Neurovascular Devices are medical tools used to treat conditions that affect the blood vessels in the brain and nervous system. These devices are available in different types of stents, coils, catheters, and flow diverters, which are essential in managing and treating disorders like ischemic strokes, aneurysms, and arteriovenous malformations. As part of the broader cerebrovascular devices market, these tools continue to evolve with advanced clinical applications.

It helps to restore normal blood flow, prevent hemorrhages, and reduce the risk of brain damage. The rising cases of neurovascular diseases and advancements in technology have led to a growing demand for these devices, which drives the growth of this market.

Neurovascular devices market is experiencing dramatic advancements due to an increasing awareness of neurological conditions like stroke and aneurysms, increasing demand for minimally invasive neurovascular treatments that are effective in managing such conditions and shortening recovery times. Neurovascular devices play a vital role in managing such conditions by improving patient outcomes while shortening recovery times. These advancements are also expanding the use of neurointerventional devices across diverse clinical settings.

Technological innovations are revolutionizing the neurovascular device market, offering products with increased precision and effectiveness. New stents, thrombectomy devices and coiling systems are revolutionizing treatment approaches, offering patients suffering from various neurovascular disorders more tailored care options for treatment. As hospitals adapt these neurovascular treatment devices, adoption rates continue to accelerate globally.

Neurovascular device demand is strongest in regions with established healthcare infrastructures such as North America and Europe however, emerging markets in Asia Pacific are experiencing rapid expansion thanks to improved access to care and increased awareness of neurological conditions - providing companies with opportunities to expand their presence into previously untapped markets.

Home healthcare and

telemedicine have opened up opportunities in the neurovascular device market. As stroke and aneurysm treatments become more accessible, manufacturers have focused on making devices user-friendly and cost-effective; creating new market growth potential in home and outpatient settings. This growing trend offers companies new avenues of exploration and innovation within neurovascular care.

As per Medtronic The neurovascular devices market has seen widespread adoption, with around 67% of hospitals globally incorporating these devices into their stroke and aneurysm treatments. In North America, approximately 72% of healthcare facilities utilize advanced neurovascular tools, such as stents and thrombectomy devices, to enhance patient outcomes. These devices are being increasingly used for minimally invasive procedures.

As per Boston Scientific Approximately 59% of neurovascular device demand comes from patients aged 65 and above, reflecting the growing incidence of cerebrovascular conditions in the elderly population. Furthermore, 63% of neurological treatments now involve some form of neurovascular technology, particularly in advanced stroke management. Manufacturers are also introducing more user-friendly devices, leading to a 53% increase in adoption.

The US Neurovascular Devices Market

The US Neurovascular Devices Market is expected to reach USD 1.1 billion by the end of 2024 and is projected to grow to USD 2.3 billion by 2033, with a CAGR of 8.5%.

The neurovascular devices market in the US is primarily driven by the rising prevalence of neurovascular disorders such as ischemic stroke, aneurysms, and arteriovenous malformations among the rising aging population globally.

Growing adoption of minimally invasive procedures in most of the US region, driven by patient preference for faster recovery times and reduced complications, are some of the key trends for the US neurovascular devices market.

Key Takeaways

- Market Growth: The Global Neurovascular Devices market is expected to grow by USD 2.3 billion, at a CAGR of 9.0 %, during the forecasted period i.e. from 2025 to 2033.

- Market Definition: Neurovascular devices are crucial in diagnosing and treating conditions related to the brain's blood vessels.

- Device Analysis: In terms of devices, cerebral embolization and aneurysm coiling devices are predicted to lead the global market with a high revenue share of 34.0 % in 2024.

- Therapeutic Application Analysis: Based on therapeutic application, stroke is expected to dominate the global market with a high market share of 33.2% in 2024.

- Size Analysis: Below 0.027" is projected to lead the market with a substantial market share of 35.6% based on size in 2024.

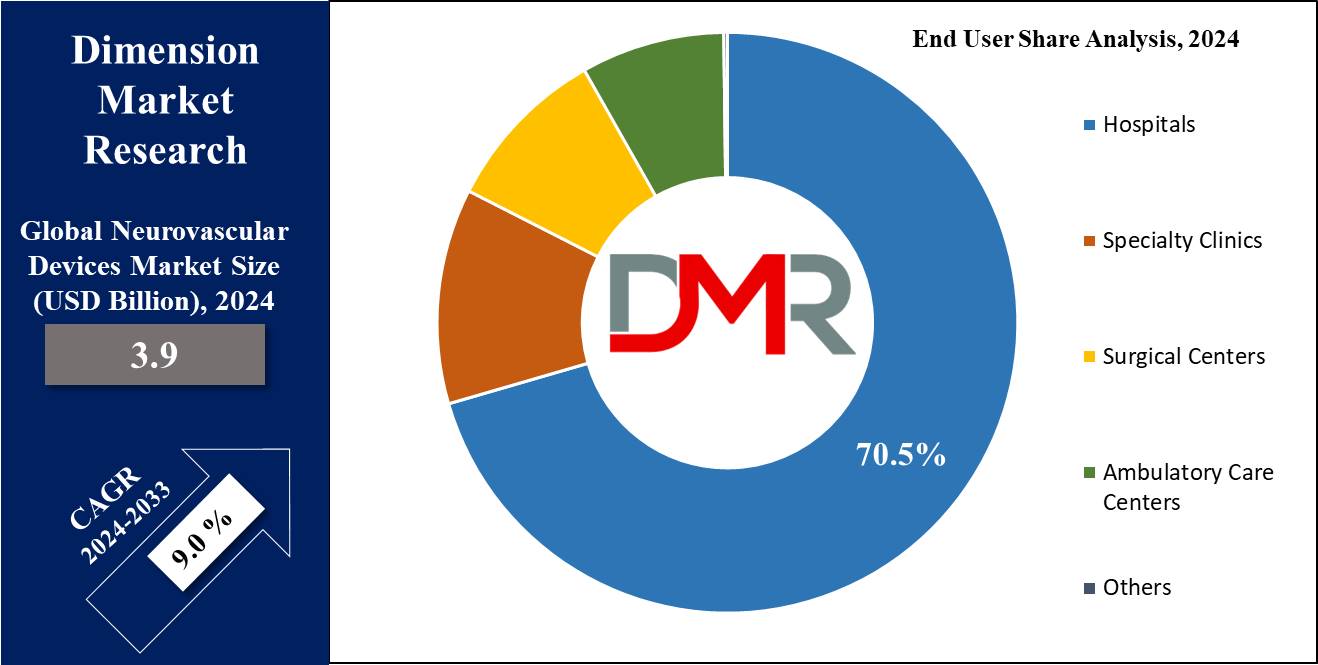

- End User Analysis: Hospitals are projected to lead the global market in terms of revenue, with a 70.5% market share in 2024.

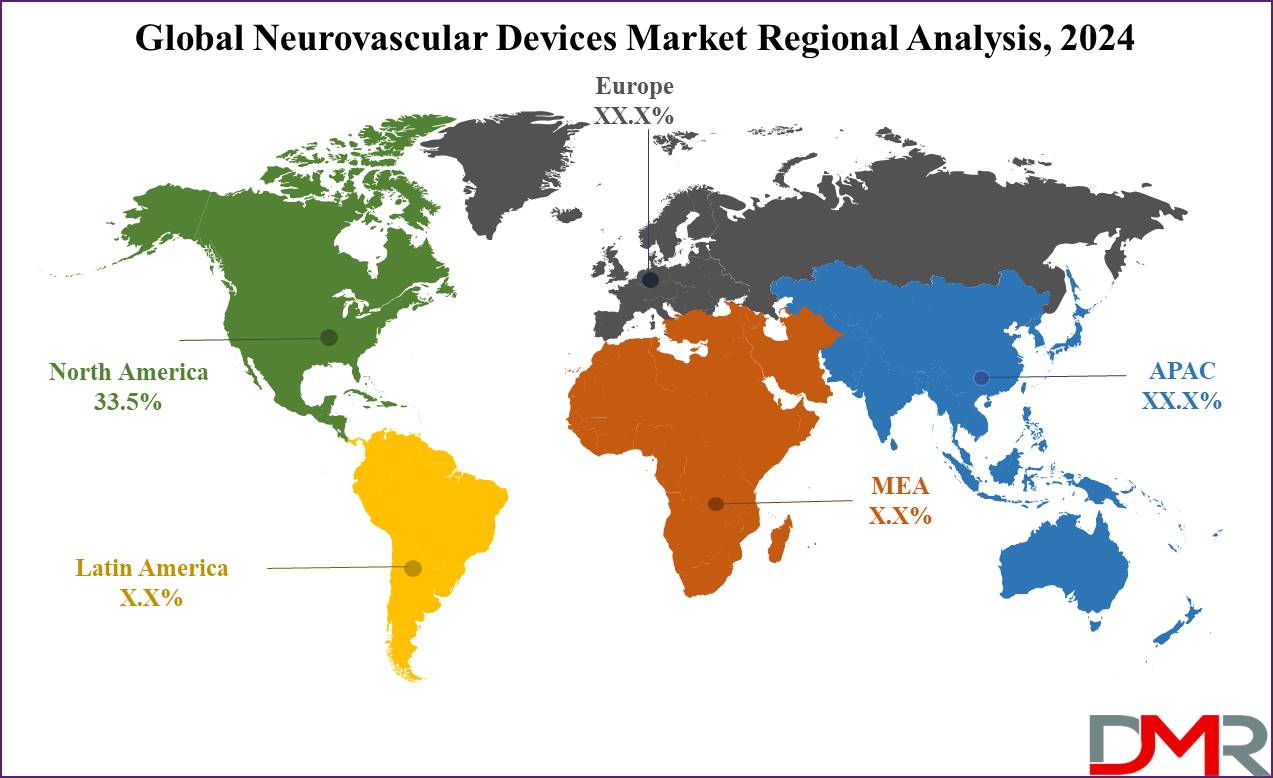

- Regional Analysis: North America is predicted to dominate the neurovascular devices market with the highest market share of 33.5 % in 2024.

Use Cases

- Stroke Intervention: Neurovascular devices are used in the management of ischemic strokes, which occur when a blood clot obstructs blood flow to a part of the brain. Thrombectomy devices, including mechanical clot retrieval systems, are designed to physically remove the clot from the blood vessel.

- Carotid Artery Stenting: Carotid artery stenting involves the insertion of a small, mesh-like tube into the affected artery to keep it open and restore proper blood flow to the brain which helps to prevent future strokes by reducing the risk of blood clots forming at the site of the blockage.

- Intracranial Pressure Monitoring: Intracranial pressure monitoring includes sensors that are placed within the brain’s ventricles or subarachnoid space to continuously measure pressure changes which is important for guiding treatment decisions.

- Arteriovenous Malformation (AVM) Management: Neurovascular devices used in managing AVMs include liquid embolic agents, which are injected into the abnormal vessels to induce clotting and block blood flow.

Market Dynamic

Drivers

Rising Neurovascular Cases among Elderly Driving Market

Increasing cases of neurovascular conditions, like stroke and cerebral aneurysms, are contributing factors to the expanding global patient population which are often common among the elderly population. Aging populations are more prone to this disease due to their inactive lifestyle which increases the neurovascular cases, thus driving the growth of the market.

Healthcare Investments and Policy Support

The rising disease burden, higher healthcare spending, and greater awareness of effective treatments lead to more individuals seeking neurovascular treatment, which has positively influenced the market. Additionally, the implementation of reimbursement policies in many countries increased the preference for these procedures, further driving the growth of the global market.

Opportunities

Safety Validation Drives Investment in Neurovascular R&D

The neurovascular device market is showing a significant growth opportunity for expanding the market due to increasing product approvals from regulatory authorities. Successful approval of new products expands their portfolios, as key players pursue organic growth strategies enabling them to offer more innovative and effective solutions to healthcare providers.

It validates the safety and efficacy of neurovascular devices and encourages further research and development investment.

Increasing Prevalence of Ischemic Stroke

Ischemic stroke cases continue to rise particularly among aging, hypertension, and diabetes populations, which increases the demand for effective treatment options. Neurovascular devices, such as stent retrievers and thrombectomy systems, play a critical role in the rapid and effective management of ischemic stroke, reducing the risk of long-term disability and improving patient outcomes.

Trends

Increasing Technological Advancements

Innovations such as enhanced imaging techniques, advanced materials, and minimally invasive procedures are improving the precision, safety, and efficacy of neurovascular treatments. These advancements not only provide better outcomes for patients but also open up possibilities for the development of new devices and techniques that address unmet clinical needs.

This trend is likely to continue as the demand for cutting-edge solutions in the treatment of neurovascular conditions grows, further accelerating market expansion.

Rising Awareness and Screening Programs

The rising awareness of neurovascular diseases, along with the increasing prevalence of screening programs, is another important trend propelling the neurovascular device market. Public health initiatives and educational campaigns are playing a crucial role in increasing awareness about the risk factors, symptoms, and treatment options for neurovascular conditions such as stroke and aneurysms.

Additionally, the implementation of more widespread screening programs is enabling earlier detection and diagnosis, which is crucial for effective intervention.

Restraints

Integration with Existing Systems

Integrating new neurovascular devices with existing medical infrastructure can be challenging and often time-consuming. This integration process is not always compatible with the equipment and

electronic health record systems used widely in most hospitals today. The complexity and resource demands of integrating new technology into established systems can significantly delay deployment, posing an obstruction to the growth of the market.

High Costs and Limited Accessibility

The high cost of neurovascular devices with limited accessibility in low-income economies, are significant factor hindering market expansion. These challenges make global adoption of these devices difficult, particularly in developing countries with constrained healthcare budgets. As a result, the diffusion of these technologies on a large scale is limited, further restricting market growth, especially in regions where financial resources are limited.

Research Scope and Analysis

By Device

Cerebral embolization and aneurysm coiling devices are likely to account for approximately 34.0% of the neurovascular device market by 2024, approximately. Coil embolization, a minimally invasive technique used to treat aneurysms, involves inserting a steerable catheter through the groin into the brain where it closes the aneurysm sac and reduces risk.

Opting for this approach has long been considered superior due to its shorter recovery times, reduced hospital stays, and overall reduced patient morbidity rates. Due to increasing cases of aneurysms among aged populations and therefore aneurysm-causing devices are in high demand. Imaging and catheter technology innovations have revolutionized these procedures, improving precision, success rates, and adoption rates.

Devices used during these procedures include embolic coils, flow diversion devices, and liquid embolic agents which further fuel their adoption rates. Embolic coils can be an extremely efficient method for blocking aneurysms by stimulating blood clotting within their sac and thereby preventing rupture. Meanwhile, flow diversion devices provide another avenue by diverting blood away from an aneurysm, thus permitting its natural repair process to proceed more rapidly.

Furthermore, liquid embolic agents are useful tools in creating vessel blockade by filling abnormal blood vessels or aneurysms leading to vessel occlusion.

By Therapeutic Application

Stroke is expected to dominate the global neurovascular device market with a 33.2 % revenue share by 2024 due to its global health impacts and widespread prevalence compared with other neurovascular conditions. Ischemic stroke is one of the primary causes of mortality & disability worldwide making it an area that needs urgent therapeutic interventions.

Increased incidences of these types of strokes due to factors like an aging population, rising rates of hypertension and diabetes as well as lifestyle changes has created an increasing need for effective treatments and devices that could fill this market gap. This market demand increases each year.

Neurovascular devices have become an essential tool in managing acute ischemic stroke. Not only are they life-saving tools that restore blood flow to the brain and lower disability risk but continuous technological developments extend therapeutic applications. Furthermore, regulatory approval has allowed new devices to enter the market.

By Size

Below 0.027" is likely to dominate the global neurovascular devices market with the largest revenue share of 35.6 % in 2024. This dominance can be attributed to their unique advantages in neurovascular procedures. Devices below 0.027" like the Bendit21 microcatheter of size 0.021" by Bendit Technologies, offer enhanced maneuverability and precision in navigating complex vascular structures, making them ideal for intricate procedures in brain, peripheral, and coronary vasculature.

The introduction of advanced products like Evasc Neurovascular’s eCLIPs Bifurcation Flow Diverter, which is designed for use with 0.021" and 0.027" ID microcatheters, is increasing the growth of this segment. They demonstrate the growing preference for smaller, more specialized devices that provide effective treatment for specific conditions such as bifurcation cerebral aneurysms.

Sizes below 0.027" offer smoother catheter crossing, and improved performance and versatility in various clinical scenarios, contributing to the segment's expanding market presence. Meanwhile above 0.071" segment is expected to grow at the highest CAGR during the forecast period due to the unique advantages and critical applications of larger-sized devices. These devices, typically used in complex neurovascular procedures, provide enhanced stability, maneuverability, and support for high-flow conditions.

By End User

Hospitals are expected to command 70.5% of revenue share in 2024's neurovascular devices market due to the alarmingly increasing rate of patients diagnosed with neurovascular disorders such as strokes, brain aneurysms, traumatic brain injuries, and arteriovenous malformation. Advanced neurovascular catheters and favorable reimbursement policies support market expansion for hospitals.

Furthermore, an increasing number of surgeries, therapies, and treatments scheduled at these healthcare providers should further drive demand for neurovascular devices. Hospitals possess all of the infrastructure, personnel, and technology needed for complex procedures, thus making them one of the primary users of these devices.

Minimally invasive techniques used by hospitals have also contributed to an increased adoption of neurovascular devices, as they offer reduced recovery times and enhanced patient outcomes. Specialty clinics are one of the leading end users after hospitals due to their dedicated expertise and specialized services, which include treating specific neurological conditions with cutting-edge technologies and trained personnel to handle complicated neurovascular cases.

The Neurovascular Devices Market Report is segmented based on the following

By Device

- Cerebral Embolization and Aneurysm Coiling Devices

- Embolic coils

- Flow diversion devices

- Liquid embolic agents

- Cerebral Angioplasty and Stenting Systems

- Carotid artery stents

- Embolic protection

- Neuro thrombectomy Devices

- Clot retrieval devices

- Suction devices/aspiration catheters

- Vascular snares

- Support Devices

- Micro catheters

- Micro guidewires

- Trans Radial Access Devices

By Therapeutic Application

- Stroke

- Carotid Artery Stenosis

- Cerebral Aneurysm

- Arteriovenous Malformation & Fistulas

- Others

By Size

- Below 0.027"

- 0.027"-0.071"

- Above 0.071"

By End Use

- Hospitals

- Specialty Clinics

- Surgical Centers

- Ambulatory Care Centers

- Others

Regional Analysis

North America is expected to dominate the neurovascular devices market with a

revenue share of 33.5% in 2024. This dominance is expected to continue due to the high prevalence of neurological disorders, increased diagnosis and treatment rates, and rising healthcare expenditures that support neurological care.

The availability of favorable reimbursement policies from private and government health insurers in the US, such as Medicare and Medicaid, further encourages the adoption of advanced neurovascular treatments. The presence of major manufacturers such as Penumbra, Inc., Stryker Corporation, Johnson & Johnson, and Merit Medical Systems, Inc. in this region is driving the growth of the United States neurovascular devices market. Moreover, the strong presence of these key players and supportive healthcare infrastructure are significantly contributing to the expansion of the North America neurovascular devices market.

Increasing R&D investment by manufacturers and government support are fueling market expansion. Meanwhile, the Asia-Pacific region is projected to experience the highest growth rate during the forecast period driven by a rising burden of target diseases, with approximately

30 million people in India affected by various neurological conditions.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The neurovascular device market is characterized by intense competition, with numerous large and small players offering software and services to domestic and international markets. Key market players are focusing on the launch of innovative types of

medical devices, growth strategies, and technological advancements.

The market is currently moderately fragmented and is moving toward a more fragmented state. Some key players in this market include Medtronic, Stryker Corporation, Johnson & Johnson, Penumbra, Inc., and MicroPort Scientific Corporation. Major players operating in the market are adopting strategies such as innovating their products and services and engaging in mergers and acquisitions to expand the functionality of their product portfolios and maintain competitiveness.

Some of the prominent players in the global neurovascular devices market are

- Medtronic

- Johnson and Johnson Services Inc.

- Penumbra, Inc.

- Microport Scientific Corporation

- Stryker

- Microvention Inc (Terumo Corporation)

- Codman Neuro

- Acandis GmbH

- NeuroVasc Technologies, Inc.

- Asahi Intecc USA, Inc.

- Perflow Medical Ltd.

- Others

Recent Development

- In June 2024, Penumbra, Inc. received CE Mark approval and launched the BMX81 and BMX96 devices in Europe for neurovascular management of ischemic and hemorrhagic strokes. Penumbra claims that these neuro-access products enable physicians to navigate the brain's complex anatomy with ease, and they are compatible with both femoral and radial access approaches.

- In July 2023, RapidAI, a company specializing in AI and innovative workflow solutions for life-threatening neurovascular diseases, secured USD 75 million in Series C funding, led by Vista Credit Partners. This funding aims to enhance the platform for further development, targeting additional disease states and market capabilities to accelerate growth in new regions and product lines.

- In May 2023, Stryker Corporation acquired Cerus Endovascular, a start-up focused on designing, developing, and supplying interventional neurovascular devices and delivery systems for the treatment of intracranial aneurysms by neuroradiologists. These strategic moves highlight the dynamic nature of the neurovascular devices sector and emphasize diversification strategies that drive innovation in the field.

- In February 2023, Phenox Inc. announced that their pRESET Thrombectomy Device received FDA clearance for treating acute ischemic stroke in the U.S. The pRESET device, which has been available in Europe for over a decade, is now approved for use in the U.S.

- In November 2022, iVascular expanded its neurovascular disease treatment portfolio by launching CE-marked products, including the iNdeep microcatheter, iNtercept retriever device, iNedit balloon distal access catheter, and iNstroke 4Fr and 6Fr aspiration catheters.