider networks grow more complex, spanning multi-cloud environments, edge devices, and dynamic traffic patterns, AI plays a pivotal role in managing this complexity through automated learning and continuous optimization.

One of the most transformative impacts of AI in network automation is seen in intent-based networking, where AI algorithms translate business intent into automated network configurations. AI enhances predictive analytics, allowing network operators to anticipate faults, congestion, or security threats before they impact performance. It also supports dynamic bandwidth allocation, traffic prioritization, and adaptive security enforcement, ensuring optimal resource utilization and minimal downtime.

Furthermore, AI-driven automation improves network orchestration in Software-Defined Networking (SDN) and Network Function Virtualization (NFV) environments by enabling context-aware adjustments. As AI continues to evolve, it is expected to become the cornerstone of next-generation autonomous networks, driving greater scalability, resilience, and cost efficiency across the global network automation market.

Global Network Automation Market: Stats & Facts

U.S. Congress / FCC Policy and Spectrum Allocation

- The U.S. Congress authorized radio frequency spectrum specifically for 5G to support automation in enterprise and telecom networks.

- Federal legislation was passed to streamline the deployment of 5G infrastructure such as small cells on federal land, supporting scalable automated networking.

- U.S. federal agencies are restricted from procuring foreign-origin telecom hardware, indirectly promoting domestic secure and automated networking systems.

U.S. Government Cybersecurity Agencies (US-CERT / NIST / NCCIC)

- U.S. cybersecurity guidelines mandate the use of automated response systems in industrial control networks as part of incident response protocols.

- The National Institute of Standards and Technology (NIST) recommends implementing software-defined network (SDN) security best practices to ensure automation does not introduce new vulnerabilities.

- NCCIC’s MOSAICS initiative promotes automated situational awareness technologies across defense and energy networks for real-time threat mitigation.

Global Network Automation Market: Market Dynamics

Global Network Automation Market: Driving Factors

Surge in Demand for Scalable and Agile Network Infrastructure

The growing reliance on cloud computing, remote collaboration tools, and connected devices has significantly increased network complexity. Organizations are turning to network automation to ensure scalable, agile, and high-performing infrastructure that supports digital transformation initiatives. Automated provisioning, intelligent routing, and real-time configuration changes enable IT teams to meet the dynamic needs of modern hybrid networks, particularly in sectors like telecom, BFSI, and manufacturing.

Proliferation of AI and Machine Learning in Network Management

AI and machine learning are becoming integral to next-gen network automation platforms. These technologies empower networks to analyze vast volumes of telemetry data, identify anomalies, and apply self-healing protocols without human intervention. AI-driven networking enhances efficiency by enabling intent-based networking, predictive maintenance, and traffic optimization, which are crucial for minimizing downtime and improving user experience across distributed environments.

Global Network Automation Market: Restraints

High Initial Deployment and Integration Costs

Despite long-term cost savings, the upfront investment required for deploying network automation solutions can be substantial. The expenses associated with integrating legacy infrastructure, training IT staff, and adopting complex automation platforms deter adoption, especially among SMEs. Additionally, aligning automation tools with existing security policies and compliance frameworks can require significant technical expertise and consulting support.

Security Risks in Automated Environments

Automating critical network functions introduces new cybersecurity challenges. If not properly configured, automated systems can propagate errors at scale or create vulnerabilities that can be exploited by threat actors. The risk of automation tools being misused or compromised underscores the importance of robust access control, policy-driven automation, and continuous monitoring, elements that some organizations struggle to implement effectively.

Global Network Automation Market: Opportunities

Growing Adoption of 5G and Edge Computing

The rollout of 5G and expansion of edge data centers open significant opportunities for network automation. Telecom operators and cloud service providers are seeking intelligent orchestration tools to manage real-time traffic, reduce latency, and ensure seamless connectivity across distributed networks. Automation platforms that support zero-touch provisioning, bandwidth slicing, and remote network configuration are increasingly in demand to support this infrastructure evolution.

Rise of Intent-Based and Policy-Driven Networking

There is a growing shift toward intent-based networking systems (IBNS) that align network behavior with high-level business objectives. This evolution allows administrators to define policies and desired outcomes, with the automation platform dynamically adjusting network configurations to fulfill those intents. As organizations seek to increase agility while ensuring governance, the demand for policy-centric automation is rising, especially in highly regulated industries such as finance and healthcare.

