Besides, growth in key sectors, including e-commerce, manufacturing, and food and beverages, speeds up demand for palletizing robots. Automation solutions are particularly important in handling repetitive tasks, contribute to the reduction of labor costs, and minimize the possibility of errors during palletization.

Growing adoption has been further fueled by continued development in articulated, gantry, and collaborative robotic technologies offering flexibility and scalability for a wide range of palletizing tasks. Key players operating in the palletizing robot industry always focus on innovation in the development of highly effective and intelligent robotic palletizer solutions that could accommodate different packaging needs and support

logistics automation processes.

This growth within the market is highly attributed to advancements within robotics, including the integration of AI and

machine learning that have bettered the functionality of palletizing robots, making them adaptable to different industries.

AI has also allowed palletizing robots to handle complex tasks, including mixed-product palletizing, optimize spacing, and thus reduce operational costs. While cobots are also becoming popular in the market, particularly for SMEs, due to their cost-effectiveness and ease of integration, they work together with the human operator by performing repetitive tasks safely and boosting productivity.

Having regional domination in perspective, North America and Europe have gained the maximum shares of the market due to advanced industrial sectors and the high adoption of automation technologies. In the said period, Asia-Pacific is expected to show very rapid growth due to rapidly growing industrialization and a need for automation solutions in emerging economies like China and India.

The global palletizing robot market has been witnessing rapid expansion, with over 45% of industrial robots used in packaging, including palletizing. By 2023, around 5,000 palletizing robots were deployed annually worldwide. The food and beverage sector accounts for approximately 30% of total robotic applications, demonstrating strong demand in industries that require fast, precise packaging and

smart warehousing systems for improved supply chain management.

The US Palletizing Robot Market

The US Palletizing Robot Market is projected to be

valued at USD 547.1 million in 2024. It is expected to witness subsequent growth in the upcoming period as it holds

USD 903.5 million in 2033 at a

CAGR of 5.7%.

The palletizing robot market in the US is excellent and is primarily growing because of the growing demands that are observed across various industries for automated palletizing systems in recent times, especially for food and beverages, e-commerce, and pharmaceutical industries.

Advancements in robotic technologies along with inflating labor costs drive the market. Companies operating in the palletizing robot market are investing increasingly in research and development aimed at delivering a highly flexible and scalable solution for efficient palletizing processes.

Among the major trends, the fact that one of the prevailing trends in the U.S. includes the rising adoption of collaborative robots, or cobots, which can safely work with humans while boosting overall productivity. Another strong trend now involves the use of

artificial intelligence and machine learning in palletizing systems to strengthen accuracy and adaptability regarding the handling of various packaging formats and materials.

The introduction of

advanced robotic arms in the U.S. has been done for medium to high payload applications due to their growing demand for handling heavier loads in industries related to manufacturing and logistics.

All this added to the growth of warehouse automation and the emphasis on supply chain efficiency, has given a further boost to the adoption of palletizing robots in the American market, indicating that the U.S. market is among the major drivers for growth in the global palletizing robot market.

