Market Overview

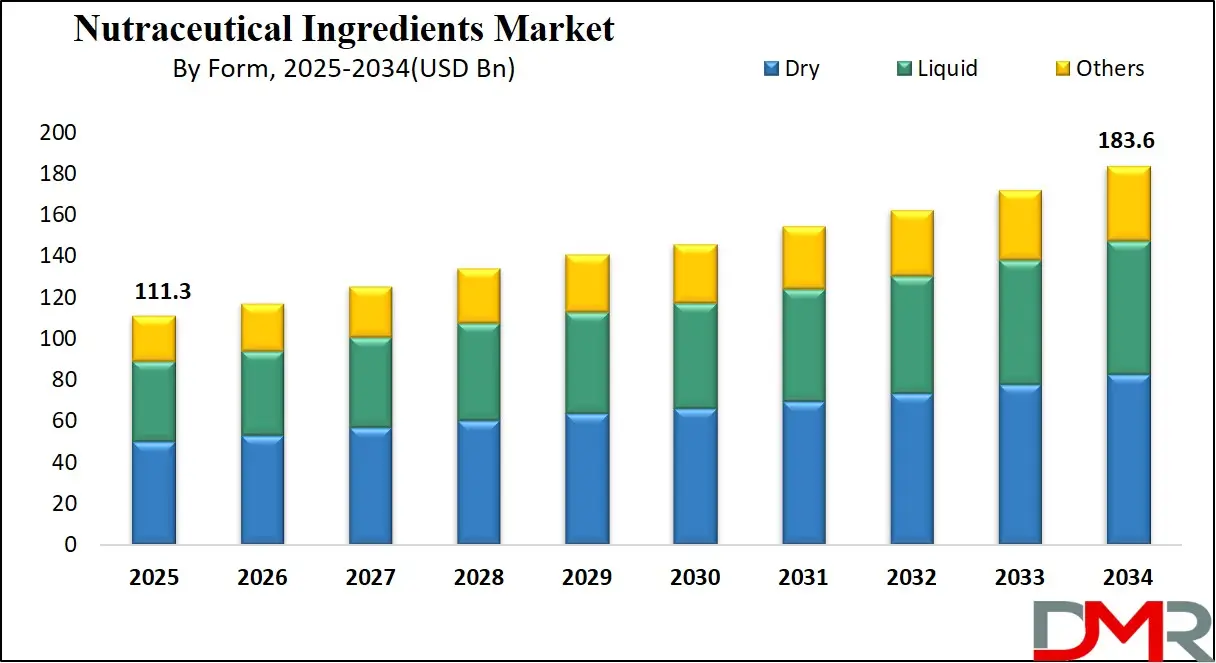

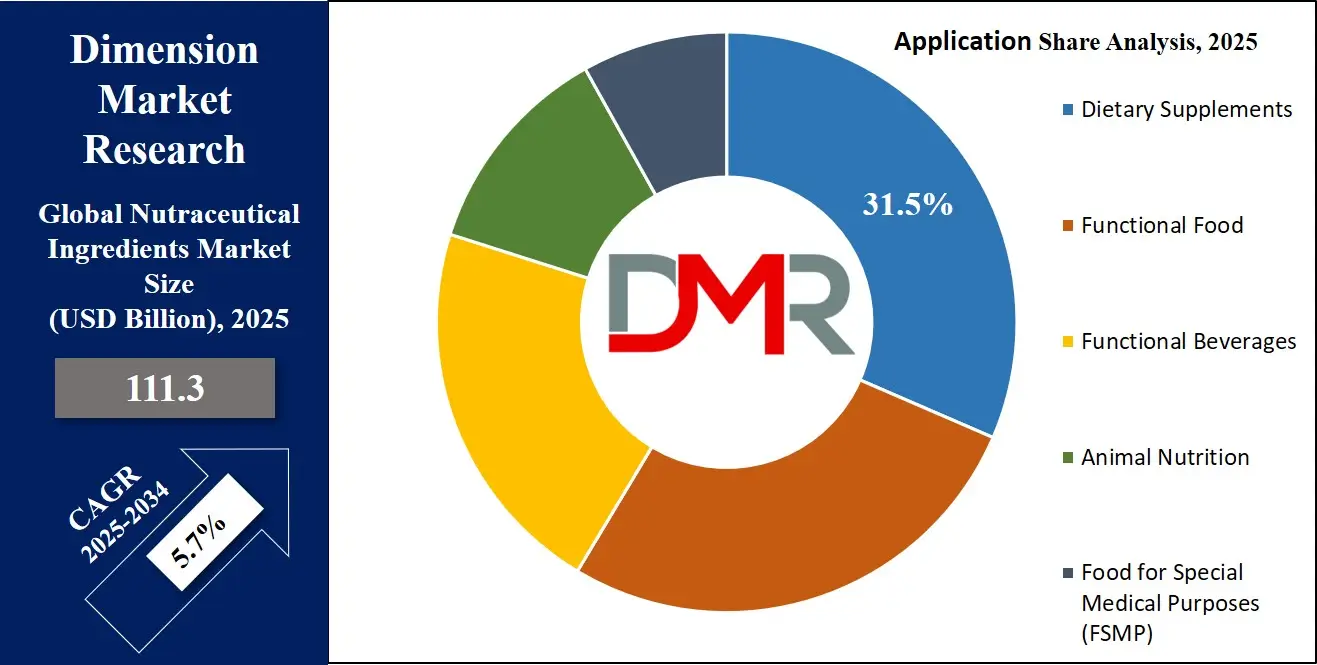

The Global Nutraceutical Ingredients Market is projected to reach USD 111.3 billion in 2025 and grow at a compound annual growth rate of 5.7% from there until 2034 to reach a value of USD 183.6 billion.

The global nutraceutical ingredients market is witnessing sustained expansion due to increasing consumer awareness of preventive healthcare, functional foods, and dietary supplementation. This market is driven by the growing inclination toward health-centric lifestyles, where individuals proactively manage chronic conditions such as obesity, diabetes, and cardiovascular diseases through nutrition-based interventions. Key trends shaping the industry include a shift towards plant-derived ingredients, clean-label formulations, and a surge in demand for personalized nutrition solutions that address individual dietary needs.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Growing urbanization, coupled with sedentary lifestyles, has propelled demand for fortified foods and beverages rich in bioactive compounds such as probiotics, omega-3 fatty acids, vitamins, minerals, and botanical extracts. Technological advancements in ingredient extraction, microencapsulation, and formulation techniques are enabling manufacturers to deliver more effective and targeted health benefits through food products.

