Market Overview

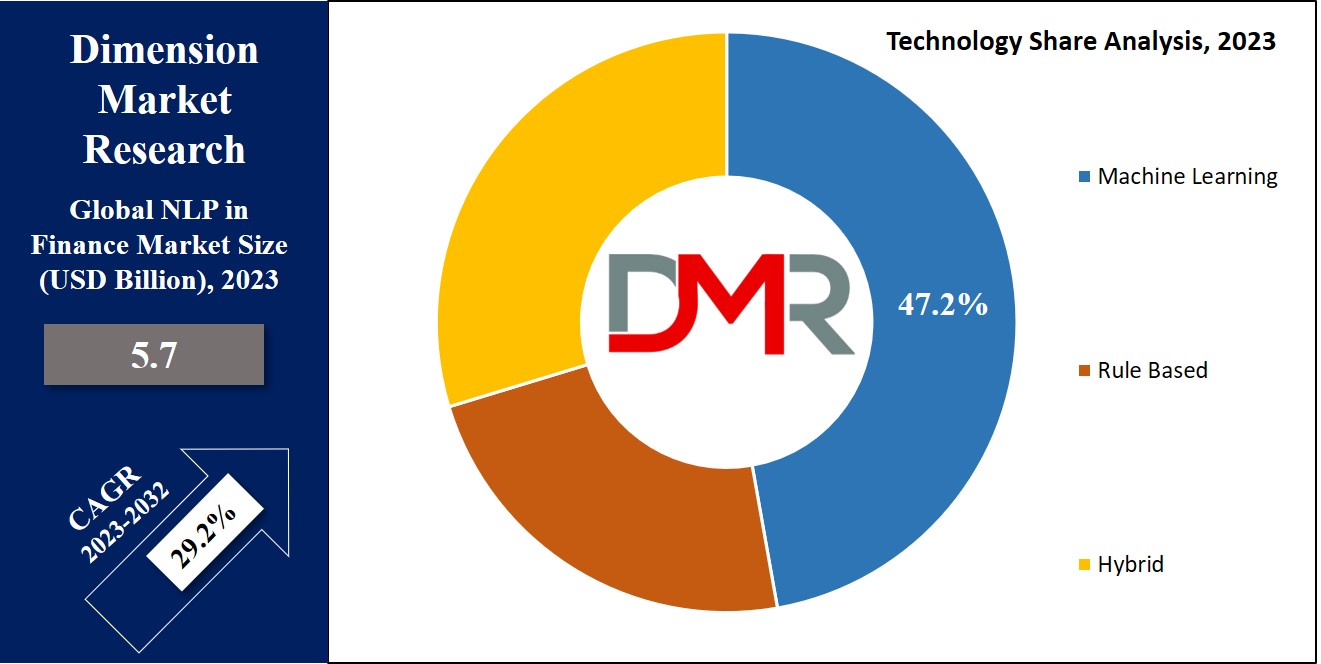

The Global NLP in Finance Market is expected to reach a value of USD 5.7 billion in 2023, and it is further anticipated to reach a market value of USD 57.5 billion by 2032 at a CAGR of 29.2%. The market has seen significant growth over the past few years and is predicted to grow significantly during the forecasted period as well.

In the financial sector,

Natural Language Processing (NLP) refers to the application of computational linguistics & artificial intelligence methods to analyze & interpret human language data, which includes examining text data from different sources like social media posts, news articles, financial records, & customer interactions to extract valuable insights.

NLP is an important tool that enables financial organizations & professionals to automate & enhance multiple processes, including risk assessment, sentiment analysis, customer service, fraud detection, & making informed investment decisions, thereby improving their overall efficiency and decision-making capabilities.

Natural Language Processing (NLP) is revolutionizing the finance sector by automating data analysis, enhancing risk management, and improving customer service. Recent trends highlight its use in sentiment analysis for market predictions and regulatory compliance.

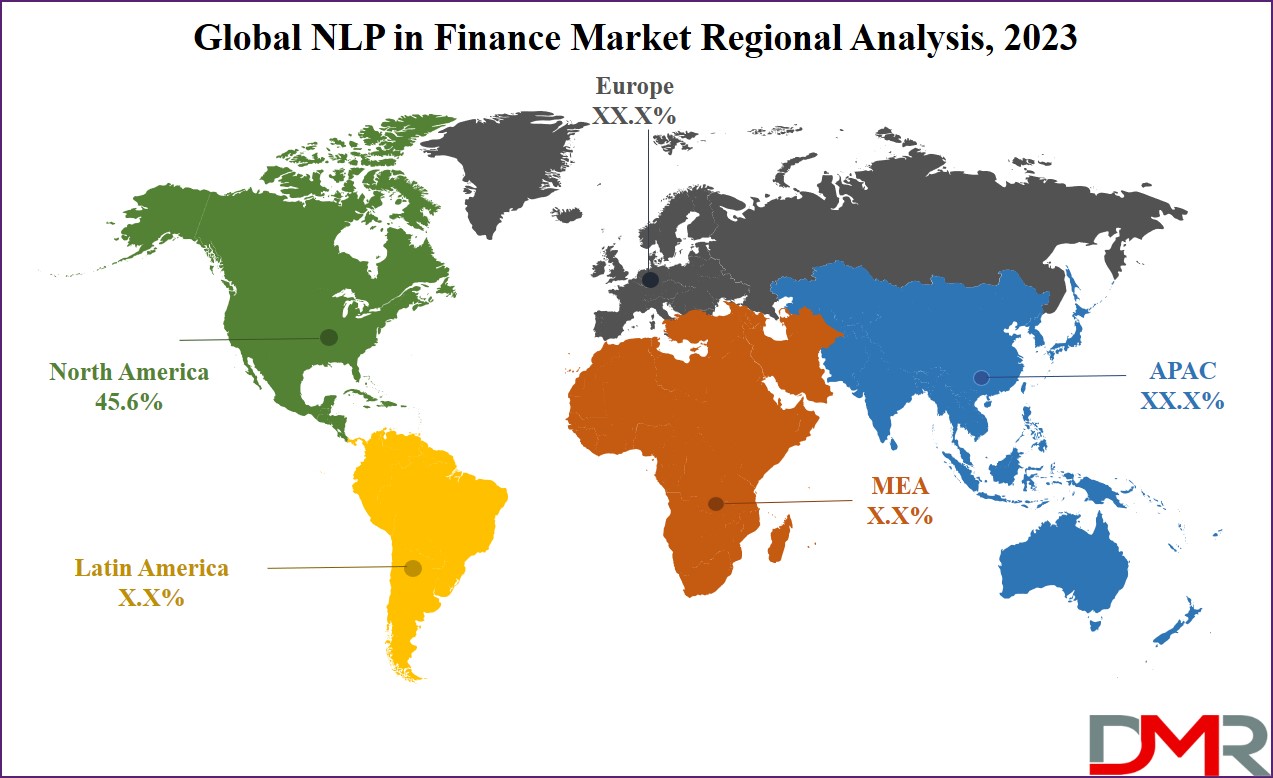

Key events like the NLP Summit bring industry leaders together to discuss advances such as emotion detection and deep learning in finance. Companies like HSBC are leveraging NLP for real-time market insights, boosting investment strategies. As demand grows, the Asia-Pacific region is poised to lead in adoption, while North America remains a dominant player.

Key Takeaways

- Market Growth: The NLP in finance market is projected to grow from USD 5.7 billion in 2023 to USD 57.5 billion by 2032, registering a strong CAGR of 29.2%.

- Service Dominance: Services account for the largest segment, making up 60% of the market share in 2023 due to high demand for implementation, support, and integration guidance.

- Fraud Detection Lead: Fraud detection and prevention is the top application area, holding a 45% market share in 2023, as institutions seek to combat financial crimes using NLP.

- Machine Learning Drive: Machine learning is the dominant technology, representing 55% share in 2023, as it enables advanced data analysis and market trend prediction.

- Banking Sector Focus: The banking industry contributes 50% of the market, leveraging NLP for customer service, risk management, and sentiment analysis.

- Regional Leadership: North America leads globally with a 45.6% market share in 2023, driven by strong R&D, technology infrastructure, and skilled talent.

- Competitive Activity: Major firms like Google, IBM, and Microsoft, along with emerging startups, are intensifying competition, offering both broad and niche NLP solutions for finance.

Use Cases

- Fraud Prevention: Automates detection of suspicious transactions by analyzing transaction records, emails, and chat logs to spot anomalies, reducing losses from financial crimes.

- Sentiment Analysis: Monitors social media and news to gauge market sentiment, helping financial institutions make more informed investment and trading decisions.

- Customer Service Automation: Powers intelligent chatbots for banks and insurers to handle queries, provide instant responses, and improve client satisfaction while reducing workload.

- Risk Assessment: Processes vast unstructured data from multiple sources to evaluate lending risk, support compliance, and enhance creditworthiness decision-making.

- Regulatory Compliance: Automates compliance monitoring and reporting, identifying irregularities in documentation or communication to ensure adherence to financial regulations.

- Market Prediction: Analyzes financial news, reports, and customer opinions to forecast market trends, supporting portfolio management and investment strategy development.

Market Dynamic

In the financial sector, an abundance of unstructured data is generated daily from different sources, like social media, news articles, and customer interactions. NLP technology is used to process & analyze this data, leading to valuable insights and a growing demand for NLP solutions within financial organizations.

Recognizing the significance of tapping into textual data, these institutions benefit from NLP, improving risk assessment, decision-making, & market analysis, while also helping in regulatory compliance through automated reporting & issue identification. The fast advancements in AI & machine learning have expanded NLP's capabilities, allowing more accurate entity recognition, sentiment analysis, & information extraction.

However, concerns about data security and compliance hinder NLP implementation in the banking industry. The complexity & context-specific nature of financial language pose challenges for NLP models, making accurate comprehension & analysis a continuing difficulty.

Yet, NLP enhances the financial industry's abilities in risk assessment & fraud detection by interpreting unstructured data to identify trends & anomalies related to fraudulent activities, facilitating rapid detection & prevention. In addition, NLP empowers

chatbots & virtual assistants to deliver customized experiences, thereby contributing to the sector's efficiency and security.

Research Scope and Analysis

By Offering

Within the NLP in finance market segmentation, the service category takes the lead with the most substantial market share in 2023, which is primarily attributed to the growing need for a range of services, including implementation support, professional services, & system integration. To utilize the full potential of NLP technology effectively, financial institutions depend on professional guidance & services like training & consultation.

Expert advice is essential when integrating NLP into their operations to ensure that the technology is being used efficiently & effectively. These factors are fueling the increase in demand within this category as financial organizations seek to optimize their use of NLP technology.

By Application

In the NLP in finance market, the category of fraud detection & prevention takes the lead in the market share in 2023, in terms of application, mainly driven by the growing need among financial institutions to identify & prevent fraudulent activities. Fraud poses a large challenge for financial organizations, resulting in significant financial losses running into billions of dollars annually.

To combat this, NLP technology plays an important role, as it analyzes large volumes of data from different sources, including transaction records, emails, social media content, chat logs, & other textual data, to look into patterns & anomalies that may show potential fraudulent behavior, which plays a critical role of NLP technology highlighting its prominence in the finance sector.

By Technology

The NLP in Finance Market, the market is categorized based on technological types, including

Machine Learning, Rule-Based, and Hybrid, among which, the Machine Learning segment emerges as the dominant force, commanding the highest market share in 2023. Machine learning has significantly propelled NLP advancements in the financial sector.

Its key advantage lies in its ability to learn from vast & complex datasets, which proves critical in the banking industry due to the sheer volume of data involved. Further, NLP models have become more sophisticated & precise, notably outperforming traditional machine learning algorithms in tasks such as sentiment analysis, resulting in more accurate predictions of market trends & behaviors.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By End User

In the global NLP in the Finance market, the banking sector drives the growth of the overall market and is anticipated to do the same throughout the forecasted period, NPL plays a major role in the banking sector, transforming the way financial institutions operate. NLP technology allows banks to analyze & extract valuable insights from large volumes of textual data, including financial news, customer inquiries, & social media interactions.

It improves customer service by automating responses to queries, providing instant support, & improving chatbots' efficiency. NLP is also instrumental in risk management, as it detects potential fraud by scrutinizing transaction data and identifying anomalies in real time. In addition, NLP assists banks in sentiment analysis, helping banks gauge market trends & customer opinions for more informed investment decisions.

The NLP in Finance Market Report is segmented on the basis of the following

By Offering

By Application

- Fraud Detection & Prevention

- Sentiment Analysis

- Risk Management

- Sentiment Analysis

- Others

By Technology

- Machine Learning

- Rule Based

- Hybrid

By End User

- Banking

- Insurance

- Investment & Wealth Management

- Others

Regional Analysis

In 2023, North America emerges as the leading region in the NLP Finance Market, having a substantial market share of 45.6%, which can be attributed to the region's rich ecosystem of technical research facilities, a skilled workforce, & advanced infrastructure. Further, the market's growth is driven by the region's advanced R&D sector & growing technical support.

In this region, NLP technology finds large applications in the financial sector, serving many purposes like sentiment analysis, risk management, fraud detection, & customer service. Its effectiveness in analyzing vast volumes of unstructured data from sources like news articles, social media content, & consumer feedback plays an important role in its growing adoption & success.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the Global NLP in the Finance market is characterized by a diverse mix of established technology companies, startups, & specialized NLP solution providers, as key players like IBM, Google, & Microsoft provide comprehensive NLP platforms with a range of financial applications, while smaller firms like Lexalytics & Ayasdi aiming at niche solutions.

In addition, emerging startups are introducing innovative, specialized NLP tools, intensifying competition. With the growing demand for NLP in finance for tasks like risk assessment, sentiment analysis, & customer service, the market is dynamic & evolving, providing several options for financial institutions & businesses.

For instance, in February 2022, Google Cloud, KeyBank, & Deloitte announced an extended, multi-year strategic alliance, to expedite KeyBank's shift towards a cloud-centric approach to banking, which highlights KeyBank's dedication to prioritizing cloud technology in its financial services, & with the integrated expertise of Google Cloud & Deloitte, they intend to enhance and modernize their banking operations, providing more efficient & innovative services to their customers in the fast-evolving financial sector.

Some of the prominent players in the global NLP in Finance Market are

- Google

- IBM

- AWS

- Oracle

- SAS

- Nuance Communications

- Microsoft Corp

- Baidu

- Inbenta

- Expert.ai

- Other Key Players

Recent Developments

- In February 2025, Accern, a no-code NLP platform for financial services, raised $20 million in funding to accelerate product development and growth.

- In July 2025, OpenAI completed a $10 billion funding round led by Microsoft to expand its GPT-4 and ChatGPT offerings for enterprise and finance use cases.

- In July 2025, Anthropic secured $5 billion in funding to develop its Claude conversational AI, targeting finance and compliance applications with advanced language safety.

- In June 2025, Mistral AI raised €600 million to grow its open-weight language model portfolio, strengthening NLP capabilities for European financial institutions.

- In June 2025, Adept AI Labs completed a $415 million round to build AI agents for automating financial workflows and improving virtual assistance in banking and investment sectors.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 5.7 Bn |

| Forecast Value (2032) |

USD 57.5 Bn |

| CAGR (2023-2032) |

29.2% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Offering (Software and Services), By Application (Fraud Detection & Prevention, Sentiment Analysis, Risk Management, Sentiment Analysis, and Others), By Technology (Machine Learning, Rule Based, and Hybrid), By End User (Banking, Insurance, Investment & Wealth Management, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Google, IBM, AWS, Oracle, SAS, Nuance Communications, Microsoft Corp, Baidu, Inbenta, Expert.ai, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global NLP in Finance Market?

▾ The Global NLP in Finance Market size is estimated to have a value of USD 5.7 billion in 2023 and is

expected to reach USD 57.5 billion by the end of 2032.

Which region accounted for the largest Global NLP in Finance Market?

▾ North America has the largest market share for the Global NLP in Finance Market with a share of about

45.6% in 2023.

Who are the key players in the Global NLP in Finance Market?

▾ Some of the major key players in the Global NLP in Finance Market are Google IBM, AWS, and many

others.

What is the growth rate in the Global NLP in Finance Market?

▾ The market is growing at a CAGR of 29.2 % over the forecasted period.