Market Overview

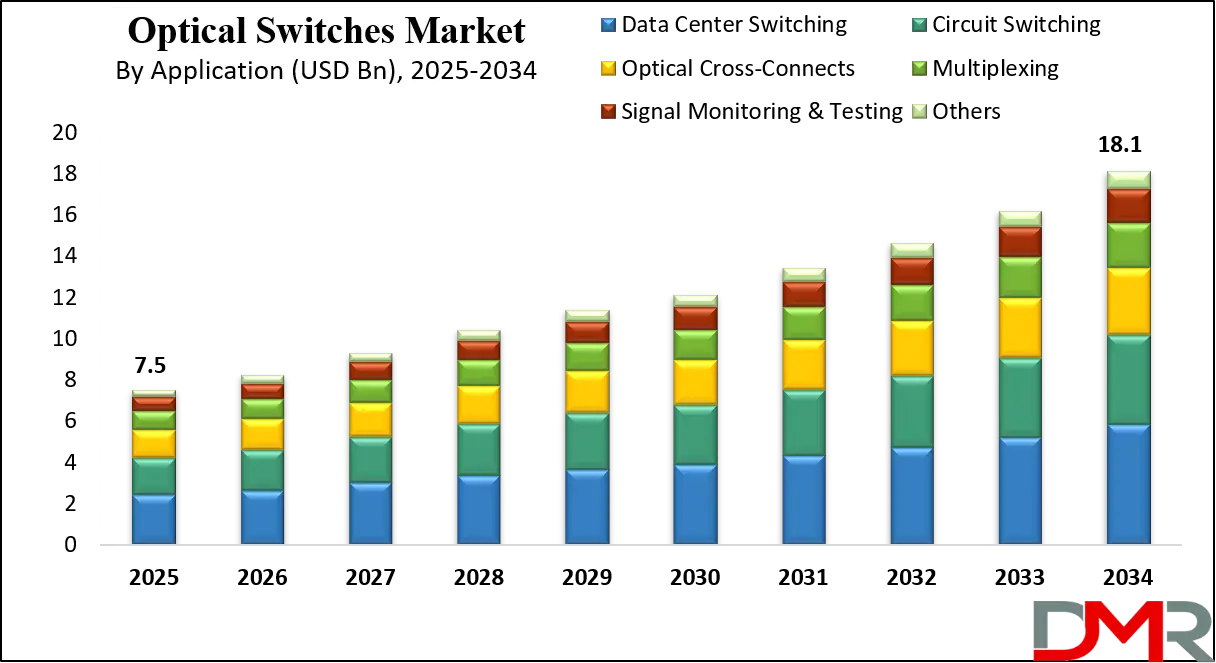

The global optical switches market is projected to reach USD 7.5 billion in 2025 and is expected to grow to USD 18.1 billion by 2034, registering a CAGR of 10.3%, driven by rising fiber optic network deployments, expanding data center infrastructure, and growing adoption of high-speed broadband and 5G technologies.

An optical switch is a device used in fiber optic communication networks to selectively transmit or redirect light signals between different optical fibers without converting them into electrical signals. It works by physically or electronically controlling the path of light within the network, enabling efficient signal routing, traffic management, and network reconfiguration.

Optical switches are essential in applications such as data centers, telecommunications, wavelength routing, testing, and signal monitoring, where high bandwidth, low latency, and scalability are critical. These devices can be based on various technologies, including micro-electromechanical systems (MEMS), electro-optic, thermo-optic, liquid crystal, or acousto-optic mechanisms, each offering unique advantages in terms of speed, power consumption, and cost-effectiveness.

The global optical switches market refers to the industry dedicated to the design, production, and deployment of switching technologies that enhance the performance and efficiency of optical communication networks. This market serves a diverse range of sectors such as telecom service providers, hyperscale data centers, enterprise IT infrastructure, government and defense, healthcare, and industrial automation.

The demand is driven by the exponential growth of internet traffic, rapid expansion of cloud computing, adoption of 5G networks, and the growing need for high-capacity, low-latency data transmission. Technological innovations in wavelength division multiplexing, network virtualization, and photonic integration are further expanding the capabilities of optical switching solutions, enabling more flexible and resilient network architectures.

Over the forecast period, the global optical switches market is expected to witness robust growth due to the rising deployment of high-speed broadband networks and the expansion of fiber optic infrastructure across emerging and developed economies. The shift toward energy-efficient networking solutions, combined with the need for dynamic bandwidth management in modern communication systems, is propelling adoption among service providers and enterprises alike.

