Market Overview

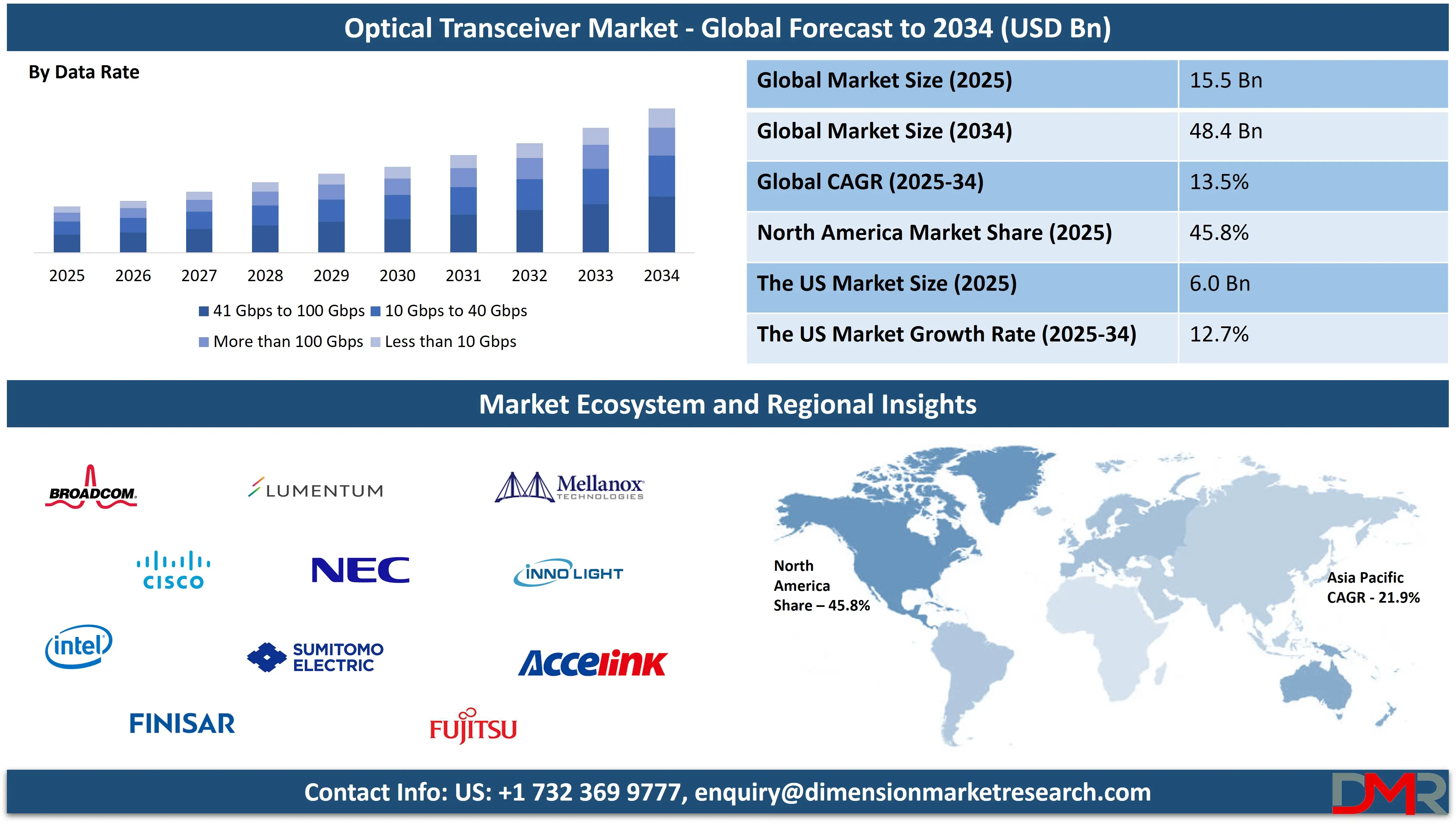

The Global Optical Transceiver Market is estimated to be valued at

USD 15.5 billion in 2025 and is further anticipated to reach

USD 48.4 billion by 2034 at a

CAGR of 13.5%.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

An optical transceiver is a compact, integrated device that combines a transmitter and a receiver into a single module, enabling bidirectional data transmission over fiber optic networks. These devices convert electrical signals into optical signals and vice versa, facilitating high-speed data communication across various distances. Optical transceivers are designed to fit into networking hardware such as switches, routers, and servers, using standard form factors and interfaces like SFP, QSFP, and CFP. By supporting high bandwidth, low latency, and long-distance communication, optical transceivers play a critical role in telecommunications infrastructure, data centers, and enterprise networks, where reliability and speed are essential.

The global optical transceiver market has witnessed significant growth in recent years, driven primarily by the surging demand for high-speed internet connectivity, rapid expansion of data centers, and the evolution of 5G networks. As organizations and consumers rely on data-intensive applications, such as cloud computing, video streaming, and AI workloads, the need for robust optical communication systems has become more pronounced. Optical transceivers, with their ability to deliver high-bandwidth transmission over both short and long distances, have become indispensable in scaling network capacity and maintaining seamless connectivity across multiple industries.

Technological advancements in form factors and data transmission rates transform the optical transceiver landscape. Innovations such as QSFP-DD, CFP8, and SFP28 allow network operators to manage rising traffic demands without compromising energy efficiency or infrastructure density. Moreover, the adoption of coherent optics and wavelength-division multiplexing (WDM) is enabling transceivers to operate over longer distances while maintaining high signal integrity. These technological upgrades are particularly relevant for hyperscale data centers and backbone telecom networks, which demand scalable and cost-efficient solutions to support their evolving requirements.

Government support and private-sector collaboration are enhancing the optical transceiver landscape in the U.S. Regulatory initiatives aimed at improving broadband accessibility, such as the Broadband Equity, Access, and Deployment (BEAD) Program, are driving infrastructure expansion into underserved regions. At the same time, growing investments in research and development, often supported through public-private partnerships, are accelerating breakthroughs in photonics and optical networking. These factors, combined with strong venture capital interest in optical communication startups, are ensuring that the U.S. remains a hub for both the innovation and adoption of cutting-edge optical transceiver technologies.

The US Optical Transceiver Market

The U.S. Optical Transceiver Market is projected to be valued at USD 6.0 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 17.5 billion in 2034 at a CAGR of 12.7%.

The U.S. optical transceiver market is a mature yet rapidly evolving segment, largely fueled by the country’s advanced digital infrastructure and the continuous demand for high-speed, low-latency connectivity. With the proliferation of cloud computing, 5G rollouts, and AI-driven applications, the need for scalable, high-bandwidth optical communication systems has intensified. U.S.-based hyperscale data center operators, telecom giants, and content delivery networks are leading adopters of optical transceivers, utilizing them to handle the surging volume of data traffic and ensure network reliability.

The presence of major cloud service providers like Amazon Web Services, Google Cloud, and Microsoft Azure further amplifies the demand for next-generation transceiver solutions that support dense and high-throughput networking environments.

Technological innovation is a key driving force behind the U.S. market’s growth trajectory. American companies such as Intel, Broadcom, and Cisco are at the forefront of optical transceiver development, pushing the envelope in terms of speed, power efficiency, and form factor miniaturization. Emerging technologies like 400G, 800G, and even terabit-class transceivers are being trialed and gradually deployed to future-proof core and metro networks.

The integration of advanced protocols, including coherent optics and DWDM, is also gaining traction, especially in long-haul applications where signal fidelity and transmission range are critical. U.S. enterprises and service providers are prioritizing these innovations to maintain their competitive edge and meet the expectations of data-intensive industries.

Global Optical Transceiver Market: Key Takeaways

- Market Value: The global optical transceiver market size is expected to reach a value of USD 48.4 billion by 2034 from a base value of USD 15.5 billion in 2025 at a CAGR of 13.5%.

- By Form Factor Segment Analysis: QSFP, QSFP+, QSFP-DD, QSFP28, and QSFP56 are poised to consolidate their dominance in the form factor segment, capturing 38.8% of the total market share in 2025.

- By Data Rate Segment Analysis: 41 Gbps to 100 Gbps data rate is anticipated to maintain its dominance in the data rate segment, capturing 38.9% of the total market share in 2025.

- By Fiber Type Segment Analysis: Single-Mode Fiber (SMF) is poised to consolidate its market position in the fiber type segment, capturing 68.3% of the total market share in 2025.

- By Distance Segment Analysis: Less than 1 KM distance is expected to maintain its dominance in the distance segment, capturing 47.5% of the total market share in 2025.

- By Wavelength Segment Analysis: 1310 NM Band is expected to maintain its dominance in the wavelength segment, capturing 39.6% of the total market share in 2025.

- By Connector Segment Analysis: LC connectors are poised to consolidate their dominance in the connector segment, capturing 53.7% of the total market share in 2025.

- By Protocol Segment Analysis: Ethernet is anticipated to maintain its dominance in the protocol segment, capturing 57.1% of the total market share in 2025.

- By Application Type Segment Analysis: Telecommunication applications are poised to consolidate their market position in the application type segment, capturing 47.3% of the total market share in 2025.

- Regional Analysis: North America is anticipated to lead the global optical transceiver market landscape with 45.8% of total global market revenue in 2025.

- Key Players: Some key players in the global optical transceiver market are Broadcom, Cisco Systems, Intel Corporation, Finisar (now part of II-VI Incorporated), II-VI Incorporated, Lumentum Holdings, Sumitomo Electric Industries, Fujitsu Optical Components, NEC Corporation, Mellanox Technologies (now part of NVIDIA), Accelink Technologies, InnoLight Technology, Hisense Broadband, Source Photonics, Applied Optoelectronics, Reflex Photonics (acquired by Smiths Interconnect), Huawei Technologies, Ciena Corporation, Viavi Solutions, AOI (Advanced Optoelectronic Technology Inc.), and Other Key Players.

Global Optical Transceiver Market: Use Cases

- 5G Network Infrastructure Backhaul: As telecom operators continue to roll out 5G globally, optical transceivers play a pivotal role in enabling high-capacity, low-latency data transport between cell sites, base stations, and core networks. The surge in mobile data traffic and real-time application requirements demands robust backhaul solutions. Optical transceivers, especially those using DWDM and coherent optics, are being deployed in metro and long-haul segments to provide the scalable bandwidth 5G networks require.

- Hyperscale Data Center Interconnect (DCI): Hyperscale data centers operated by companies like Amazon, Google, Meta, and Microsoft require efficient interconnects to manage massive data volumes across regional clusters. Optical transceivers are critical in Data Center Interconnect (DCI) applications, enabling point-to-point and point-to-multipoint connections across short (<2 km) to medium (2–80 km) distances.

- Fiber to the Home (FTTH) & Last-Mile Connectivity: Governments and ISPs around the world are investing in fiber broadband infrastructure to bridge the digital divide. Optical transceivers are widely used in FTTH applications, particularly in Optical Line Terminals (OLTs) and Optical Network Units (ONUs). These transceivers enable high-speed internet access directly to homes and businesses, improving digital access in rural and underserved areas.

- High-Speed Trading & Financial Networks: In the financial sector, milliseconds can determine competitive advantage. Optical transceivers are deployed in high-frequency trading (HFT) environments where ultra-low latency and high data throughput are essential. Financial firms use these transceivers to build private networks and ensure direct market access (DMA) to global stock exchanges.

Global Optical Transceiver Market: Stats & Facts

- According to NASA (U.S.):

- The optical transceiver market utilizing integrated photonics is projected to grow 20-fold over the next five years to meet the demands of large data centers.

- According to the Department of Telecommunications (India):

- As of November 2024, India had 2.948 million Mobile Base Transceiver Stations (BTS) and 813,000 mobile towers.

- Foreign Direct Investment (FDI) in the telecommunications sector during April to September 2024 was US$670 million, up from US$282 million in the same period of 2023.

- According to the European Commission (CORDIS):

- Between 2010 and 2015, optical transceivers based on gallium arsenide (GaAs) optics accounted for 15–20% of the market, with expectations of increased share in the following years.

- According to the UK Government:

- A newly developed fibre optic network was designed to handle up to 192,000 gigabits per second of data transmission at its full capacity.

- According to the Telecom Regulatory Authority of India (TRAI):

- As of December 2022, India had 2.398 million Mobile Base Transceiver Stations (BTS) and 740,000 mobile towers.

- According to the Telecommunication Engineering Centre (India):

- The 100G QSFP28 SR4 is a pluggable, parallel, fiber-optic transceiver module designed for 100/40 Gigabit Ethernet, Infiniband DDR/EDR, and 32G Fibre Channel applications, highlighting India's technical evaluation of global optical standards.

- According to the UK Department for Science, Innovation and Technology (DSIT):

- The UK’s National Semiconductor Strategy includes a comprehensive baseline study of semiconductor-related activity, which underpins optical transceiver development and deployment across telecom infrastructure.

- According to the European Commission’s Joint Research Centre (JRC):

- A strategic forecast identifies the increasing demand for raw materials, such as rare earth elements and specialty glass, used in the manufacture of optical transceivers, underlining their criticality to Europe’s technology supply chain.

- According to the UK Government’s Telecom Supply Chain Diversification Report:

- The UK is implementing a long-term plan to promote diverse and secure telecom supply chains, emphasizing the need for greater resilience and innovation in optical transceiver technologies.

- According to the European Commission’s RocketChip Project:

- Photonics firms such as EFFECT Photonics are spearheading efforts to deliver low-cost, high-performance optical transceiver modules using advanced integration techniques supported by the European Union’s digital innovation programs.

Global Optical Transceiver Market: Market Dynamics

Global Optical Transceiver Market: Driving Factors

Surge in AI and Machine Learning Workloads Driving High-Speed Optical ConnectivityThe global expansion of artificial intelligence (AI) and machine learning (ML) workloads is placing unprecedented demand on data infrastructure, directly accelerating the adoption of high-speed optical transceivers. As AI models become more complex and data-hungry, particularly in natural language processing, image recognition, and autonomous systems, the volume of data that needs to be processed, transferred, and stored across distributed computing environments has skyrocketed. Optical transceivers capable of supporting 200G, 400G, and even 800G are becoming essential components in high-performance computing (HPC) clusters and hyperscale cloud data centers.

Government-Led Digital Infrastructure Initiatives and Broadband Expansion

Across developed and emerging economies, government initiatives to modernize digital infrastructure and expand broadband access are significantly contributing to the optical transceiver market’s growth. Programs such as the U.S. Broadband Equity, Access, and Deployment (BEAD) initiative, the EU’s Digital Decade targets, and Asia-Pacific’s Smart Nation projects are injecting billions of dollars into fiber network deployments, particularly in underserved rural and suburban areas. Optical transceivers are the backbone of these projects, powering the high-speed transmission of data from central offices to homes, schools, healthcare centers, and businesses through FTTx architectures.

Global Optical Transceiver Market: Restraints

Supply Chain Disruptions and Raw Material Volatility

The complex manufacturing ecosystem of optical transceivers, which involves suppliers across the U.S., Asia-Pacific, and Europe, makes the market highly vulnerable to geopolitical tensions, trade restrictions, and logistic delays. Events like the global semiconductor shortage, COVID-19-related factory shutdowns, and regional conflicts (e.g., U.S.-China tech restrictions) have all contributed to delayed production cycles, lead times, and rising costs. Moreover, raw material price volatility, especially for rare earth elements and specialized glass used in photonic components, puts financial strain on manufacturers and limits their ability to scale cost-effectively.

Interoperability Challenges and Lack of Standardization Across Vendors

Many large-scale deployments, particularly in data centers and telecom networks, use equipment from multiple vendors. However, the lack of universal standards in transceiver design, firmware compatibility, and form factor specifications often leads to integration problems. Customization needs and proprietary firmware restrictions can create vendor lock-in situations, reducing flexibility and operational complexity for network administrators. Additionally, newer high-speed transceivers (e.g., 400G, 800G) frequently require upgraded infrastructure, such as specific connectors, new cooling mechanisms, or power supply enhancements, which may not be backward-compatible with existing setups.

Global Optical Transceiver Market: Opportunities

Emergence of Co-Packaged Optics (CPO) as a Next-Generation Integration Paradigm

Unlike traditional pluggable optics, CPO drastically reduces the electrical signal path between components, thereby minimizing latency, power consumption, and thermal overhead. This innovation is particularly critical in next-gen hyperscale data centers, which are blocked by the limitations of copper-based electrical interfaces at speeds above 800 G. Leading companies and consortiums like the COBO (Consortium for On-Board Optics) and Open Compute Project are actively working to standardize CPO implementations, opening the door for a new product segment with high margins and long-term growth potential. As AI and high-performance computing workloads continue to grow, CPO could redefine data center infrastructure and unlock a multi-billion-dollar market for advanced optical solutions.

Growing Adoption of Green Data Centers and Energy-Efficient Network Architectures

Optical transceivers inherently consume less power than copper-based alternatives for equivalent bandwidth, and new designs are emerging with advanced modulation techniques and photonic integration to further reduce energy usage. Governments, cloud providers, and hyperscale operators are setting ambitious targets to reduce data center carbon footprints, driving demand for energy-efficient transceivers such as 100G QSFP28, 400G QSFP-DD, and future 800 G+ form factors optimized for lower power per bit. In addition, transceivers supporting intelligent monitoring, thermal management, and adaptive optics are gaining traction as enterprises seek to align with global ESG (Environmental, Social, and Governance) goals.

Global Optical Transceiver Market: Trends

Shift toward Higher-Speed Transceivers for Cloud and Edge Computing

With cloud service providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud expanding their global infrastructure, the demand for high-speed, low-latency optical transceivers (ranging from 100G to 800G and beyond) is on the rise. These transceivers, particularly in QSFP-DD, OSFP, and emerging 800G formats, enable seamless data transfer between geographically dispersed data centers, ensuring minimal latency for mission-critical applications such as real-time analytics, AI training, and virtual collaboration. Additionally, edge computing, which places computational resources closer to end-users to reduce latency and improve performance, requires high-throughput, low-latency connectivity between edge data centers and the core cloud.

Integration of AI and Machine Learning into Network Management for Optical Systems

As networks become more complex with the growing deployment of high-speed optical transceivers, network operators are turning to AI-driven platforms to optimize performance, automate troubleshooting, and predict equipment failures. By leveraging AI/ML algorithms, these platforms can analyze vast amounts of data from transceivers and network devices in real time, allowing for predictive maintenance, dynamic bandwidth allocation, and proactive fault management. For example, AI-based optical network optimization can enable adaptive modulation and power-saving modes in transceivers based on traffic patterns, reducing operational costs while maximizing network uptime.

Global Optical Transceiver Market: Research Scope and Analysis

By Form Factor Analysis

The QSFP, QSFP+, QSFP-DD, QSFP28, and QSFP56 form factors are expected to hold a dominant position in the optical transceiver market, capturing an estimated 38.8% of the total market share in 2025. This growth is driven by the rising demand for high-speed, high-density solutions in environments such as data centers, telecommunications, and enterprise networks. These form factors, especially QSFP28 and QSFP56, are ideal for ultra-high-speed optical transceivers, typically supporting speeds from 25G to 400G and beyond.

Their compact size and ability to support multiple lanes of data transfer make them ideal for high-bandwidth, space-constrained environments, where density and performance are paramount. The QSFP family of form factors offers scalability and flexibility, which makes them the preferred choice in cloud data centers and hyperscale networks, where efficiency and speed are critical. Moreover, the transition to 400G Ethernet and 800G optics has driven the growth of QSFP-DD (Double Density) transceivers, offering higher data rates while maintaining compatibility with existing infrastructure.

On the other hand, the CFP, CFP2, CFP4, and CFP8 form factors, while not as dominant as the QSFP family, are critical players in specific niches of the optical transceiver market. These form factors are primarily used in high-capacity, long-distance applications, including telecommunication networks and high-performance computing (HPC) setups. The CFP (C form-factor pluggable) family was initially designed for 100G Ethernet and has evolved to include CFP2, CFP4, and CFP8 to meet the growing demand for higher-speed optical transmission. Each successive generation in the CFP family offers a more compact form factor while maintaining high data rate capabilities, such as 400G and beyond, making them well-suited for large-scale, high-capacity network backbones.

By Data Rate Analysis

The 41 Gbps to 100 Gbps data rate segment is projected to retain its leading position in the optical transceiver market, capturing an estimated 38.9% of the total market share in 2025. This dominance is driven by the ongoing demand for high-speed connectivity in critical applications such as data centers, telecommunications, and cloud services. Transceivers within this data rate range, such as 100G Ethernet and 100G optical transport, are crucial for supporting high-bandwidth applications like real-time data processing, AI workloads, and big data analytics.

As enterprises, service providers, and cloud vendors scale their infrastructure, the need for faster data transmission and greater capacity becomes vital to meet the growing volume of data being generated and consumed globally. The 100G optical transceivers, such as those based on QSFP28 and QSFP56 form factors, are particularly important for high-throughput networking. These transceivers provide reliable and efficient solutions for applications like server-to-server communication, backbone networking, and interconnects between data centers.

On the other hand, the 10 Gbps to 40 Gbps data rate segment plays an essential role in the market, catering to applications where lower but still substantial data rates are sufficient. Transceivers in this range, such as 10G and 40G Ethernet, continue to serve a wide range of applications, including enterprise networks, smaller-scale data centers, and telecommunications. These data rates provide a balance between performance and cost, making them attractive for businesses and service providers that need robust networking capabilities without the higher price tag of 100G solutions. The 10 Gbps to 40 Gbps segment also benefits from the ongoing migration of network infrastructures, as businesses look to upgrade from older, slower systems to more efficient solutions that support modern network demands.

By Fiber Type Analysis

Single-Mode Fiber (SMF) is expected to maintain a dominant position in the fiber type segment, capturing an estimated 68.3% of the total market share in 2025. This is primarily due to the growing demand for high-capacity, long-distance optical communication, where SMF excels due to its ability to transmit data over much greater distances with lower attenuation and reduced signal loss compared to multimode fiber. SMF is crucial in applications such as long-haul telecommunications, inter-data center links, and high-speed backbone networks, where maintaining signal integrity over long distances is critical.

The demand for SMF is also driven by the widespread deployment of high-speed optical transceivers such as 100G, 400G, and beyond, which require the superior transmission capabilities of SMF to support high-bandwidth and long-range connectivity without significant degradation in signal quality. Furthermore, with the rising adoption of technologies such as 5G, the expansion of cloud data centers, and the growing need for high-speed internet access globally, SMF continues to be the preferred choice for telecom operators and large-scale network deployments.

In contrast, Multimode Fiber (MMF) continues to play an important role, though it captures a smaller share of the market in comparison to SMF. MMF is typically used in shorter-distance applications, where its ability to carry multiple light modes or paths simultaneously allows for more cost-effective solutions in environments such as enterprise networks, data centers, and local area networks (LANs).

MMF is well-suited for applications where the distances are relatively short, typically up to 500 meters to a few kilometers, depending on the data rate and specific type of MMF. This makes MMF an ideal solution for network setups that require high-speed connections over shorter distances, such as within data centers, building-to-building connections, and for interconnecting network switches or routers within a single facility.

By Distance Analysis

Less than 1 KM distance segment is projected to capture 47.5% of the total market share in 2025, reflecting its dominant position in the optical transceiver market. This dominance is driven by the growing demand for high-speed connectivity in environments where short-range communication is essential, such as within data centers, campus networks, and enterprise environments.

Optical transceivers that cater to this distance range are often used for interconnection between equipment within the same facility or between buildings that are close to each other, where cost-effectiveness and high bandwidth are essential for delivering reliable network performance. For data centers, the demand for optical transceivers supporting connections of less than 1 km is driven by the need for high-density and low-latency communication links, ensuring fast data transfer between servers, storage devices, and network switches within the same site.

In addition to data centers, optical transceivers for less than 1 km distances are also widely used in telecommunication backbones, especially for local connections within metropolitan areas, known as metro networks. These links, which typically connect telecom exchanges, central offices, and points of presence (POPs), require high-speed and efficient data transmission over shorter distances, making the "less than 1 km" segment essential for metropolitan telecommunications infrastructure. The market's growth in this segment is also attributed to the growing need for high-bandwidth applications such as video streaming, cloud storage, and IoT devices.

By Wavelength Analysis

The 1310 NM band is expected to capture 39.6% of the total market share in the wavelength segment in 2025, positioning itself as the dominant wavelength in the optical transceiver market. This is primarily due to its suitability for a wide range of optical transmission applications, particularly in medium-distance communication networks. The 1310 NM band offers a balanced combination of performance and cost-efficiency, making it ideal for applications in both enterprise and telecommunication networks. The wavelength operates in the "second transmission window", which provides relatively low loss and minimal dispersion over medium distances, typically up to 80 km, depending on the type of optical fiber and network setup.

The 1310 NM wavelength is commonly used for interconnections within metropolitan networks and data centers where reliable, high-speed transmission is needed over moderate distances. Additionally, it supports long-haul networks and regional telecommunications, contributing to its wide adoption in various applications. The advances in optical transceiver technology, including 1310 NM wavelength solutions, are enabling faster data transfer speeds in optical communication systems, supporting the growing demands for services such as cloud computing, video streaming, and IoT applications.

On the other hand, the 1550 NM band is expected to maintain a significant presence in the optical transceiver market due to its ability to transmit data over longer distances with even lower attenuation than the 1310 NM wavelength. The 1550 NM band is particularly favored in long-haul applications, where it is used for the backbone of telecom networks and undersea cables, as it can carry signals over much greater distances (typically 100 km or more) without significant loss of signal strength. This makes the 1550 NM band highly suitable for high-capacity long-distance transmission systems, particularly those involving dense wavelength division multiplexing (DWDM) technologies, which allow for the transmission of multiple signals over a single optical fiber at different wavelengths.

By Connector Analysis

The LC connector is expected to capture 53.7% of the total market share in the connector segment in 2025, maintaining its dominant position in the optical transceiver market. The widespread adoption of LC connectors can be attributed to their compact size and high performance, which make them ideal for use in high-density applications such as data centers, enterprise networks, and telecommunications. LC connectors are smaller than SC connectors, allowing them to accommodate more connections in a given space, which is particularly important in environments where space efficiency is crucial.

This compact design, combined with their ability to deliver reliable signal transmission, makes LC connectors the preferred choice for high-speed optical networks, where both performance and space optimization are key. In addition to their size advantages, LC connectors are known for their ease of installation and reliability, making them suitable for a wide range of optical network applications. As the demand for higher-density networks continues to rise with the proliferation of cloud computing, 5G deployments, and data centers, LC connectors play a crucial role in enabling high-density fiber optic connections that support high-speed data transmission.

On the other hand, SC connectors continue to have a significant presence in the market, though their market share is expected to be lower compared to LC connectors. SC connectors, which feature a push-pull mechanism for easy insertion and removal, are widely used in applications that do not require the ultra-high density provided by LC connectors. SC connectors are generally larger in size compared to LC connectors, which makes them better suited for applications where space is not as critical.

These connectors are known for their robustness and reliability, making them suitable for use in more traditional networking environments, such as in enterprise networks, local area networks (LANs), and telecommunications infrastructure. SC connectors are commonly used in longer-range optical communication systems, where their slightly larger form factor does not pose significant space limitations. They are also used in environments where simplicity and ease of handling are key considerations.

By Protocol Analysis

Ethernet is anticipated to dominate the protocol segment of the optical transceiver market, capturing 57.1 percent of the total market share in 2025. This widespread dominance is largely attributed to the universal adoption of Ethernet across various types of networks, including local area networks, enterprise environments, hyperscale data centers, and cloud infrastructure. Ethernet offers a highly scalable and cost-effective solution for data transmission, and its evolving standards, from 10G to 25G, 40G, 100G, and now even 400G and beyond, allow organizations to continuously upgrade their network speeds without overhauling their entire infrastructure.

This scalability, along with its compatibility with a vast array of devices and systems, makes Ethernet a default choice for most networking environments. The growing demand for high-speed internet, real-time data sharing, and cloud-based services has further fueled the deployment of Ethernet-based transceivers. These transceivers are commonly used in core and access networks, supporting seamless communication between servers, switches, and storage systems.

In contrast, fiber channel technology holds a more specialized role in the optical transceiver market, primarily within storage area networks (SANs) and enterprise-level data centers that require high levels of reliability, data integrity, and low-latency performance. Fiber channel transceivers are optimized for transmitting data between storage arrays and servers, often in mission-critical environments such as financial institutions, government data centers, and large-scale enterprises.

While they may not match the market breadth of Ethernet, fiber channel transceivers continue to be essential where ultra-fast and lossless data transfer is crucial. Fiber channel networks operate independently of Ethernet-based networks, offering dedicated bandwidth for storage traffic. This separation ensures that critical storage applications do not experience congestion or delays caused by other network traffic.

By Application Analysis

Telecommunication applications are projected to capture 47.3 percent of the total market share in the application type segment in 2025, positioning themselves as the leading end-use for optical transceivers. This dominance is primarily driven by the global expansion of mobile networks, the rapid rollout of 5G infrastructure, and the growing demand for high-speed broadband services in both urban and rural areas.

Optical transceivers are essential in telecommunications networks as they enable high-capacity data transmission across long distances with low latency and minimal signal loss. Their role is particularly critical in connecting cell towers, central offices, and backbone network infrastructure, where reliability and speed are vital. As telecom operators modernize their networks to accommodate the exponential growth in mobile data usage, video streaming, and real-time communication, the demand for high-performance optical transceivers continues to rise.

Data center applications also represent a substantial share of the optical transceiver market and are gaining momentum as global data generation accelerates. Optical transceivers are integral components in data center environments, where they facilitate high-speed communication between servers, switches, and storage systems.

As cloud computing, artificial intelligence, and edge computing continue to grow, data centers are under pressure to manage massive volumes of data with minimal latency and maximum efficiency. This has led to a surge in demand for advanced optical transceivers that support faster data rates such as 100G, 200G, and 400G, allowing operators to scale infrastructure quickly and effectively.

The Optical Transceiver Market Report is segmented on the basis of the following

By Form Factor

- SFF and SFP

- SFP+ and SFP28

- QSFP, QSFP+, QSFP-DD, QSFP28, and QSFP56

- CFP, CFP2, CFP4, and CFP8

- XFP

- CXP

By Data Rate

- Less than 10 GBPS

- 10 GBPS to 40 GBPS

- 41 GBPS to 100 GBPS

- More than 100 GBPS

By Fiber Type

- Single-Mode Fiber (SMF)

- Multimode Fiber (MMF)

By Distance

- Less than 1 KM

- 1 to 10 KM

- 11 to 100 KM

- More than 100 KM

By Wavelength

- 850 NM Band

- 1310 NM Band

- 1550 NM Band

- Other Wavelengths

By Connector

By Protocol

- Ethernet

- Fiber Channels

- CWDM/DWDM

- FTTX

- Other Protocols

By Application

- Telecommunication

- Data Center

- Enterprise

Global Optical Transceiver Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to lead the global optical transceiver market in 2025, accounting for 45.8 percent of the total global market revenue. This strong regional dominance is underpinned by a combination of mature infrastructure, aggressive adoption of next-generation technologies, and the presence of major industry players. The region is home to some of the world’s largest cloud service providers, data center operators, and telecommunications companies, all of which continuously invest in upgrading their network capabilities to handle the surge in data traffic and connectivity demands.

These investments directly drive the demand for advanced optical transceivers, which serve as the critical interface for high-speed data transfer across fiber networks. The expansion of 5G infrastructure across the United States and Canada is a key catalyst for market growth. As telecom operators build out their 5G networks, they require high-performance transceivers capable of supporting low-latency, high-bandwidth communication across various network segments, including metro, access, and long-haul.

Region with significant growth

Asia Pacific is expected to record the highest compound annual growth rate (CAGR) in the global optical transceiver market over the forecast period. This rapid growth is largely driven by the region’s ongoing digital transformation, widespread deployment of high-speed broadband infrastructure, and investments in 5G, cloud computing, and data center expansion. Countries such as China, India, Japan, South Korea, and Southeast Asian nations are witnessing a significant surge in internet penetration and mobile device usage, which in turn drives the demand for robust and scalable network infrastructure supported by high-performance optical transceivers. One of the key factors behind the region’s strong growth trajectory is the large-scale rollout of 5G networks, particularly in China and South Korea, where government-led initiatives and public-private partnerships are accelerating infrastructure upgrades.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Optical Transceiver Market: Competitive Landscape

The global competitive landscape of the optical transceiver market is characterized by intense innovation, strategic collaborations, and continual consolidation as companies strive to gain technological superiority and expand their global footprints. A diverse mix of long-established technology giants and highly specialized optical component manufacturers compete across different verticals, including data centers, telecommunications, enterprise networks, and cloud service infrastructures. This dynamic ecosystem fosters rapid product development, where companies race to deliver transceivers with higher data rates, better power efficiency, and reduced form factors to meet the evolving demands of next-generation networks.

Leading players in the market are actively investing in research and development to stay ahead in the transition toward 400G, 800G, and emerging 1.6T transceiver technologies. These companies are also focusing on vertical integration to gain better control over production and quality while reducing dependency on third-party suppliers. Innovation in photonic integration, silicon photonics, and coherent optical technology is central to many product pipelines, helping manufacturers push the limits of speed and distance while maintaining cost-effectiveness. Moreover, with network equipment vendors and hyperscale operators demanding highly customized solutions, vendors that offer modular, scalable, and interoperable transceiver designs are gaining a competitive edge.

Some of the prominent players in the Global Optical Transceiver market are

- Broadcom

- Cisco Systems

- Intel Corporation

- Finisar (now part of II-VI Incorporated)

- Lumentum Holdings

- Sumitomo Electric Industries

- Fujitsu Optical Components

- NEC Corporation

- Mellanox Technologies (now part of NVIDIA)

- Accelink Technologies

- InnoLight Technology

- Hisense Broadband

- Source Photonics

- Applied Optoelectronics

- Reflex Photonics (acquired by Smiths Interconnect)

- Huawei Technologies

- Ciena Corporation

- Viavi Solutions

- AOI (Advanced Optoelectronic Technology Inc.)

- Other Key Players

Global Optical Transceiver Market: Recent Developments

- March 2025: Cisco Systems announced its acquisition of a niche optical component startup focused on developing AI-optimized transceivers for edge data centers, enhancing Cisco’s custom silicon capabilities.

- October 2024: Lumentum Holdings acquired a European-based photonics firm specializing in tunable transceivers and integrated optics to strengthen its position in the DWDM systems segment.

- June 2024: Ciena Corporation completed the acquisition of a Japan-based optical subsystem provider to expand its presence in the Asia Pacific region and bolster its 800G solution portfolio.

- February 2024: II-VI Incorporated, now operating under Coherent Corp., acquired a silicon photonics design house to accelerate the development of energy-efficient transceivers for AI workloads.

- December 2023: InnoLight Technology merged with a domestic Chinese fiber-optic equipment provider to vertically integrate transceiver manufacturing with network system deployment.

- September 2023: Marvell Technology acquired a small-scale fabless transceiver startup specializing in coherent DSPs for metro and long-haul applications, enhancing its 400G+ portfolio.

- August 2023: Broadcom completed a strategic acquisition of an Israeli firm specializing in low-power datacenter interconnect modules to further diversify its hyperscale cloud offerings.

- July 2023: AOI (Applied Optoelectronics Inc.) acquired a U.S.-based industrial transceiver firm to expand its ruggedized and automotive-grade optics portfolio.

- May 2023: Reflex Photonics, under Smiths Interconnect, absorbed a Canadian startup working on radiation-hardened transceivers to support aerospace and defense applications.

- January 2023: Hisense Broadband acquired a Southeast Asian optical transceiver manufacturer to expand its production capacity and tap into emerging 5G infrastructure markets.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 15.5 Bn |

| Forecast Value (2034) |

USD 48.4 Bn |

| CAGR (2025-2034) |

13.5% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 6.0 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Form Factor (SFF and SFP, SFP+ and SFP28, QSFP, QSFP+, QSFP-DD, QSFP28, and QSFP56, CFP, CFP2, CFP4, and CFP8, XFP, CXP), By Data Rate (Less than 10 Gbps, 10 Gbps to 40 Gbps, 41 Gbps to 100 Gbps, More than 100 Gbps), By Fiber Type (Single-Mode Fiber (SMF), Multimode Fiber (MMF)), By Distance (Less than 1 KM, 1 to 10 KM, 11 to 100 KM, More than 100 KM), By Wavelength (850 NM Band, 1310 NM Band, 1550 NM Band, Other Wavelengths), By Connector (LC, SC, MPO, RJ-45), and By Protocol (Ethernet, Fiber Channels, CWDM/DWDM, FTTX, Other Protocols), By Application (Telecommunication, Data Center, Enterprise) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Broadcom, Cisco Systems, Intel Corporation, Finisar (now part of II-VI Incorporated), II-VI Incorporated, Lumentum Holdings, Sumitomo Electric Industries, Fujitsu Optical Components, NEC Corporation, Mellanox Technologies (now part of NVIDIA), Accelink Technologies, InnoLight Technology, Hisense Broadband, Source Photonics, Applied Optoelectronics, Reflex Photonics (acquired by Smiths Interconnect), Huawei Technologies, Ciena Corporation, Viavi Solutions, AOI (Advanced Optoelectronic Technology Inc.), and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global Optical Transceiver market?

▾ The global Optical Transceiver market size is estimated to have a value of USD 15.5 billion in 2025 and is expected to reach USD 48.4 billion by the end of 2034.

What is the size of the US Optical Transceiver market?

▾ The US Optical Transceiver market is projected to be valued at USD 6.0 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 17.5 billion in 2034 at a CAGR of 12.7%.

Which region accounted for the largest global Optical Transceiver market?

▾ North America is expected to have the largest market share in the global Optical Transceiver market, with a share of about 45.8% in 2025.

Who are the key players in the global Optical Transceiver market?

▾ Some of the major key players in the global Optical Transceiver market are Broadcom, Cisco Systems, Intel Corporation, Finisar (now part of II-VI Incorporated), II-VI Incorporated, Lumentum Holdings, Sumitomo Electric Industries, Fujitsu Optical Components, NEC Corporation, Mellanox Technologies (now part of NVIDIA), Accelink Technologies, InnoLight Technology, Hisense Broadband, Source Photonics, Applied Optoelectronics, Reflex Photonics (acquired by Smiths Interconnect), Huawei Technologies, Ciena Corporation, Viavi Solutions, AOI (Advanced Optoelectronic Technology Inc.), and Other Key Players.

What is the growth rate of the global Optical Transceiver market?

▾ The market is growing at a CAGR of 13.5 percent over the forecasted period.