However, the market faces challenges such as stringent global regulatory frameworks and the complex process of validating health claims with scientific backing. Moreover, high production costs and consumer skepticism about unverified claims continue to restrain market penetration.

Despite these obstacles, the nutraceutical ingredients sector holds significant growth prospects. Emerging economies are experiencing rising disposable incomes, expanding middle-class populations, and a cultural shift towards wellness and longevity, creating lucrative opportunities for manufacturers and suppliers. Additionally, innovations in delivery formats, such as gummies, powders, and beverages, are increasing product accessibility and appeal across various age groups.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global nutraceutical ingredients market is well-positioned for long-term growth, underpinned by the convergence of health, nutrition, and science, making it a pivotal component of modern food and healthcare ecosystems.

The US Nutraceutical Ingredients Market

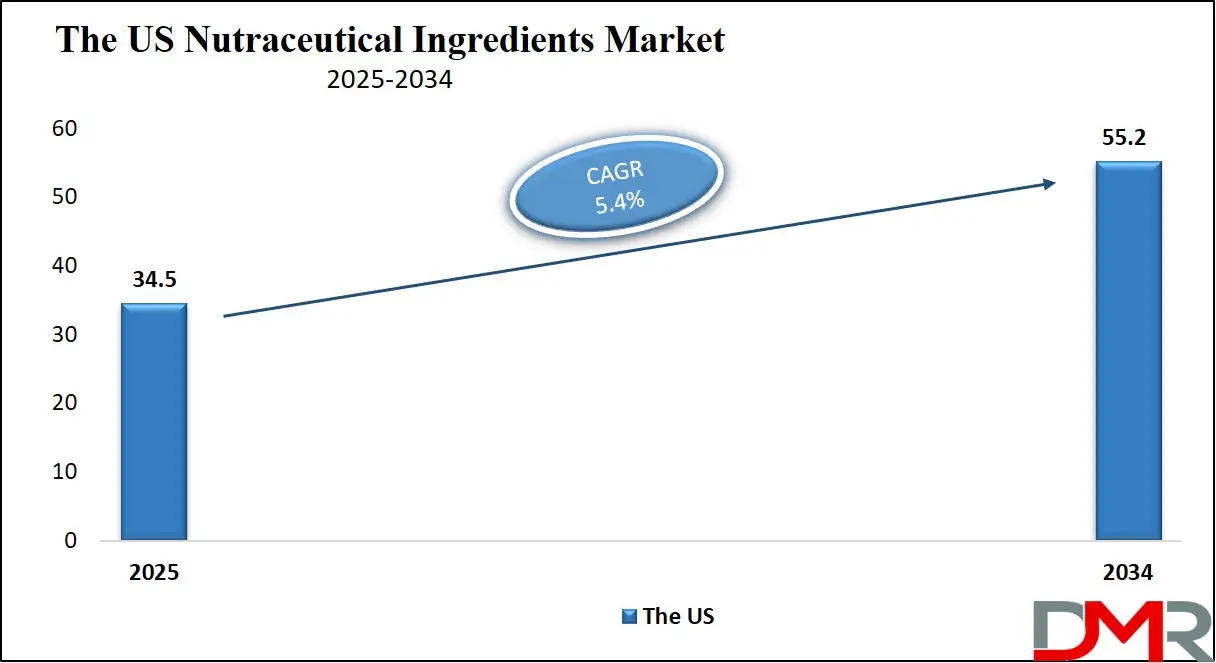

The US Nutraceutical Ingredients Market is projected to reach USD 34.5 billion in 2025 at a compound annual growth rate of 5.4% over its forecast period.

The U.S. nutraceutical ingredients market is thriving, bolstered by a large health-aware population, advanced nutrition science, and favorable demographic trends. The country’s aging population, with over 55 million individuals aged 65 and older, continues to fuel demand for preventive health products and dietary supplements tailored to age-related health concerns like bone density loss, cognitive decline, and heart health. Furthermore, over 60% of American adults now use dietary supplements regularly, reflecting high penetration across demographic segments.

Government organizations such as the U.S. Food and Drug Administration (FDA) provide clear frameworks for the labeling, safety, and marketing of functional foods and dietary supplements, encouraging innovation while maintaining consumer protection. The U.S. Department of Agriculture (USDA) promotes nutrition guidelines and bioactive-rich food consumption, creating a favorable climate for nutraceutical adoption.

Lifestyle-related health challenges, such as obesity, metabolic syndrome, and hypertension, are widespread in the U.S., reinforcing the demand for health-enhancing food ingredients like plant-based proteins, omega-3 oils, prebiotics, and antioxidant-rich botanicals. Rising awareness of immune health, gut health, and mental wellness, especially post-pandemic, has accelerated demand for multifunctional and personalized supplement formats.

The market is also supported by robust domestic manufacturing capabilities, high consumer spending power, and widespread availability of health-focused retail and e-commerce platforms. These factors have created a dynamic ecosystem for nutraceutical innovation, allowing brands to rapidly launch novel products targeting wellness, longevity, and disease prevention.

With strong regulatory support, scientific research backing, and a health-conscious public, the U.S. remains one of the most mature and lucrative nutraceutical ingredients markets globally.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The European Nutraceutical Ingredients Market

The Europe Nutraceutical Ingredients Market is estimated to be valued at USD 19.5 billion in 2025 and is further anticipated to reach USD 31.9 billion by 2034 at a CAGR of 5.5%.

Europe’s nutraceutical ingredients market is characterized by its emphasis on health, safety, and environmental sustainability. The region benefits from a well-established healthcare infrastructure and an aging population that prioritizes preventive health solutions. With nearly 21% of Europeans over the age of 65, there is growing demand for ingredients that support cognitive health, cardiovascular function, bone strength, and metabolic wellness.

The European Food Safety Authority (EFSA) plays a pivotal role in regulating health claims and ensuring the scientific substantiation of functional foods and supplements. This regulatory rigor promotes consumer trust but also requires manufacturers to invest heavily in clinical trials and evidence-based formulations.

