Market Overview

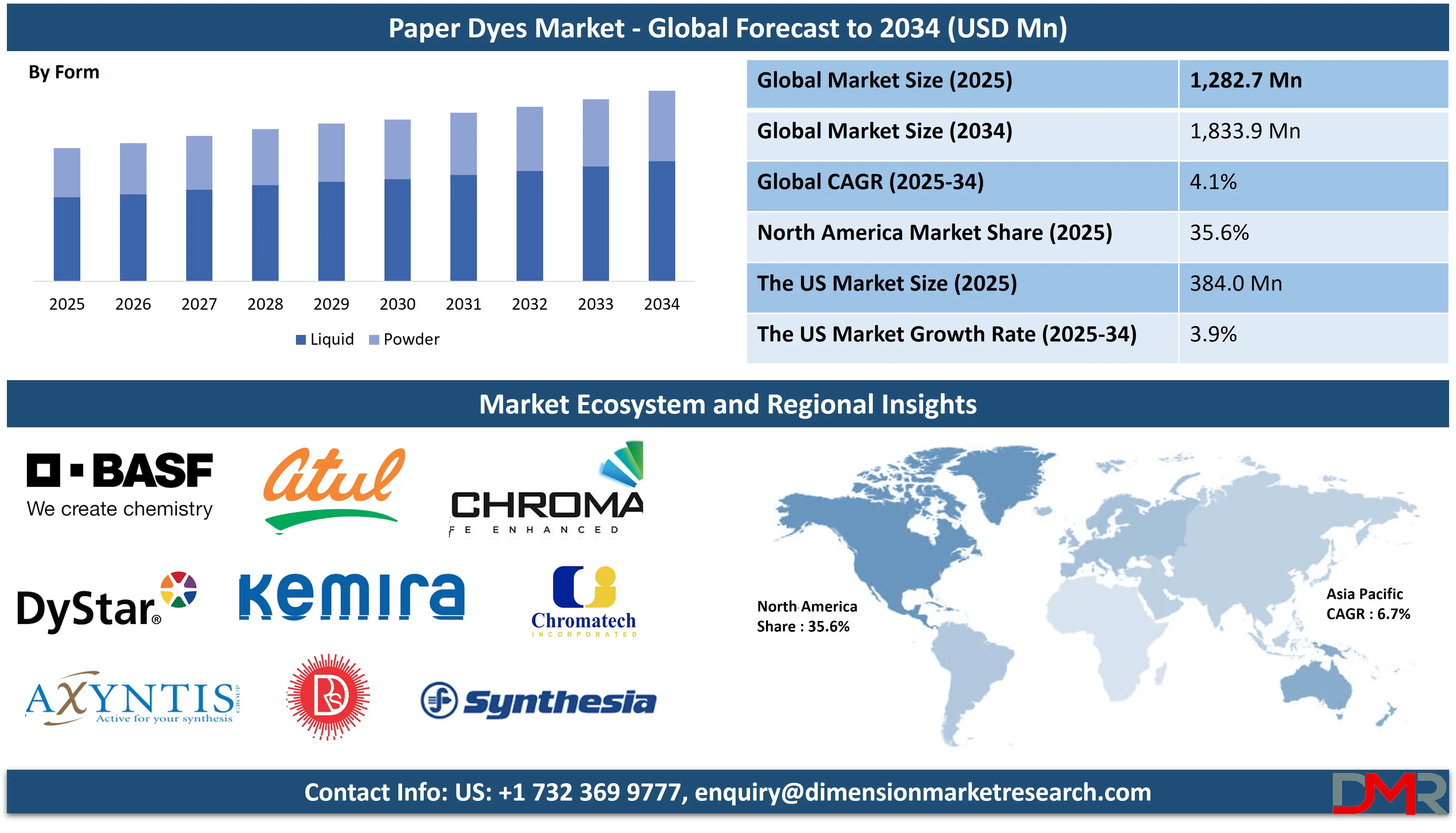

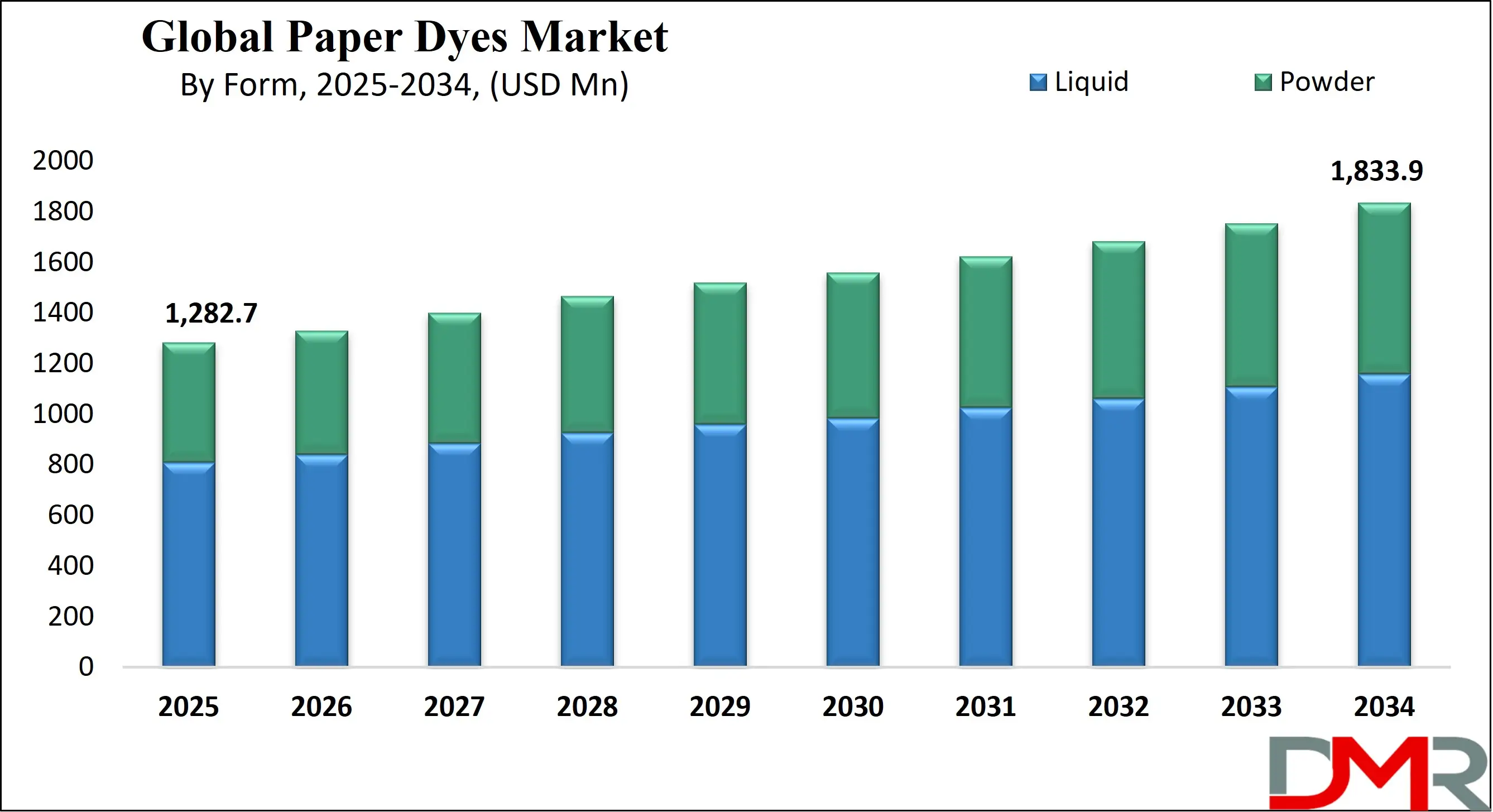

The Global Paper Dyes Market is predicted to be valued at USD 1,282.7 million in 2025 and is expected to grow to USD 1,833.9 million by 2034, registering a compound annual growth rate (CAGR) of 4.1% from 2025 to 2034.

Paper dyes are colorants specifically formulated to color paper during the manufacturing process. They are water-soluble dyes that bind well with cellulose fibers, ensuring uniform and lasting coloration. These dyes enhance the visual appeal of paper products and are used in writing paper, packaging, decorative paper, tissues, and specialty papers. Unlike pigments, paper dyes penetrate the fibers rather than coating the surface, resulting in vibrant and consistent shades.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Available in various types like basic, direct, and acid dyes, they offer a wide color range and compatibility with different pH levels and production methods, making them essential in the pulp and paper industry.