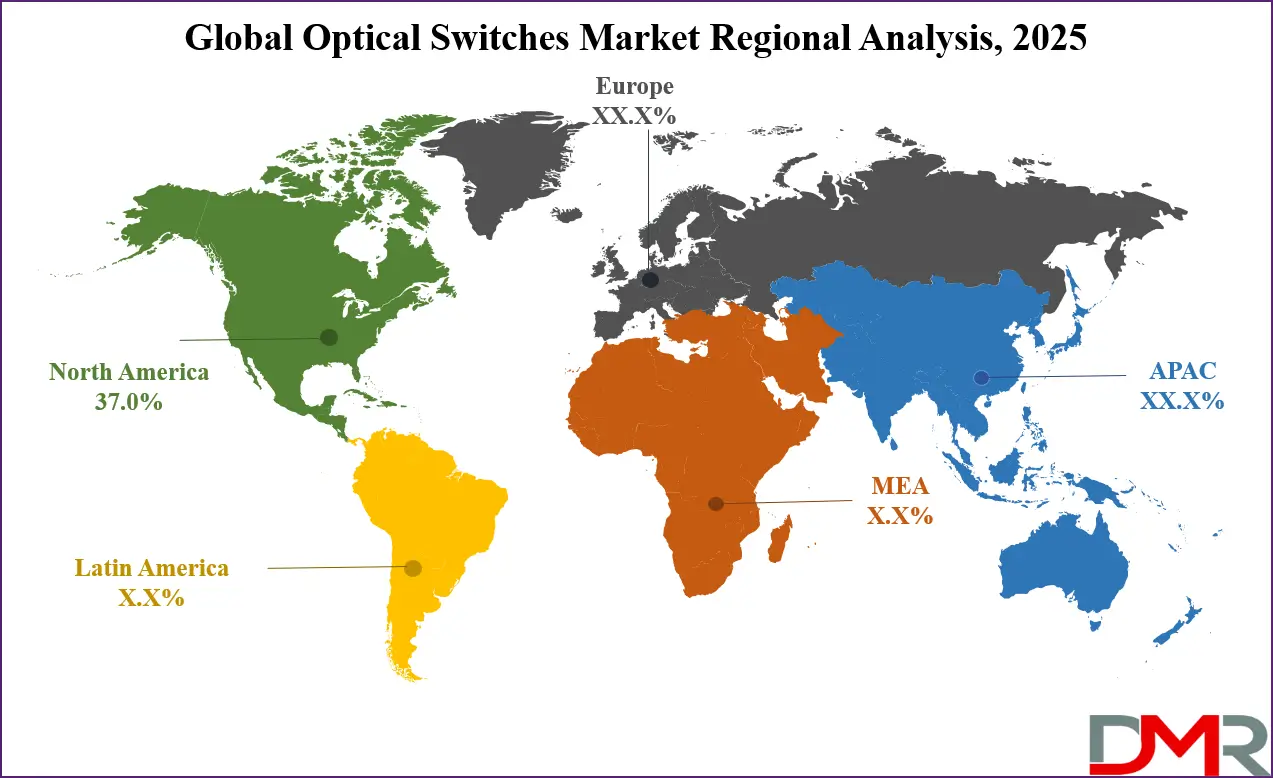

Regional market dynamics vary, with North America leading in technological advancement and Asia Pacific experiencing the fastest expansion due to large-scale investments in digital infrastructure. As network traffic continues to surge, optical switches are becoming an indispensable element of next-generation communication networks, offering the scalability and reliability required for the data-driven economy.

