Organic electronics capitalize on carbon-based compounds, delivering strong and cost-effective alternatives to traditional inorganic materials. Their alignment with energy efficiency & sustainability makes them appealing for several applications. Small molecule organic electronics, using vacuum deposition and conductive polymers, optimize production efficiency. Printable semiconductor polymers allow direct circuit printing on plastic sheets, streamlining scalable roll-to-roll manufacturing, and ultimately lowering production costs.

The market is expanding strongly due to the quick adoption of displays & lighting, driven by enhanced device features and access. This growth emphasizes organic electronics' edge, efficiently bypassing traditional silicon-based limitations. Industries are carefully welcoming this change, and looking at organic electronics as a way to innovate and offer better solutions.

also, innovations in display technologies are fueling demand for organic electronic devices, such as Organic Light Emitting Diodes (OLEDs). OLEDs have quickly become one of the most advanced display technologies on the market; used widely across televisions, smartphones, laptops and other display devices; OLEDs will likely play an essential role in market expansion over the coming years.

Organic electronics have quickly gained favor over inorganic alternatives due to easier production methods and lower material usage during manufacture. Advanced technological products now increasingly utilize organic materials such as dielectrics, semiconductors and conductors, emphasizing their versatility and sustainability this trend highlights their critical place in modern electronics.

Government policies supporting the organic electronics sector serve as key growth drivers. For example, the DOE Solid-State Lighting (SSL) Program enhances U.S. scientific capabilities, encourages private sector investment, provides globally recognized insights, and fosters innovation in developing efficient and flexible lighting solutions that improve health, productivity, and well-being.

Additionally, solid-state lighting (SSL), particularly LED-based technologies, holds significant potential for further advancements. According to DOE projections, by 2035, modern lighting systems could save 6.9 trillion kWh of electricity by achieving efficiency, control, and connected lighting goals. These energy savings would translate into approximately US$ 710 billion in cost reductions and prevent the emission of 2.1 billion metric tons of carbon dioxide.

Such initiatives drive progress in OLED longevity, cost-effectiveness, and efficiency by providing essential funding and research support, ultimately contributing to the expansion of the organic electronics market.

Key Takeaways

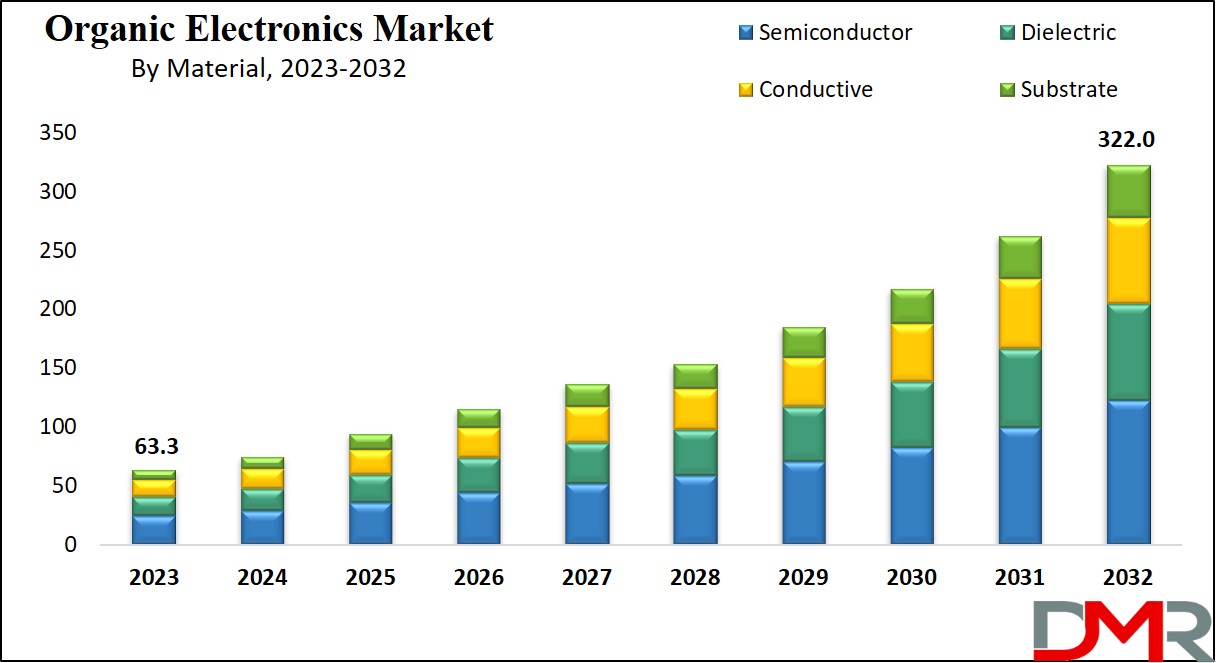

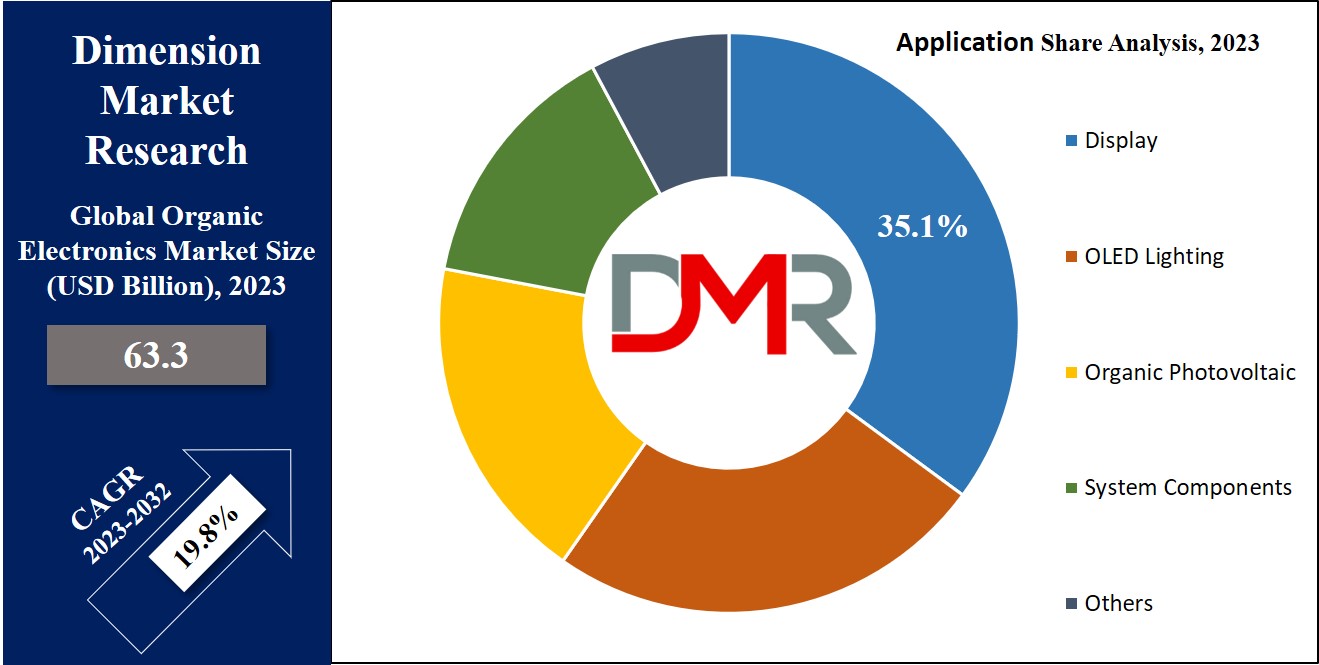

- Market Size & Share: Global Organic Electronics Market is expected to reach a value of USD 63.3 billion in 2023, and it is further anticipated to reach a market value of USD 322.0 billion by 2032 at a CAGR of 19.8%.

- Flexible and Wearable Electronics Trend: Lightweight and versatile organic materials fuel innovations in smart textiles, fitness trackers, and medical sensors, reshaping the electronics landscape.

- Challenges with Cost and Durability: High production costs and sensitivity to environmental factors limit widespread adoption, necessitating advancements in material stability and cost-effective processes.

- Sustainability Opportunities: Growing demand for eco-friendly electronics, such as organic photovoltaics and biodegradable devices, aligns with global efforts to reduce electronic waste and carbon footprints.

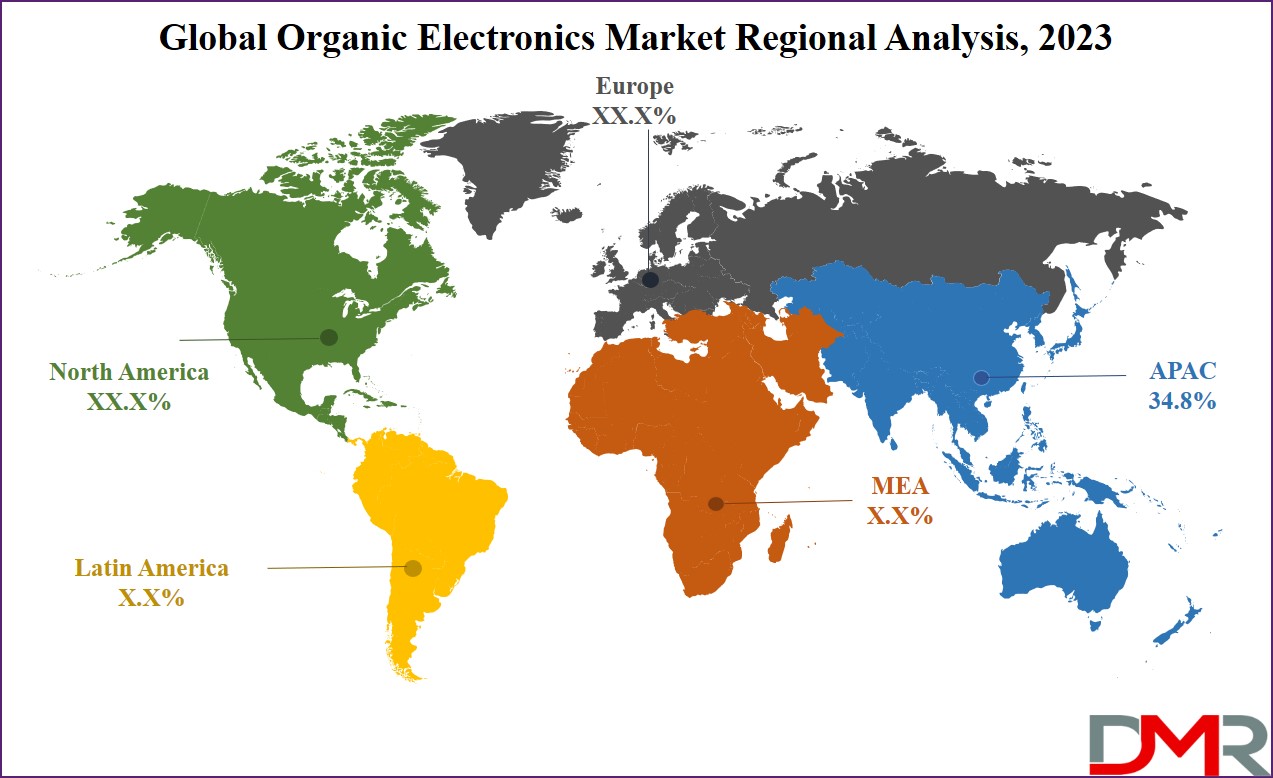

- Regional Analysis: In 2023, the Asia Pacific region dominates the global market with a substantial share, accounting for about 34.8%.

Use Cases

- Flexible & Wearable Displays– Used in smartphones, smartwatches, and foldable screens, offering lightweight, bendable, and energy-efficient display solutions.

- Organic Solar Cells (OPVs)– Applied in renewable energy solutions, enabling lightweight, flexible, and cost-effective solar panels for portable and building-integrated photovoltaics.

- OLED Lighting Solutions– Used in automotive lighting, commercial displays, and home illumination due to their thin, energy-efficient, and high-quality light output.

- Medical & Biosensors– Integrated into healthcare devices for real-time monitoring, diagnostics, and wearable biosensors for patient health tracking.

- Smart Packaging & Printed Electronics– Used in RFID tags, interactive labels, and electronic paper, enhancing product tracking, anti-counterfeiting, and user engagement.

Market Dynamic

The advancements in display technologies are fueling the need for advanced organic electronic devices, such as Organic Light Emitting Diodes (OLEDs), a cutting-edge display solution.

OLED displays are extensively used in TVs, laptops, mobile phones, and several other electronic devices, making them a driving force for market growth.

Furthermore, organic electronics have an edge over inorganic alternatives due to their straightforward manufacturing processes & efficient use of materials. This makes them a preferred choice for developing high-end technological products, incorporating components such as dielectrics, semiconductors, and conductive materials.

However, the organic electronics market faces challenges in attaining prolonged stability & performance from organic materials, which can degrade faster than inorganic alternatives. Further, the high production costs for specific materials, along with the importance of improving energy efficiency & reliability, also hinder the progress.

Ensuring consistent quality control and efficiently scaling up manufacturing processes while remaining cost-effective presents additional hurdles. Nevertheless, ongoing research aims to tackle these constraints and enhance the potential of organic electronics across diverse applications.

Driving Factors

Organic Light Emitting Diodes (OLEDs) have become one of the key drivers in organic electronics market growth. OLEDs boast superior display qualities including higher contrast ratios, faster response times and energy efficiency, making them popular choices in televisions, smartphones and wearable devices; furthermore their flexible and lightweight nature has allowed innovative applications such as foldable or rollable screens to emerge.

As consumer demand for advanced display technologies grows and industries adopt OLEDs into next generation devices, organic electronics market continues to expand due to OLED's widespread integration across various sectors driving this growth further expansion of organic electronics market growth.

Trending Factors

Wearable Electronic Devices One key trend in organic electronics market is the rapid emergence of wearable and flexible electronic devices. Organic materials known for their flexibility and lightweight properties have increasingly been integrated into smart textiles, fitness trackers and medical sensors as part of organic electronics.

These innovations meet consumer desires for personalized and portable technology. Inkjet printing techniques such as inkjet and roll to roll printing enable cost effective production of flexible organic devices, while as industries prioritize sustainable innovations flexible wearable electronics are revolutionizing organic electronics landscape. Driven by substantial growth and technological progress.

Restraining Factors

Organic electronics market remains lucrative but also has significant barriers such as higher manufacturing costs and limited durability of organic materials. Producing advanced devices like OLEDs and organic photovoltaics requires special processes and materials, leading to higher production expenses than with inorganic alternatives.

Organic materials tend to be susceptible to environmental influences like moisture and oxygen, which can diminish their performance over time. Organic electronics present unique challenges when applied in mass market applications and must address these limitations through further research to enhance material stability and production cost cutting methods. Overcoming these hurdles is essential to realizing their full potential.

Opportunity

The expanding emphasis on environmental responsibility presents organic electronics manufacturers with an immense market opportunity. Organic devices crafted from biodegradable and non toxic materials align perfectly with global efforts to reduce electronic waste while encouraging eco friendly practices.

Organic photovoltaics provide a more eco friendly alternative to traditional solar panels, while organic LEDs offer energy efficient lighting solutions. As industries and consumers focus on sustainability initiatives, the organic electronics market stands to benefit from rising consumer interest in green technologies.

Research Scope and Analysis

By Material

In the organic electronics market, particularly in terms of materials in 2023, the semiconductor segment plays a vital role in driving the market by contributing significantly towards the growth of the market. This segment uses specialized organic materials with semiconducting properties to create components such as transistors, diodes, & sensors. These materials allow controlled electric current flow, forming the foundation of working electronic devices.

The importance of this segment highlights the promising potential of organic electronics, particularly in applications such as displays & photovoltaics, known for their flexibility, lightweight nature, & cost-effectiveness. As a result, this segment is likely to continue and grow as a driving factor for the future of the market as well.

By Application

In 2023, the integration of display technologies emerges as a significant driving force to the application segments organic electronics market. This segment's importance is derived from the seamless incorporation of organic electronic devices into diverse display applications, mainly in products such as televisions, laptops, mobile phones, & other electronic devices. This integration substantially fueled the market's expansion.

Furthermore, the display application sector gained notable traction by delivering enhanced visual experiences, growing energy efficiency, and improved design flexibility. These attributes expanded the aesthetics of displays utilizing organic electronics, growing their adoption across a range of spectrums of applications. This trend is anticipated to endure, with the display segment continuing to play a major role in driving the growth of the organic electronics market during the forecasted period.

By End User

In 2023, the healthcare sector emerged as one of the major driving forces within the end-user industry segments of the organic electronics market. This sector's growth has been followed by the seamless integration of organic electronic devices into various healthcare applications, spanning medical devices, wearable monitors, and diagnostic equipment. This integration substantially boosted market growth.

Furthermore, the healthcare application segment gained notable momentum by delivering improved patient experiences, enhanced diagnostics, and increased flexibility in

medical devices. These attributes heightened the appeal of healthcare solutions using organic electronics, driving their adoption across various applications. This trend is further anticipated to persist, with the healthcare sector continuing to play a major role in driving the growth of the organic electronics market during the forecasted future.

The Global Organic Electronics Market Report is segmented on the basis of the following

By Material

- Dielectric

- Semiconductor

- Conductive

- Substrate

By Application

- Display

- OLED Lighting

- Organic Photovoltaic

- System Components

- Others

By End-user

- Healthcare

- Automotive

- Consumer Electronics

- Military and Defense

- Energy

- Others

How Does Artificial Intelligence Contribute To Improve Organic Electronics Market ?

- Material Discovery & Optimization – AI accelerates the development of new organic materials by predicting molecular properties, improving efficiency, and reducing R&D costs.

- Enhanced Manufacturing Processes – AI-driven automation and machine learning optimize printing and fabrication techniques, ensuring higher precision and reduced material waste.

- Performance Prediction & Quality Control – AI analyzes real-time data to predict performance, detect defects, and improve the durability of organic electronic components.

- Energy Efficiency & Smart Integration – AI enhances the functionality of organic electronics in smart devices, optimizing power consumption in OLED displays, solar cells, and flexible sensors.

- Personalized & Adaptive Applications – AI-powered organic electronics enable adaptive wearable devices, smart textiles, and responsive lighting systems that adjust based on user behavior and environmental conditions.

Regional Analysis

In 2023, the Asia Pacific region dominates the global market with a substantial share, accounting for

about 34.8% of the total revenue in the global organic electronics market. This expansion is fueled by the rapid integration of organic electronic technologies across multiple applications utilizing displays, lighting, and healthcare devices. Leading economies such as China, Japan, India, and South Korea prominently adapt and expand to provide growth in the market.

Furthermore, the region's diverse consumer electronics landscape and strong manufacturing sectors lent considerable force to the market's advancement, having a major role in shaping the trajectory of the organic electronics sector over the forecasted period.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Global Organic Electronics Market is quite consolidated due to substantial entry barriers and high initial investments. This dynamic compels market players to strategically navigate the landscape. Companies focus on innovative research and development, looking for new partnerships and optimizing supply chains for efficiency. These strategic moves allow them to not only penetrate the market but also ensure sustainable growth in the challenging times

For instance, in July 2023, Columbia Engineering researchers announced the development of a pioneering fully organic bioelectronic device. This compact device, only around 100 times smaller than a human hair, can independently acquire, and transmit neurophysiological brain signals, and generate its own power. The device's organic transistor architecture, featuring a vertical channel and miniature water conduit, ensures stability, optimal electrical performance, and low-voltage operation to prevent damage to biological tissue.

Some of the prominent players in The Global Organic Electronics Market are

- BASF SE

- Merck KGaA

- AU Optronics Corp

- Universal Display Corp

- Heliatek GmbH

- Samsung Display

- Sony Corp

- LG Display Co. Ltd

- DuPont

- FUJIFILM Holdings Corp

- Other Key Players

Recent Developments

- February 2025: Greatech launched its Sensoco® Loomair Solar, a maintenance-free, light-powered CO₂ sensor tailored for smart buildings. The device is powered by Epishine’s indoor solar cells and integrates e-peas’ power management IC, offering multi-connectivity and eliminating the need for batteries.

- June 2024: FlexEnable began shipping the world’s first mass-produced consumer product that integrates organic transistor (OTFT) technology—a secure crypto wallet named Ledger Stax developed by Ledger.

- January 2025: Evonik announced the creation of Smart Effects via the strategic merger of its Silica and Silanes Business Lines. The new entity, effective as of January 1, 2025, includes around 3,500 employees and aims to enhance efficiency and sustainability across sectors including electronics.

- July 2025: Amber Group, an electronics manufacturer, secured a 40.24% controlling stake in Israel’s Unitronics through an all-cash deal valued at over ₹400 crore. This acquisition is set to strengthen Amber’s presence in industrial automation and expand its global footprint.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 63.3 Bn |

| Forecast Value (2032) |

USD 322.0 Bn |

| CAGR (2023-2032) |

19.8% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Material (Dielectric, Semiconductor, Conductive and Substrate), By Application (Display, OLED Lighting, Organic Photovoltaic, System Components and Others), By End-user (Healthcare, Automotive, Consumer Electronics, Military & Defense, Energy and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

BASF SE, Merck kGaA, AU Optronics Corp, Universal Display Corp, Heliatek GmbH, Samsung Display, Sony Corp, LG Display Co. Ltd, DuPont, FUJIFILM Holding Corp and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |