Market Overview

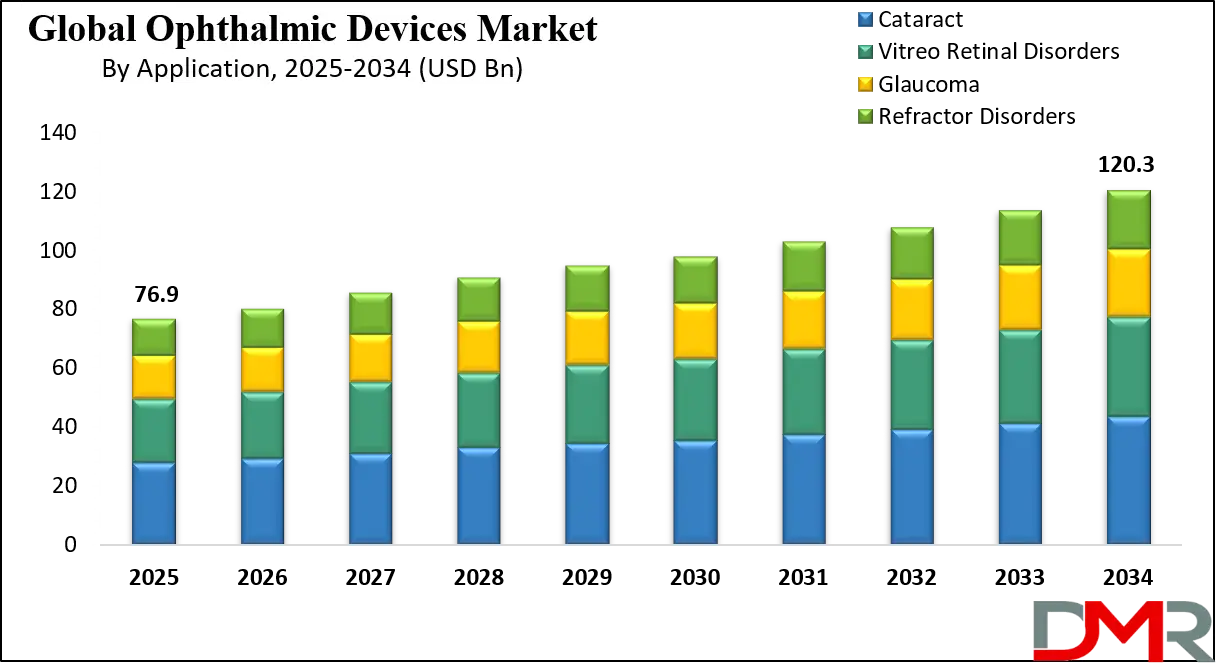

The Global Ophthalmic Devices Market is projected to reach USD 76.9 billion by 2025 and is expected to expand at a steady CAGR of 5.1%, ultimately attaining a market value of USD 120.3 billion by 2034.

Ophthalmic devices are medical devices specifically designed for the diagnosis and treatment of eye disorders, and the global ophthalmic devices market includes its wide assortment of products to diagnose, treat, and observe various eye diseases. The tendencies described in the current literature show that there is a rising rate of cataracts, glaucoma, and retinal diseases, and technology.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Such a scenario has been on the rise thanks to the existing improvement in eye care inventions. The main trends in this market are concentrated on the higher popularity of minimally invasive surgical designs, devices, and AI diagnosis tools to extend a helping hand in the sphere of eye treatment. Services with higher accuracy and speed lead to the growth of the market and its expansion. The world population is gradually rising, with an aging population for whom treatment is often a concern. Indication of eye diseases, when diabetes is viewed as a demographic and has also been on the rise, has created a need for ophthalmic devices as well.

Diagnostic and besides, monitoring devices, surgical instruments, and vision care products are all encompassed. Below this type of product, they also employed various strategies for this category of products. OCT scanners and such are diagnostic structures that can be utilized by patients at home. Fundus cameras’ popularity is attributed to the early detection that comes with the models. It also consists of management tools related to several diseases and is more expensive in terms of cost. Bausch Health Companies and Ziemer Ophthalmic Systems AG mainly focus on research and development to be able to provide the latest technology in ophthalmic equipment that maintains their top spot.

The global ophthalmic devices market is expanding steadily due to the growing prevalence of vision disorders such as cataracts, glaucoma, age-related macular degeneration (AMD), and diabetic retinopathy. Increasing geriatric populations worldwide are a major driver, as older adults face a higher risk of eye diseases. Advancements in diagnostic imaging, laser systems, intraocular lenses, and minimally invasive surgical instruments are enhancing clinical efficiency and patient outcomes.