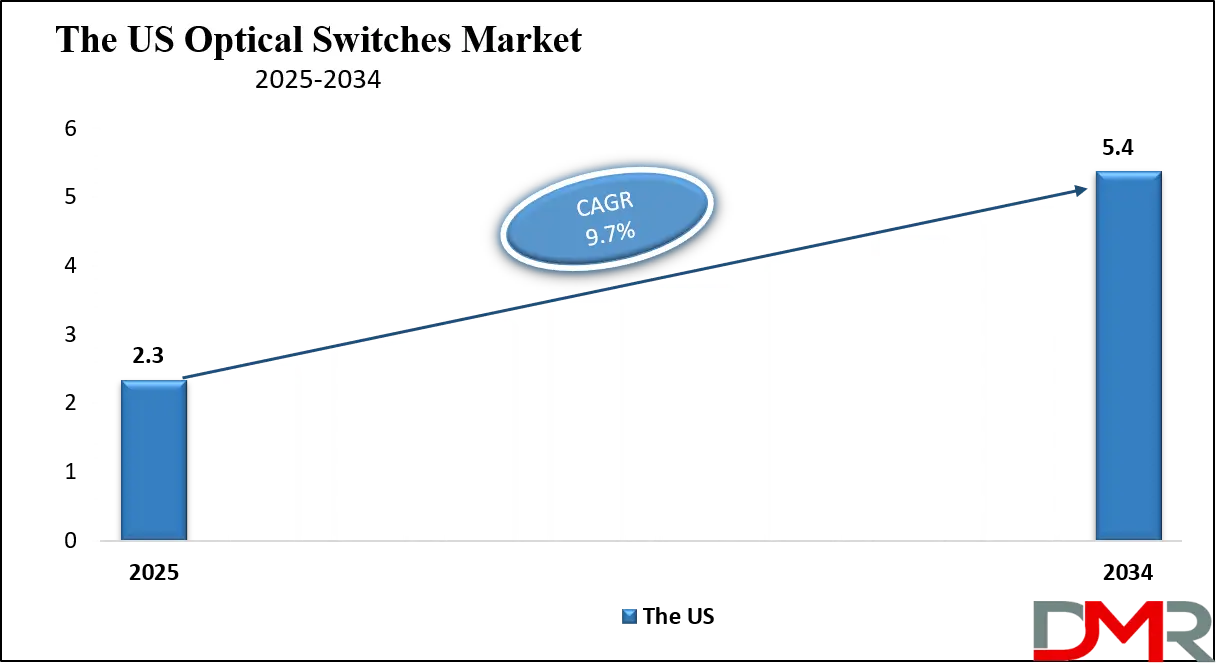

The US Optical Switches Market

The U.S. Optical Switches market size is projected to be valued at USD 2.3 billion by 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 5.4 billion in 2034 at a CAGR of 9.7%.

The US optical switches market is experiencing steady growth, driven by the rapid expansion of high-speed fiber optic networks, large-scale data center deployments, and growing adoption of 5G infrastructure. With the United States being a global leader in advanced networking technologies, optical switches are becoming integral to managing the surging data traffic generated by cloud computing, video streaming, IoT applications, and enterprise networking.

Leading telecom operators and hyperscale cloud providers are investing heavily in optical switching solutions to enable faster data transmission, reduce network latency, and improve bandwidth efficiency. The market also benefits from ongoing advancements in MEMS-based optical switches, electro-optic switching technologies, and wavelength division multiplexing (WDM), which are enhancing network scalability and operational flexibility. Additionally, government-backed broadband expansion programs and investments in smart city projects are further boosting demand for high-performance optical switching systems.

In the US, the adoption of optical switches spans multiple industry verticals, including telecommunications, data centers, BFSI, defense, and healthcare, each leveraging the technology for reliable, secure, and high-capacity connectivity. The rise of AI-driven data analytics, edge computing, and real-time applications is pushing enterprises to upgrade to photonic-based switching solutions for low-power, high-speed operations.

North American market players are focusing on integrating optical switches into software-defined networking (SDN) frameworks and network function virtualization (NFV) to enable dynamic traffic management and automated provisioning. The US also serves as a hub for research and innovation in optical communication, with collaborations between technology vendors, universities, and federal agencies accelerating product development and standardization. With an growing emphasis on energy-efficient networking and the ability to handle exponential data growth, the US optical switches market is positioned for sustained expansion over the coming decade.

Europe Optical Switches Market

Europe’s optical switches market is projected to reach approximately USD 2.2 billion in 2025, driven by the region’s robust digital infrastructure investments, rapid adoption of high-speed broadband, and the ongoing expansion of 5G networks. The presence of advanced telecom operators, strong government support for fiber-optic deployments, and growing demand for cloud-based services is fueling the adoption of optical switching technologies across various sectors.

Additionally, the surge in data traffic from streaming platforms, IoT devices, and enterprise connectivity needs is prompting data centers and network providers in Europe to adopt more efficient and scalable switching solutions to ensure low latency and high bandwidth performance. Countries such as Germany, the UK, and France are emerging as key contributors, with major tech hubs driving innovation and deployment.

With a forecast CAGR of 10.1%, Europe’s optical switches market is expected to experience sustained growth through the next decade. This momentum will be supported by the integration of AI-driven network management, adoption of software-defined networking (SDN) for more agile infrastructures, and the push for greener, energy-efficient optical networking solutions in line with the EU’s sustainability goals. The region’s strong presence of leading optical technology manufacturers and collaborations between research institutions and industry players are further accelerating advancements.

Moreover, as enterprises in Europe increasingly shift toward edge computing and hybrid cloud models, the demand for high-capacity, low-latency optical switches will continue to expand, solidifying the region’s position as a significant player in the global market landscape.

Japan Optical Switches Market

Japan’s optical switches market is expected to be valued at approximately USD 200 million in 2025, reflecting the country’s strong position in advanced telecommunications infrastructure and high-speed fiber-optic network adoption. Japan’s dense urban centers, extensive use of high-bandwidth applications, and early 5G deployment have created significant demand for optical switching technologies to manage large-scale data transmission efficiently. The nation’s technology-driven economy, integrated with its highly connected population, is fostering rapid adoption across data centers, enterprise networks, and telecom service providers.

Additionally, Japan’s leadership in photonics research and its well-established electronics manufacturing sector are contributing to the steady integration of next-generation optical switching solutions into various industries.

