Market Overview

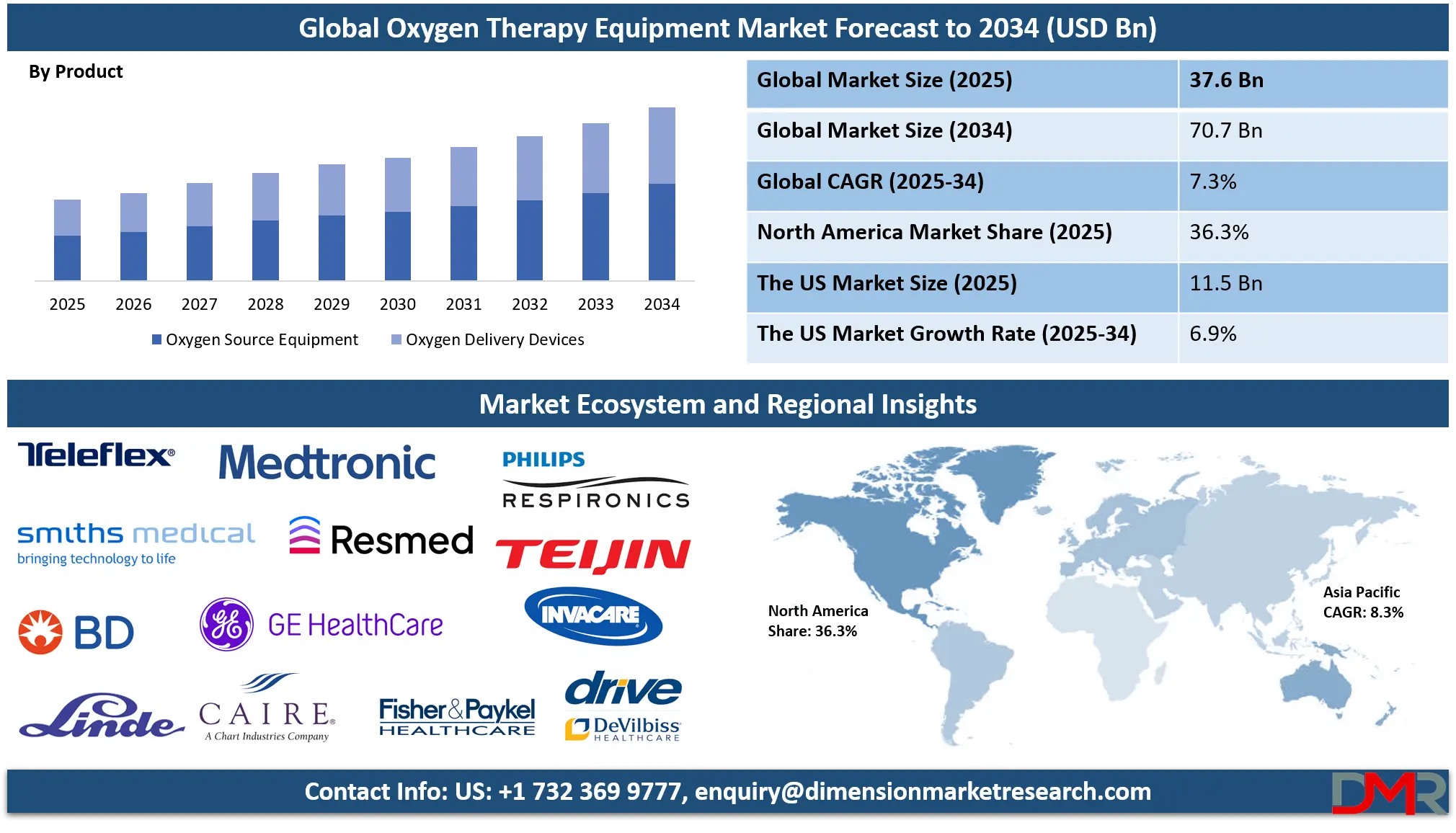

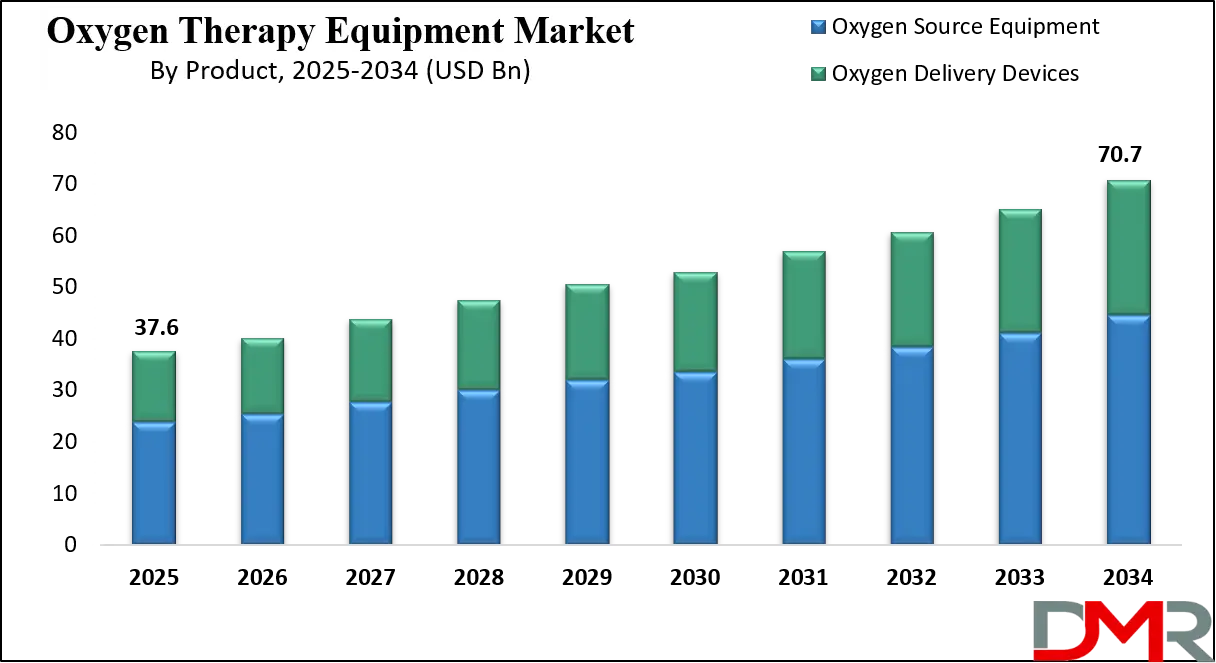

The Global Oxygen Therapy Equipment Market is projected to reach USD 37.6 billion in 2025 and is expected to grow at a compound annual growth rate (CAGR) of 7.3% from 2025 to 2034, ultimately attaining a market value of USD 70.7 billion by 2034. This growth is driven by the rising prevalence of chronic respiratory diseases such as COPD, asthma, and sleep apnea, alongside increasing adoption of home healthcare and portable oxygen concentrators. Advancements in oxygen delivery technologies, growing awareness regarding oxygen therapy benefits, and expanding elderly populations further accelerate market expansion.

The global landscape for oxygen therapy equipment is experiencing a significant upswing, propelled by the rising prevalence of chronic respiratory conditions such as COPD and asthma. A key trend shaping this sector is the pronounced shift towards portable oxygen concentrators, which grant patients unprecedented mobility and freedom compared to traditional, stationary systems.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

This evolution is further accelerated by technological integration, with devices now featuring smart connectivity for remote patient monitoring, allowing healthcare providers to track usage and adherence, thereby improving clinical outcomes. The market is also seeing a surge in the development of lightweight, energy-efficient designs that enhance user comfort and operational convenience, making long-term therapy more manageable for a growing patient population.

Substantial growth prospects are anchored in the expanding geriatric demographic, which is inherently more susceptible to respiratory and cardiac ailments requiring supplemental oxygen. Emerging economies present a vast, untapped opportunity as healthcare infrastructure improves, disposable incomes rise, and awareness of advanced treatment modalities grows. The aftermath of the COVID-19 pandemic has also left a lasting impact, with a heightened focus on respiratory health and the establishment of robust homecare frameworks, creating a sustained demand for oxygen delivery systems beyond the acute phase of the pandemic, ensuring a positive long-term outlook for the industry.

However, the market's expansion is not without its restraints. Stringent regulatory frameworks governing the approval and commercialization of medical devices can slow down the introduction of innovative products. The high cost associated with advanced portable oxygen concentrators remains a significant barrier to adoption, particularly in cost-sensitive markets and for patients without comprehensive insurance coverage. Furthermore, a lack of awareness and inadequate reimbursement policies in developing nations can limit market penetration, preventing patients from accessing the most effective and modern oxygen therapy solutions available.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Oxygen Therapy Equipment Market

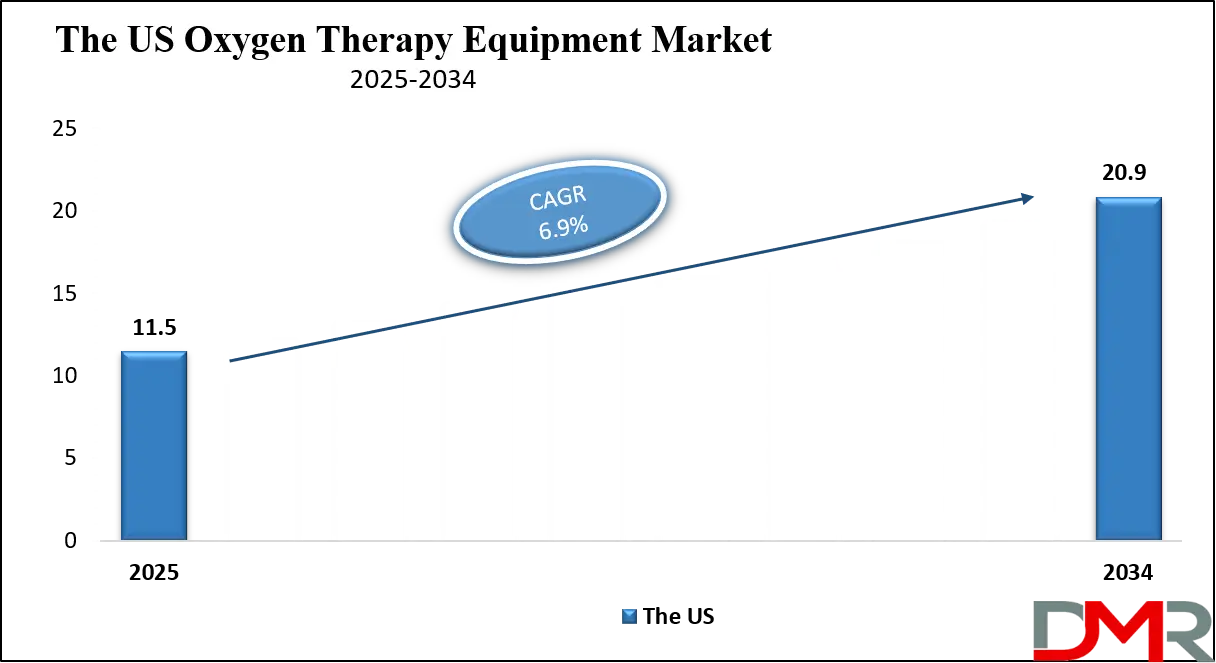

The US Oxygen Therapy Equipment Market is projected to reach USD 11.5 billion in 2025 at a compound annual growth rate of 6.9% over its forecast period.

The United States represents a dominant force in the oxygen therapy equipment market, driven by a high disease burden and supportive regulatory frameworks. According to the Centers for Disease Control and Prevention (CDC), Chronic Obstructive Pulmonary Disease (COPD) affects approximately 16 million Americans, creating a substantial and consistent patient base requiring long-term oxygen support.

This high prevalence is a primary demographic driver for the adoption of various oxygen delivery systems, from stationary concentrators in home settings to portable units for ambulatory use. The National Heart, Lung, and Blood Institute underscores the severity of respiratory diseases as a leading cause of mortality and morbidity, further emphasizing the critical need for these medical devices.

Demographic shifts heavily favor market growth, with the U.S. Census Bureau projecting a significant increase in the population aged 65 and older, a cohort disproportionately affected by conditions like COPD, pneumonia, and congestive heart failure. This aging population structure ensures a sustained demand for oxygen therapy.

Furthermore, reimbursement policies from the Centers for Medicare & Medicaid Services (CMS) play a pivotal role in shaping the market landscape, influencing the types of equipment prescribed and the adoption of new technologies by setting coverage criteria and payment rates, thereby directly impacting patient access and manufacturer innovation.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Europe Oxygen Therapy Equipment Market

The Europe Oxygen Therapy Equipment Market is estimated to be valued at USD 5.6 billion in 2025 and is further anticipated to reach USD 10.3 billion by 2034 at a CAGR of 7.0%.

The European market for oxygen therapy equipment is characterized by advanced healthcare systems and a growing emphasis on home-based care. A significant demographic advantage is the region's rapidly aging population. Data from Eurostat, the statistical office of the European Union, confirms that Europe has one of the highest shares of people aged 80 and over globally, a demographic segment with a high incidence of chronic respiratory and cardiovascular diseases that necessitate long-term oxygen therapy. This demographic reality is a fundamental driver for the consistent demand for both stationary and portable oxygen solutions across member states.

Government and public health bodies are actively shaping the market environment. The European Respiratory Society highlights the substantial burden of diseases like COPD, which affects over 200 million people worldwide, with Europe accounting for a significant portion. National health services, such as the NHS in the United Kingdom, have established clear guidelines for domiciliary oxygen therapy, which standardizes care and drives equipment adoption. Furthermore, initiatives by the World Health Organization's Regional Office for Europe to combat non-communicable diseases and promote healthy aging indirectly support the market by raising awareness and improving diagnostic rates for conditions that require oxygen therapy as a primary intervention.

The Japan Oxygen Therapy Equipment Market

The Japan Oxygen Therapy Equipment Market is projected to be valued at USD 2.2 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 4.1 billion in 2034 at a CAGR of 7.1%.

Japan's oxygen therapy equipment market is uniquely driven by the world's most pronounced super-aged society. Official statistics from the Ministry of Health, Labour and Welfare (MHLW) consistently show that Japan has the highest proportion of citizens aged 65 and over globally. This demographic structure creates a vast and growing patient population for age-related respiratory ailments such as COPD and pulmonary fibrosis, ensuring a robust and stable demand for oxygen therapy products. The government's focus on extending healthy life expectancy further reinforces the need for effective chronic disease management tools like oxygen concentrators.

The Japanese government, through its policies, actively influences the medical device landscape. The MHLW's approval processes and national health insurance (NHI) reimbursement schedules are critical factors for market access and patient affordability. The widespread integration of home healthcare, supported by government initiatives to reduce long-term hospitalization costs, has made home oxygen therapy a standard treatment modality. This is complemented by a sophisticated healthcare infrastructure and high health literacy among the population, facilitating the adoption of advanced portable oxygen concentrators that enable elderly patients to maintain active and mobile lifestyles, thereby improving their overall quality of life.

Global Oxygen Therapy Equipment Market: Key Takeaways

- Global Market Size Insights: The Global Oxygen Therapy Equipment Market size is estimated to have a value of USD 37.6 billion in 2025 and is expected to reach USD 70.7 billion by the end of 2034.

- The Global Market Growth Rate: The market is growing at a CAGR of 7.3% over the forecasted period of 2025.

- The US Market Size Insights: The US Oxygen Therapy Equipment Market is projected to be valued at USD 11.5 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 20.9 billion in 2034 at a CAGR of 6.9%.

- Regional Insights: North America is expected to have the largest market share in the Global Oxygen Therapy Equipment Market with a share of about 36.3% in 2025.

- Key Players: Some of the major key players in the Global Oxygen Therapy Equipment Market are Philips Healthcare, ResMed Inc., Fisher & Paykel Healthcare, Medtronic plc, Chart Industries (CAIRE), Invacare Corporation, Drive DeVilbiss Healthcare, GE Healthcare, Teijin Limited, and many others.

Global Oxygen Therapy Equipment Market: Use Cases

- Post-COVID Pulmonary Rehabilitation: Patients recovering from severe COVID-19 with lasting lung damage use portable oxygen concentrators at home to support their breathing during physical therapy and daily activities, aiding in functional recovery and improving exercise tolerance.

- COPD Management in Homecare: An elderly individual with advanced Chronic Obstructive Pulmonary Disease relies on a stationary oxygen concentrator for continuous overnight therapy and a lightweight portable unit for trips outside, managing symptoms and preventing hospitalization.

- Emergency Relief Operations: During natural disasters or in remote field hospitals, deployable oxygen concentrators and cylinders provide critical respiratory support for patients with pneumonia, asthma attacks, or trauma when centralized oxygen supplies are unavailable.

- Neonatal and Pediatric Care: In hospital settings, specialized low-flow oxygen delivery systems, such as CPAP machines and pediatric nasal cannulas, are used to treat premature infants and children with respiratory distress syndrome or congenital heart conditions.

- High-Altitude Activities and Travel: Mountain climbers and individuals with mild respiratory conditions traveling to high-altitude destinations use compact, pulse-dose portable concentrators to prevent altitude sickness and alleviate hypoxia symptoms.

Global Oxygen Therapy Equipment Market: Stats & Facts

Centers for Disease Control and Prevention (CDC)

- Chronic Obstructive Pulmonary Disease (COPD) affects approximately 16 million Americans.

- In 2020, COPD was the fourth leading cause of death among Americans aged 65 and over.

- Asthma affects over 25 million people in the United States, including 5 million children.

World Health Organization (WHO)

- Chronic Obstructive Pulmonary Disease (COPD) is the third leading cause of death worldwide.

- It is estimated that over 200 million people globally live with COPD.

- Over 3 million people die from COPD each year, accounting for nearly 6% of all deaths globally.

- An estimated 262 million people worldwide are affected by asthma.

National Heart, Lung, and Blood Institute (NHLBI)

- Over 16 million Americans have been diagnosed with COPD.

- Millions more are believed to have COPD but remain undiagnosed.

- In the United States, COPD is a leading cause of disability.

Eurostat

- Over 20% of the European Union's population was aged 65 and over in 2020.

- The share of people aged 80 years or over in the EU is projected to more than double by 2100.

Statistics Bureau of Japan

- As of 2023, the population aged 65 and over in Japan accounts for over 29% of the total population, the highest rate in the world.

American Lung Association

- Nearly 15 million adults in the U.S. have been diagnosed with COPD.

- Lung disease is a leading cause of death for infants in the United States.

Environmental Protection Agency (EPA)

- Exposure to air pollutants like ozone and particulate matter is linked to the development and worsening of COPD and asthma.

National Institutes of Health (NIH)

- Research funded by the NIH indicates that long-term oxygen therapy can improve survival in patients with severe COPD and resting hypoxemia.

Global Oxygen Therapy Equipment Market: Market Dynamic

Driving Factors in the Global Oxygen Therapy Equipment Market

Rising Geriatric Population and Chronic Respiratory Disease Burden

The single most powerful driver for the oxygen therapy equipment market is the demographic inevitability of a growing global elderly population. This cohort is disproportionately affected by chronic, progressive respiratory conditions like Chronic Obstructive Pulmonary Disease (COPD) and interstitial lung disease, for which supplemental oxygen is a cornerstone of standard medical management. As life expectancy increases worldwide, the prevalence of these age-related ailments rises in lockstep, creating a large and sustained patient base that requires long-term oxygen therapy. This demographic shift ensures a consistent and expanding demand for both stationary and portable oxygen delivery systems, securing the market's foundational growth.

Heightened Global Focus on Respiratory Health Post-Pandemic

The COVID-19 pandemic served as a stark, global reminder of the critical importance of respiratory health and robust medical infrastructure. It led to a massive, acute shortage of oxygen therapy equipment, exposing vulnerabilities in supply chains and highlighting its life-saving role. This experience has driven governments and healthcare systems worldwide to invest heavily in strengthening their oxygen production and distribution capabilities. Furthermore, it has increased public and clinical awareness of respiratory diseases, leading to higher diagnosis rates for conditions like COPD and a greater acceptance of home-based oxygen therapy as a viable and effective long-term treatment strategy.

Restraints in the Global Oxygen Therapy Equipment Market

Stringent Regulatory Hurdles and Reimbursement Challenges

The oxygen therapy equipment market is heavily regulated, with devices requiring approvals from bodies like the FDA in the U.S. and the CE mark in Europe. These processes are often lengthy, complex, and costly, potentially delaying the launch of innovative products and increasing development expenses for manufacturers. Compounding this issue are inconsistent and often restrictive reimbursement policies. In many regions, insurance coverage may not fully encompass the latest portable technologies, placing a significant financial burden on patients and acting as a major deterrent to the adoption of advanced, mobility-enhancing equipment.

High Product Costs and Limited Awareness in Developing Regions

The significant upfront cost of advanced oxygen therapy equipment, particularly portable oxygen concentrators, remains a formidable barrier to widespread adoption. This is especially acute in price-sensitive emerging markets and for underinsured populations in developed nations. Furthermore, in many developing countries, there is a critical lack of awareness among both the public and primary healthcare providers about the benefits and availability of modern oxygen therapy, leading to under-diagnosis and suboptimal management of chronic respiratory conditions, which severely limits market potential and patient access to life-improving care.

Opportunities in the Global Oxygen Therapy Equipment Market

Expansion into Emerging Economies with Improving Healthcare Access

There exists a substantial, untapped growth frontier in emerging markets across Asia, Latin America, and Africa. In these regions, rising disposable incomes, rapid urbanization, and significant government investments in healthcare infrastructure are converging to improve access to medical care. As diagnostic capabilities for chronic respiratory diseases improve in these countries, a vast patient population that was previously undiagnosed or untreated is being identified. This creates a massive opportunity for market penetration of basic and eventually more advanced oxygen therapy equipment, representing the next major wave of growth for global manufacturers.

Technological Innovation in Lightweight and Energy-Efficient Designs

Continuous product innovation presents a significant opportunity to capture value and expand the addressable market. The development of next-generation portable oxygen concentrators that are exceptionally lightweight, have extended battery life, and are more energy-efficient can dramatically improve patient adherence and quality of life. Such advancements not only cater to existing users seeking upgrades but also make oxygen therapy a more feasible option for a broader segment of patients with milder impairments or active lifestyles, thereby expanding the user base beyond the most severe cases and driving market growth through technological superiority.

Trends in the Global Oxygen Therapy Equipment Market

Proliferation of Portable and Smart Oxygen Concentrators

The market is witnessing a decisive shift away from bulky, stationary systems towards lightweight, portable oxygen concentrators (POCs) that offer patients greater autonomy. These next-generation devices are not only more compact and efficient but are increasingly integrated with digital health technologies.

They feature Bluetooth connectivity and companion mobile applications, enabling remote monitoring of patient usage patterns, oxygen saturation levels, and device functionality. This data-driven trend allows healthcare providers to personalize treatment plans, improve patient compliance, and intervene proactively, thereby enhancing the overall quality of care and transitioning oxygen therapy from a passive treatment to an active, managed health solution.

Convergence of Home Healthcare and Telemedicine

A powerful and enduring trend is the fusion of oxygen therapy with the expanding home healthcare and telemedicine ecosystems. Driven by cost-containment pressures and patient preference for receiving care at home, there is a growing institutional push to manage chronic respiratory conditions outside traditional hospital settings. Oxygen therapy equipment is a cornerstone of this model. Telehealth platforms facilitate virtual consultations where clinicians can assess a patient's need for and adjustment of oxygen therapy, while connected devices provide the vital data stream needed for informed decision-making, creating a seamless, efficient, and patient-centric care continuum.

Global Oxygen Therapy Equipment Market: Research Scope and Analysis

By Product Analysis

Oxygen Source Equipment is projecyed to dominates the product segment. Oxygen source equipment includes devices like oxygen concentrators, liquid oxygen systems, and cylinders. These devices are essential for providing a continuous and reliable supply of oxygen to patients with chronic or acute respiratory conditions. Among these, oxygen concentrators are particularly dominant due to their efficiency, cost-effectiveness, and ease of use in both home and clinical settings. Companies like Philips Healthcare, ResMed, and Invacare lead this segment by offering high-performance, durable, and user-friendly concentrators. Concentrators do not require frequent cylinder refills, making them ideal for long-term oxygen therapy.

Additionally, technological advancements such as portable concentrators with adjustable flow rates and battery backups have enhanced patient mobility and compliance. While oxygen delivery devices (like masks and nasal cannulas) are critical for actual oxygen administration, they are considered secondary equipment and are typically paired with concentrators or cylinders.

The preference for oxygen source equipment is driven by rising prevalence of chronic respiratory diseases such as COPD, increased aging populations, and growing adoption of home care solutions. In hospitals, liquid oxygen systems are preferred for high-flow requirements, but concentrators dominate overall market volume due to their affordability, portability options, and long-term operational cost savings. This dominance is reinforced by reimbursement support in many regions, further facilitating adoption in both developed and emerging markets.

By Portability Analysis

Stationary (fixed) devices is anticipated to dominate the portability segment. These devices are primarily used in hospitals, clinics, and long-term care facilities, providing high-flow, uninterrupted oxygen supply. Stationary oxygen concentrators and liquid oxygen systems are preferred because they can deliver large volumes of oxygen consistently, which portable units often cannot match. They are ideal for patients with severe respiratory conditions requiring continuous therapy, such as advanced COPD or respiratory distress syndrome.

Companies like Chart Industries, Linde plc, and Drive DeVilbiss Healthcare lead the stationary devices market due to their robust, high-capacity solutions. Hospitals benefit from stationary units as they reduce the need for frequent refills and maintenance compared to cylinders, ensuring operational efficiency and patient safety. While portable devices are gaining traction in home care and ambulatory settings, stationary systems still dominate overall due to higher adoption in institutional environments.

Moreover, stationary devices often integrate advanced monitoring systems and safety features that are essential in clinical settings. The trend of hospital expansion and increasing ICU capacities globally also contributes to stationary devices maintaining a dominant position in this segment. Additionally, in emerging markets, stationary units remain preferred for institutional oxygen delivery due to their reliability and the availability of continuous power supply in hospital infrastructure.

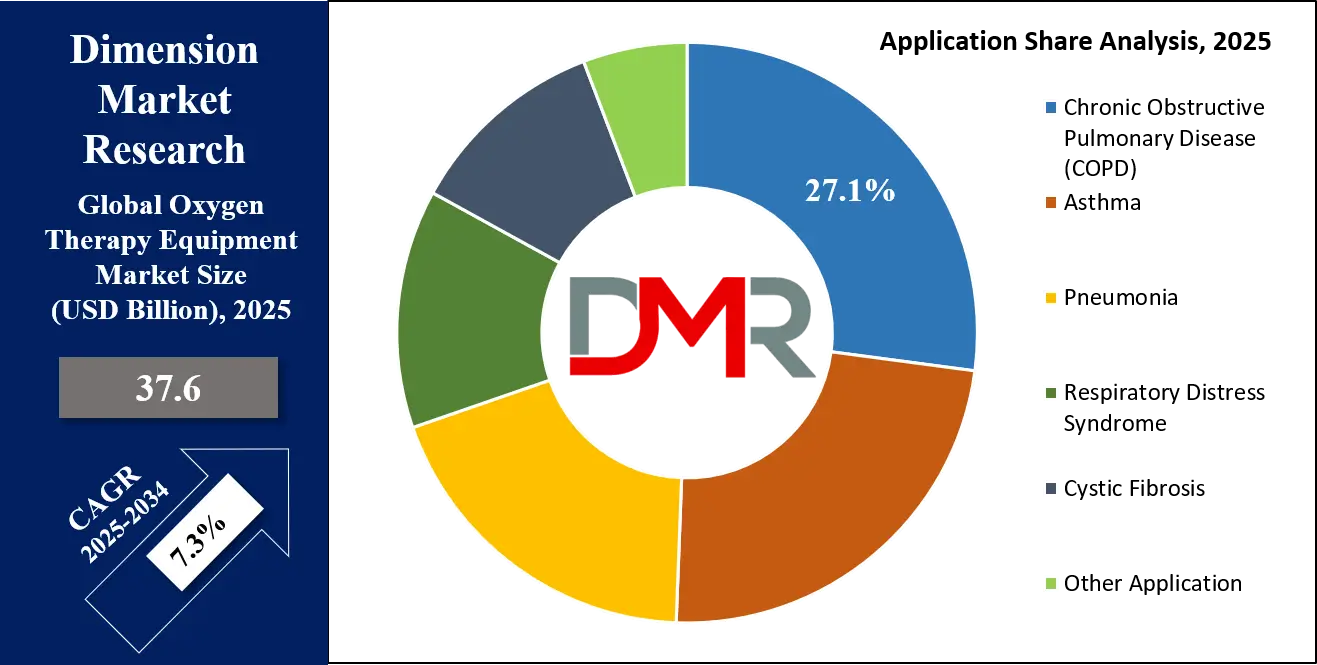

By Application Analysis

Chronic Obstructive Pulmonary Disease (COPD) is poised to dominates the application segment. COPD is a highly prevalent respiratory condition worldwide, characterized by airflow obstruction and persistent breathing difficulties, leading to chronic oxygen deficiency in patients. Oxygen therapy is critical for managing COPD, improving survival rates, reducing hospitalizations, and enhancing quality of life. This high demand makes COPD the primary driver of the oxygen therapy equipment market.

Leading companies like ResMed, Philips Healthcare, and Invacare focus on devices designed specifically for long-term oxygen therapy in COPD patients, including home-use concentrators and portable oxygen systems. The dominance of COPD in the application segment is further reinforced by the aging global population, rising smoking rates in some regions, and increasing awareness of respiratory health management. While other conditions like asthma, pneumonia, and cystic fibrosis also require oxygen therapy, their patient population is comparatively smaller or requires short-term oxygen use.

COPD’s chronic nature creates consistent, long-term demand for both oxygen source equipment and delivery devices, ensuring high adoption across hospitals, clinics, and home care settings. Additionally, government programs, insurance reimbursements, and clinical guidelines globally strongly recommend oxygen therapy for COPD patients with hypoxemia, further cementing its leading position in market application.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By End User Analysis

Hospitals & Clinics is expected to dominate the end-user segment. These facilities represent the primary point of care for patients with acute and chronic respiratory conditions, including COPD, pneumonia, and respiratory distress syndrome. Hospitals require high-capacity oxygen delivery systems, such as stationary concentrators, liquid oxygen systems, and high-flow nasal cannula devices, to support critical care units, emergency departments, and general wards.

Leading companies like Philips Healthcare, GE Healthcare, and Chart Industries provide customized solutions for hospital setups, offering reliability, scalability, and integration with monitoring systems. The dominance of hospitals & clinics is driven by several factors: first, the complexity of patient cases often necessitates continuous and high-volume oxygen delivery, which home-care or ambulatory devices cannot always provide. Second, hospitals are equipped with trained staff capable of handling complex equipment, which encourages adoption of advanced oxygen therapy technologies.

While home care is growing due to portable devices and aging populations, hospitals continue to account for the largest revenue share because of high equipment volumes, recurring maintenance contracts, and preference for fixed, robust systems. Moreover, government regulations and accreditation standards in healthcare emphasize maintaining reliable oxygen supply infrastructure, reinforcing hospitals and clinics as the primary end-user segment dominating the global market.

The Global Oxygen Therapy Equipment Market Report is segmented on the basis of the following:

By Product

- Oxygen Source Equipment

- Oxygen Concentrators

- Oxygen Cylinders

- Liquid Oxygen Devices

- Oxygen Delivery Devices

- Masks

- Nasal Cannulas

- Venturi Masks

- Non-Rebreather Masks

- Bag-Valve Masks

By Portability

- Stationary (fixed) Devices

- Portable

By Application

- Chronic Obstructive Pulmonary Disease (COPD)

- Asthma

- Pneumonia

- Respiratory Distress Syndrome

- Cystic Fibrosis

- Other Application

By End User

- Hospitals & Clinics

- Home Care Settings

- Ambulatory Surgical Centers / Physician Offices

- Other End User

Impact of Artificial Intelligence in the Global Oxygen Therapy Equipment Market

- Predictive Maintenance and Reduced Downtime: Artificial Intelligence-powered monitoring systems in oxygen concentrators and delivery devices can predict equipment malfunctions before they occur. By analyzing sensor data in real-time, AI can alert healthcare providers to potential failures, reducing unexpected downtime and ensuring continuous oxygen delivery, especially in critical care settings.

- Personalized Oxygen Therapy: AI algorithms can optimize oxygen flow rates based on patient-specific parameters such as blood oxygen levels, heart rate, activity, and medical history. This personalization ensures that patients receive the exact oxygen dosage they need, improving therapeutic outcomes, reducing over-oxygenation risks, and enhancing patient comfort in both hospital and home care environments.

- Remote Monitoring and Telehealth Integration: AI-enabled oxygen therapy devices can transmit real-time patient data to healthcare professionals via connected platforms. This allows remote monitoring, early intervention for deteriorating respiratory conditions, and integration into telehealth services.

- Enhanced Operational Efficiency for Providers: AI tools can optimize device usage patterns, inventory management, and supply chain logistics for oxygen equipment providers. Predictive analytics help in forecasting demand for concentrators, cylinders, and delivery accessories, reducing wastage, ensuring timely availability, and lowering operational expenses.

- Advanced Data Analytics for Research and Development: AI enables analysis of large datasets from patient outcomes, device performance, and environmental factors. This helps manufacturers design next-generation oxygen therapy equipment, improve device efficiency, and develop innovative solutions like smart portable concentrators, adaptive flow devices, and integrated AI-driven oxygen delivery systems.

Global Oxygen Therapy Equipment Market: Regional Analysis

Region with the Largest Revenue Share

North America, led by the United States, is projected to commands a dominant position in the global oxygen therapy equipment market with 36.3% of the market share by the end of 2025, due to a confluence of powerful factors. The region grapples with a high and well-documented prevalence of chronic respiratory diseases, with the Centers for Disease Control and Prevention (CDC) citing millions of Americans affected by COPD and asthma, creating a substantial, sustained patient base.

This is compounded by a significant geriatric demographic, a cohort highly susceptible to conditions requiring supplemental oxygen. Crucially, the region benefits from a sophisticated healthcare infrastructure with high adoption rates of advanced medical technologies and favorable reimbursement frameworks, particularly from the Centers for Medicare & Medicaid Services (CMS), which facilitates patient access to both stationary and portable devices.

High healthcare expenditure per capita allows for the adoption of premium, technologically advanced products like smart portable oxygen concentrators. Furthermore, the presence of major global manufacturers, a robust regulatory environment with the FDA, and a deeply entrenched home healthcare culture ensure that North America remains at the forefront of market revenue, driven by a cycle of innovation, accessibility, and high clinical demand.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with the Highest CAGR

The Asia Pacific region is poised to register the highest Compound Annual Growth Rate (CAGR) in the oxygen therapy equipment market, fueled by dynamic and transformative drivers. This explosive growth is primarily attributed to the rapidly expanding and aging populations in countries like Japan and China, where the sheer volume of elderly individuals significantly increases the pool of patients with chronic respiratory and cardiac ailments.

Concurrently, massive investments in healthcare infrastructure across emerging economies such as India, China, and Southeast Asian nations are dramatically improving diagnostic capabilities and access to medical care, bringing previously undiagnosed patients into the healthcare system. Rising disposable incomes enable a larger segment of the population to afford advanced medical treatments, including home-based oxygen therapy.

Governments in the region are increasingly focusing on improving healthcare access and are becoming more aware of the burden of non-communicable diseases, leading to better funding and policy support. The post-pandemic period has also led to a heightened focus on respiratory health and oxygen supply resilience. This combination of a vast unmet clinical need, economic development, and infrastructural modernization creates a fertile ground for unprecedented market expansion.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Oxygen Therapy Equipment Market: Competitive Landscape

The global oxygen therapy equipment market is characterized by a mix of well-established multinational medtech giants and specialized players, creating a moderately consolidated yet competitive environment. Key participants, including Koninklijke Philips N.V., ResMed, and Linde plc (through its GCE Healthcare division), leverage their strong brand recognition, extensive distribution networks, and robust research and development capabilities to maintain significant market share.

These industry leaders compete on technological innovation, focusing on developing quieter, more energy-efficient, and lighter portable oxygen concentrators (POCs) with enhanced battery life and smart connectivity features for remote patient monitoring. The competitive intensity is further heightened by strategic activities such as mergers and acquisitions, which allow companies to rapidly expand their product portfolios and geographic footprint.

Simultaneously, there is a notable presence of smaller, agile companies that often compete on cost or by targeting specific niche segments, such as ultra-compact POCs for active users or specialized pediatric systems. The landscape is dynamic, with competition revolving around product efficacy, patient comfort, regulatory approvals, and the ability to navigate diverse and complex reimbursement structures across different regional markets.

Some of the prominent players in the Global Oxygen Therapy Equipment Market are:

- Philips Healthcare (Philips Respironics)

- ResMed Inc.

- Fisher & Paykel Healthcare

- Medtronic plc

- Chart Industries, Inc. (CAIRE Inc.)

- Invacare Corporation

- Drive DeVilbiss Healthcare

- GE Healthcare

- Teijin Limited (Teijin Pharma)

- Linde plc

- Becton, Dickinson and Company (BD)

- Smiths Medical

- Teleflex Incorporated

- Hersill S.L.

- TECNO-GAZ S.p.A.

- Allied Healthcare Products, Inc.

- Nidek Medical Products, Inc.

- Air Liquide

- Precision Medical, Inc.

- Taiyo Nippon Sanso Corporation

- Other Key Players

Recent Developments in the Global Oxygen Therapy Equipment Market

- May 2024: Philips Respironics announced a collaboration with a major European telehealth provider to integrate its portable oxygen concentrators into a remote patient management platform for COPD.

- March 2024: ResMed launched the AirSense 11 CPAP device in new markets, featuring enhanced connectivity, which is expected to influence its adjacent oxygen therapy ecosystem.

- February 2024: Invacare Corporation announced a strategic investment in its manufacturing facility for home oxygen therapy products to increase production capacity and streamline its supply chain.

- November 2023: CAIRE Inc. (a part of NGK Spark Plugs) showcased its new FreeStyle Comfort portable oxygen concentrator at the MEDICA trade fair in Düsseldorf, emphasizing its lightweight design and extended battery performance.

- September 2023: Linde plc's GCE Healthcare division and Drive DeVilbiss Healthcare announced a partnership to co-develop next-generation flowmeter and regulator technology for hospital and homecare use.

- July 2023: Inogen, Inc. reported preliminary results from a clinical study demonstrating the clinical benefits of its portable oxygen concentrators for patients with interstitial lung disease.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 37.6 Bn |

| Forecast Value (2034) |

USD 70.7 Bn |

| CAGR (2025–2034) |

7.3% |

| The US Market Size (2025) |

USD 11.5 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product (Oxygen Source Equipment, Oxygen Delivery Devices), By Portability (Stationary (fixed) Devices, Portable), By Application (Chronic Obstructive Pulmonary Disease (COPD), Asthma, Pneumonia, Respiratory Distress Syndrome, Cystic Fibrosis, Other Applications), By End User (Hospitals & Clinics, Home Care Settings, Ambulatory Surgical Centers / Physician Offices, Other End Users) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Philips Healthcare, ResMed Inc., Fisher & Paykel Healthcare, Medtronic plc, Chart Industries (CAIRE), Invacare Corporation, Drive DeVilbiss Healthcare, GE Healthcare, Teijin Limited, Linde plc, Becton Dickinson (BD), Smiths Medical, Teleflex Incorporated, Hersill S.L., TECNO-GAZ S.p.A., Allied Healthcare Products Inc., Nidek Medical Products Inc., Air Liquide, Precision Medical Inc., and Taiyo Nippon Sanso Corporation, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Oxygen Therapy Equipment Market?

▾ The Global Oxygen Therapy Equipment Market size is estimated to have a value of USD 37.6 billion in 2025 and is expected to reach USD 70.7 billion by the end of 2034.

What is the growth rate in the Global Oxygen Therapy Equipment Market in 2025?

▾ The market is growing at a CAGR of 7.3 percent over the forecasted period of 2025.

What is the size of the US Oxygen Therapy Equipment Market?

▾ The US Oxygen Therapy Equipment Market is projected to be valued at USD 11.5 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 20.9 billion in 2034 at a CAGR of 6.9%.

Which region accounted for the largest Global Oxygen Therapy Equipment Market?

▾ North America is expected to have the largest market share in the Global Oxygen Therapy Equipment Market with a share of about 36.3% in 2025.

Who are the key players in the Global Oxygen Therapy Equipment Market?

▾ Some of the major key players in the Global Oxygen Therapy Equipment Market are Philips Healthcare, ResMed Inc., Fisher & Paykel Healthcare, Medtronic plc, Chart Industries (CAIRE), Invacare Corporation, Drive DeVilbiss Healthcare, GE Healthcare, Teijin Limited, and many others.