The global paper dyes market is witnessing steady growth, driven by the rising demand for aesthetically enhanced paper products across diverse sectors such as packaging, printing, and stationery. Paper dyes are essential chemicals used in the pulp and paper industry to impart color to various paper grades, including tissue paper, coated paper, craft paper, and specialty papers. These dyes are preferred due to their excellent solubility, fiber affinity, and cost-effectiveness in delivering vibrant and consistent coloration.

A significant driver of the paper dyes industry is the growing need for colored paper in branding, advertising, and product packaging, where visual appeal plays a critical role. The surge in e-commerce activities and food packaging applications has further fueled the use of colored and printed paper, supporting the adoption of high-performance paper colorants.

Moreover, advancements in dyeing technologies and the availability of customized dye formulations are encouraging paper manufacturers to opt for efficient and sustainable solutions. This trend aligns with the increasing global adoption of Paper Packaging Material to replace plastics and reduce environmental impact.

The shift toward eco-friendly and low-VOC dyes, in response to environmental regulations, is reshaping the market dynamics. Key manufacturers are increasingly investing in the development of biodegradable dyes and water-based dye systems to meet the rising demand for sustainable paper dyeing solutions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The use of complementary eco-materials such as Biodegradable Plastics in packaging is also contributing to a broader sustainability shift across industries. Asia-Pacific, with its expanding industrial base and high consumption of paper products, represents a lucrative regional market.

Additionally, innovations in reactive dyes, acid dyes, and basic dyes are enabling better compatibility with modern paper production techniques. Overall, the market is evolving with a strong emphasis on performance, sustainability, and regulatory compliance, creating new opportunities for stakeholders. The use of fibers such as Polyester Staple Fiber in blended applications is also gaining traction, driving new synergies between paper coloration and textile-related materials.