Trends such as AI-assisted screening, teleophthalmology platforms, and smart contact lenses are reshaping eye care delivery. Opportunities lie in expanding access to affordable devices in emerging markets, particularly in the Asia-Pacific and Latin America, where healthcare infrastructure is improving. Furthermore, rising awareness about preventive eye care through public health campaigns boosts demand for screening equipment and home-based vision monitoring tools.

However, high costs of advanced devices and surgical procedures, coupled with reimbursement limitations in some regions, act as restraints. Shortages of trained ophthalmic professionals in rural and underserved areas also hinder timely access to care. The industry is witnessing strong growth prospects from increasing investment in research and development of next-generation solutions like femtosecond lasers, foldable IOLs, and AI-driven diagnostic tools.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Companies are also focusing on integrating digital health systems for remote diagnosis and patient engagement. With increasing rates of myopia among younger populations and rising screen time driving ocular strain, the ophthalmic devices market is expected to maintain a healthy growth trajectory through technological innovation, demographic shifts, and global health initiatives focused on preventing avoidable blindness.

The US Ophthalmic Devices Market

The US Ophthalmic Devices market is projected to be valued at USD 25.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 38.6 billion in 2034 at a CAGR of 4.8%.

The United States ophthalmic devices market benefits from a strong healthcare infrastructure, high adoption of advanced technology, and a large patient base. According to the U.S. Centers for Disease Control and Prevention (CDC), approximately 12 million Americans aged 40 years and older experience vision impairment, including 1 million who are blind.

The aging U.S. population, with the U.S. Census Bureau projecting that nearly 80 million Americans will be aged 65 and older by 2040, creates sustained demand for cataract surgery equipment, glaucoma monitoring devices, and diagnostic imaging systems. The U.S. Food and Drug Administration (FDA) supports innovation through regulatory pathways for ophthalmic implants, lasers, and digital health integrations, accelerating new product introductions.

Federal health programs like Medicare and Medicaid play a pivotal role in ensuring accessibility for older adults and low-income patients. Initiatives from the National Eye Institute (NEI) focus on preventing and treating eye diseases, driving adoption of early-detection technologies. Increasing myopia among children and the surge in screen-related digital eye strain are spurring demand for corrective lenses, refractive surgery systems, and vision therapy tools. With a robust ecosystem of research institutions, device manufacturers, and specialty clinics, the U.S. market remains a hub for innovation and clinical advancements.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Europe Ophthalmic Devices Market

The Europe Ophthalmic Devices Market is estimated to be valued at USD 11.5 billion in 2025 and is further anticipated to reach USD 17.8 billion by 2034 at a CAGR of 5.0%.

Europe’s ophthalmic devices market is supported by strong public health systems, early adoption of surgical technologies, and a growing elderly population. According to Eurostat, over 21% of the EU population was aged 65 and over in 2023, a demographic highly prone to cataracts, presbyopia, and glaucoma. Countries like Germany, France, and the UK have well-established reimbursement policies that facilitate access to advanced intraocular lenses, optical coherence tomography (OCT) devices, and laser surgery systems.

The European Society of Cataract and Refractive Surgeons (ESCRS) and similar bodies actively promote clinical training and standardization, ensuring high-quality care. Public health campaigns across the EU emphasize regular eye screenings, particularly for diabetes patients at risk of retinopathy. Technological integration, such as AI-assisted diagnostics and cloud-based image sharing, is becoming more prevalent, enabling cross-border teleophthalmology services.

The increasing prevalence of myopia in younger populations, as reported by the World Health Organization’s European office, is driving demand for preventive and corrective devices. Additionally, sustainability trends are influencing device design, encouraging the use of reusable surgical tools and eco-friendly manufacturing practices. Government-backed innovation funding, combined with a mature medical device regulatory framework (MDR), positions Europe as a significant and progressive market for ophthalmic technologies.

The Japan Ophthalmic Devices Market

The Japan Ophthalmic Devices Market is projected to be valued at USD 4.6 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 6.5 billion in 2034 at a CAGR of 4.0%.

Japan’s ophthalmic devices market is driven by a rapidly aging society, advanced healthcare infrastructure, and high public awareness of eye health. According to the Statistics Bureau of Japan, nearly 30% of the population is aged 65 and above, contributing to high demand for cataract surgery devices, glaucoma monitoring equipment, and refractive correction technologies. Japan has one of the highest rates of myopia globally, with studies from the Ministry of Health, Labour and Welfare highlighting a sharp rise in childhood and teenage myopia linked to increased near-work activities and digital device usage.

