Market Overview

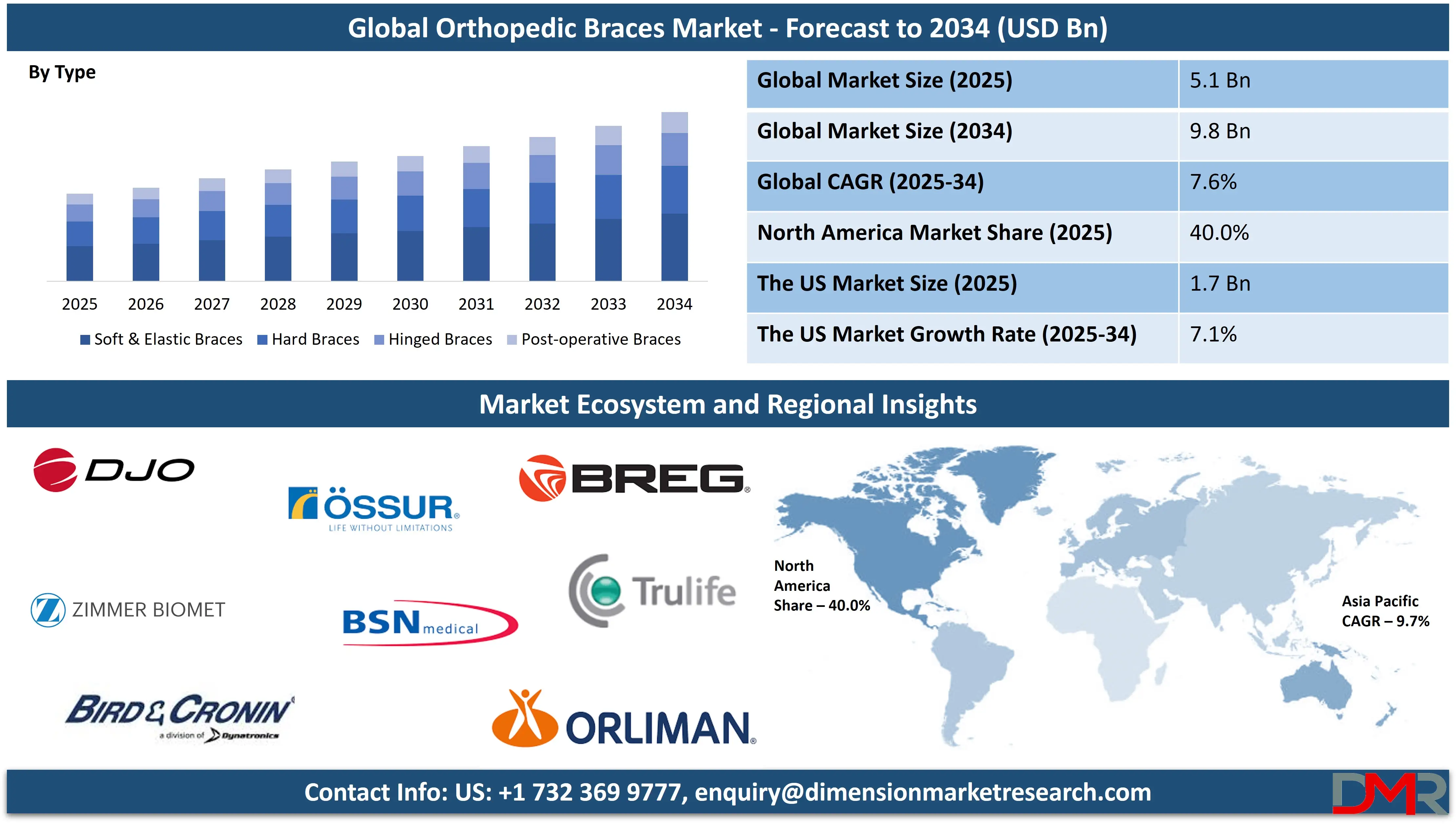

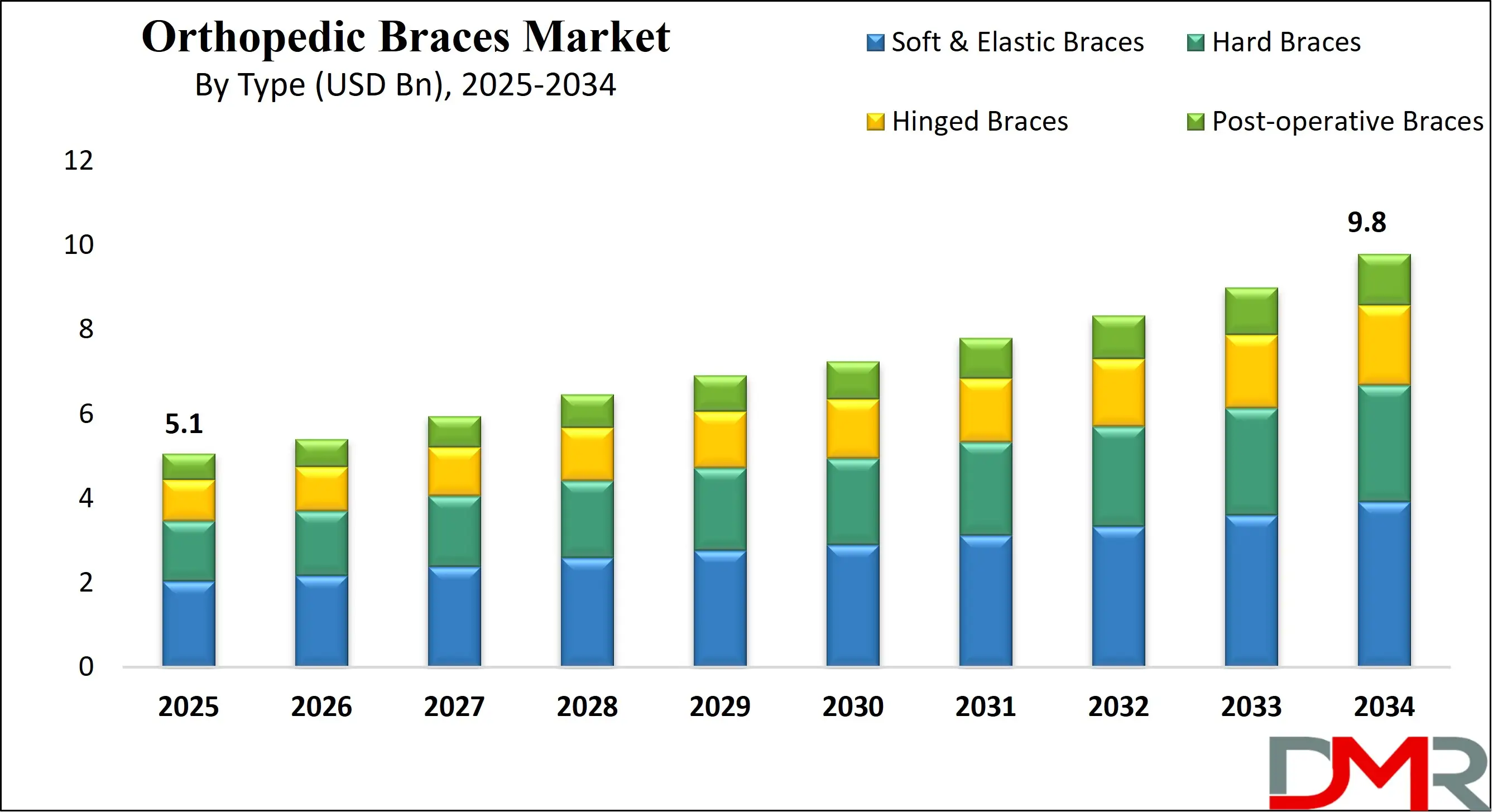

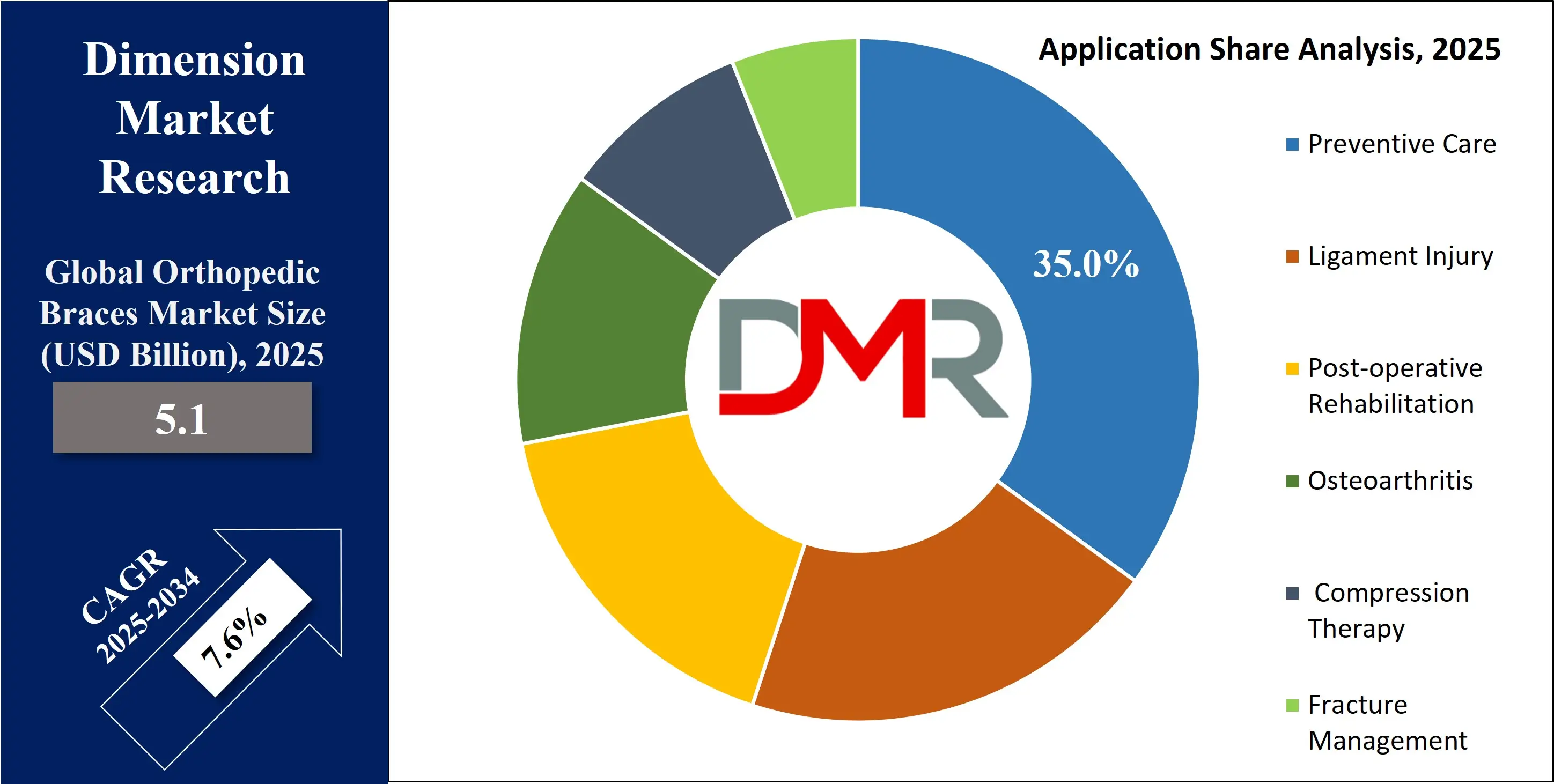

The Global Orthopedic Braces Market size is projected to reach USD 5.1 billion in 2025 and grow at a compound annual growth rate of 7.6% to reach a value of USD 9.8 billion in 2034.

Orthopedic braces are medical devices designed to support, align, prevent, or correct musculoskeletal issues. They help stabilize joints, limit undesirable movement, and reduce pain during recovery from injuries or chronic conditions. Braces can be soft, semi-rigid, or rigid, depending on the level of support needed, and are commonly used for the spine, knee, ankle, wrist, elbow, and shoulder.

These devices play an important role in rehabilitation by protecting healing tissues and promoting proper biomechanics. After surgeries or acute injuries, braces help control motion to prevent re-injury and guide the body toward correct alignment. For chronic conditions such as arthritis, scoliosis, or tendon disorders, they can reduce strain on affected structures and assist with posture correction or joint offloading.

Orthopedic braces are typically prescribed or recommended by healthcare professionals to ensure that the type, fit, and duration of use are appropriate. Many are adjustable to improve comfort and accommodate changes during recovery. Advances in materials and design have led to lighter, more breathable, and more customizable options that enhance patient compliance.

Overall, orthopedic braces serve as valuable tools in both injury prevention and rehabilitation, supporting mobility while promoting safe and effective healing. In addition, Orthopedic Software now plays a growing role in this process by assisting clinicians with brace selection, digital fitting, patient monitoring, and treatment planning, further improving accuracy, efficiency, and patient outcomes.

The US Orthopedic Braces Market

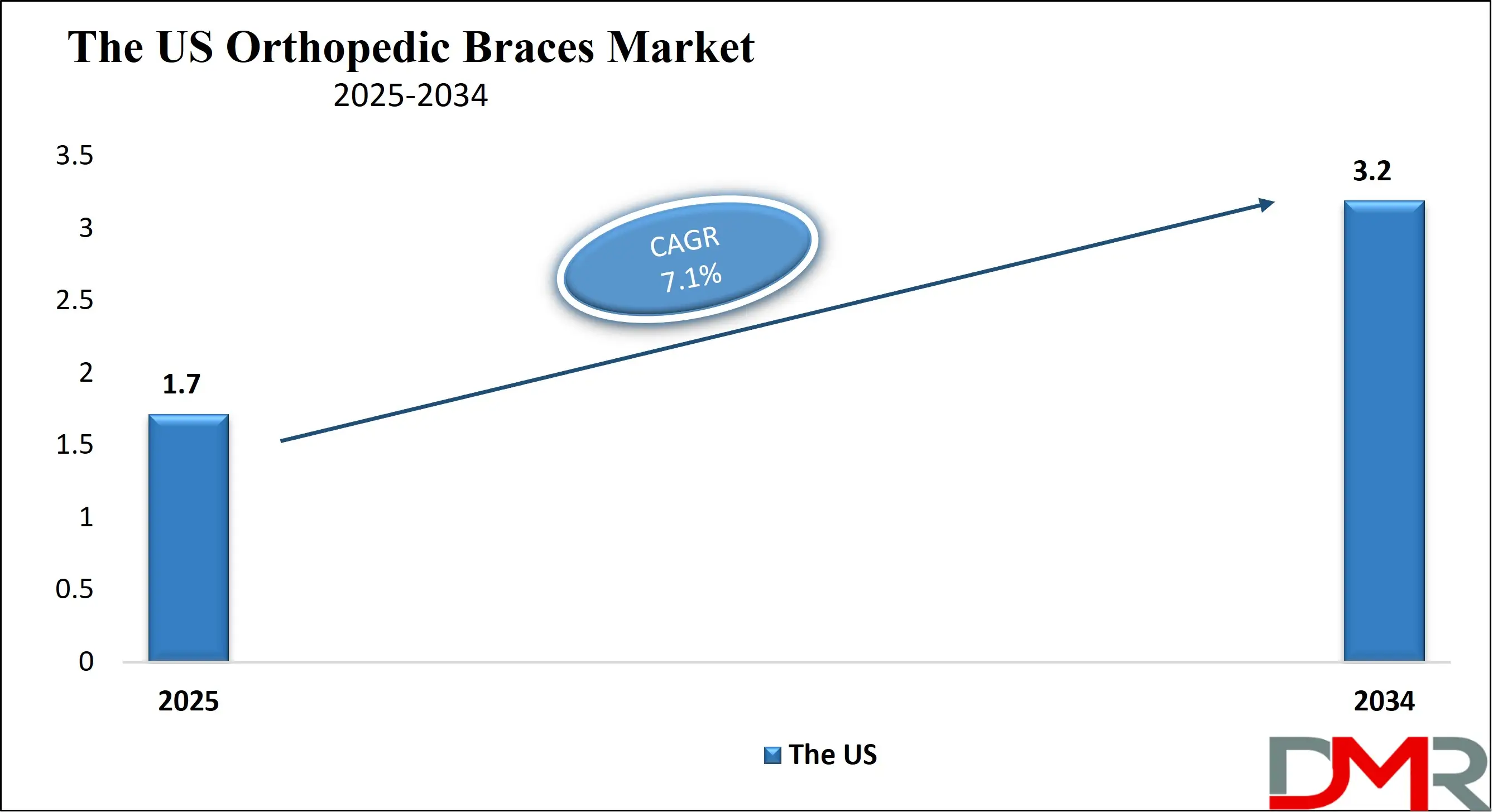

The US Orthopedic Braces Market size is projected to reach USD 1.7 billion in 2025 at a compound annual growth rate of 7.1% over its forecast period.

In the United States, the orthopedic braces market has experienced significant growth due to increasing demand for preventative care and rehabilitation following musculoskeletal injuries. Rising awareness regarding physical fitness, an aging population, and a greater focus on improving post-operative recovery have spurred the adoption of orthopedic braces. Furthermore, the growing popularity of sports, combined with a higher incidence of chronic conditions such as arthritis, has led to a surge in demand for various types of braces.

Europe Orthopedic Braces Market

Europe Orthopedic Braces Market size is projected to reach USD 1.1 billion in 2025 at a compound annual growth rate of 7.4% over its forecast period.

Europe has witnessed a steady demand for orthopedic braces, driven by the increasing prevalence of chronic orthopedic conditions and sports injuries. The market benefits from robust healthcare infrastructure and the adoption of advanced technologies in medical devices. European countries with an aging population, such as Germany and the UK, are major contributors to the growth of this market. The expansion of online sales channels and increased awareness of preventive care is likely to continue shaping the market in the region.

Japan Orthopedic Braces Market

Japan Orthopedic Braces Market size is projected to reach USD 255 million in 2025 at a compound annual growth rate of 7.9% over its forecast period.

Japan's orthopedic braces market has experienced a notable increase in demand, fueled by the country’s aging population and the growing incidence of age-related musculoskeletal disorders. With a high number of elderly individuals, there is a growing need for support and rehabilitation products. Furthermore, Japan's healthcare system is well-established, allowing easy access to orthopedic devices. The market is poised for growth, particularly in the segment of knee and back braces, which are most commonly used for degenerative diseases like osteoarthritis.

Orthopedic Braces Market: Key Takeaways

- Market Growth: The Orthopedic Braces Market size is expected to grow by USD 4.4 billion, at a CAGR of 7.6%, during the forecasted period of 2026 to 2034.

- By Type: The soft & elastic braces segment is anticipated to get the majority share of the Orthopedic Braces Market in 2025.

- By Application: The prevention care segment is expected to get the largest revenue share in 2025 in the Orthopedic Braces Market.

- Regional Insight: North America is expected to hold a 40.0% share of revenue in the Global Orthopedic Braces Market in 2025.

- Use Cases: Some of the use cases of Orthopedic Braces include preventive care post-operative recovery, and more

Orthopedic Braces Market: Use Cases

- Sports Injury Rehabilitation: Orthopedic braces are widely used to support and stabilize joints during rehabilitation, aiding recovery from sprains, fractures, or ligament injuries.

- Osteoarthritis Management: Braces help alleviate joint pain, reduce inflammation, and provide support, improving quality of life for individuals with osteoarthritis.

- Post-Operative Recovery: After surgeries, orthopedic braces are crucial in aiding mobility, reducing pain, and protecting the surgical site during healing.

- Preventive Care: Used by athletes and workers exposed to repetitive motion, orthopedic braces prevent injuries by providing necessary joint support.

Stats & Facts

- The U.S. Department of Health and Human Services reports that around 54 million adults in the United States experience some form of arthritis, often leading to the need for orthopedic braces.

- The European Commission estimates that the prevalence of musculoskeletal disorders in Europe is at approximately 22%, with an increasing demand for orthopedic supports.

- The World Health Organization states that musculoskeletal conditions are the leading cause of disability worldwide, with a growing trend in countries like Japan due to aging populations.

- The National Institute of Health reports that 10% of adults aged 60 and older have knee osteoarthritis, a condition for which knee braces are commonly prescribed.

Market Dynamic

Driving Factors in the Orthopedic Braces Market

Aging Population

The global population is rapidly aging, especially in developed regions like North America, Europe, and parts of Asia. As people age, they are more prone to chronic conditions such as osteoarthritis, osteoporosis, and other degenerative joint diseases.

These conditions often require long-term management, including the use of orthopedic braces for pain relief, joint stability, and improved mobility. For example, knee, back, and wrist braces are frequently used to support weakened joints, reduce inflammation, and help prevent further damage. With an aging demographic, the demand for orthopedic braces is expected to rise significantly, as older adults seek ways to maintain their independence and quality of life.

Sports-Related Injuries

The growing participation in sports activities, both at the professional and recreational levels, contributes to an increase in sports-related injuries such as sprains, fractures, ligament tears, and tendonitis.

These injuries often require orthopedic support during recovery. In contact sports like football, basketball, and rugby, as well as in high-impact individual sports like running or weightlifting, orthopedic braces help to protect vulnerable joints from further injury and assist with faster recovery. Advanced, customizable braces designed to fit the individual needs of athletes provide critical support during rehabilitation and can prevent future injuries, boosting the demand for specialized products in this segment.

Restraints in the Orthopedic Braces Market

High Cost of Advanced Braces

While the market for orthopedic braces is growing, the cost of advanced braces, especially those with high-tech features like 3D printing, smart sensors, or customization, can be a significant barrier. These high-quality braces are often priced higher than standard models, making them less accessible to certain populations, particularly in developing regions or among lower-income groups.

The affordability of orthopedic braces is a concern in areas where healthcare coverage or insurance is limited. Additionally, the costs associated with ongoing care, including follow-up visits to doctors or physical therapists, may further limit the adoption of advanced orthopedic devices. As a result, the high cost of cutting-edge braces could slow market growth in some regions.

Lack of Awareness in Developing Regions

In many developing countries, awareness of orthopedic conditions and the benefits of using orthopedic braces remains low. People in these regions may still rely on traditional methods of care, such as herbal remedies or physical therapy, rather than turning to medical devices like braces for injury prevention or rehabilitation.

This lack of awareness can hinder the adoption of orthopedic braces and limit the market potential. Furthermore, limited healthcare infrastructure and access to medical professionals may prevent individuals from receiving proper diagnoses and treatments that include the use of orthopedic supports. Bridging this gap through education and outreach campaigns is necessary to expand the reach of orthopedic braces in these regions.

Opportunities in the Orthopedic Braces Market

Technological Advancements

One of the most promising opportunities in the orthopedic braces market lies in the development of smart braces and other technological innovations. Modern orthopedic braces now include sensors that monitor movement, temperature, and even muscle activity. These smart braces, often connected to mobile apps, enable patients to track their recovery in real time, providing both patients and healthcare providers with data to optimize treatment plans.

For example, braces with embedded sensors can alert users if they are overexerting themselves or if their joints are out of alignment. This data-driven approach can lead to better recovery outcomes, faster healing times, and a more personalized treatment experience, thus driving demand for these high-tech solutions.

Growing Online Sales

The shift toward e-commerce is opening new avenues for orthopedic brace manufacturers to reach a global customer base. Online platforms enable consumers to easily browse a wide variety of products, access detailed information, and make purchases without having to visit physical stores.

This is particularly beneficial for individuals in remote or underserved areas who may have limited access to orthopedic stores. Additionally, online platforms often provide customer reviews, making it easier for consumers to make informed choices. The convenience of online shopping, along with the ability to offer a broad range of products, makes e-commerce a fast-growing channel in the orthopedic brace market. Companies are increasingly leveraging digital marketing, social media, and online retail partnerships to reach consumers directly, further driving growth.

Trends in the Orthopedic Braces Market

Customization and Personalization

As healthcare increasingly becomes more patient-centric, the demand for customized solutions is growing, and orthopedic braces are no exception. Advances in 3D printing technology, along with better understanding of patient-specific needs, allow for braces that are perfectly tailored to an individual's body. Customization goes beyond size and shape—braces can now be designed to accommodate specific conditions, ensuring better comfort and efficacy. This trend toward personalization is not limited to just functional design but extends to aesthetic elements, allowing patients to select colors, patterns, and materials that suit their preferences. These personalized braces not only improve the user's comfort and compliance but also enhance overall treatment outcomes by ensuring that the device fits perfectly and offers maximum support.

Eco-Friendly Materials

Sustainability is becoming an important trend across many industries, and the orthopedic brace market is no exception. Manufacturers are increasingly using eco-friendly materials, such as recyclable plastics, bio-based polymers, and natural fibers, to produce orthopedic supports. These materials help reduce the environmental impact of manufacturing processes while maintaining the necessary performance and durability of the braces.

This trend is especially relevant to environmentally-conscious consumers who are looking for sustainable alternatives to traditional medical products. Eco-friendly braces appeal to those who want to minimize their carbon footprint without sacrificing the effectiveness of the devices. As a result, the use of sustainable materials in orthopedic braces is expected to grow as consumers and manufacturers alike place more emphasis on green practices.

Impact of Artificial Intelligence in Orthopedic Braces Market

- Improved Diagnosis: AI is aiding in more accurate and quicker diagnosis of musculoskeletal conditions, helping to design better-fitting and more effective orthopedic braces.

- Personalized Treatment Plans: AI-driven algorithms can recommend the most suitable brace for patients based on their individual needs and medical history, improving treatment outcomes.

- Smart Braces: AI-powered braces with built-in sensors can monitor patient progress, adjust support levels in real-time, and alert healthcare providers about potential issues.

- Supply Chain Optimization: Artificial Intelligence is enhancing inventory management and production efficiency, reducing costs and improving the availability of orthopedic braces.

- Predictive Analytics for Market Trends: AI tools are enabling manufacturers to predict market trends and demand, helping them adjust production and marketing strategies accordingly.

Research Scope and Analysis

By Product Analysis

Knee braces are expected to lead the orthopedic braces market with 30% of the market share in 2025. This segment’s dominance is driven by the high prevalence of knee injuries, osteoarthritis, and the need for post-surgical rehabilitation. As the global population ages and sports-related knee injuries increase, knee braces remain the most commonly used orthopedic support for improving joint stability, reducing pain, and preventing further damage. Their widespread use across different age groups and medical conditions makes them the leading product category in the market.

Elbow braces represent a fast-growing segment in the orthopedic braces market, driven by rising awareness and increased usage in sports rehabilitation. However, knee braces remain the leading product category due to the higher incidence of knee injuries and degenerative joint conditions.

By Type Analysis

Soft and elastic braces are expected to capture 40% of the market share in 2025, making them the leading type. These braces are favored for their comfort, flexibility, and suitability for mild injuries and general support during rehabilitation. Soft braces provide the necessary support while allowing for some mobility, making them ideal for conditions like sprains, strains, and arthritis. Their widespread use in both preventive care and rehabilitation, along with their ease of use, positions them as the dominant type of orthopedic brace.

Hard braces, while a fast-growing segment, will remain smaller than soft and elastic braces in 2025. These braces are essential for conditions requiring more rigid support, such as post-surgical recovery or severe injuries. They provide greater stability but are less commonly used compared to the more flexible, comfortable soft braces.

By Application Analysis

Preventive care applications are expected to hold 35% of the market share by 2025, driven by the increasing focus on injury prevention in sports, fitness, and physically demanding jobs. Braces used for preventive care help protect joints during high-impact activities, reducing the risk of injuries and long-term joint damage. This proactive approach to musculoskeletal health is particularly prominent in athletes and people engaged in manual labor, making preventive care the leading application in the orthopedic braces market.

While post-operative rehabilitation is a fast-growing segment, preventive care still leads the market in terms of share. Post-operative rehabilitation braces help stabilize and protect surgical sites during recovery, aiding in faster healing. The increasing number of surgeries, particularly joint replacements and ligament repairs, contributes to the growing demand for post-surgical braces.

By End User Analysis

Hospitals are expected to lead the end-user market with 45% of the total market share in 2025. Hospitals are key consumers of orthopedic braces, as they provide treatment for patients undergoing surgery or trauma recovery. As a primary healthcare provider, hospitals rely on orthopedic braces for post-surgical rehabilitation, fracture management, and pain relief, making them the largest end-user segment in the market.

Orthopedic clinics, while a fast-growing segment, will still account for a smaller share compared to hospitals. These specialized clinics focus on treating musculoskeletal conditions, such as joint injuries and arthritis. The growing demand for specialized orthopedic care in these clinics will continue to drive their expansion, although hospitals remain the dominant segment.

By Distribution Channel Analysis

Orthopedic stores are expected to hold the largest market share, with 50% of the orthopedic braces market in 2025. These stores provide a direct and personalized shopping experience, offering a variety of orthopedic products along with professional fitting services. Customers benefit from expert guidance in selecting the right brace for their specific needs, contributing to the dominance of orthopedic stores in the market.

Online channels are the fastest-growing segment for the distribution of orthopedic braces. With more consumers turning to e-commerce for convenience and accessibility, online platforms are rapidly expanding. While orthopedic stores currently dominate the distribution channel, the shift toward online sales, especially in regions with limited access to physical stores, is driving growth in this segment.

The Orthopedic Braces Market Report is segmented on the basis of the following:

By Product

- Knee Braces & Supports

- Ankle Braces & Supports

- Back, Hip & Spine Braces

- Shoulder Braces & Supports

- Elbow Braces & Supports

- Wrist & Hand Braces

- Foot Walkers & Calipers

- Pediatric Braces

By Type

- Soft & Elastic Braces

- Hard Braces

- Hinged Braces

- Post-operative Braces

By Application

- Preventive Care

- Ligament Injury

- Post-operative Rehabilitation

- Osteoarthritis

- Compression Therapy

- Fracture Management

By End User

- Hospitals

- Orthopedic Clinics

- Rehab Centers & Physiotherapy Centers

- Homecare

By Distribution Channel

- Orthopedic Stores

- Pharmacies & Retail Stores

- Online Channels

Regional Analysis

Leading Region in the Orthopedic Braces Market

The North American region is expected to lead the orthopedic braces market, capturing 40% of the market share in 2025. This dominance is driven by the high prevalence of orthopedic conditions such as arthritis, joint degeneration, and musculoskeletal injuries, particularly among the aging population.

Additionally, North America boasts advanced healthcare infrastructure, which supports the adoption of orthopedic braces for both preventive care and rehabilitation. The region’s growing awareness about musculoskeletal health, the widespread availability of orthopedic products, and the strong demand for post-surgical recovery solutions contribute significantly to the market’s leadership position.

Fastest Growing Region in the Orthopedic Braces Market

The Asia-Pacific region is the fastest-growing market in the orthopedic braces sector. This growth is primarily attributed to increasing awareness about musculoskeletal health, coupled with rising disposable incomes and improvements in healthcare infrastructure, especially in rapidly developing countries like China and India. As these nations continue to urbanize and experience an increase in lifestyle-related injuries, the demand for orthopedic braces is expected to rise. The region's large, aging population, along with a growing emphasis on sports participation and injury prevention, further drives the market’s rapid expansion in this area.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the orthopedic braces market is characterized by the presence of several key players, including Zimmer Biomet, Breg, Inc., and DonJoy, who dominate the industry.

These companies are focusing on technological innovations and expanding their product portfolios to cater to a wide range of medical conditions. The market also includes regional players providing specialized products tailored to local needs. Collaboration with healthcare providers and a strong distribution network are critical strategies for market success.

Some of the prominent players in the global Orthopedic Braces are

- DJO Global

- Össur

- DePuy Synthes

- Bauerfeind

- Breg

- Zimmer Biomet

- Ottobock

- BSN Medical

- Medi GmbH

- Bird & Cronin

- Thuasne

- Deroyal Industries

- Alcare

- Lohmann & Rauscher

- Trulife

- Orliman

- Orthomerica

- Aspen Medical Products

- Allard International

- Corflex

- Other Key Players

Recent Developments

- In May 2025, Zimmer Biomet acquired the startup OrthoTech, which specializes in 3D-printed orthopedic braces. This acquisition allows Zimmer Biomet to expand its product offerings in customized, high-tech braces designed for a range of musculoskeletal injuries and conditions, enhancing patient comfort and support.

- In April 2025, Breg, Inc. launched a new line of smart knee braces featuring embedded sensors and wireless connectivity. This innovation allows for real-time monitoring of the patient's recovery, providing data to both the patient and healthcare provider for improved rehabilitation outcomes.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 5.1 Bn |

| Forecast Value (2034) |

USD 9.8 Bn |

| CAGR (2025–2034) |

7.6% |

| The US Market Size (2025) |

USD 1.7 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Knee Braces & Supports, Ankle Braces & Supports, Back, Hip & Spine Braces, Shoulder Braces & Supports, Elbow Braces & Supports, Wrist & Hand Braces, Foot Walkers & Calipers, and Pediatric Braces), By Type (Soft & Elastic Braces, Hard Braces, Hinged Braces, and Post-operative Braces), By Application (Preventive Care, Ligament Injury, Post-operative Rehabilitation, Osteoarthritis, Compression Therapy, and Fracture Management), By End User (Hospitals, Orthopedic Clinics, Rehab Centers & Physiotherapy Centers, and Homecare), By Distribution Channel (Orthopedic Stores, Pharmacies & Retail Stores, and Online Channels) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

DJO Global, Össur, DePuy Synthes, Bauerfeind, Breg, Zimmer Biomet, Ottobock, BSN Medical, Medi GmbH, Bird & Cronin, Thuasne, Deroyal Industries, Alcare, Lohmann & Rauscher, Trulife, Orliman, Orthomerica, Aspen Medical Products, Allard International, Corflex, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Orthopedic Braces Market size is expected to reach a value of USD 5.1 billion in 2025 and is expected to reach USD 9.8 billion by the end of 2034.

North America is expected to have the largest market share in the Global Orthopedic Braces Market, with a share of about 40.0% in 2025.

The Orthopedic Braces Market in the US is expected to reach USD 1.7 billion in 2025.

Some of the major key players in the Global Orthopedic Braces Market include DJO, Ossur, Alcare and others

The market is growing at a CAGR of 7.6 percent over the forecasted period.