Market Overview

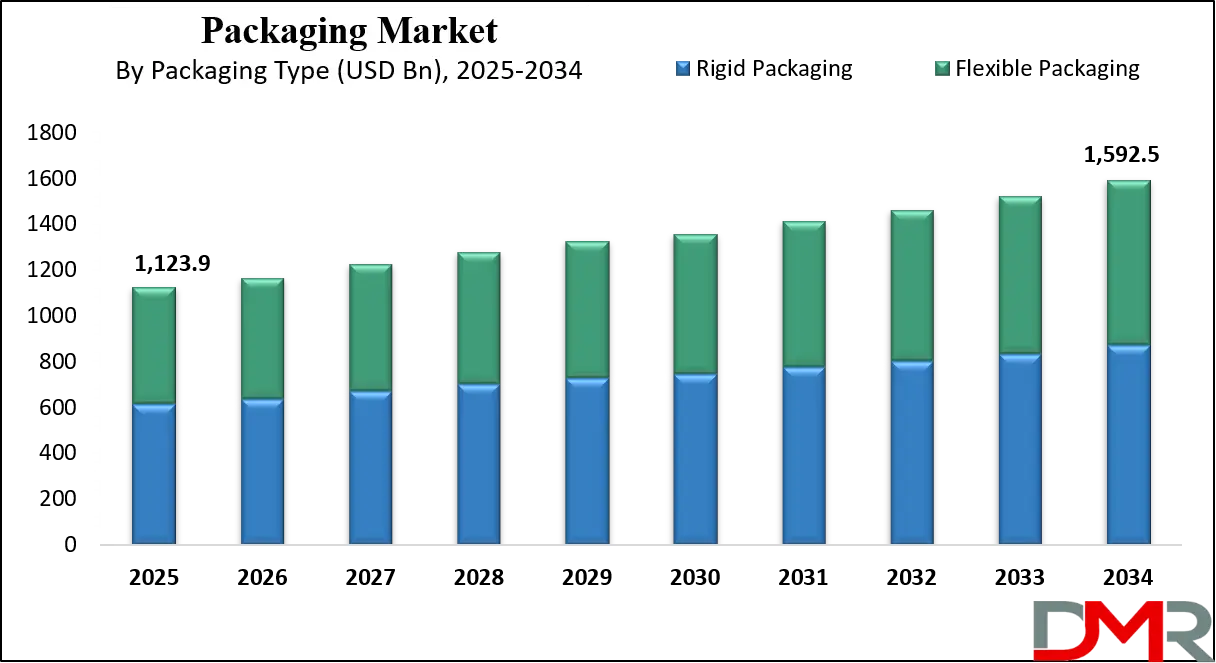

The Global Packaging Market size is projected to reach USD 1,123.9 billion in 2025 and grow at a compound annual growth rate of 3.9% from there until 2034 to reach a value of USD 1,592.5 billion

Packaging, at its core, is the art, science, and technology of enclosing or protecting products for distribution, storage, sale, and ultimate use. It's a comprehensive system that coordinates the preparation of goods, ensuring their containment, protection, preservation, and efficient transport. Beyond these practical functions, packaging serves as a critical communication tool, providing information about the product, its usage, and disposal. In the modern marketplace, packaging also acts as a powerful marketing instrument, influencing consumer purchasing decisions through its design, aesthetics, and branding. It encompasses various materials like paper, plastic, glass, and metal, each chosen based on the product's specific needs and increasingly, environmental considerations.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The packaging industry has experienced significant growth demands in recent years, propelled by several key factors. The booming e-commerce sector has created an immense need for robust and efficient packaging solutions that can withstand the rigors of shipping and delivery. Furthermore, rising disposable incomes and increasing urbanization have led to a greater demand for packaged and processed goods across various sectors, particularly food and beverage, pharmaceuticals, and personal care.

This growth is also influenced by government initiatives promoting organized retail and ensuring product safety. While plastic has traditionally dominated the market due to its versatility and affordability, there's a noticeable shift towards paper-based and other sustainable alternatives, driven by evolving consumer preferences and stricter environmental regulations.

Current trends in packaging are largely centered around sustainability, technological integration, and enhanced consumer experience. Sustainable packaging is no longer just a niche interest but a mainstream demand, with a strong focus on reducing single-use plastics and embracing materials that are recyclable, reusable, or biodegradable. This involves innovations in plant-based plastics, barrier papers, and minimalist designs that reduce material usage.

Automation, driven by AI and robotics, is streamlining packaging processes, improving efficiency, and reducing errors. Smart packaging, incorporating technologies like QR codes and RFID, offers improved product tracking, authenticity verification, and interactive consumer engagement, providing real-time information about a product's journey and attributes.

Recent years have seen a surge in packaging-related events and trade fairs, reflecting the industry's dynamic nature and its focus on innovation. Major exhibitions like Interpack, Pack Expo, and All4Pack serve as crucial platforms for showcasing the latest developments in machinery, materials, and design. These events highlight emerging trends such as sustainable production methods, digitalization of packaging processes, and the increasing adoption of smart packaging solutions.

They also facilitate networking and knowledge transfer among industry leaders, fostering collaboration and driving the development of new technologies and materials. These gatherings emphasize the collective effort towards addressing environmental challenges and meeting evolving consumer expectations.

A significant insight from the packaging industry in recent years is the paramount importance of sustainability and transparency. Consumers are increasingly concerned about the environmental impact of packaging, leading to a strong preference for eco-friendly options and a willingness to pay more for them. This has compelled brands to rethink their packaging strategies, investing in research and development for new sustainable materials and processes.

Another crucial insight is the power of technology to transform packaging, from automated production lines to connected packaging that enhances consumer interaction and supply chain efficiency. The industry is navigating the challenge of balancing product protection and convenience with environmental responsibility, pushing for a more circular economy where packaging materials are reused and recycled effectively.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The shift in consumer behavior, driven by environmental consciousness, is a defining insight. There's a clear trend of consumers avoiding over-packaged products and actively seeking out items with reduced or minimal packaging. This has led to a growing demand for simpler, more efficient designs that use fewer materials. Furthermore, consumers are scrutinizing recycling information on labels, highlighting the need for clear and accurate communication about disposal.

The industry recognizes that sustainable packaging is not just a regulatory requirement but a powerful tool for brand perception and market positioning. Companies that proactively embrace sustainable practices, innovate with new materials, and educate consumers about their efforts are gaining a competitive advantage and building stronger customer loyalty.

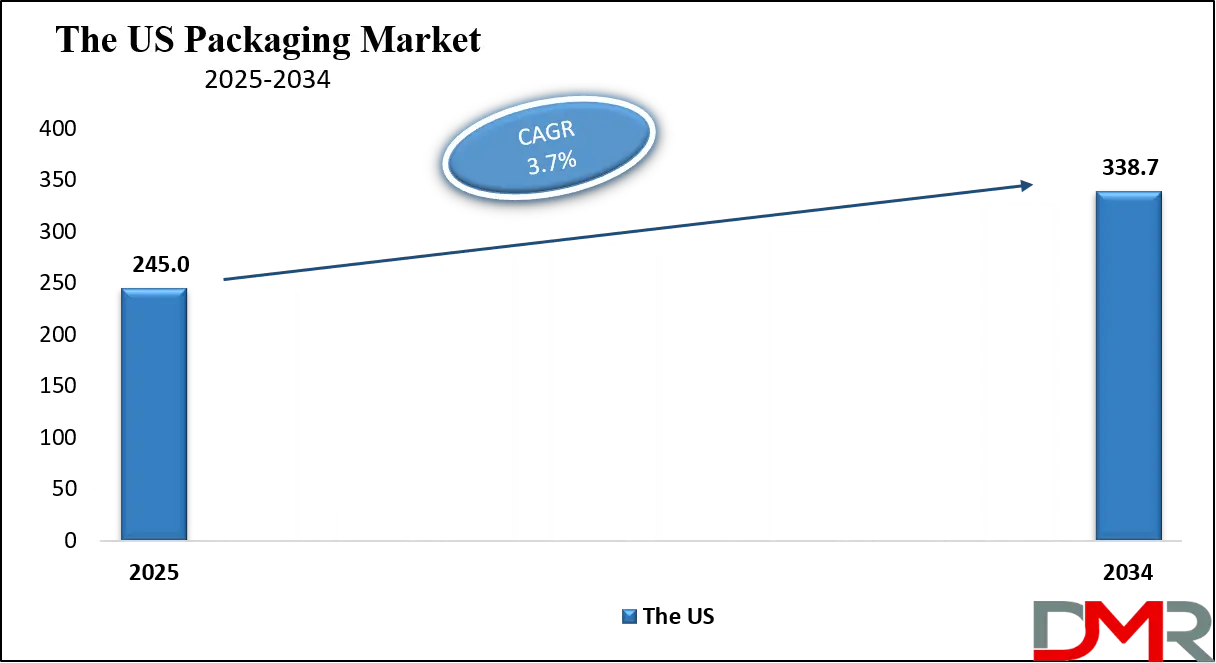

The US Packaging Market

The US Packaging Market size is projected to reach USD 245.0 billion in 2025 at a compound annual growth rate of 3.7% over its forecast period

The US holds a significant role in the global packaging market, being a major consumer and innovator. Its large and diverse economy drives substantial demand across various sectors like food and beverages, Pharmaceutical Packaging, and e-commerce. The US is a hub for technological advancements in packaging, leading the development of smart packaging, automation, and advanced materials.

Furthermore, evolving consumer preferences and increasing environmental consciousness within the US strongly influence global trends, particularly regarding sustainability. US companies are at the forefront of developing recyclable, compostable, and reusable packaging solutions, often pushing for industry-wide adoption of circular economy principles. This dynamic interplay of demand, innovation, and sustainability initiatives solidifies the US's impactful position in the global packaging landscape.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Packaging Market

Europe Packaging Market size is projected to reach USD 258.5 billion in 2025 at a compound annual growth rate of 4.1% over its forecast period.

