Market Overview

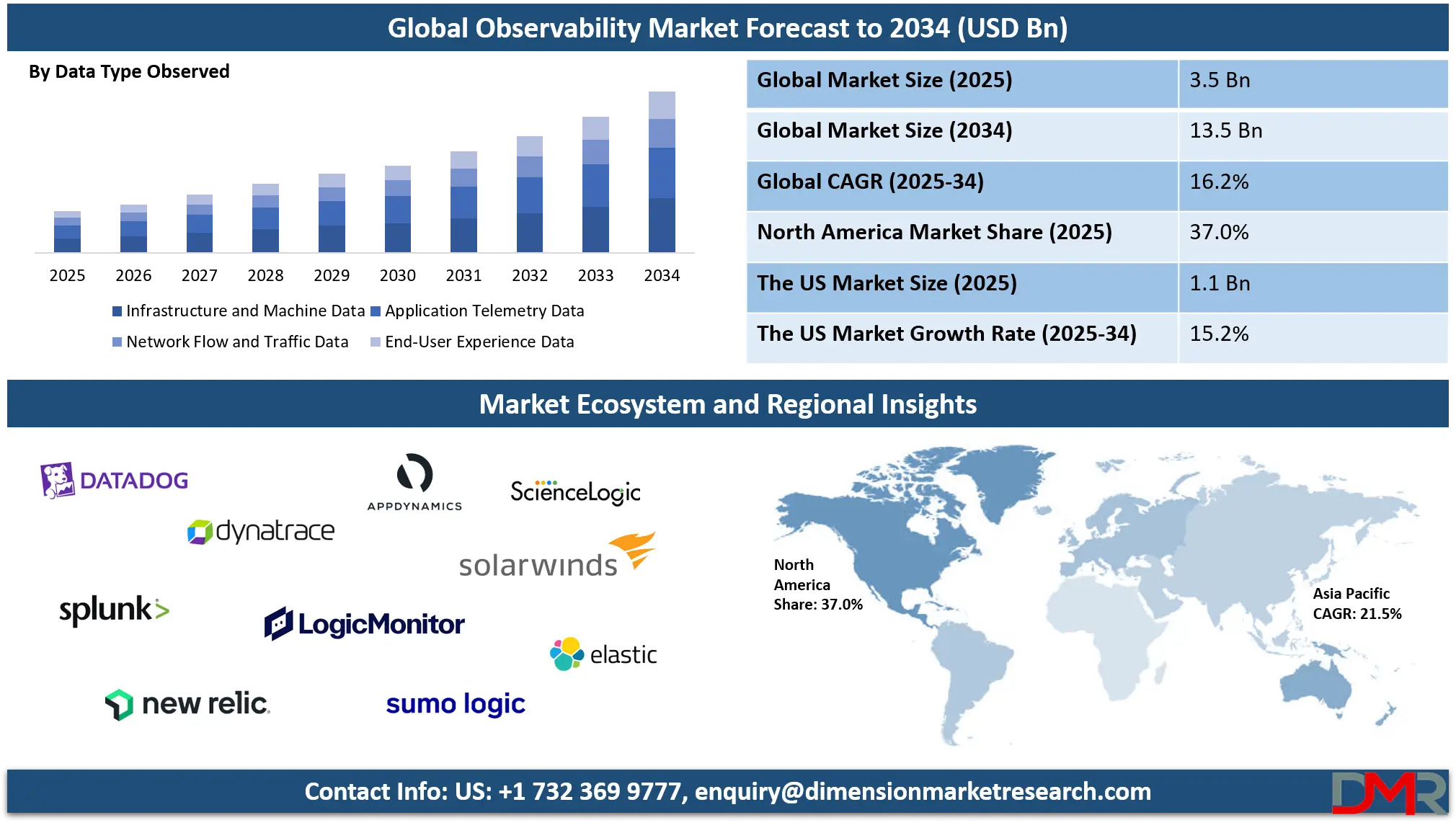

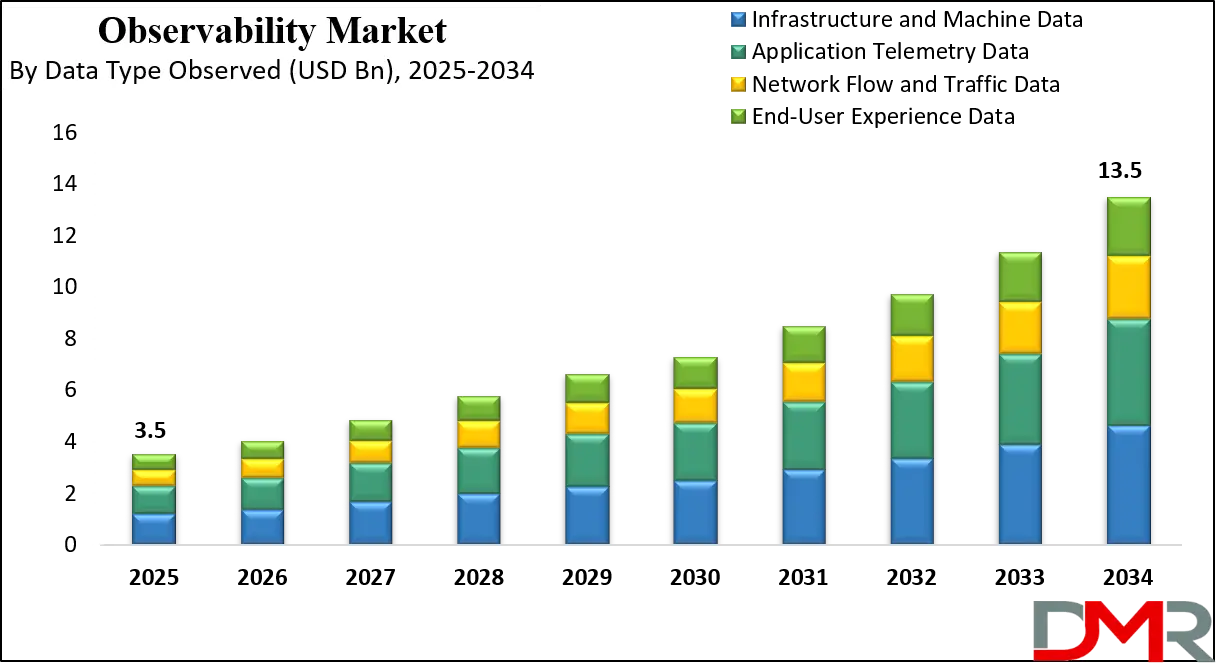

The global Observability Market was valued at USD 3.5 billion in 2025 and is projected to reach USD 13.5 billion by 2034, growing at a CAGR of 16.2%, driven by rising adoption of cloud native architectures, application performance monitoring, distributed tracing, and real time infrastructure visibility across enterprises.

Observability refers to the capability of understanding the internal state and behavior of complex digital systems by analyzing the data they generate during operation. It goes beyond traditional monitoring by enabling teams to explore unknown issues rather than only tracking predefined metrics. Observability relies on the continuous collection and correlation of telemetry data such as logs, metrics, traces, and user experience signals to provide deep visibility into applications, infrastructure, and networks. This approach allows engineering and operations teams to detect anomalies, diagnose performance bottlenecks, identify root causes, and improve system reliability in dynamic environments such as cloud native architectures and distributed systems.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global Observability Market represents the ecosystem of platforms, software, and services that enable enterprises to gain real time visibility into modern IT environments. The market is driven by the rapid adoption of cloud computing, microservices, containers, and application programming interfaces, which have increased system complexity across industries. Organizations are increasingly investing in observability solutions to ensure application performance, maintain service availability, enhance digital experience monitoring, and support DevOps and site reliability engineering practices. Growing reliance on data driven operations and automation further supports market expansion.

The market also reflects rising demand from industries such as information technology, financial services, healthcare, retail, and manufacturing, where uninterrupted digital services and performance optimization are critical. Enterprises are adopting unified observability platforms to consolidate infrastructure monitoring, application performance management, network visibility, and security insights into a single analytical layer. As businesses continue digital transformation initiatives, the global Observability Market is evolving toward advanced analytics, artificial intelligence driven insights, and scalable cloud based deployment models to support hybrid and distributed enterprise environments.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Observability Market

