from 2025 to 2034.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Oilfield chemicals are essential substances used in various stages of oil and gas extraction and production. These chemicals improve drilling efficiency, enhance well performance, and ensure safe production environments. They include corrosion inhibitors, scale preventers, demulsifiers, and biocides, each designed to address specific challenges in harsh reservoir conditions. By reducing operational downtime and maintaining equipment integrity, oilfield chemicals contribute to cost-effective production.

Innovations in chemical formulations continue to drive performance improvements and environmental safety. The effective application of these chemicals ensures optimal extraction rates while minimizing environmental impact, making them a critical component in the global energy supply chain overall. Technological innovations, increased global energy demand, and tightening environmental regulations are driving dramatic transformations within the oilfield chemicals industry.

Companies now must invest in innovative chemical solutions to increase operational efficiencies while improving safety, sustainability, and traceability during extraction processes. The specialty oilfield chemicals market has long played an indispensable role in optimizing drilling operations, improving well stimulation techniques, and prolonging reservoir productive life optimizing drilling by improving well stimulation techniques while prolonging reservoir productive life by offering corrosion protection, scale inhibition, and flow assurance crucial tools when dealing with complex geological formations or harsh extraction environments.

The US Oilfield Chemicals Market

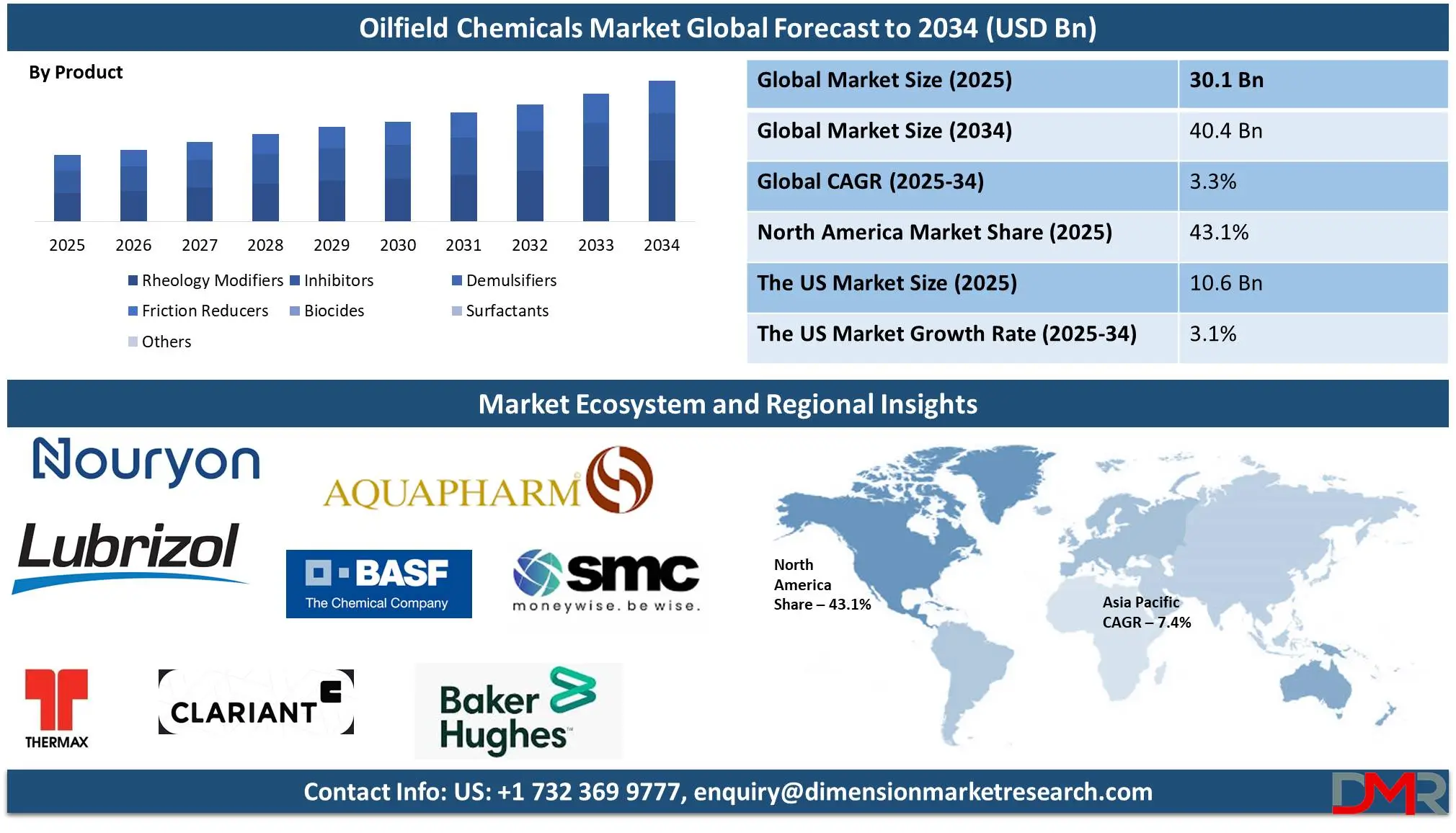

The US Oilfield Chemicals market is projected to be valued at USD 10.6 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 13.9 billion in 2034 at a CAGR of 3.1%.

Robust oil production and intensified deep drilling processes are key drivers for the American oilfield chemicals industry. The heavy reliance on unconventional drilling and intensified offshore drilling processes demand more stringent chemical solutions for performance improvement, anti-corrosion, and scale prevention. The increase in operational complexity, regulations, and need for effective extraction also drive the industry, with consistent demand for oilfield chemicals being guaranteed with varying exploration and production processes.

