Market Overview

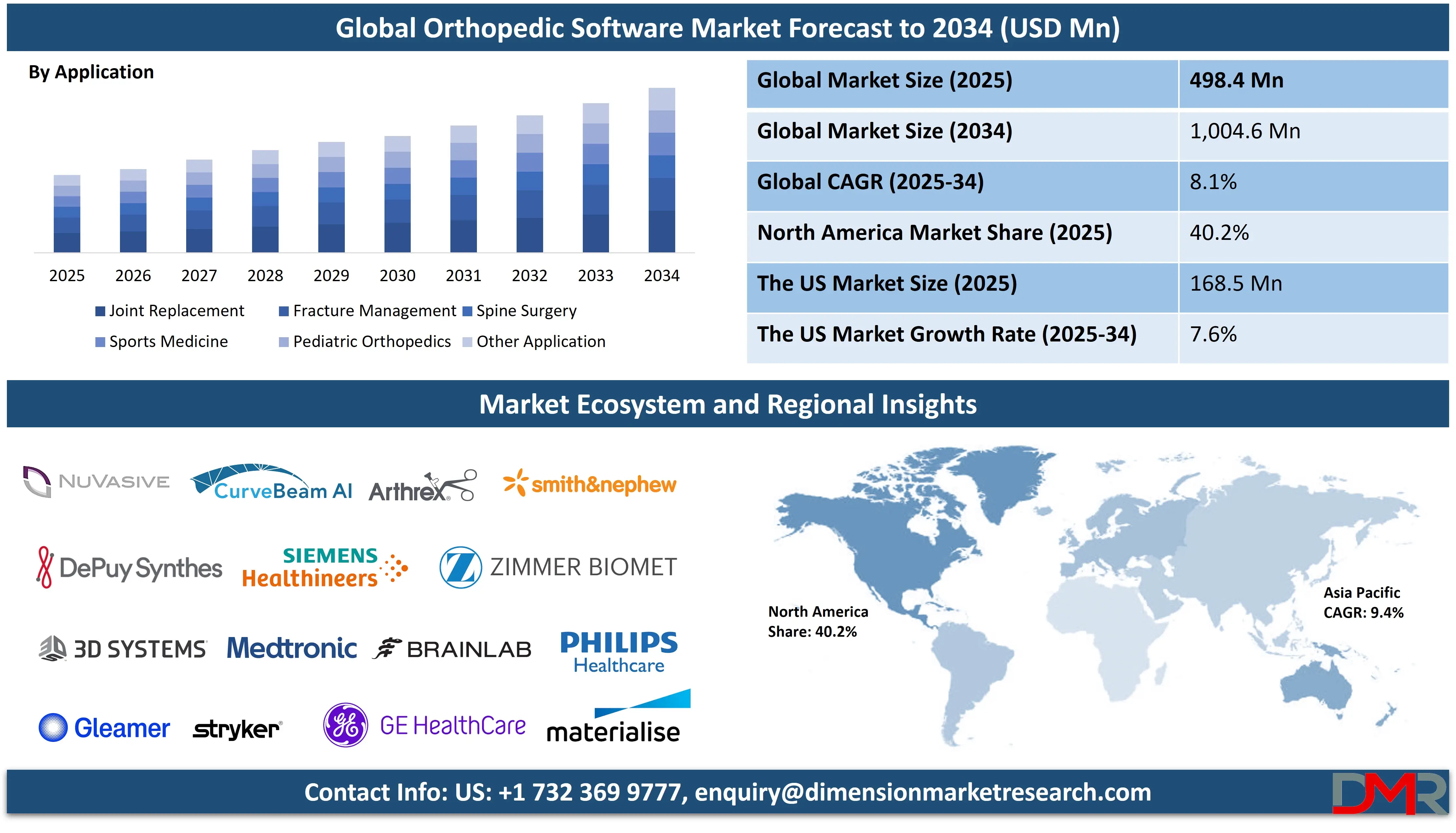

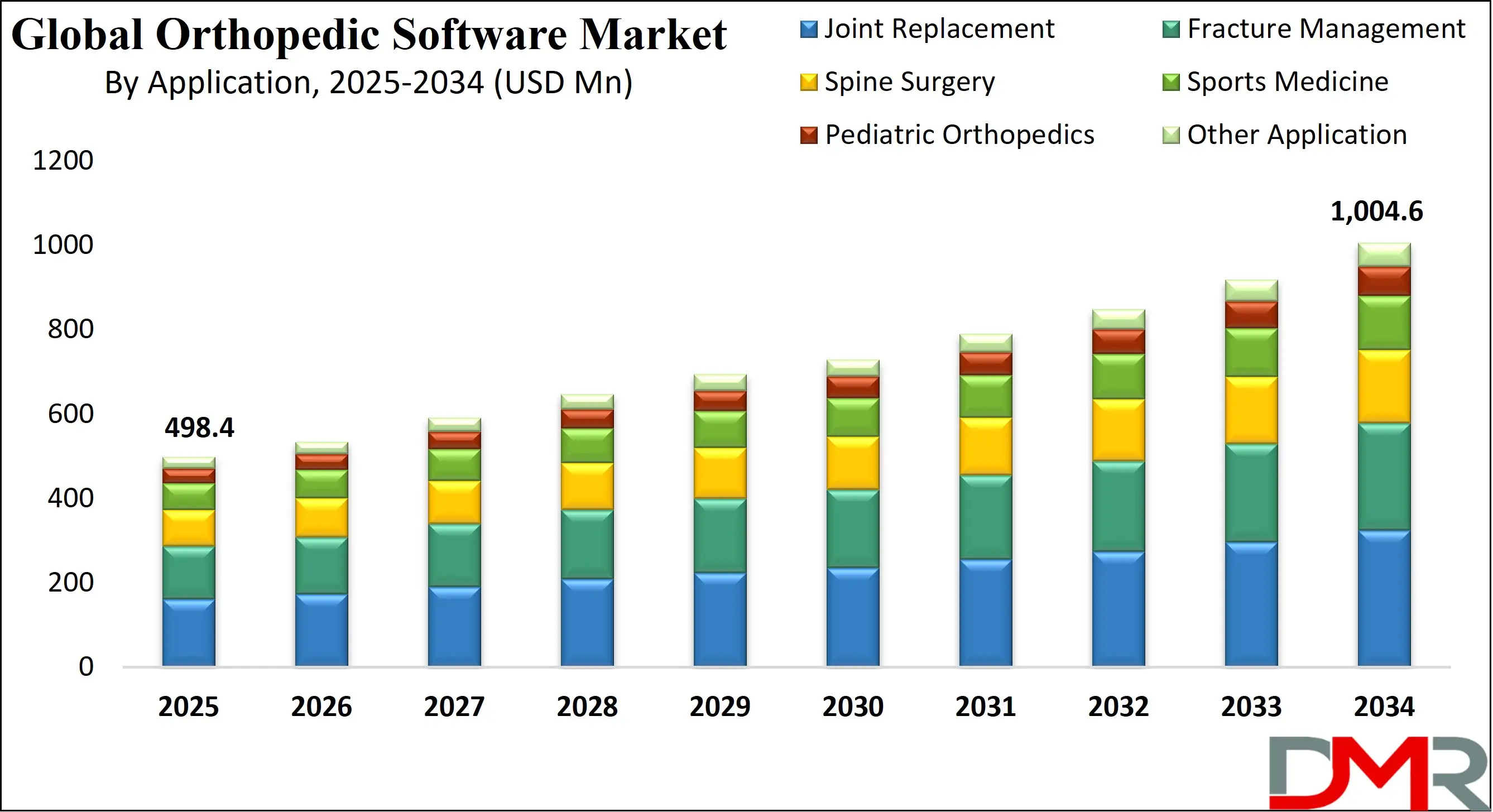

The Global Orthopedic Software Market is projected to reach USD 498.4 million in 2025 and is expected to grow at a CAGR of 8.1% from 2025 to 2034, attaining a value of USD 1,004.6 million by 2034. The market's robust growth is driven by the rising global prevalence of musculoskeletal disorders, an aging population, and the increasing adoption of digital solutions for surgical planning, patient management, and value-based care.

Orthopedic software enables enhanced clinical workflows through AI-powered imaging analysis, 3D anatomical modeling, robotic surgery integration, and cloud-based data management, supporting surgeons in improving procedural accuracy and patient outcomes. The model addresses global challenges related to osteoarthritis, osteoporosis, and complex fractures, affecting hundreds of millions worldwide, and helps reduce surgical complications and recovery times through precision planning.

Technological advancements, including AI-driven implant sizing, virtual surgical planning (VSP), interoperable EHR-PACS platforms, robotic-assisted surgery software, and predictive analytics for patient outcomes, are transforming the market into a highly integrated and data-driven ecosystem. Integration of machine learning algorithms for fracture detection, implant longevity prediction, and postoperative risk assessment is reshaping orthopedic care.

Growing government initiatives promoting digital health records, bundled payment models, and adoption of surgical robotics further accelerate global adoption. However, barriers such as high implementation costs, data security concerns, interoperability challenges, and resistance to workflow changes remain. Despite these limitations, the convergence of digital health, AI innovation, and surgical technology modernization positions orthopedic software as a central driver of global musculoskeletal care transformation through 2034.

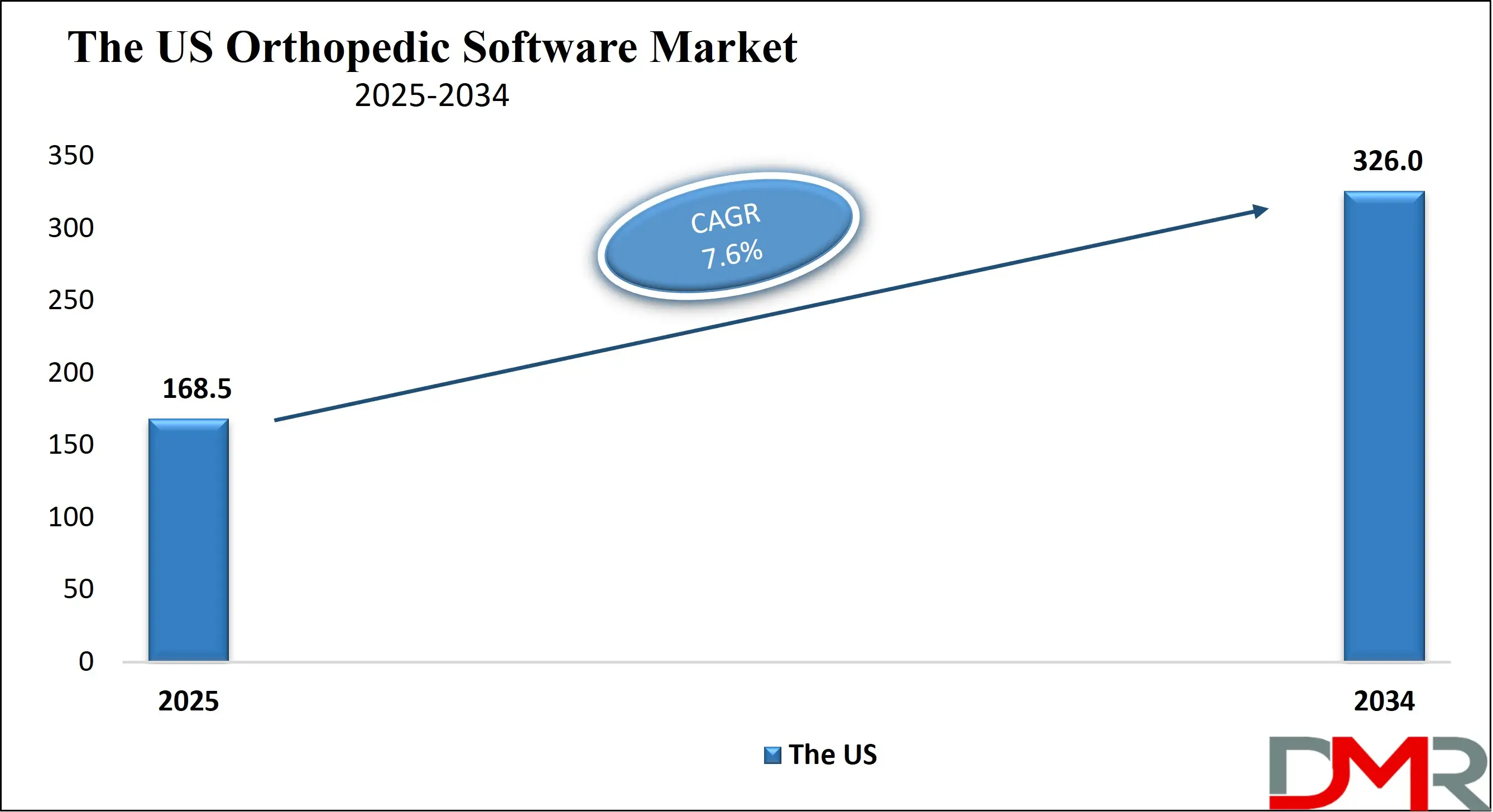

The US Orthopedic Software Market

The U.S. Orthopedic Software Market is projected to reach USD 168.5 million in 2025 and grow at a CAGR of 7.6%, reaching USD 326.0 million by 2034. The U.S. leads global adoption due to its advanced healthcare IT infrastructure, high volume of orthopedic procedures, and strong reimbursement frameworks for digital health solutions.

Major health systems such as Mayo Clinic, Cleveland Clinic, and Hospital for Special Surgery (HSS) have integrated AI-enabled preoperative planning, robotic surgery platforms, and cloud-based patient outcome tracking. The shift toward value-based care and bundled payments for joint replacement procedures is accelerating the adoption of software for cost and outcome optimization.

U.S. reimbursement is expanding, with Medicare and private payers covering digital tools for surgical planning and remote patient monitoring. The FDA's clearance of AI-based diagnostic and planning tools, such as those from Stryker, Zimmer Biomet, and Smith & Nephew, further validates the clinical and economic value of orthopedic software.

The rapid rise of interoperable EHRs, cloud PACS, 3D printing integration, and predictive analytics continues to redefine the U.S. orthopedic landscape, positioning the country as a global leader in digital musculoskeletal innovation.

The Europe Orthopedic Software Market

The Europe Orthopedic Software Market is projected to be valued at approximately USD 99.6 million in 2025 and is projected to reach around USD 200.9 million by 2034, growing at a CAGR of about 8.1% from 2025 to 2034. Europe's leadership is anchored by strong regulatory frameworks, high adoption of robotic surgery, and government-supported digital health initiatives.

Countries such as the U.K., Germany, France, Italy, and Spain have widely adopted EHR systems, PACS, and surgical planning platforms, driven by national health services and private hospital chains. The NHS in the U.K., for example, is implementing integrated orthopedic pathways that leverage software for preoperative planning and postoperative recovery tracking.

Europe's aging population, increasing prevalence of osteoarthritis, and emphasis on minimally invasive surgeries further drive software uptake. Funding through the EU4Health Program and Horizon Europe supports the adoption of AI in imaging, tele-rehabilitation, and surgical robotics.

Hospitals and ambulatory surgery centers increasingly deploy cloud-based PACS, 3D planning modules, and AI-powered outcome predictors. With strong clinical governance and digital maturity, Europe remains one of the most advanced regions in orthopedic software penetration.

The Japan Orthopedic Software Market

The Japan Orthopedic Software Market is anticipated to be valued at approximately USD 24.9 million in 2025 and is expected to attain nearly USD 50.2 million by 2034, expanding at a CAGR of about 8.1% during the forecast period. Japan's rapidly aging population over 29% aged 65 or older drives high demand for joint replacements, fracture repair, and osteoporosis management.

The Ministry of Health, Labour and Welfare (MHLW) actively supports digital health adoption through national strategies, enabling the use of AI-based imaging, robotic surgery software, and cloud-based patient management systems. Japan's leadership in robotics and imaging technologies accelerates innovation in surgical navigation, 3D planning, and predictive analytics.

Japan's concept of "Society 5.0", driven by companies like Medtronic, Sony, and Fujitsu, integrates IoT-enabled surgical devices with cloud platforms. Urban regions are deploying AI-driven diagnostic hubs, while rural prefectures use tele-orthopedics for specialist consultations. Japan's focus on precision medicine and aging care positions the country as a high-growth innovator in orthopedic software.

Global Orthopedic Software Market: Key Takeaways

- Strong Global Market Growth Outlook: The Global Orthopedic Software Market is expected to be valued at USD 498.4 million in 2025 and is projected to reach USD 1,004.6 million by 2034, showcasing rapid expansion supported by rising demand for digital surgery solutions and data-driven patient management.

- High CAGR Driven by Digital Surgery Adoption: The market is expected to grow at an impressive CAGR of 8.1% from 2025 to 2034, fueled by accelerated adoption of AI, robotic assistance, 3D planning, and value-based care models worldwide.

- Strong Growth Trajectory in the United States: The U.S. Orthopedic Software Market stands at USD 168.5 million in 2025 and is projected to reach USD 326.0 million by 2034, expanding at a CAGR of 7.6% due to robust reimbursement structures and deep integration of digital tools into surgical workflows.

- North America Maintains Regional Dominance: North America is expected to capture approximately 40.2% of the global market share in 2025, supported by advanced healthcare IT infrastructure, high digital literacy, early AI adoption, and strong surgeon–technology integration.

- Rapid Advancement in Orthopedic Software Technologies: Innovations including AI-based implant planning, virtual reality surgical simulators, cloud-integrated PACS, and robotic navigation systems are significantly accelerating precision, efficiency, and outcomes in orthopedic care.

- Growing Burden of Musculoskeletal Disorders Boosts Adoption: Rising global prevalence of osteoarthritis, osteoporosis, fractures, and sports injuries is driving sustained demand for advanced planning, minimally invasive techniques, and postoperative monitoring software.

Global Orthopedic Software Market: Use Cases

- Total Joint Replacement Planning: Surgeons use 3D anatomical modeling and AI-based implant sizing software to plan knee and hip replacements, improving alignment and longevity.

- Fracture Detection and Classification: AI algorithms analyze X-rays and CT scans to automatically detect and classify fractures, reducing diagnostic errors and speeding up treatment.

- Robotic-Assisted Surgery Integration: Software platforms interface with surgical robots to provide real-time guidance, haptic feedback, and precision control during complex procedures.

- Remote Patient Monitoring and Tele-Rehabilitation: Patients use mobile apps and wearable sensors to track recovery, perform guided exercises, and share data with clinicians for continuous oversight.

- Surgical Outcome Prediction: Predictive analytics models use patient data to forecast surgery success, complication risks, and recovery timelines, aiding shared decision-making.

Global Orthopedic Software Market: Stats & Facts

- The World Health Organization (WHO) states that 1.71 billion people have musculoskeletal conditions worldwide, highlighting the critical need for efficient, scalable digital solutions like Artificial Intelligence planning and tele-orthopedics.

- The International Osteoporosis Foundation (IOF) reports that osteoporosis causes more than 8.9 million fractures annually, driving demand for bone density analysis software and fracture risk assessment tools.

- The U.S. FDA has cleared AI-based systems like Zimmer Biomet's ROSA® Knee and Stryker's Mako for robotic-assisted surgery, achieving up to 30% improvement in implant placement accuracy, validating software as essential for modern orthopedic care.

- The American Academy of Orthopaedic Surgeons (AAOS) notes that 3D preoperative planning reduces surgery time by up to 25% and improves patient-specific instrument accuracy, reinforcing the value of digital planning.

- According to Global Digital Health Surveys, adoption of cloud-based PACS in orthopedics is growing over 20% annually across hospitals, as platforms like Sectra and GE HealthCare enable seamless image sharing and collaborative planning.

- The International Society for Orthopaedic Surgery (ISOS) reports over 60% of rural hospitals lack specialized orthopedic surgeons, creating delays; orthopedic software mitigates this by enabling teleconsultation, remote planning, and outcome tracking.

Global Orthopedic Software Market: Market Dynamic

Driving Factors in the Global Orthopedic Software Market

Rising Prevalence of Musculoskeletal Disorders

The growing burden of chronic conditions such as osteoarthritis, osteoporosis, rheumatoid arthritis, and sports injuries is a major driver for orthopedic software adoption. Aging populations across Europe, Japan, and North America significantly increase demand for joint replacements and fracture care. Meanwhile, obesity and sedentary lifestyles contribute to a surge in orthopedic interventions. Software solutions expand diagnostic and planning capacity, enabling precision treatment via 3D modeling, AI-assisted imaging, and predictive analytics. This reduces surgical errors, minimizes recovery time, and optimizes resource use, especially in underserved regions.

Technology Innovation

Orthopedic software benefits heavily from rapid progress in AI algorithms, 3D imaging, robotic integration, and cloud interoperability. Modern platforms offer virtual surgical planning, real-time navigation, automated implant selection, and outcome prediction. AI-powered tools analyze X-rays, MRIs, and CT scans for pathology detection and procedural planning. Cloud-based PACS and EHR systems centralize patient data, ensuring easy access across networks. These innovations greatly enhance surgical accuracy, operational efficiency, and patient satisfaction, making orthopedic software an essential element of modern musculoskeletal care.

Restraints in the Global Orthopedic Software Market

High Implementation and Maintenance Costs

Many healthcare facilities, especially in low- and middle-income regions, face significant financial barriers to adopting advanced orthopedic software. High upfront costs for licenses, hardware, training, and integration with existing systems can be prohibitive. Ongoing expenses for updates, cloud storage, and technical support further strain budgets. In regions with limited healthcare funding, software programs often struggle to achieve scale. Additionally, staff may require extensive training to operate new systems, delaying implementation and reducing ROI. Without financial incentives or subsidized programs, adoption remains limited.

Interoperability and Data Security Concerns

Orthopedic software must integrate with diverse hospital IT systems, including EHRs, PACS, and billing platforms. Lack of standardization and interoperability can lead to data silos, workflow disruptions, and user frustration. Data privacy regulations such as GDPR in Europe and HIPAA in the U.S. require strict security measures, which can be challenging for smaller providers to implement. Concerns over data breaches, patient confidentiality, and system vulnerabilities may slow adoption. For orthopedic software to scale globally, seamless interoperability and robust cybersecurity frameworks are essential.

Opportunities in the Global Orthopedic Software Market

AI-Integrated Surgical Pathways

Hospitals and health systems worldwide are increasingly adopting end-to-end digital surgical pathways that integrate AI-based planning, navigation, and outcome tracking. These systems enable personalized treatment plans, reduce variability in surgical outcomes, and support training and credentialing. Countries such as the U.S., Germany, Japan, and Australia are deploying integrated digital platforms for joint replacement, spine surgery, and trauma care. AI also enables continuous learning and protocol refinement, supporting consistent clinical quality. As cloud platforms expand, real-time analytics, registry integration, and predictive modeling will create new opportunities for innovation.

Expansion in Emerging Economies

Emerging markets represent major growth opportunities due to rising healthcare access, increasing medical tourism, and government digital health initiatives. Countries in Asia-Pacific, Latin America, and the Middle East are adopting EHRs, PACS, and surgical planning tools in public and private hospitals. The affordability of mobile-based imaging and AI diagnostics allows mid-tier hospitals to offer advanced care. Government-led programs in India, Brazil, and Saudi Arabia are incorporating orthopedic software into national health missions. As AI-assisted planning becomes more accessible, emerging economies will drive the next phase of market expansion.

Trends in the Global Orthopedic Software Market

Cloud-Based Orthopedic Platforms

Cloud-based platforms are modernizing orthopedics by centralizing imaging, planning, collaboration, and analytics. Cloud PACS enables instant data sharing between surgeons, radiologists, and hospitals. Diagnostic AI engines integrated into cloud workflows provide automated fracture detection, implant sizing, and alignment analysis. Integration with EHR systems ensures seamless patient record updates and longitudinal tracking. Cloud platforms reduce hardware costs, enable scalability, and support remote consultation, telementoring, and multi-center research. By streamlining processes, cloud solutions enhance care efficiency and enable global orthopedic networks.

AI and Predictive Analytics for Outcome Optimization

AI is increasingly used to predict patient outcomes, personalize treatment plans, and reduce complications. Machine learning models analyze preoperative data—such as bone density, anatomy, and comorbidities—to forecast surgery success, recovery time, and risk of revision. Predictive analytics also help hospitals with resource planning, cost management, and quality reporting. As data volumes grow and algorithms improve, AI-driven insights will become a standard feature of orthopedic software, supporting proactive and precision-based care.

Global Orthopedic Software Market: Research Scope and Analysis

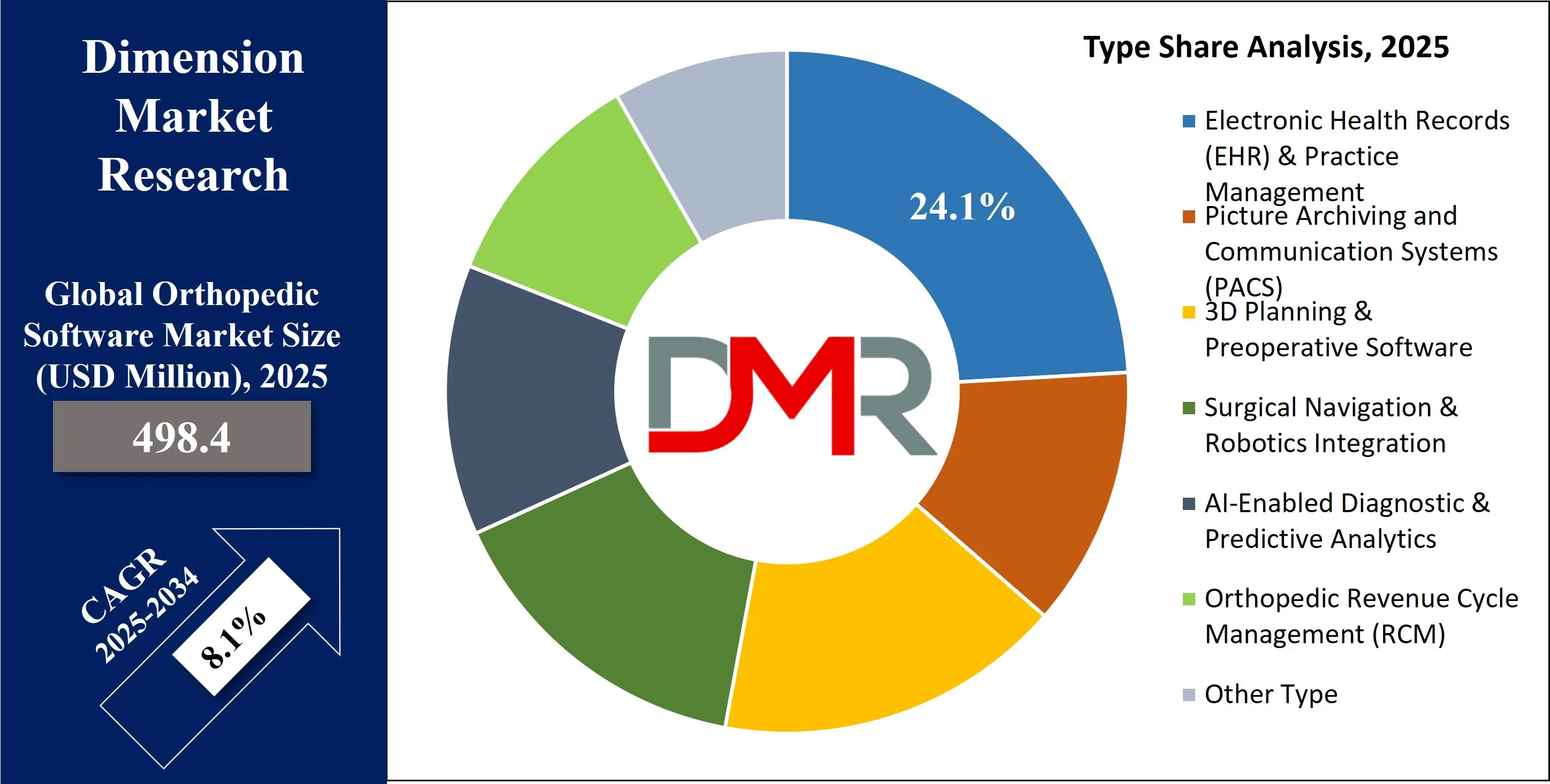

By Type Analysis

EHR & Practice Management is projected to dominate the global market due to its foundational role in patient management, scheduling, billing, and regulatory compliance. These systems streamline clinical and administrative workflows, reduce paperwork, and improve data accuracy. Integration with PACS, planning software, and billing systems enhances their utility. The shift toward value-based care and bundled payments further drives adoption, as EHRs enable outcome tracking and cost analysis. Cloud-based EHRs are particularly popular in mid-sized clinics and emerging markets due to lower upfront costs and scalability.

3D Planning & Preoperative Software ranks as the second-largest segment, driven by the growing demand for personalized surgery. These tools create patient-specific 3D models from CT or MRI scans, allowing surgeons to simulate procedures, select optimal implants, and design custom guides. The technology improves surgical accuracy, reduces operative time, and enhances patient satisfaction. With increasing adoption of joint replacement and complex spine surgery, 3D planning software is becoming a standard in advanced orthopedic practice.

By Mode of Delivery

The Cloud-Based mode of delivery is the projected to unequivocally dominant and fastest-growing segment in the orthopedic software market. This supremacy is driven by a fundamental shift in healthcare IT economics and operational needs, moving away from the substantial capital expenditure (CapEx) of On-Premises systems to the predictable, operational expense (OpEx) model of Software-as-a-Service (SaaS). Cloud solutions eliminate the need for healthcare providers to invest in and maintain expensive internal server infrastructure and dedicated IT staff, making advanced software accessible and affordable, especially for small to mid-sized clinics and Ambulatory Surgery Centers (ASCs).

Beyond cost, cloud platforms offer unparalleled scalability and agility, allowing practices to easily add users, storage, or new functionalities as they grow. They facilitate critical modern workflows, such as providing surgeons secure, remote access to patient records and medical images from any location, which supports telehealth initiatives and decentralized care models. Interoperability between hospitals, clinics, and diagnostic centers is also significantly enhanced through cloud-based ecosystems. Furthermore, vendors manage all software updates, security patches, and compliance with regulatory standards like HIPAA, ensuring all users are on the latest, most secure version without any manual intervention. This combination of lower total cost of ownership, superior flexibility, enhanced collaboration, and robust, vendor-managed security makes cloud-based delivery the default and dominant choice for new software implementations across the orthopedic care continuum.

By Application Analysis

Joint Replacement is poised to be the largest and most dominant application segment in the orthopedic software market, accounting for the highest share globally. With the rising prevalence of osteoarthritis and an aging population, millions undergo hip and knee replacements annually. Software enables precise preoperative planning, intraoperative navigation, and postoperative outcome assessment. Dominance is reinforced by the integration of robotic systems and AI-based planning tools from leading vendors. Because joint replacement is highly protocol-driven and outcomes-sensitive, hospitals prioritize software adoption to ensure consistency and quality.

Fracture Management ranks as the second-largest application segment due to the high incidence of traumatic and osteoporotic fractures. Software supports imaging analysis, classification, surgical planning, and implant selection. AI tools assist in detecting subtle fractures and assessing bone healing. The segment benefits from the urgent nature of trauma care and the need for rapid, accurate decision-making.

By End User Analysis

Hospitals & Ambulatory Surgery Centers (ASCs) are anticipated to dominate the orthopedic software market because they are the primary sites for complex procedures, advanced imaging, and specialist care. They house the necessary infrastructure, including EHRs, PACS, and surgical navigation systems. Software integrates seamlessly into hospital workflows through cloud platforms, AI analytics, and robotic interfaces. Hospitals frequently serve as hubs for interpreting images, planning surgeries, and training staff. The need for advanced clinical validation, regulatory compliance, and outcome reporting further strengthens hospital dominance.

Specialty Orthopedic Clinics are the second-largest end-user segment due to their focus on high-volume elective procedures like arthroscopy and joint injections. These clinics benefit from software for patient management, imaging integration, and minimally invasive planning. Cloud-based solutions allow smaller clinics to access advanced tools without major capital investment. Countries such as the U.S., Germany, and India have a growing number of specialty clinics adopting digital workflows to enhance efficiency and patient experience.

The Global Orthopedic Software Market Report is segmented on the basis of the following:

By Type

- Electronic Health Records (EHR) & Practice Management

- Picture Archiving and Communication Systems (PACS)

- 3D Planning & Preoperative Software

- Surgical Navigation & Robotics Integration

- AI-Enabled Diagnostic & Predictive Analytics

- Orthopedic Revenue Cycle Management (RCM)

- Other Type

By Mode of Delivery

By Application

- Joint Replacement

- Fracture Management

- Spine Surgery

- Sports Medicine

- Pediatric Orthopedics

- Other Application

By End User

- Hospitals & Ambulatory Surgery Centers (ASCs)

- Specialty Orthopedic Clinics

- Diagnostic Imaging Centers

- Research & Academic Institutes

- Other End Users

Impact of Artificial Intelligence in the Global Orthopedic Software Market

- AI for Automated Fracture Detection: AI analyzes X-rays and CT scans to identify fractures, dislocations, and degenerative changes within seconds. It reduces diagnostic errors, supports emergency care, and enables high-volume screening with consistent accuracy.

- AI-Assisted Implant Selection and Sizing: AI algorithms recommend optimal implant types and sizes based on patient anatomy and surgical history. This improves fit, reduces inventory costs, and shortens planning time.

- AI-Based Outcome Prediction: AI evaluates patient data to predict surgery success, recovery timelines, and risk of complications. This supports shared decision-making and personalized care pathways.

- Robotic Surgery Planning and Navigation: AI integrates with robotic systems to optimize surgical pathways, provide real-time feedback, and enhance precision in bone cutting and implant placement.

- Predictive Analytics for Resource Planning: AI helps hospitals forecast surgery demand, optimize operating room schedules, and manage implant inventories, improving operational efficiency.

Global Orthopedic Software Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to dominate the Global Orthopedic Software Market with 40.2% of market share by the end of 2025, owing to advanced healthcare IT infrastructure, high adoption of surgical robotics, strong reimbursement policies, and a large patient base requiring orthopedic care. The United States and Canada have deeply integrated digital tools into orthopedic practice, supported by HIPAA-compliant cloud systems, FDA-cleared AI solutions, and widespread EHR use. Large health networks such as Mayo Clinic, Cleveland Clinic, and HSS have institutionalized software for 3D planning, robotic surgery, and outcome analytics.

The region has one of the highest rates of joint replacement procedures, driving demand for precision planning tools. Reimbursement from Medicare, Medicaid, and private insurers for digital planning and navigation supports financial viability.

Region with the Highest CAGR

Asia-Pacific holds the highest CAGR and is poised to achieve significant market share due to its large population, rising healthcare investment, and growing medical tourism. The region accounts for a rising share of global orthopedic procedures, with India, China, and South Korea leading adoption. APAC faces shortages of specialized surgeons, especially in rural areas, creating demand for tele-orthopedics and AI diagnostics. Government programs such as India's Ayushman Bharat and China's Healthy China 2030 promote digital health adoption. Affordable mobile-based imaging and cloud platforms are accelerating uptake in mid-tier hospitals and clinics.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Orthopedic Software Market: Competitive Landscape

The Global Orthopedic Software Market is moderately fragmented, driven by a diverse ecosystem of medical software firms, device manufacturers, AI startups, and cloud platform providers. Leading companies Stryker, Zimmer Biomet, Medtronic, and Smith & Nephew dominate through integrated hardware-software offerings for robotic surgery and 3D planning.

AI-focused innovators such as GLEAMER, Brainlab, and Imagen Technologies significantly influence market dynamics by offering automated fracture detection, surgical navigation, and predictive analytics. Their solutions reduce diagnostic errors and improve planning efficiency.

Telemedicine and software leaders like Philips Healthcare, GE HealthCare, and Siemens Healthineers expand their portfolios with cloud PACS, AI analytics, and interoperable EHR modules. Emerging specialists Arthrex, CurveBeam, and Materialise strengthen market penetration with specialized modules for arthroscopy, weight-bearing imaging, and 3D printing integration.

Some of the prominent players in the Global Orthopedic Software Market are

- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

- Medtronic plc

- Smith & Nephew plc

- Philips Healthcare

- GE HealthCare

- Siemens Healthineers

- Brainlab AG

- Materialise NV

- Arthrex, Inc.

- CurveBeam AI

- GLEAMER

- Imagen Technologies

- 3D Systems, Inc.

- DePuy Synthes (Johnson & Johnson)

- NuVasive, Inc.

- Globus Medical, Inc.

- OrthoGrid Systems, Inc.

- Other Key Players

Recent Developments in the Global Orthopedic Software Market

- November 2025: Stryker launches AI-based trauma planning module

Stryker introduced an AI-enhanced module for trauma surgery planning, enabling automated fracture classification and implant suggestion. The cloud-based platform supports real-time collaboration between surgeons and radiologists.

- October 2025: Zimmer Biomet showcases robotic-integrated software at AAOS

Zimmer Biomet presented its ROSA® Robotics platform with enhanced AI planning features at AAOS 2025. Demonstrations emphasized personalized knee and hip replacement pathways and outcome predictive analytics.

- September 2025: Medtronic acquires digital surgery startup

Medtronic completed the acquisition of a digital surgery software firm to expand its AI-based spine and navigation portfolio. The integration aims to enhance preoperative planning and intraoperative guidance for complex procedures.

- August 2025: Brainlab launches cloud-based orthopedic PACS

Brainlab introduced a cloud PACS platform with integrated AI analytics for joint replacement and spine surgery. The system enables multi-center collaboration and real-time outcome tracking.

- July 2025: FDA clears AI fracture detection software

The U.S. FDA cleared an AI-based X-ray analysis tool from Gleamer for automatic fracture detection, boosting adoption in emergency and urgent care settings.

- June 2025: Philips partners with hospital chains for EHR-PACS integration

Philips Healthcare announced partnerships with major U.S. and European hospital networks to deploy integrated EHR-PACS-orthopedic planning platforms, improving data flow and clinical decision support.

- May 2025: Materialise introduces 3D planning suite for ASCs

Materialise launched a cost-effective 3D planning suite tailored for ambulatory surgery centers, increasing accessibility to patient-specific instruments and virtual surgical planning.

- April 2025: Smith & Nephew integrates AI into CORI® robotics

Smith & Nephew enhanced its CORI® Surgical System with AI-driven planning and outcome prediction, supporting surgeons in optimizing alignment and soft-tissue balance.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 498.4 Mn |

| Forecast Value (2034) |

USD 1,004.6 Mn |

| CAGR (2025–2034) |

8.1% |

| The US Market Size (2025) |

USD 168.5 Mn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Electronic Health Records (EHR) & Practice Management, Picture Archiving and Communication Systems (PACS), 3D Planning & Preoperative Software, Surgical Navigation & Robotics Integration, AI-Enabled Diagnostic & Predictive Analytics, Orthopedic Revenue Cycle Management (RCM), Other Type), By Mode of Delivery (On-Premises, Cloud Based), By Application (Joint Replacement, Fracture Management, Spine Surgery, Sports Medicine, Pediatric Orthopedics, Other Application), By End User (Hospitals & Ambulatory Surgery Centers (ASCs), Specialty Orthopedic Clinics, Diagnostic Imaging Centers, Research & Academic Institutes, Other End Users) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Stryker Corporation, Zimmer Biomet Holdings Inc., Medtronic plc, Smith & Nephew plc, Philips Healthcare, GE HealthCare, Siemens Healthineers, Brainlab AG, Materialise NV, Arthrex Inc., CurveBeam AI, GLEAMER, Imagen Technologies, 3D Systems Inc., DePuy Synthes (Johnson & Johnson), NuVasive Inc., Globus Medical Inc., OrthoGrid Systems Inc., and Other Key Players |

| Purchase Options |

We have three licenses to opt for (Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Orthopedic Software Market size is estimated to have a value of USD 498.4 million in 2025 and is expected to reach USD 1,004.6 million by the end of 2034.

The market is growing at a CAGR of 8.1 percent over the forecasted period of 2025 to 2034.

The US Orthopedic Software Market is projected to be valued at USD 168.5 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 168.5 million in 2034 at a CAGR of 7.6%.

North America is expected to have the largest market share in the Global Orthopedic Software Market with a share of about 40.2% in 2025.

Some of the major key players in the Global Orthopedic Software Market are Stryker Corporation, Zimmer Biomet Holdings, Inc., Medtronic plc, Smith & Nephew plc, Philips Healthcare, and many others.