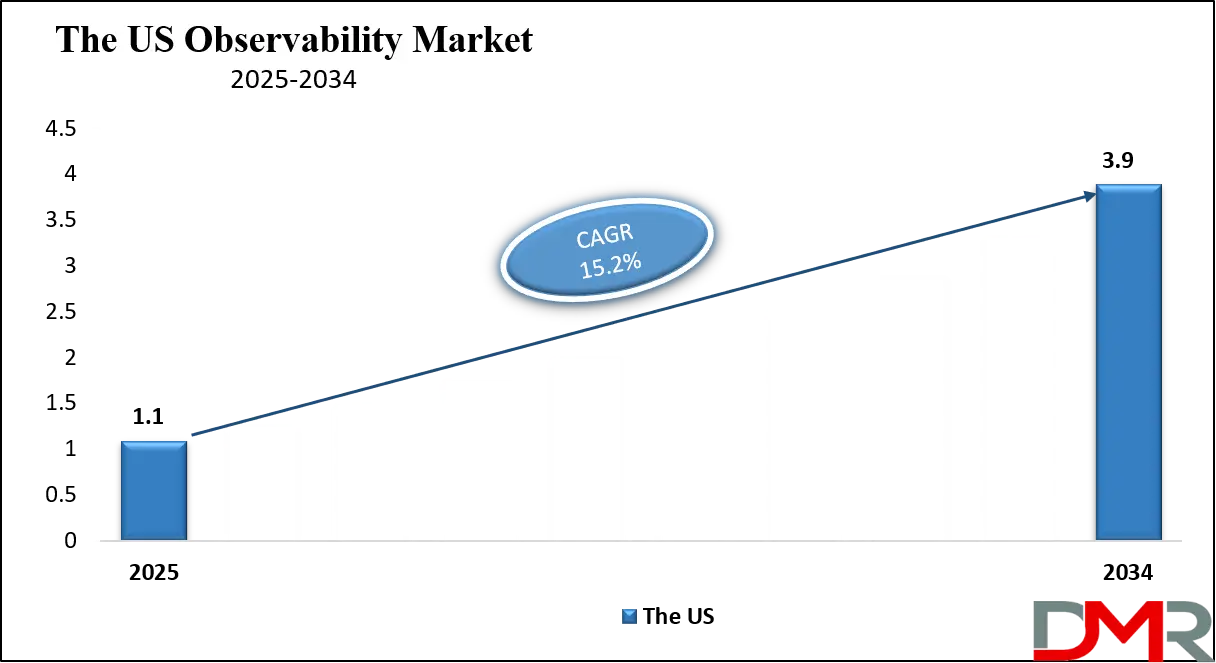

The U.S. Observability market size was valued at USD 1.1 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 3.9 billion in 2034 at a CAGR of 15.2%.

The US Observability Market is witnessing strong growth driven by the widespread adoption of cloud computing, microservices architecture, and large scale digital transformation initiatives across enterprises. Organizations in the United States are increasingly deploying observability platforms to gain real time visibility into application performance, infrastructure health, and network behavior. High penetration of DevOps practices, site reliability engineering, and continuous deployment models is accelerating demand for advanced telemetry data analysis. The presence of leading technology vendors and early adoption of artificial intelligence based monitoring further strengthen the market landscape.

The market is also supported by strong demand from sectors such as information technology, financial services, healthcare, retail, and media, where system reliability and digital experience are critical. US enterprises prioritize unified observability solutions that integrate logs, metrics, and traces to improve incident response and root cause analysis. Increasing focus on cybersecurity observability, regulatory compliance, and hybrid IT environments is shaping purchasing decisions. As organizations modernize legacy systems and expand cloud native workloads, observability continues to play a central role in operational efficiency and service optimization.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Observability Market

The Europe Observability Market was valued at USD 980 million in 2025, reflecting significant adoption of observability solutions across enterprise IT environments. Organizations in the region are increasingly leveraging platforms and services to gain real time visibility into applications, infrastructure, and networks. The market growth is driven by widespread digital transformation initiatives, adoption of cloud computing, and modernization of legacy systems. Enterprises are prioritizing performance monitoring, log analytics, and distributed tracing to optimize operational efficiency, ensure system reliability, and improve digital user experience.

A robust CAGR of 13.4% highlights the region’s steady growth trajectory, supported by increasing investment in artificial intelligence powered observability, automated root cause analysis, and unified monitoring platforms. Industries such as IT and telecommunications, banking and financial services, healthcare, and retail are major contributors, as they require uninterrupted services and enhanced digital experiences. The growing emphasis on hybrid IT environments, compliance, and security observability further strengthens demand for advanced solutions, positioning Europe as a key market within the global Observability landscape.

Japan Observability Market

The Japan Observability Market was valued at USD 175 million in 2025, reflecting growing adoption of advanced monitoring and analytics solutions by enterprises to manage complex IT infrastructures. Japanese organizations are increasingly implementing observability platforms to gain real time insights into application performance, infrastructure health, and network operations. The market growth is driven by the rise of cloud computing, digital transformation initiatives, and modernization of legacy systems across industries such as IT, manufacturing, and financial services. This adoption ensures improved operational efficiency, system reliability, and enhanced digital user experiences.

With a projected CAGR of 12.9%, the market in Japan is showing steady growth as enterprises focus on unified observability, artificial intelligence powered analytics, and automated root cause detection. The demand is further supported by the need for compliance management, security observability, and performance optimization in hybrid and multi cloud environments. As organizations increasingly rely on distributed applications, microservices architectures, and real time telemetry data, Japan continues to emerge as a strategic regional market within the global Observability landscape.

Global Observability Market: Key Takeaways

- Rapid Market Expansion: The global Observability Market is growing strongly, driven by cloud native adoption, microservices, and distributed system complexity, reaching USD 13.5 billion by 2034 from USD 3.5 billion in 2025.

