Market Overview

The

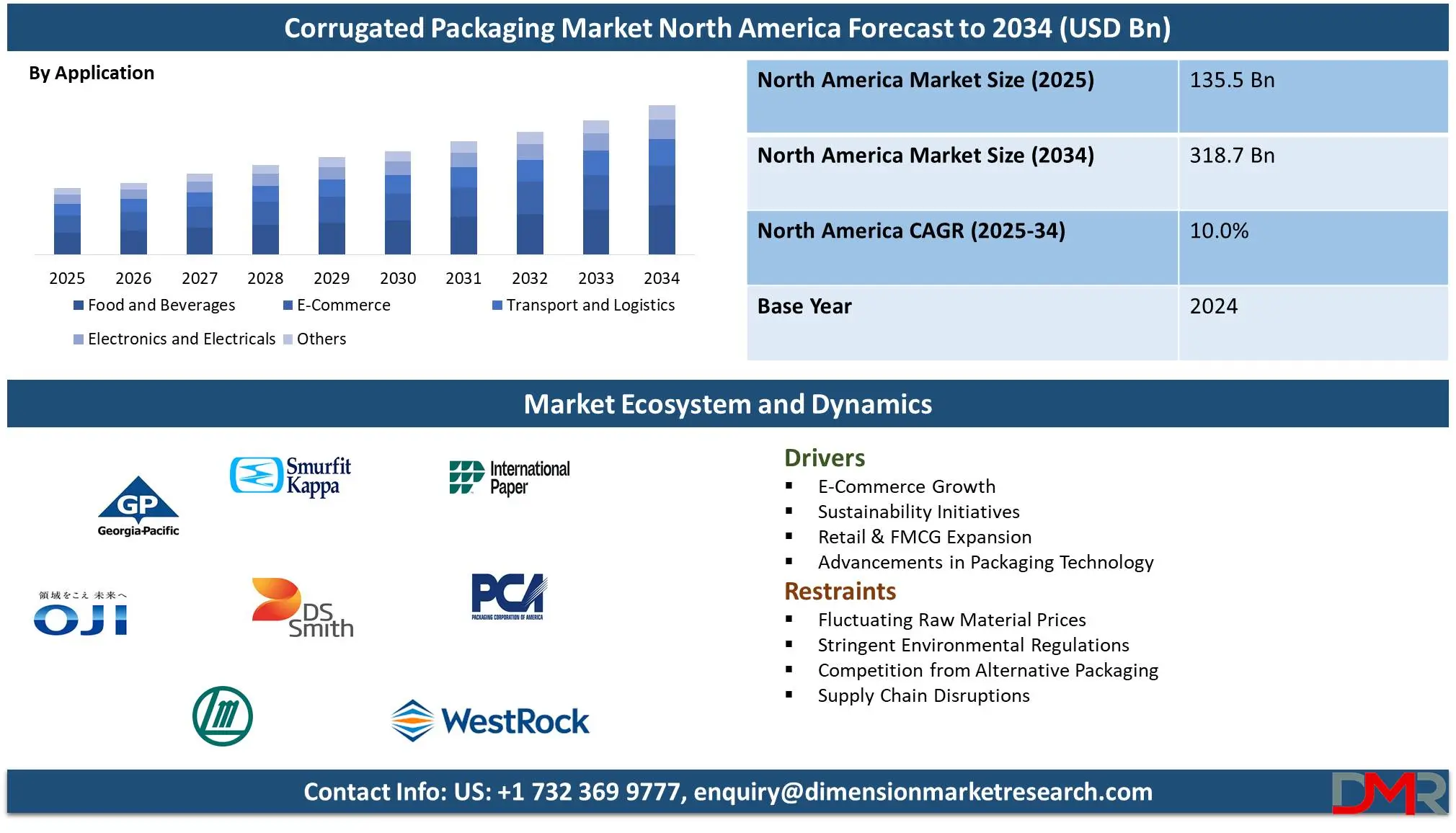

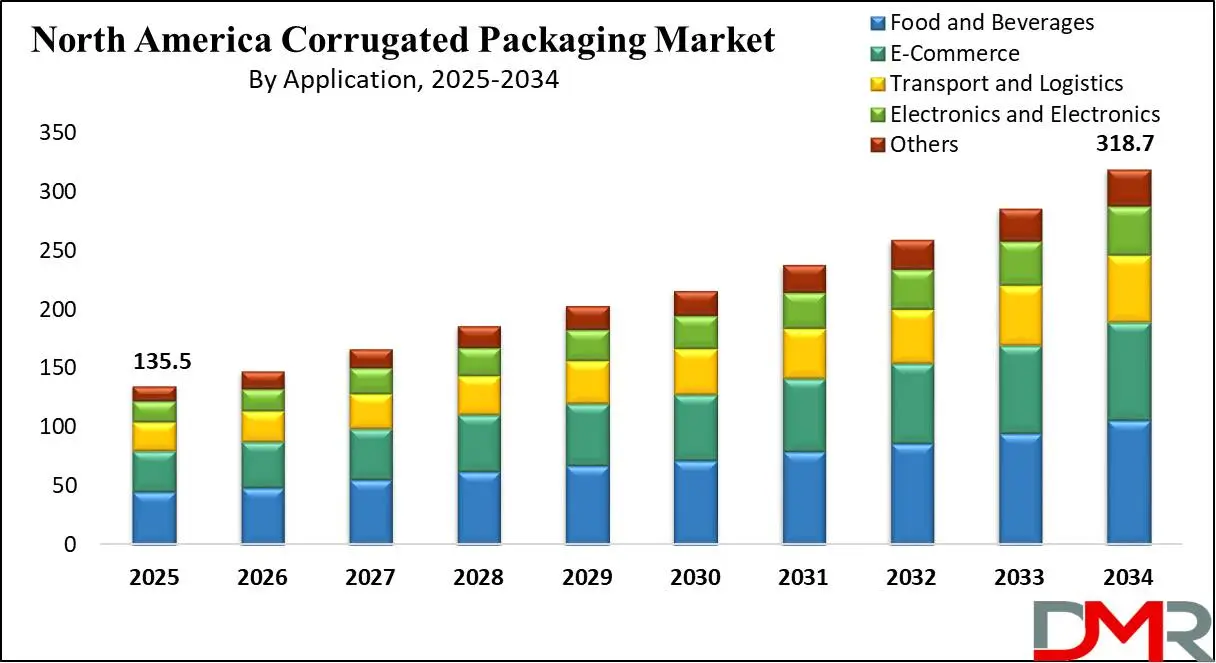

North America Corrugated Packaging Market size is expected to reach a value of

USD 135.5 billion in 2025, and it is further anticipated to reach a market value of

USD 318.7 billion by 2033 at a

CAGR of 10.0%.

The North American corrugated packaging market includes the production, distribution, and utilization of corrugated materials in packaging applications across various industries. Corrugated packaging uses fluted corrugated sheets between one or more flat linerboards to form a strong yet cost-effective barrier against transporting and storing goods.

It has long been recognized for its structural integrity and versatility, making it a popular choice across various industries including e-commerce, food and beverage, consumer goods, pharmaceuticals, and industrial manufacturing. Furthermore, its recyclable qualities make it a sustainable packaging option amid growing environmental concerns and regulatory mandates encouraging the use of eco-friendly materials.

Sustainability initiatives have further propelled market expansion as consumers and businesses prioritize eco-friendly packaging solutions. Corrugated material is biodegradable, recyclable, and often made from renewable resources, an attractive alternative to plastic-based packaging materials.

Furthermore, governments of the US and Canada have implemented stringent regulations designed to limit plastic waste that has encouraged manufacturers and retailers to adopt more eco-friendly materials. This has led to innovations within this sector such as lightweight but high-strength corrugated materials that enhance efficiency while mitigating environmental impacts.