With a forecast CAGR of 9.2%, Japan’s optical switches market is poised for consistent growth, supported by continued investments in smart city projects, IoT expansion, and AI-enabled network management. The country’s strong commitment to innovation, integrated with collaborations between domestic tech giants and international partners, is accelerating advancements in low-latency, high-capacity switching technologies.

As enterprises and service providers increasingly embrace cloud migration, edge computing, and ultra-reliable low-latency communication (URLLC) for industrial applications, the role of optical switches in ensuring seamless, high-speed connectivity will become even more critical. This sustained growth trajectory underscores Japan’s position as a key market within the Asia-Pacific optical networking ecosystem.

Global Optical Switches Market: Key Takeaways

- Market Value: The global optical switches market size is expected to reach a value of USD 18.1 billion by 2034 from a base value of USD 7.5 billion in 2025 at a CAGR of 10.3%.

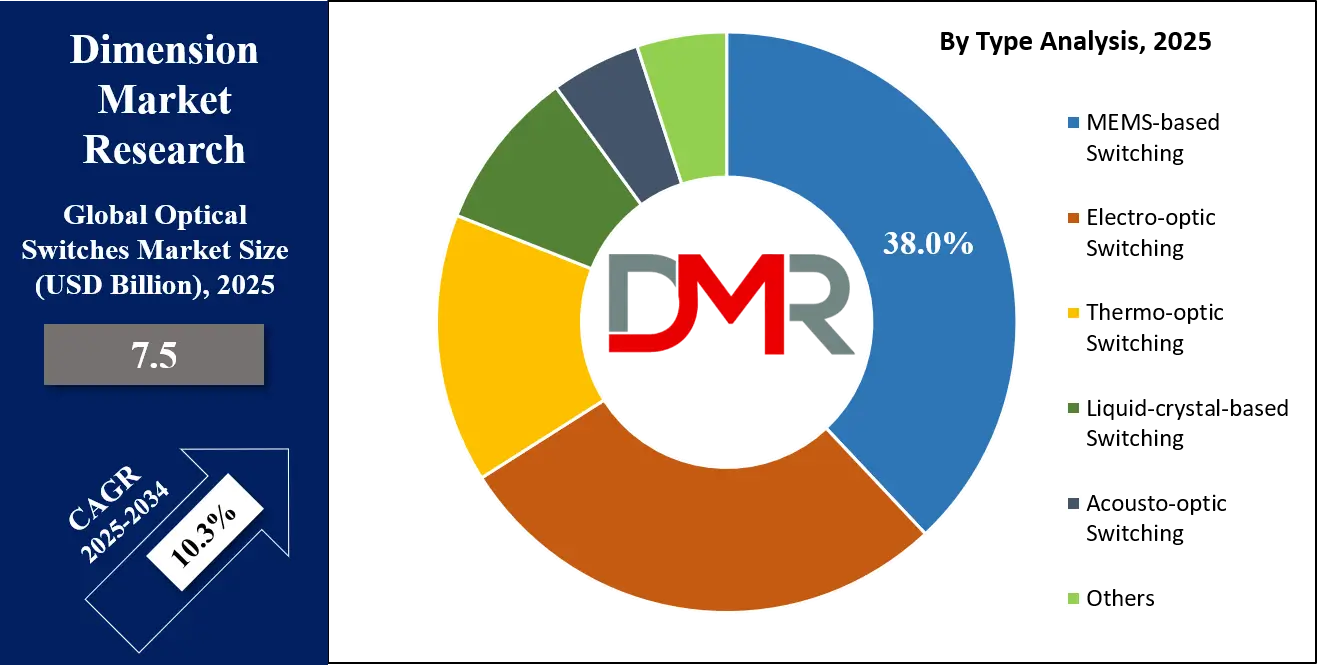

- By Type Segment Analysis: MEMS-based Switching is anticipated to dominate the type segment, capturing 38.0% of the total market share in 2025.

- By Application Segment Analysis: Data Center Switching applications will dominate the application segment, capturing 32.0% of the market share in 2025.

- By Industry Vertical Segment Analysis: The Telecommunication industry is expected to dominate the industrial vertical segment, capturing 42.0% of the market share in 2025.

- Regional Analysis: North America is anticipated to lead the global optical switches market landscape with 37.0% of total global market revenue in 2025.

- Key Players: Some key players in the global optical switches market are Cisco Systems, Inc., Huawei Technologies Co., Ltd., Fujitsu Limited, NEC Corporation, Corning Incorporated, Juniper Networks, Inc., Ciena Corporation, Broadcom Inc., Nokia Corporation, Infinera Corporation, Arista Networks, Inc., ZTE Corporation, Lumentum Holdings Inc., ADVA Optical Networking SE, Ekinops S.A., Acacia Communications, and Others.

