Market Overview

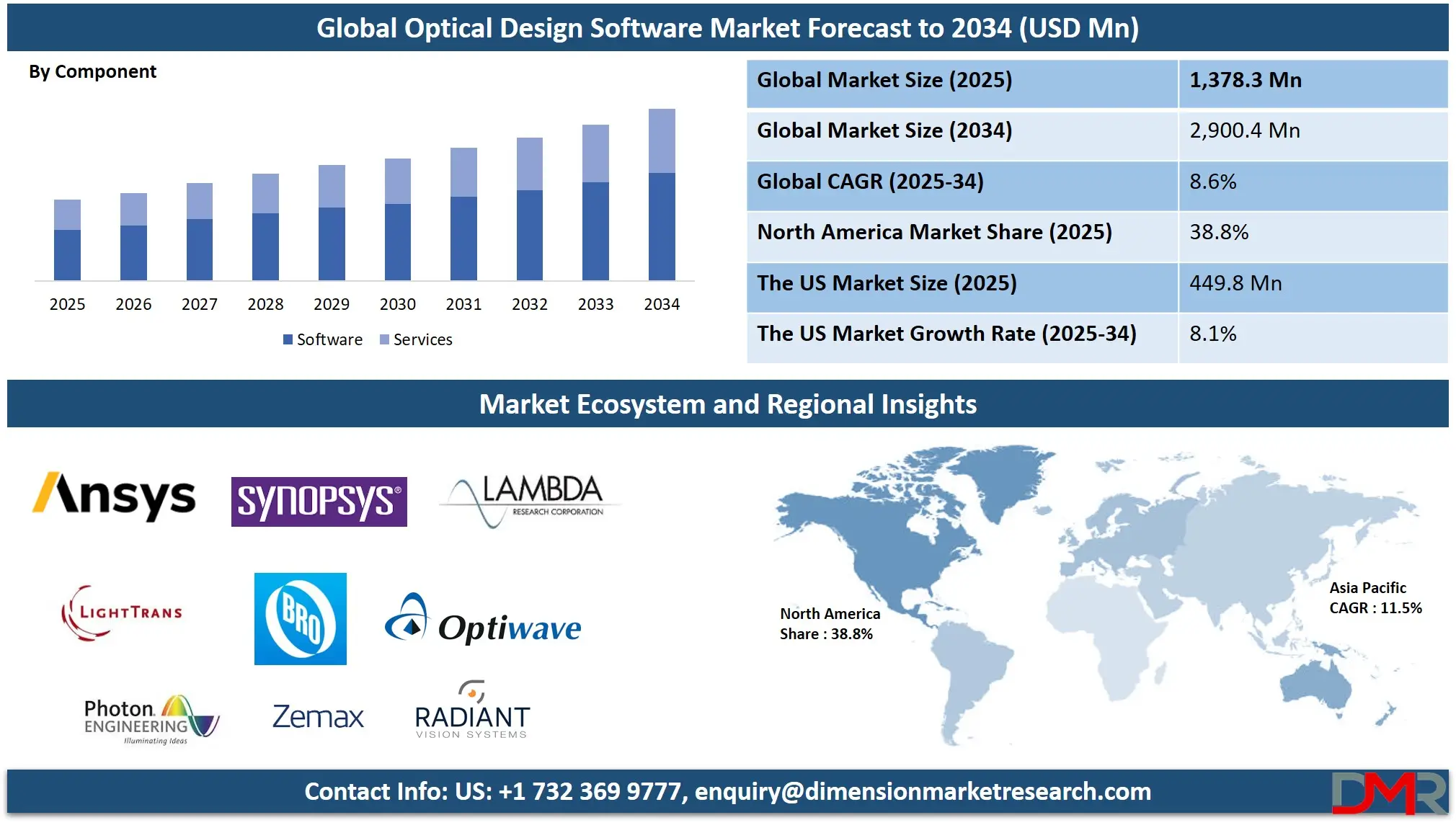

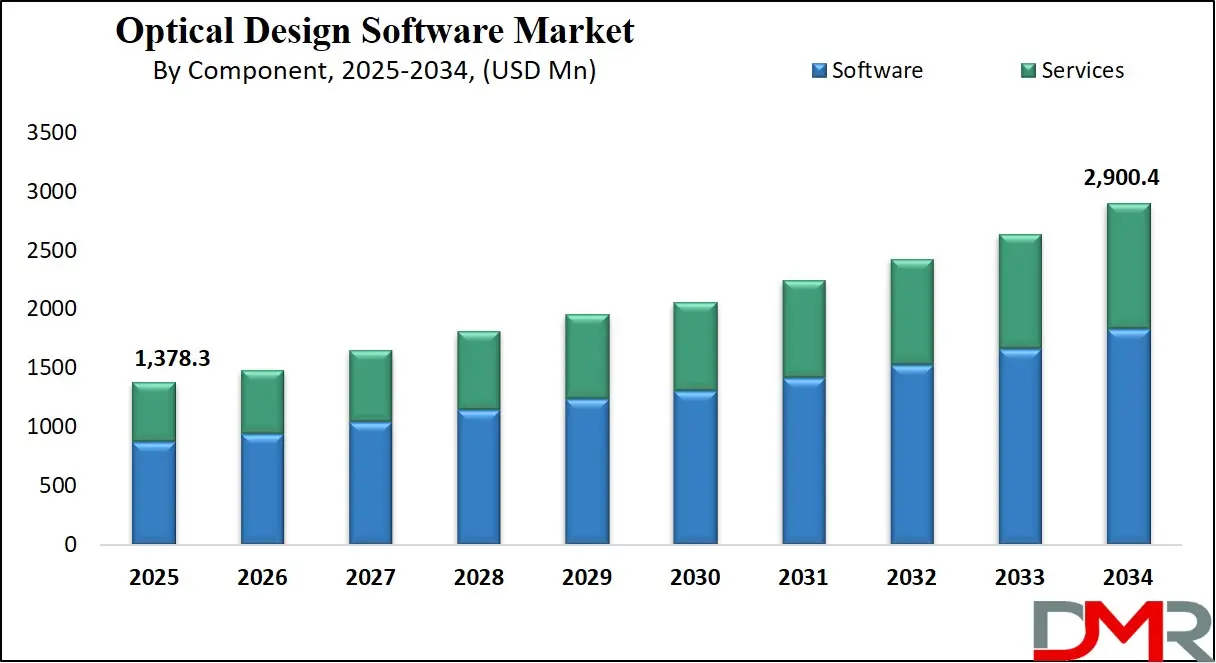

The Global Optical Design Software Market is predicted to be valued at USD 1,378.3 million in 2025 and is expected to grow to USD 2,900.4 million by 2034, registering a compound annual growth rate (CAGR) of 8.6% from 2025 to 2034.

Optical Design Software is specialized computer-aided design (CAD) software used to model, simulate, and optimize optical systems such as lenses, lasers, fiber optics, and imaging devices. It enables engineers and designers to analyze the behavior of light as it passes through different optical components, helping them to create efficient, high-performance systems. The software supports ray tracing, wavefront analysis, tolerance evaluation, and illumination design. It is widely used in industries such as consumer electronics, automotive, aerospace, healthcare, and telecommunications to develop products like cameras, sensors, optical instruments, and photonic devices with precision and efficiency.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global optical design software market is experiencing robust growth driven by increasing demand for precision optics in various high-tech industries. This software plays a critical role in designing complex optical systems, including imaging lenses, laser components, and fiber optics, by simulating light behavior and optimizing performance. Companies across sectors rely on these advanced tools to reduce prototyping costs and accelerate time-to-market.

As consumer electronics evolve, especially with innovations in AR/VR, smartphones, and cameras, the demand for sophisticated optical system design is rising. Optical design software enables engineers to perform ray tracing, tolerance analysis, and illumination modeling, which are crucial for developing compact and high-efficiency devices with superior image quality and reliability.

In the automotive and aerospace sectors, the software is widely used for developing advanced driver-assistance systems (ADAS), lidar technologies, and aviation sensors. The integration of optical components in smart vehicles and aircraft systems requires precise modeling and simulation, making optical design software indispensable for innovation in these industries.

Additionally, healthcare applications such as surgical optics, endoscopy, and diagnostic imaging are further fueling adoption.Technological advancements like artificial intelligence, cloud-based platforms, and real-time simulation capabilities are transforming the optical design software landscape. Companies are focusing on integrating AI algorithms to automate complex design processes, enhance optical system accuracy, and improve performance.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Furthermore, the rise in photonics, quantum computing, and 5G infrastructure is contributing to the growing need for efficient optical engineering software that ensures high-speed communication and precision in light-based technologies across numerous industrial applications.

The US Optical Design Software Market

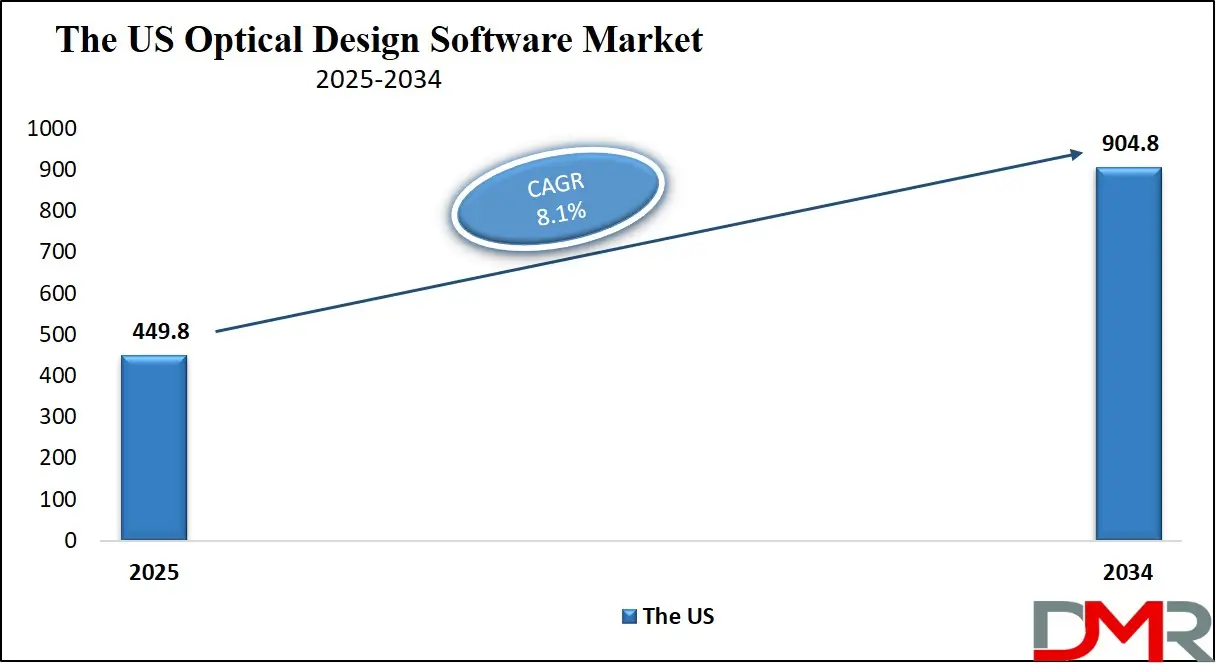

The US Optical Design Software Market is projected to be valued at USD 449.8 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 904.8 million in 2034 at a CAGR of 8.1%.

The US optical design software market is driven by the rapid advancement in consumer electronics, automotive LiDAR systems, and biomedical imaging technologies. Growing demand for compact, high-performance optical systems across industries boosts the need for sophisticated simulation and optimization tools. The integration of optical components in smartphones, AR/VR devices, and autonomous vehicle systems also fuels software adoption.

Additionally, increased investments in defense and aerospace sectors further support the use of advanced photonics simulation tools. Continuous innovation in lens design, optical communication, and imaging solutions encourages firms to invest in high-precision optical design platforms, accelerating software usage across research and development.

Emerging trends in the US optical design software market include the integration of artificial intelligence and machine learning to automate and optimize optical modeling processes. There is a rising preference for cloud-based platforms to enable collaborative design, remote access, and efficient data management.

The adoption of augmented reality and virtual prototyping for simulating optical systems is also gaining traction. Software vendors are increasingly focusing on user-friendly interfaces and customizable modules to cater to various industry-specific needs. Moreover, sustainability in product development is influencing the adoption of design tools that improve energy efficiency and minimize material usage in optical system design.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Japan Optical Design Software Market

The Japan Optical Design Software Market is projected to be valued at USD 96.5 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 180.2 million in 2034 at a CAGR of 7.0%.

Japan’s optical design software market is driven by its leadership in consumer electronics, imaging systems, and semiconductor inspection equipment. The demand for highly accurate, miniaturized optical components in cameras, sensors, and display systems stimulates the use of precision optical modeling tools. Japan’s automotive sector, particularly in autonomous driving and advanced driver-assistance systems, further propels the need for robust optical design platforms.

Additionally, government initiatives supporting photonics research and the presence of globally renowned optical product manufacturers contribute significantly. The integration of optics in industrial robotics and factory automation also acts as a major catalyst for market expansion.

In Japan, trends in the optical design software market include the rising use of digital twins and real-time simulation in optical system prototyping. Companies are increasingly adopting software with AI-assisted optimization and cloud-based capabilities to accelerate design cycles. Miniaturization of optical systems in wearable technology and medical devices is also influencing the demand for high-resolution simulation tools.

Furthermore, there is a strong push toward harmonizing optics with electronics and mechanics through multi-domain simulation. Academic-industry partnerships continue to play a vital role in driving software innovation, particularly in advanced imaging and precision optical metrology applications.

The Europe Optical Design Software Market

The Europe Optical Design Software Market is projected to be valued at USD 241.2 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 495.7 million in 2034 at a CAGR of 8.8%.

A strong focus on precision engineering, photonics innovation, and smart manufacturing initiatives drives the Europe optical design software market. Growth in sectors like telecommunications, automotive optics, and biomedical instrumentation increases the demand for advanced simulation tools. Research institutions and universities across Europe actively contribute to software adoption through photonics and optoelectronics research.

Furthermore, the region's emphasis on Industry 4.0 and digital transformation encourages the integration of high-end optical design solutions. Supportive regulatory frameworks, funding for R&D, and a well-established base of optical component manufacturers further enhance the market’s momentum in Europe.

A key trend in Europe’s optical design software market is the increasing collaboration between academic institutions and commercial vendors for advanced optical system modeling. There is growing demand for interoperable software that supports integration with mechanical and electrical CAD platforms, improving design efficiency. Sustainability-driven design practices are influencing optical system optimization to reduce waste and improve lifecycle performance.

Additionally, there is heightened interest in adaptive optics and freeform optics, prompting the development of more sophisticated modeling tools. Customized simulation environments for niche applications such as quantum optics and biosensing are also gaining traction across the European market.

Optical Design Software Market: Key Takeaways

- Market Overview: The global optical design software market is projected to reach a value of USD 1,378.3 million in 2025 and is anticipated to grow significantly, hitting USD 2,900.4 million by 2034, at a CAGR of 8.6% during the forecast period from 2025 to 2034.