The country’s universal health insurance system ensures access to essential ophthalmic procedures and diagnostic equipment for a broad population base. Japanese companies are at the forefront of innovation, particularly in miniaturized surgical instruments, AI-powered retinal imaging, and advanced contact lens technologies.

Government initiatives, such as the “Health Japan 21” program, include vision health promotion as part of broader preventive healthcare strategies. Collaborations between academic institutions and industry players foster continuous R&D, while an emphasis on precision, safety, and long product lifecycles aligns with the market’s high-quality standards. With an aging population and rising lifestyle-related eye disorders, Japan is expected to remain a leader in ophthalmic technology adoption and innovation.

Key Takeaways

- Market Value: The Global Ophthalmic Devices Market size is estimated to have a value of USD 76.9 billion in 2025, which is further expected to reach USD 120.3 billion in 2034.

- Global Growth Rate: The market is growing at a CAGR of 5.1 percent over the forecasted period.

- The US Market Value: The US Ophthalmic Devices market is projected to be valued at USD 38.6 billion in 2034 from a base value of USD 25.4 billion in 2025 at a CAGR of 4.8%.

- By Product Segment Insights: Diagnostic and monitoring devices are projected to dominate the global ophthalmology market as they hold 43.7% of the market share in 2025.

- By Application Segment Insights: Cataracts are anticipated to dominate the application segment as they hold 36.0% of the market share in 2025.

- Regional Analysis: North America is expected to have the largest market share in the global ophthalmic devices Market with a share of about 39.2% in 2025.

Use Cases

- Cataract Surgery: Utilizing cutting-edge intraocular lenses (IOLs) and phacoemulsification equipment, cataract surgery can safely and efficiently improve vision while shortening recovery times for patients.

- Glaucoma Management: Utilizing tonometers and optical coherence tomography (OCT) scanners to monitor intraocular pressure and optic nerve health in allowing real-time early intervention and the prevention of vision loss.

- Refractive Surgery: Refractive surgery utilizes excimer and femtosecond lasers to correct refractive errors such as myopia, hyperopia, and astigmatism - providing patients with an alternative solution to wearing glasses or contact lenses.

- Diabetic Retinopathy Screening: Employing fundus cameras and retinal imaging systems, this screening can detect early symptoms of diabetic retinopathy to provide timely treatment and avoid severe vision impairment.

Global Ophthalmic Devices Market: Stats & Facts

World Health Organization (WHO)

- At least 2.2 billion people globally have near or distance vision impairment.

- Of those, about 1 billion have vision impairment that could have been prevented or is yet to be addressed.

- The leading global causes of vision impairment are uncorrected refractive errors and cataract.

- Cataract accounts for a very large share of treatable vision impairment; an estimated 94 million people aged 50+ have moderate-to-severe vision impairment from cataract.

- Presbyopia (difficulty with near vision) affects roughly 826 million people worldwide.

- Vision impairment disproportionately affects older adults: a large majority of people with blindness or moderate–severe vision impairment are over age 50.

International Agency for the Prevention of Blindness (IAPB) / Vision Atlas

- Approximately 1.1 billion people live with sight loss of some degree.

- Annual global productivity losses due to sight loss are estimated at roughly US$410–411 billion.

- The IAPB notes that roughly 90% of sight loss is preventable or treatable if services are accessible.

U.S. National Eye Institute (NEI) / National Institutes of Health

- An estimated 1.3 million Americans are blind (visual acuity ≤20/200); projections indicate blindness could reach ~2.2 million by 2030 if trends continue.

- Approximately 2.9 million Americans have low vision (<20/40); projections indicate low vision may rise to ~5 million by 2030.

- Age-related macular degeneration, cataract, diabetic retinopathy, and glaucoma together account for the largest share of vision loss in the U.S.

- NEI estimates the economic burden (direct and indirect costs) of vision disorders in the U.S. is on the order of hundreds of billions of dollars annually.

U.S. Centers for Disease Control and Prevention (CDC)

- About 7 million people in the United States have vision impairment, including roughly 1 million who are blind.

- As of past national estimates, 4.2 million Americans aged 40+ have uncorrectable vision impairment; that figure is projected to more than double by 2050 due to population ageing and chronic disease trends.

- A large survey found ~93 million U.S. adults (≈4 in 10) were at high risk for vision loss; among those, a substantial share did not receive an eye exam in the previous year.

American Academy of Ophthalmology (AAO) / IRIS Registry

- The AAO’s IRIS clinical registry aggregates data from a very large portion of U.S. ophthalmology practices — tens of millions of patients and hundreds of millions of encounters (registry sample sizes have exceeded 50 million patients in recent years).

- Cataract surgery is among the most common surgical procedures in the U.S.; multi-million cataract extractions are performed annually (commonly quoted figures in governmental/clinical literature are in the 2–4 million per year range).

- The IRIS registry data are widely used to monitor outcomes, device performance, and real-world practice patterns across ophthalmology.

Eurostat / European data sources

- In the European Union, over one-fifth (≈21–22%) of the population is aged 65 or older, a demographic group with much higher rates of eye disease and surgery.

- In many EU countries, cataract surgery rates exceed 1,000 procedures per 100,000 population (several EU members report very high per-capita cataract surgical rates).

Organisation for Economic Co-operation and Development (OECD)

- In around three-quarters of OECD countries with data, 90% or more of cataract surgeries are performed as ambulatory (day-case) procedures.

- The OECD reports substantial cross-country variation in cataract surgery volumes and waiting times; some countries report very high per-capita cataract surgery rates while others remain far lower, reflecting system capacity differences.

National Health Service (NHS England) / Royal College of Ophthalmologists (UK)

- England conducts over 400,000 cataract procedures per year, making cataract surgery one of the most frequent operations in NHS practice.

- Cataract surgery represents a substantial share of elective surgical workload (for example, several percent of total surgical activity), and rates have risen significantly over recent years in many areas.

Japan: Ministry of Health, Labour and Welfare (MHLW) / national statistics

- Japan is an advanced-age society: official statistics show a very large share of the population is aged 65+ (roughly about 30% in recent years), driving high demand for age-related ophthalmic care such as cataract and glaucoma treatment.

- National health policy documents and health statistics emphasize eye health in elderly care and project continued growth in demand for ophthalmic surgeries and diagnostic services as the population ages.

United Nations / World Bank

- UN population projections indicate the number of people aged 65+ worldwide is rising rapidly (the global 65+ population is projected to more than double over the coming decades), a major structural driver of future eye-care service demand.

- World Bank / UN demographic databases report growing shares of older adults across most regions, implying rising prevalence of age-related ocular conditions and greater need for ophthalmic devices and surgery.

Market Dynamic

Trends in Global Ophthalmic Devices Market

Incorporation of AI into Diagnostics

Artificial intelligence has transformed eye diagnosis. Tools have been created to aid ophthalmologists in early and accurate diagnoses of diseases, including diabetic retinopathy and macular degeneration. AI systems can process large volumes of data quickly and proficiently, allowing ophthalmologists to make better diagnoses earlier than before, while individual patient treatment programs are designed using these systems, thus providing patients with superior patient care.

Increase in Minimally Invasive Surgeries

Ophthalmic practices around the world have increasingly adopted minimally invasive surgeries as part of their practice strategies, particularly laser cataract surgery and MIGS procedures, which are minimally invasive, require shorter recovery times, cause less trauma to patients' bodies, and ultimately provide greater comfort to them. Such growth drivers include laser cataract surgery and MIGS.

Growth Drivers in Global Ophthalmic Devices Market

Aging Population

An ever-increasing aging population worldwide is driving the global ophthalmic devices market forward. The elderly are more likely to develop age-related eye diseases such as cataracts, glaucoma, and macular degeneration - risk factors that translate to greater demand for diagnostic and surgical instruments from an ophthalmologist - such as cataract surgery, glaucoma treatment, or macular degeneration treatments; consequently resulting in higher demand for eye diagnostic and surgical instruments as a shift in demographics means higher needs for diagnostic and surgical instruments as demand from older individuals looking to preserve their sight while living an enhanced quality of life.

Increased Incidence of Diabetes

A significant factor fueling the expansion of the ophthalmic devices market is an increasing global incidence of diabetes, which is on an upward trend globally. Diabetes is widely acknowledged to contribute to various eye diseases, including diabetic retinopathy, cataracts, and glaucoma - thus necessitating more eye checkups and treatment to ensure disordered pathologies don't develop further; high-tech equipment like fundus cameras and OCT scanners must also be included when testing these diseases for proper examination.

Growth Opportunities in Global Ophthalmic Devices Market

Emerging Markets

Emerging markets in regions such as Asia-Pacific, Latin America, and the Middle East present significant growth opportunities for the ophthalmic devices market. These regions are experiencing improvements in healthcare infrastructure, increased healthcare spending, and a growing awareness of eye health. Companies are expanding their presence in these markets to capitalize on the rising demand for ophthalmic devices. Additionally, governments in these regions are implementing initiatives to improve access to eye care services, further driving market growth.

Technological Advancements

Continuous technological developments in ophthalmic devices create substantial growth opportunities. Technologies like optical coherence tomography (OCT) angiography, AI-powered diagnostic systems, and advanced surgical lasers are expanding eye care professionals' abilities by offering more precise diagnoses, better surgical outcomes, and enhanced patient care services. Companies investing in R&D for such advanced technologies stand to capture market share and drive industry development.

Restraints in Global Ophthalmic Devices Market

High Cost of Advanced Devices

The high costs associated with advanced ophthalmic devices are an obstacle in developing regions. Many patients and healthcare providers struggle to afford them, which in turn limits adoption. Such costs can impede market expansion, especially where budgets for healthcare services are stretched thin, necessitating cost-efficient innovations and affordable pricing strategies to address this barrier to growth. Companies must prioritize cost-cutting innovations over high prices to effectively face this obstacle and overcome this challenge.

Stringent Regulatory Requirements

The ophthalmic devices market is subject to rigorous regulatory requirements and approval processes, making navigating them both time-consuming and costly for manufacturers. Authorities such as the FDA in the United States and the EMA in Europe impose stringent standards of safety and efficacy, which can delay product launches while increasing development costs significantly. Compliance with such regulations is necessary to gain market access; however, compliance can present many difficulties for smaller firms with limited resources.

Research Scope and Analysis

By Product Analysis

Diagnostic and monitoring devices are projected to dominate the global ophthalmology market as they hold 43.7% of the market share in 2025. Diagnostic and monitoring devices are important in the global ophthalmic devices market because of their critical use in the early diagnosis and management of eye disease. These devices include OCT scanners, fundus cameras, and ophthalmic ultrasound imaging systems, and are critical for the proper diagnosis and monitoring of glaucoma, cataracts, and retinal disorders.

The increasing incidence of eye diseases and the rising awareness regarding the need for early diagnosis are some of the factors projected to boost the overall demand for these devices. Advanced diagnostic tools enable them to catch the disease at its first stage, leading to timely intervention and better patient outcomes. For instance, OCT scanners are used to provide the imaging of the retina in high resolution, with which any subtle changes could be identified, which may reflect the onset of diseases like macular degeneration and diabetic retinopathy.

In addition, advancements in technology toward advanced diagnostic devices that are user-friendly push up the demand for these devices. Artificial intelligence integrated into diagnostic tools provides more accurate and efficient ophthalmic practice, hence making the practice next to indispensable in modern practice. Leading market players are aimed at constant innovation and hence stay at the top in competitiveness, which drives the market for diagnostic and monitoring devices.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Application Analysis

Cataracts are anticipated to dominate the application segment as they hold 36.0% of the market share in 2025. The cataracts application segment occupies a strong majority of the global ophthalmic devices market because this disease is highly prevalent, particularly among the elderly population. Cataracts are the most common cause of vision loss and are associated with blindness worldwide. Their incidence is increasing owing to an increase in the world population's median age. This major demographic shift has driven massive demand for cataract surgery devices, including intraocular lenses, ophthalmic viscoelastic devices, and phacoemulsification devices.

Further, in cataracts, technological advances have helped surgical techniques and technologies innovate towards higher efficiency and greater access for the general populace. Technological advancements in surgery, including the work of a femtosecond laser in cataract surgery, along with premium intraocular lenses to correct a spectrum of vision problems other than cataracts, have been important determinants in improving surgical results and patient satisfaction. Apart from technology, other demographic factors also acted as a catalyst in soaring the prevalence of cataract surgeries, which continue to head the ophthalmic devices market.

Furthermore, the cataract operation procedure has to be a recognized procedure in ophthalmology, and that is the reason it also has a high acceptance and demand level. Other than this, governments and health organizations around the globe have also started a range of programs to reduce the burden of blindness induced by cataracts, in return making cataract surgery services more accessible to the population. This focus on the curative procedures for treating cataracts makes a share of cataract-based ophthalmic devices in an overall more significant segment of ophthalmic devices and helps in driving growth continuously.

By End User Analysis

From the point of view of end-users, hospitals and eye clinics are poised to define the central role in the global ophthalmic devices market and, as such, serve the purpose of providing total eye care services. Furnished with the latest diagnostic and surgical equipment, these facilities provide patients with different services: from common eye checkups to highly sophisticated surgery. The presence of specialized ophthalmologists coupled with advanced technology is resulting in an increased influx of patients toward hospitals and eye clinics for getting specialized eye care.

The rising prevalence of eye disorders, including cataracts, glaucoma, and retinal diseases, is pulling more and more patients toward treatment at eye establishments across the world. Hospitals and eye clinics are mostly the first to conduct check-ups for patients who visit with vision problems and are also the first places other patients go to, further driving diagnostic and treatment procedures to these locations. Most importantly, it greatly increases the patient load and demand for ophthalmic devices at both hospitals and eye clinics.

Furthermore, hospitals and other eye clinics have relatively better funding and resourcing bases than research and academic laboratories and have therefore been able to invest in the available on the market as the most advanced technologies of ophthalmology and to update them regularly. The focus on providing a holistic approach to eye care services further cements the ophthalmic devices market for hospitals and eye clinics.

The Ophthalmic Devices Market Report is segmented on the basis of the following:

By Product

- Diagnostic and Monitoring Devices

- Optical Coherence Tomography Scanners

- Ophthalmic Ultrasound Imaging Systems

- Ophthalmic A-Scan Ultrasound

- Ophthalmic B-Scan Ultrasound

- Ophthalmic Ultrasound Biomicroscopes

- Ophthalmic Pachymeters

- Fundus Camera

- Ophthalmoscopes

- Retinoscope

- Wavefront Aberrometer

- Corneal Topography Systems

- Autorefractors And Keratometers

- Phoropters

- Specular Microscope

- Perimeters/Visual Field Analysers

- Tonometers

- Slit Lamps

- Lensmeter

- Optical Biometry Systems

- Chart Projectors

- Surgical Devices

- Cataract Surgery Devices

- Intraocular Lens (IOLs)

- Ophthalmic Viscoelastic Devices (OVDs)

- Phacoemulsification Devices

- Cataract Surgery Lasers

- IOL Injectors

- Vitreoretinal Surgery Devices

- Vitrectomy Machines

- Vitreoretinal Packs

- Photocoagulation Lasers

- Illumination Devices

- Vitrectomy Probes

- Backflush

- Chandelier

- Refractive Surgery Devices

- Excimer Lasers

- Femtosecond Lasers

- Other Lasers

- Glaucoma Surgery Devices

- Glaucoma Drainage Devices (GDDs)

- Microinvasive Glaucoma Surgery Devices

- Glaucoma Laser Systems

- Ophthalmic Microscopes

- Accessories

- Surgical Sets & Instruments

- Tips & Handles

- Scissors

- Forceps

- Spatulas

- Macular Lenses

- Cannulas

- Other Ophthalmic Surgical Accessories

- Vision Care

- Spectacles

- Contact Lenses

By Application

- Cataract

- Vitreo Retinal Disorders

- Glaucoma

- Refractor Disorders

By End-user

- Hospitals & Eye Clinics

- Academic & Research Laboratory

- Others

Impact of Artificial Intelligence in the Global Ophthalmic Devices Market

- Enhanced Diagnostic Accuracy with AI-Based Retinal Imaging: Artificial Intelligence algorithms applied to optical coherence tomography (OCT) and fundus photography are significantly improving diagnostic accuracy for conditions like diabetic retinopathy, age-related macular degeneration, and glaucoma.

- Teleophthalmology and Remote Screening Expansion: AI empowers teleophthalmology platforms by automating image analysis and triage, enabling non-specialists to capture retinal images in remote or underserved areas and receive real-time, AI-based interpretation.

- Streamlined Clinical Workflows and Increased Efficiency: In clinical settings, AI software embedded in diagnostic and surgical systems helps optimize workflows by automating image segmentation, measuring anatomical parameters, and pre-populating reports. This reduces clinician burden, enhances efficiency, and allows deeper focus on complex cases.

- Personalized Treatment Planning and Surgical Guidance: AI systems are increasingly used to analyze patient-specific ocular anatomy and disease characteristics to guide treatment planning—such as selecting the optimal intraocular lens power, predicting outcomes of refractive surgery, or customizing laser ablation profiles.

- Accelerated Innovation and Regulatory Ecosystem Evolution: The rising interest in AI for ophthalmic applications is driving manufacturers to invest heavily in R&D, resulting in a faster pace of innovation. Regulatory bodies (e.g., U.S. FDA, EU MDR) are adapting frameworks to evaluate AI-based software as medical devices, introducing pathways for real-world performance monitoring and iterative updates.