- Platform Dominance: Observability platforms and software lead the market, accounting for the majority share due to integrated telemetry collection, AI analytics, and real time monitoring across applications, infrastructure, and networks.

- US and North America Lead: North America, particularly the US, dominates revenue share with 37% of the global market, supported by early AI adoption, DevOps penetration, and advanced enterprise IT infrastructures.

- AI and Automation Driving Value: Artificial intelligence and machine learning are transforming observability by enabling predictive insights, anomaly detection, and automated root cause analysis, improving operational efficiency and service reliability.

- Hybrid and Cloud Focus: Enterprises are increasingly favoring cloud based and hybrid observability deployments to manage multi cloud and legacy systems efficiently, while SMEs adopt SaaS solutions for cost effective telemetry and performance monitoring.

Global Observability Market: Use Cases

- Application Performance Monitoring: Observability solutions help enterprises track application behavior across cloud native and microservices environments. By analyzing logs, metrics, and traces, teams quickly detect latency issues, improve uptime, and ensure consistent digital user experience.

- Infrastructure and Cloud Resource Visibility: Organizations use observability platforms to monitor servers, containers, and cloud resources in real time. This enables better capacity planning, cost optimization, and infrastructure reliability across hybrid IT environments.

- Incident Detection and Root Cause Analysis: Observability enables faster incident response by correlating telemetry data across systems. Teams can identify anomalies, isolate failures, and resolve issues efficiently, improving operational resilience.

- Security and Compliance Observability: Observability tools provide visibility into abnormal system behavior and access patterns. This supports threat detection, compliance monitoring, and secure operations in distributed and cloud based environments.

Impact of Artificial Intelligence on the global Observability market

Artificial intelligence is reshaping the global Observability Market by enhancing how enterprises detect, analyze, and resolve system issues in complex IT environments. Traditional observability relied heavily on manual configuration of thresholds and alerts, but AI-driven analytics now enable automated anomaly detection, predictive insights, and intelligent correlation of telemetry data across logs, metrics, and traces. Machine learning models can surface subtle performance degradations before they impact end users, accelerate root cause analysis, and reduce alert fatigue by prioritizing critical incidents. This leads to improved operational efficiency, faster incident response, and stronger service reliability for applications and infrastructure.

AI also expands the value of observability by enabling adaptive monitoring in dynamic environments such as cloud native ecosystems, containers, and microservices. Natural language processing and generative AI assist observability users with automated query suggestions, contextual insights, and guided troubleshooting, making observability platforms more accessible to cross-functional teams beyond traditional DevOps. As enterprises increasingly adopt AI-powered observability, demand for advanced analytics, autonomous monitoring, and real-time performance intelligence continues to grow, fueling innovation and market expansion.

Global Observability Market: Stats & Facts

Eurostat (European Union Government ICT Data)

- 52.74% of EU enterprises used paid cloud computing services in 2025, up from 45.32% in 2023, showing accelerated cloud adoption that underpins observability platforms and telemetry‑driven operations. In 2025 a high share (82.92%) of ICT enterprises in the information and communications sector used cloud services.

OECD Government at a Glance (OECD Public Sector Digital Transformation Indicators)

- OECD digital government strategies show that a growing number of member countries embed digital technology at the core of public service transformation by 2025, supporting adoption of digital platforms and data driven systems across public sectors.

- OECD Government at a Glance 2025 database includes detailed indicators on digital public services and public policy monitoring performance in 2023 and 2025, reflecting improved ICT governance and analytics capabilities across OECD countries.

Digital Government Index (OECD)

- The OECD Digital Government Index tracks the advancement of digital government strategies across member countries in 2025, indicating increased integration of digital technologies in public administration which correlates with rising demand for observability practices in large government IT systems.

UK Government Digital Services (State of Digital Government Review 2025)

- Digital and data spending in the UK public sector grew by 11% over the past five years up to 2025, highlighting increasing government IT investment that drives adoption of modern monitoring and observability‑related practices.

Global Observability Market: Market Dynamics

Global Observability Market: Driving Factors

Growing Complexity of IT Environments

The shift to cloud native architectures, microservices, container orchestration, and hybrid deployments has increased system complexity. Organizations require comprehensive observability solutions to collect and correlate telemetry data, enabling real-time visibility into application performance, infrastructure health, and network behavior. This complexity elevates demand for unified observability that supports distributed tracing, log analytics, and metrics monitoring across diverse environments.

Demand for Enhanced Digital Experience and Reliability

Enterprises increasingly prioritize digital user experience and zero-downtime services to maintain customer satisfaction and competitive advantage. Observability platforms help teams proactively detect performance anomalies, optimize application response times, and reduce service disruptions. This focus on reliability and performance optimization drives adoption of advanced monitoring tools and intelligent observability analytics.