Key Takeaways

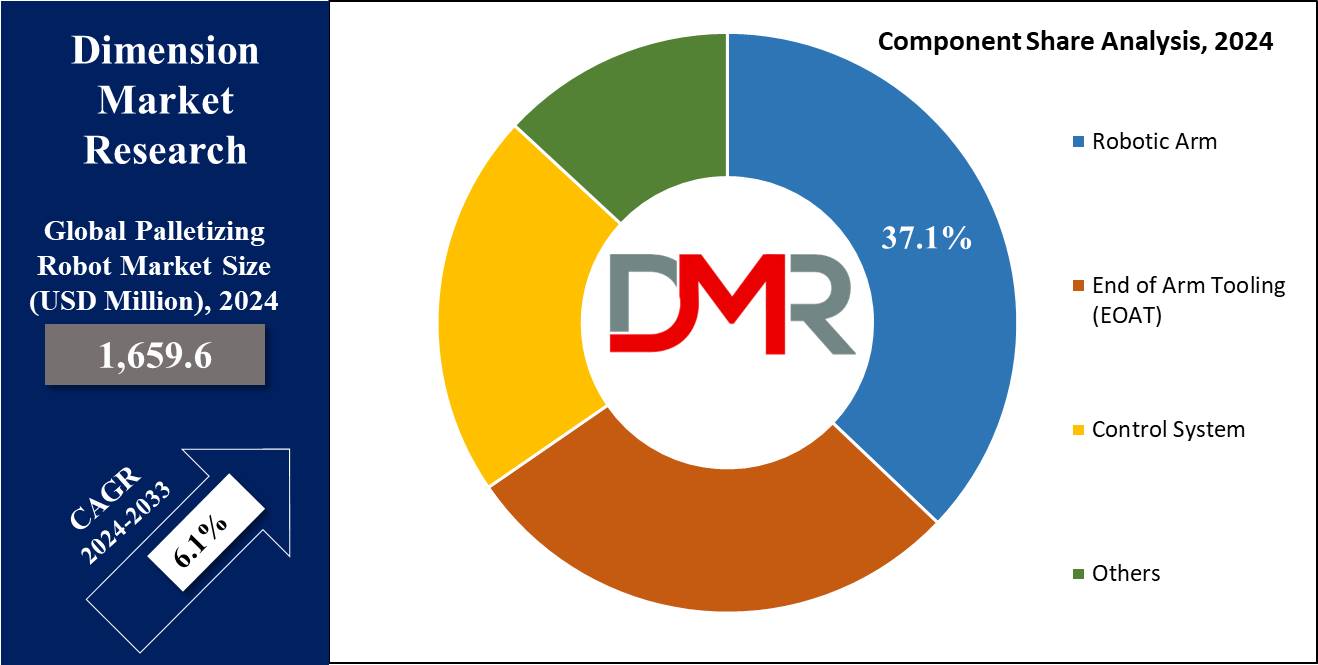

- Global Value: The global palletizing robot market size is estimated to have a value of USD 1,659.6 million in 2024 and is expected to reach USD 2,834.6 million by the end of 2033.

- The US Market Value: The US Palletizing Robot Market is projected to be valued at USD 903.5 million in 2033 from a base value of USD 547.1 million in 2024 at a CAGR of 5.7%.

- Regional Analysis: North America is expected to have the largest market share in the global palletizing robot market with a share of about 39.2% in 2024.

- By Component Segment Analysis: Robotic arms are projected to dominate the component segment in this market as they hold 37.1% of the market share in 2024.

- By Robotic Palletizers Technology Segment: Articulated robots are anticipated to dominate the robotic palletizers' technology segment with 35.0% of the market share in 2024.

- Key Players: Some major key players in the Global Palletizing Robot Market are FANUC Corporation, Yaskawa Electric Corporation, Kawasaki Heavy Industries Ltd., Mitsubishi Electric Corporation, ABB Ltd., and many others.

- Global Growth Rate: The market is growing at a CAGR of 6.1 percent over the forecasted period.

Use Cases

- Food and Beverage Industry: Palletizing robots are very important in the food and beverage industries, especially for handling such products as cans, bottles, and packaged goods. These robots ensure precision in stacking to optimize space on pallets and improve general operational efficiency.

- E-commerce and Retail: With the swift growth of e-commerce activities, the demand for effective warehousing and distribution has gone up a notch. In such a situation, robots are being vastly utilized to deal with the ever-growing parcels and packages by carrying out the task of stacking numbers of items of different natures onto pallets meant for shipment.

- Pharmaceutical Industry: The pharmaceutical industry has to deal with a lot of sensitive products, such as medicines and vaccines. That is the reason why palletizing robots are greatly in demand in this industry. Thus, such robots are supposed to ensure high levels of precision in the stacking of products without allowing fragile products to get contaminated or ruined.

- Manufacturing and Automotive: The manufacturing and automobile industries use palletizing robots to automate the process of stacking heavy components like machinery and parts of an engine onto pallets. It speeds up the pace of production lines and safely handles bulk and irregularly shaped items.

Market Dynamic

Trends

Integration of Artificial Intelligence and Machine Learning

The use of artificial intelligence (AI) and machine learning on palletizing robots forms a different dimension towards approaches by industries in the aspect of automation. AI further allows the robot to learn from data acquired during operation and perform dynamic adjustments in the palletization processes, such as pattern change or optimization of stacking for various sizes of products. This aligns with the evolution of

Industry 5.0 and hyperautomation, enhancing the precision and adaptability of robotic systems.

This trend significantly enhances operational flexibility and efficiency, especially in those industries with high product variability, such as e-commerce and retail. In this regard, AI technology will materialize in the continuous evolution of its integration into robotic systems for driving huge enhancements in the precision and speed of palletizers.

Rise of Collaborative Robots (Cobots)

The cobot trend has gradually started to emerge in the palletizing robot market. These robots collaborate with human operators in performing palletizing tasks safely and efficiently. In addition, cobots have been fitted with enhanced sensors, making them aware of the presence of humans, leading to the adjustment of operations to prevent accidents.

This trend will be important for industries such as pharmaceuticals, where precision and oversight by humans are very essential. Other benefits of cobots include their cost-effectiveness because they are adaptable to existing systems without requiring major infrastructural changes, making them perfect for SMEs.

Growth Drivers

Increasing Demand for Automation in E-commerce and Retail

The increase in the rate of e-commerce, particularly after the pandemic, has put an unusual demand for automated warehousing and logistics. Palletizing robots play a very important role in sorting, stacking, and packaging products for shipment, reducing human labor, hence speeding up order fulfillment. This expansion has also supported the rise of

digital logistics and E-commerce platforms that integrate with robotic palletizing systems to enhance order visibility and delivery accuracy.

Major companies of e-commerce like Amazon and Alibaba invest in automated palletizing systems to handle high volumes of orders intelligently. Hence, it will be a pretty fair deal to expect this trend to accelerate when consumer demand for faster delivery times increases further and enables the growth of the market in palletizing robots in the global market.

Labor Shortages and Rising Operational Costs

Labor shortages, especially in developed economies, are another key growth driver for the palletizing robot market. Moreover, the pandemic situation has resulted in an increased shortage of skilled labor, specifically in industries requiring manual and repetitive tasks like palletizing. Now, with rising labor costs, companies are seeking to bridge the gap through automation.

Palletizing robots offer an economical solution by lowering the reliance on human labor and increasing output. Besides, there's no question of recurrent fatigue or errors when a robot works without intermission right through the night, thus getting operational efficiency greatly improved along with decreased long-term cost.

Growth Opportunities

Expansion into Emerging Markets

Emerging markets, particularly in Asia-Pacific and Latin America, are considered prime growth avenues for the palletizing robot market. Infrastructure modernization in manufacturing industries within these emerging economies is boosting demand for automation technologies. Countries like South Korea are advancing in warehouse automation and South Korea warehousing infrastructure, making the region one of the fastest-growing in the global logistics robotics sector.

Governments and businesses embark on investments in improving automated systems to increase efficiency and competitiveness in the global market while reducing labor costs. Key industries in these regions, such as food and beverages, pharmaceuticals, and manufacturing, are embracing palletizing robots, and these markets are thus bound to see remarkable growth in this period.

Development of Customizable and Modular Palletizing Solutions

Modular and custom-designed palletizing systems meet the growing urge to have versatile solutions in industries. Companies look for robots that can meet different ranges of size and weight of products and packaging formats because various production requirements are becoming more necessary.

The advantage of modular palletizing systems is scalability businesses have the ease of scaling operations up or down without having to change their setup; this trend becomes quite crucial in industries that update product lines quite often or deal with fluctuating demand, like consumer goods and e-commerce.

These systems allow for quicker set-up, less downtime, and more flexibility in operation, thereby offering ample growth opportunities for the manufacturers.

Restraints

High Initial Investment Costs

The high initial investments in purchasing and installing such palletizing robots are currently one of the major obstacles in introducing these into everyday use. The mere investment in hardware and software, coupled with infrastructure modifications, makes robotic investment prohibitive for most SMEs. In addition, routine maintenance and possible upgrading increase the financial burden.

However, the long-term cost benefits are outweighed by the large initial expenditure their applications are thus limited to a few areas where cost sensitivity has not been a big factor in market considerations.

Technical Challenges and Maintenance Requirements

The biggest restraint in implementation and maintenance hinders many businesses from accepting robotic palletizing systems. These systems require expert technicians at the time of setup, programming, and troubleshooting, which might not be that easily available in all parts, especially in emerging markets.

Besides that, there are technical problems in integrating robotic palletizers into an already existing production line due to older machinery or custom setups. Downtime created for maintenance, repairs, or systemic failure further affects operational efficiency and is yet another challenge to businesses contemplating automation.

Research Scope and Analysis

By Component

Robotic arms are projected to dominate the component segment of the palletizing robot market as they hold 37.1% of the market share in 2024. Robotic arms dominate the component segment of the palletizing robot market, driven by several key attributes: versatility, precision, and adaptability across different industries.

Most of the tasks in palletizing often require repetition with high-precision movements for which robotic arms are remarkably well-suited to place the products correctly on the pallet. These arms are fitted with advanced sensors and control systems that enable them to handle a wide range of products with varying shapes, sizes, and weights. One of the major advantages of robotic arms is deployment versatility.

Whether this robot is deployed in food and beverage, pharmaceuticals, or manufacturing industries, it can easily be reprogrammed and fitted for different tasks or new products without major reconfigurations. This, therefore, reduces downtime and operational costs, thereby making robotic arms very attractive for companies that seek scalable automation solutions.

The capability to perform complex palletization with increased efficiency and minimum human supervision was further enhanced by robotic arms as AI and machine learning were integrated into their systems. In the process, all this has increased demand for robotic arms in industries like high-speed e-commerce, where a great deal of accuracy is essential.

Besides, with robotic arms being capable of manipulating medium to heavy payloads makes their adoption apt for processing heavier products, which seems to grow in sectors like automotive and logistics. The trend of investing more in robotic arms by companies to raise their operational efficiency and meet the growing demand for automation is likely to continue their dominance in the palletizing robot market.

By Technology

Articulated robots are anticipated to dominate the robotic palletizers' technology segment with 35.0% of the market share in 2024. Articulated robots dominate the technology segment of robotic palletizers because of their flexibility, precision, and capacity to perform complex palletizing tasks.

Most of the robots have several joints that allow a wide range of movement, making articulated robots very versatile in performing different kinds of tasks in industries concerned with food, beverages, pharmaceuticals, and manufacturing concerns. Its dexterity allows it to stack products of different shapes, weights, and sizes efficiently to address modern production and packaging lines, which are very dynamic.

Amongst the reasons behind such domination by articulated robots is their capability to work in confined spaces and perform intricate patterns of palletizing. This makes them quite ideal for industries comprising fragile or irregularly shaped items. Multi-axis motion enables articulated robots to place the items into the pallets with increased precision, which in turn helps them optimize space and minimize product damage.

Apart from that, these robots are also well-known for their high payload capability, by which they manage heavier products quite easily and also perform faster stacking operations. Their scalability and programmability have contributed much to their wide adaptation since they are integrated into different automated systems quite easily without requiring extensive reconfiguration.

Continuous development in the field of robotics, integration of AI, and machine learning are increasing the efficiency of articulated robots by enabling them to adapt to real-time changes in the palletizing process. Thus, articulated robots have become the technology of choice for businesses aiming at increasing productivity while reducing errors and overall labor costs, hence holding a leading position in the global palletizing robot market.

By Payload Capacity

Media payload capacity ranges from 101 to 500 kilograms and has gained wide acceptance globally because of its versatility in use, especially in different industries. Industries in food and beverages, pharmaceuticals, and manufacturing, where the palletizing robots are supposed to handle products with weights that vary from light consumer goods down to moderately heavy industrial parts, find positive applications within this range.

This is mainly the premier section as it can balance its handling capacity with velocity. Medium payload robots can stack and palletize almost all kinds of products efficiently without losing cycle time, as well as precision, which makes them highly adaptable to changing production demands. For example, for bottling and food industries, operations such as palletizing cases of bottled beverages or packaged goods fall into this weight category.

Because of scalability and flexibility, medium payload robots also include those features that enable the company to optimize its palletizing without frequent replacements or changes in equipment. They can handle mixed-product palletizing by nature and, as such, find application in those industries that have product lines running into several types. The capacity to handle moderately heavy products reduces the requirement for several specialized robots, a factor lowering operational costs.

Due to this fact, medium-payload robots have financially become viable solutions for businesses willing to automate the art of palletizing in large volumes, since companies across industries attach much importance to automation for efficiency and reduction of human element labor. Also, versatility, cost-effectiveness, and efficiency are some key drivers that continue to attract demand for medium-payload robots.

By Application

The case palletizing segment would remain dominant in the application segment of the global palletizing robot market, considering the wide applications in industries such as food and beverages, pharmaceuticals, and consumer goods. Application refers to the stacking of cases, boxes, or cartons on the pallets. This is usually considered a vital task in packaging lines, especially when the volume is high and efficiency with speed is required.

The dominance in case palletizing can be attributed to one fundamental reason: the rising demand for the automation of handling large volumes of packaged goods. Companies scaling up operations become inefficient, slow, and prone to errors when performing palletizing manually. Palletizing robots designed for case handling offer definite advantages in speed and precision, accurately placing products on top of each other securely onto pallets for shipment or storage.

Food and beverage industries normally pack their products in cases or cartons, for which automatic case palletizing generally increases efficiency in the supply chain. These robots can handle a wide range of product shapes and sizes, adapt to manifold packaging format variations, and are hence highly versatile. Besides, case palletizing robots contribute to lowering labor costs and mitigating the risk of injury from repetitive activities, further propelling their adoption.

With the introduction of AI and other vision systems, modern case palletizing robots also offer mixed-case palletizing whereby different products are stacked on one single pallet. This is very useful in industries dealing with e-commerce and retail since orders are generally customized and require flexibility in palletizing. With automation rampant, case palletizing is still considered one of the dominant applications within the global palletizing robot market.

By End User

The dominating share of the end-user segment in the global palletizing robot market is garnered by the pharmaceutical industry, driven by a high inhibition factor for precision, hygiene, and operational efficiency. Palletization robots play an important role in handling pharmaceutical products, medicines, vaccines, and medical equipment, which are critical to their safety and accuracy, requiring careful packaging and transportation to avoid contamination or damage.

A related key factor contributing to the dominance of this industry is the rising demand for automation in handling sensitive and high-value products. The palletizing robots are designed to meet the high standards set forth by the industry in the field of precision and hygiene functions, as they minimize human intervention in palletizing, hence resulting in reduced possibilities of contamination.

These robots can manipulate a wide range of products with variable packaging requirements, ensuring that delicate items are stacked safely onto pallets, ready to go into storage or to be shipped out.

Besides, increased dependency on cold chain logistics by the pharmaceutical industry, concerning vaccines and biologics, in particular, has triggered further demand for robotic palletizing solutions. Palletizing robots installed with AI and sensor technologies can work in temperature-controlled environments and hence safely handle temperature-sensitive products.

Moving toward palletizing robotics helps pharmaceutical companies adhere to regulatory legislation about product traceability and quality control. Because volumes have gone up in periods of high demand for example, the COVID-19 pandemic-efficient and reliable palletizing solutions have driven the lean of the pharmaceutical industry toward automation, placing the industry as one of the leading end-users for palletizing robots.

The Palletizing Robot Market Report is segmented based on the following

By Component

- Robotic Arm

- End of Arm Tooling (EOAT)

- Control System

- Others

By Technology Robotic Palletizers

- Articulated Robots

- Cartesian (Gantry) Robots

- SCARA Robots (Selective Compliance Assembly Robot Arm)

- Collaborative Robots (Cobots)

- Delta Robots

- Hybrid Palletizing Robots

- Robotic Grippers

- Vacuum Grippers

- Magnetic Grippers

- Mechanical Grippers

By Payload Capacity

- Low Payload (Up to 100 kg)

- Medium Payload (101–500 kg)

- High Payload (Above 500 kg)

By Application

- Case Palletizing

- Bag Palletizing

- Bottle Palletizing

- Drum Palletizing

By End User

- Food & Beverage

- Pharmaceutical

- Consumer Goods

- Chemical

- Logistics & Warehousing

Regional Analysis

North America is projected to dominate the global palletizing robot market as it is anticipated to command over

39.2% of the market share by the end of 2024. This dominance is due to its advanced industrial base, high adoption of automation technologies, and a strong focus on improving operational efficiency across industries.

Robotic palletizing systems have been an early adopter in this region owing to the need for improved productivity with reduced labor costs, thereby especially benefiting the established manufacturing and logistics sectors of the U.S. and Canada.

It is one of the dominant regions because most industries, such as food and beverages, e-commerce, and pharmaceuticals, implement automation across North America. The industries discussed above majorly utilize palletizing robots, which help support packaging and distribution lines by allowing the offering of speed order fulfillment with higher accuracy. Increasing demand for customized packaging of products coupled with a surge in e-commerce has also bolstered the acceptance of robotic palletizers in the region.

Also, scarcity of labor and inflated labor costs have forced the companies in the region to automate many functions. The regulatory framework in the region further advocates the use of automation technologies for ensuring workplace safety and productivity, which has been driving the palletizing robot market.

The integration of AI and cobots are some of the following technologies that have served to further cement North America's position in the market. With the major market players operating in the palletizing robot industry headquartered in the U.S., the region continues to remain ahead in terms of innovation and market share, thus setting the pace for other regions.

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global palletizing robot market is highly competitive, and numerous players operating within it strive to gain market share through innovation, product development, and strategic alliances. Key market companies such as ABB Ltd, Fanuc Corporation, KUKA AG, and Yaskawa Electric Corporation dominate this space and provide an assortment of palletizing robots designed specifically to serve various needs across industries like food & beverages, pharmaceuticals, and logistics.

These companies are investing heavily in developing robotic technology by incorporating AI, machine learning, and sensor systems to expand the capabilities of their palletizing solutions. ABB's IRB series and Fanuc's collaborative palletizing robots have set benchmarks in terms of flexibility and precision when it comes to palletizing tasks.

Players have also seen greater investment in modular and customizable palletizing systems to meet the specialized requirements of different industries, further driving market expansion. Regional players entering emerging markets, particularly Asia-Pacific where demand for automated palletizing systems has seen significant growth, have further altered the competitive landscape by offering cost-effective solutions that cater to local industries and meet specific market requirements. Mergers, acquisitions, and collaborations remain effective strategies employed by market leaders as they expand globally while strengthening technological capabilities.

Some of the prominent players in the Global Palletizing Robot Market are

- FANUC Corporation

- Yaskawa Electric Corporation

- Kawasaki Heavy Industries, Ltd.

- Mitsubishi Electric Corporation

- ABB Ltd.

- KUKA AG

- Siemens AG

- Schneider Electric SE

- Honeywell International Inc.

- Columbia/Okura LLC

- Fuji Robotics

- Universal Robots A/S

- Other Key Players

Recent Developments

- August 2024: ABB launched the IRB 1300 Palletizing Robot, which features cutting-edge AI-driven functionalities, making it one of the fastest and most precise palletizing robots in the market. The new model is tailored to address the specific needs of the food and beverage industry, offering improved accuracy and speed in palletizing diverse product lines.

- July 2024: Fanuc Corporation announced a strategic partnership with Covariant, a leader in AI robotics. This partnership focuses on integrating AI-based decision-making into Fanuc's collaborative palletizing robots, allowing them to adapt in real time to changing conditions on packaging lines. By enhancing the robot's ability to process mixed-product pallets with high variability, this development is expected to revolutionize how palletizing is approached in the e-commerce and retail sectors.

- May 2024: Yaskawa launched its latest collaborative robot designed for medium payload (101–500 kg) palletizing applications in industries such as pharmaceuticals and manufacturing. The robot features enhanced safety systems, allowing it to work alongside human operators. Its ability to handle heavier products while ensuring worker safety is expected to boost adoption in industries that deal with moderate-to-heavy goods.

- March 2024: KUKA AG expanded its presence in the U.S. by opening a new robotic research and development center focused on palletizing solutions. This facility is intended to accelerate innovation in robotic palletizing for industries such as e-commerce and logistics, which are seeing rapid growth in the region.

- January 2024: ABB announced a partnership with a leading logistics company to co-develop next-generation palletizing systems integrated with machine vision technology. These systems will offer improved accuracy in palletizing operations by analyzing product dimensions and positioning in real time. The collaboration aims to address the logistical challenges faced by companies handling diverse product lines with high demand for speed and precision

Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 1,659.6 Mn |

| Forecast Value (2033) |

USD 2,834.6 Mn |

| CAGR (2024-2033) |

6.1% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 547.1 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Component (Robotic Arm, End of Arm Tooling (EOAT), Control System, and Others), By Technology Robotic Palletizers (Articulated Robots, Cartesian (Gantry) Robots, SCARA Robots (Selective Compliance Assembly Robot Arm), Collaborative Robots (Cobots), Delta Robots, Hybrid Palletizing Robots, and Robotic Grippers), By Payload Capacity (Low Payload (Up to 100 kg), Medium Payload (101–500 kg), and High Payload (Above 500 kg)), By Application (Case Palletizing, Bag Palletizing, Bottle Palletizing, and Drum Palletizing), By End User (Food & Beverage, Pharmaceutical, Consumer Goods, Chemical, and Logistics & Warehousing) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

FANUC Corporation, Yaskawa Electric Corporation, Kawasaki Heavy Industries Ltd., Mitsubishi Electric Corporation, ABB Ltd., KUKA AG, Siemens AG, Schneider Electric SE, Honeywell International Inc., Columbia/Okura LLC, Fuji Robotics, Universal Robots A/S, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Palletizing Robot Market size is estimated to have a value of USD 1,659.6 million in 2024 and is expected to reach USD 2,834.6 million by the end of 2033.

The US Palletizing Robot Market is projected to be valued at USD 547.1 million in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 903.5 million in 2033 at a CAGR of 5.7%.

North America is expected to have the largest market share in the Global Palletizing Robot Market with a share of about 39.2% in 2024.

Some major key players in the Global Palletizing Robot Market are FANUC Corporation, Yaskawa Electric Corporation, Kawasaki Heavy Industries Ltd., Mitsubishi Electric Corporation, ABB Ltd., and many others.

The market is growing at a CAGR of 6.1 percent over the forecasted period.