Market Overview

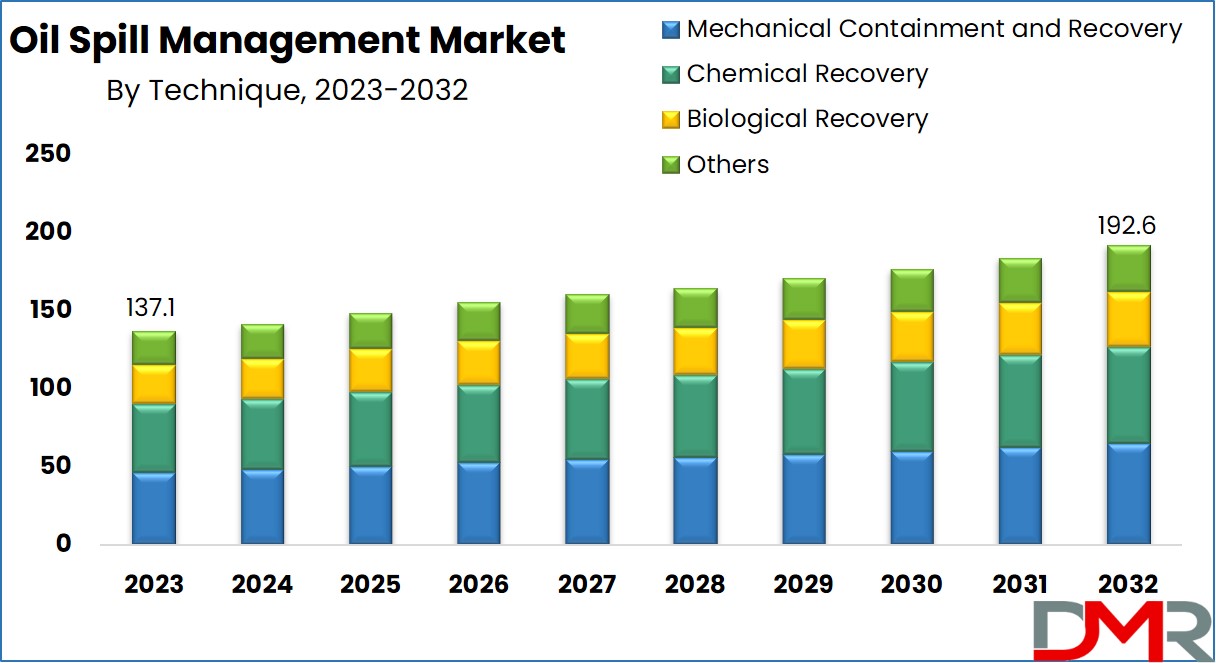

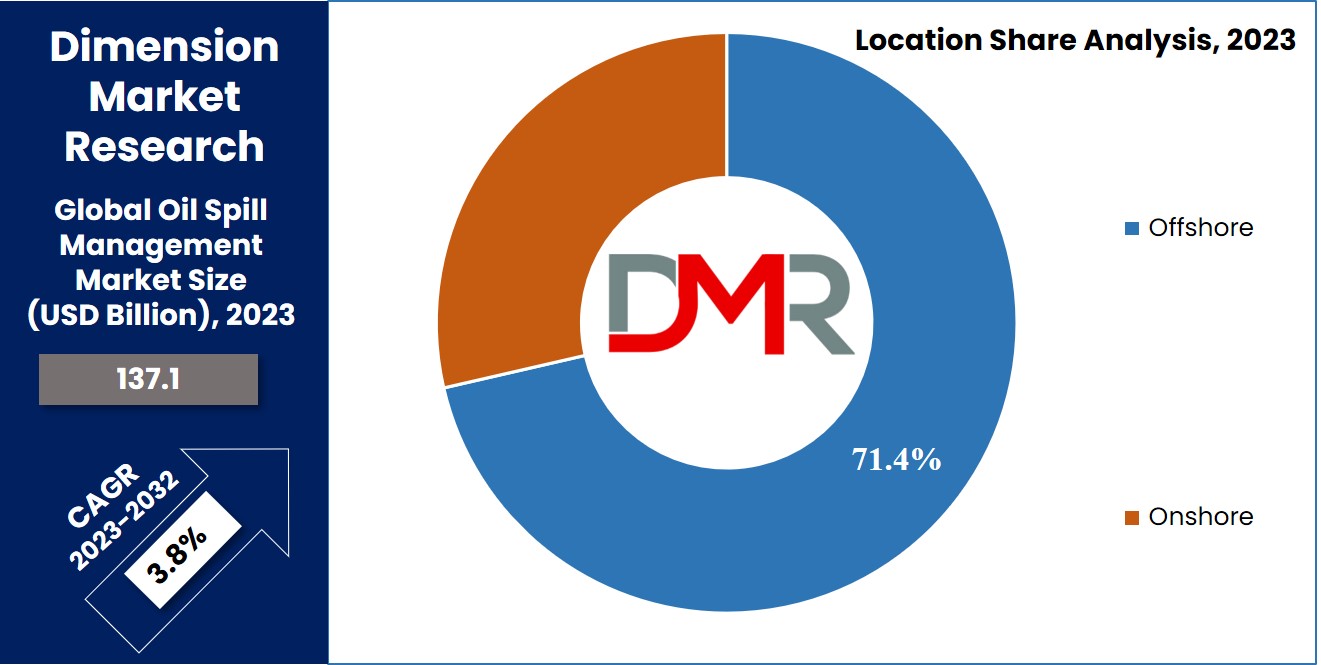

The Global Oil Spill Management Market is expected to reach a value of USD 137.1 billion in 2023 and is forecasted to achieve a 3.8% CAGR from 2023 to 2032. Rising safety issues and a noticeable uptick in environmental contamination via the spill of oil on a global scale in recent years underpin this growth trajectory.

With growing emphasis on environmental responsibility, this market is also being closely associated with broader trends in marine pollution control and environmental risk management. Oil spill management refers to the strategies, technologies, and processes used to prevent, mitigate, and clean up oil spills in the environment, particularly in marine and coastal areas. This field encompasses a range of activities, including the detection of spills, containment efforts, the recovery of spilled oil, and the restoration of affected ecosystems.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

In 2024, the oil spill management market presents significant growth opportunities driven by increasing regulatory pressure and growing awareness about environmental protection. Large industry players, particularly those in the oil and gas sector, are expected to continue investing in advanced spill response technologies and solutions to meet stricter environmental standards.

For newer or entry-level businesses, there are ample opportunities to innovate in areas where technology is still evolving. For example, startups could focus on developing AI-based solutions for real-time spill monitoring, remote sensing technologies, or novel materials for spill containment.

With the rising demand for sustainable practices, smaller firms could also tap into the growing market for biodegradable or non-toxic dispersants. This trend aligns with consumer preferences in industries like Almond Oil, Health and Wellness, and even Personal Safety App solutions, where innovation and safety are top priorities.

Another significant trend is the growing emphasis on sustainability within the oil spill management sector. Environmental concerns are pushing companies to adopt greener, more eco-friendly methods for oil spill containment and cleanup. Bioremediation, the use of microorganisms to break down oil, is gaining traction as an environmentally friendly alternative to traditional chemical dispersants.

Similarly, research into biodegradable booms and skimmers is driving innovation, with a focus on reducing the long-term environmental impact of oil spill response efforts. As global environmental regulations tighten, the shift towards more sustainable practices is expected to play a key role in shaping the future of the market.

Finally, a notable trend is the increase in collaboration between public and private entities to strengthen oil spill preparedness. Governments are partnering with oil and gas companies to enhance spill response infrastructure and improve preparedness for worst-case scenarios.

This includes investments in research and development, joint exercises, and shared resources for rapid response capabilities. The trend reflects a growing recognition that addressing the risks of oil spills requires a collaborative, multi-stakeholder approach that integrates expertise from all sectors.

According to a recent survey, there was an average of 1.3 large oil spills per year from tanker incidents during the decade from 2020 onward. This statistic highlights the ongoing need for effective spill management strategies, despite advancements in spill prevention technologies.

Additionally, the percentage of double-hulled tankers, which are designed to reduce the risk of spills, increased from 80% in 2014 to 95% in 2024, significantly reducing the frequency of oil spills from these vessels. However, large-scale spills continue to pose significant challenges.

In terms of risk assessment, the Bureau of Ocean Energy Management (BOEM) states that spills of 1,000 barrels or more—representing about 1% of all spill events in the U.S. Outer Continental Shelf—are the primary focus of the Oil Spill Risk Analysis model. These large spills are particularly critical because they can persist on the water long enough to require detailed trajectory analysis to predict their movement and impacts on the environment.

Key Takeaways

- The Global Oil Spill Management Market is projected to reach USD 137.1 billion in 2023, with a 3.8% CAGR from 2023-2032.

- Chemical recovery techniques, using gelling and dispersant agents, accounted for 32.4% of the market share in 2023.

- Pre-oil spill management, especially double-hull technology, holds a dominant market share, comprising 70.2% in 2023.

- Offshore applications lead the pre-oil spill management sector, driven by the need for solutions in remote and deepwater environments.

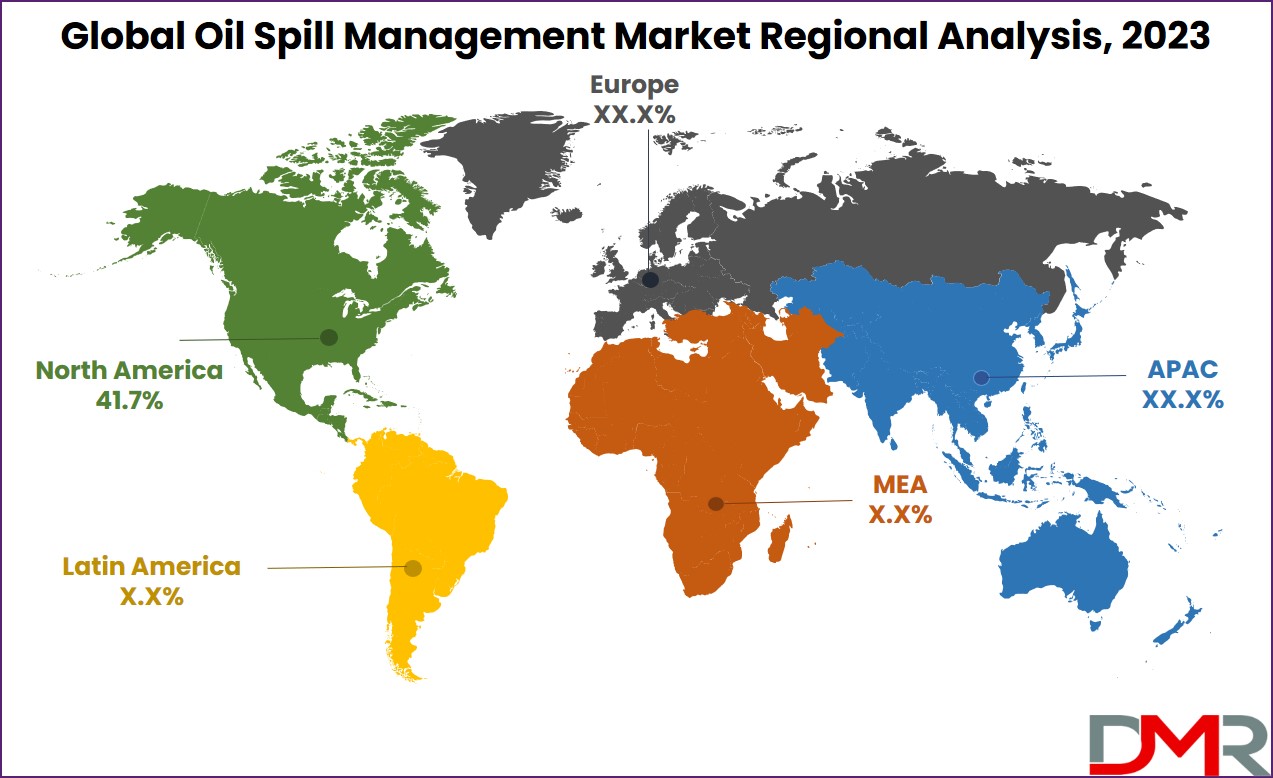

- North America holds the largest market share (41.7% in 2023) and is expected to see continued growth due to increased oil and gas exploration and stringent regulatory measures.

Use Cases

- Offshore Oil & Gas Operations: Growing offshore drilling and exploration activities in regions like the Gulf of Mexico and South China Sea drive adoption of double-hull tankers, blowout preventers, and advanced containment systems to minimize environmental risks.

- Onshore Refineries & Pipelines: Oil refineries, storage facilities, and pipeline operators implement leak detection systems, chemical dispersants, and skimmers to prevent spills and ensure regulatory compliance while safeguarding local ecosystems.

- Marine Transport & Shipping: Shipping companies and tanker operators deploy mechanical containment, sorbent booms, and oleophilic skimmers to reduce the risk of oil spills during transportation, enhancing maritime safety and environmental responsibility.

- Environmental & Emergency Response Services: Governments and private firms leverage bioremediation, biodegradable booms, and rapid response teams to mitigate the impact of accidental spills, restoring affected marine and coastal environments efficiently.

- Research & Innovation: Startups and technology developers focus on AI-based monitoring, remote sensing, and eco-friendly dispersants, offering predictive spill detection and sustainable cleanup solutions for a range of industries, including oil production and health & wellness sectors.

Market Dynamic

Safety agencies and governments worldwide, including the OSHA (Occupational Safety & Health Administration), have undertaken numerous initiatives aimed at monitoring & controlling oil and gas leakages and spills both at the source and during transportation.

These efforts entail requirements such as the upgradation of leak detection sensors for pipelines & the adoption of double-hulling for carriers of transportation.

The rising concern for safety & the strict regulatory standards aimed at avoiding on-site & transportation-related hazards at petroleum sites is expected to drive the implementation of technologies for oil spill avoidance in advance, in the foreseeable future. Key offshore regions prone to oil spills include the Persian Gulf (Middle East), the Gulf of Mexico, the Gulf of Alaska, & the North Sea (Europe).

The increasing occurrence of offshore & onshore oil spill accidents is anticipated to propel market growth for the forecast period. Notable onshore areas affected include the United States, Russia, Azerbaijan, Indonesia, Kuwait, Canada, Australia, Libya, Saudi Arabia, Nigeria, Iraq, Angola & Venezuela.

Research Scope and Analysis

By Technique

The response techniques for Post-Oil Spill encompass various categories, including mechanical containment & recovery (comprising containment booms such as sorbent booms, hard booms, and fire booms, as well as skimmers like weir skimmers, oleophilic skimmers, & non-oleophilic skimmers), chemical recovery involving dispersing & gelling agents, biological recovery, and Others.

Chemical recovery techniques constituted more than 32.4% share in 2023. This approach involves the utilization of gelling & dispersant agents, which facilitate the natural breaking of oil components. Chemical dispersant agents work by chemically binding water & oil, preventing the slick from spreading across the water's surface & increasing the oil molecules’ surface area.

By Technology

The Oil Spill Management Market utilizes two major technologies: pre-oil spill and post-oil spill management. Within pre-oil spill management, there are several subcategories, including double-hull technology, pipeline leak detection, blowout preventers, & others. The technology of Double-hulling has been the dominant pre-oil spill management method in recent years, accounting for more than 70.2% of the share in the market in 2023.

This is primarily due to the significant role marine transportation plays in the oil and gas sector, especially for the energy sectors in and the Asia Pacific & Europe. The increasing demand for crude petroleum & oil products has driven market growth expectations in upcoming years.

Concerns about the ecological repercussions of hull breaches have forced and governments & international organizations to regulate the designs of tankers & enhance safeguards against collisions & unforeseen calamities. These factors are expected to fuel the growth of double-hull technology for the forecast period.

By Location

In 2023, offshore applications dominate the pre-oil spill management market, with the highest market share. The growing need for oil spill management technology in challenging environments, remote areas, & deepwater locations is expected to fuel demand for these products for the forecast period.

Anticipated projects, primarily in the Persian Gulf regions & South China Sea, as well as the reactivation of abandoned wells, are set to drive offshore exploration & production activities in the foreseeable future. Increased regulations, taxes, & fines related to post-oil spill containment are putting pressure on midstream & upstream oil and gas companies to utilize protective gear to ensure continuous and smooth operations.

This includes the adoption of BOPs (blowout preventers), pipeline leak detection systems, & other safety measures. Significant growth in pre-oil spill technology demand is expected, particularly in Qatar, the United States, and Saudi Arabia, over the forecast period.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Global Oil Spill Management Market Report is segmented based on the following:

By Technique

- Mechanical Containment and Recovery

- Containment Booms

- Hard Booms

- Fire Booms

- Others

- Skimmers

- Weir Shimmers

- Oleophilic Skimmers

- Non-Oleophilic Skimmers

- Others

- Sorbent

- Others

- Chemical Recovery

- Dispersing Agents

- Gelling Agents

- Others

- Biological Recovery

- Others

By Technology

- Pre-Oil Spill

- Double-hull

- Pipeline Leak Detection

- Blow-out preventers

- Others

- Post-Oil Spill

By Location

Regional Analysis

North America dominates the market with a share of over 41.7% in 2023 and is expected to expand its share due to increasing oil and gas exploration & production activities. The region has implemented stringent regulations for onshore and offshore oil and gas operations following incidents like Exxon Valdez, Deepwater Horizon & Marathon Oil.

The Asia Pacific oil spill management market is projected to grow at a CAGR of 4% from 2023 to 2032. Currently, China, South Korea & India, are the primary hubs for oil and gas exploration & production in the Asia-Pacific region. Initiatives by the government, such as reducing taxes and providing financial support for hydrocarbon discovery, & are expected to drive this sector’s growth in these countries over the forecast period.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Oil Spill Management industry is highly competitive, with key players vying for market share through diverse services, technologies, and equipment for oil spill prevention and response. Notable competitors include Clean Harbors, Inc., known for its global presence and industry partnerships; Oil Spill Response Limited (OSRL), recognized for its swift response services and extensive resources; and Lamor Corporation, an innovator in oil spill response technology. Regional and local firms also play roles.

Success hinges on continuous innovation, strategic partnerships, and environmental commitment. Technological advances, regulatory changes, and collaborations shape the market. In sum, Oil Spill Management Market players continually enhance capabilities, expand market reach, and offer effective response solutions.

Some of the prominent players in the Global Oil Spill Management Market are:

- BASF SE

- Varco

- CURA Emergency Services

- OPEC Limited

- Schlumberger Limited

- Northern Marine Ltd.

- General Electric

- Control Flow Inc.

- Ecolab

- Deepwater Horizon

- Exxon Mobil Corporation

- Other Key Players

Recent Developments

- In August 2025, WaterBridge Infrastructure filed for a U.S. IPO to expand its oil and gas water management services.

- In August 2025, Patagonia, Argentina, is preparing a major crude oil export port, raising ecological and oil spill concerns.

- In July 2025, analysts expect further consolidation in the oil and gas industry, impacting efficiency and sustainability strategies.

- In May 2025, Guyana passed an oil pollution bill imposing strict liabilities and financial assurances for oil spill damages.

- In April 2025, Miros launched its Oil Spill Detection Monitoring application in the cloud to enhance real-time spill response.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 137.1 Bn |

| Forecast Value (2032) |

USD 192.6 Bn |

| CAGR (2023-2032) |

3.8% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Technique (Mechanical Containment and Recovery, Chemical Recovery, Biological Recovery, and Others), By Technology (Pre-Oil Spill, and Post-Oil Spill), and By Location (Onshore, and Offshore). |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

BASF SE, Varco, CURA Emergency Services, OPEC Limited, Schlumberger Limited, Northern Marine Ltd., General Electric, Control Flow Inc., Ecolab, Deepwater Horizon, Exxon Mobil Corporation, and Other Key Players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

What is the estimated value of the Global Oil Spill Management Market in 2023?

▾ The Global Oil Spill Management Market is estimated to reach a value of USD 137.1 billion in 2023.

What is the expected CAGR for the Global Oil Spill Management Market?

▾ The Global Oil Spill Management Market is forecasted to achieve a 3.8% compound annual growth rate (CAGR) from 2023 to 2032.

Which region has dominated the Global Oil Spill Management Market?

▾ North America dominated the oil spill management market in 2022 and is anticipated to account for over 41.7% in 2023.

Who are the prominent players in the Global Oil Spill Management Market?

▾ Some of the prominent players in the Global Oil Spill Management Market include BASF SE, Varco, CURA Emergency Services, OPEC Limited, Schlumberger Limited, Northern Marine Ltd., General Electric, Control Flow Inc., Ecolab, Deepwater Horizon, etc.