Global Optical Switches Market: Use Cases

- Data Center Network Optimization: Optical switches are extensively deployed in hyperscale and enterprise data centers to enhance network performance, reduce latency, and improve bandwidth utilization. They enable seamless routing of high-volume data traffic between servers, storage systems, and network nodes without the need for electrical conversion. By integrating optical switches with wavelength division multiplexing (WDM) and software-defined networking (SDN), operators achieve scalable, low-power, and high-speed interconnects essential for cloud computing, virtualization, and AI-driven workloads.

- 5G and High-Speed Broadband Deployment: With the rollout of 5G networks and the expansion of fiber-to-the-home (FTTH) broadband services, telecom operators rely on optical switches for dynamic wavelength routing, traffic segmentation, and network redundancy. These switches support rapid reconfiguration of optical paths, ensuring low latency and high reliability for ultra-fast mobile broadband, IoT devices, and real-time applications such as AR/VR and autonomous vehicle communication.

- Defense and Secure Communication Systems: In government and defense networks, optical switches are used for secure, high-capacity communication infrastructure. They provide enhanced protection against signal interception while enabling rapid switching between multiple secure channels. Applications include military command centers, encrypted satellite communications, and mission-critical battlefield networks, where reliability and speed are paramount.

- Telemedicine and Healthcare Connectivity: Optical switching technology is increasingly applied in healthcare for telemedicine, high-resolution medical imaging, and real-time patient monitoring. Hospitals and research institutions use optical switches to transfer large imaging files, support remote diagnostics, and connect distributed healthcare facilities through high-speed fiber optic backbones. The low latency and high throughput of optical networks ensure seamless delivery of time-sensitive medical data.

Impact of Artificial Intelligence on the Optical Switches Market

Artificial intelligence is playing a transformative role in the optical switches market by enabling smarter, more adaptive, and energy-efficient network operations. AI-driven algorithms are being integrated into optical network management systems to automate traffic routing, predict congestion, and dynamically reconfigure switching paths based on real-time demand.

This automation reduces manual intervention, enhances operational efficiency, and minimizes downtime, which is critical for high-capacity environments such as hyperscale data centers and 5G telecom networks. AI also supports proactive maintenance by leveraging predictive analytics to detect faults or performance degradation in optical switches before they lead to service disruptions, thereby improving reliability and service quality.

Moreover, AI-powered optical switches are helping service providers optimize wavelength allocation, balance loads across multiple network nodes, and reduce energy consumption through intelligent resource management. In cloud computing, edge data centers, and content delivery networks, AI enables optical switching systems to adapt dynamically to fluctuating workloads, ensuring consistent low latency and high throughput.

The combination of AI and optical switching is also fostering advancements in autonomous network architectures, paving the way for self-healing, self-optimizing optical infrastructures that can handle the exponential growth of internet traffic. As AI technology matures, its integration with optical switches is expected to become a key differentiator for network scalability, resilience, and cost-effectiveness in the global communication ecosystem.

Global Optical Switches Market: Stats & Facts

International Telecommunication Union (ITU) — Facts & Figures 2024

- 2024 internet users reached about 5.4 billion people, up 3.4% vs. 2023.

- About 2.6 billion people remained offline in 2024.

- The global internet use rate was ~67% of the population in 2024.

- ITU’s 2024 brief highlights continued growth in internet traffic and bandwidth year over year.

Federal Communications Commission (USA)

- As of June 30, 2024, roughly 94% of broadband-serviceable locations had at least one provider reporting 100/20 Mbps fixed service available.

- In March 2024, the FCC raised the fixed broadband benchmark from 25/3 Mbps to 100/20 Mbps.

- The FCC also set a long-term goal of 1 Gbps/500 Mbps for fixed broadband.

- The FCC noted that ~45 million Americans lack access to both 100/20 Mbps fixed service and 35/3 Mbps 5G-NR mobile service (2024 report context).

- In July 2025, the FCC initiated its next broadband availability inquiry, continuing the 100/20 Mbps focus for reporting.

NTIA / Internet for All (USA)

- The BEAD program allocates USD 42.45 billion to states and territories for high-speed internet deployment (announced June 26, 2023).

- By July 22, 2025, all 56 states and territories had approvals to proceed under BEAD milestones.

European Commission — State of the Digital Decade (EU)

- 5G coverage in populated areas across the EU exceeded 83% by 2023, with further progress through 2024–2025.

- The EU’s 2030 targets remain 100% gigabit coverage and widespread 5G availability across all populated areas.

Eurostat (EU) — Cloud Computing in Enterprises (2024 release)

- In 2023, 45% of EU enterprises used cloud computing services.

- Cloud use by large enterprises was about 78% in 2023.

- Country variation in 2023: leaders included Finland (~79%) and Sweden (~75%) of enterprises using cloud.

- Small firms’ cloud adoption also rose in 2023, contributing to the overall EU increase.