Consumer preferences in Europe are steadily shifting toward plant-based, organic, and clean-label ingredients. This aligns with regional sustainability goals and ethical food sourcing trends. Countries such as Germany, France, and Italy lead in adopting nutraceuticals that support immunity, digestion, and mental clarity.

Functional beverages, gummies, and fortified dairy products are growing rapidly across European supermarkets and specialty health stores. Innovations in nutrigenomics and microbiome-targeted nutrition are further expanding the possibilities for personalized health interventions.

Despite a fragmented regulatory landscape due to the EU’s diverse member states, Europe presents substantial opportunities for global and regional manufacturers. Premiumization, transparency, and eco-conscious packaging are driving purchasing behavior, along with rising demand for vegan, allergen-free, and sugar-reduced formulations.

Europe’s nutraceutical ingredients market stands as a model for regulatory quality, ingredient traceability, and consumer engagement, offering fertile ground for innovation in health-promoting nutritional solutions.

The Japan Nutraceutical Ingredients Market

The Japan Nutraceutical Ingredients Market is projected to be valued at USD 6.6 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 10.3 billion in 2034 at a CAGR of 5.0%.

Japan's nutraceutical ingredients market reflects a fusion of advanced scientific development and cultural traditions rooted in holistic health. The country has one of the world’s oldest populations, with more than 28% of its citizens aged over 65, prompting a growing focus on anti-aging, cognitive health, and chronic disease prevention through functional foods and supplements.

The Ministry of Health, Labour and Welfare oversees Japan's regulatory structure for nutraceuticals, including Foods for Specified Health Uses (FOSHU) and Foods with Function Claims (FFC). This dual framework facilitates innovation while ensuring consumer safety and substantiation of health benefits.

Japanese consumers have long embraced dietary components that promote longevity, such as fermented soy, green tea, seaweed, and fish oils. Recently, demand has surged for Western nutraceutical ingredients like astaxanthin, coenzyme Q10, lutein, and glucosamine, integrated into modern delivery systems such as capsules, tablets, and ready-to-drink formats.

Functional foods addressing gut microbiota balance, including probiotics and prebiotics, have widespread popularity in Japan. Additionally, collagen-based ingredients are extensively used in beauty-from-within formulations targeting skin elasticity and joint support, especially among middle-aged and older women.

Despite a highly regulated market and strong competition from established domestic brands, international players are increasingly attracted to Japan due to its high per capita spending on health-related products and openness to innovation.

Japan’s nutraceutical industry continues to grow as it capitalizes on demographic shifts, cultural alignment with preventive care, and a technologically advanced R&D ecosystem, making it a global hub for next-generation health ingredients and personalized nutrition.

Global Nutraceutical Ingredients Market: Key Takeaways

- Global Market Size Insights: The Global Nutraceutical Ingredients Market size is estimated to have a value of USD 111.3 billion in 2025 and is expected to reach USD 183.6 billion by the end of 2034.

- The US Market Size Insights: The US Nutraceutical Ingredients Market is projected to be valued at USD 34.5 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 55.2 billion in 2034 at a CAGR of 5.4%.

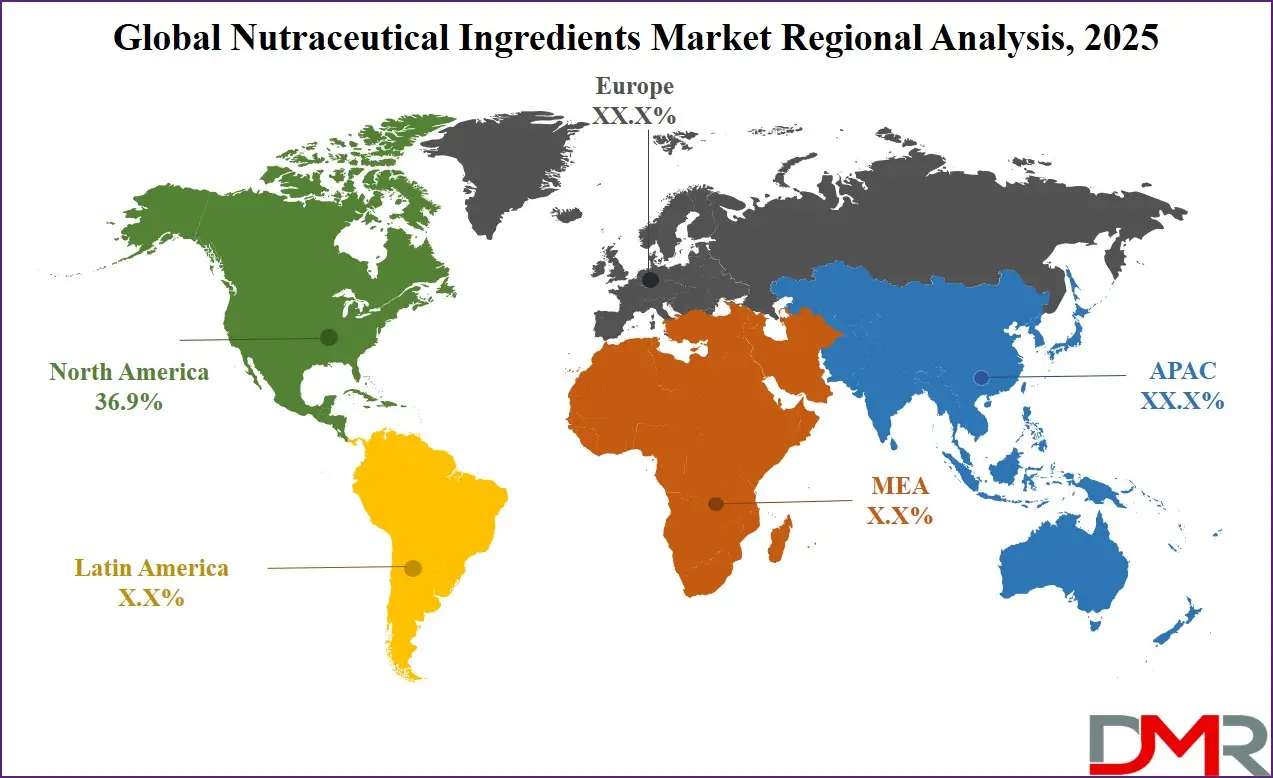

- Regional Insights: North America is expected to have the largest market share in the Global Nutraceutical Ingredients Market with a share of about 36.9% in 2025.