Advancements in packaging technology have contributed significantly to market expansion. Advancements like water-resistant coatings, digital printing, and smart packaging solutions have enhanced both the usability and aesthetic appeal of corrugated packaging, meeting consumer demand for visually appealing yet informative packaging.

Also, advances in automation and logistics have streamlined production and distribution, improving supply chain efficiency. The North American corrugated packaging market is experiencing strong growth, however, its growth can be hindered by fluctuating raw material costs for paper and pulp products, particularly paperboard. Competition from alternative packaging solutions such as flexible plastics, molded fiber, and rigid plastic containers can further limit the market expansion.

North America Corrugated Packaging Market: Key Takeaways

- Market Value: The North American corrugated packaging market size is expected to reach a value of USD 318.7 billion by 2034 from a base value of USD 135.5 billion in 2025 at a CAGR of 10.0%.

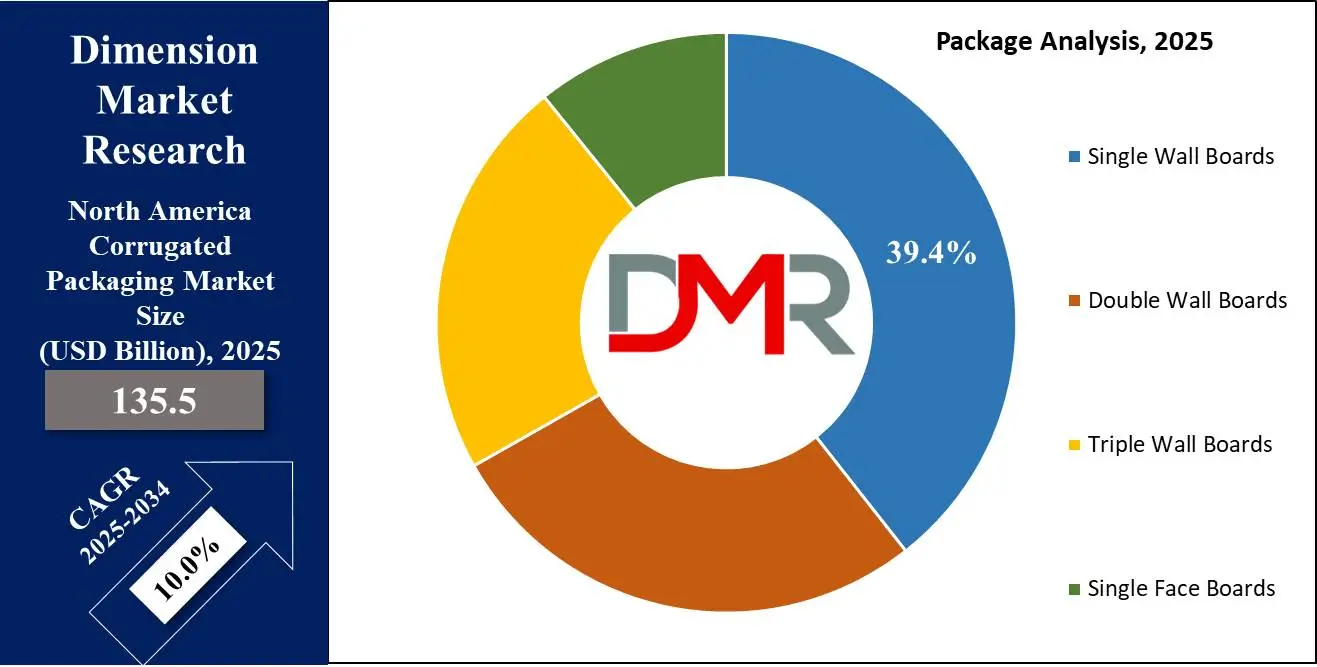

- By Package Type Segment Insights: Single Wall Boards is projected to maintain its dominance in the package type segment, capturing 39.4% of the market share in 2025.

- By Application Type Segment Insights: Food and Beverages are poised to dominate the application type segment in the North American corrugate packaging market, holding 33.2% of the market share in 2025.

- By End-User Type Segment Insights: Processed Foods are anticipated to dominate the end-user type segment, capturing 32.0% of the market share in 2025.

- Key Players: Some major key players in the North American corrugated packaging market are, Georgia-Pacific, Lee & Man Paper Manufacturing Ltd., Smurfit Kappa, DS Smith, and Other Key Players.

North America Corrugated Packaging Market: Use Cases

- E-commerce and Online Retail Growth: The rapid expansion of e-commerce in North America, driven by major players like Amazon, Walmart, and Shopify, has significantly increased the demand for corrugated packaging. Online shopping requires sturdy, lightweight, and cost-effective packaging solutions to protect products during transit. Corrugated boxes are preferred due to their durability, recyclability, and ability to be customized for various product categories.

- Sustainability Initiatives and Eco-friendly Packaging Demand: Increasing environmental concerns and stringent government regulations on plastic packaging have created a shift toward sustainable packaging solutions, including corrugated boxes. Many brands and retailers are prioritizing recyclable and biodegradable packaging to meet corporate sustainability goals and align with consumer preferences for eco-friendly products.

- Growth in the Food & Beverage Industry and Retail Sector: The food and beverage industry is one of the largest consumers of corrugated packaging due to its hygienic, protective, and customizable nature. The rising demand for packaged and processed foods, along with an increasing focus on convenience and takeout/delivery services, has boosted the adoption of corrugated boxes, trays, and cartons. Grocery retail chains, supermarkets, and warehouse clubs (e.g., Costco, Kroger, and Walmart) rely heavily on corrugated packaging for bulk product storage, transportation, and display-ready packaging solutions.

- Advancements in Corrugated Packaging Technology and Customization: Technological advancements in corrugated packaging, including digital printing, automation in box manufacturing, and smart packaging solutions, have significantly improved efficiency and customization capabilities. Digital printing allows for high-quality, cost-effective customization, which is essential for branding, promotional packaging, and seasonal packaging designs.

North America Corrugated Packaging Market: Stats & Facts

- The North American corrugated packaging industry is a significant segment of the manufacturing sector, encompassing the production of corrugated and solid fiber boxes. This industry is classified under the North American Industry Classification System (NAICS) code 322211.

- According to the U.S. Bureau of Labor Statistics (BLS), the corrugated and solid fiber box manufacturing industry (NAICS 322211) reported an incidence rate of 2.2 nonfatal occupational injuries and illnesses per 100 full-time workers in 2020.

- According to the United States Environmental Protection Agency, Containers and packaging make up a major portion of municipal solid waste (MSW), amounting to 82.2 million tons of generation in 2018 (28.1 percent of total generation).

North America Corrugated Packaging Market: Market Dynamic

North America Corrugated Packaging Market: Driving Factors

E-commerce Growth and Packaging Demand

E-commerce is one of the primary drivers for the North American corrugated packaging market. Amazon, Walmart, and Target as well as numerous smaller businesses rely heavily on corrugated boxes as a cost-efficient means of shipping their goods at scale. E-commerce has revolutionized how goods are packaged and delivered. Customers now expect prompt, reliable service with emphasis placed on product safety during transit.

Businesses operating e-commerce must carefully choose their packaging not just to protect products but also to ensure customer satisfaction. Well-packed products ensure customers receive them intact which helps build customer loyalty in this highly competitive online market. Corrugated packaging provides strong yet lightweight protection, ensuring items arrive undamaged.

Sustainability and Environmental Concerns

Sustainability has emerged as a priority in both consumer and business practices, significantly impacting demand for corrugated packaging in North America. As environmental concerns surrounding plastic waste, resource depletion, and carbon emissions increase, businesses face mounting pressure to adopt sustainable practices in their operations. Businesses that utilize sustainable packaging solutions such as corrugated boxes can meet regulatory requirements while simultaneously appealing to clients who value sustainability. Governments, especially in North America, have played an essential role in driving the shift toward sustainable packaging practices. Regulations like plastic bans, extended producer responsibility (EPR) laws, and mandatory recycling programs have put pressure on companies to reduce their reliance on non-recyclable or single-use plastic packaging.

North America Corrugated Packaging Market: Restraints

High Production Costs and Raw Material Price Fluctuations

Corrugated packaging companies depend heavily on reliable supplies of recycled paper and virgin fibers, both of which can fluctuate due to supply chain disruptions, trade policies, natural disasters, and price hikes caused by factors like supply chain disruptions or natural disasters that impact pulp production. Price fluctuations of raw materials have an enormous effect on corrugated production costs.

For instance, changes in wood pulp prices which is an essential ingredient used in corrugated paper production may increase costs significantly and have detrimental repercussions for both suppliers and end-users of corrugated paper production costs overall. Labor costs associated with producing corrugated packaging can also be an obstacle, particularly in regions with rising wages and labor shortages.

Increased Competition from Alternative Packaging Solutions

North American corrugated packaging market growth is being hindered by competition from alternative packaging materials, including plastics, flexible packaging, and molded pulp. While corrugated remain an attractive solution in various industries, alternative materials offer distinct advantages that could make them more desirable choices.

Plastic packaging has long been utilized across various industries for products that require waterproofing, flexibility, and durability. Plastic can provide effective moisture protection as well as being easily formed into custom designs to offer maximum design flexibility. Plastic is often cheaper and lighter than corrugated options making it an attractive solution for businesses wishing to reduce packaging costs while increasing shipping efficiency which may be especially appealing in today's highly competitive e-commerce market.

North America Corrugated Packaging Market: Opportunities

Growth in Sustainable Packaging Demand

The increasing demand for sustainable packaging solutions, driven by both consumer preferences and regulatory pressures, presents a significant opportunity for the North American corrugated packaging market. Sustainability is a driving factor transforming industries around the globe, including packaging.

Consumers are becoming more environmentally aware and prefer products in packaging made of recyclable or biodegradable material or made with renewable resources. Corrugated packaging companies have adopted more sustainable sourcing practices for raw materials, such as recycled paper and sustainably harvested virgin fibers, to minimize environmental impact while satisfying growing consumer demand for eco-friendly options.

Expansion in Emerging Applications

Corrugated packaging continues to provide North American businesses with growth opportunities as healthcare and pharmaceutical sectors increase demand for packaging solutions. Its durability, customizability, and sustainability make it well-suited for meeting these regulatory standards and ensuring compliance. Corrugated packaging has become an indispensable component of healthcare e-commerce, especially in health supplements, personal care products, and pharmaceutical drugs.

Customers demand ease and safety in their online health purchases, so corrugated ensures products arrive intact at their destinations safely. The corrugated packaging market can seize this opportunity to enter new and growing sectors like healthcare and pharmaceutical by providing secure, eco-friendly, and versatile packaging options that meet growing industry requirements.

North America Corrugated Packaging Market: Trends

Rise of E-commerce and Online Retail

The rise of e-commerce and online retailing, where more consumers are shifting toward purchasing their goods online, driving unprecedented demand for packaging solutions capable of safely and efficiently transporting these goods. E-commerce businesses from major giants like Amazon to smaller direct-to-consumer brands rely heavily on corrugated boxes to ensure products reach consumers undamaged.

Corrugated packaging's ability to protect goods during transit while upholding structural integrity makes it the preferred choice when shipping electronics, clothing, or perishable goods. E-commerce companies are capitalizing on this trend with innovative corrugated packaging designs. With consumer personalization on the rise, packaging plays an essential role in customer satisfaction and brand identity.

Shift Towards Sustainable and Eco-friendly Packaging Solutions

Another trend in the North American corrugated packaging market is focusing on sustainability and eco-friendly solutions. As environmental concerns become more prominent, both consumers and businesses are prioritizing these options in favor of traditional ones due to increased awareness about plastic waste, climate change, and their environmental impact on packaging materials.