Technological advancements and shifts in exploration techniques are revolutionizing the trends of the American oilfield chemicals industry. Deep offshore drilling and unconventional extractions drive demand for chemicals with novel properties. Organizations invest in environment-friendly, performance chemicals, which boost drilling performance and reduce environment-related problems. The adoption of digital monitoring and automation also spurs innovations, inducing industry trends towards more environment-friendly, stable, and low-priced chemicals for more challenging extractions in industries.

Oilfield Chemicals Market: Key Takeaways

- Market Growth: The global Oilfield Chemicals market is anticipated to expand by USD 9.3 billion, achieving a CAGR of 3.3% from 2026 to 2034.

- Product Analysis: Rheology modifiers are projected to lead the global oilfield chemicals market with the highest revenue share of 26.5% by the end of 2025.

- Location Analysis: The onshore location also stands to dominate the Oilfield Chemicals Market with the highest share of 67.2% of revenue towards the end of 2025,

- Application Analysis: Drilling is expected to be the leader of the Oilfield Chemicals market with the highest percentage of revenue towards the end of 2025,

- Regional Analysis: North America is projected to dominate the global market, holding a market share of 43.1% by 2025.

- Prominent Players: Some of the major key players in the Global Oilfield Chemicals Market are Baker Hughes, Halliburton, Clariant, and many others.

Oilfield Chemicals Market: Use Cases

- Drilling Fluids Enhancement: Drilling fluids, also known as drilling muds, are crucial for safe and efficient drilling operations in oil and gas wells. Oilfield chemicals enhance these fluids by optimizing viscosity, controlling fluid loss, and minimizing friction along the drill bit and wellbore walls.

- Well Stimulation: Well-stimulation processes such as acidizing and hydraulic fracturing rely on specialized oilfield chemicals to improve reservoir permeability and enhance production. Acid treatments dissolve mineral deposits while fracturing fluids contain proppants and friction reducers that create and sustain fractures in rock formations.

- Enhanced Oil Recovery (EOR): Enhanced Oil Recovery (EOR) employs oilfield chemicals such as polymers, surfactants, and alkalis to significantly improve the mobilization of residual hydrocarbons within a reservoir.

- Corrosion and Scale Inhibition: Corrosion and scale formation are major challenges in oilfield operations that can lead to equipment degradation and reduced production efficiency. Inhibitors and dispersants are added to fluids to prevent corrosive reactions and the deposition of mineral scales on metal surfaces and within pipelines.

Oilfield Chemicals Market: Stats & Facts

- Energy Shale Gas Production projects that by 2040, natural gas production will account for at least 30% in Canada and over 75% in Mexico.

- The Canadian Association of Petroleum Producers (CAPP) reported that from 2018 to 2020, Canada's upstream oil and natural gas activities generated annual revenues of USD 209 billion.

- The International Energy Agency (IEA) and BP's Statistical Review of World Energy 2022 indicate that China is one of the top crude oil importers, bringing in over 10 million barrels per day.

- Data from the National Bureau of Statistics reveals that in 2021, Chinese refineries processed an average of 14.5 million barrels of crude oil, marking a 7.3% year-on-year increase.

- According to the China National Petroleum Corporation (CNPC), during the 14th Five-Year Plan (2021-2025), China's natural gas demand is projected to grow by over 20 billion cubic meters annually, reaching a total of 430 billion cubic meters by 2025.

Oilfield Chemicals Market: Market Dynamic

Driving Factors in the Oilfield Chemicals Market

Increased Global Energy DemandGlobal energy consumption continues to rise amid rapid industrialization and population growth. This surge in energy demand prompts nations to invest heavily in exploration and production activities to secure reliable energy sources. The increased drive to access oil and gas reserves intensifies the need for specialized oilfield chemicals that improve extraction efficiency and minimize environmental impacts.

In response, industry players are leveraging technological advances and innovative chemical formulations to optimize production processes, mitigate challenges, and extend reservoir life. Ultimately, heightened global energy demand propels oil and gas companies to rely on advanced oilfield chemicals for improved operational performance and global efficiency.

Growth in Exploration and Production (E&P) Activities

The global energy landscape sees a surge in exploration and production projects spanning conventional and unconventional oil and gas fields. This growth in E&P activities drives increased demand for specialized oilfield chemicals designed to enhance extraction efficiency, mitigate environmental risks, and improve overall reservoir performance.

Technological innovations and evolving extraction techniques have expanded the applicability of these chemicals across diverse field conditions. As companies invest in new drilling operations and retrofit aging infrastructure, advanced chemical solutions become crucial for optimizing production rates and reducing costs. The expansion in E&P projects underpins a robust market for oilfield chemicals and supports growth.

Restraints in the Oilfield Chemicals Market

Fluctuating Oil Prices

Fluctuating oil prices present a significant restraint on the global oilfield chemicals market by introducing economic uncertainty. When crude oil prices decline, exploration and production activities often slow down due to lower profitability, reducing demand for chemicals used in drilling, stimulation, and production processes. Companies may postpone capital investments, leading to lower volumes of oilfield chemicals purchased. Conversely, when prices surge, operational costs and financial risks can deter spending on new projects. This volatility makes long-term planning challenging for suppliers and customers alike, forcing market participants to adopt conservative strategies and budget constraints that ultimately inhibit market growth and innovation.

Stringent Environmental Regulations

Stringent environmental regulations serve as a major restraint on the global oilfield chemicals market by increasing compliance costs and operational complexities. Companies must invest in advanced technologies and sustainable practices to meet strict standards, driving up expenses and reducing profit margins. Regulatory frameworks often require extensive documentation, frequent inspections, and timely reporting, which can delay project timelines and create uncertainty.

Additionally, the pressure to minimize environmental impact forces companies to adopt safer but more expensive chemical formulations and processes. These factors collectively limit market growth as operators become cautious in allocating budgets for oilfield chemicals amid rising regulatory burdens globally.

Opportunities in the Oilfield Chemicals Market

Enhanced Oil Recovery (EOR) Techniques

EOR Techniques Enhancement Oil Recovery (EOR) techniques present significant opportunities in the global oilfield chemical market by creating demand for specialty formulations. As mature oil fields struggle with declining production, operators increasingly turn to chemical EOR methods as an avenue of increasing recovery rates. This shift has spurred on innovative chemicals designed for viscosity control, emulsification, and altering wettability alterations. Manufacturers can leverage this trend by investing in research and development of cost-effective, cutting-edge solutions that address the difficulties inherent to enhanced recovery processes. As EOR techniques require tailored high-performance chemical additives to maximize oil extraction efficiency globally, manufacturers have a significant opportunity for market expansion.