The US Paper Dyes Market

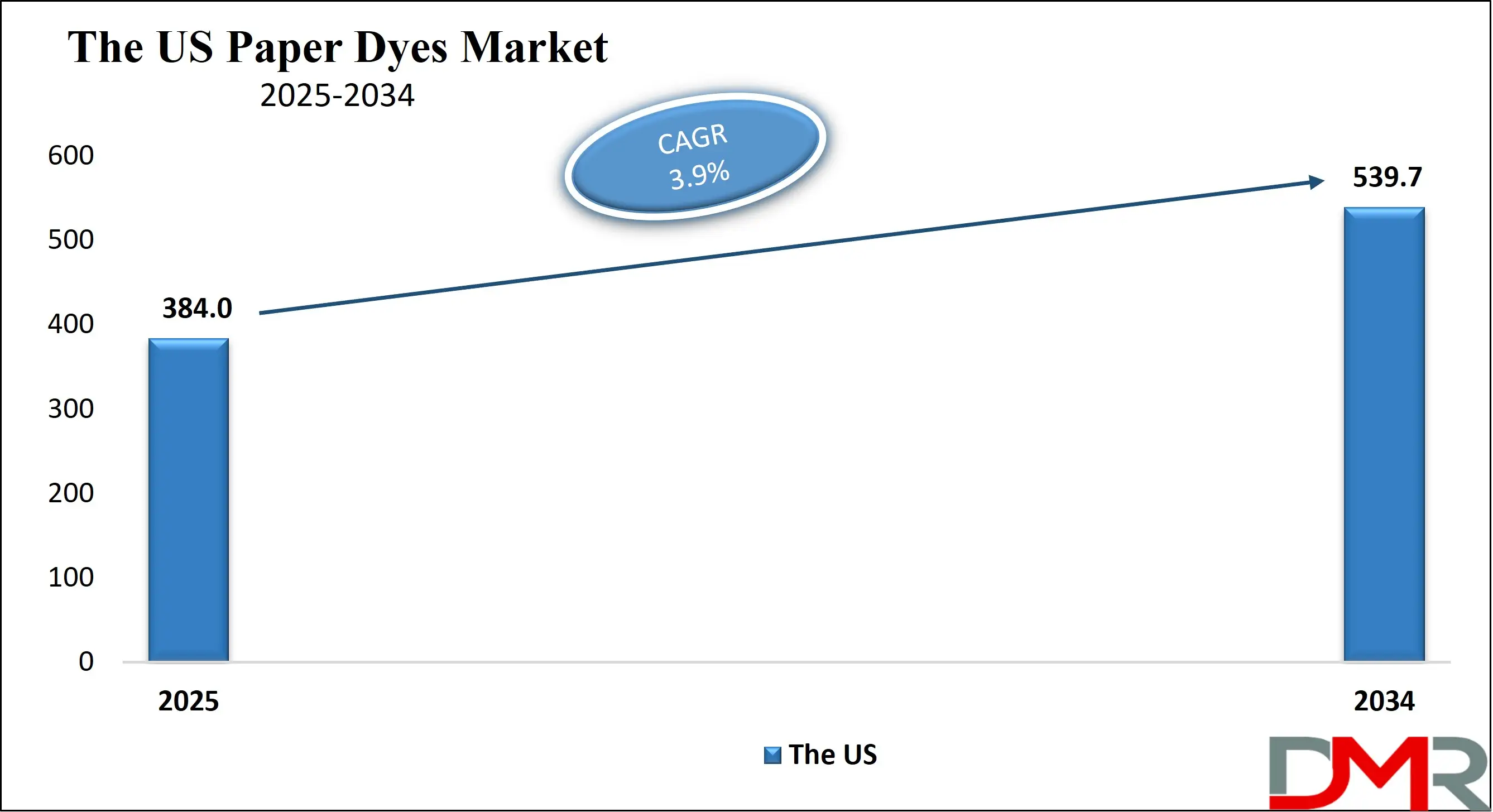

The US Paper Dyes Market is projected to be valued at USD 384.0 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 539.7 million in 2034 at a CAGR of 3.9%.

The US paper dyes market is primarily driven by increasing demand for eco-friendly and sustainable dyeing solutions across the paper manufacturing industry. Growing consumer awareness regarding biodegradable and non-toxic dyes is encouraging manufacturers to shift toward synthetic-free alternatives.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Additionally, the resurgence in demand for specialty papers in packaging, stationery, and labeling is fostering the use of vivid and customized dye solutions. Technological advancements in colorfast and lightfast dyes are also supporting industry growth. Furthermore, the presence of strict environmental regulations in the US motivates companies to adopt high-performance, low-impact dye formulations for paper production.

A key trend in the US paper dyes market is the rising focus on water-based and solvent-free dye systems to meet environmental compliance and reduce ecological footprint. Increasing adoption of automated and digital color dosing systems for precision dyeing is gaining traction among manufacturers. There is also a growing shift towards liquid dyes over powders for better solubility and handling.

Custom color solutions tailored to specific brand identities are being increasingly demanded by end-use sectors like packaging and print media. Furthermore, market players are investing in R&D to develop dyes compatible with recycled fiber paper and advanced coating processes.

The Japan Paper Dyes Market

The Japan Paper Dyes Market is projected to be valued at USD 102.6 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 139.8 million in 2034 at a CAGR of 3.5%.

The primary driving factor for the Japan paper dyes market is the country's commitment to environmental sustainability and precision manufacturing. Japan's paper industry is focusing on eco-conscious solutions to align with its low-carbon and recycling goals. As demand for premium-quality paper for packaging, publishing, and origami crafts rises, so does the need for high-performance, vibrant dyes that are both aesthetically pleasing and environmentally safe.

Additionally, the integration of automation in paper production encourages the use of dyes with consistent dispersion properties. Rising demand for culturally inspired paper products also supports the use of custom color dye applications.

In Japan, a significant trend is the development and adoption of water-soluble, non-toxic dyes that meet stringent national environmental standards. The market is increasingly favoring dye formulations that are compatible with recycled paper and suitable for small-batch, high-quality production. Traditional Japanese paper art forms like Washi are also influencing modern dyeing techniques, encouraging innovation in natural and plant-based dyes.

Demand for premium stationery and packaging is prompting the use of customized and gradient dye patterns. Furthermore, Japan's advancements in nanotechnology and materials science are being leveraged to enhance dye penetration and retention in specialty paper applications.

The Europe Paper Dyes Market

The Europe Paper Dyes Market is projected to be valued at USD 448.0 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 648.9 million in 2034 at a CAGR of 4.2%.

The European paper dyes market is driven by stringent environmental standards and strong regulatory frameworks promoting the use of low-VOC, non-toxic dye formulations. Increasing emphasis on circular economy practices has pushed the demand for dyes that are suitable for recycled paper applications. The rise of e-commerce and sustainable packaging is fueling growth in the specialty and colored paper segments.

Additionally, heightened public awareness about eco-labeling and responsible sourcing in the European Union has led paper manufacturers to prioritize dye solutions with minimal environmental impact. Innovations in high-performance dyes with better light stability are also contributing to market growth.

In Europe, there is a rising trend of integrating biodegradable and bio-based dye technologies into paper production. Sustainable and low-impact manufacturing processes are gaining popularity, with a preference for dyes that are compliant with REACH and other environmental regulations. The market is also witnessing a shift towards automation and digitization of the dyeing process for higher efficiency and reduced waste.

Tailored color matching solutions and multi-functional dyes that offer aesthetic appeal along with performance benefits like water resistance are emerging as favored choices. Additionally, collaborative innovation between dye producers and paper mills is shaping next-generation eco-friendly dye systems.

Paper Dyes Market: Key Takeaways

- Market Overview: The Global Paper Dyes Market is anticipated to reach a valuation of USD 1,282.7 million in 2025 and is projected to grow to USD 1,833.9 million by 2034, expanding at a compound annual growth rate (CAGR) of 4.1% during the forecast period from 2025 to 2034.

- By Form Analysis: Among the forms, liquid paper dyes are expected to lead the global market, capturing approximately 59.3% of the total market share by the end of 2025.

- By Type Analysis: Direct Dyes are projected to be the most widely used type within the global paper dyes industry, representing 37.8% of the market share by 2025.