Global Network Automation Market: Trends

Integration of Network Automation with DevOps and NetOps

A key trend is the merging of network operations with software development practices, often referred to as NetDevOps. Organizations are integrating network automation into their DevOps pipelines to accelerate infrastructure delivery, version control network configurations, and automate testing in staging environments. This approach fosters agility, improves change management, and enables continuous deployment of network policies and services in line with business needs.

Shift toward Multi-Vendor Interoperability and Open Standards

Enterprises are increasingly seeking vendor-agnostic network automation platforms that can integrate with diverse hardware and software ecosystems. The move toward open-source tools, APIs, and interoperable protocols like REST, gRPC, and YANG is driving innovation and reducing vendor lock-in. This trend supports the deployment of flexible automation architectures that can adapt to evolving business environments and accommodate future technology shifts such as IoT expansion or SD-WAN optimization.

Global Network Automation Market: Research Scope and Analysis

By Component Analysis

In the network automation market, the component segment is broadly categorized into solutions and services. Among these, solutions are expected to dominate, capturing approximately 63.0% of the total market share in 2025. This dominance is primarily driven by the rising adoption of advanced software platforms that enable centralized network orchestration, real-time monitoring, and policy-based automation.

These solutions encompass a wide range of functionalities, including intent-based networking, AI-driven traffic analysis, dynamic configuration, and zero-touch provisioning, which are critical for managing increasingly complex and hybrid IT environments. Enterprises and telecom operators are investing heavily in these platforms to enhance operational efficiency, reduce manual errors, and achieve faster service delivery.

On the other hand, the services segment, while smaller in share, plays a crucial supporting role in enabling successful implementation and long-term functionality of network automation solutions. This includes professional services such as consulting, integration, and deployment support, as well as managed services for ongoing monitoring, troubleshooting, and optimization of automated network environments.

As businesses adopt more sophisticated automation tools, there is a growing need for expert guidance to align these solutions with specific business objectives, security policies, and compliance requirements. Additionally, the demand for managed services is increasing as organizations seek to outsource network operations to reduce internal IT workload and focus on core business activities. Together, both components are essential in driving the scalability and reliability of modern automated networks.

By Network Type Analysis

Within the network type segment of the network automation market, physical networks are expected to maintain their dominance, accounting for around 52.0% of the total market share in 2025. This continued lead is attributed to the foundational role physical infrastructure still plays in global enterprise and telecom environments. Despite the rise of virtualized solutions, most organizations rely on routers, switches, firewalls, and other hardware-based components to support core networking functions.

These physical network environments require advanced automation to manage configurations, monitor performance, and ensure high availability. As organizations expand their data centers, adopt edge computing, and upgrade to high-speed connectivity, the need for intelligent automation in physical networks remains strong, especially to handle complex traffic loads and prevent manual errors in large-scale deployments.

In contrast, virtual networks are rapidly gaining momentum as enterprises move toward more flexible, software-defined environments. Virtual network infrastructure, which includes technologies like software-defined networking (SDN) and network function virtualization (NFV), allows organizations to create, manage, and optimize network services using software instead of physical hardware.

These networks enable scalable and cost-efficient operations by decoupling control and data planes, making it easier to orchestrate traffic and implement policy-driven automation across multi-cloud and hybrid environments. While currently holding a slightly smaller share, the virtual network segment is expected to witness faster growth over the coming years, driven by increasing cloud adoption, remote work trends, and the need for agile, programmable network frameworks that support rapid business innovation.

By Deployment Mode Analysis

In the deployment mode segment of the network automation market, the on-premise model is expected to dominate in 2025, accounting for approximately 44.0% of the total market share. This preference is largely driven by organizations that prioritize data control, security, and compliance. Industries such as banking, healthcare, and government often manage sensitive information and operate within strict regulatory frameworks, making on-premise deployment more suitable.

With on-premise network automation, enterprises can maintain full visibility and governance over their infrastructure, customize configurations to meet internal policies, and minimize external access points that may pose security risks. Large enterprises especially favor this model with existing IT infrastructure and the resources to manage network operations in-house.

Despite the growing popularity of cloud-based models, on-premise deployment remains relevant due to its performance reliability and ability to integrate seamlessly with legacy systems. Organizations with complex networks or those in regions with limited cloud infrastructure support often choose on-premise automation to ensure consistent network uptime and low-latency operations.

Additionally, some businesses prefer on-premise solutions to maintain operational autonomy and avoid reliance on third-party cloud vendors. While cloud-based automation is growing rapidly, on-premise deployments continue to be essential for mission-critical environments that demand high levels of customization, control, and security assurance.

By Network Infrastructure Analysis

In the network infrastructure segment of the network automation market, wireless networks are expected to consolidate their lead by capturing approximately 59.0% of the total market share in 2025. This growing dominance is driven by the widespread adoption of mobile devices, increasing use of cloud-based applications, and the rollout of technologies such as Wi-Fi 6 and 5G. Wireless infrastructure supports greater flexibility, mobility, and scalability, making it essential for modern enterprise networks, especially in industries embracing digital transformation and remote operations.

Automation plays a crucial role in managing wireless networks by enabling dynamic access point provisioning, intelligent load balancing, real-time performance monitoring, and automated troubleshooting. These capabilities are vital for ensuring seamless connectivity and low-latency performance in environments with dense user traffic or high bandwidth demands.

On the other hand, wired networks continue to hold an important share of the market and are essential in scenarios that demand stability, speed, and high security. Organizations with mission-critical operations, such as data centers, financial institutions, and manufacturing plants, rely heavily on wired infrastructure for its reliability and consistent throughput.

Network automation in wired environments facilitates tasks such as port configuration, firmware updates, and fault detection, helping reduce downtime and optimize operations. Although the market share for wired networks is comparatively smaller, these networks remain the backbone of enterprise connectivity, supporting wireless systems and serving as a critical layer for high-performance computing, storage systems, and core communication channels.

By Technology Analysis

In the technology segment of the network automation market, Software-Defined Networking (SDN) is expected to maintain its leading position, capturing around 28.0% of the total market share in 2025. SDN offers a centralized, programmable approach to managing network infrastructure, which significantly simplifies control over complex and distributed networks. By decoupling the control plane from the data plane, SDN enables greater agility, scalability, and flexibility in configuring network services.

This makes it particularly beneficial for enterprises and telecom operators looking to optimize traffic flow, enforce policy-based routing, and quickly adapt to changing business requirements. Network automation tools integrated with SDN platforms allow real-time provisioning, intelligent traffic management, and seamless integration with cloud-native applications, which are critical in environments that demand high responsiveness and operational efficiency.

Alongside SDN, Network Functions Virtualization (NFV) also plays a significant role in transforming traditional network operations by virtualizing key network services such as firewalls, load balancers, and intrusion detection systems. NFV reduces the dependency on proprietary hardware and allows organizations to run these functions as software on standard servers, resulting in reduced costs and improved scalability.

In the context of network automation, NFV supports dynamic service chaining, automated resource allocation, and rapid deployment of network functions across virtualized environments. As more businesses shift to multi-cloud and edge computing models, NFV becomes an enabler of agility and service innovation. While its market share is slightly lower compared to SDN, NFV continues to gain traction, especially among telecom providers aiming to modernize their network architecture and deliver services faster and more efficiently.

By Application Analysis

In the application segment of the network automation market, network provisioning is projected to account for the largest share, capturing approximately 22.0% of the total market value in 2025. Network provisioning involves the automated setup of network resources, including switches, routers, firewalls, and access controls, to support the deployment of services and applications. This process is essential for ensuring that users, devices, and systems can connect to the network securely and efficiently from the moment they are introduced.

As organizations increasingly adopt cloud infrastructure, IoT, and distributed work environments, the demand for rapid and accurate provisioning has grown significantly. Automation tools streamline this process by enabling zero-touch provisioning, reducing setup time, and minimizing configuration errors. This is particularly important for telecom providers and large enterprises that manage thousands of devices across diverse locations, where manual provisioning would be time-consuming and prone to inconsistencies.

Network configuration also plays a vital role in the network automation ecosystem by automating the setup and modification of device parameters and policies across the network infrastructure. This includes managing IP addresses, routing protocols, access control lists, VLANs, and firmware updates.

Automated configuration reduces the risk of human error, ensures compliance with internal and regulatory standards, and allows IT teams to roll out changes at scale with minimal disruption. With increasing network complexity and the growing need for consistent performance and security, businesses are turning to automation solutions that support real-time configuration updates, rollback capabilities, and centralized management. While it captures a slightly smaller share compared to provisioning, network configuration remains a foundational element in achieving efficient, secure, and policy-driven network operations.

By Industry Vertical Analysis

In the industry vertical segment of the network automation market, the IT and telecom sector is projected to maintain its dominant position, capturing around 38.0% of the market share in 2025. This dominance is largely attributed to the sector’s continuous drive for innovation, the rapid expansion of 5G networks, and the increasing reliance on cloud computing, edge technologies, and data-intensive services.

Telecom providers, in particular, are leveraging network automation to manage high volumes of data traffic, optimize bandwidth allocation, and enable faster deployment of new services through software-defined networking and intent-based automation.

The IT sector, encompassing data centers, managed service providers, and cloud platforms, uses automation to ensure network scalability, improve performance, and reduce downtime. With rising pressure to deliver reliable and secure digital services, IT and telecom companies are at the forefront of adopting AI-driven network intelligence, real-time provisioning, and automated monitoring to maintain operational efficiency and customer satisfaction.

The BFSI sector, while comparatively smaller in share, plays a crucial role in the growth of the network automation market. Financial institutions require robust and highly secure network infrastructure to support digital banking, real-time payments, and regulatory compliance. Automation in BFSI helps ensure uninterrupted connectivity, enforce stringent security protocols, and manage network changes without manual intervention. It also enables rapid incident response and facilitates disaster recovery in the event of system failures or cyberattacks.

Given the sensitivity of customer data and the need for 24/7 operations, banks and insurance companies are adopting automation to gain better visibility into their networks, maintain audit readiness, and streamline compliance with standards like PCI-DSS and SOX. As digital transformation deepens across the financial sector, network automation will become increasingly essential in supporting secure, scalable, and compliant network operations.

The Network Automation Market Report is segmented based on the following:

By Component

By Network Type

- Physical Networks

- Virtual Networks

By Deployment Mode

By Network Infrastructure

- Wired Networks

- Wireless Networks

By Technology

- SDN (Software-Defined Networking)

- NFV (Network Functions Virtualization)

- Intent-Based Networking (IBN)

- AI & ML Integration

- Traditional Network Management

By Application

- Network Provisioning

- Network Configuration

- Network Monitoring

- Security & Compliance

- Policy Management

- Troubleshooting & Diagnostics

- Others

By Industry Vertical

- IT & Telecom

- BFSI

- Healthcare

- Manufacturing

- Retail & E-commerce

- Government & Defense

- Energy & Utilities

- Others

Global Network Automation Market: Regional Analysis

Region with the Largest Revenue Share

North America is anticipated to dominate the global network automation market in 2025, contributing approximately 38.0% of the total market revenue. This leadership is driven by the strong presence of key technology providers, early adoption of advanced networking solutions, and significant investments in AI-driven automation, 5G infrastructure, and cloud-native platforms.

Enterprises across the region, particularly in the United States and Canada, are increasingly leveraging software-defined networking, intent-based automation, and hybrid cloud environments to enhance operational agility and network resilience. Additionally, regulatory compliance needs and the demand for secure, scalable, and high-performance networks are further fueling the adoption of network automation across industries such as telecom, finance, healthcare, and government.

Region with significant growth

Asia Pacific is projected to witness the most significant growth in the network automation market over the coming years, driven by rapid digitalization, expanding telecom infrastructure, and increasing adoption of cloud and 5G technologies across emerging economies like China, India, and Southeast Asian countries.

The region’s growing base of internet users, coupled with the surge in data traffic and demand for low-latency connectivity, is prompting both enterprises and service providers to invest in scalable and intelligent network automation solutions.

Government-led initiatives supporting smart city development, industrial automation, and digital transformation are further accelerating the deployment of AI-enabled networking, SDN, and NFV technologies. As businesses in Asia Pacific modernize their IT infrastructure to remain competitive, the demand for automated, resilient, and cost-effective network operations is expected to rise sharply.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Network Automation Market: Competitive Landscape

The global competitive landscape of the network automation market is characterized by the presence of both established technology giants and emerging innovators, all striving to enhance network intelligence, agility, and efficiency.