- Key Players: Some of the major key players in the Global Nutraceutical Ingredients Market are BASF SE, Koninklijke DSM N.V., Archer Daniels Midland Company (ADM), DuPont de Nemours, Inc., Cargill, Incorporated, Kerry Group plc, Glanbia plc, and many others.

- The Global Market Growth Rate: The market is growing at a CAGR of 5.4 percent over the forecasted period of 2025.

Global Nutraceutical Ingredients Market: Use Cases

- Immune Support Supplements: Nutraceutical ingredients like vitamin C, zinc, echinacea, and elderberry are commonly formulated into supplements that help fortify the immune system, especially during seasonal flu outbreaks or periods of increased health risk. These products are widely used by health-conscious consumers aiming to reduce infection susceptibility.

- Weight Management Products: Natural extracts such as green tea catechins, garcinia cambogia, and conjugated linoleic acid are popular in weight management nutraceuticals. These compounds are incorporated into tablets, meal replacements, and functional drinks to support metabolism, enhance fat oxidation, and promote satiety without harmful side effects.

- Heart Health Formulations: Ingredients such as omega-3 fatty acids, phytosterols, garlic extract, and coenzyme Q10 are found in nutraceuticals that support cardiovascular function. They help reduce LDL cholesterol, maintain healthy blood pressure, and improve endothelial function, thereby reducing the risk of heart disease and stroke.

- Joint Health Supplements: Nutraceuticals aimed at joint mobility and inflammation relief often contain glucosamine, chondroitin, collagen peptides, and turmeric (curcumin). These are commonly consumed by elderly individuals and athletes to improve joint comfort, enhance cartilage health, and manage age-related osteoarthritis symptoms.

- Cognitive Function Enhancers: Nootropic ingredients such as ginkgo biloba, bacopa monnieri, phosphatidylserine, and DHA are used in nutraceuticals designed to enhance memory, concentration, and brain function. These supplements are particularly popular among students, professionals, and older adults concerned about cognitive decline.

Global Nutraceutical Ingredients Market: Stats & Facts

World Health Organization (WHO)

The WHO highlights the increasing global health burden driven by non-communicable diseases (NCDs), directly propelling the demand for nutraceuticals that offer preventive health benefits.

- Chronic diseases, including cardiovascular conditions, cancers, respiratory diseases, and diabetes, now account for 74% of all deaths worldwide, representing a major public health crisis.

- Cardiovascular diseases are the leading cause of death globally, responsible for approximately 17.9 million lives each year.

- Cancers claim over 9.3 million deaths annually, followed by 4.1 million from chronic respiratory diseases and 2 million from diabetes, including related kidney diseases.

- More than 80% of premature deaths from NCDs occur in low- and middle-income countries, underlining an urgent need for accessible, functional nutrition to aid prevention.

U.S. Food and Drug Administration (FDA)

The FDA governs the classification, marketing, and labeling of nutraceuticals under the dietary supplement category in the U.S.

- All dietary supplements are regulated as food, not drugs, which impacts how they are marketed and formulated.

- Supplement products can carry structure/function claims such as “supports bone health” or “boosts immunity,” but must be backed by scientific data and cannot claim to treat or cure disease.

- Each supplement label must include a mandatory disclaimer: “These statements have not been evaluated by the FDA. This product is not intended to diagnose, treat, cure, or prevent any disease.”

National Institutes of Health (NIH)

Through its Office of Dietary Supplements, NIH provides insights into usage patterns and public health relevance.

- Approximately 50% of U.S. adults report using one or more dietary supplements regularly, reflecting broad acceptance across demographics.

- Multivitamins are the most commonly consumed supplement type, followed by vitamin D, vitamin C, calcium, and omega-3 fatty acids.

- The NIH recommends supplements for individuals with documented deficiencies or special health needs, including pregnant women, older adults, and those with chronic conditions.

European Food Safety Authority (EFSA)

EFSA is responsible for risk assessments and health claim approvals for food and supplement ingredients across the EU.

- All nutritional and health claims on food and supplement products must undergo scientific validation and approval before being used on product labels.

- Nutraceutical products making unapproved health claims are subject to regulatory action and product recall, ensuring consumer safety and scientific integrity across the EU market.

Ministry of Commerce & Industry, Government of India

India is emerging as a key nutraceutical hub with increasing domestic demand and growing exports of nutrition-based products.

- India’s pharmaceutical exports reached USD 16.3 billion in FY 2020, with nutraceuticals contributing significantly to this figure.

- The Indian nutraceutical ingredients market was valued at USD 6.11 billion in 2023 and is projected to grow at a CAGR of 11.4% through 2029.

- Foreign direct investment (FDI) in the sector rose from USD 131.4 million in 2012 to USD 584.7 million in 2019, reflecting increasing investor confidence in health-centric food innovation.

World Metrics Organization

- 77% of adults in the U.S. reported using some form of dietary supplement regularly.

- Probiotics, omega-3s, and botanical extracts are some of the fastest-growing product segments, due to their perceived immune-boosting and anti-inflammatory properties.

- Asia-Pacific remains the fastest-growing region for nutraceuticals, driven by rising middle-class populations, urbanization, and traditional herbal knowledge integration.

Global Nutraceutical Ingredients Market: Market Dynamics

Driving Factors in the Global Nutraceutical Ingredients Market

Escalating Global Burden of Lifestyle-Related Chronic Diseases

The alarming rise in non-communicable lifestyle diseases such as obesity, diabetes, cardiovascular disorders, and metabolic syndrome is one of the strongest growth drivers for the nutraceutical ingredients market. Sedentary lifestyles, high stress, urbanization, and poor dietary habits have made the global population increasingly vulnerable to long-term health conditions. Consumers, especially in urban and aging populations, are turning to nutraceuticals as preventive healthcare options to manage blood pressure, cholesterol, blood glucose, and inflammation.

