With growing emphasis on environmental responsibility, this market is also being closely associated with broader trends in marine pollution control and environmental risk management. Oil spill management refers to the strategies, technologies, and processes used to prevent, mitigate, and clean up oil spills in the environment, particularly in marine and coastal areas. This field encompasses a range of activities, including the detection of spills, containment efforts, the recovery of spilled oil, and the restoration of affected ecosystems.

In 2024, the oil spill management market presents significant growth opportunities driven by increasing regulatory pressure and growing awareness about environmental protection. Large industry players, particularly those in the oil and gas sector, are expected to continue investing in advanced spill response technologies and solutions to meet stricter environmental standards.

For newer or entry-level businesses, there are ample opportunities to innovate in areas where technology is still evolving. For example, startups could focus on developing AI-based solutions for real-time spill monitoring, remote sensing technologies, or novel materials for spill containment.

Another significant trend is the growing emphasis on sustainability within the oil spill management sector. Environmental concerns are pushing companies to adopt greener, more eco-friendly methods for oil spill containment and cleanup. Bioremediation, the use of microorganisms to break down oil, is gaining traction as an environmentally friendly alternative to traditional chemical dispersants.

Similarly, research into biodegradable booms and skimmers is driving innovation, with a focus on reducing the long-term environmental impact of oil spill response efforts. As global environmental regulations tighten, the shift towards more sustainable practices is expected to play a key role in shaping the future of the market.

Finally, a notable trend is the increase in collaboration between public and private entities to strengthen oil spill preparedness. Governments are partnering with oil and gas companies to enhance spill response infrastructure and improve preparedness for worst-case scenarios.

This includes investments in research and development, joint exercises, and shared resources for rapid response capabilities. The trend reflects a growing recognition that addressing the risks of oil spills requires a collaborative, multi-stakeholder approach that integrates expertise from all sectors.

According to a recent survey, there was an average of 1.3 large oil spills per year from tanker incidents during the decade from 2020 onward. This statistic highlights the ongoing need for effective spill management strategies, despite advancements in spill prevention technologies.

Additionally, the percentage of double-hulled tankers, which are designed to reduce the risk of spills, increased from 80% in 2014 to 95% in 2024, significantly reducing the frequency of oil spills from these vessels. However, large-scale spills continue to pose significant challenges.

In terms of risk assessment, the Bureau of Ocean Energy Management (BOEM) states that spills of 1,000 barrels or more—representing about 1% of all spill events in the U.S. Outer Continental Shelf—are the primary focus of the Oil Spill Risk Analysis model. These large spills are particularly critical because they can persist on the water long enough to require detailed trajectory analysis to predict their movement and impacts on the environment.

Key Takeaways

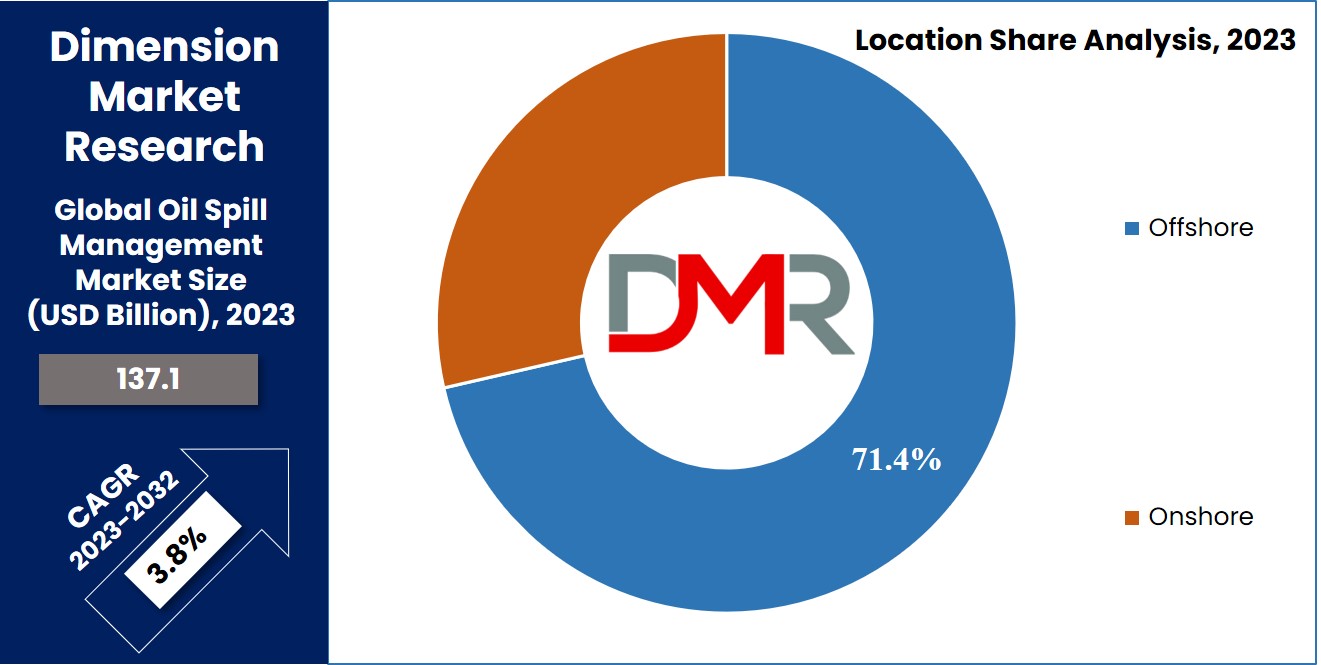

- The Global Oil Spill Management Market is projected to reach USD 137.1 billion in 2023, with a 3.8% CAGR from 2023-2032.