Europe plays a pivotal and often pioneering role in the global packaging market, largely driven by its ambitious environmental agenda. The region is at the forefront of implementing stringent regulations, such as the new EU Packaging and Packaging Waste Regulation (PPWR), which mandates higher recycling rates, minimum recycled content targets, and increased reusability.

This legislative push compels packaging manufacturers and brands across Europe to innovate rapidly, leading to significant advancements in sustainable materials like advanced paper-based solutions, bioplastics, and reusable systems. European consumers are also highly conscious of environmental impact, further accelerating the demand for eco-friendly packaging. This strong focus on circularity and sustainability positions Europe as a key influencer in shaping global packaging trends and setting new benchmarks for responsible production and consumption.

Japan Packaging Market

Japan Packaging Market size is projected to reach USD 56.2 billion in 2025 at a compound annual growth rate of 4.9% over its forecast period.

Japan holds a distinctive and influential role in the global packaging market, characterized by its emphasis on precision, aesthetics, and increasingly, sustainability. Japanese packaging is renowned for its high quality, meticulous attention to detail, and user-friendliness, often featuring innovative designs for convenience and portion control. While traditionally known for extensive, often multi-layered, plastic packaging to ensure product integrity and presentability, there's a strong and growing push towards eco-friendly alternatives.

Japan is actively investing in research and development for advanced recycling technologies, bioplastics, and paper-based solutions. Regulations are becoming stricter, driving companies to adopt circular economy principles. This commitment to balancing functional excellence with environmental responsibility, combined with a highly discerning consumer base that values both product safety and aesthetic appeal, positions Japan as a key innovator and a significant contributor to the global evolution of sustainable and high-performance packaging.

Packaging Market: Key Takeaways

- Market Growth: The Packaging Market size is expected to grow by USD 428.9 billion, at a CAGR of 3.9%, during the forecasted period of 2026 to 2034.

- By Packaging Type: The rigid packaging segment is anticipated to get the majority share of the Packaging Market in 2025.

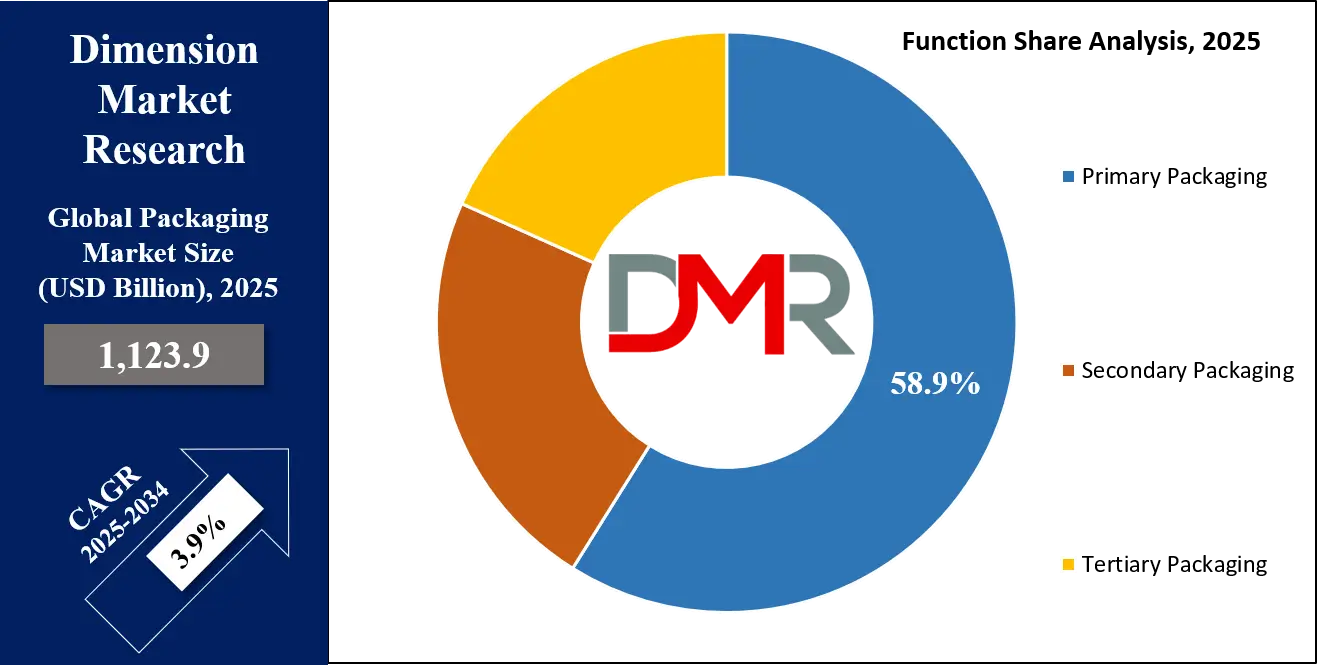

- By Function: The primary packaging segment is expected to get the largest revenue share in 2025 in the Packaging Market.

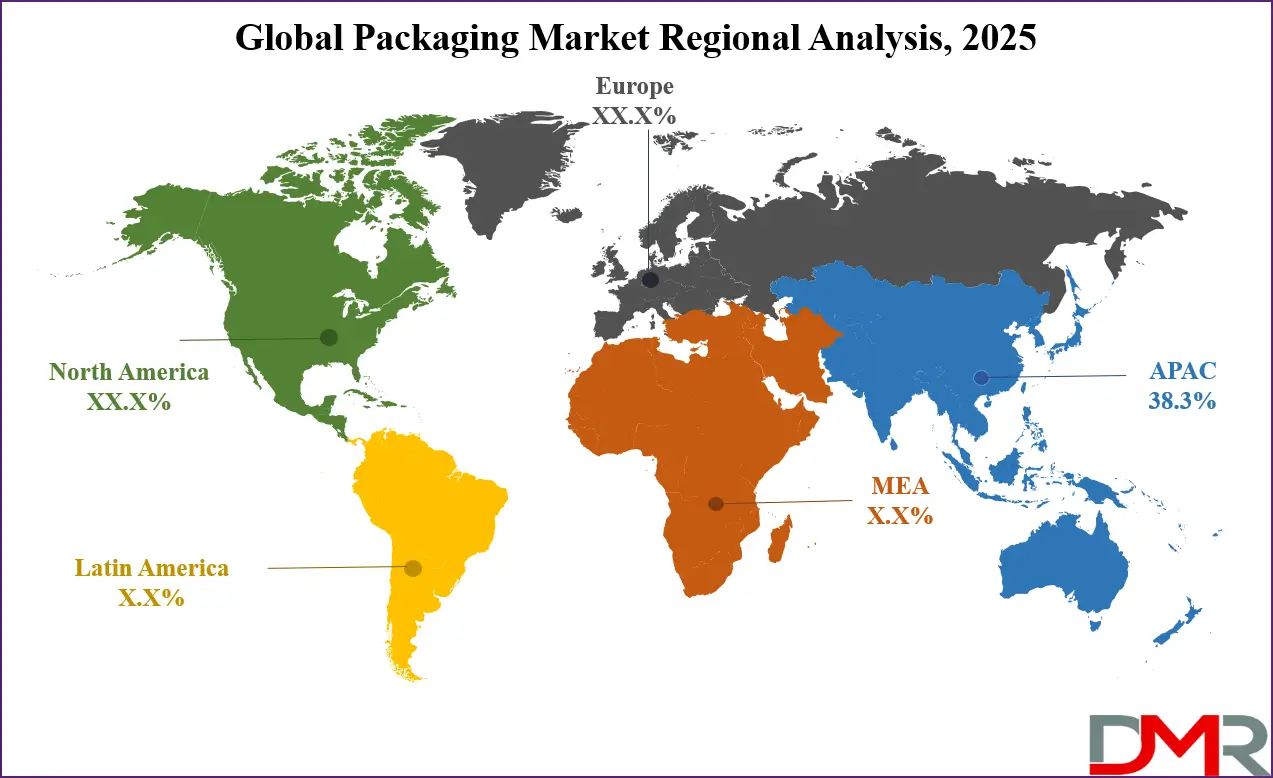

- Regional Insight: Asia Pacific is expected to hold a 38.3% share of revenue in the Global Packaging Market in 2025.

- Use Cases: Some of the use cases of Packaging include protection & preservation, marketing & branding and more.

Packaging Market: Use Cases

- Protection and Preservation: Packaging serves as the primary shield for products against physical damage, environmental factors like moisture and light, and contamination during transit and storage. This is crucial for delicate items, food products to extend shelf life, and pharmaceuticals requiring sterile conditions. Effective packaging ensures the product reaches the consumer in its intended state, maintaining quality and safety.

- Information and Communication: Packaging acts as a vital medium for conveying essential product information to consumers. This includes ingredients, nutritional facts, usage instructions, safety warnings, and branding elements. Clear and concise labeling not only fulfills regulatory requirements but also empowers consumers to make informed purchasing decisions and use the product correctly.

- Marketing and Branding: Beyond its functional role, packaging is a powerful marketing tool that differentiates products on crowded shelves. Attractive design, unique shapes, and vibrant graphics can capture consumer attention and communicate brand identity and values. Packaging can evoke emotions, tell a story, and ultimately influence buying behavior, making it a critical component of a product's overall marketing strategy.

- Convenience and Usability: Modern packaging is designed with consumer convenience in mind, offering features that enhance the product experience. This includes easy-open closures, reclosable options for extended freshness, portion control packaging, and ergonomic designs for comfortable handling. Convenient packaging adds value to the product, making it more user-friendly and appealing in daily life.

Stats & Facts

- Pressure-sensitive labels made up over 75% of the global labels market in 2023, showcasing their widespread adoption and versatility across various sectors, as stated by Meyers.

- Consumer preferences are strongly influencing market dynamics, leading to sustainable products experiencing 2.7 times faster growth compared to traditional goods, a compelling finding from Meyers.

- Globally, a significant portion of consumers, specifically 69%, perceive compostable and plant-based packaging as the most sustainable option available, indicating a clear preference for environmentally conscious materials, as reported by Meyers.

- About 50% of consumers in the US are willing to pay a higher price for products that feature sustainable packaging, highlighting a growing market segment driven by environmental awareness, according to Meyers.

- A majority of corporate sustainability commitments, around 60%, are focused on achieving full packaging recyclability and increasing the use of recycled content, demonstrating a strong industry-wide push towards circular economy principles, as detailed by Meyers.

- Product packaging design holds considerable sway over purchasing decisions, with 72% of American consumers acknowledging its influence, emphasizing the importance of visual appeal and consumer engagement, Meyers found.

- Transparency in branding, particularly through clear and accurate product labeling, significantly enhances consumer trust and loyalty, with 94% of consumers more likely to remain loyal to such brands, as indicated by Meyers.

- CSIR-NIIST notes that the Council of Scientific and Industrial Research (CSIR) has launched the National Mission on Sustainable Packaging Solutions, a strategic initiative aimed at achieving a net-zero future through innovation.

- This mission, led by CSIR-NIIST, is specifically concentrating on developing advanced sustainable materials, improving recycling methodologies, and establishing state-of-the-art testing facilities to boost India's packaging sector and address environmental challenges.

- The emphasis on eco-friendly options is not just theoretical; consumer preference has resulted in sustainable products growing 2.7 times faster than conventional goods, a trend observed by Meyers.

- A notable trend reveals that approximately 50% of US consumers are prepared to invest more in products that come with sustainable packaging, reflecting a conscious shift in purchasing behavior, according to Meyers.

- Industry-wide, around 60% of sustainability pledges prioritize ensuring packaging is fully recyclable and contains a greater proportion of recycled content, underscoring a collective commitment to environmental responsibility, as highlighted by Meyers.

Market Dynamic

Driving Factors in the Packaging Market

The E-commerce Boom

The explosive growth of e-commerce has fundamentally reshaped the packaging landscape, serving as a significant growth driver. With an increasing number of consumers opting for online shopping, there's an escalating demand for packaging that can endure the rigors of shipping, handling, and multiple touchpoints in the supply chain. This translates to a need for durable, protective, and often lightweight packaging solutions to minimize shipping costs and product damage. Furthermore, the "unboxing experience" has become a crucial element of online retail, pushing brands to invest in aesthetically pleasing and customizable packaging that reinforces brand identity and enhances customer satisfaction, ultimately driving innovation in design and materials.

Sustainability and Shifting Consumer Preferences

A powerful growth driver for the packaging market is the pervasive trend towards sustainability and the evolving preferences of environmentally conscious consumers. There is an undeniable shift away from traditional, single-use plastics towards more eco-friendly alternatives such as recyclable, compostable, and biodegradable materials.

This demand is not only consumer-driven but also propelled by increasingly stringent environmental regulations and corporate sustainability goals. Packaging manufacturers are therefore investing heavily in research and development to create innovative green solutions, including plant-based plastics, paper-based barriers, and designs that minimize material usage, ultimately shaping the future trajectory of the industry.

Restraints in the Packaging Market

Volatile Raw Material Prices

One significant restraint on the packaging market's growth is the volatility of raw material prices. The industry relies heavily on commodities like crude oil (for plastics), wood pulp (for paper and cardboard), and various metals. Fluctuations in the global supply and demand of these materials, often influenced by geopolitical events, economic shifts, or natural disasters, can lead to unpredictable and sharp increases in production costs for packaging manufacturers.

These cost spikes can erode profit margins, especially for companies with long-term contracts, and force them to pass on higher prices to consumers, potentially impacting demand for packaged goods. This inherent instability makes long-term planning and investment challenging for businesses across the packaging value chain.

Stringent Environmental Regulations and Public Scrutiny

The packaging market faces a considerable restraint from increasingly stringent environmental regulations and heightened public scrutiny regarding packaging waste. Governments worldwide are implementing policies aimed at reducing plastic pollution, promoting recycling, and encouraging the use of sustainable materials. This includes bans on single-use plastics, extended producer responsibility schemes, and mandates for recycled content. While these regulations are vital for environmental protection, they often require significant investment in new machinery, materials, and processes from packaging companies.

Furthermore, growing public awareness and negative perception surrounding excessive or non-recyclable packaging can lead to consumer boycotts and damage brand reputation, forcing companies to undertake costly overhauls of their packaging strategies to meet evolving societal expectations.

Opportunities in the Packaging Market

Advancements in Smart and Connected Packaging

The integration of smart technologies into packaging presents a significant growth opportunity. This involves embedding sensors, QR codes, RFID tags, and NFC chips that allow for enhanced traceability throughout the supply chain, combating counterfeiting, and providing real-time data on product conditions like temperature and humidity.

For consumers, this translates to interactive experiences, allowing them to access detailed product information, verify authenticity, and even engage with augmented reality features. As consumers demand greater transparency and brands seek more efficient logistics and marketing tools, the development and adoption of smart packaging solutions will continue to expand, offering new avenues for value creation and differentiation in the market.

Expansion into Emerging Markets and Specialized Applications

The burgeoning economies in developing regions, coupled with the increasing demand for packaged goods in specialized sectors, offer substantial growth opportunities. Rapid urbanization, rising disposable incomes, and the growth of organized retail in countries across Asia, Africa, and Latin America are driving the consumption of packaged food, beverages, pharmaceuticals, and personal care products.

Beyond geographical expansion, there's a growing need for highly specialized packaging solutions for niche markets such as medical devices, Medical Packaging Films, active and functional foods, and cannabis products. These segments often require stringent regulatory compliance, advanced barrier properties, and innovative designs, pushing the boundaries of packaging technology and opening up new, high-value revenue streams for manufacturers.

Trends in the Packaging Market

Circular Economy Principles and Reusability

A significant recent trend in the packaging market is the accelerating adoption of circular economy principles, moving beyond mere recyclability to emphasize reusability. This involves designing packaging that can be refilled, returned, or repurposed multiple times, drastically reducing waste and resource consumption.

Brands are experimenting with subscription models for refillable containers, return schemes for glass bottles, and standardized reusable packaging systems, particularly in the B2B sector. This trend is driven by stricter regulations, such as those seen in the EU aiming for higher reusability targets, and a growing consumer desire to minimize their environmental footprint, pushing the industry to rethink the entire lifecycle of packaging materials.

Digitalization and Personalization

The packaging industry is experiencing a rapid transformation driven by digitalization, leading to increased personalization and enhanced consumer engagement. Advances in digital printing technology allow for cost-effective customization of packaging, enabling brands to create limited-edition designs, personalized messages, and even individualize packaging for direct-to-consumer sales.

Beyond aesthetics, digital technologies like QR codes, NFC tags, and augmented reality (AR) are being integrated into packaging to provide consumers with rich, interactive content, product traceability information, and even real-time freshness indicators. This trend leverages technology to build stronger brand connections, offer greater transparency, and cater to the modern consumer's demand for unique and informative experiences.

Research Scope and Analysis

By Packaging Type Analysis

Rigid packaging, encompassing materials like glass, hard plastics, metals, and rigid paperboard, is set to remain a dominant force in the packaging market, projected to command a substantial share of around 54.8% in 2025. This segment's enduring prominence stems from its superior protective qualities, offering excellent product integrity, barrier properties, and extended shelf life, especially for delicate or perishable goods such as beverages, dairy, and pharmaceuticals.

The ability of rigid packaging to provide structural support, resist external forces, and offer a premium aesthetic appeal also contributes to its sustained demand. Furthermore, innovations in recyclable and recycled content within rigid formats, alongside ongoing advancements in material science, ensure its continued relevance in a market increasingly focused on sustainability.

Flexible packaging, which includes pouches, films, and bags made from plastics, paper, and foils, will experience significant growth over the forecast period. Its appeal lies in its inherent advantages like lightweight nature, material efficiency, and cost-effectiveness, leading to reduced transportation costs and a smaller environmental footprint compared to rigid alternatives.

The versatility of flexible packaging allows for diverse applications, from snack foods to personal care products, often incorporating convenient features such as resealable closures and easy-open designs. As consumer lifestyles demand more portable and portion-controlled options, and as the e-commerce sector expands, the demand for flexible packaging solutions that offer both protection and convenience will continue to drive its market expansion.

By Material Analysis

Plastic as a packaging material is poised to maintain a substantial presence in the market, estimated to hold a leading share of approximately 38.1% in the current year, 2025. This enduring dominance stems from its unparalleled versatility, lightweight nature, and cost-effectiveness, making it a preferred choice across numerous industries including food and beverages, pharmaceuticals, and personal care. Plastic offers excellent barrier properties, protecting products from moisture, oxygen, and contamination, thereby extending shelf life and ensuring product integrity.

Ongoing innovations in plastic formulations, including lighter-weight designs and advancements in recycling technologies, are contributing to its sustained relevance, despite increasing scrutiny regarding its environmental impact. Its adaptability to various forms like bottles, films, and trays further solidifies its extensive application in modern packaging solutions.

Biodegradable materials are projected to exhibit significant growth within the packaging market over the upcoming forecast period. These innovative materials, derived from renewable resources such as corn starch, sugarcane, and cellulose, offer a compelling alternative to conventional plastics due to their ability to naturally decompose into benign substances, reducing environmental pollution.

As consumer awareness about sustainability intensifies and regulatory pressures for eco-friendly packaging solutions increase globally, the demand for biodegradable options is rapidly expanding. While still facing challenges in terms of scalability and cost-competitiveness compared to traditional plastics, continuous advancements in material science and manufacturing processes are making biodegradable packaging an increasingly viable and attractive choice for a wide range of applications, aligning with the growing circular economy initiatives.

By Function Analysis

Primary packaging, which directly encloses the product, is estimated to hold a dominant position in the packaging market, projected to capture a substantial share of around 58.9% in 2025. This segment's critical role lies in its immediate contact with the product, providing essential protection, preservation, and containment. For perishable goods like food and pharmaceuticals, primary packaging ensures safety, extends shelf life, and maintains quality from production to consumption.

It's also the primary interface for consumer interaction, carrying vital product information, branding, and often incorporating features for convenience like easy-open seals or reclosable designs. Innovations in primary packaging, particularly in barrier materials and sustainable formats, are continuously driven by consumer health and safety concerns and evolving regulatory landscapes, solidifying its irreplaceable function in the supply chain.

Secondary packaging, which serves to group multiple primary packaged units or provide additional protection during transport and display, is anticipated to exhibit significant growth over the forecast period. This layer of packaging plays a crucial role in logistics efficiency, allowing for easier handling, stacking, and distribution of products.

Beyond practical considerations, secondary packaging is increasingly utilized for branding and marketing purposes, serving as a larger canvas for promotional messages and product differentiation on retail shelves. It also consolidates smaller items, reducing the risk of damage and pilferage. As e-commerce expands and supply chains become more complex, the demand for effective secondary packaging that balances protection, cost-efficiency, and visual appeal will continue to drive its market expansion.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By End Use Industry Analysis

The Food & Beverages sector is poised to be a dominant end-use industry in the packaging market, projected to hold a substantial share of around 40.7% in 2025. This consistent leadership is driven by the universal and continuous demand for packaged food and beverage products, encompassing everything from fresh produce and processed foods to bottled water and alcoholic beverages.

Packaging in this sector is crucial for ensuring food safety, extending shelf life, maintaining product freshness, and providing vital nutritional information to consumers. As global populations grow and urbanization trends accelerate, the consumption of convenience foods, Baby Food Packaging, and ready-to-drink beverages will further boost the need for innovative and efficient packaging solutions, making it an ever-expanding segment.

The e-commerce & retail industry will experience significant growth within the packaging market over the forecast period. The surging popularity of online shopping has created unique demands for packaging that can withstand the rigors of direct-to-consumer shipping, ensuring product protection from warehouse to doorstep. This involves a focus on robust, tamper-evident, and often minimalist designs that minimize waste while enhancing the "unboxing experience" for consumers.

As more goods, from electronics to groceries, are purchased online, the need for specialized packaging solutions like protective mailers, custom-sized boxes, and temperature-controlled packaging will continue to escalate, driving substantial innovation and investment in this rapidly evolving end-use segment.

The Packaging Market Report is segmented on the basis of the following:

By Packaging Type

- Rigid Packaging

- Bottles & Jars

- Trays

- Cans

- Boxes

- Flexible Packaging

- Pouches

- Bags

- Films & Wraps

By Material

- Plastic

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Polystyrene (PS)

- Paper & Paperboard

- Metal

- Glass

- Biodegradable Materials

By Function

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

By End Use Industry

- Food & Beverages

- Healthcare & Pharmaceuticals

- Personal Care & Cosmetics

- E-commerce & Retail

- Industrial/Consumer Goods

Regional Analysis

Leading Region in the Packaging Market

The Asia Pacific region is a dominant force in the global packaging market, and it is estimated to hold a substantial market share of around 38.3% in the current year, 2025. This leading position is primarily driven by robust economic growth, rapid urbanization, and a burgeoning middle class across countries like China, India, and Southeast Asian nations. These factors fuel an immense demand for packaged consumer goods, including food and beverages, personal care items, and pharmaceuticals. The flourishing e-commerce sector in the region further accelerates this growth, necessitating innovative and protective packaging solutions for online deliveries.

Additionally, increasing awareness and regulatory pushes for sustainable packaging solutions, such as recyclable and biodegradable materials, are fostering significant investment and innovation in the Asia Pacific packaging landscape, ensuring its continued prominence.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Fastest Growing Region in the Packaging Market

The Middle East and Africa (MEA) region is exhibiting significant growth in the packaging market over the forecast period, driven by a confluence of factors. Rapid urbanization and a burgeoning young population are leading to increased consumption of packaged food, beverages, and personal care products. The expanding e-commerce landscape in countries like the UAE and Saudi Arabia further fuels demand for protective and efficient packaging solutions to support online retail logistics.

Additionally, rising disposable incomes are contributing to a greater preference for convenient and attractively packaged goods. While the region is still evolving in terms of sustainable practices, there's a growing awareness and regulatory push towards eco-friendly packaging materials and recycling infrastructure, indicating a shift towards more sustainable packaging solutions.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The packaging market is a dynamic and intensely competitive arena, featuring a mix of large global players and numerous smaller, specialized firms. Competition centers not only on pricing and product quality but increasingly on innovation, particularly in sustainable solutions. Companies are striving to develop eco-friendly materials and designs that meet consumer demand for reduced environmental impact.

Technological advancements, such as automation and smart packaging features, are also key differentiators, enhancing efficiency and consumer engagement. The rise of e-commerce further fuels this competition, driving demand for robust and efficient packaging that can withstand complex supply chains. Therefore, success in this market hinges on a company's ability to adapt to evolving consumer preferences, embrace technological innovation, and commit to environmentally responsible practices.

Some of the prominent players in the global Packaging are:

- Amcor plc

- Ball Corporation

- Crown Holdings, Inc.

- WestRock Company

- International Paper Company

- Sealed Air Corporation

- Smurfit Kappa Group

- Berry Global Group, Inc.

- Mondi Group

- DS Smith Plc

- Tetra Pak International S.A.

- Sonoco Products Company

- Stora Enso Oyj

- Huhtamaki Oyj

- Owens-Illinois, Inc. (O-I Glass)

- Ardagh Group S.A.

- Reynolds Group Holdings Limited

- Graphic Packaging Holding Company

- Uflex Ltd.

- RPC Group Plc

- Other Key Players

Recent Developments

- In May 2025, PepsiCo is refining its PepsiCo Positive (Pep+) sustainability goals across climate, packaging, agriculture, and water to align resources with core business priorities. The company's updated targets consider external realities and business growth, aiming for actionable and achievable long-term sustainable growth. Specifically, new plastic packaging goals will focus on driving scale in key markets where PepsiCo believes its efforts can achieve the most positive impact, while also accounting for external factors.

- In February 2025, Tetra Pak introduced food and beverage carton packages in India using certified recycled polymers, a first for the industry in the country. These innovative packages incorporate 5% certified recycled polymers, meeting the Ministry of Environment's Plastic Waste Management Rules 2022 mandate effective April 1, 2025. The material's sustainability is verified by ISCC PLUS certification, showcasing Tetra Pak's commitment to a circular economy and responsible packaging solutions.

- In October 2024, Bayer, in collaboration with Liveo Research, launched a pioneering polyethylene terephthalate (PET) blister packaging for its Aleve brand, a first for the healthcare sector. This innovative solution significantly reduces the packaging's carbon footprint by 38% and eliminates problematic polyvinyl chloride (PVC), addressing a long-standing recycling challenge for blister packs. Initially available in the Netherlands, Bayer aims to transition all its blister packaging to more sustainable alternatives in the coming years, marking a key step in environmental stewardship.

- In June 2024, Innventure LLC's flexible packaging venture, AeroFlexx, partnered with European manufacturer Chemipack to introduce innovative and sustainable liquid packaging to the European market, which focuses on meeting industry demand and aligning with critical packaging initiatives by offering an alternative to rigid bottles. AeroFlexx's design eliminates up to 85% of virgin plastic and is curbside recyclable, directly addressing proposed EU policies to reduce packaging waste and ban single-use plastics by 2030. This marks AeroFlexx's continued global expansion.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 1,123.0 Bn |

| Forecast Value (2034) |

USD 1,592.5 Bn |

| CAGR (2025–2034) |

3.9% |

| The US Market Size (2025) |

USD 245.0 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Packaging Type (Rigid Packaging and Flexible Packaging), By Material (Plastic, Paper & Paperboard, Metal, Glass, and Biodegradable Materials), By Function (Primary Packaging, Secondary Packaging, and Tertiary Packaging), By End Use Industry (Food & Beverages, Healthcare & Pharmaceuticals, Personal Care & Cosmetics, E-commerce & Retail, and Industrial/Consumer Goods) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Amcor plc, Ball Corporation, Crown Holdings, Inc., WestRock Company, International Paper Company, Sealed Air Corporation, Smurfit Kappa Group, Berry Global Group, Inc., Mondi Group, DS Smith Plc, Tetra Pak International S.A., Sonoco Products Company, Stora Enso Oyj, Huhtamaki Oyj, Owens-Illinois, Inc. (O-I Glass), Ardagh Group S.A., Reynolds Group Holdings Limited, Graphic Packaging Holding Company, Uflex Ltd., RPC Group Plc , and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Packaging Market?

▾ The Global Packaging Market size is expected to reach a value of USD 1,123.9 billion in 2025 and is expected to reach USD 1,592.5 billion by the end of 2034.

Which region accounted for the largest Global Packaging Market?

▾ Asia Pacific is expected to have the largest market share in the Global Packaging Market, with a share of about 38.3% in 2025.

How big is the Packaging Market in the US?

▾ The Packaging Market in the US is expected to reach USD 245.0 billion in 2025.

Who are the key players in the Global Packaging Market?

▾ Some of the major key players in the Global Packaging Market are Amcor plc, Ball Corporation, Crown Holdings, and others

What is the growth rate in the Global Packaging Market?

▾ The market is growing at a CAGR of 3.9 percent over the forecasted period.