As healthcare costs rise and access to preventive medicine becomes a global concern, individuals are investing more in self-care through functional nutrition. This has elevated the demand for functional ingredients like omega-3 fatty acids, plant sterols, amino acids, and probiotics, along with innovations in probiotics packaging to ensure stability and effectiveness. Governments and health bodies worldwide are actively promoting food fortification and healthy eating campaigns, further supporting the nutraceutical ecosystem. This preventive health approach, backed by scientific and clinical validation, is projected to accelerate the adoption of condition-specific nutraceutical formulations across both developed and developing regions.

Rising Geriatric Population and Demand for Healthy Aging Solutions

The global population is aging at an unprecedented rate, creating robust demand for nutraceutical ingredients targeted toward age-related health concerns. According to the United Nations, over 1.5 billion people will be aged 65 or older by 2050, representing a key demographic for the nutraceuticals market. Older adults are especially susceptible to conditions such as arthritis, osteoporosis, cognitive decline, poor immunity, and vision loss. This has fueled the consumption of nutraceutical ingredients like collagen peptides, glucosamine, lutein, curcumin, and omega-3s that support bone, joint, brain, and eye health. The preference for non-invasive, supplement-based preventive care over pharmaceutical interventions is also contributing to this trend.

Additionally, functional foods designed to aid digestion, improve nutrient absorption, and maintain energy in seniors are gaining momentum. Supplement formulations targeting memory, muscle mass, and cardiovascular function are among the highest in demand. The intersection of aging populations, rising healthcare costs, and preference for natural remedies is making healthy aging one of the most critical growth pillars for the global nutraceutical ingredients market.

Restraints in the Global Nutraceutical Ingredients Market

Regulatory Complexity and Lack of Harmonized Global Standards

The nutraceutical ingredients market faces significant challenges due to inconsistent and fragmented regulatory frameworks across different regions. While some countries regulate nutraceuticals as food supplements, others classify them under pharmaceuticals or functional foods, creating compliance barriers for global manufacturers. Each region has unique requirements related to ingredient safety, permitted health claims, permissible dosages, and manufacturing protocols. For instance, the European Union mandates scientific approval of health claims through EFSA, while the U.S. allows structure/function claims with disclaimers under FDA rules. This lack of global harmonization increases the cost of product registration, delays go-to-market timelines, and creates risk for import/export bans or recalls.

Additionally, ambiguous definitions of what constitutes a nutraceutical or functional food often leave regulatory gaps that undermine credibility. Smaller companies especially struggle to navigate these evolving frameworks, hindering innovation. Until an international framework emerges, market fragmentation and inconsistent enforcement will continue to pose a restraint for industry scalability and cross-border operations.

Risk of Contamination, Adulteration, and Mislabeling in Ingredients

One of the major challenges undermining consumer trust in nutraceuticals is the recurring issue of ingredient adulteration, contamination, and inaccurate labeling. The global supply chain for nutraceutical ingredients is vast and often opaque, increasing the risk of intentional or accidental quality compromise. Cases of supplements being tainted with heavy metals, banned substances, synthetic analogs, or undeclared allergens have led to widespread recalls and regulatory action.

Inconsistent quality assurance and inadequate third-party verification further compound the problem, particularly for botanicals sourced from unregulated regions. For example, adulterated curcumin or ashwagandha extracts can not only reduce product efficacy but also pose health risks.

Mislabeling regarding ingredient concentration, purity levels, or bioavailability undermines brand integrity and consumer safety. These risks are especially critical in e-commerce channels, where oversight is limited. To mitigate this restraint, manufacturers are increasingly investing in GMP-certified facilities, DNA barcoding, and third-party audits. However, the industry’s reputation still suffers from bad actors, necessitating greater transparency, traceability, and regulatory vigilance.

Opportunities in the Global Nutraceutical Ingredients Market

Integration of Nutraceuticals into Mainstream Healthcare and Preventive Medicine

There is a growing alignment between nutraceuticals and conventional healthcare systems, opening a substantial opportunity for ingredient suppliers and formulators. Increasingly, medical professionals and integrative healthcare providers are recommending nutraceuticals as adjunct therapies for chronic conditions, immune support, inflammation control, and digestive health.

Hospitals and clinics are incorporating nutrition-based interventions into patient care protocols, creating demand for pharmaceutical-grade nutraceutical ingredients that meet GMP, GRAS, and clinical safety standards. In several countries, including Germany, Japan, and India, government health systems are also acknowledging the role of preventive nutrition, promoting nutraceutical ingredients through wellness schemes and nutrition subsidies.

The COVID-19 pandemic further reinforced the critical role of functional foods and supplements in immune resilience, accelerating mainstream acceptance. This convergence of clinical nutrition, functional medicine, and dietary science offers enormous potential for nutraceutical brands to collaborate with healthcare providers, research institutions, and pharmacies. Long term, this may lead to nutraceuticals being covered by insurance policies in select regions, significantly boosting ingredient demand.

Expansion of Clean Label, Sustainable, and Ethical Ingredient Sourcing

The global rise of eco-conscious consumers and environmental accountability is opening opportunities for plant-based, ethically harvested, and sustainably processed nutraceutical ingredients. Manufacturers are under pressure to demonstrate transparency, traceability, and responsible sourcing across the supply chain. Clean-label demands are encouraging formulators to replace synthetic additives with natural alternatives such as fruit concentrates, plant polyphenols, marine minerals, and fermentation-derived vitamins.

Additionally, the use of regenerative agriculture, organic farming, upcycled ingredients, and carbon-neutral processing is gaining traction as consumers demand more from the brands they trust. Companies that invest in green chemistry and circular supply chains can command premium pricing and brand loyalty.

Regions like Scandinavia, Canada, and Australia are leading this ethical sourcing movement, supported by regulatory bodies and sustainability frameworks such as the EU Green Deal. Moreover, blockchain and digital verification technologies are helping validate claims and ensure authenticity. This growing consumer and regulatory push toward sustainability is expected to redefine global sourcing and innovation strategies across the nutraceutical ingredient sector.

