Market Overview

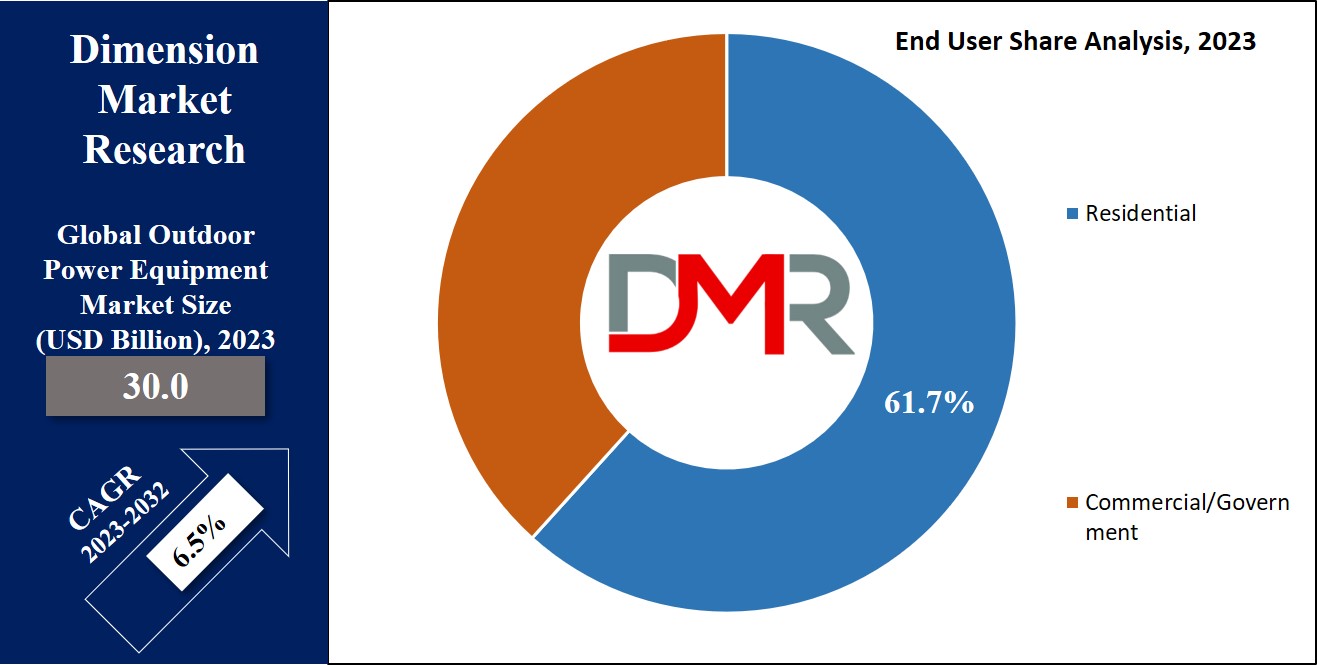

The Global Outdoor Power Equipment Market is expected to reach a value of USD 30.0 billion in 2023, and it is further anticipated to reach a market value of USD 53.1 billion by 2032 at a CAGR of 6.5%. The market has seen significant growth over the past few years and is predicted to grow significantly during the forecasted period as well.

Outdoor power equipment consists of machinery & tools that have small motors or engines & are mainly used for outdoor applications, which includes but is not limited to, a variety of equipment such as aerators, augers, blowers, brush clearers, brush cutters, hedge trimmers, lawn mowers, pole saws, chain saws, dethatchers, edgers, snow blowers, & tillers.

Further, market growth is fueled by the current technological development in outdoor power equipment. Companies are continuously improving their efficiency & adaptability, and integrating smart features like GPS tracking & remote controls. These innovations lead to changing consumer needs & expectations, enhancing the look of outdoor power equipment. Such developments not only attract new customers but also drive overall market growth, along with shaping the market's future.

Key Takeaways

- Market Growth: The global outdoor power equipment market is projected to grow from USD 30.0 billion in 2023 to USD 53.1 billion by 2032, with a CAGR of 6.5%.

- Tech Innovation: Advancements like GPS tracking, remote controls, and smart features are making equipment more efficient and attracting new consumers, driving market expansion.

- Market Dynamics: Increased gardening interest among younger generations and a rise in home improvement projects are major growth drivers, though high maintenance costs may limit expansion.

- Segment Trends: Chainsaws dominate due to infrastructure and furniture needs, while robotic and automated lawn mowers are rapidly gaining popularity owing to technological advances.

- Power Source Shift: While gasoline-powered tools still hold a large share, battery-powered equipment is expected to grow because of lower emissions, regulatory pressures, and lighter weight.

- End User Focus: The residential segment leads due to DIY gardening trends and increased time spent outdoors post-pandemic, but commercial demand is rising from urbanization and sports facility development.

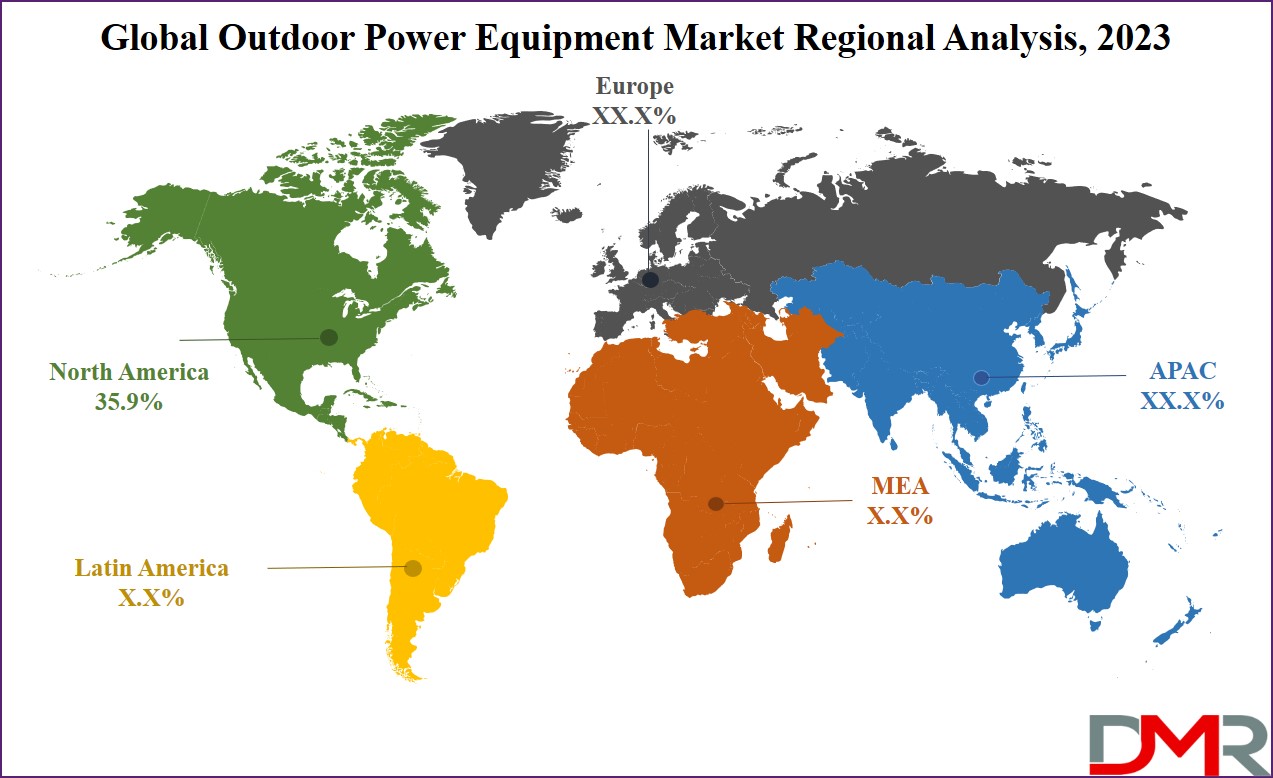

- Regional Insight: North America boasts the largest market share (about 35.9%) due to vast gardens and government investments, while Asia Pacific is growing quickly due to rising incomes and mega sports events.

- Competitive Landscape: The market is fragmented and highly competitive, with companies focusing on cost-effective, ergonomic designs and innovation to gain an edge. Notable player: Robert Bosch with products like the “Keo” cordless garden saw.

Use Cases

- Smart Landscaping: Remote-controlled and GPS-enabled mowers optimize lawn care for large gardens, parks, or sports grounds, saving manual labor and improving maintenance efficiency.

- Urban Gardening: Lightweight, compact power tools help city residents maintain small lawns and rooftop gardens, supporting urban agriculture and enhancing property aesthetics.

- Golf Course Maintenance: Specialized blowers and trimmers facilitate efficient upkeep of golf courses, driving business for sports facility operators by maintaining pristine grounds.

- Home DIY Projects: Robotic and affordable battery-powered chainsaws and trimmers allow homeowners to manage tree pruning and landscaping, reducing reliance on professional services.

- Green Public Spaces: Municipalities use low-emission, electric outdoor equipment for city parks and community green areas, meeting environmental regulations while ensuring effective upkeep.

- Sports Event Preparation: Organizers deploy heavy-duty tillers and automated mowers to prepare stadium turf and grounds rapidly, improving safety and visual appeal for events.

Market Dynamic

Gardening is noticing rapid growth, mainly among younger generations who are showing their interest in cultivating vegetables, fruits, & herbs. Given that many young individuals live in smaller yard spaces, the need has shifted towards equipment & tools designed for compact spaces. In response, the gardening & lawn industry is advancing to meet these varied consumer needs by introducing lighter-weight equipment that enhances ease & comfort while gardening. In addition, the growing popularity of home improvement projects also holds well for the anticipated growth of the outdoor power equipment market during the forecast period.

However, while the market holds a promising position, it notices various challenges related to the rising maintenance costs involved. Achieving major operational efficiency requires constant inspections of outdoor power equipment at different intervals. These inspections contain a variety of factors, like scrutinizing cords, lubrication, performing sharpening, assessing for damaged switches, & addressing other major repairs to enable the equipment's proper functionality. Moreover, the relatively high maintenance cost associated with outdoor power equipment is expected to restrain the market's growth during the forecasted period.

Research Scope and Analysis

By Type

The equipment category for outdoor power equipment includes lawn mowers, chainsaws, trimmers & edgers, blowers, tillers & cultivators, snow throwers, and others. Majorly the chainsaw segment contributed significantly towards the total global revenue for the overall market and is anticipated to experience significant growth throughout the forecast period. Chainsaws are handheld, portable mechanical devices majorly used for cutting wood & wood-related materials. The growing rate of deforestation due to many new infrastructure projects is expected to be a key driver of market growth. Additionally, the growing need for interior design elements like wood-based flooring, roofing, panels, & more is further contributing to the increasing use of chainsaws in many furniture applications.

Moreover, the lawn mower segment also secured a significant market share and is anticipated to have rapid growth during the forecasted period. Various companies are actively engaged in developing diverse robotic mowers in response to the growing need for technologically advanced lawn mowers. Moreover, advanced automated

lawn mowers are equipped with features like GPS tracking & remote controls, simplifying the user's ability to operate, monitor, and track the mower's performance. Additionally, shifts in consumer spending patterns & their growing emphasis on the aesthetic appeal of their garden spaces are expected to give a further boost to the market's growth.

By Power Source

The power source category has been divided into three distinct segments: gasoline,

battery, and electric cord. In 2023, the gasoline segment holds a significant portion of the market share; however, it is anticipated that it may experience a decline in demand due to concerns related to gas emissions & noise generation. Various governmental regulations have been introduced to tackle the environmental challenges associated with gasoline-powered equipment. For instance, in California, legislation is set to prohibit the use of gas-powered chainsaws, lawnmowers, and leaf blowers, with these bans to be taken into effect as early as 2024.

Moreover, the battery power source is projected to see a high growth throughout the forecast period. This growth in the battery-powered segment can be seen considering factors such as lower shipping expenses, lighter weight in comparison to gasoline counterparts, & more affordability when purchased via online channels. Additionally, many online retailers are adapting their inventory to align with changing government regulations related to the development of electric outdoor power equipment products, further fueling the growth of this battery-powered segment.

By End User

The end-user category has been divided into two sectors, mainly commercial & residential. In 2023, the residential sector dominates the market, primarily due to the increasing inclination among residential users to dedicate more time to gardening & outdoor activities, which is anticipated to fuel the need for outdoor power equipment. Moreover, the growth in sales of do-it-yourself (DIY) outdoor power equipment, driven by the effects of the pandemic, is anticipated to contribute significantly to the growth of the segment.

Further, the commercial segment is also seeing substantial growth, which is anticipated to persist during the forecasted period. This major growth is fueled by the development of smart cities and growing urbanization. Additionally, the commercial sector is expected to notice an increase in demand due to the increasing population of golf enthusiasts & the corresponding growth in golf club facilities. This combination of all such factors is expected to drive the demand for various outdoor power equipment in the commercial segment.

The Global Outdoor Power Equipment Market Report is segmented on the basis of the following:

By Type

- Lawn Mower

- Trimmer & Edger

- Snow Throwers

- Chainsaw

- Blowers

- Tillers & Cultivators

- Others

By Power Source

- Battery

- Electric

- Gasoline

By End User

- Commercial/ Government

- Residential

Regional Analysis

The North American region holds a major market share, constituting

about 35.9% of the total revenue in the global outdoor power equipment market. The growth of the regional market can be said due to North America's large geographical area compared to the population of the region, resulting in a wide spread of gardens & lawns. Moreover, the presence of outdoor spaces has constantly shown a growth in the demand for outdoor power equipment. Further, the growth of the region can be noticed by the government's funding for major infrastructural development. For instance, the government of Canada announced an investment of USD 1.5 billion in 2022 to the Canada Mortgage & Housing Corp to expand the rapid housing initiative while focusing on building houses to address housing needs in the region.

Moreover, significant growth in the Asia Pacific market is also seen, which is anticipated to grow more over the forecast period. The expansion in the region can be seen owing to the growing levels of disposable income & the evolving lifestyles evident in many major emerging economies like India and China. Furthermore, the increase in annual mega-events like the Indian Premier League (IPL), World Baseball Classic, Asian Games, & various other sports spectacles is anticipated to stimulate the growing demand for outdoor power equipment, particularly for the improvement & maintenance of sports stadiums & athletic facilities.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The market shows fragmentation & notices intense competition among market players. Many businesses prioritize the delivery of cost-effective & ergonomically designed products, which are major aspects of their product portfolios. In this competitive landscape, companies constantly strive to improve their offerings to meet consumer needs, ensuring that the products offered by them not only give value but also prioritize user comfort & efficiency. This emphasis on cost-effectiveness & ergonomic design enhances the dynamic nature of the market, where innovation & customer-centric approaches are key drivers of success.

For instance, in January 2022, Robert Bosch GmbH unveiled Keo, a cordless garden saw, as part of their product lineup. Keo is a main addition to the 18V Power for All System, a collaborative effort with the Husqvarna Group. This product features an advanced & interchangeable battery pack, along with replaceable saw blades, tailored for do-it-yourself (DIY) applications in the gardening domain.

Some of the prominent players in the Global Outdoor Power Equipment Market are:

- Deere & Company

- Robert Bosch

- Husqvarna AB

- Ariens Company

- The Toro Company

- Briggs & Stratton

- Honda Motors Co Ltd

- Vb Emak

- Jonsered

- Cub Cadet

- Other Key Players

Recent Developments

- In March 2025, Greenworks Commercial unveiled the 2025 OPTIMUS series, a fully electric line of commercial-grade outdoor equipment, expanding their eco-friendly offerings.

- In October 2024, Frasers Group divested N Brown Group to Flacon 24 Topco for $535 million as part of portfolio realignment in the outdoor/recreation sector.

- In October 2024, Vista Outdoors sold Revelyst to Strategic Value Partners for $1.2 billion, furthering consolidation in the broader outdoor equipment industry.

- In September 2024, Topgolf Callaway Brands announced the spinoff of Callaway and Topgolf into two independent companies, highlighting strategic restructuring in the outdoor sector.

- In November 2023, United Ag & Turf Northeast acquired Chad Little Outdoor Power Equipment to strengthen their presence and offerings in Maine, USA.

- In November 2023, Stanley Black & Decker completed its $1.6 billion acquisition of MTD Holdings Inc., expanding its cordless electric outdoor power equipment portfolio.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 30.0 Bn |

| Forecast Value (2032) |

USD 53.1 Bn |

| CAGR (2023–2032) |

6.5% |

| Historical Data |

2017 – 2022 |

| Forecast Data |

2023 – 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Lawn Mower, Trimmer & Edger, Snow Throwers, Chainsaw, Blowers, Tillers & Cultivators and Others), By Power Source (Battery, Electric and Gasoline), By End User (Commercial/ Government and Residential) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Deere & Company, Robert Bosch, Husqvarna AB, Ariens Company, The Toro Company, Briggs & Stratton, Honda Motors Co Ltd, Vb Emak, Jonsered, Cub Cadet, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Outdoor Power Equipment Market size is estimated to have a value of USD 30.0 billion in 2023 and is expected to reach a value of USD 53.1 billion by the end of 2032.

North America dominates the Global Outdoor Power Equipment Market with a share of 35.9% in 2023.

Some of the major key players in the Global Outdoor Power Equipment Market are Deere & Company, Robert Bosch, Cub Cadet and many others.

The market is growing at a CAGR of 6.5 percent over the forecasted period.