Bundesnetzagentur (Germany)

- The 9th annual broadband speed-test report (period Oct 2023–Sep 2024) counted 276,081 valid fixed and 562,305 valid mobile tests.

- In June 2025, Germany’s regulator outlined a spectrum-usage rights extension approach in key mobile bands through end-2036 to provide investment certainty.

Australian Communications and Media Authority (ACMA) — Trends & Developments 2023–24

- ACMA’s 2023–24 telecommunications trends report documents increased reliance on both wired and wireless services as Australians move more activity online.

- ACMA’s 2023–24 overview underpins policy and spectrum planning for 2024–29, aligned with the government’s Better Connectivity Plan.

Singapore IMDA — Telecom Statistics 2024

- International outgoing retail call minutes totaled ~544.9 million in June 2024; including transit, ~2.347 billion minutes.

- Total fixed-line subscriptions rose to ~1.975 million by June 2024.

- Of these, ~1.182 million were residential and ~0.794 million were corporate/business lines (June 2024).

- IMDA’s Jul–Dec 2024 monitoring includes complaints per 10,000 subscribers and resolution rates for mobile and broadband services.

- IMDA publishes ongoing telecom KPIs covering mobile market and broadband subscriptions for 2024.

Canadian Radio-television and Telecommunications Commission (CRTC) — Telecom Regulatory Policy 2024-180

- As of August 2024, more than 4 million Canadian households were buying gigabit-speed internet plans.

- The CRTC notes as many as 17% of Canadian households were not yet connected to a network capable of gigabit speeds.

- Cable companies’ FTTP builds connected about 5% of households, informing wholesale access decisions (2024).

U.S. Energy Information Administration (EIA)

- U.S. utility-scale electricity generation reached an all-time high in 2024, reflecting rising load from sectors including data centers.

- EIA projected +2% generation growth in 2025 from the 2024 high.

Global Optical Switches Market: Market Dynamics

Global Optical Switches Market: Driving Factors

Surge in Data Center Expansion and Cloud Adoption

The rapid growth of hyperscale and enterprise data centers, fueled by cloud computing, big data analytics, and streaming services, is driving a significant growth in demand for optical switches. These facilities require high-speed, low-latency, and scalable optical interconnects to handle rising traffic volumes. Optical switching technology, integrated with wavelength division multiplexing (WDM) and software-defined networking (SDN), offers the agility and bandwidth management essential for dynamic cloud workloads.

Accelerated 5G Network Deployments

The ongoing global rollout of 5G infrastructure is a major growth catalyst for the optical switches market. Telecom operators are leveraging optical switches to support ultra-reliable low-latency communication (URLLC), network slicing, and massive machine-type communications. These switches enable efficient wavelength routing, traffic segmentation, and fiber optimization, which are critical for supporting IoT devices, autonomous vehicles, and immersive technologies such as AR and VR.

Global Optical Switches Market: Restraints

High Initial Investment Costs

Deploying advanced optical switching systems involves significant capital expenditure, including the cost of hardware, installation, and integration with existing network infrastructure. For small and medium enterprises (SMEs) and operators in developing regions, these high initial costs can limit adoption despite the long-term efficiency benefits.

Complexity in Network Integration

Integrating optical switches into multi-vendor, multi-protocol network environments can be challenging. Compatibility issues, along with the need for skilled technicians to manage and configure photonic switching, may slow down implementation, particularly in legacy network setups.

Global Optical Switches Market: Opportunities

Rising Adoption of Edge Computing

The growing trend toward decentralized computing through edge data centers is creating new demand for compact, high-performance optical switches. These systems facilitate rapid data processing closer to end-users, supporting latency-sensitive applications such as smart manufacturing, connected vehicles, and telehealth services.

Expansion of Smart City Infrastructure

Governments and municipalities globally are investing in smart city projects, which require robust fiber optic backbones for traffic management, public safety, and IoT-driven services. Optical switches provide the high-capacity, reconfigurable networks necessary to interconnect sensors, cameras, and control systems in urban environments.

Global Optical Switches Market: Trends

Integration with Artificial Intelligence and Automation

Optical switches are increasingly being integrated with AI-powered network management tools that enable predictive maintenance, real-time traffic optimization, and automated fault recovery. This trend supports the development of autonomous and self-healing networks, reducing operational costs and improving service reliability.

Growing Shift toward Green Networking Solutions

With sustainability becoming a priority, manufacturers are developing energy-efficient optical switching systems that minimize power consumption without compromising performance. This includes innovations in low-loss photonic components, passive optical switching, and optimized cooling mechanisms for data center deployments.

Global Optical Switches Market: Research Scope and Analysis

By Type Analysis

In the global optical switches market, MEMS-based switching is projected to lead the type segment, accounting for approximately 38.0% of the total market share in 2025. This technology relies on micro-electromechanical systems that use tiny movable mirrors to physically redirect optical signals between fibers without converting them into electrical form. Its popularity stems from its exceptional scalability, low insertion loss, energy efficiency, and precise light path control, making it well-suited for large-scale telecom backbones, hyperscale data centers, and wavelength division multiplexing (WDM) networks.

MEMS-based switches also excel in reliability, compact form factors, and cost-effectiveness over the long term, enabling network operators to achieve flexible reconfiguration, efficient bandwidth management, and improved network resilience. Their compatibility with automated network provisioning further strengthens their adoption in environments requiring high-performance photonic switching with minimal maintenance.

Electro-optic switching represents another significant subsegment in the optical switches market, valued for its unparalleled switching speed and responsiveness. This technology operates by altering the refractive index of electro-optic materials, such as lithium niobate, when an electric field is applied, enabling the rapid modulation and routing of light signals. Due to its ultra-low latency and ability to handle extremely high-frequency operations, electro-optic switching finds strong demand in specialized applications including high-frequency trading systems, mission-critical defense communication, and real-time optical signal processing.

Although these switches typically involve higher power consumption and production costs compared to MEMS-based alternatives, their superior speed makes them indispensable in use cases where rapid optical path changes are essential for maintaining service quality and competitive performance. Continuous advancements in electro-optic materials and integration with photonic integrated circuits are also enhancing their efficiency, potentially expanding their share in future high-speed networking environments.

By Application Analysis

Data center switching is anticipated to be the leading application in the optical switches market, capturing around 32.0% of the share in 2025, primarily due to the explosive growth of cloud computing, big data analytics, artificial intelligence workloads, and content streaming services. Optical switches in data centers enable high-speed, low-latency connectivity between servers, storage devices, and network equipment, supporting the massive data throughput required in hyperscale and enterprise facilities.

Their ability to manage dynamic traffic patterns, integrate with wavelength division multiplexing (WDM) systems, and operate with energy efficiency makes them a critical component in reducing network congestion and ensuring consistent performance. As enterprises adopt software-defined networking (SDN) and network function virtualization (NFV), optical switches are increasingly deployed to deliver flexible, automated, and scalable network architectures capable of adapting to evolving workload demands.

Circuit switching is another important application area within the optical switches market, focusing on the establishment of dedicated communication paths between endpoints for the duration of a transmission session. In optical networks, circuit switching ensures consistent bandwidth and predictable latency, which is essential for applications such as telecommunication backbone links, secure government communications, and certain industrial control systems.

While less flexible than packet-switched architectures, circuit switching provides a guaranteed quality of service (QoS) by preventing data from competing for network resources once the circuit is established. This makes it particularly valuable in environments that require continuous, uninterrupted data flows, such as real-time video conferencing, voice communications, or mission-critical defense operations. The reliability and stability offered by optical circuit switching continue to sustain its relevance in specialized high-performance networking scenarios.

By Industry Vertical Analysis

The telecommunication industry is projected to dominate the industry vertical segment of the optical switches market in 2025, accounting for around 42.0% of the share. This dominance is driven by the rapid expansion of 5G networks, growing fiber-to-the-home (FTTH) deployments, and the growing demand for high-capacity, low-latency connectivity to support modern digital services. Optical switches play a pivotal role in telecom infrastructure by enabling efficient traffic management, wavelength routing, and dynamic network reconfiguration to handle surging data volumes.

They are essential in supporting long-haul fiber networks, metropolitan area networks (MANs), and subsea cable systems, ensuring optimized bandwidth utilization and reduced signal loss. As telecom operators continue to upgrade their infrastructure to meet the demands of IoT devices, cloud applications, and video streaming, the adoption of optical switching solutions is expected to grow significantly, enhancing both network efficiency and service quality.

Data centers and cloud service providers also represent a crucial industry vertical in the optical switches market, driven by the exponential growth of hyperscale facilities and the need for seamless interconnection between computing, storage, and networking resources. Optical switches in these environments provide the high-speed, scalable, and low-latency links necessary to support AI-driven analytics, edge computing workloads, and content delivery networks.

They enable dynamic traffic routing, load balancing, and energy-efficient operation, which are essential for maintaining optimal performance and operational cost control in data-intensive environments. The shift toward hybrid and multi-cloud architectures is further fueling demand for optical switching technologies, as organizations require fast, reliable, and secure data transfer between geographically dispersed facilities. This ongoing digital transformation ensures that data centers and cloud providers will remain a significant growth driver for the optical switches market in the coming years.

The Optical Switches Market Report is segmented on the basis of the following:

By Type

- MEMS-based Switching

- Electro-optic Switching

- Thermo-optic Switching

- Liquid-crystal-based Switching

- Acousto-optic-Switching

- Others

By Application

- Data Center Switching

- Circuit Switching

- Optical Cross-Connects

- Multiplexing

- Signal Monitoring & Testing

- Others

By Industry Vertical

- Telecommunications

- Data Centers & Cloud

- BFSI

- Government & Defense

- Healthcare

- Manufacturing & Industrial

Global Optical Switches Market: Regional Analysis

Region with the Largest Revenue Share

North America is expected to lead the global optical switches market in 2025, capturing approximately 37.0% of total market revenue, supported by the region’s advanced telecommunications infrastructure, rapid adoption of 5G technology, and strong presence of hyperscale data centers. The demand is further fueled by high investments in fiber optic network expansions, the proliferation of cloud computing, and the growing need for high-speed, low-latency connectivity to support AI, IoT, and streaming services.

Additionally, the presence of key industry players, robust R&D activities, and early adoption of emerging optical networking technologies position North America as a dominant force in shaping the market’s growth trajectory.

Region with significant growth

Asia Pacific is projected to witness the most significant growth in the global optical switches market, driven by rapid digital transformation, expanding 5G deployments, and large-scale fiber optic network rollouts across countries such as China, India, Japan, and South Korea. The surge in data center construction, growing adoption of cloud services, and growing internet penetration is creating strong demand for high-speed optical networking solutions in the region.

Government initiatives to strengthen broadband connectivity, integrated with rising investments from telecom operators and technology giants, are further accelerating market expansion. This combination of infrastructure development, technological adoption, and economic growth positions Asia Pacific as the fastest-growing regional market in the coming years.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Optical Switches Market: Competitive Landscape

The global competitive landscape of the optical switches market is characterized by a mix of established networking giants, specialized optical component manufacturers, and innovative technology startups, all striving to capture market share through product innovation, strategic partnerships, and global expansion. Leading players such as Cisco Systems, Huawei Technologies, Ciena Corporation, Fujitsu, and Nokia dominate through extensive R&D investments, diversified product portfolios, and integration of advanced technologies like artificial intelligence and software-defined networking into optical switching solutions.

Competition is further intensified by emerging companies focusing on cost-effective and energy-efficient designs tailored for hyperscale data centers, telecom operators, and cloud service providers. Mergers, acquisitions, and collaborations are common strategies, enabling companies to enhance their technological capabilities, expand geographic presence, and strengthen customer relationships in a rapidly evolving market.

Some of the prominent players in the global optical switches market are:

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd.

- Fujitsu Limited

- NEC Corporation

- Corning Incorporated

- Juniper Networks, Inc.

- Ciena Corporation

- Broadcom Inc.

- Nokia Corporation

- Infinera Corporation

- Arista Networks, Inc.

- ZTE Corporation

- Lumentum Holdings Inc.

- ADVA Optical Networking SE

- Ekinops S.A.

- Acacia Communications, Inc.

- Mellanox Technologies Ltd. (NVIDIA)

- TE Connectivity Ltd.

- O-Net Technologies Group Limited

- Huawei Marine Networks Co., Ltd.

- Other Key Players

Global Optical Switches Market: Recent Developments

- May 2025: iPronics unveils the world’s first silicon photonics-based optical circuit switch designed specifically for AI-driven data center networks, promising transformative performance improvements.

- April 2025: Telescent debuts its G5 optical patch panel featuring MPO-16 connectors capable of switching 16,128 fibers within a single rack, an unprecedented capacity tailored for hyperscale data centers and AI clusters.

- April 2025: nEye Systems secures USD 58 million in Series B funding led by CapitalG, along with participation from Microsoft M12, Micron Ventures, NVIDIA, and others, bringing total funding to USD 72.5 million to advance its wafer-scale optical switch technology for AI data centers.

- February 2025: Salience Labs, a UK-based silicon photonics startup, closes a USD 30 million Series A round led by ICM HPQC Fund and Applied Ventures to accelerate development of its high-bandwidth, low-latency photonic switches for AI-scale infrastructure.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 7.5 Bn |

| Forecast Value (2034) |

USD 18.1 Bn

|

| CAGR (2025–2034) |

10.3%

|

| The US Market Size (2025) |

USD 2.3 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (MEMS-based Switching, Electro-optic Switching, Thermo-optic Switching, Liquid-crystal-based Switching, Acousto-optic Switching, and Others), By Application (Data Center Switching, Circuit Switching, Optical Cross-Connects, Multiplexing, Signal Monitoring & Testing, and Others), and By Industry Vertical (Telecommunications, Data Centers & Cloud, BFSI, Government & Defense, Healthcare, and Manufacturing & Industrial) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Cisco Systems, Inc., Huawei Technologies Co., Ltd., Fujitsu Limited, NEC Corporation, Corning Incorporated, Juniper Networks, Inc., Ciena Corporation, Broadcom Inc., Nokia Corporation, Infinera Corporation, Arista Networks, Inc., ZTE Corporation, Lumentum Holdings Inc., ADVA Optical Networking SE, Ekinops S.A., Acacia Communications, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |