Market Overview

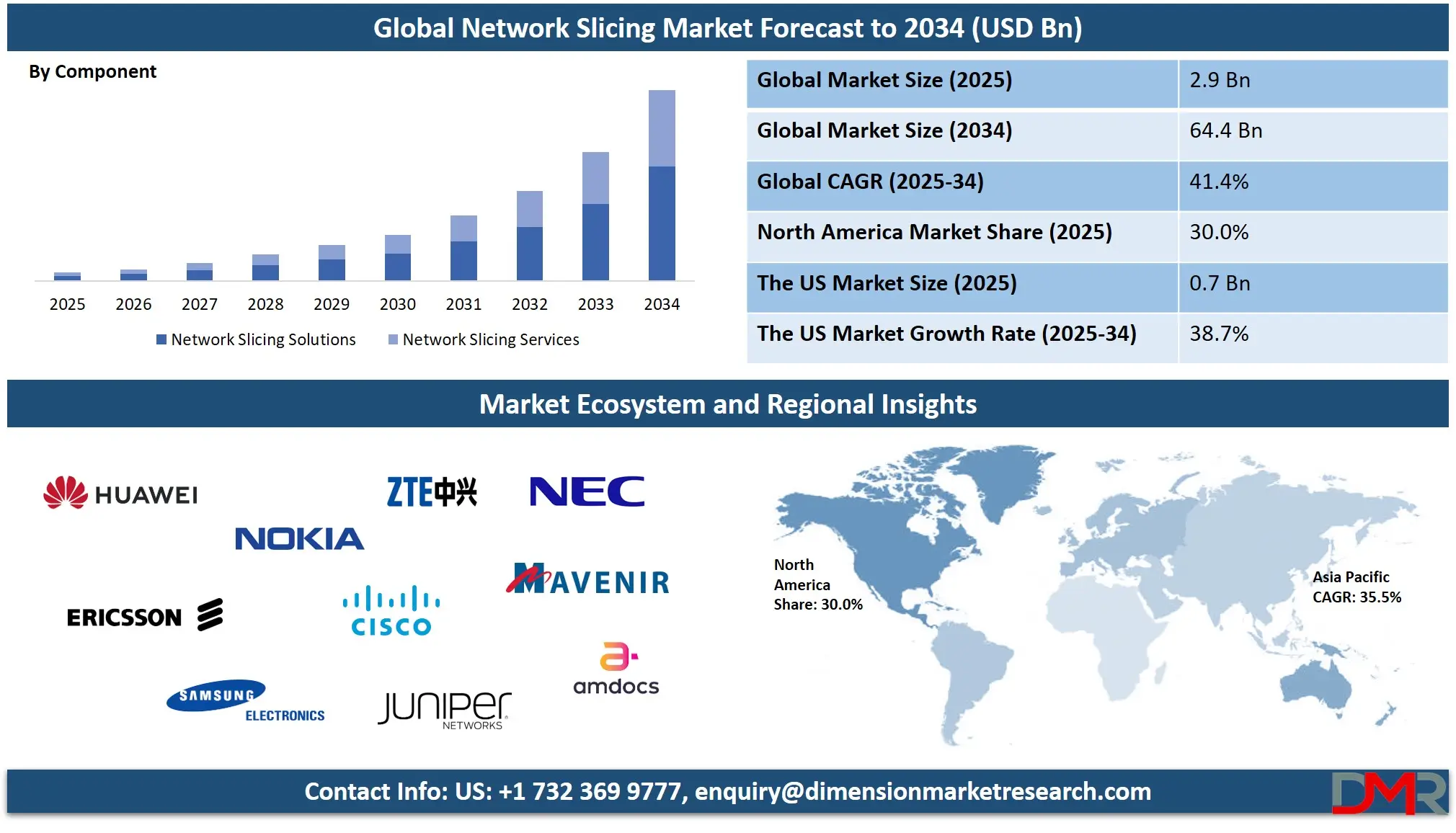

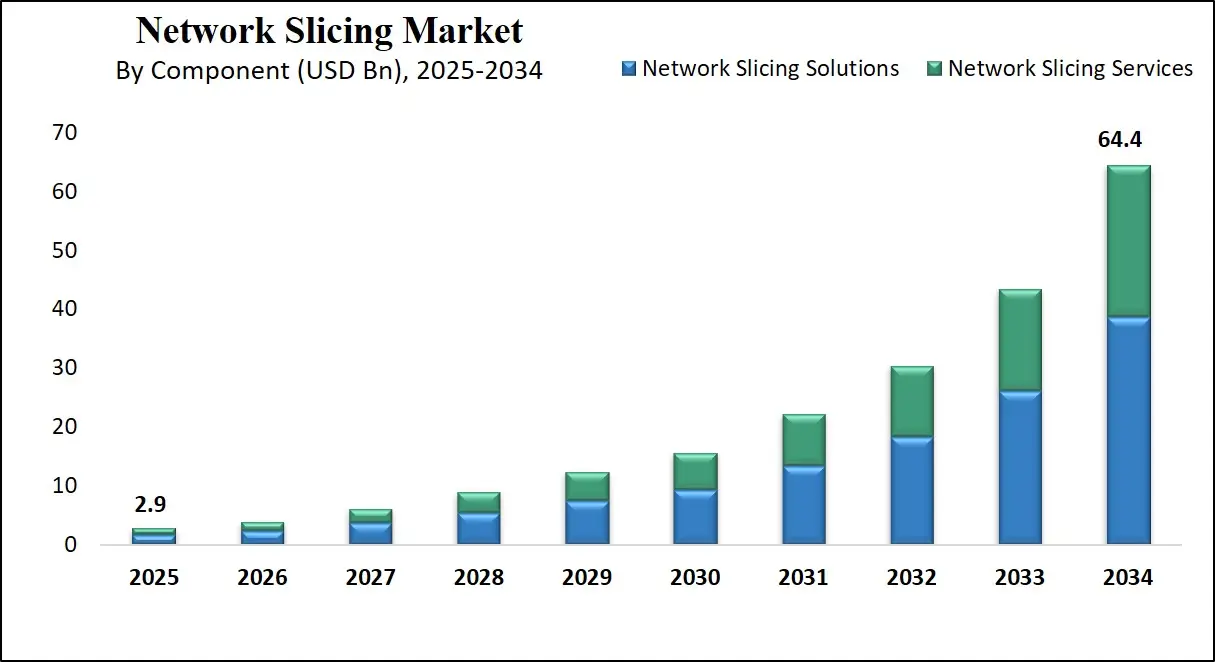

The Global Network Slicing Market is projected to reach USD 2.9 billion in 2025 and is expected to surge to USD 64.4 billion by 2034, reflecting a robust CAGR of 41.4%. This growth highlights accelerating adoption of 5G standalone networks, increasing demand for low latency connectivity, and rising deployment of cloud native slicing solutions across telecom operators and enterprise verticals.

Network slicing refers to the technique of dividing a physical network into multiple virtual and independent logical networks that run on shared infrastructure. Each slice is tailored to meet specific performance, latency, bandwidth, and reliability requirements, allowing operators to deliver customized connectivity for diverse applications such as autonomous vehicles, industrial automation, immersive media, and IoT ecosystems.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

This approach enables 5G networks to become more flexible and efficient because every slice operates as an isolated end to end system with its own resources, quality controls, and security parameters, ensuring highly differentiated service delivery across consumer and enterprise environments.

The global network slicing market represents the rapidly expanding ecosystem of technologies, platforms, orchestration tools, and service models that enable telecom operators and enterprises to create and manage virtualized network partitions across the core network, the radio access network, and the transport layer.

This market is driven by the growing adoption of 5G standalone architecture, increasing demand for low latency communications, and the rise of digital transformation initiatives across industries such as automotive, manufacturing, healthcare, and smart cities. Vendors are also investing heavily in cloud native architectures, AI enabled network automation, and dynamic slice lifecycle management to improve operational efficiency and service agility.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

As organizations accelerate their shift toward enterprise private networks and advanced connectivity solutions, network slicing is emerging as a foundational technology for mission critical applications, ultra-reliable communications, and massive IoT deployments. The market is further supported by collaborations among telecom operators, cloud service providers, and network equipment manufacturers who are building interoperable slicing ecosystems capable of supporting diverse industrial use cases.

With increasing emphasis on service differentiation, enhanced mobile broadband services, and multi domain orchestration, the global network slicing market is positioned for strong growth through innovations in virtualization, edge computing, and 5G monetization strategies.

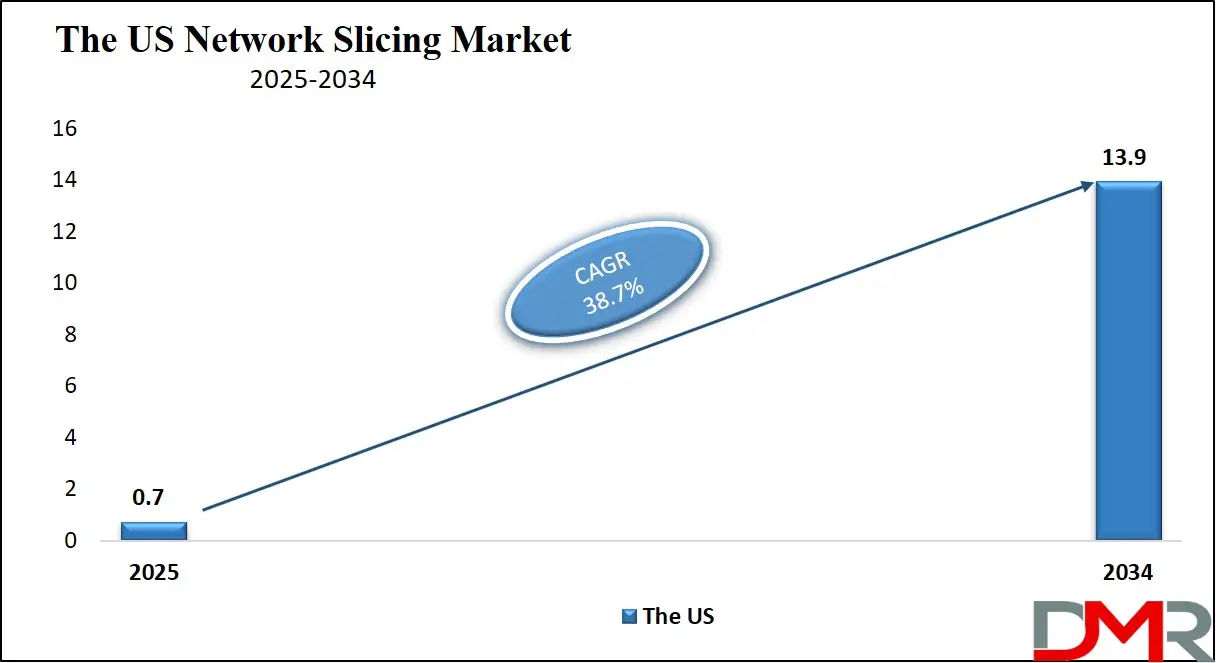

The US Network Slicing Market

The U.S. Network Slicing market size is projected to be valued at USD 0.7 billion by 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 13.9 billion in 2034 at a CAGR of 38.7%.

The US network slicing market is expanding rapidly as telecom operators accelerate nationwide 5G standalone deployments and invest in virtualized network infrastructure to support advanced digital services. Growth is driven by rising adoption of cloud native cores, AI powered orchestration tools, and multi domain automation that allow carriers to configure dedicated slices for enhanced mobile broadband, ultra-low latency applications, enterprise private networks, and massive IoT ecosystems.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Increasing demand from industries such as automotive, smart manufacturing, healthcare, public safety, and media streaming is pushing service providers toward highly customizable connectivity models that deliver guaranteed performance, security isolation, and real time scalability. This environment is positioning network slicing as a key enabler of next generation enterprise transformation in the United States.

The market is further strengthened by strong investments from US technology vendors, hyperscale cloud providers, and telecom operators collaborating on interoperable slicing frameworks and edge computing integration. As organizations prioritize mission critical communications, remote operations, industrial automation, and immersive digital experiences, network slicing is becoming a central component of the country’s connectivity roadmap.

Government initiatives supporting 5G innovation, rapid expansion of private wireless networks, and increasing commercialization of slicing based services are expected to unlock new revenue models across sectors. With growing focus on network virtualization, AI driven traffic management, and programmable connectivity, the US network slicing market is set to evolve into one of the most advanced and competitive ecosystems globally.

Europe Network Slicing Market

The Europe network slicing market is projected to reach approximately USD 700 million in 2025, driven by widespread 5G adoption, strong investment in cloud native and virtualized network infrastructures, and a high focus on enterprise digital transformation. Telecom operators across Germany, France, the UK, and Italy are deploying dedicated network slices to support enhanced mobile broadband, ultra-reliable low latency communications, and massive IoT applications. The growing need for private 5G networks in industrial automation, smart factories, healthcare, and public safety is further accelerating the deployment of slicing solutions in the region.

The market is expected to grow at a robust CAGR of 35% as operators and technology vendors invest in AI driven orchestration platforms, edge computing integration, and multi domain slice management. Strategic partnerships, technology collaborations, and government initiatives supporting 5G innovation are also contributing to market expansion. With increasing demand from enterprises for predictable performance, secure connectivity, and flexible bandwidth allocation, the Europe network slicing market is positioned for strong growth, offering significant opportunities for service providers and solution vendors in both consumer and industrial sectors.

Japan Network Slicing Market

The Japan network slicing market is estimated to reach around USD 2,700 million in 2025, driven by rapid deployment of 5G standalone networks, strong government support for next generation connectivity, and active adoption of cloud native and virtualized network infrastructures. Telecom operators in Japan are focusing on creating dedicated slices for enhanced mobile broadband, ultra-reliable low latency applications, and enterprise private networks to serve sectors such as automotive, manufacturing, healthcare, and smart cities. The increasing demand for mission critical communications, autonomous mobility solutions, and industrial IoT is further boosting the adoption of network slicing solutions across the country.

The market is expected to grow at a CAGR of 32%, supported by investments in AI based orchestration platforms, multi access edge computing, and automation of slice lifecycle management. Japanese operators are also leveraging strategic partnerships and technology collaborations to enhance interoperability and optimize network performance. With enterprises and public sector organizations prioritizing secure, high performance, and customizable connectivity solutions, the Japan network slicing market is poised for strong expansion, presenting lucrative opportunities for technology vendors and service providers in both industrial and consumer applications.

Global Network Slicing Market: Key Takeaways

- Market Value: The global Network Slicing market size is expected to reach a value of USD 64.4 billion by 2034 from a base value of USD 2.9 billion in 2025 at a CAGR of 41.4%.

- By Component Analysis: Network Slicing Solutions are anticipated to dominate the component segment, capturing 60.0% of the total market share in 2025.

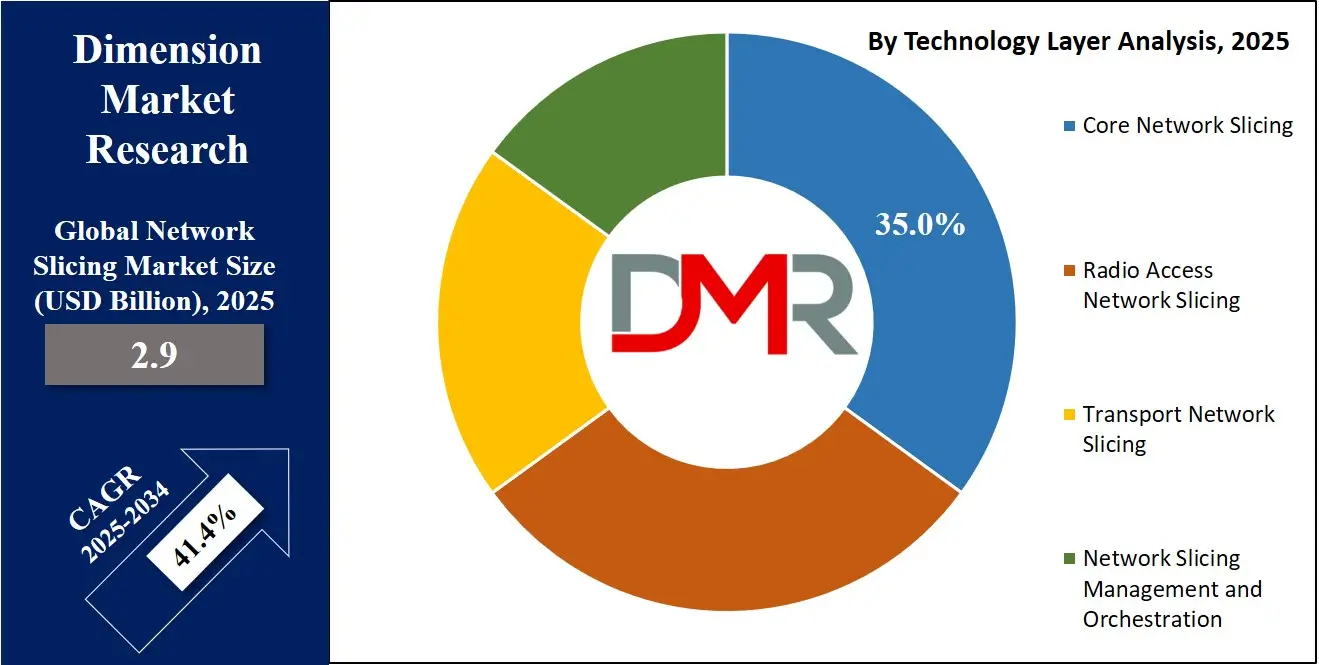

- By Technology Layer Segment Analysis: Core Network Slicing is expected to maintain its dominance in the technology layer segment, capturing 35.0% of the total market share in 2025.

- By Slice Type Segment Analysis: Enhanced Mobile Broadband Slice will dominate the slice type segment, capturing 35.0% of the market share in 2025.

- By Deployment Model Segment Analysis: Cloud-Native Deployment will account for the maximum share in the deployment model segment, capturing 50.0% of the total market value.

- By Organization Size Segment Analysis: Large Enterprises will dominate the organization size segment, capturing 60.0% of the market share in 2025.

- By End-User Industry Segment Analysis: Telecommunications Providers will capture the maximum share in the end-user industry segment, capturing 40.0% of the market share in 2025.

- Regional Analysis: Asia Pacific is anticipated to lead the global Network Slicing market landscape with 40.0% of total global market revenue in 2025.

- Key Players: Some key players in the global Network Slicing market are Huawei Technologies Co., Ltd., Nokia Corporation, Ericsson AB, Samsung Electronics Co., Ltd., ZTE Corporation, Cisco Systems, Inc., NEC Corporation, Mavenir Systems, Inc., Juniper Networks, Inc., Amdocs Inc., Affirmed Networks (Microsoft), Oracle Corporation, and Others.

Global Network Slicing Market: Use Cases

- Enhanced Mobile Broadband Applications: Enhanced mobile broadband is one of the most widely adopted use cases for the global network slicing market as operators leverage virtualized network segments to deliver high speed connectivity, seamless video streaming, immersive AR and VR experiences, and congestion free performance in high traffic zones. This slice enables telecom carriers to optimize bandwidth allocation, ensure consistent quality of service, and support data intensive applications across smart cities, public venues, and enterprise environments.

- Ultra Reliable Low Latency Communications: Network slicing is a critical enabler for ultra-reliable low latency communications required in autonomous vehicles, industrial automation, remote surgeries, and mission critical control systems. By allocating dedicated network resources with strict latency and reliability parameters, operators can guarantee deterministic communication for real time operations. This use case is accelerating demand for cloud native 5G cores, multi access edge computing, and AI based network orchestration.

- Massive Internet of Things Ecosystems: The global network slicing market supports massive IoT deployments by offering specialized slices designed for large scale sensor networks, smart utilities, smart agriculture, and connected devices that require efficient power usage and moderate data throughput. This approach enables operators to manage millions of device connections simultaneously while ensuring energy efficiency, network stability, and secure data transmission across geographically distributed environments.

- Enterprise Private Network Services: Enterprise private network slices are emerging as a major growth driver as manufacturing plants, logistics hubs, healthcare facilities, and corporate campuses require dedicated connectivity with enhanced security, predictable performance, and end to end isolation. Through network slicing, operators can deliver tailored services such as smart factory automation, fleet management, cloud robotics, remote monitoring, and AR guided operations. This use case is helping enterprises accelerate digital transformation and unlock new operational efficiencies.

Impact of Artificial Intelligence on the global Network Slicing market

Artificial intelligence is having a transformative impact on the global network slicing market by enabling fully automated, predictive, and highly efficient slice creation and management across 5G networks. AI driven analytics enhance real time decision making by monitoring traffic patterns, user behavior, and service demand to dynamically allocate network resources, ensuring optimal performance for enhanced mobile broadband, ultra-reliable low latency applications, and massive IoT deployments.

Machine learning models help operators identify congestion risks, predict QoS degradation, and optimize slice scaling with minimal human intervention, significantly reducing operational costs and improving service reliability.

AI powered orchestration platforms also enable intelligent slice lifecycle management that automates provisioning, configuration, monitoring, and healing across multi domain environments including the core network, radio access network, and edge computing layers. This level of automation accelerates deployment of enterprise private networks, supports mission critical communications, and strengthens network security through anomaly detection and automated threat mitigation.

As telecom operators adopt cloud native architectures and integrate AI based traffic engineering tools, the global network slicing market is poised for faster commercialization, enhanced monetization opportunities, and improved delivery of differentiated connectivity services.

Global Network Slicing Market: Stats & Facts

- International Telecommunication Union (ITU) – Global/Regional Connectivity Data

- As of 2025 there are ~9.2 billion mobile‑cellular subscriptions globally, equivalent to ~112 subscriptions per 100 inhabitants.

- Mobile broadband subscriptions reached 99 per 100 inhabitants globally in 2025.

- 36% of global mobile‑broadband subscriptions are now 5G / IMT‑2020 subscriptions.

- In 2025, 5G network coverage is estimated to reach 55% of the world’s population.

- In high‑income countries, 5G coverage reaches 84% of the population, while in low‑income countries it remains only 4%.

- Regional 5G coverage in 2025: Europe ~ 74% of population, Asia‑Pacific ~ 70%, Americas ~ 60%.

- Fixed broadband penetration in OECD countries (as of mid‑2024) averages 36.3 subscriptions per 100 inhabitants.

- Organisation for Economic Co‑operation and Development (OECD) – Broadband & 5G Trends in High‑Income Economies

- Within OECD countries, total 5G subscriptions grew by 48% over the preceding year (to 2024), reaching 33% of all mobile subscriptions (in data‑available countries).

- Fixed wireless access (FWA) subscriptions increased by 17% between June 2023–June 2024 across OECD countries, reflecting diversification of wireless broadband delivery.

- In several OECD countries, fibre-optic networks now represent 44.6% of all fixed broadband connections.

- GSMA / GSMA Intelligence – 5G Deployment & Connection Forecasts

- As of early 2024, there are 1.6 billion global 5G connections; GSMA expects this to rise to 5.5 billion by 2030.

- 5G is projected to become the dominant mobile technology in many markets, accounting for more than half of all mobile connections by 2029.

- In the Asia‑Pacific region, 5G is expected to represent around 41% of all mobile connections by 2030 (up from ~4% in 2022).

Global Network Slicing Market: Market Dynamics

Global Network Slicing Market: Driving Factors

Rapid expansion of 5G standalone networks

The growth of global network slicing is strongly supported by the accelerated rollout of 5G standalone architecture, which enables true end to end virtualization across the core, RAN, and transport layers. Telecom operators are adopting cloud native cores and software defined networking to deliver customized slices for enhanced mobile broadband, ultra-low latency applications, and enterprise private networks. This transition is increasing demand for programmable connectivity, automated network orchestration, and dynamic service delivery across multiple industry verticals.

Growing need for enterprise specific connectivity solutions

Large enterprises in manufacturing, logistics, healthcare, and automotive sectors are requesting dedicated network performance for mission critical operations, remote monitoring, and IoT ecosystems. Network slicing offers predictable latency, secure isolation, and flexible bandwidth allocation, making it ideal for Industry 4.0 systems, autonomous mobility, and real time robotics. This enterprise centric shift is driving strong adoption of slicing based service models and expanding the commercial use cases for 5G networks.

Global Network Slicing Market: Restraints

High complexity of multi domain integration

Integrating network slicing across heterogeneous domains such as core networks, radio access, transport systems, and edge computing introduces operational complexity. Operators must manage slice orchestration, QoS assurance, and resource synchronization in real time, which requires advanced AI tools and cloud native capabilities. The complexity of aligning legacy infrastructure with new virtualized environments can slow deployment and increase implementation costs.

Security and compliance challenges

As network slicing creates multiple virtual partitions on shared infrastructure, ensuring slice level security, data isolation, and end user privacy becomes more challenging. Any vulnerability in orchestration systems or misconfiguration across slices can lead to cross slice attacks or data leakage. Strict regulatory compliance across sensitive industries such as healthcare and finance further increases the need for robust slice level protection and continuous monitoring.

Global Network Slicing Market: Opportunities

Expansion of private 5G networks across enterprises

The rise of private 5G networks in factories, campuses, hospitals, and transportation hubs is creating significant opportunities for dedicated network slices tailored to industry specific workflows. Enterprises are using slicing to support automation, AI powered robotics, smart surveillance, and digital twin systems with guaranteed performance. This growing demand offers new revenue streams for telecom operators and technology vendors offering customizable slicing solutions.

Integration with edge computing platforms

Combining network slicing with multi access edge computing opens major opportunities for ultra-low latency applications such as AR guided operations, remote surgery, connected vehicles, and real time industrial analytics. Edge enabled slices can deliver localized processing, improved security, and faster response times. This convergence creates high potential for innovative service models and advanced connectivity ecosystems.

Global Network Slicing Market: Trends

AI driven automation of slice lifecycle management

Artificial intelligence is becoming a central trend in the network slicing market as operators deploy machine learning algorithms for predictive resource allocation, automated slice creation, and real time performance optimization. AI based platforms enhance slice orchestration, detect network anomalies, and ensure consistent service delivery for diverse use cases ranging from enhanced mobile broadband to massive IoT systems.

Growing adoption of cloud native and open network architectures

Telecom operators are increasingly moving toward cloud native 5G cores, containerized network functions, and open RAN frameworks to support flexible and scalable network slicing. This trend enables faster service deployment, multi vendor interoperability, and improved cost efficiency. The shift toward open and virtualized infrastructure is strengthening the ecosystem for slicing based services and accelerating innovation across global markets.

Global Network Slicing Market: Research Scope and Analysis

By Component Analysis

Network slicing solutions are expected to dominate the component segment with a projected 60% share in 2025 because operators globally are investing heavily in platforms that enable end to end virtualization, dynamic slice orchestration, automated resource allocation, and seamless integration across the core, RAN, and transport domains.

These solutions act as the technical backbone of slicing by allowing telecom providers to design, deploy, and manage customized network partitions that support enhanced mobile broadband, ultra-reliable low latency communication, and enterprise private networks. The rapid shift toward cloud native 5G cores, software defined networking, and AI driven traffic optimization is further accelerating adoption, as carriers need flexible, scalable, and high performance architectures to meet diverse connectivity requirements.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Network slicing services also hold significant importance in this segment as operators and technology vendors expand their consulting, integration, and managed service portfolios to support enterprises in adopting slicing based connectivity. These services include slice planning, design, lifecycle management, SLA assurance, monitoring, and continuous optimization to ensure reliable performance across mission critical applications.

With enterprises increasingly seeking customized connectivity for smart factories, healthcare systems, IoT deployments, and connected mobility, service providers are offering end to end deployment and operational support. This growing demand positions network slicing services as a key complementary component to solutions, enabling organizations to implement slicing technology without requiring deep in house technical capabilities.

By Technology Layer Analysis

Core network slicing is expected to lead the technology layer segment with 35% share in 2025 because it serves as the central layer where most of the intelligence, policy control, authentication, traffic management, and service orchestration functions reside. As operators transition to 5G standalone architecture, the core becomes fully cloud native and software defined, enabling dynamic slice creation, real time QoS enforcement, and automated resource allocation across different service categories such as eMBB, URLLC, and massive IoT.

The ability to isolate traffic flows, manage subscriber policies, and integrate AI driven analytics within the core makes this layer the most critical component for enabling slice scalability, security, and end to end automation. This growing reliance on virtualized and programmable core networks is driving its sustained dominance in the overall market.

Radio access network slicing also plays a crucial role in this segment by allowing operators to allocate dedicated radio resources, spectrum blocks, and scheduling mechanisms for different service requirements at the network edge. As 5G networks experience rising traffic from high density urban areas, connected vehicles, industrial automation, and consumer broadband services, RAN slicing ensures efficient utilization of radio spectrum while maintaining consistent performance and low latency.

It enables differentiated service tiers, prioritizes mission critical applications, and supports real time traffic balancing. The increasing adoption of open RAN, edge computing, and distributed cloud architectures is further enhancing the capabilities of RAN slicing, making it essential for operators aiming to deliver high quality, customized connectivity experiences across diverse environments.

By Slice Type Analysis

Enhanced mobile broadband slice is projected to dominate the slice type segment with 35% share in 2025 because it supports the highest volume of consumer and enterprise data traffic across 5G networks. As demand rises for UHD video streaming, cloud gaming, AR and VR applications, and high capacity connectivity in urban centers, operators rely on eMBB slices to deliver faster speeds, wider coverage, and consistent quality of service.

These slices allow flexible bandwidth allocation, dynamic scaling, and efficient traffic handling, making them essential for managing large data loads across smartphones, fixed wireless access, smart venues, and public hotspots. The strong push toward digital entertainment, virtual collaboration tools, and high speed broadband services further reinforces eMBB as the most widely deployed slicing use case in the global market.

Ultra reliable low latency communication slice is another key segment supporting mission critical applications that require deterministic performance, minimal delay, and high reliability. Industries such as autonomous transportation, industrial automation, remote surgery, robotics, and public safety depend on URLLC slices to maintain real time responsiveness and uninterrupted communication.

These slices are engineered with strict latency thresholds, prioritized traffic handling, and robust security mechanisms to ensure mission critical continuity even in congested network environments. As enterprises adopt advanced automation, connected machinery, and time sensitive operations, the demand for URLLC slices continues to rise, making them essential for next generation industrial and safety critical deployments.

By Deployment Model Analysis

Cloud native deployment is expected to account for the largest share in the deployment model segment, capturing 50% of the market value, because it allows telecom operators to build highly flexible, scalable, and efficient 5G network slices using containerized functions and microservices architecture. This approach enables dynamic resource allocation, real time orchestration, and automated lifecycle management across the core network, radio access network, and edge environments.

Cloud native deployments support faster service rollouts, simplified integration with multi vendor ecosystems, and enhanced operational efficiency, making them ideal for enterprise private networks, ultra-reliable low latency applications, and massive IoT ecosystems. The growing adoption of AI driven traffic management and cloud based orchestration tools further reinforces the dominance of this deployment model in the global market.

Virtualized deployment also plays a significant role in the market as it leverages virtual network functions on existing hardware to create flexible and isolated network slices without fully transitioning to cloud native architectures. This model allows operators to optimize existing infrastructure, support multiple service types, and reduce capital expenditure while still providing the benefits of network slicing such as customized connectivity, SLA assurance, and predictable performance.

Virtualized deployments are particularly useful for regions or enterprises where cloud adoption is gradual, enabling gradual migration to software defined 5G networks while ensuring reliable connectivity for enhanced mobile broadband, mission critical communications, and enterprise IoT applications.

By Organization Size Analysis

Large enterprises are expected to dominate the organization size segment, capturing 60% of the market share in 2025, as they are the primary adopters of network slicing solutions to support complex, mission critical operations and high volume data traffic. These organizations, including telecom operators, manufacturing conglomerates, healthcare providers, and logistics companies, require dedicated connectivity with guaranteed performance, low latency, and strong security.

Network slicing allows them to deploy private networks, support industrial automation, enable autonomous systems, and manage large scale IoT ecosystems efficiently. The scale of operations and the need for customized, reliable, and scalable connectivity make large enterprises the leading segment in the global network slicing market.

Small and medium enterprises also contribute to the network slicing market, albeit to a lesser extent, as they adopt slicing solutions to improve operational efficiency, enhance digital services, and support emerging applications without heavy infrastructure investment. SMEs benefit from managed services, cloud based slicing platforms, and flexible deployment models that allow them to access reliable connectivity for remote monitoring, smart office solutions, and moderate IoT implementations.

While their share is smaller compared to large enterprises, the increasing digitalization of SMEs across sectors such as retail, healthcare, and technology is gradually driving growth and expanding adoption of network slicing in this segment.

By End-User Industry Analysis

Telecommunications providers are expected to capture the maximum share in the end-user industry segment, accounting for 40% of the market in 2025, as they are the primary drivers of network slicing adoption. These operators leverage slicing to offer differentiated services, optimize network resources, and meet the increasing demand for high speed connectivity, ultra-reliable low latency communication, and massive IoT support.

By implementing dedicated slices, telecom providers can deliver enhanced mobile broadband, private enterprise networks, and mission critical applications efficiently while ensuring SLA compliance, traffic prioritization, and security isolation. Their central role in 5G deployment and investment in cloud native cores, AI driven orchestration, and multi domain slice management positions them as the largest end-users in the global market.

The automotive and transportation sector is emerging as a significant adopter of network slicing, using dedicated slices to support connected vehicles, autonomous mobility, smart traffic management, and real time navigation systems. These slices provide ultra-low latency, reliable communication, and secure data transmission required for vehicle to vehicle, vehicle to infrastructure, and fleet management applications.

As demand grows for autonomous cars, intelligent transport systems, and logistics optimization, automotive companies rely on slicing to ensure safety, real time responsiveness, and operational efficiency. The increasing integration of edge computing, 5G connectivity, and IoT enabled sensors is further driving the adoption of network slicing in this sector, making it an important vertical for growth.

The Network Slicing Market Report is segmented on the basis of the following:

By Component

- Network Slicing Solutions

- Network Slicing Services

By Technology Layer

- Core Network Slicing

- Radio Access Network Slicing

- Transport Network Slicing

- Network Slicing Management and Orchestration

By Slice Type

- Enhanced Mobile Broadband Slice

- Ultra-Reliable Low-Latency Slice

- Enterprise Private Network Slice

- Massive Machine-Type Communication Slice

By Deployment Model

- Cloud-Native Deployment

- Virtualized Deployment

- Hybrid Deployment

- On-Premises Deployment

By Organization Size

- Large Enterprises

- SMEs

- Public Sector Organizations

By End-User Industry

- Telecommunications Providers

- Automotive and Transportation

- Industrial and Manufacturing

- Healthcare

- Media and Entertainment

- Government and Public Safety

- Energy and Utilities

- Other Industries

Global Network Slicing Market: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is anticipated to lead the global network slicing market, capturing 40% of total market revenue in 2025, driven by rapid 5G deployment, extensive adoption of cloud native architectures, and strong investment in digital infrastructure across countries such as China, Japan, South Korea, and India. Telecom operators in the region are focusing on advanced network virtualization, AI powered orchestration, and multi domain slice management to support enhanced mobile broadband, ultra-reliable low latency applications, and massive IoT ecosystems.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Growing demand from industries including manufacturing, automotive, healthcare, and smart cities, combined with government initiatives promoting 5G innovation and private network adoption, further strengthens the region’s dominance in the market.

Region with significant growth

North America is expected to witness significant growth in the network slicing market due to the rapid commercialization of 5G standalone networks, strong presence of leading telecom operators, and high adoption of advanced technologies such as cloud native cores, AI driven orchestration, and edge computing.

Enterprises across sectors including healthcare, automotive, industrial automation, and media are increasingly deploying dedicated slices to enable mission critical communications, ultra-low latency applications, and private network solutions. Supportive government initiatives, continuous infrastructure upgrades, and investments in innovative slicing solutions are driving accelerated market expansion in the region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Network Slicing Market: Competitive Landscape

The global network slicing market is highly competitive and rapidly evolving, characterized by intense innovation in software defined networking, cloud native architectures, and AI driven orchestration platforms. Key players are focusing on strategic collaborations, technology partnerships, and continuous product enhancements to offer end to end slicing solutions across core networks, radio access networks, and transport layers.

Companies are investing heavily in managed services, lifecycle management tools, and enterprise private network offerings to cater to diverse industry verticals including automotive, healthcare, manufacturing, and smart cities. The competitive landscape is also shaped by the adoption of open RAN frameworks, edge computing integration, and multi domain interoperability, driving differentiation and market expansion globally.

Some of the prominent players in the global Network Slicing market are

- Huawei Technologies Co., Ltd.

- Nokia Corporation

- Ericsson AB

- Samsung Electronics Co., Ltd.

- ZTE Corporation

- Cisco Systems, Inc.

- NEC Corporation

- Mavenir Systems, Inc.

- Juniper Networks, Inc.

- Amdocs Inc.

- Affirmed Networks (Microsoft)

- Oracle Corporation

- Hewlett Packard Enterprise (HPE)

- Intel Corporation

- VMware, Inc.

- Ribbon Communications Inc.

- Telefonaktiebolaget LM Ericsson

- AT&T Inc.

- Deutsche Telekom AG

- Telefonica S.A.

- Other Key Players

Global Network Slicing Market: Recent Developments

- Feb 2025: A major network vendor rolled out its dynamic network slicing solution integrated with a partner’s orchestration platform, enabling enterprises on a live 5G standalone network to activate on‑demand slices with real‑time resource allocation and SLA assurance for industrial and enterprise use cases.

- Feb 2025: A leading telecom operator in the Middle East launched a commercial 5G network slicing product over its standalone network for business customers, offering tailored virtual‑network slices that guarantee performance and reliability for IoT, critical infrastructure, and enterprise applications.

- Feb 2025: A multinational networking company completed the acquisition of a prominent optical‑network equipment vendor, consolidating its assets and strengthening its positioning in optical transport and slicing‑capable backbone infrastructure to support emerging 5G and enterprise networking demands globally.

- Dec 2024: A domestic telecom startup secured funding under a national telecom technology development fund to build an indigenous 5G standalone core, an essential component for enabling cloud‑native core network slicing and private network deployments.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 2.9 Bn |

| Forecast Value (2034) |

USD 64.4 Bn |

| CAGR (2025–2034) |

41.4% |

| The US Market Size (2025) |

USD 0.7 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Component (Network Slicing Solutions, Network Slicing Services), By Technology Layer (Core Network Slicing, Radio Access Network Slicing, Transport Network Slicing, Network Slicing Management and Orchestration), By Slice Type (Enhanced Mobile Broadband Slice, Ultra-Reliable Low-Latency Slice, Enterprise Private Network Slice, Massive Machine-Type Communication Slice), By Deployment Model (Cloud-Native Deployment, Virtualized Deployment, Hybrid Deployment, On-Premises Deployment), By Organization Size (Large Enterprises, SMEs, Public Sector Organizations), By End-User Industry (Telecommunications Providers, Automotive and Transportation, Industrial and Manufacturing, Healthcare, Media and Entertainment, Government and Public Safety, Energy and Utilities, Other Industries) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Huawei Technologies Co., Ltd., Nokia Corporation, Ericsson AB, Samsung Electronics Co., Ltd., ZTE Corporation, Cisco Systems, Inc., NEC Corporation, Mavenir Systems, Inc., Juniper Networks, Inc., Amdocs Inc., Affirmed Networks (Microsoft), Oracle Corporation, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global Network Slicing market?

▾ The global Network Slicing market size is estimated to have a value of USD 2.9 billion in 2025 and is expected to reach USD 64.4 billion by the end of 2034.

What is the size of the US Network Slicing market?

▾ The US Network Slicing market is projected to be valued at USD 0.7 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 13.9 billion in 2034 at a CAGR of 38.7%.

Which region accounted for the largest global Network Slicing market?

▾ Asia Pacific is expected to have the largest market share in the global Network Slicing market, with a share of about 40.0% in 2025.

Who are the key players in the global Network Slicing market?

▾ Some of the major key players in the global Network Slicing market are Huawei Technologies Co., Ltd., Nokia Corporation, Ericsson AB, Samsung Electronics Co., Ltd., ZTE Corporation, Cisco Systems, Inc., NEC Corporation, Mavenir Systems, Inc., Juniper Networks, Inc., Amdocs Inc., Affirmed Networks (Microsoft), Oracle Corporation, and Others.

What is the growth rate of the global Network Slicing market?

▾ The market is growing at a CAGR of 41.4 percent over the forecasted period.