Offshore and Deepwater Drilling

Offshore and deep water drilling present the oilfield chemicals market with tremendous opportunities due to its complex underwater operations. Marine environments present extreme environmental challenges that necessitate chemical solutions with reliable performance in extreme conditions. High-performing chemicals play an integral part in stimulating ecosystem health, preventing scale build-up, and providing corrosion protection. Operators rely on advanced formulations for deepwater projects to enhance safety, boost drilling efficiency, and cut maintenance costs. With exploration and production taking place offshore regions like remote Africa or Alaska, demand increases exponentially for innovative yet durable chemical products, driving both market growth and further research development within the oilfield chemicals sector.

Trends in the Oilfield Chemicals Market

Rising Use of Eco-friendly Oilfield Chemicals

The growing emphasis on environmentally sustainable solutions is a key trend shaping the global oilfield chemicals market. Manufacturers are increasingly adopting eco-friendly chemicals that are less harmful to the environment, focusing on properties such as low toxicity, reduced flammability, and higher biodegradability. Companies like Nouryon are introducing innovative products like demulsifiers that help separate crude oil with minimal environmental impact. As global governments tighten environmental regulations and promote clean energy, there is a rising demand for greener oilfield chemicals, especially in high-growth markets such as China, India, and Southeast Asia.

Expansion of Shale Oil & Gas Drilling & Production

The expansion of shale oil and gas drilling and production is a driving force behind the oilfield chemicals market. As crude oil output increases and deeper offshore and onshore drilling operations become more common, the demand for specialized chemicals grows. These chemicals enhance key processes like emulsification, thickening, and stabilization. The rise in shale gas extraction technologies and the increasing focus on advanced oilfield chemicals provide opportunities for market expansion. This trend is particularly evident in regions with booming exploration and production activities, including the U.S., China, and Brazil, driving market growth through 2030.

Oilfield Chemicals Market: Research Scope and Analysis

By Product

Rheology modifiers are projected to lead the global oilfield chemicals market with the highest revenue share of 26.5% by the end of 2025 due to their critical role in optimizing drilling fluid performance. They provide crucial changes by altering oil well rheological properties by controlling viscosity, yield stress, and relaxation time. MFC can stabilize fluids at lower shear rates than alternatives like xanthan gum and makes pumping simpler than with those materials. MFC can also be used to transport small particles beneath reservoir surfaces in fracturing liquid, helping the particles flow in water while remaining suspended.

Their adaptability to harsh conditions and eco-friendliness as a natural polymer further push their adoption in global projects, improving operational safety and effectiveness while contributing to operational efficiencies and effectiveness across oilfield operations.

Inhibitors are anticipated to claim second place due to their pivotal role in preventing corrosion and scale formation during oilfield operations, prolonging equipment lifespan while increasing process efficiencies, and guaranteeing operational reliability in harsh conditions. Furthermore, their proven effectiveness as maintenance strategies drives market adoption rapidly.

By Location

The onshore location also stands to dominate the Oilfield Chemicals Market with the highest share of 67.2% of revenue towards the end of 2025 due to significant advancements in terms of technology and improved methods of oil recovery, transforming onshore exploration. The growth in demand for oil products has also fostered exploration efforts, notably in developing economies. In Brazil, for instance, private operators such as Petro Reconcavo and Eneva's forays into acquiring onshore oil fields from state-owned operators have led to expected growth in onshore output. Onshore fields also boast more convenient infrastructure and fewer logistic headaches compared with offshore and, therefore, are a more appealing alternative for investment.

Offshore locations are anticipated to be the second dominating segment due to the process complexity of offshore environments. The regions require chemicals for the oilfield to treat the challenge of corrosion, buildup of hydrates, and stability of infrastructure, and this enhances demand in the segment.

By Application

Drilling is expected to be the leader of the Oilfield Chemicals market with the highest percentage of revenue towards the end of 2025, with heavy reliance on specialty chemicals for optimal performance, removal of the cut, stability of the wellbore, and protection of the machinery. The drilling industry is expected to dominate the industry of oilfield chemicals because drilling requires performance-driven additives for the viscosity of the fluid, prevention of corrosion, and emulsification. Expansion of global exploration, particularly in harsh environments, generates demand for novel chemicals for reducing risk and optimizing drilling performance.

The growth of exploration and the movement towards alternative sources also demand the use of novel chemicals, and this boosts growth and investment in drilling processes around the world. This stringent demand triggers innovations and capital investment.

Workover & Completion operations are key for maximizing reservoir performance and extending wells' lives. The industry depends on chemicals for optimal stimulation, scale inhibition, and liquid recovery in this field. The need for chemicals for maintaining and optimizing wells enhances the use of chemicals in workover and completion processes.

The Oilfield Chemicals Market Report is segmented based on the following

By Product

- Rheology Modifiers

- Inhibitors

- Demulsifiers

- Friction Reducers

- Biocides

- Surfactants

- Other Products

By Location

By Application

- Drilling

- Workover & Completion

- Production

- Cementing

Regional Analysis

Region with the largest Share

North America is predicted to dominate the Oilfield Chemicals Market with a revenue

share of 43.1% by the end of 2025 due to its strong energy sector, robust infrastructure, and advanced technological capabilities. The region’s longstanding oil and gas industry supports extensive exploration and production activities, which drive demand for specialized chemicals used in drilling, stimulation, and enhanced oil recovery.

Significant investments in research and development have led to innovative, high-performance chemical formulations designed to optimize extraction efficiency and meet stringent environmental and safety regulations. Moreover, the presence of leading multinational corporations and strong partnerships with academic institutions fosters continuous improvement and the adoption of cutting-edge solutions. Regulatory frameworks in North America further stimulate the development of eco-friendly chemicals, ensuring sustainable operations in challenging extraction environments.

Region with Highest CAGR

Asia Pacific’s anticipated highest CAGR stems from rapid industrialization, increasing energy demand, and substantial investments in oil and gas exploration. A growing emphasis on efficient resource extraction and evolving regulatory landscapes drives continuous innovation in oilfield chemicals.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global oilfield chemicals market remains highly competitive, driven by fluctuating oil prices, technological advancements, and evolving environmental regulations. Major players are investing in research and development to create more efficient and eco-friendly products while responding to dynamic market conditions. In this landscape, multinational corporations and emerging regional players vie for market share through strategic mergers, acquisitions, and partnerships. The competitive strategies employed by leading firms focus on innovation, product differentiation, and cost optimization, fostering an environment of constant evolution and specialization.

Some of the prominent players in the Global Oilfield Chemicals are

- Nouryon

- BASF SE

- SMC Global

- Baker Hughes

- Halliburton

- The Lubrizol Corporation

- Aquapharm Chemical Pvt. Ltd.

- Clariant

- Solvay S.A.

- Thermax Chemical Division

- Other Key Players

Recent Developments

- In November 2024, with a business valuation of more than US$80 billion, the Abu Dhabi National Oil Company (ADNOC) announced the establishment of XRG, a revolutionary global lower-carbon energy and chemicals investment firm, after the Board's strategic endorsement.

- In October 2024, Kuwait, a member of OPEC, intends to release bids for the construction of an oilfield. Four international companies will be invited to submit bids for the Mutraba field when the Kuwait Petroleum Corporation (KPC) issues tenders soon.

- In June 2023, the U.S.-based firm NexTier Oilfield Solutions and Patterson-UTI announced the decision to merge in an all-stock deal. The resultant firm from this merger became the second-largest oilfield services company in North America, with a market value of USD 5.40 billion in 2023.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 30.1 Bn |

| Forecast Value (2034) |

USD 40.4 Bn |

| CAGR (2025-2034) |

3.3% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 10.6 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Rheology Modifiers, Inhibitors, Demulsifiers, Friction Reducers, Biocides, Surfactants, and Other Products), By Location (Onshore, and Offshore), By Application (Drilling, Workover & Completion, Production, and Cementing) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Nouryon, BASF SE, SMC Global, Baker Hughes, Halliburton, The Lubrizol Corporation, Aquapharm Chemical Pvt. Ltd., Clariant, Solvay S.A., Thermax Chemical Divisio, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |