Market Overview

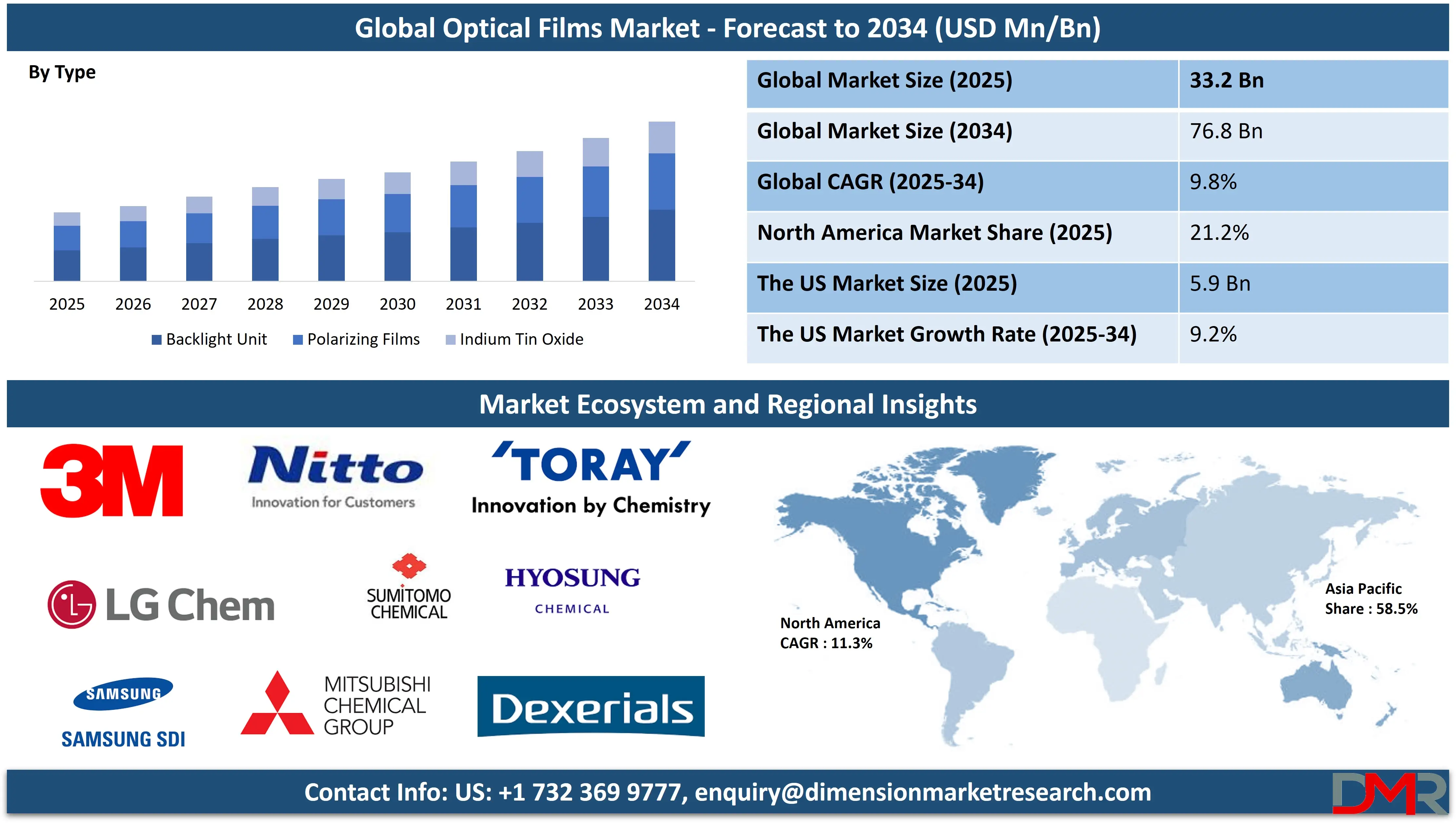

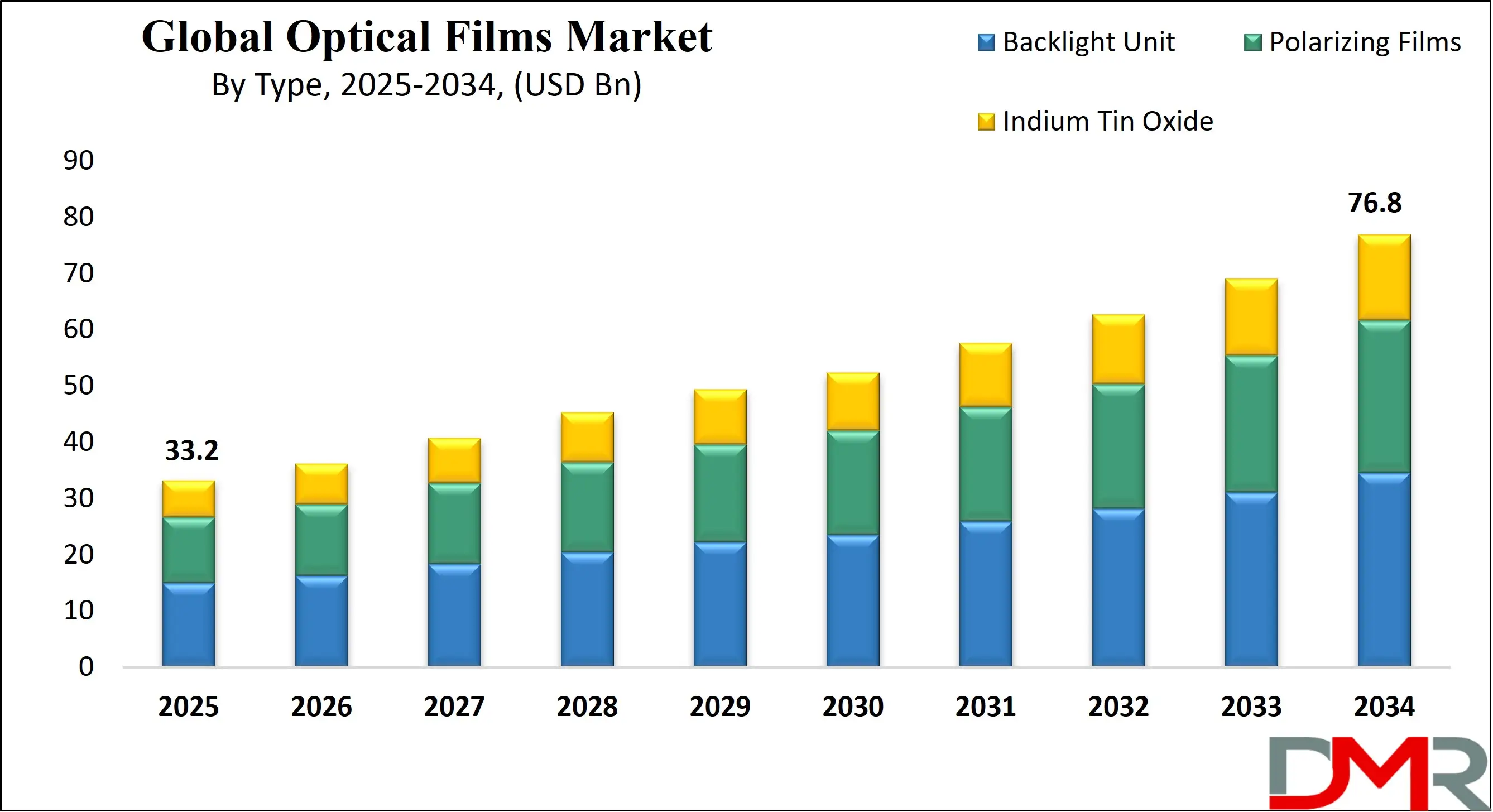

The Global Optical Films Market is predicted to be valued at USD 33.2 billion in 2025 and is expected to grow to USD 76.8 billion by 2034, registering a compound annual growth rate (CAGR) of 9.8% from 2025 to 2034.

Optical films are thin layers of materials designed to manipulate light properties such as reflection, transmission, absorption, and polarization. These films are widely used in display technologies, including LCDs, OLEDs, and touchscreens, to enhance brightness, contrast, and visibility. Common types include polarizing films, anti-reflective coatings, and backlight films. They are typically made from polymers like PET and are engineered to meet specific optical requirements.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Optical films play a critical role in consumer electronics, automotive displays, solar panels, and lighting systems by improving energy efficiency, visual performance, and durability. Their versatility makes them essential components in modern optoelectronic applications. The global optical film market is experiencing robust growth, driven by the rising demand for high-performance display technologies across multiple industries.

Optical films are essential components in modern electronic devices, offering enhanced light management and improved image clarity. Their applications span across consumer electronics, automotive displays, solar energy systems, and lighting solutions. The growing penetration of smartphones, tablets, and televisions is significantly boosting the demand for polarizing films, anti-reflective coatings, and backlight unit films.

As manufacturers strive to deliver slimmer, energy-efficient, and high-resolution displays, the role of optical films in LCD and OLED panels has become increasingly critical. These films help optimize brightness, contrast, and visibility under various lighting conditions, enhancing user experience. Technological advancements in display panels, such as flexible and foldable screens, are further augmenting the adoption of advanced optical film solutions.

Sustainability is also shaping market trends, with rising interest in recyclable and eco-friendly optical film materials. Additionally, the automotive sector’s integration of head-up displays (HUDs), infotainment systems, and advanced driver assistance systems (ADAS) is contributing to market expansion.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Asia-Pacific leads in both production and consumption of optical films, supported by a strong electronics manufacturing base. Meanwhile, North America and Europe are witnessing increased adoption due to innovations in smart devices and growing interest in energy-efficient technologies.

Overall, the global optical film industry is poised for sustained development, propelled by innovation in display technologies, consumer demand for superior visual experiences, and expanding industrial applications that require precision light management and optical enhancement solutions.

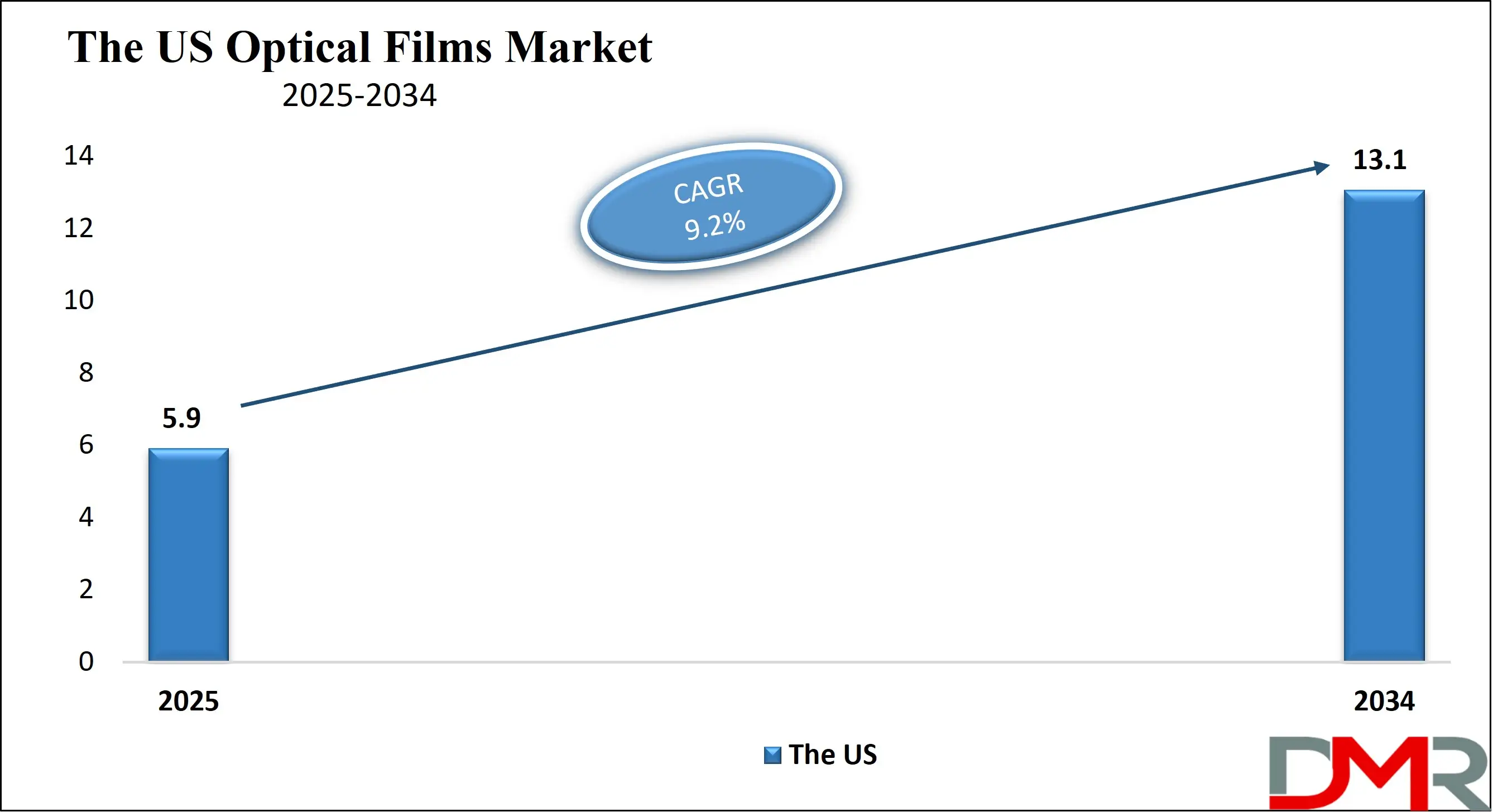

The US Optical Films Market

The US Optical Films Market is projected to be valued at USD 5.9 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 13.1 billion in 2034 at a CAGR of 9.2%.

The US optical films market is primarily driven by the rapid expansion of the consumer electronics industry, particularly the growing demand for high-resolution displays in smartphones, laptops, and televisions. The rising adoption of OLED and LED technologies has created a need for advanced light management films and anti-reflective coatings.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Furthermore, the emphasis on energy efficiency in electronic devices and strict regulatory standards are encouraging manufacturers to invest in innovative optical film solutions. Increasing applications in automotive displays and smart windows are also adding momentum to the market growth, supported by advancements in nanotechnology and material science.

One of the prominent trends in the US optical films market is the integration of optical films in augmented reality (AR) and virtual reality (VR) devices, driven by demand from gaming, healthcare, and education sectors. There is a noticeable shift towards flexible and foldable displays, which require durable and transparent optical film layers. Sustainability is becoming a major focus, leading to the development of biodegradable and recyclable films.

Furthermore, manufacturers are prioritizing anti-glare, anti-fingerprint, and UV-protection films to meet consumer preferences. Collaborations between tech firms and material developers are accelerating the introduction of multifunctional, high-performance optical films.

The Japan Optical Films Market

The Japan Optical Films Market is projected to be valued at USD 3.3 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 6.5 billion in 2034 at a CAGR of 7.5%.

Japan’s optical films market is driven by its highly advanced electronics manufacturing sector, which consistently demands superior display technologies for products like smartphones, TVs, and gaming devices. The country’s leadership in semiconductor and display panel innovation fosters the development of sophisticated optical films.

Additionally, Japan's robust automotive industry increasingly integrates digital displays and head-up displays, contributing to steady demand for optical film solutions. The culture of precision engineering and continuous innovation pushes domestic manufacturers to develop films with enhanced durability, light transmittance, and anti-reflective properties, further boosting the market.

In Japan, a significant trend is the adoption of ultra-thin and flexible optical films tailored for foldable and curved screens, reflecting the nation’s pursuit of advanced display form factors. Smart glass integration in architecture and automotive applications is also gaining momentum, leveraging films that enable privacy control and UV protection.

Another trend is the focus on transparent conductive films in emerging technologies such as wearable electronics and touch interfaces. Japanese firms are also investing heavily in nano-coating technologies, creating optical films that offer self-cleaning, anti-smudge, and high-contrast enhancement functionalities.

The Europe Optical Films Market

The Europe Optical Films Market is projected to be valued at USD 6.6 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 13.3 billion in 2034 at a CAGR of 8.2%.

In Europe, the optical films market is being propelled by the growing penetration of smart consumer devices and stringent environmental regulations promoting energy-efficient display technologies. The increasing popularity of electric vehicles and in-vehicle infotainment systems has boosted the demand for high-quality optical films.

Additionally, government initiatives to digitalize public services and educational systems have expanded the need for electronic displays, indirectly supporting market growth. The presence of leading electronics manufacturers and rising R&D investment in advanced film materials are fostering innovation and creating growth opportunities in the region’s optical films industry.

A key trend shaping the European optical films market is the emphasis on green technologies and eco-friendly materials in film production. Manufacturers are increasingly exploring sustainable raw materials and circular economy models. The growing preference for organic light-emitting diode (OLED) displays in smartphones and televisions is also influencing product development.

Additionally, the rising use of optical films in photovoltaic panels and building-integrated smart glass is expanding the market beyond electronics. Cross-industry collaboration is fueling innovation, leading to the creation of multifunctional films offering glare reduction, color enhancement, and increased brightness in energy-saving devices.

Optical Films Market: Key Takeaways

- Market Overview: The global optical films market is anticipated to reach a valuation of USD 33.2 billion in 2025 and is projected to expand to USD 76.8 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.8% during the forecast period from 2025 to 2034.

- By Type Analysis: The Backlight Unit category is expected to lead the optical films market by 2025, contributing more than 42.3% to the overall market share.

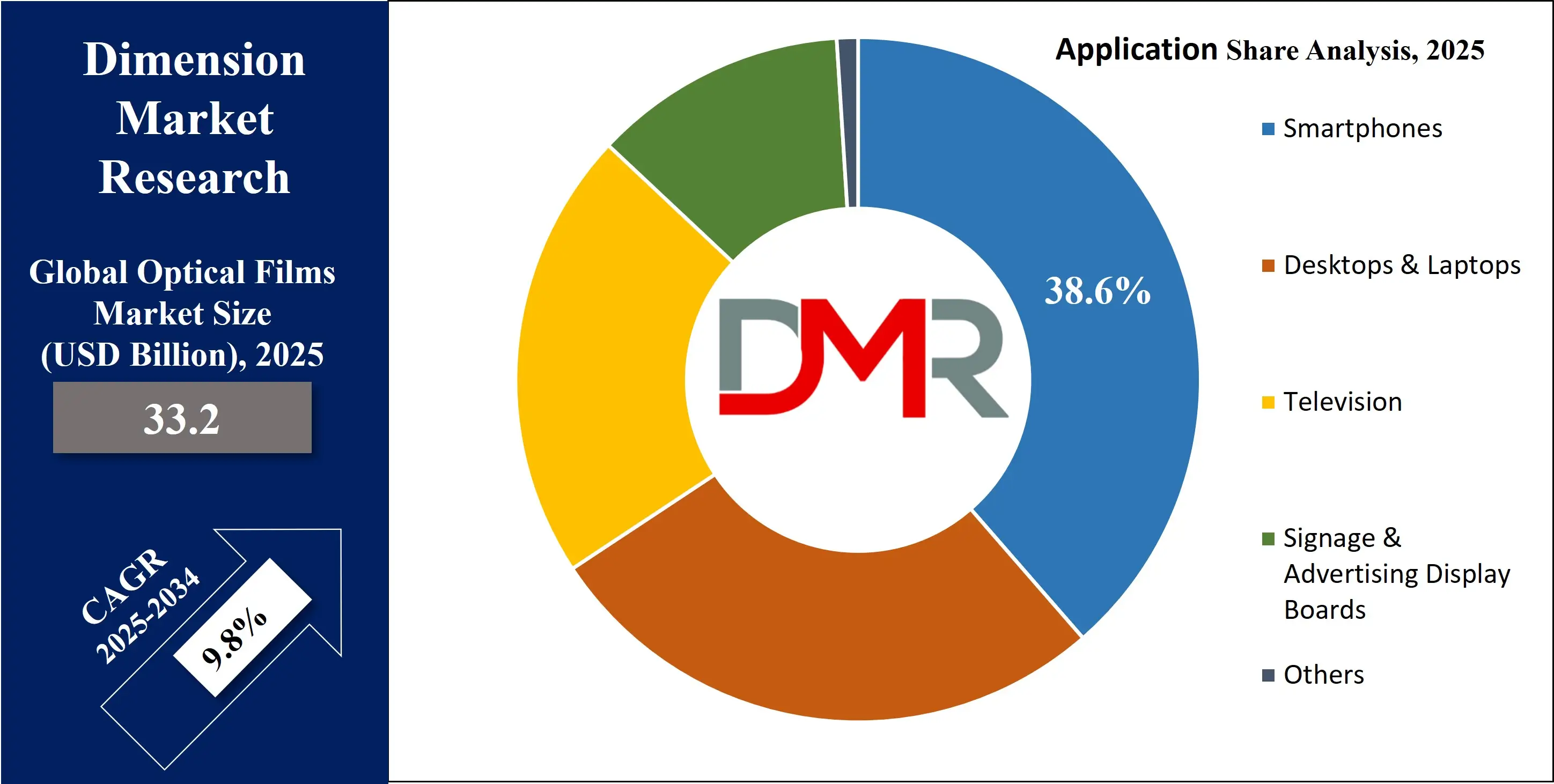

- By Application Analysis: Among various applications, the smartphones segment is projected to dominate in 2025, accounting for approximately 38.6% of the global market share.

- Regional Insight: Asia Pacific is forecasted to emerge as the leading regional market by 2025, capturing around 58.5% of the total global revenue in the optical films sector.

Optical Films Market: Use Cases

- Display Panels: Optical films enhance brightness, contrast, and viewing angles in LCD and OLED screens. Used in smartphones, tablets, and TVs, they help optimize light transmission and reduce power consumption by improving backlight efficiency and minimizing reflection, resulting in vibrant visuals and improved user experience.

- Automotive Displays: In modern vehicles, optical films are integrated into dashboard displays, heads-up displays (HUDs), and infotainment systems. These films reduce glare, increase screen clarity in varying lighting conditions, and provide anti-fog or anti-reflection properties, ensuring safer, more readable interfaces for drivers and passengers.

- Solar Control Windows: Optical films are applied to architectural and automotive windows to regulate solar heat gain and reduce glare. These films allow natural light transmission while filtering ultraviolet and infrared radiation, enhancing indoor comfort, reducing air conditioning load, and protecting interiors from UV-induced fading and damage.

- Camera and Optical Lenses: Anti-reflective and polarizing films are used in camera lenses, optical sensors, and eyewear to minimize light scattering and enhance image clarity. They improve optical performance by reducing ghosting, glare, and lens flare, which is essential for high-precision imaging in photography, surveillance, and scientific instruments.

- Touchscreen Devices: In smartphones, tablets, and kiosks, optical films provide anti-smudge, anti-glare, and anti-fingerprint features. They enhance screen readability under bright light and offer scratch resistance. These films support multi-touch sensitivity and are essential for improving user interaction with capacitive and resistive touchscreen technologies.

Optical Films Market: Stats & Facts

- Samsung Display reported that over 70% of its OLED panels use advanced polarizing films to improve screen clarity and reduce glare in ambient light conditions.

- LG Display revealed in a 2023 press release that its QD-OLED panels use multi-layer optical films to enhance contrast ratio by more than 50% compared to conventional LCDs.

- Sony Corporation claims that its TRILUMINOS™ display technology uses optical films to achieve 25% wider color gamut coverage than traditional LED displays.

- Panasonic disclosed that its IPS Alpha panel technology integrates dual brightness enhancement films (DBEF), increasing brightness by approximately 30% without additional power consumption.

- AU Optronics stated that optical films used in their high-transparency automotive HUDs offer over 90% light transmission while maintaining anti-reflection properties.

- 3M, a global optical film manufacturer, claims its Vikuiti™ brightness enhancement films improve display efficiency by up to 40%, reducing the need for additional backlights.

- BOE Technology Group stated that integrating multi-layer optical diffusion films into their LCDs contributes to a 15–20% increase in luminance uniformity.

- Sharp Corporation mentions in its product specifications that optical films applied in their IGZO displays result in 35% power saving through better light control and reduced backlight dependency.

- Apple Inc., in its environmental reports, noted that optical films in iPads and iPhones have helped reduce display energy use by around 25% since the iPhone X.

- Toshiba technical whitepapers describe how advanced prism films used in laptop displays enhanced viewing angle performance by more than 60 degrees horizontally.

Optical Films Market: Market Dynamics

Driving Factors in the Optical Films Market

Increasing Demand for Consumer Electronics

The rising global consumption of smartphones, tablets, laptops, and televisions is significantly fueling demand for optical films. As display technologies become more advanced—such as OLED and QLED panels—the need for high-performance backlight units, polarizing films, and anti-reflective films is growing. Optical films help enhance brightness, contrast ratio, and energy efficiency in these devices.

Moreover, manufacturers in the electronics sector are prioritizing thinner, lighter, and more durable display solutions, which optical films can deliver. The rapid expansion of the consumer electronics market in Asia-Pacific and North America continues to push innovation in optical coating films, display protection films, and light control films, thus acting as a key driver for the industry.

Adoption of Energy-Efficient Displays

Growing environmental concerns and rising electricity costs are accelerating the adoption of energy-efficient technologies, particularly in display systems. Optical films are integral to improving light transmission and reducing energy consumption in LCD and OLED screens. Polarizing films, brightness enhancement films (BEFs), and reflective films optimize light usage, enabling devices to operate efficiently with lower power input.

Governments worldwide are promoting eco-friendly product designs, further encouraging the use of optical films in energy-saving displays. These sustainability goals are not only influencing manufacturers but also shaping consumer preferences, making energy-efficient displays and the advanced optical films supporting them a crucial growth factor across various applications.

Restraints in the Optical Films Market

High Manufacturing Costs

The production of optical films involves complex processes, such as multi-layer coating, precision lamination, and advanced material integration, which contribute to high manufacturing costs. Materials like polycarbonate, triacetyl cellulose (TAC), and indium tin oxide are expensive, and any fluctuation in their prices directly impacts production budgets.

Additionally, specialized manufacturing equipment and strict quality control protocols raise capital expenditure for manufacturers. These high costs can limit the adoption of optical films, especially among small and medium-sized enterprises. Furthermore, the price sensitivity of end-use markets like consumer electronics may pressure manufacturers to compromise on profit margins, thereby restraining growth in the optical protection films and light control films sectors.

Technological Complexity and Compatibility Issues

As display technologies evolve rapidly, integrating optical films into new-generation panels becomes increasingly complex. Manufacturers often face compatibility issues when trying to match optical films with newer substrates or novel display formats like flexible and foldable screens. Customization requirements for different display sizes and configurations further complicate the production process.

Moreover, variations in optical properties such as reflectivity, polarization, and transmittance require precise engineering, increasing lead times and reducing scalability. This technical complexity creates barriers for companies entering the market and poses challenges for existing players trying to adapt to innovations in the display films and anti-glare film segments.

Opportunities in the Optical Films Market

Growing Adoption in Automotive Displays

The automotive industry is increasingly integrating advanced display technologies in instrument panels, infotainment systems, and heads-up displays (HUDs). This creates significant opportunities for optical films, particularly anti-reflective coatings, polarizers, and light control films, to enhance visibility and display performance under varying lighting conditions.

As electric vehicles and autonomous driving technologies evolve, the demand for interactive, high-resolution in-vehicle displays will surge. Optical films that offer durability, glare reduction, and improved brightness can meet these evolving requirements. Furthermore, the automotive sector’s demand for smart mirrors and augmented reality displays presents a lucrative growth avenue for film manufacturers focused on high-performance optical coating films.

Emergence of Flexible and Foldable Displays

The rise of flexible and foldable display technologies is opening new possibilities for optical film applications. These innovative screens require highly adaptable and durable optical films, such as ultra-thin polarizers, bendable brightness enhancement films, and transparent conductive films.

The shift toward lightweight, flexible devices in smartphones, tablets, and wearable electronics is creating demand for specialized optical film solutions that maintain optical integrity even under mechanical stress. As tech giants invest heavily in foldable OLED and AMOLED displays, the need for innovative display films is accelerating. This trend presents immense opportunities for companies offering customized and flexible optical solutions for next-gen consumer electronics.

Trends in the Optical Films Market

Shift toward Eco-Friendly and Recyclable Films

Sustainability has emerged as a major trend in the optical films market. Manufacturers are increasingly developing eco-friendly films using recyclable materials like bio-based polyesters and low-VOC (volatile organic compound) coatings. This aligns with global regulatory standards and consumer demand for greener electronics.

Companies are also focusing on reducing carbon footprints by optimizing production processes and incorporating sustainable raw materials in polarizing films and backlight units. Additionally, recyclable optical films are gaining popularity in packaging applications, further driving market growth. This green transition is fostering innovation and competitive differentiation in optical coating films and environmentally friendly display protection films.

Integration of Nanotechnology in Optical Films

Nanotechnology is revolutionizing the performance capabilities of optical films, allowing manufacturers to create ultra-thin, multi-functional films with enhanced optical and mechanical properties. Nano-coated films offer superior anti-reflection, anti-smudge, and scratch resistance features, making them ideal for high-end displays, solar panels, and precision optics.

The development of nanostructured layers within polarizing films and light diffusers improves light management and energy efficiency. This trend is particularly prominent in the production of transparent conductive films for touchscreens and flexible electronics. As research advances, nanotech-driven innovations are expected to shape the future landscape of optical films across multiple industries.

Optical Films Market: Research Scope and Analysis

By Type Analysis

The Backlight Unit segment is projected to dominate the global optical films market by the end of 2025, accounting for over 42.3% of the total market share. Backlight units are essential for enhancing brightness and uniform light distribution in LCD panels, making them indispensable across various consumer electronics.

The increasing demand for thinner, energy-efficient, and high-performance display panels in smartphones, televisions, and tablets is driving the adoption of backlight optical films. As panel manufacturers aim to improve optical clarity and reduce power consumption, these films are seeing widespread integration. The proliferation of LCDs in automotive displays and medical equipment further strengthens this segment’s market presence, reinforcing its leadership in the optical display technology ecosystem.

The Indium Tin Oxide (ITO) segment is anticipated to grow at the highest CAGR in the optical films market by 2025. ITO films are renowned for their superior transparency and electrical conductivity, which are crucial in applications such as touchscreens, solar panels, and flexible OLEDs. The surging adoption of smart wearable devices, foldable smartphones, and interactive display surfaces is significantly contributing to this growth.

Additionally, ITO’s role in enhancing optoelectronic performance and compatibility with next-generation flexible electronics is expanding its scope. As manufacturers invest in transparent conductive films and thin-film technologies, the ITO segment is emerging as a key driver in the transition toward more advanced and multifunctional optical interfaces.

By Application Analysis

The Smartphones segment is expected to lead the global optical films market by 2025, securing a market share of 38.6%. Optical films are vital components in smartphone displays, enabling improved brightness, contrast, and energy efficiency. As the global smartphone user base expands and manufacturers emphasize high-resolution displays and slimmer profiles, the integration of advanced optical film materials becomes imperative.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Growth in 5G smartphone adoption and innovations in AMOLED and foldable displays are further intensifying demand. With continuous R&D focused on enhancing screen visibility under varying lighting conditions, smartphones are becoming the primary application area for cutting-edge light-control and enhancement film technologies, making this segment the most influential in market expansion.

The Signage & Advertising Display Boards segment is predicted to grow at the highest CAGR by 2025 in the optical films market. The rising implementation of digital signage in retail, transportation, hospitality, and corporate environments is fueling demand for high-performance optical enhancement films. These films improve visual clarity, brightness, and viewing angles in both indoor and outdoor displays, ensuring content visibility in varied lighting conditions.

Additionally, the increasing preference for dynamic, large-format LED and LCDs in advertising is boosting the need for robust and weather-resistant optical films. As smart city infrastructure and public information systems expand, this application area is rapidly emerging as a key growth engine for optical film technologies.

The Optical Films Market Report is segmented on the basis of the following:

By Type

- Backlight Unit

- Polarizing Films

- Indium Tin Oxide

By Application

- Smartphones

- Desktops & Laptops

- Television

- Signage & Advertising Display Boards

- Others

Regional Analysis

Region with the largest Share

Asia Pacific is projected to hold the largest share of the global optical films market by the end of 2025, accounting for 58.5% of the total revenue. The region’s dominance is driven by the robust presence of leading consumer electronics manufacturers in countries like China, South Korea, Taiwan, and Japan. High production volumes of LCD panels, smartphones, televisions, and tablets continue to boost demand for advanced optical film materials.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Additionally, strong R&D investments, supportive government initiatives, and low manufacturing costs make the region a key hub for optical display innovations. The growing middle-class population and increasing adoption of smart devices further solidify Asia Pacific’s leadership in the display and optical component industries.

Region with Highest CAGR

North America is expected to register the highest compound annual growth rate (CAGR) in the global optical films market by 2025. This growth is fueled by the region’s increasing investments in next-generation display technologies, including OLEDs, microLEDs, and augmented reality devices. A surge in demand for smart consumer electronics, coupled with growing applications of optical films in automotive displays and digital signage, is driving market expansion.

The presence of key technology companies, along with the rising adoption of advanced visualization systems in healthcare and industrial sectors, is further accelerating growth. Additionally, sustainability trends and the push for energy-efficient solutions are promoting the use of innovative optical film materials across North American industries.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Impact of Artificial Intelligence in the Optical Film Market

- Material Design and Innovation: AI accelerates the discovery of advanced materials for optical films by simulating molecular structures and light-interaction properties. Machine learning models help predict optical clarity, reflectivity, and UV resistance, leading to faster development of high-performance films used in displays, solar panels, automotive, and lighting applications.

- Manufacturing Process Optimization: AI enhances manufacturing efficiency by monitoring coating thickness, curing times, and environmental conditions in real time. Predictive analytics and automated process adjustments reduce defects, material waste, and energy usage. This ensures consistent film quality, increases production yield, and reduces overall operational costs in large-scale manufacturing environments.

- Precision Quality Control: AI-driven vision systems and sensors detect microscopic defects such as bubbles, scratches, and alignment errors in optical films. Deep learning algorithms ensure accurate, real-time quality assurance, improving product reliability and reducing rework. These systems help maintain high standards critical to applications like touchscreens, OLED displays, and optical lenses.

- Smart Demand Forecasting and Supply Chain Management: AI enables accurate demand forecasting and inventory optimization for optical film producers. By analyzing market trends, customer behavior, and production data, AI supports agile supply chains, reduces lead times, and enhances responsiveness to market changes, ensuring timely delivery and cost-effective operations across the value chain.

Competitive Landscape

The global optical films market is highly competitive, with several prominent players focusing on innovation, strategic partnerships, and capacity expansion to gain a competitive edge. Key companies include 3M, Nitto Denko Corporation, LG Chem, Sumitomo Chemical, and Mitsubishi Chemical Corporation. These firms are actively investing in research and development to improve light control films, reflective polarizers, and advanced anti-reflection coatings. With rising demand from consumer electronics, display panels, and automotive infotainment systems, manufacturers are enhancing product durability, flexibility, and transparency.

Strategic collaborations between display panel makers and optical film suppliers are becoming increasingly common, especially in the development of OLED and foldable displays. The shift toward energy-efficient backlight films in LED and LCD technologies is creating new revenue streams. Additionally, emerging players are entering the market with cost-effective, multilayer film technologies tailored for touchscreens, signage displays, and wearable devices.

Asia Pacific-based companies dominate the production landscape due to proximity to electronics manufacturing hubs, but North American and European firms are gaining traction with advanced optical materials for aerospace and healthcare displays. As the industry transitions toward thinner, more sustainable, and higher-performance materials, the competition is intensifying, driving continuous innovation in display enhancement and optoelectronic applications.

Some of the prominent players in the Global Optical Films Market are:

- 3M

- Nitto Denko Corporation

- Toray Industries, Inc.

- LG Chem

- Sumitomo Chemical Co., Ltd.

- Hyosung Chemical Corporation

- Samsung SDI Co., Ltd.

- Mitsubishi Chemical Corporation

- Dexerials Corporation

- Kolon Industries, Inc.

- Zeon Corporation

- Sanritz Co., Ltd.

- Toppan Inc.

- Toyobo Co., Ltd.

- Chi Mei Corporation

- Shinwha Intertek

- Fujifilm Holdings Corporation

- BenQ Materials Corporation

- CSG Holding Co., Ltd.

- MNTech Co., Ltd.

- Other Key Players

Recent Developments

- In March 2024, Nikon Corporation announced the full acquisition of RED.com, LLC (RED), making RED a wholly owned subsidiary of Nikon under a Membership Interest Purchase Agreement.

- In January 2024, FlexEnable introduced optical evaluation kits specifically designed for AR and VR applications. These kits include ambient dimming and tunable lens film modules built using FlexEnable’s flexible liquid crystal (LC) technology. This innovation offers significantly enhanced optical performance, enabling the development of smaller, lighter, and curved AR/VR device, crucial for achieving visual comfort and long-term usability.

- In September 2023, FUJIFILM North America Corporation’s Optical Devices Division launched the FUJINON Duvo 1 HZK24-300mm Portable PL Mount Zoom Lens (“Duvo 24-300mm”). This dual-format lens is compatible with two types of large-image sensors and is designed to deliver shallow depth-of-field and aesthetically pleasing bokeh effects.

- In August 2023, Precision Glass & Optics (PG&O) unveiled a new capability which extended operating wavelength range for finished optics, covering from mid-ultraviolet (0.2 µm) to longwave infrared (15 µm). This enhancement is available on high-precision polished substrates ranging from 0.059 inches to 30 inches in diameter.

- In April 2023, IDEX Corporation announced a definitive agreement to acquire Iridian Spectral Technologies for CAD 150 million (approximately USD 110 million), subject to standard closing adjustments. This acquisition strengthens IDEX’s optical coating capabilities and broadens its technical foundation to serve current and emerging markets more effectively.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 33.2 Bn |

| Forecast Value (2034) |

USD 76.8 Bn |

| CAGR (2025–2034) |

9.8% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 5.9 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Backlight Unit, Polarizing Films, Indium Tin Oxide), By Application (Smartphones, Desktops & Laptops, Television, Signage & Advertising Display Boards, Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

3M, Nitto Denko Corporation, Toray Industries, Inc., LG Chem, Sumitomo Chemical Co., Ltd., Hyosung Chemical Corporation, Samsung SDI Co., Ltd., Mitsubishi Chemical Corporation, Dexerials Corporation, Kolon Industries, Inc., Zeon Corporation, Sanritz Co., Ltd., Toppan Inc., Toyobo Co., Ltd., Chi Mei Corporation, Shinwha Intertek, Fujifilm Holdings Corporation, BenQ Materials Corporation, CSG Holding Co., Ltd., MNTech Co., Ltd., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Optical Films Market?

▾ The Global Optical Films Market size is estimated to have a value of USD 33.2 billion in 2025 and is expected to reach USD 76.8 billion by the end of 2034.

Which region accounted for the largest Global Optical Films Market?

▾ Asia Pacific is expected to be the largest market share for the Global Optical Films Market with a share of about 58.5% in 2025.

Who are the key players in the Global Optical Films Market?

▾ Some of the major key players in the Global Optical Films Market are 3M, Nitto Denko Corporation, LG Chem, and many others.

What is the growth rate in the Global Optical Films Market?

▾ The market is growing at a CAGR of 9.8% over the forecasted period.

How big is the US Optical Films Market?

▾ The US Optical Films Market size is estimated to have a value of USD 5.9 billion in 2025 and is expected to reach USD 13.1 billion by the end of 2034.