Global Observability Market: Restraints

High Implementation and Operational Costs

Deploying comprehensive observability solutions can require significant investment in licensing, infrastructure, and skilled personnel. Small and medium enterprises may struggle with cost barriers, particularly when integrating multiple telemetry sources and managing high volumes of metrics, logs, and traces. These financial constraints can limit adoption, especially in budget-sensitive industries.

Skills Gap and Resource Constraints

Effective observability requires expertise in data analysis, telemetry interpretation, and platform configuration. A shortage of skilled professionals in DevOps, site reliability engineering, and cloud operations can slow deployment and reduce utilization of observability tools. Organizations may face challenges aligning existing teams with evolving observability technologies and practices.

Global Observability Market: Opportunities

Integration of Artificial Intelligence and Machine Learning

AI driven observability presents a major growth avenue by automating anomaly detection, predictive insights, and root cause analysis. Machine learning algorithms can analyze large volumes of telemetry data to identify patterns and forecast potential issues before they impact systems. This intelligent analytics capability enables more proactive operations and reduces dependency on manual intervention.

Expansion of Data Observability Use Cases

Beyond traditional infrastructure and application monitoring, the rise of data observability is creating new opportunities. Organizations are seeking visibility into data pipelines, quality metrics, and business-level insights to ensure trustworthy data flows. This trend expands the market beyond IT operations into data engineering and analytics domains, broadening customer segments and use cases.

Global Observability Market: Trends

Unified Observability Platforms Adoption

Organizations are moving toward integrated platforms that consolidate logs, metrics, traces, and user experience data into a single analytical layer. Unified observability enables cross-domain insights, simplifies tool sprawl, and improves team collaboration. This trend reduces operational silos and enhances overall system transparency.

Focus on Security-Centric Observability

As cyber threats become more sophisticated, observability is increasingly leveraged for security monitoring and compliance tracking. Security-centric observability combines telemetry data with threat intelligence to detect abnormal behavior, support incident response, and maintain regulatory adherence. This convergence of performance monitoring and security intelligence strengthens enterprise defenses while enhancing operational visibility.

Global Observability Market: Research Scope and Analysis

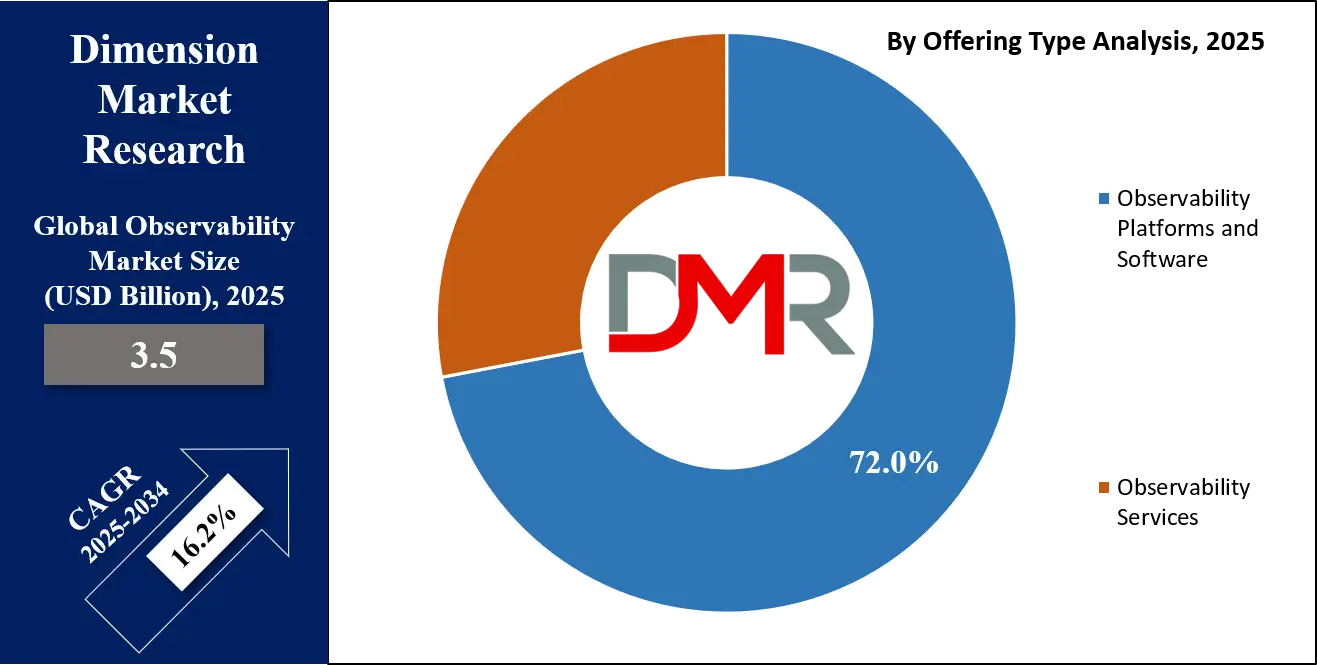

By Offering Type Analysis

Observability platforms and software are expected to dominate the offering type segment in 2025, accounting for nearly 72.0% of the total market share, primarily due to their ability to deliver unified and real time visibility across complex IT environments. Enterprises increasingly prefer integrated observability platforms that combine metrics monitoring, log analytics, distributed tracing, and user experience insights within a single solution.

These platforms support proactive performance management, faster root cause analysis, and improved system reliability across cloud native, hybrid, and microservices based architectures. Continuous innovation in artificial intelligence driven analytics and automation further strengthens the adoption of software centric observability solutions across large enterprises.

Observability services, while holding a comparatively smaller share of the market, play a critical supporting role in enabling successful deployment and optimization of observability solutions. Services such as consulting, system integration, managed observability, and technical support are increasingly adopted by organizations facing skills shortages and complex multi cloud environments.

These services help enterprises customize observability frameworks, integrate diverse data sources, and ensure effective use of telemetry data for operational insights. Growing demand for managed services and ongoing optimization is expected to support steady growth of the services segment alongside platform adoption.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Data Type Observed Analysis

Infrastructure and machine data are expected to dominate the data type observed segment in 2025, accounting for approximately 34.0% of the total market share, as organizations continue to prioritize visibility into the foundational layers of their IT environments. This data type includes system level metrics generated from servers, virtual machines, containers, storage systems, and cloud infrastructure, which are critical for maintaining uptime, performance stability, and capacity planning. Enterprises rely on infrastructure and machine data to monitor resource utilization, detect anomalies, and prevent system failures across hybrid and distributed environments, making it a core component of observability strategies.

Application telemetry data also represents a significant portion of the observability market, driven by the growing adoption of cloud native applications and microservices architectures. This data type captures detailed insights into application behavior, including response times, error rates, transaction flows, and service dependencies. Organizations use application telemetry to optimize application performance, improve digital user experience, and accelerate root cause analysis during incidents. As applications become more distributed and dynamic, demand for deep application level visibility continues to rise, supporting sustained growth of this segment.

By Technology Environment Analysis

Cloud native and microservices architecture are expected to dominate the technology environment segment in 2025, accounting for approximately 41.0% of the total market share, as enterprises increasingly adopt modern, scalable, and flexible IT architectures. These environments rely on containerized applications, orchestrated services, and dynamic workloads, which require advanced observability solutions to provide real time visibility across distributed systems.

Observability in cloud native and microservices setups enables monitoring of service performance, detection of anomalies, and optimization of resource utilization, helping organizations maintain high application availability and improve digital user experience in complex, fast changing infrastructures.

Hybrid enterprise IT environments also form a significant portion of the observability market, driven by organizations that operate a combination of on premise systems and cloud deployments. These environments present unique challenges in terms of monitoring and correlating telemetry data across diverse platforms, networks, and workloads. Observability solutions for hybrid IT provide unified insights into infrastructure performance, application behavior, and network health, enabling enterprises to ensure reliability, optimize operations, and maintain compliance. As more organizations adopt hybrid strategies to balance legacy systems with cloud scalability, demand for hybrid observability solutions continues to grow steadily.

By Deployment Model Analysis

Cloud based deployment is expected to dominate the deployment model segment in 2025, capturing approximately 69.0% of the total market share, as enterprises increasingly shift workloads to public cloud environments for scalability, flexibility, and cost efficiency. Cloud based observability solutions provide real time monitoring, centralized telemetry collection, and automated analytics across distributed applications and infrastructure, enabling organizations to quickly detect performance issues and optimize system reliability. The ease of deployment, reduced infrastructure overhead, and seamless integration with cloud native and microservices architectures make cloud based observability the preferred choice for modern enterprises.

Hybrid deployment also represents a notable share of the observability market, driven by organizations that maintain a mix of on premise systems and cloud environments to balance legacy investments with digital transformation goals. Hybrid observability solutions enable enterprises to collect and analyze telemetry data across multiple platforms, providing unified visibility into infrastructure performance, application behavior, and network health. This approach supports operational efficiency, ensures compliance across heterogeneous systems, and allows organizations to gradually migrate workloads to the cloud while maintaining service reliability.

By Organization Size Analysis

Large enterprises are expected to dominate the organization size segment in 2025, capturing approximately 64.0% of the total market share, due to their complex and large scale IT infrastructures that require comprehensive observability solutions. These organizations often operate multi cloud environments, distributed applications, and microservices architectures, which generate massive volumes of telemetry data including logs, metrics, and traces. Observability platforms help large enterprises monitor system performance, optimize application behavior, detect anomalies, and ensure high availability, supporting operational efficiency and maintaining a seamless digital experience for a wide customer base.

Small and medium enterprises also contribute to the observability market, though with a smaller share, as they increasingly adopt cloud based and scalable observability solutions to manage growing digital workloads. SMEs often rely on software as a service observability platforms to monitor application performance, infrastructure health, and user experience without heavy investment in on premise resources or specialized personnel. The flexibility, cost efficiency, and ease of integration offered by modern observability solutions enable SMEs to enhance system reliability, improve operational visibility, and support business growth in competitive digital markets.

By Application Analysis

Application performance monitoring is expected to dominate the application segment in 2025, capturing approximately 38.0% of the total market share, as enterprises increasingly prioritize optimizing digital experiences and maintaining high application availability. This use case involves tracking response times, transaction flows, error rates, and service dependencies across distributed applications and microservices architectures. Observability platforms provide real time insights that help teams detect performance bottlenecks, reduce downtime, and improve user satisfaction. The integration of machine learning and AI driven analytics further enhances the ability to predict and resolve potential issues proactively.

Infrastructure and server monitoring also represents a significant portion of the market, as organizations require continuous visibility into servers, virtual machines, containers, storage systems, and network infrastructure. Observability solutions collect telemetry data from these resources to monitor performance, detect anomalies, optimize resource utilization, and support capacity planning. This capability is critical for ensuring system stability, reducing operational risks, and maintaining business continuity in hybrid and cloud environments. The growing reliance on cloud and multi cloud deployments further drives demand for robust infrastructure monitoring solutions.

By Industry Vertical Analysis

Information technology and telecommunications are expected to dominate the industry vertical segment in 2025, capturing approximately 29.0% of the total market share, as these sectors operate highly complex digital infrastructures and rely heavily on continuous service availability. Enterprises in IT and telecom deploy observability platforms to monitor application performance, network traffic, cloud workloads, and distributed systems in real time. The growing adoption of microservices, containerized applications, and hybrid IT environments in this sector drives demand for unified observability solutions that provide actionable insights, reduce downtime, and enhance overall digital experience for enterprise clients and end users.

Banking, financial services, and insurance also represent a major portion of the observability market, driven by the need for secure, reliable, and high performing digital services. Organizations in this sector use observability solutions to monitor transaction flows, detect anomalies, ensure regulatory compliance, and optimize system performance. Real time visibility into applications, infrastructure, and network behavior is critical for minimizing service disruptions, preventing fraud, and maintaining customer trust. The increasing digitalization of banking operations and adoption of cloud based financial platforms further fuels the demand for advanced observability tools in this industry.

The Observability Market Report is segmented on the basis of the following:

By Offering Type

- Observability Platforms and Software

- Metrics Monitoring

- Log Analytics

- Distributed Tracing

- Real User Monitoring

- Synthetic Monitoring

- Observability Services

- Consulting and Advisory

- System Integration and Deployment

- Managed Observability Services

- Training and Technical Support

By Data Type Observed

- Infrastructure and Machine Data

- Application Telemetry Data

- Network Flow and Traffic Data

- End-User Experience Data

By Technology Environment

- Cloud Native and Microservices Architecture

- Hybrid Enterprise IT Environment

- Legacy Enterprise Systems

- Edge Computing and Internet of Things Environment

By Deployment Model

- Cloud-Based Deployment

- Hybrid Deployment

- On-Premise Deployment

By Organization Size

- Large Enterprises

- Small and Medium Enterprises

By Application

- Application Performance Monitoring

- Infrastructure and Server Monitoring

- Network Observability

- Security and Compliance Monitoring

- Business Transaction Monitoring

By Industry Vertical

- Information Technology and Telecommunications

- Banking Financial Services and Insurance

- Healthcare and Life Sciences

- Retail and Ecommerce

- Manufacturing and Industrial Operations

- Media and Entertainment

- Government and Public Sector

- Energy Utilities and Other Industries

Global Observability Market: Regional Analysis

Region with the Largest Revenue Share

North America is expected to lead the global Observability Market in 2025, capturing approximately 37.0% of the total market revenue, driven by widespread adoption of cloud computing, microservices architectures, and large scale digital transformation initiatives across enterprises. The region benefits from the presence of major technology vendors, high investment in artificial intelligence and machine learning based observability solutions, and strong implementation of DevOps and site reliability engineering practices. Organizations leverage unified observability platforms to gain real time visibility into application performance, infrastructure health, and network operations, ensuring optimized system reliability and enhanced digital user experiences.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

The Asia Pacific region is expected to witness significant growth in the Observability Market over the forecast period, driven by rapid digital transformation, increasing adoption of cloud computing, and expanding IT infrastructure across countries such as India, China, and Japan. Enterprises in the region are increasingly deploying observability platforms to monitor application performance, infrastructure health, and network behavior in real time, supporting scalable cloud native and hybrid IT environments. Rising investment in artificial intelligence enabled analytics, growing demand for improved digital experiences, and expansion of technology driven industries contribute to the region’s accelerated market growth.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Observability Market: Competitive Landscape

The competitive landscape of the global Observability Market is characterized by intense innovation and differentiation as vendors strive to enhance real‑time visibility, analytics accuracy, and integration capabilities across complex IT ecosystems.

Market participants are increasingly focusing on expanding platform functionalities to encompass unified telemetry collection, machine learning powered anomaly detection, and automated root cause analysis that spans applications, infrastructure, and network layers. Strategic investments in partnerships, cloud native integrations, and managed observability services are shaping competitive dynamics, while customer demand for scalable, flexible, and AI driven observability solutions continues to influence product roadmaps and market positioning across regions and industry verticals.

Some of the prominent players in the global Observability market are:

- Datadog

- Dynatrace

- Splunk

- New Relic

- AppDynamics (Cisco)

- LogicMonitor

- ScienceLogic

- SolarWinds

- Sumo Logic

- Elastic

- Broadcom

- IBM

- Microsoft

- GitLab

- Auvik Networks

- Nexthink

- Monte Carlo (Data observability)

- Lightstep

- Atatus

- Riverbed Technology

- Other Key Players

Global Observability Market: Recent Developments

- January 2026: Snowflake announced plans to acquire the AI‑powered observability platform Observe, signaling expansion into data‑centric observability and deeper integration of telemetry analytics within its data cloud offerings to support complex enterprise and AI workloads.

- October 2025: Grafana Labs unveiled a series of new observability updates at ObservabilityCON 2025, including Adaptive Traces, Adaptive Profiles, Bring Your Own Cloud capability, and FedRAMP‑authorized cloud offerings that enhance telemetry control, compliance, and operational insights across metrics, logs, and traces.

- August 2025: Riverbed introduced its new AI‑driven intelligent network observability solutions that provide automated insights, improve network performance visibility, and help enterprise IT teams detect and resolve issues faster across complex infrastructure environments.

- July 2025: Observe Inc. closed a USD 156 million Series C funding round led by major venture investors, reflecting strong enterprise demand for AI‑driven observability that scales with telemetry volume and lowers operational complexity.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 3.5 Bn |

| Forecast Value (2034) |

USD 13.5 Bn |

| CAGR (2025–2034) |

16.2% |

| The US Market Size (2025) |

USD 1.1 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Offering Type (Observability Platforms and Software: Metrics Monitoring, Log Analytics, Distributed Tracing, Real User Monitoring, Synthetic Monitoring; Observability Services: Consulting and Advisory, System Integration and Deployment, Managed Observability Services, Training and Technical Support), By Data Type Observed (Infrastructure and Machine Data, Application Telemetry Data, Network Flow and Traffic Data, End-User Experience Data), By Technology Environment (Cloud Native and Microservices Architecture, Hybrid Enterprise IT Environment, Legacy Enterprise Systems, Edge Computing and Internet of Things Environment), By Deployment Model (Cloud-Based Deployment, Hybrid Deployment, On-Premise Deployment), By Organization Size (Large Enterprises, Small and Medium Enterprises), By Application (Application Performance Monitoring, Infrastructure and Server Monitoring, Network Observability, Security and Compliance Monitoring, Business Transaction Monitoring), and By Industry Vertical (Information Technology and Telecommunications, Banking Financial Services and Insurance, Healthcare and Life Sciences, Retail and Ecommerce, Manufacturing and Industrial Operations, Media and Entertainment, Government and Public Sector, Energy Utilities and Other Industries). |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Datadog, Dynatrace, Splunk, New Relic, AppDynamics (Cisco), LogicMonitor, ScienceLogic, SolarWinds, Sumo Logic, Elastic, Broadcom, IBM, Microsoft, GitLab, Auvik Networks, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global Observability market?

▾ The global Observability market size was valued at USD 3.5 billion in 2025 and is expected to reach USD 13.5 billion by the end of 2034.

What is the size of the US Observability market?

▾ The US Observability market was valued at USD 1.1 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 3.9 billion in 2034 at a CAGR of 15.2%.

Which region accounted for the largest global Observability market?

▾ North America is expected to have the largest market share in the global Observability market, with a share of about 37.0% in 2025.

Who are the key players in the global Observability market?

▾ Some of the major key players in the global Observability market are Datadog, Dynatrace, Splunk, New Relic, AppDynamics (Cisco), LogicMonitor, ScienceLogic, SolarWinds, Sumo Logic, Elastic, Broadcom, IBM, Microsoft, GitLab, Auvik Networks, and Others.