Governments and regulatory bodies are also contributing to this shift by enacting stringent regulations around packaging waste and sustainability. For instance, several states in the US have introduced bans on single-use plastics, prompting businesses to find more sustainable packaging solutions. Corrugated packaging manufacturers have responded to this trend by adopting more eco-friendly practices, including using recycled fibers, decreasing the weight of packaging to reduce material use, and using water-based inks and adhesives that promote sustainability.

North America Corrugated Packaging Market: Research Scope and Analysis

By Package Type

Single Wall Boards is projected to maintain its dominance in the package type segment, capturing 39.4% of the market share in 2025. This dominance is due to their versatility, cost-effectiveness, and wide applicability across various industries. Constructed with one layer of fluted paper integrated between two flat liners providing strength while maintaining flexibility, single wall boards make an ideal solution for light to medium-weight products that need packaging.

Single wall boards have become incredibly popular due to an increase in demand for effective packaging that protects products in transit while remaining cost-effective. They're widely used across e-commerce, retail packaging, and shipping due to their efficient design which facilitates easy handling, storage, and transportation. Their relatively lower costs compared to double or triple wall boards make them especially appealing to businesses aiming to cut packaging costs while maintaining adequate levels of protection.

Double wall boards are also contributing to the growth of corrugated packaging markets, particularly sectors requiring extra strength and durability. Double wall boards consist of two fluted paper layers, layered over three liners to provide superior protection compared to single wall boards. Their strength makes them suitable for protecting heavier items that require additional support, such as electronics, machinery, or large consumer goods.

E-commerce's rapid expansion is one of the primary drivers behind double wall boards' use. Businesses searching for long-distance shipping, handling, and movement solutions need packaging solutions capable of withstanding crushing or damage during transit. Double wall boards offer enhanced protection from such hazards which is especially helpful when shipping bulky or fragile products, they also boast greater weight load capacities as well as superior stacking strength.

By Application

Food and Beverages are poised to dominate the application type segment in the North American corrugate packaging market, holding 33.2% of the market share in 2025. Corrugated packaging has long been the preferred choice in this sector due to its superior protective qualities, cost-effectiveness, and ability to accommodate various product types. Food and beverage products, particularly fresh products, beverages, dry goods, and frozen goods rely on packaging that protects freshness, quality, and safety.

Corrugated boards provide vital protection during transportation, guarding against impacts, moisture, and contamination to help ensure safe delivery. Customization also gives companies an edge in this highly competitive food and beverage market, helping increase product visibility and strengthen branding efforts.

E-commerce, as a highly prominent sector, also contributes significantly to driving demand for corrugated packaging in North America. As more and more consumers opt for online shopping due to its convenience and global events. E-commerce businesses using direct-to-consumer (DTC) models increasingly rely on corrugated packaging due to its durability and adaptability in customizing it for individual orders. Companies can take advantage of this trend to craft distinctive and branded packaging that enhances customer experiences while increasing brand recognition.

By End-User

Processed Foods are anticipated to dominate the end-user type segment, capturing 32.0% of the market share in 2025. This dominance can be attributed to the widespread use of corrugated packaging in the processed food sector, food products requiring processing require durable packaging that can withstand distribution, storage, and retail handling processes.

This requires containers that can withstand temperature extremes as well as retail sales environments. Corrugated packaging provides products with strength and protection with versatility as an option for packaging food products of various sizes and shapes, which makes them an excellent choice for use within the processed food industry. Corrugated packaging's recyclable and biodegradable features fit nicely into processed food manufacturers' focus on sustainability, which coincides with an increased need for eco-friendly solutions in response to busy lifestyles and a growing desire for convenience in packaging solutions.

Fresh foods and produce are also contributing significantly to the growth of the corrugated packaging market. Fresh produce such as fruits and vegetables require packaging that not only offers protection but also allows for ventilation and moisture control to maintain freshness during transport.

Corrugated packaging is ideal for this use as it can easily be modified with perforations for airflow, helping reduce risk and extend the shelf life of the product. Consumer preferences for healthier eating and an increasing awareness of fresh produce is driving demand for fresh foods in the North American market landscape.

The North America Corrugated Packaging Market Report is segmented on the basis of the following:

By Package Type

- Single Wall Boards

- Double Wall Boards

- Triple Wall Boards

- Single Face Boards

By Application

- Food and Beverages

- E-Commerce

- Transport and Logistics

- Electronics and Electricals

- Others

By End-Use

- Processed Foods

- Fresh Foods and Produce

- Beverages

- Paper Products

- Electrical Products

- Others

North America Corrugated Packaging Market: Competitive Landscape

North American corrugated packaging market is highly dynamic, featuring multiple key players with a major emphasis on sustainability and continuous innovations to meet industry requirements. The market features large multinational corporations, regional players, and emerging companies.

These players focus on offering diverse corrugated solutions suitable for food & beverage packaging needs, retail applications as well as industrial use cases. Notable players in the North American corrugated packaging market include International Paper Company, WestRock Company, Georgia-Pacific LLC, and Smurfit Kappa Group. These players boast significant market presence, extensive manufacturing capabilities, and well-established supply chains that enable them to serve large clients across different sectors.

Alongside these large players, the market also features regional companies specializing in providing customized corrugated packaging solutions to specific industries. These regional companies often rely on flexibility and personalized service to cater to niche markets like local food producers, small e-commerce businesses, or specialty product manufacturers. While they might lack the vast resources of their larger counterparts, these regional firms still provide competitive offerings with quick turnaround times and modified packaging solutions.

Some of the prominent players in the North America Corrugated Packaging are

- Georgia-Pacific

- Oji Holdings Corporation

- Lee & Man Paper Manufacturing Ltd.

- Smurfit Kappa

- DS Smith

- WestRock Company

- International Paper

- Packaging Corporation of America

- Mondi Group

- Rengo Co. Ltd

- Other Key Players

North America Corrugated Packaging Market: Recent Developments

- July 2024: Smurfit Kappa and US-based WestRock merged to form Smurfit WestRock, creating a global leader in corrugated packaging. The merger has led to increased sales in the North American segment. Despite a third-quarter net loss reported in October 2024, the merger has provided a strong foundation for future growth.

- June 2024: Green Bay Packaging, a prominent player in the North American corrugated packaging market, expanded its operations by acquiring SMC Packaging Group, a corrugated box manufacturer based in Springfield, Missouri. This acquisition significantly enhanced Green Bay Packaging's vertical integration capabilities, enabling the company to manage several hundred thousand acres of forestland, where it harvests and reforests approximately 5,500 acres per year, planting 5 million pine trees annually.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 135.5 Bn |

| Forecast Value (2033) |

USD 318.7 Bn |

| CAGR (2024-2033) |

10.0% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Package Type (Single Wall Boards, Double Wall Boards, Triple Wall Boards, and Single Face Boards), By Application (Electronics and Electricals, Food and Beverages, Transport and Logistics, E-commerce, and Others), and By End-User (Processed Foods, Fresh Food and Produce, Beverages, Paper Products, Electrical Products, and Others) |

| Regional Coverage |

Saudi Arabia |

| Prominent Players |

Georgia-Pacific, Oji Holdings Corporation, Lee & Man Paper Manufacturing Ltd., Smurfit Kappa, DS Smith, WestRock Company, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The North American corrugated packaging market is projected to be valued at USD 135.5 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 318.7 billion in 2034 at a CAGR of 10.0%.

Some of the major key players in North American corrugated packaging are Georgia-Pacific, Lee & Man Paper Manufacturing Ltd., Oji Holdings Corporation, Smurfit Kappa, and many others.

The market is growing at a CAGR of 10.0 percent over the forecasted period.