Market Overview

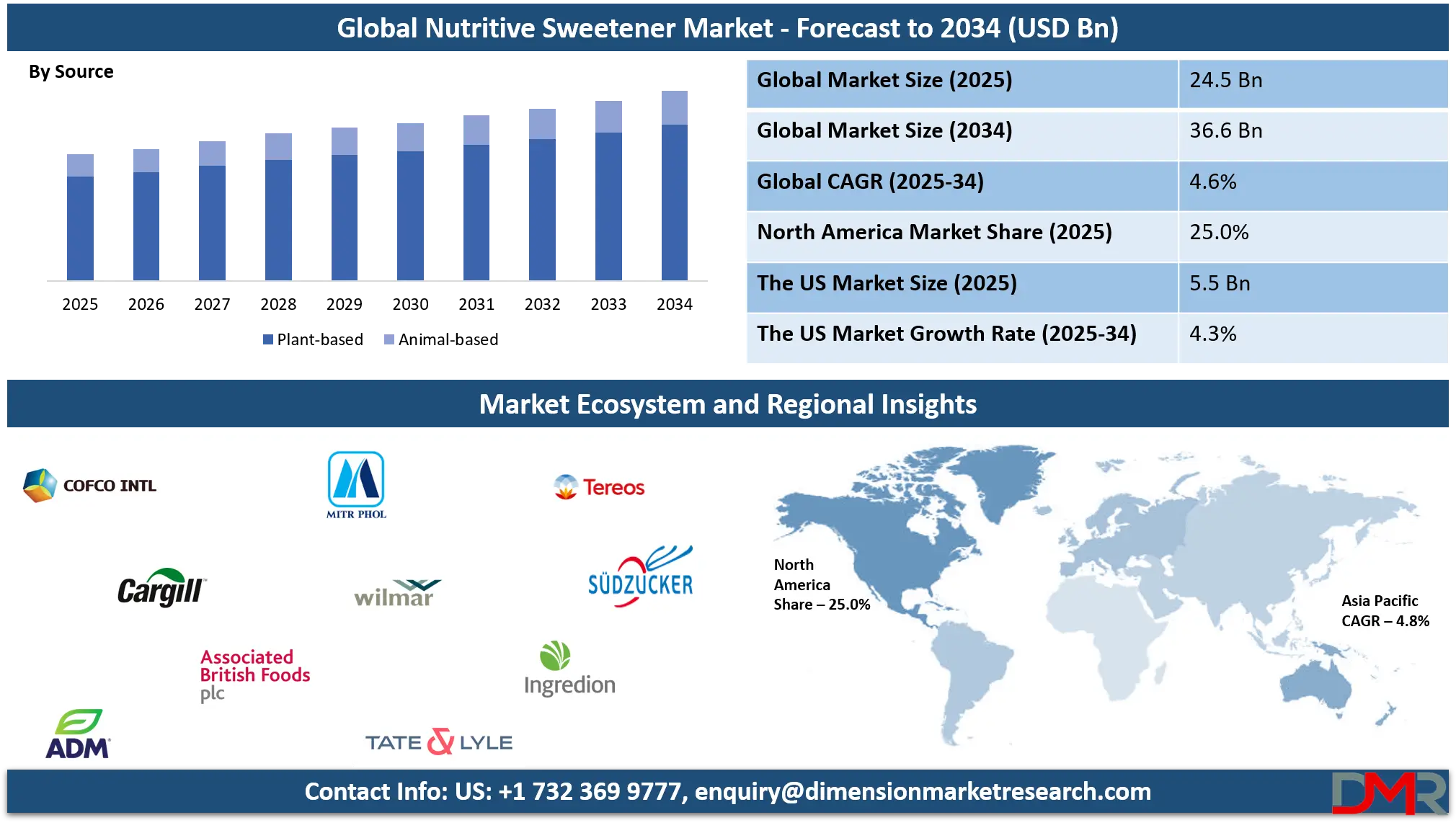

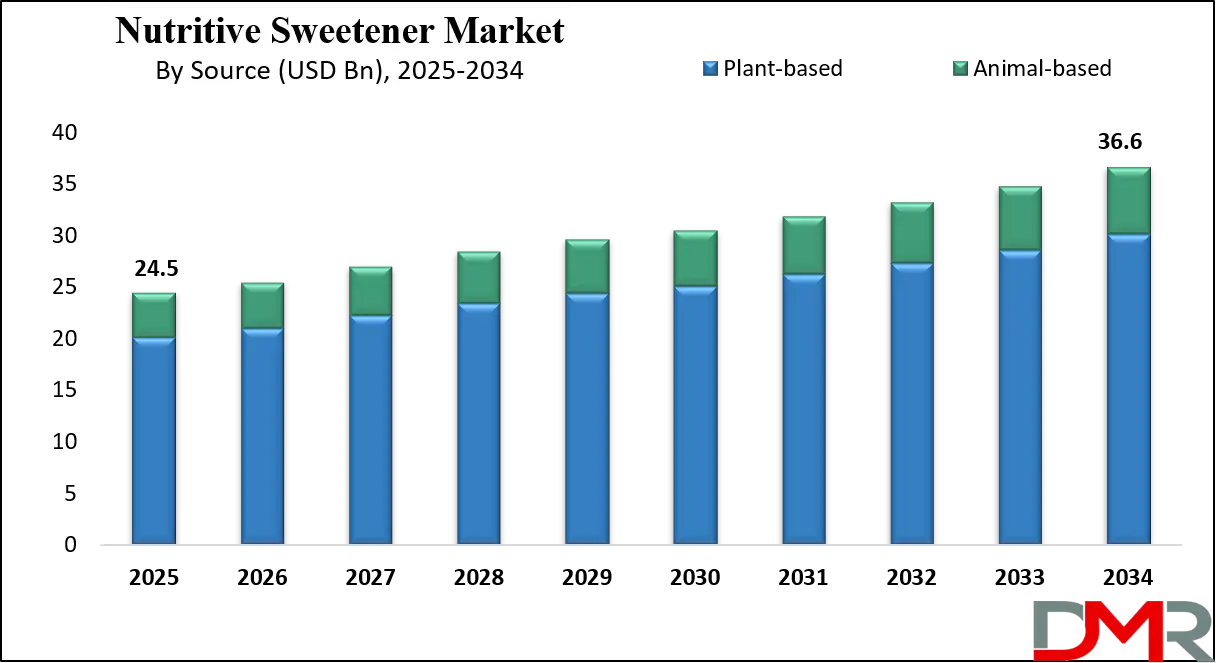

The Global Nutritive Sweetener Market size is projected to reach USD 24.5 billion in 2025 and grow at a compound annual growth rate of 4.6% to reach a value of USD 36.6 billion in 2034.

The Nutritive Sweetener refers to caloric sweetening substances derived from natural or processed sources that provide energy along with sweetness. These include sugar, syrups, and natural sweeteners such as honey and agave nectar, widely used across food, beverage, pharmaceutical, and personal care industries. Nutritive sweeteners play a critical role in taste enhancement, texture improvement, fermentation, and shelf-life extension, making them integral to global food systems. Their economic importance is closely tied to agricultural output, food processing industries, and international trade flows.

The sector is experiencing structural transformation driven by evolving dietary habits, higher consumption of packaged foods, and expanding urban populations. Developments in food formulation technologies have enabled the use of nutritive sweeteners in reduced quantities while maintaining sensory appeal. Simultaneously, product diversification, such as organic and minimally processed variants, is reshaping supply chains and value propositions within the industry.

Also, shifts toward clean-label products, transparency in sourcing, and traceability are influencing purchasing decisions. Regulatory scrutiny on labeling and sugar content has encouraged manufacturers to reformulate products rather than eliminate nutritive sweeteners entirely. This balance between functionality, consumer acceptance, and regulatory compliance continues to influence overall market momentum.

The US Nutritive Sweetener Market

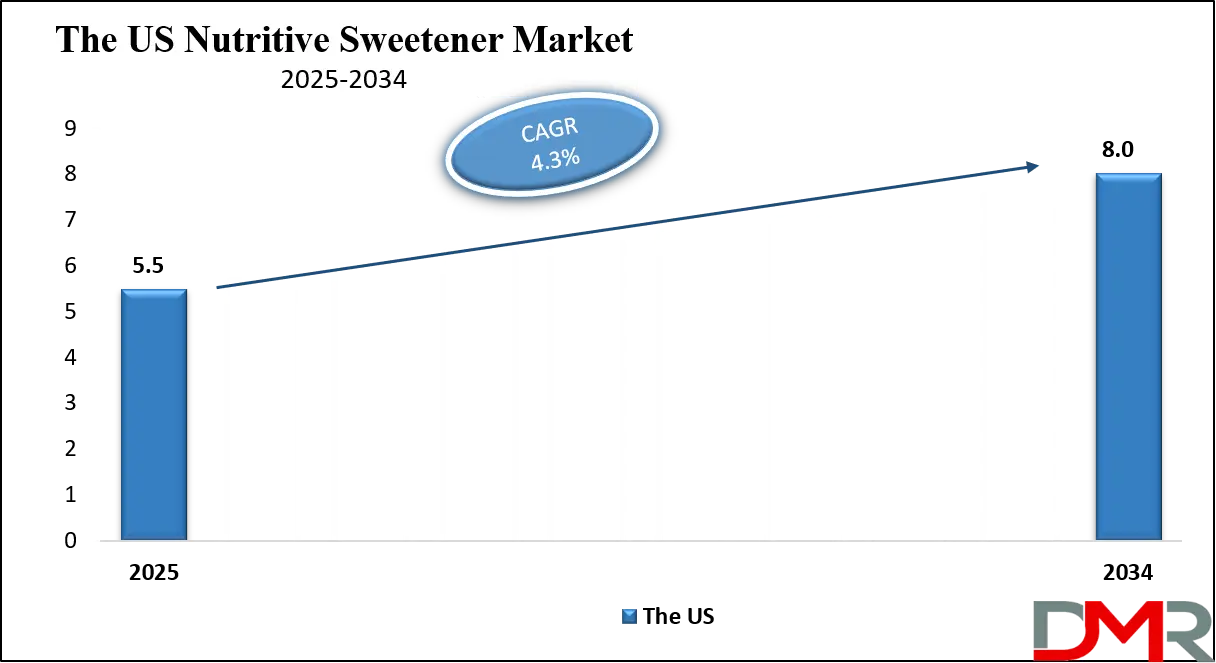

The US Nutritive Sweetener Market size is projected to reach USD 5.5 billion in 2025 at a compound annual growth rate of 4.3% over its forecast period.

The US market is shaped by a mature food and beverage industry, strong agricultural infrastructure, and continuous product innovation. Large-scale food manufacturers rely heavily on sugar and corn-derived syrups due to cost efficiency and established supply chains. Government policies supporting corn and sugar beet farming indirectly sustain raw material availability. Consumer preference shifts toward natural sweeteners such as honey and maple syrup have driven diversification. Regulatory emphasis on nutritional labeling has influenced reformulation strategies, encouraging optimized usage rather than outright substitution, maintaining steady market growth.

Europe Nutritive Sweetener Market

Europe Nutritive Sweetener Market size is projected to reach USD 4.9 billion in 2025 at a compound annual growth rate of 4.5% over its forecast period.

Europe’s market is strongly influenced by regulatory frameworks and sustainability initiatives, including policies aligned with the European Green Deal. The region shows high demand for organic, sustainably sourced, and traceable sweeteners. Sugar beet dominates regional production, supported by advanced agricultural practices. Food manufacturers increasingly adopt natural sweeteners to align with clean-label trends. Strict food safety standards and environmental regulations have encouraged innovation in processing efficiency, positioning Europe as a leader in premium and responsibly sourced nutritive sweeteners.

Japan Nutritive Sweetener Market

Japan Nutritive Sweetener Market size is projected to reach USD 1.7 billion in 2025 at a compound annual growth rate of 4.1% over its forecast period.

Japan’s market is driven by advanced food processing technologies, urban consumption patterns, and strong domestic demand for high-quality ingredients. The confectionery and beverage sectors represent the fastest-growing applications, emphasizing consistency and taste precision. Government support for food innovation and functional foods has sustained demand for refined sugars and syrups. Challenges include limited agricultural land and reliance on imports, but opportunities exist in specialty sweeteners and premium natural products tailored to health-conscious consumers.

Nutritive Sweetener Market: Key Takeaways

- Market Growth: The Nutritive Sweetener Market size is expected to grow by USD 11.1 billion, at a CAGR of 4.6%, during the forecasted period of 2026 to 2034.

- By Source: The plant-based segment is anticipated to get the majority share of the Nutritive Sweetener Market in 2025.

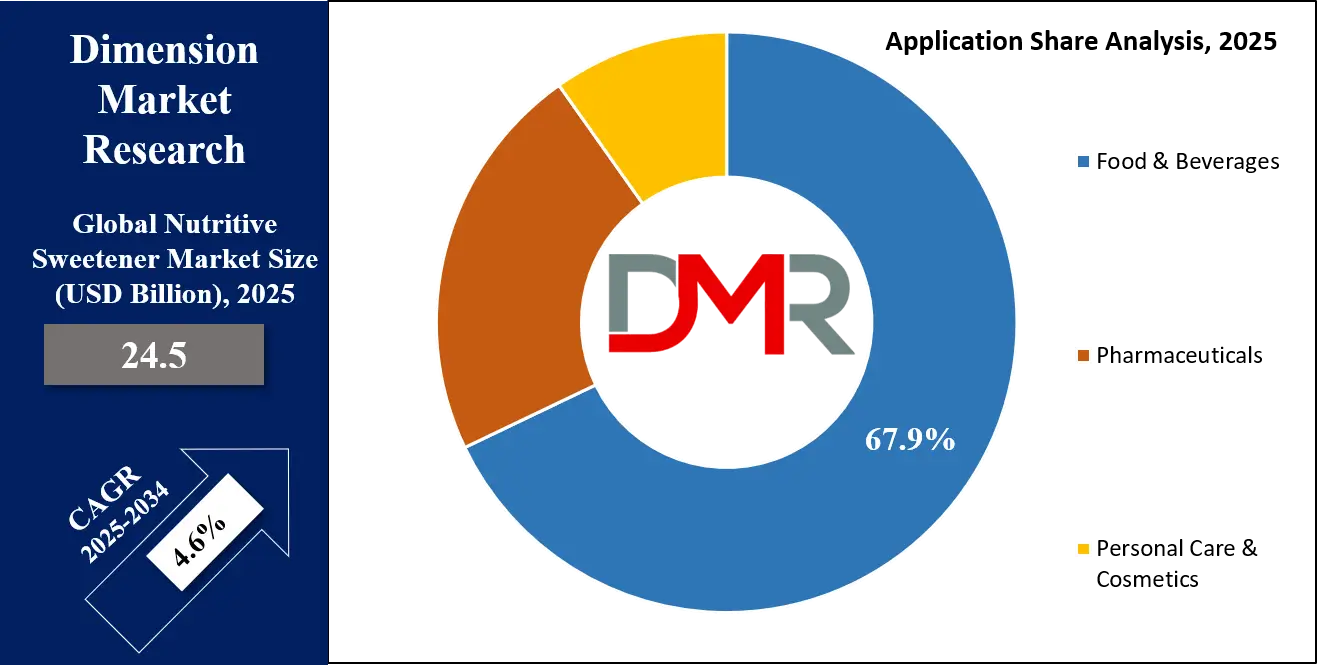

- By Application: The food & beverages segment is expected to get the largest revenue share in 2025 in the Nutritive Sweetener Market.

- Regional Insight: Asia Pacific is expected to hold a 38.7% share of revenue in the Global Nutritive Sweetener Market in 2025.

- Use Cases: Some of the use cases of Nutritive Sweetener include bakery & confectionery, beverage formulation, and more.

Nutritive Sweetener Market: Use Cases

- Bakery and Confectionery: Enhances flavor, texture, browning, and shelf stability in baked goods and sweets.

- Beverage Formulation: Provides sweetness, mouthfeel, and fermentation support in soft drinks and functional beverages.

- Pharmaceutical Applications: Used as excipients to improve the palatability of syrups and oral medicines.

- Personal Care Products: Acts as humectants and stabilizers in cosmetics and oral care formulations.

Stats & Facts

- US Department of Agriculture reported sugar production exceeding 9 million metric tons in 2024 due to expanded sugar beet cultivation.

- European Commission indicated that over 65% of sweetener imports in 2025 were directed toward food processing industries.

- Food and Agriculture Organization recorded global honey output crossing 1.9 million metric tons in 2024.

- Japan Ministry of Agriculture noted a 6.2% increase in syrup imports during 2025 to support beverage manufacturing.

- OECD highlighted that nutritive sweeteners accounted for over 70% of caloric sweetener consumption globally in 2024.

Market Dynamic

Driving Factors in the Nutritive Sweetener Market

Expanding Processed Food Consumption

Rising consumption of processed and packaged foods is a major growth driver for nutritive sweeteners. Urbanization, busy lifestyles, and increased demand for convenience foods have expanded the use of sugars and syrups across bakery, dairy, and ready-to-eat meals. These sweeteners provide essential functional properties such as preservation, texture, and flavor balance. Food manufacturers continue to rely on nutritive sweeteners due to their cost-effectiveness, scalability, and compatibility with existing production processes, reinforcing sustained demand across both developed and emerging economies.

Agricultural and Supply Chain Stability

Well-established agricultural systems supporting sugarcane, sugar beet, and corn cultivation underpin market stability. Technological improvements in farming, harvesting, and refining have enhanced yields and reduced volatility. Government subsidies and trade agreements further stabilize supply chains, allowing manufacturers to secure long-term sourcing contracts. This reliability makes nutritive sweeteners a preferred choice over alternative sweetening solutions, directly influencing market resilience and consistent growth.

Restraints in the Nutritive Sweetener Market

Regulatory Pressure on Sugar Consumption

Increasing regulatory focus on sugar reduction poses a challenge to market expansion. Governments are implementing labeling requirements, sugar taxes, and nutritional guidelines to address public health concerns. These measures can reduce per-capita consumption and force manufacturers to reformulate products. Compliance costs and reformulation investments create pressure on producers, particularly smaller players, potentially limiting expansion in certain applications.

Volatility in Raw Material Prices

Fluctuations in agricultural commodity prices due to climate variability, trade disruptions, and energy costs impact production economics. Sugarcane and corn yields are sensitive to weather patterns, affecting supply consistency. Price volatility can compress margins for processors and manufacturers, making long-term planning difficult and discouraging capacity expansion in some regions.

Opportunities in the Nutritive Sweetener Market

Growth in Natural and Organic Sweeteners

Rising consumer interest in natural and organic food products presents strong growth opportunities. Natural nutritive sweeteners such as honey, maple syrup, and agave nectar are gaining traction due to perceived health and sustainability benefits. Premiumization trends allow manufacturers to command higher margins, encouraging investment in certified organic sourcing and specialty product lines, especially in developed markets.

Emerging Markets Consumption Expansion

Rapid population growth, rising disposable incomes, and expanding food industries in emerging economies create untapped potential. Increased urbanization and Westernized diets are boosting demand for packaged foods and beverages, directly supporting nutritive sweetener consumption. Investments in local refining and processing infrastructure further enhance market penetration and long-term growth prospects.

Trends in the Nutritive Sweetener Market

Clean-Label and Transparency Initiatives

Manufacturers are increasingly prioritizing clean-label formulations, emphasizing recognizable ingredients and transparent sourcing. This trend supports the use of traditional nutritive sweeteners over synthetic alternatives. Clear labeling, traceability, and sustainability certifications are becoming competitive differentiators, influencing procurement and marketing strategies across the value chain.

Technological Optimization in Sweetener Usage

Advances in food processing technology allow precise control over sweetness intensity and functional performance. Improved blending, crystallization, and enzymatic processing techniques enable reduced usage levels without compromising taste or texture. This trend supports regulatory compliance while sustaining demand, reshaping how nutritive sweeteners are incorporated into formulations.

Impact of Artificial Intelligence in Nutritive Sweetener Market

- Process Optimization: Artificial Intelligence improves refining efficiency and reduces energy consumption.

- Demand Forecasting: Predictive analytics enhance supply chain planning accuracy.

- Quality Control: Machine vision systems detect impurities and inconsistencies.