Trends in the Global Nutraceutical Ingredients Market

Rising Preference for Natural, Organic, and Plant-Based Nutraceutical Ingredients

Consumers are increasingly shifting toward clean-label, plant-based nutraceuticals that avoid synthetic additives and genetically modified organisms. This shift stems from growing awareness about the long-term health risks associated with artificial preservatives, colors, and synthetic vitamins. Nutraceutical manufacturers are responding by formulating products with organic botanical extracts, herbal adaptogens, marine-based omega-3s, and superfoods like spirulina and turmeric. This trend is especially strong among millennials and Gen Z consumers who prioritize sustainability, traceability, and ethically sourced ingredients.

Furthermore, traditional plant-based systems such as Ayurveda, Traditional Chinese Medicine, and naturopathy are being integrated into modern functional food formulations. As consumer demand for organic certifications and non-GMO ingredients increases, the market is witnessing a surge in R&D focused on bioavailability and efficacy of plant-derived compounds. With the regulatory environment supporting cleaner labeling and sustainability claims, this trend is expected to drive innovation and reshape ingredient sourcing strategies for the global nutraceutical industry in the coming years.

Expansion of Personalized Nutrition Fueled by Digital Health Technologies

Personalized nutrition is becoming a cornerstone trend in the nutraceutical ingredients industry, driven by advancements in digital health tools, wearable technologies, and DNA-based nutritional profiling. Consumers now seek customized health solutions tailored to their genetic makeup, microbiome composition, lifestyle, and metabolic needs. Companies are leveraging artificial intelligence, machine learning, and at-home diagnostic kits to gather real-time health data that informs nutrient recommendations.

As a result, ingredients are now being customized in microdoses or synergistic blends for specific health conditions like gut health, immunity, cognitive performance, and weight management. This precision in nutrient delivery is boosting the demand for high-potency, bioavailable nutraceutical ingredients, including nootropics, peptides, and enzyme blends.

The growing interest in "hyper-personalized" functional foods and supplements is not only redefining product development but also encouraging ingredient suppliers to focus on modular ingredient systems. As consumer awareness of individualized nutrition grows globally, this trend is expected to expand significantly, particularly in e-commerce and direct-to-consumer distribution channels.

Global Nutraceutical Ingredients Market: Research Scope and Analysis

By Ingredient Type Analysis

Protein ingredients are expected to hold a dominant position in the global nutraceutical ingredients market due to their vital role in human health, fitness, and disease prevention. Proteins are essential macronutrients responsible for muscle growth, tissue repair, enzyme production, and immune system support. The rising awareness of protein’s benefits across all age groups—from athletes seeking muscle recovery to older adults aiming to prevent sarcopenia—is driving demand.

Additionally, the global fitness culture, fueled by increasing gym memberships, sports nutrition trends, and home workout adoption, has made protein supplements ubiquitous in daily health regimes. Protein ingredients such as whey, casein, soy, pea, and rice protein are preferred for their high bioavailability and essential amino acid profiles.

Moreover, protein’s versatility in formulation allows it to be used in dietary supplements, functional foods, beverages, and meal replacements, expanding its reach across multiple product categories. The clean-label movement has also accelerated the rise of plant-based proteins as consumers seek non-GMO, allergen-free, and vegan-friendly options. Regulatory bodies often recognize a protein’s safety profile, which facilitates faster market entry and consumer trust. The aging population’s need for nutritional support to maintain muscle mass further boosts protein ingredient consumption.

Finally, protein ingredients benefit from continuous innovation in processing technologies that improve taste, solubility, and digestibility, enhancing consumer acceptance. This combination of functional benefits, broad applicability, evolving consumer preferences, and technological advancements firmly establishes protein as the leading ingredient type in the nutraceutical space.

By Form Analysis

The dry form of nutraceutical ingredients is projected to dominate the market primarily because of its superior stability, longer shelf life, and ease of transportation compared to liquid or semi-solid forms. Dry powders, granules, and flakes exhibit minimal moisture content, which reduces the risk of microbial contamination, degradation, and chemical instability. This inherent stability is crucial for sensitive ingredients like vitamins, minerals, probiotics, and herbal extracts, ensuring that their potency and efficacy remain intact throughout the supply chain. Manufacturers and formulators favor dry forms as they simplify ingredient handling, dosing accuracy, and blending into final products such as capsules, tablets, and powdered drink mixes.

Additionally, dry ingredients offer logistical advantages. They are lighter and less bulky than liquid alternatives, reducing shipping costs and storage space requirements. This is especially beneficial for global supply chains where cost efficiency and product integrity during transit are paramount. Dry forms are also easier to standardize, allowing precise concentration of active compounds, which is critical for quality control and regulatory compliance.

From a consumer standpoint, dry nutraceuticals are convenient for on-the-go consumption when mixed with water or other beverages, catering to fast-paced lifestyles. The dry form also aligns well with the trend for clean-label and natural formulations, as many botanical powders and plant extracts are naturally available in dry form. Furthermore, dry forms are compatible with emerging delivery technologies such as encapsulation and controlled-release systems, enhancing bioavailability and consumer experience. These combined factors make dry forms the preferred choice, dominating the nutraceutical ingredients market globally.

By Function Analysis

Medical supplements are anticipated to lead the functional segment of the global nutraceutical ingredients market due to their critical role in disease management, recovery support, and targeted therapeutic nutrition. Unlike general wellness supplements, medical nutraceuticals are specifically formulated to aid individuals with clinical conditions such as malnutrition, digestive disorders, immune deficiencies, and chronic diseases. This segment’s dominance is fueled by rising global incidences of lifestyle-related and age-associated illnesses that require adjunct nutritional interventions to conventional medical treatments.

Medical supplements often contain high-potency ingredients such as specialized amino acids, omega-3 fatty acids, prebiotics, probiotics, and antioxidants, which are supported by clinical research demonstrating their efficacy in symptom alleviation, inflammation reduction, and metabolic support. Healthcare professionals increasingly recommend these supplements as part of integrative treatment protocols, boosting consumer confidence and market penetration. The aging global population, coupled with increasing awareness about preventive healthcare, is creating sustained demand for medical-grade nutraceutical formulations to support healthy aging, bone health, cardiovascular function, and cognitive performance.

Moreover, stringent quality controls, regulatory oversight, and certifications in the medical supplements segment ensure safety and consistency, encouraging adoption in hospital settings, nursing homes, and home care. Advances in nutrigenomics and personalized medicine are also expanding the scope for customized medical supplements, enhancing treatment outcomes. The COVID-19 pandemic underscored the importance of immune-supporting medical supplements, accelerating research, innovation, and acceptance. Together, these factors cement the leadership of medical supplements in driving the functional nutraceutical ingredients market.

By Application Analysis

Dietary supplements are projected to dominate the application segment in the global nutraceutical ingredients market because they represent the most accessible and widely consumed form of nutraceuticals worldwide. These supplements provide a convenient and efficient way for consumers to fill nutritional gaps, enhance health, and prevent chronic diseases without altering their diet significantly. With busy lifestyles and increasing health consciousness, dietary supplements like multivitamins, minerals, protein powders, and botanicals are favored for their ease of use, portability, and quick integration into daily routines.

The diversity of dietary supplements—from capsules and tablets to powders and gummies—caters to various consumer preferences, age groups, and health goals, fueling widespread adoption. Additionally, dietary supplements benefit from strong retail presence, including pharmacies, health stores, supermarkets, and e-commerce platforms, making them highly accessible globally. Regulatory frameworks generally classify dietary supplements under food rather than pharmaceuticals, enabling faster product approvals and market entry.

Increasing consumer interest in preventive healthcare, immunity boosting, sports nutrition, and cognitive support is driving continuous demand for innovative formulations in this category. Marketing campaigns emphasizing natural ingredients, organic certifications, and clean-label credentials resonate strongly with consumers, further enhancing dietary supplement sales. The segment also benefits from extensive educational initiatives by governments and health organizations promoting supplement use for micronutrient deficiencies and overall wellness.

These factors collectively ensure that dietary supplements remain the largest and fastest-growing application segment within the nutraceutical ingredients market, supported by ongoing innovation, accessibility, and rising health awareness globally.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Global Nutraceutical Ingredients Market Report is segmented on the basis of the following:

By Ingredient Type

- Proteins

- Amino Acids

- Branched Chain Amino Acids (BCAAs)

- Leucine

- Isoleucine

- Valine

- Lysine

- Methionine

- Threonine

- Tryptophan

- Glutamic Acid

- Phenylalanine

- Other Amino Acids

- Fibers & Specialty Carbohydrates

- Probiotics

- Prebiotics

- Phytochemicals & Plant Extracts

- Functional Fats & Oils

- Polyunsaturated Fatty Acids (PUFAs)

- Omega-3 Fatty Acids

- Omega-6 Fatty Acids

- Conjugated Linoleic Acid (CLA)

- Omega-9 Fatty Acids

- Medium Chain Triglycerides (MCTs)

- Other Functional Fats & Oils

- Vitamins

- Vitamin A

- Vitamin B Complex

- Vitamin C

- Vitamin D

- Vitamin E

- Vitamin K

- Minerals

- Carotenoids

- Lutein

- Astaxanthin

- Zeaxanthin

- Beta-Carotene

- Lycopene

- Other Carotenoids

- Others

By Form

By Function

- Additional Supplements

- General Nutrition

- Weight Management

- Skin Health

- Medicinal Supplements

- Gut Health

- Heart Health

- Bone Health

- Immunity Boosters

- Eye Health

- Other Therapeutic Areas

- Sports Nutrition

- Pre-workout

- Intra-workout

- Post-workout Recovery

By Application

- Dietary Supplements

- General Health

- Disease-Specific Supplements

- Functional Food

- Bakery & Snacks

- Confectionery

- Dairy Products

- Meat & Meat Products

- Baby Food

- Other Food Products

- Functional Beverages

- Energy Drinks

- Juices

- Health Drinks

- Animal Nutrition

- Companion Animal Nutrition

- Livestock Nutrition

- Amino Acids in Animal Feed

- Food for Special Medical Purposes (FSMP)

Global Nutraceutical Ingredients Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to exert its dominance in the nutraceutical ingredients market as it commands over 36.9% of the total revenue by the end of 2025. It is primarily driven by its highly developed healthcare infrastructure, advanced research capabilities, and strong consumer awareness about health and wellness. The region benefits from a robust regulatory framework, led by agencies like the FDA, which ensures product safety, efficacy, and quality, fostering consumer trust and market growth.

High disposable incomes and a large aging population concerned with preventive health and chronic disease management further propel demand for nutraceutical ingredients. Additionally, the widespread adoption of fitness lifestyles and sports nutrition contributes significantly to market expansion.

The U.S. is a key market, supported by extensive government initiatives promoting dietary supplements and nutritional health. Consumers in North America prioritize clean-label, natural, and plant-based ingredients, encouraging innovation and diversification in product offerings. Moreover, well-established distribution networks, including pharmacies, health food stores, and online retail channels, facilitate wide accessibility. The presence of major global nutraceutical companies with headquarters or significant operations in North America also strengthens the competitive environment, reinforcing the region’s market leadership.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with the Highest CAGR

Asia Pacific is experiencing the highest CAGR in the nutraceutical ingredients market due to its large and growing middle-class population, increasing health awareness, and rapid urbanization. Rising disposable incomes and expanding healthcare infrastructure are driving demand for preventive healthcare solutions, especially in emerging economies such as China, India, Japan, and Southeast Asia. Traditional knowledge of herbal and botanical ingredients combined with modern nutraceutical science fuels consumer interest in natural health products.

Government initiatives aimed at improving nutrition and reducing disease burden, coupled with increasing penetration of e-commerce and modern retail channels, make nutraceuticals more accessible across diverse demographics. Youthful populations with changing lifestyles are seeking dietary supplements for immunity, weight management, and overall wellness, accelerating market growth.

Moreover, the increasing prevalence of lifestyle diseases like diabetes and cardiovascular issues emphasizes the need for nutraceutical interventions. The region’s dynamic innovation ecosystem and relatively less stringent regulatory environment compared to Western markets also encourage new product launches, contributing to rapid growth.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Nutraceutical Ingredients Market: Competitive Landscape

The global nutraceutical ingredients market is highly competitive and fragmented, with several established players and emerging companies vying for market share. Leading companies focus on innovation, strategic partnerships, mergers and acquisitions, and expanding their product portfolios to address diverse consumer needs and comply with evolving regulatory standards. Key market players include Archer Daniels Midland Company, Cargill, Ingredion Incorporated, DuPont Nutrition & Health, Kerry Group, and BASF SE, among others.

These companies invest heavily in research and development to enhance ingredient efficacy, improve bioavailability, and develop clean-label, plant-based, and organic solutions to meet rising consumer demand for natural products. Strategic collaborations with academic institutions and startups facilitate technology advancements, while geographic expansion into emerging markets broadens their global footprint.

Brand differentiation is often achieved through certifications (e.g., non-GMO, organic, vegan), transparent labeling, and sustainability initiatives addressing environmental concerns. The increasing trend toward personalized nutrition also encourages companies to develop customized ingredient solutions. Competitive pricing, supply chain efficiency, and strong distribution networks through retail, e-commerce, and direct-to-consumer channels further strengthen their market positions. Continuous innovation and consumer-centric strategies remain pivotal for companies to maintain leadership and capitalize on the growing nutraceutical ingredients market.

Some of the prominent players in the Global Nutraceutical Ingredients Market are:

- BASF SE

- Koninklijke DSM N.V.

- Archer Daniels Midland Company (ADM)

- DuPont de Nemours, Inc.

- Cargill, Incorporated

- Kerry Group plc

- Glanbia plc

- Chr. Hansen Holding A/S

- Ingredion Incorporated

- Tate & Lyle PLC

- Lonza Group AG

- Associated British Foods plc

- Evonik Industries AG

- Biorigin (Zilor Group)

- Roquette Frères

- Sabinsa Corporation

- NutraScience Labs

- Nutraceutix, Inc.

- Zhejiang Medicine Co., Ltd.

- Givaudan SA

- Other Key Players

Recent Developments in the Global Nutraceutical Ingredients Market

April 2025

- Investment: Ingredion Incorporated announced a $120 million investment to expand its manufacturing capacity for plant-based proteins in North America. This strategic investment aims to address the escalating demand for clean-label and sustainable protein ingredients, reflecting growing consumer preference for plant-derived nutraceuticals.

- Collaboration: Kerry Group entered a joint venture with a leading biotechnology firm to develop next-generation probiotic strains aimed at enhancing gut health and immunity supplements. The partnership focuses on leveraging cutting-edge microbiome research to innovate functional ingredient solutions.

February 2025

- Merger: DuPont Nutrition & Health completed the acquisition of a specialty carotenoid producer to strengthen its portfolio of natural colorants and antioxidant ingredients. This merger enhances DuPont’s competitive edge in delivering high-efficacy nutraceutical ingredients tailored for immune and skin health applications.

- Conference: The annual Nutraceutical Innovation Forum took place virtually, attracting global industry leaders discussing trends such as personalized nutrition, regulatory harmonization, and advancements in functional fats and oils.

December 2024

- Expo: SupplySide West 2024 convened in Las Vegas, spotlighting breakthroughs in protein hydrolysates and prebiotic fibers. The event provided a platform for ingredient suppliers and manufacturers to showcase sustainable sourcing practices and novel delivery technologies.

- Investment: Cargill announced a strategic investment in fermentation technology startups to accelerate the production of bioactive peptides with applications in sports nutrition and weight management supplements.

September 2024

- Collaboration: BASF SE and a leading dietary supplement manufacturer partnered to co-develop fortified vitamin blends focusing on enhanced bioavailability and stability for global markets. This collaboration aligns with the rising demand for immunity and bone health supplements amid aging populations.

- Conference: The International Conference on Nutraceuticals and Functional Foods hosted experts who deliberated on regulatory challenges and innovations in botanical extracts and omega fatty acids.

July 2024

- Merger: Archer Daniels Midland Company (ADM) acquired a specialty prebiotic and fiber ingredient company to diversify its product offering in digestive health segments. This strategic merger enhances ADM’s capabilities in catering to consumer demands for gut-friendly nutraceutical formulations.

- Investment: A leading nutraceutical ingredient company secured $75 million in funding to scale up R&D efforts focused on amino acid derivatives with enhanced absorption and targeted health benefits.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 111.3 Bn |

| Forecast Value (2034) |

USD 183.6 Bn |

| CAGR (2025–2034) |

5.7% |

| The US Market Size (2025) |

USD 34.5 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Ingredient Type (Proteins, Amino Acids, Fibers & Specialty Carbohydrates, Probiotics, Prebiotics, Phytochemicals & Plant Extracts, Functional Fats & Oils, Vitamins, Minerals, Carotenoids, Others), By Form (Dry, Liquid, Others), By Function (Additional Supplements, Medicinal Supplements, Sports Nutrition), By Application (Dietary Supplements, Functional Food, Functional Beverages, Animal Nutrition, Food for Special Medical Purposee)

|

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

BASF SE, Koninklijke DSM N.V., Archer Daniels Midland Company (ADM), DuPont de Nemours, Inc., Cargill, Incorporated, Kerry Group plc, Glanbia plc, Chr. Hansen Holding A/S, Ingredion Incorporated, Tate & Lyle PLC, Lonza Group AG, Associated British Foods plc, Evonik Industries AG, Biorigin (Zilor Group), Roquette Frères, Sabinsa Corporation, NutraScience Labs, Nutraceutix, Inc., Zhejiang Medicine Co., Ltd., Givaudan SA., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Nutraceutical Ingredients Market?

▾ The Global Nutraceutical Ingredients Market size is estimated to have a value of USD 111.3 billion in 2025 and is expected to reach USD 183.6 billion by the end of 2034.

What is the size of the US Nutraceutical Ingredients Market?

▾ The US Nutraceutical Ingredients Market is projected to be valued at USD 34.5 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 55.2 billion in 2034 at a CAGR of 5.4%.

Which region accounted for the largest Global Nutraceutical Ingredients Market?

▾ North America is expected to have the largest market share in the Global Nutraceutical Ingredients Market with a share of about 36.9% in 2025.

Who are the key players in the Global Nutraceutical Ingredients Market?

▾ Some of the major key players in the Global Nutraceutical Ingredients Market are BASF SE, Koninklijke DSM N.V., Archer Daniels Midland Company (ADM), DuPont de Nemours, Inc., Cargill, Incorporated, Kerry Group plc, Glanbia plc, and many others.

What is the growth rate in the Global Nutraceutical Ingredients Market in 2025?

▾ The market is growing at a CAGR of 5.4 percent over the forecasted period of 2025.