- Chemical recovery techniques, using gelling and dispersant agents, accounted for 32.4% of the market share in 2023.

- Pre-oil spill management, especially double-hull technology, holds a dominant market share, comprising 70.2% in 2023.

- Offshore applications lead the pre-oil spill management sector, driven by the need for solutions in remote and deepwater environments.

- North America holds the largest market share (41.7% in 2023) and is expected to see continued growth due to increased oil and gas exploration and stringent regulatory measures.

use cases

- Offshore Oil & Gas Operations: Growing offshore drilling and exploration activities in regions like the Gulf of Mexico and South China Sea drive adoption of double-hull tankers, blowout preventers, and advanced containment systems to minimize environmental risks.

- Onshore Refineries & Pipelines: Oil refineries, storage facilities, and pipeline operators implement leak detection systems, chemical dispersants, and skimmers to prevent spills and ensure regulatory compliance while safeguarding local ecosystems.

- Marine Transport & Shipping: Shipping companies and tanker operators deploy mechanical containment, sorbent booms, and oleophilic skimmers to reduce the risk of oil spills during transportation, enhancing maritime safety and environmental responsibility.

- Environmental & Emergency Response Services: Governments and private firms leverage bioremediation, biodegradable booms, and rapid response teams to mitigate the impact of accidental spills, restoring affected marine and coastal environments efficiently.

- Research & Innovation: Startups and technology developers focus on AI-based monitoring, remote sensing, and eco-friendly dispersants, offering predictive spill detection and sustainable cleanup solutions for a range of industries, including oil production and health & wellness sectors.

Market Dynamic

Safety agencies and governments worldwide, including the OSHA (Occupational Safety & Health Administration), have undertaken numerous initiatives aimed at monitoring & controlling oil and gas leakages and spills both at the source and during transportation.

These efforts entail requirements such as the upgradation of leak detection sensors for pipelines & the adoption of double-hulling for carriers of transportation.

The rising concern for safety & the strict regulatory standards aimed at avoiding on-site & transportation-related hazards at petroleum sites is expected to drive the implementation of technologies for oil spill avoidance in advance, in the foreseeable future. Key offshore regions prone to oil spills include the Persian Gulf (Middle East), the Gulf of Mexico, the Gulf of Alaska, & the North Sea (Europe).

The increasing occurrence of offshore & onshore oil spill accidents is anticipated to propel market growth for the forecast period. Notable onshore areas affected include the United States, Russia, Azerbaijan, Indonesia, Kuwait, Canada, Australia, Libya, Saudi Arabia, Nigeria, Iraq, Angola & Venezuela.

Research Scope and Analysis

By Technique

The response techniques for Post-Oil Spill encompass various categories, including mechanical containment & recovery (comprising containment booms such as sorbent booms, hard booms, and fire booms, as well as skimmers like weir skimmers, oleophilic skimmers, & non-oleophilic skimmers), chemical recovery involving dispersing & gelling agents, biological recovery, and Others.

Chemical recovery techniques constituted more than 32.4% share in 2023. This approach involves the utilization of gelling & dispersant agents, which facilitate the natural breaking of oil components. Chemical dispersant agents work by chemically binding water & oil, preventing the slick from spreading across the water's surface & increasing the oil molecules’ surface area.

By Technology

The Oil Spill Management Market utilizes two major technologies: pre-oil spill and post-oil spill management. Within pre-oil spill management, there are several subcategories, including double-hull technology, pipeline leak detection, blowout preventers, & others. The technology of Double-hulling has been the dominant pre-oil spill management method in recent years, accounting for more than 70.2% of the share in the market in 2023.

This is primarily due to the significant role marine transportation plays in the oil and gas sector, especially for the energy sectors in and the Asia Pacific & Europe. The increasing demand for crude petroleum & oil products has driven market growth expectations in upcoming years.

Concerns about the ecological repercussions of hull breaches have forced and governments & international organizations to regulate the designs of tankers & enhance safeguards against collisions & unforeseen calamities. These factors are expected to fuel the growth of double-hull technology for the forecast period.

By Location

In 2023, offshore applications dominate the pre-oil spill management market, with the highest market share. The growing need for oil spill management technology in challenging environments, remote areas, & deepwater locations is expected to fuel demand for these products for the forecast period.

Anticipated projects, primarily in the Persian Gulf regions & South China Sea, as well as the reactivation of abandoned wells, are set to drive offshore exploration & production activities in the foreseeable future. Increased regulations, taxes, & fines related to post-oil spill containment are putting pressure on midstream & upstream oil and gas companies to utilize protective gear to ensure continuous and smooth operations.

This includes the adoption of BOPs (blowout preventers), pipeline leak detection systems, & other safety measures. Significant growth in pre-oil spill technology demand is expected, particularly in Qatar, the United States, and Saudi Arabia, over the forecast period.

The Global Oil Spill Management Market Report is segmented based on the following:

By Technique

- Mechanical Containment and Recovery

- Containment Booms

- Hard Booms

- Fire Booms

- Others

-

Skimmers

- Weir Shimmers

- Oleophilic Skimmers

- Non-Oleophilic Skimmers

- Others

- Sorbent

- Others