Global Ophthalmic Devices Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to dominate the global ophthalmology market as it holds 39.2% of the market share by the end of 2024. North America holds the largest share of the global ophthalmic devices market because of several factors. High healthcare practices, greater healthcare spending, and well-defined reimbursement systems in the region are other factors that help the growth of the market. Key market players and advances in technologies in ophthalmic devices add to the strength of North America’s position.

A major factor that contributes to the need for ophthalmology in the region is that ophthalmic diseases are among the most rampant. The growing number of people in old age, along with the growing prevalence of primary diseases like diabetes, which is a significant risk for eye ailments, also positively influences the requirement for enhanced diagnostic and surgical tools. There is also an endorsement from North America on frequent eye health checks and early detection, which also creates the market need for such devices.

Moreover, North America is home to numerous research institutions and academic centers dedicated to ophthalmology, driving continuous advancements in ophthalmic technologies. The region's strong focus on research and development results in the frequent introduction of innovative products, enhancing the capabilities of eye care professionals.

The robust presence of key market players, including Bausch Health Companies and Alcon, ensures a steady supply of cutting-edge ophthalmic devices. These companies invest heavily in product development and strategic collaborations, maintaining North America's leadership in the global ophthalmic devices market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with the Highest CAGR

Asia Pacific is expected to register the highest CAGR in the global ophthalmic devices market, driven by rapid urbanization, growing healthcare investments, and an expanding middle-class population. Countries such as China, India, Japan, and South Korea are experiencing a surge in lifestyle-related and age-related eye disorders, including diabetic retinopathy and myopia, creating a substantial need for diagnostic, surgical, and vision correction devices.

Government initiatives to improve access to quality eye care—such as national cataract eradication programs and subsidized screenings—are boosting device adoption. The region is also witnessing a rapid rise in the establishment of advanced eye hospitals and specialty clinics, supported by both public and private funding. Growing medical tourism in countries like Thailand, India, and Malaysia, driven by cost-effective yet advanced ophthalmic surgeries, further accelerates demand.

The integration of AI-powered diagnostic imaging devices and portable ophthalmic tools is particularly significant in rural and underserved areas, where there is a shortage of ophthalmologists. Local manufacturers are increasingly collaborating with global players to produce affordable yet high-performance ophthalmic equipment tailored to regional needs.

Furthermore, rising health awareness, improving insurance penetration, and the growing availability of financing options for elective eye surgeries are increasing the accessibility of advanced treatments. With a large patient base, expanding infrastructure, and increasing technology adoption, the Asia Pacific is positioned to be the fastest-growing region in the ophthalmic devices market over the coming years.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Ophthalmic Devices Market: Competitive Landscape

The ophthalmic devices market around the world is more or less fragmented and very competitive, and several players tend to expand their market share through engagements in the development of new products and business strategies. Alcon, Bausch Health Companies, Carl Zeiss Meditec AG, and Johnson & Johnson Vision Control share a large market while providing sophisticated ophthalmic devices.

Alcon, a division of Novartis, is a market leader that has a versatile range of products in surgical devices, diagnostic Instruments, and vision care products. The company has translated this ethos into the development of innovations, which include AcrySof IQ PanOptix Trifocal IOL and the NGENUITY 3D Visualization System to increase surgical accuracy and the quality of care for patients.

In the same way, Johnson & Johnson Vision has established a corporate strategy of geographical growth and product expansion to serve its consumers even better. Abbott’s buyout of AMO and its link with Google in creating smart contact lenses focused more on the company’s concern in ophthalmic innovation.

These leading players remain involved in research and development activities, mergers and acquisitions, and strategic alliances to sustain their competitiveness and also to cope with the increasing demand for well-developed ophthalmic devices.

Some of the prominent players in the Global Ophthalmic Devices Market are:

- Johnson & Johnson Vision

- Alcon Inc.

- Bausch + Lomb

- Carl Zeiss Meditec AG

- EssilorLuxottica

- Topcon Corporation

- NIDEK Co., Ltd.

- HOYA Corporation

- STAAR Surgical Company

- Canon Medical Systems Corporation

- Santen Pharmaceutical Co., Ltd.

- Shire PLC (part of Takeda)

- Glaukos Corporation

- NovaBay Pharmaceuticals

- Optovue, Inc.

- Quantel Medical

- Lumenis Ltd.

- Ellex Medical Lasers

- ViewRay, Inc.

- Iridex Corporation

- Other Key Players

Recent Developments

- July 2025: Johnson & Johnson Vision expanded its intraocular lens manufacturing facility in Florida to increase production capacity, addressing rising global demand for cataract surgery solutions and supporting faster delivery of advanced implants to healthcare providers and patients worldwide.

- June 2025: Alcon launched an upgraded Argos biometer in the U.S., enhancing measurement accuracy for cataract surgery preoperative planning. The improved device helps surgeons achieve better visual outcomes by providing precise biometric data, thereby optimizing intraocular lens selection.

- May 2025: Bausch + Lomb partnered with a leading artificial intelligence healthcare firm to integrate AI-powered diagnostic tools into retinal disease screening programs. This collaboration aims to improve early detection rates of diabetic retinopathy and other retinal disorders globally.

- March 2025: Carl Zeiss Meditec unveiled a new OCT angiography platform at a prominent ophthalmology conference, offering faster imaging and higher resolution for detailed retinal vasculature visualization, aiding clinicians in diagnosing and monitoring vascular eye diseases more effectively.

- January 2025: Topcon Healthcare acquired a diagnostic imaging software company to bolster its tele-ophthalmology offerings, enabling remote screening and consultation services. This move supports expanding access to quality eye care, especially in underserved and rural regions worldwide.

- October 2024: HOYA Vision Care introduced a myopia management spectacle lens in Europe, targeting pediatric populations. The lens aims to slow the progression of myopia in children, addressing a growing public health concern linked to increased screen time and lifestyle changes.

- September 2024: EssilorLuxottica invested in augmented reality-powered vision testing tools to enhance its optical retail technology portfolio, offering consumers innovative, immersive eye exams that provide precise prescriptions and improved patient engagement in eyecare retail environments.

- July 2024: NIDEK Co., Ltd. launched a high-speed optical coherence tomography (OCT) device designed for early glaucoma detection. This advanced imaging system accelerates diagnosis and aids ophthalmologists in timely intervention, helping prevent irreversible vision loss.

- May 2024: Canon Medical Systems released a fully digital fundus camera at a major vision expo, offering enhanced image quality and a user-friendly interface. The device supports efficient retinal screening, especially for diabetic patients, facilitating better disease management and follow-up.

- March 2024: STAAR Surgical received regulatory approval for its EVO Visian implantable collamer lens (ICL) designed for presbyopia correction in several Asian markets. This milestone expands access to advanced refractive solutions in fast-growing regions with increasing vision correction needs.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 13.0 Bn |

| Forecast Value (2034) |

USD 25.7 Bn |

| CAGR (2025–2034) |

8.3% |

| The US Market Size (2025) |

USD 4.2 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Hardware, Software, Services), By ACaaS Deployment (Hosted, Managed, Hybrid), By Authentication Method (Single-Factor, Multi-Factor, Mobile Credential/Bluetooth LE), By Connectivity Technology (RFID/NFC, Smart Cards, Bluetooth Low Energy, Ultra-Wideband), By Technology (Authentication Systems, Detection Systems, Alarm Panels, Communication Devices, Perimeter Security Systems), By End-Use Vertical (Commercial Buildings, Industrial & Manufacturing, Government & Public Sector, Military & Defense, Transport & Logistics, Healthcare, Residential & Smart Homes, Education & Research, Energy & Utilities, Hospitality & Entertainment, Retail & Customer-Facing, Financial Institutions, Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

ASSA ABLOY, dormakaba Group, Johnson Controls, Allegion plc, Honeywell International, Identiv Inc., Nedap N.V., Suprema Inc., Bosch Security Systems, Thales Group, AMAG Technology, Axis Communications, NEC Corporation, Gallagher Group, Brivo Systems, SALTO Systems, Genetec Inc., HID Global, Siemens, Cansec Systems., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Ophthalmic Devices Market?

▾ The Global Ophthalmic Devices Market size is estimated to have a value of USD 76.9 billion in 2025 and is expected to reach USD 120.3 billion by the end of 2034.

What is the size of the US Ophthalmic Devices Market?

▾ The US Ophthalmic Devices market is projected to be valued at USD 25.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 38.6 billion in 2034 at a CAGR of 4.8%.

Which region accounted for the largest Global Ophthalmic Devices Market?

▾ North America is expected to have the largest market share in the Global Ophthalmic Devices Market with a share of about 39.2% in 2025.

Who are the key players in the Global Ophthalmic Devices Market?

▾ Some of the major key players in the Global Ophthalmic Devices Market are Alcon Vision LLC, Essilor International S.A., Johnson & Johnson Vision Care, Carl Zeiss Meditec AG, Bausch & Lomb Incorporated, and many others.

What is the growth rate in the Global Ophthalmic Devices Market?

▾ The market is growing at a CAGR of 5.1 percent over the forecasted period.