- Product Formulation: AI models optimize sweetness profiles with minimal input.

- Agricultural Analytics: AI-driven tools improve crop yield predictions and sourcing decisions.

Research Scope and Analysis

By Product Type Analysis

Sugar remains the dominant product type, accounting for 46.8% market share in 2025, due to its unmatched versatility, affordability, and functional reliability. It is extensively used across food and beverage manufacturing because it provides sweetness, texture, color development, and preservation. Cane and beet sugar play a critical role in bakery, confectionery, dairy, and beverage formulations, supporting processes such as caramelization, fermentation, and moisture retention. The presence of well-established global trade routes, large-scale refining infrastructure, and consistent raw material availability further strengthens sugar’s leadership.

Additionally, advancements in refining efficiency, waste reduction, and sustainable farming practices are helping manufacturers maintain cost competitiveness while aligning with regulatory and environmental expectations, ensuring continued dominance.

Natural sweeteners represent the fastest-growing product type, supported by rising consumer awareness around ingredient transparency, clean-label products, and minimally processed foods. Sweeteners such as honey, maple syrup, and agave nectar are increasingly favored in premium, organic, and specialty food categories. Consumers are willing to pay higher prices due to perceived health benefits, natural sourcing, and reduced processing.

This segment is benefiting from innovation in sustainable sourcing, improved shelf stability, and certified organic production. Foodservice providers and artisanal food brands are also incorporating natural sweeteners to differentiate offerings. As regulatory pressure on artificial additives increases, natural sweeteners are expected to gain broader acceptance across mainstream food and beverage applications.

By Source Analysis

Plant-based sources account for 82.3% market share in 2025, making them the backbone of the global nutritive sweetener supply. Sugarcane, sugar beet, and corn dominate production due to their high yields, scalability, and cost efficiency. These crops benefit from extensive agricultural infrastructure, government support programs, and technological improvements in cultivation and harvesting. Plant-based sweeteners are adaptable across both solid and liquid forms, allowing wide application in food processing, beverages, and industrial manufacturing. Established processing facilities and global logistics networks ensure consistent supply and pricing stability. The ability to meet large-volume demand while maintaining competitive costs reinforces the continued dominance of plant-based sources.

Animal-based sweeteners, primarily honey, are experiencing steady growth driven by their natural image, nutritional associations, and multifunctional properties. Honey is widely used in premium food products, pharmaceuticals, and personal care formulations due to its flavor profile, antimicrobial properties, and humectant qualities. Although production volumes are limited by environmental factors and higher sourcing costs, this constraint supports premium pricing and value growth. Demand is particularly strong in organic, functional, and wellness-focused products. Additionally, growing interest in traditional and natural remedies has increased honey usage in health-related applications. While scale limitations restrict mass adoption, value-driven growth remains strong.

By Form Analysis

Solid forms hold 58.6% market share in 2025, driven by widespread use in bakery product, confectionery, food manufacturing, and household consumption. Granulated, powdered, and crystalline sweeteners offer advantages such as long shelf life, ease of storage, accurate dosing, and compatibility with traditional manufacturing equipment. These forms are preferred in dry food formulations where precise sweetness control and stability are essential. Solid sweeteners are also easier to transport and store in bulk, reducing logistical complexity. Their familiarity among consumers and manufacturers supports continued demand. As food production volumes grow globally, solid forms are expected to retain their dominant position.

Liquid sweeteners are expanding rapidly due to their efficiency in beverage production and processed food manufacturing. Syrups and concentrated liquids offer superior solubility, uniform sweetness distribution, and easier handling in automated production lines. These properties reduce processing time and minimize waste, making liquid forms highly attractive for industrial-scale applications. Beverage manufacturers, in particular, prefer liquid sweeteners for consistency and blending efficiency. Growing demand for ready-to-drink beverages and liquid food products continues to drive adoption. Technological advancements in storage and transportation have further improved the feasibility of liquid sweeteners, supporting strong growth momentum.

By Application Analysis

Food and beverages dominate the market with a 67.9% share in 2025, reflecting extensive use across bakery, dairy, beverages, and packaged foods. Nutritive sweeteners play a crucial role in enhancing flavor, mouthfeel, color, and shelf stability. Their functional versatility allows manufacturers to meet taste expectations while maintaining cost efficiency. Growing consumption of processed and convenience foods globally has further strengthened demand. Additionally, product innovation in flavored beverages, desserts, and ready-to-eat foods continues to expand application scope. As global food production scales to meet population growth, this segment is expected to maintain its leading position.

Pharmaceutical applications are growing steadily due to increasing demand for patient-friendly oral medications. Nutritive sweeteners are widely used to improve taste, mask bitterness, and enhance overall palatability of syrups, suspensions, and chewable tablets. Improved taste directly supports patient compliance, particularly among pediatric and geriatric populations. Sweeteners also contribute to formulation stability and viscosity control. As healthcare access expands globally and demand for liquid and flavored medications increases, the role of nutritive sweeteners in pharmaceutical manufacturing continues to strengthen, supporting consistent growth in this segment.

By Distribution Channel Analysis

Business-to-business channels account for 61.4% market share in 2025, driven by large-scale procurement from food, beverage, and pharmaceutical manufacturers. Bulk purchasing ensures cost efficiency, supply consistency, and long-term operational stability. Manufacturers often enter long-term supply contracts with producers to mitigate price volatility and secure raw material availability. This channel benefits from established logistics networks and predictable demand patterns. The dominance of B2B distribution reflects the industrial-scale usage of nutritive sweeteners and the reliance of manufacturers on stable, high-volume inputs for continuous production operations.

Business-to-consumer channels are expanding rapidly, supported by growing household consumption of sugar and natural sweeteners. Increased interest in home baking, cooking, and premium ingredients has boosted retail demand. Supermarkets, hypermarkets, and online retail platforms have improved accessibility and product variety. E-commerce growth, in particular, has enabled direct-to-consumer sales of specialty and natural sweeteners. Attractive packaging, branding, and health-oriented marketing strategies are further driving adoption. This segment benefits from changing consumer lifestyles and increased awareness of ingredient choices.

By End User Analysis

Food manufacturers lead the market with a 54.2% share in 2025, reflecting extensive usage across multiple product categories. These manufacturers depend on consistent quality, reliable supply, and cost stability to maintain production efficiency. Nutritive sweeteners are essential inputs for large-scale food processing due to their multifunctional properties. Long-term sourcing agreements and integrated supply chains further support dominance. Continuous innovation in food formulations and rising global food demand ensure sustained reliance on nutritive sweeteners, reinforcing the leadership of food manufacturers as the primary end users.

Household consumers represent a steadily growing end-user segment, driven by increased home cooking and baking activities. Changing lifestyles, interest in traditional recipes, and preference for natural ingredients are supporting demand. Consumers are increasingly exploring alternatives such as honey and agave nectar alongside traditional sugar. Improved retail availability, smaller packaging formats, and online purchasing options have enhanced accessibility. While volumes are lower compared to industrial usage, consistent demand growth and premiumization trends contribute to the segment’s expanding market presence.

The Nutritive Sweetener Market Report is segmented on the basis of the following:

By Product Type

- Sugar

- Syrups

- High Fructose Corn Syrup

- Glucose Syrup

- Maltose Syrup

- Natural Sweeteners

- Honey

- Maple Syrup

- Agave Nectar

By Source

- Plant-Based

- Sugarcane

- Sugar Beet

- Corn

- Animal-Based

By Form

- Solid

- Granulated

- Powder

- Crystalline

- Liquid

- Syrup

- Concentrated Liquid

By Application

- Food and Beverages

- Bakery and Confectionery

- Dairy Products

- Beverages

- Processed and Packaged Foods

- Pharmaceuticals

- Personal Care and Cosmetics

By Distribution Channel

- Business to Business

- Business to Consumer

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail

By End User

- Food Manufacturers

- Beverage Manufacturers

- Pharmaceutical Companies

- Household Consumers

Regional Analysis

Leading Region in the Nutritive Sweetener Market

Asia-Pacific leads the nutritive sweetener market with a 38.7% share in 2025, supported by its large population base, rapidly expanding food and beverage industries, and strong agricultural production capacity. Countries such as India, China, and Thailand benefit from favorable climatic conditions that support large-scale sugarcane cultivation, enabling cost-efficient production and stable supply. Government initiatives focused on agricultural modernization, rural development, and export promotion further strengthen the region’s market position. Rising consumption of processed and packaged foods, driven by urbanization and changing dietary habits, continues to boost demand. Additionally, increasing exports of sugar and syrups to global markets reinforce Asia-Pacific’s dominance and long-term growth stability.

Fastest Growing Region in the Nutritive Sweetener Market

Latin America is the fastest-growing region in the nutritive sweetener market, driven by expanding sugarcane cultivation and a strong focus on export-oriented production. Countries such as Brazil and Mexico benefit from favorable climatic conditions, abundant arable land, and long-established expertise in sugar processing. Rising investments in modern refining infrastructure and sustainable farming practices are improving production efficiency and output quality. Growth in domestic food and beverage processing is further strengthening regional demand. Increasing trade integration, favorable trade agreements, and growing global demand for competitively priced sweeteners are accelerating market expansion. These combined factors position Latin America as a key growth engine in the global nutritive sweetener market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The market is characterized by high entry barriers due to capital-intensive refining infrastructure and established supply networks. Participants focus on cost optimization, vertical integration, and long-term sourcing agreements to maintain competitiveness. Investment in sustainable farming, process efficiency, and product diversification is central to growth strategies. Strategic partnerships with food manufacturers and continuous R&D to enhance functionality and reduce environmental impact play a critical role in sustaining market positions.

Some of the prominent players in the global Nutritive Sweetener are:

- Cargill

- Archer Daniels Midland

- Südzucker

- Wilmar International

- Tate & Lyle

- Ingredion

- Associated British Foods

- Tereos

- Mitr Phol Sugar

- COFCO

- Cosan

- Louis Dreyfus Company

- Nordzucker

- Illovo Sugar Africa

- American Crystal Sugar

- Tongaat Hulett

- EID Parry

- Wilmar Sugar

- RAR Group

- British Sugar

- Other Key Players

Recent Developments

- In September 2024, Archer Daniels Midland announced a strategic investment in corn syrup processing facilities in North America to enhance production efficiency and meet rising beverage industry demand. The expansion focused on automation and energy-efficient technologies, supporting long-term supply reliability and operational cost reduction.

- In March 2024, Cargill launched an expanded portfolio of sustainably sourced cane sugar solutions aimed at food manufacturers seeking clean-label ingredients. The initiative included investments in traceability systems and supplier partnerships to improve transparency and reduce environmental impact. This development strengthened Cargill’s position in premium and sustainable nutritive sweeteners.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 24.5 Bn |

| Forecast Value (2034) |

USD 36.6 Bn |

| CAGR (2025–2034) |

4.6% |

| The US Market Size (2025) |

USD 5.5 Bn |

| Historical Data |

2019 – 2023 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Sugar, Syrups, and Natural Sweeteners) By Source (Plant-Based and Animal-Based), By Form (Solid and Liquid), By Application (Food and Beverages, Pharmaceuticals, and Personal Care and Cosmetics), By Distribution Channel (Business to Business and Business to Consumer), By End User (Food Manufacturers, Beverage Manufacturers, Pharmaceutical Companies, and Household Consumers) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Cargill, Archer Daniels Midland, Südzucker, Wilmar International, Tate & Lyle, Ingredion, Associated British Foods, Tereos, Mitr Phol Sugar, COFCO, Cosan, Louis Dreyfus Company, Nordzucker, Illovo Sugar Africa, American Crystal Sugar, Tongaat Hulett, EID Parry, Wilmar Sugar, RAR Group, British Sugar, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Nutritive Sweetener Market size is expected to reach a value of USD 24.5 billion in 2025 and is expected to reach USD 36.6 billion by the end of 2034.

Asia Pacific is expected to have the largest market share in the Global Nutritive Sweetener Market, with a share of about 38.7% in 2025.

The US Nutritive Sweetener market is expected to reach USD 5.5 billion by 2025.

Some of the major key players in the Global Nutritive Sweetener Market include Cargill, ADM, COFCO, and others

The market is growing at a CAGR of 4.6 percent over the forecasted period.

Contents