- By Component Analysis: The software segment is expected to hold the largest share of the market by 2025, contributing approximately 58.3% of the total revenue.

- By Deployment Mode Analysis: The on-premise deployment mode is set to lead the market in 2025, capturing around 63.7% of the global revenue.

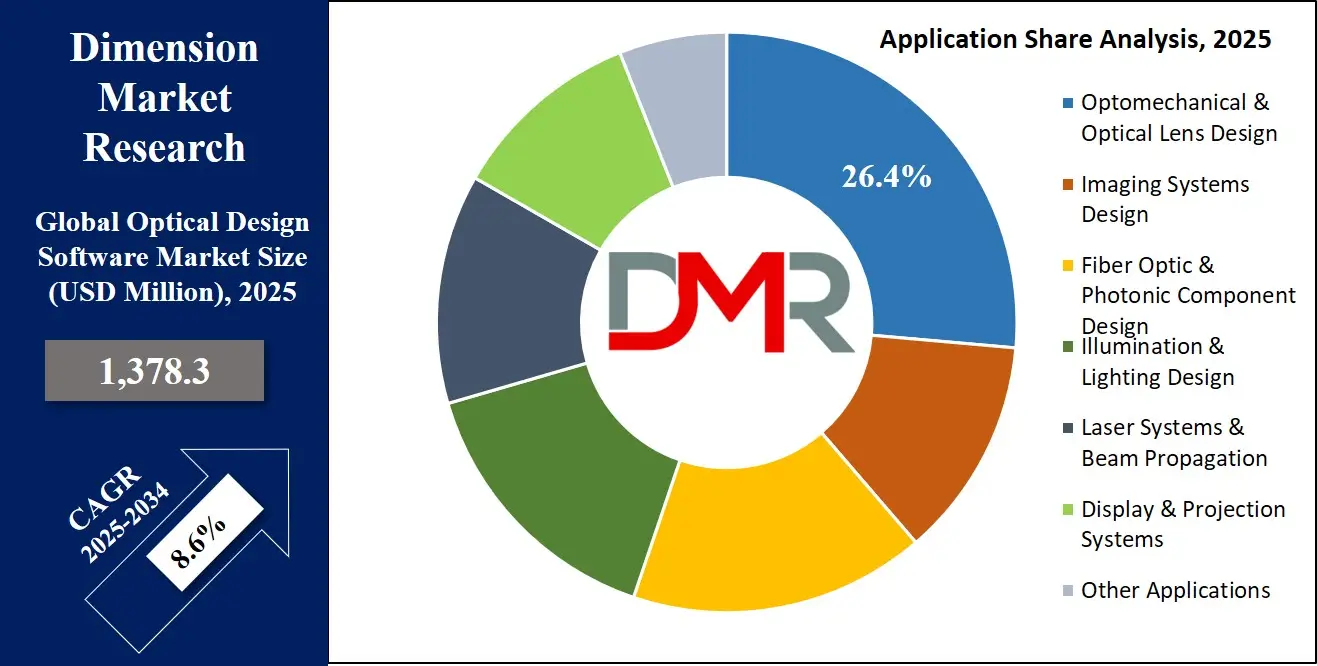

- By Application Analysis: Optomechanical & optical lens design is anticipated to be the leading application area in 2025, accounting for about 26.4% of the total market value.

- By End User Analysis: The aerospace & defense sector is forecasted to be the top end user in 2025, representing nearly 24.9% of the overall revenue share.

- Region with the Largest Share: North America is expected to maintain its position as the leading regional market by 2025, securing a significant 38.8% share of the global market.

Optical Design Software Market: Use Cases

- Camera Lens Design: Optical design software is widely used to develop high-performance camera lenses for smartphones, DSLRs, and surveillance systems. It enables engineers to simulate lens performance, correct aberrations, optimize image clarity, and ensure compact design, thereby accelerating product development and improving image quality across varied lighting conditions.

- Automotive Lighting Systems: In the automotive industry, optical design software helps create efficient headlights, taillights, and interior lighting. It supports beam shaping, glare reduction, and compliance with global lighting standards. Designers can virtually test and optimize reflectors, lenses, and light guides to enhance safety, energy efficiency, and aesthetic appeal in vehicles.

- Medical Optical Devices: Optical design tools aid in developing precision instruments like endoscopes, microscopes, and ophthalmic devices. The software simulates light behavior in complex biological environments, ensuring high-resolution imaging, minimal distortion, and ergonomic designs. This helps medical professionals achieve better diagnostic accuracy and improves patient outcomes in clinical settings.

- Telecommunication Components: Optical design software is critical in designing fiber optic components such as lenses, couplers, and beam collimators used in high-speed data transmission. Engineers use it to reduce signal loss, optimize wavelength handling, and ensure compatibility with photonic integrated circuits, thus enabling reliable and faster communication networks.

- Virtual and Augmented Reality (VR/AR): VR/AR systems require compact, high-performance optical modules. Optical design software enables the creation of lightweight lenses and waveguides that deliver clear visuals with minimal distortion. It supports iterative prototyping and real-time simulation, helping manufacturers deliver immersive, comfortable, and optically accurate experiences for gaming, training, and simulation applications

Optical Design Software Market: Stats & Facts

- SPIE (The International Society for Optics and Photonics): Over 90% of optical engineers use specialized optical design software like Zemax or Code V in both academic and industrial projects, reflecting its critical role in photonics and optics R&D.

- OSA (Optica, formerly Optical Society of America): In a 2023 report, it was noted that over 60% of optics-focused startups rely on simulation-based software during prototyping to reduce physical trial-and-error costs.

- IEEE Xplore: A study published in 2022 found that integrating AI into optical design workflows can reduce optical system optimization time by up to 40% compared to traditional iterative methods.

- NASA Technical Reports Server (NTRS): NASA missions such as the James Webb Space Telescope used optical simulation software extensively during the optical alignment and calibration phase, involving simulations of more than 18 mirrors working in unison.

- OSA Publishing (Applied Optics Journal): Research shows that software-aided freeform lens design has increased by 150% in published papers between 2017 and 2022, highlighting the growing reliance on digital tools for complex optical geometries.

- GitHub: Open-source optical design tools such as OpticSim.jl (in Julia) have seen over 5,000 downloads and growing community contributions, showing an increasing interest in non-commercial platforms for advanced optical modeling.

- U.S. Patent and Trademark Office (USPTO): There has been a 32% increase in patents mentioning "optical design software" between 2018 and 2023, indicating its deepening impact on innovation.

- European Space Agency (ESA): Optical design software played a key role in ESA’s Hera mission, which involved simulating asteroid deflection experiments using multi-element optical systems.

- LinkedIn Talent Insights: As of mid-2024, there were more than 8,000 job postings globally that listed proficiency in tools like Zemax, LightTools, or Code V as a preferred qualification in optics-related roles.

- ResearchGate: A 2023 meta-analysis of optics education papers reveals that 75% of engineering curricula now include at least one course that mandates hands-on training with optical design software tools.

Optical Design Software Market: Market Dynamics

Driving Factors in the Optical Design Software Market

Rising Demand for Precision Optical Components in Emerging Technologies

The surge in demand for precision optical components in sectors like AR/VR, autonomous vehicles, and advanced robotics is a major driver of the optical design software market. These sectors rely heavily on accurate optical modeling and simulation for performance and safety. Tools such as ray tracing algorithms and optical system simulation platforms are essential for designing complex lens systems and image sensors.

The growing integration of photonics in wearable devices and smart consumer electronics also boosts the need for photonic simulation tools. Optical design software enables rapid prototyping and validation of intricate designs, minimizing cost and reducing development cycles. This rising need for exactness and efficiency across innovative industries is fueling the adoption of advanced virtual prototyping platforms.

Growth in R&D Investments in Aerospace and Medical Imaging

Increased investments in R&D across the aerospace and medical imaging sectors significantly drive the optical design software market. These industries demand high-performance optical systems for satellite imaging, laser systems, and diagnostic tools. Optical modeling software supports the precise design of optical imaging systems and lenses used in endoscopes and surgical instruments.

Governments and private institutions are funding advanced optical research, requiring simulation tools capable of handling wave optics, polarization, and diffraction effects. Lens design software helps researchers iterate and validate models in shorter time spans. The adoption of digital twins and simulation-based engineering further enhances the relevance of optical CAD tools in high-stakes R&D applications.

Restraints in the Optical Design Software Market

High Cost and Complexity of Advanced Optical Design Tools

One significant restraint in the optical design software market is the high cost of acquiring and maintaining professional-grade tools. Platforms that offer advanced ray tracing capabilities, polarization analysis, or illumination simulation come with steep licensing fees, making them less accessible to small enterprises and academic institutions.

Moreover, the steep learning curve associated with mastering such software limits broader adoption. Users often need specialized knowledge in optical physics, programming, and design optimization, which deters non-expert engineers and designers. This creates a bottleneck for industries aiming for rapid prototyping and simulation-driven development. The lack of skilled professionals to operate high-end optical modeling tools further compounds this barrier.

Limited Interoperability with Other Engineering Software Ecosystems

Another constraint is the lack of seamless integration between optical design platforms and broader engineering simulation tools like CAD, CAE, and PCB design software. This hinders a unified design approach for multi-domain product development, especially in optoelectronics, LiDAR systems, and photonic integrated circuits. Optical simulation software often operates in isolated environments, limiting collaboration and data flow across departments.

For industries relying on cross-functional development, such as telecom or defense, this disconnect leads to increased design cycles and rework. The absence of standardized data exchange formats and limited API accessibility further restrain the efficiency of optical design workflows, affecting scalability and adoption.

Opportunities in the Optical Design Software Market

Integration of Artificial Intelligence in Optical Design Workflows

AI integration presents a transformative opportunity for the optical design software market. Machine learning algorithms can assist in design optimization, tolerance analysis, and predictive modeling of optical systems. AI-driven simulation platforms can significantly cut down the time required for iterative ray tracing and component layout.

For instance, neural networks can be trained to propose optimal lens configurations based on input parameters like focal length and aperture. These intelligent tools enhance productivity and accuracy, especially in industries such as autonomous driving, optical telecommunications, and augmented reality. The combination of AI and photonic simulation tools could redefine how optical engineering is performed, offering scalability and innovation.

Expanding Applications in Emerging Markets and Education Sectors

Emerging economies are increasingly investing in photonics, optical imaging, and laser-based technologies across industries such as renewable energy, telecommunications, and life sciences. This creates a significant opportunity for optical design software vendors to offer localized, cost-effective, and cloud-based tools.

In parallel, academic institutions worldwide are incorporating lens design and optical modeling software into engineering and physics curricula. This not only boosts awareness but cultivates a future-ready workforce skilled in using these tools. Offering freemium models, educational licenses, and cloud-based optical CAD platforms can help vendors tap into these expanding markets and promote the democratization of simulation-driven optical engineering.

Trends in the Optical Design Software Market

Rise of Cloud-Based Optical Design Platforms

A key trend reshaping the optical design software market is the shift toward cloud-based platforms. These solutions offer collaborative features, real-time updates, and remote accessibility, which are particularly useful for globally distributed R&D teams. Cloud-native optical design tools allow integration with digital twins, simulation management systems, and PLM tools.

They also facilitate high-performance computing (HPC) for complex optical simulations involving diffraction, non-sequential ray tracing, and aspheric lens modeling. With increased reliance on virtual prototyping and reduced time-to-market goals, companies are increasingly opting for flexible, subscription-based optical software-as-a-service (SaaS) models.

Adoption of Augmented Reality and Virtual Testing in Optical Simulation

The adoption of AR/VR technologies within optical simulation workflows is an emerging trend that is enhancing design visualization and user experience. Engineers can now interact with 3D models of lens assemblies or optical paths using VR headsets, improving error detection and design efficiency. Optical design software integrated with AR environments allows real-time visualization of beam propagation, light interaction, and component placement.

This trend is particularly valuable in industries such as automotive LiDAR, smartphone cameras, and biomedical imaging. Enhanced realism and interactivity enable faster stakeholder alignment and more intuitive system validation, pushing the boundaries of traditional lens modeling and virtual testing.

Optical Design Software Market: Research Scope and Analysis

By Component Analysis

The Software segment is projected to dominate the global optical design software market, accounting for 58.3% of the total revenue share in 2025. The rising demand for advanced ray tracing, optical system modeling, and wavefront analysis tools across sectors such as aerospace, telecommunications, and healthcare is driving this dominance.

Additionally, the growing integration of AI-based algorithms and cloud-enabled simulation tools is enhancing the flexibility and scalability of software platforms. Companies are increasingly investing in customized and interoperable design suites to improve optical performance and reduce development cycles. These advancements are enabling engineers and researchers to conduct precise virtual prototyping, thereby significantly boosting the uptake of optical software over traditional methods.

The Services segment is anticipated to register the highest CAGR in the global optical design software market by the end of 2025. Growing adoption of tailored consulting, software customization, and technical support among end users is a key factor contributing to this surge. As industries become more reliant on complex optical systems, demand for specialized service offerings such as integration consulting and expert-led training is rising.

Additionally, the expansion of optical technologies into newer applications, like autonomous driving and wearable medical imaging, necessitates ongoing support and adaptation, increasing reliance on service providers. This evolving need for continuous system optimization and knowledge transfer will strongly support the growth of the services market segment.

By Deployment Mode Analysis

On-Premise deployment mode is expected to dominate the global optical design software market with a 63.7% revenue share in 2025. Industries such as aerospace & defense and automotive prefer on-premise deployment due to its superior data security, customization flexibility, and system control. This model allows for robust performance without dependency on internet connectivity, which is essential for handling sensitive optical simulations and proprietary design data.

Additionally, organizations operating in regulated environments favor in-house infrastructure for ensuring compliance and protecting intellectual property. The ability to operate within isolated networks while maintaining low-latency performance gives on-premise solutions a competitive edge in precision-driven optical engineering environments.

The Cloud-Based segment is projected to witness the highest CAGR in the global optical design software market by the end of 2025. Growing demand for scalable computing power, remote collaboration, and real-time updates is fueling the shift toward cloud platforms. Cloud-based solutions enable seamless integration with AI-driven analytics and IoT-enabled photonics tools, facilitating innovation across sectors like consumer electronics and telecommunications.

Moreover, the increasing adoption of subscription-based models and reduced upfront infrastructure costs appeals to startups and research institutions alike. This deployment mode also enhances accessibility for global engineering teams, allowing them to work concurrently on complex optical designs, boosting productivity, design iteration speed, and time-to-market efficiency.

By Application Analysis

The Optomechanical & Optical Lens Design segment is expected to dominate the global optical design software market by the end of 2025, capturing 26.4% of the total revenue share. This dominance is driven by the increasing need for precise lens modeling, mechanical alignment, and thermal sensitivity simulations in industries such as medical devices, automotive optics, and aerospace systems.

As optical systems become more compact and multifunctional, engineers rely on advanced design tools that integrate both mechanical and optical parameters. This segment also benefits from rising R&D in compact imaging systems and augmented reality devices, where lens precision directly impacts performance and usability, further pushing the adoption of optomechanical simulation platforms across high-tech manufacturing environments.

The Fiber Optic & Photonic Component Design segment is projected to record the highest CAGR in the optical design software market by 2025. The rapid expansion of high-speed data networks, integrated photonics, and quantum communication systems is driving demand for design platforms that support waveguide modeling and photonic circuit simulation. With increasing investments in 5G infrastructure, data centers, and advanced sensing technologies, designers require high-accuracy tools for creating low-loss, high-bandwidth optical components.

Moreover, growing applications in LIDAR, biomedical photonics, and optical computing are fostering innovation in this segment. The scalability and precision of fiber-optic simulation software are becoming critical for engineers looking to meet next-generation connectivity and miniaturization goals.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By End User Analysis

Aerospace & Defense segment is forecasted to lead the global optical design software market, accounting for 24.9% of the total revenue share in 2025. The sector’s increasing reliance on advanced targeting optics, infrared imaging, and space-grade optical assemblies is fueling this dominance. Optical design tools are essential in the development of high-precision instruments for satellites, UAVs, and missile guidance systems.

The demand for ruggedized, miniaturized, and thermally stable optical components in defense technologies further emphasizes the need for simulation platforms capable of extreme condition modeling. With continued government funding and modernization of military systems, the segment remains the largest adopter of sophisticated optical engineering solutions.

The Healthcare & Medical Devices segment is projected to grow at the highest CAGR in the global optical design software market by 2025. The surge in demand for non-invasive imaging systems, diagnostic sensors, and wearable optical technologies is accelerating the adoption of optical design platforms in medical innovation. Designers are leveraging simulation tools to enhance precision in endoscopic systems, optical coherence tomography, and biomedical lasers.

Additionally, the rise of personalized healthcare and point-of-care diagnostics is pushing for the miniaturization and integration of photonics into compact devices. These trends, supported by increased R&D investments and regulatory approvals, are transforming healthcare into a high-growth frontier for optical software vendors.

The Optical Design Software Market Report is segmented on the basis of the following:

By Component

- Software

- Design & Simulation Software

- Modeling & Analysis Software

- Integration & Optimization Tools

- Services

- Consulting Services

- Support & Maintenance

- Customization Services

- Training & Education

By Deployment Mode

By Application

- Optomechanical & Optical Lens Design

- Imaging Systems Design

- Fiber Optic & Photonic Component Design

- Illumination & Lighting Design

- Laser Systems & Beam Propagation

- Display & Projection Systems

- Other Applications

By End User

- Consumer Electronics

- Automotive & Transportation

- Healthcare & Medical Devices

- Aerospace & Defense

- Telecommunications & Networking

- Industrial Manufacturing

- Research & Academia

- Others

Regional Analysis

Region with the largest Share

North America is projected to dominate the global optical design software market by the end of 2025, holding a substantial 38.8% market share. The region’s leadership is attributed to the presence of advanced R&D centers, leading aerospace & defense contractors, and top-tier medical device manufacturers. The strong ecosystem of optical component suppliers and universities drives innovation in photonic system design.

Additionally, early adoption of cutting-edge technologies such as augmented reality, LIDAR, and autonomous driving optics boosts demand for high-performance simulation software. Favorable government investments in defense and telecom infrastructure, combined with the presence of key players offering customized software solutions, contribute to the region’s sustained dominance in the optical design software landscape.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with Highest CAGR

Asia Pacific is expected to register the highest CAGR in the global optical design software market by 2025. Rapid industrialization, expanding consumer electronics production, and growing investments in telecommunication infrastructure are driving demand for advanced optical design tools. Countries like China, Japan, South Korea, and India are investing heavily in photonic integration, fiber optics, and semiconductor innovation, boosting the adoption of simulation platforms.

Additionally, the region’s fast-growing automotive and healthcare sectors are incorporating optical technologies for sensing, imaging, and safety applications. Rising demand for cost-effective design solutions and increasing government support for local innovation hubs are further propelling Asia Pacific as the fastest-growing region in the optical software ecosystem.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Impact of Artificial Intelligence in the Optical Design Software Market

- Enhanced Precision and Optimization: Artificial Intelligence (AI) is significantly improving the accuracy and efficiency of optical design processes. By leveraging machine learning algorithms, optical design software can now analyze vast datasets, simulate real-world conditions, and automatically suggest optimized designs. This results in reduced errors, higher-quality prototypes, and faster turnaround times. AI enables real-time performance prediction and automatic lens adjustments, streamlining complex design calculations.

- Accelerated Product Development Cycles: AI-driven automation is reducing the time required for optical system development. Traditional iterative design cycles are being replaced by intelligent systems that learn from previous designs to suggest optimal solutions instantly. This acceleration is particularly valuable in industries like consumer electronics, automotive optics, and medical imaging, where time-to-market is critical.

- Adaptive Learning and Customization: AI allows optical design software to learn user preferences and project-specific requirements, providing tailored recommendations for different applications. This adaptability enables designers to create highly customized systems, whether for AR/VR headsets, LiDAR systems, or high-end telescopic equipment. Such personalized design support increases user productivity and encourages innovation.

- Integration with Emerging Technologies: AI is also facilitating seamless integration with other advanced technologies like cloud computing, digital twins, and Internet of Things (IoT). This enhances collaborative design, remote simulation, and predictive maintenance. As a result, the optical design software market is witnessing a transformative shift toward smarter, more interconnected ecosystems.

Competitive Landscape

The competitive landscape of the global optical design software market is characterized by the presence of several established players and a growing number of niche innovators. Leading companies are focusing on enhancing their optical simulation capabilities, expanding software compatibility with multiphysics platforms, and integrating AI for improved performance and automation.

Major players such as Synopsys, Zemax (Ansys), Lambda Research Corporation, and LightTrans are investing heavily in R&D to deliver advanced solutions for optical modeling, ray tracing, and photonic component design.

Strategic partnerships with hardware manufacturers, universities, and aerospace contractors are also key growth strategies to accelerate innovation and ensure end-to-end design validation. Moreover, the increasing demand for custom optical system development, cloud-based deployment models, and cross-platform interoperability is reshaping competitive dynamics. Companies are also tailoring their solutions to specific end-use industries like telecommunications, healthcare imaging, and consumer electronics to address unique application needs.

As new players enter with specialized lens design and laser propagation tools, incumbents are responding with bundled services, user-friendly interfaces, and faster rendering engines to retain market share. The landscape is dynamic, driven by continuous technological advancements and rising adoption of virtual prototyping in optical engineering processes.

Some of the prominent players in the Global Optical Design Software Market are:

- Ansys Inc.

- Synopsys Inc.

- Lambda Research Corporation

- LightTrans International UG

- Breault Research Organization (BRO)

- Optiwave Systems Inc.

- Photon Engineering LLC

- Zemax (An Ansys Company)

- OpticsBuilder (Zemax)

- Radiant Vision Systems

- COMSOL Inc.

- Lumerical (A part of Ansys)

- GenICam (EMVA Standard)

- OSLO (Lambda Research)

- Optica Software

- LightTools (Synopsys)

- Siemens Digital Industries Software

- SCHOTT AG

- ESI Group

- KISTLER Group

- Other Key Players

Recent Developments

- In March 2025, Synopsys released an update to its CODE V software, featuring enhanced optimization algorithms, improved lens design automation, and expanded tolerance analysis tools for complex imaging system development.

- In February 2025, LightTrans introduced VirtualLab Fusion 2025 with AI-driven modeling tools, enabling faster hybrid optical system simulation and integration of freeform optics with improved user interface and processing speed.

- In October 2024, Breault Research Organization (BRO) launched ASAP 2024.3, introducing expanded polarization ray tracing, better CAD integration, and GPU-accelerated simulations to reduce rendering times and increase modeling accuracy.

- In August 2024, Optiwave Systems unveiled OptiSystem 2024.2, offering new photonic component libraries, improved co-simulation with MATLAB, and enhanced support for LiDAR and integrated photonics applications.

- In May 2024, Photon Engineering updated FRED Optical Engineering Software with improved stray light analysis tools, enhanced scripting capabilities, and support for non-sequential ray tracing in high-power laser systems.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 1,378.3 Mn |

| Forecast Value (2034) |

USD 2,900.4 Mn |

| CAGR (2025–2034) |

8.6% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 449.8 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Software, Services), By Deployment Mode (On-Premise, Cloud-Based), By Application (Optomechanical & Optical Lens Design, Imaging Systems Design, Fiber Optic & Photonic Component Design, Illumination & Lighting Design, Laser Systems & Beam Propagation, Display & Projection Systems, Other Applications), By End User (Consumer Electronics, Automotive & Transportation, Healthcare & Medical Devices, Aerospace & Defense, Telecommunications & Networking, Industrial Manufacturing, Research & Academia, Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Ansys Inc., Synopsys Inc., Lambda Research Corporation, LightTrans International UG, Breault Research Organization, Optiwave Systems Inc., Photon Engineering LLC, Zemax, OpticsBuilder (Zemax), Radiant Vision Systems, COMSOL Inc., Lumerical, GenICam, OSLO, Optica Software, LightTools, Siemens Digital Industries Software, SCHOTT AG, ESI Group, KISTLER Group, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Optical Design Software Market?

▾ The Global Optical Design Software Market size is estimated to have a value of USD 1,378.3 million in 2025 and is expected to reach USD 2,900.4 million by the end of 2034.

Which region accounted for the largest Global Optical Design Software Market?

▾ North America is expected to be the largest market share for the Global Optical Design Software Market with a share of about 38.8% in 2025.

Who are the key players in the Global Optical Design Software Market?

▾ Some of the major key players in the Global Optical Design Software Market are Ansys Inc., Synopsys Inc., Lambda Research Corporation, and many others.

What is the growth rate in the Global Optical Design Software Market?

▾ What is the growth rate in the Global Optical Design Software Market?

How big is the US Optical Design Software Market?

▾ The US Optical Design Software Market size is estimated to have a value of USD 449.8 million in 2025 and is expected to reach USD 904.8 million by the end of 2034.