Key players such as Cisco Systems, Juniper Networks, IBM, Hewlett Packard Enterprise, and Arista Networks are leveraging their extensive portfolios in SDN, NFV, and AI-driven automation to offer end-to-end solutions tailored for complex enterprise and telecom environments. These companies focus heavily on R&D, strategic acquisitions, and cloud-native platform development to maintain market leadership.

Simultaneously, niche players like NetBrain, Itential, and Forward Networks are gaining traction by delivering specialized automation tools with intuitive orchestration, real-time analytics, and policy-based management capabilities.

As competition intensifies, vendors are increasingly adopting open-source frameworks, collaborating with cloud providers, and integrating advanced security and compliance features to differentiate their offerings in a rapidly evolving digital networking ecosystem.

Some of the prominent players in the global network automation market are:

- Cisco Systems

- Juniper Networks

- IBM Corporation

- Hewlett-Packard Enterprise (HPE)

- Arista Networks

- VMware

- Nokia

- Huawei Technologies

- NetBrain Technologies

- SolarWinds

- Apstra (acquired by Juniper)

- Red Hat (an IBM company)

- BlueCat Networks

- Forward Networks

- Riverbed Technology

- Itential

- Anuta Networks

- Micro Focus

- Fortinet

- Ciena Corporation

- Other Key Players

Global Network Automation Market: Recent Developments

Product Launches

- June 2025: Cisco unveiled its latest secure network architecture tailored for campus, branch, and industrial environments. Designed for AI workloads, it features unified management, embedded security, and simplified operations to support intelligent networking and automation.

- February 2025: Juniper Networks expanded its AI-native routing portfolio with the Mist AI‑driven ACX7020 Access Edge Router. This launch enhances WAN routing automation, closed-loop remediation, and edge performance.

Mergers & Acquisitions

- July 2025: Hewlett-Packard Enterprise completed a USD 14 billion acquisition of Juniper Networks, strengthening its AI-native and cloud‑native networking capabilities and creating a powerful hybrid-cloud provider.

- June 2025: Netgear acquired Bengaluru‑based cybersecurity startup Exium to enhance its managed service and secure network automation offerings for MSP clients.

- July 2025: NetBox Labs secured USD 35 million in Series B funding from NGP Capital and others to advance its open-source NetBox platform for AI-centric data center and network infrastructure automation.

- April 2025: Cisco’s corporate venture arm led an investment in Opanga, a startup developing AI-powered network optimization tools, reinforcing Cisco’s focus on intelligent automation.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 7.0 Bn |

| Forecast Value (2034) |

USD 46.6 Bn |

| CAGR (2025–2034) |

23.5% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 2.2 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Solutions and Services), By Network Type (Physical Networks and Virtual Networks), By Deployment Mode (Cloud-Based and On-Premise), By Network Infrastructure (Wired Networks and Wireless Networks), By Technology (SDN, NFV, Intent-Based Networking, AI & ML Integration, and Traditional Network Management), By Application (Network Provisioning, Network Configuration, Network Monitoring, Security & Compliance, Policy Management, Troubleshooting & Diagnostics, and Others), By Industry Vertical (IT & Telecom, BFSI, Healthcare, Manufacturing, Retail & E-commerce, Government & Defense, Energy & Utilities, and Others). |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Cisco Systems, Juniper Networks, IBM Corporation, Hewlett-Packard Enterprise, Arista Networks, VMware, Nokia, Huawei Technologies, NetBrain Technologies, SolarWinds, Apstra, Red Hat, BlueCat Networks, Forward Networks, Riverbed Technology, Itential, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The global network automation market size is estimated to have a value of USD 7.0 billion in 2025 and is expected to reach USD 46.6 billion by the end of 2034.

The US network automation market is projected to be valued at USD 2.2 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 13.4 billion in 2034 at a CAGR of 22.0%.

North America is expected to have the largest market share in the global network automation market, with a share of about 38.0% in 2025.

Some of the major key players in the global network automation market are Cisco Systems, Juniper Networks, IBM Corporation, Hewlett-Packard Enterprise, Arista Networks, VMware, Nokia, Huawei Technologies, NetBrain Technologies, SolarWinds, Apstra, Red Hat, BlueCat Networks, Forward Networks, Riverbed Technology, Itential, and Others.

The market is growing at a CAGR of 23.5 percent over the forecasted period.