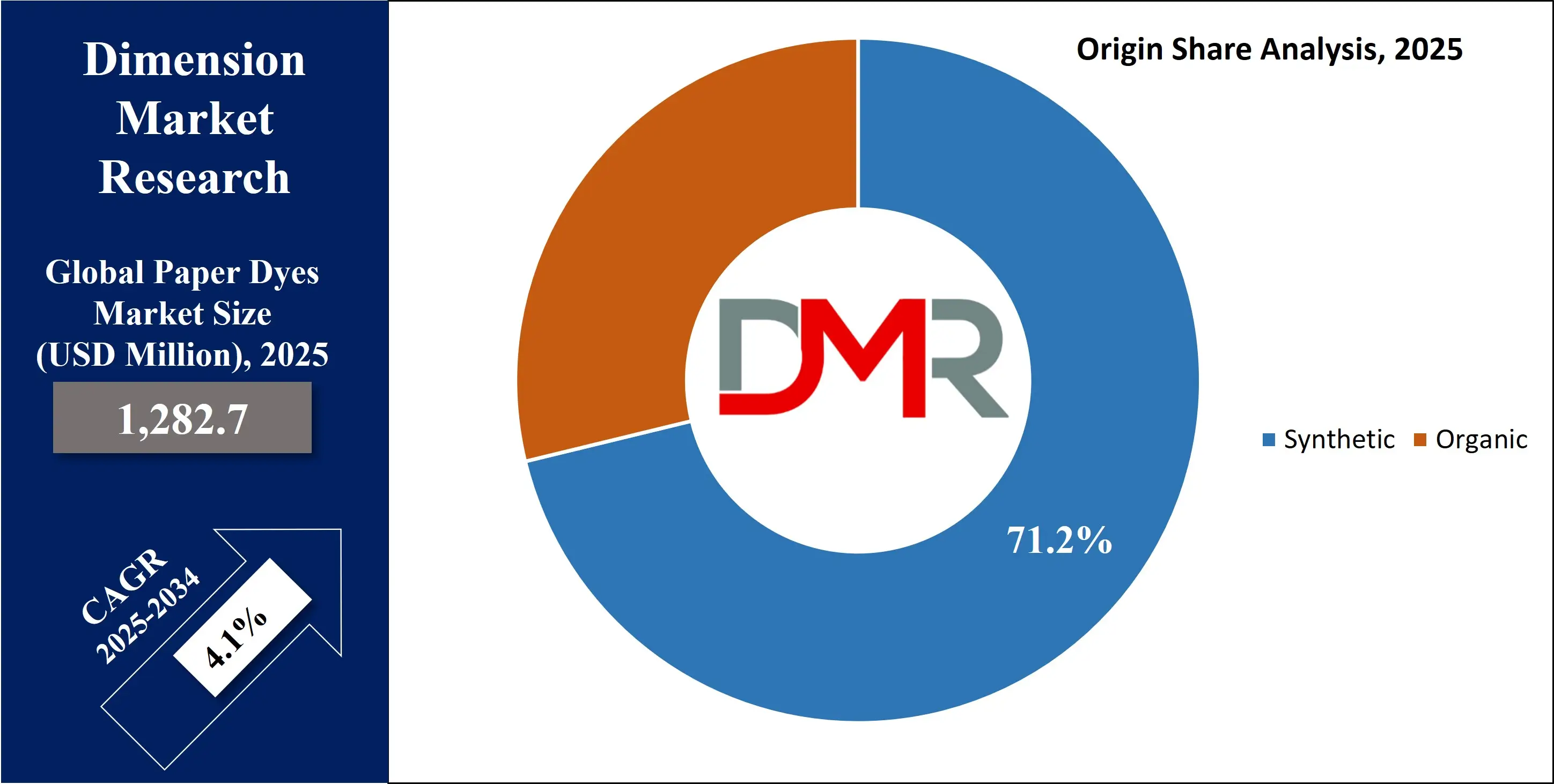

- By Origin Analysis: Synthetic dyes are forecasted to remain the dominant category in the market, accounting for 71.2% of the global share by the end of 2025.

- By Application Analysis: In terms of application, the Packaging Board segment is expected to hold the highest market share, reaching 34.5% by 2025.

- Regional Analysis: North America is estimated to lead the global paper dyes market in terms of regional share, contributing 35.6% to the overall market by the end of 2025.

Paper Dyes Market: Use Cases

- Packaging Industry: Paper dyes are extensively used to color kraft and coated papers used in packaging. These dyes enhance visual appeal, support branding, and improve product differentiation. Their compatibility with various paper types and fastness properties makes them ideal for folding cartons, wrapping paper, and retail packaging applications.

- Tissue Paper Coloring: In hygiene product manufacturing, paper dyes are applied to facial tissues, napkins, and toilet papers. The dyes offer soft, non-toxic color enhancements that maintain product safety while aligning with consumer aesthetic preferences. Their solubility and even dispersion ensure uniform coloration and fast drying in high-speed production environments.

- Printing & Writing Papers: Paper dyes are widely employed in coloring writing and printing papers for stationery, books, and notepads. The dyes provide bright and consistent shades, good lightfastness, and compatibility with ink. They are essential in producing pastel-colored sheets, ledger papers, and security documents that require specific hues.

- Decorative & Specialty Papers: Specialty paper products such as greeting cards, wallpapers, and gift wraps utilize paper dyes for vibrant and diverse color finishes. These dyes allow for customization, intricate designs, and colorfast properties. Their adaptability supports diverse printing techniques and enhances the final product’s aesthetic and tactile appeal.

- Newspaper Production: Paper dyes are used to impart a uniform tint to newsprint, helping reduce glare and eye strain for readers. These dyes must meet fastness and bleed-resistance standards, ensuring minimal interference with ink clarity. Additionally, they help newspapers achieve a distinct identity through slight shade variations.

Paper Dyes Market: Stats & Facts

- Statista: In 2023, the global paper production reached approximately 417 million metric tons, a key indicator for paper dye demand tied to industrial-scale printing and packaging.

- World Bank: Over 35% of global wood harvest is used for paper production, driving the need for dyes that are both effective and environmentally compliant.

- FAO (Food and Agriculture Organization): Asia produced nearly 50% of the world’s paper in 2022, significantly influencing regional consumption of paper dyes, particularly in packaging and hygiene paper.

- U.S. Environmental Protection Agency (EPA): About 9.2 million tons of paper and paperboard were recycled in the U.S. in 2021, prompting innovation in recyclable and non-toxic paper dye formulations.

- OECD: In OECD countries, more than 40% of paper consumption is associated with packaging, where direct and liquid dyes are heavily used for corrugated and kraft paper customization.

- European Chemicals Agency (ECHA): Over 500 paper dye formulations are registered under REACH, indicating the diversity and regulatory focus on safe and compliant dye ingredients.

- India Brand Equity Foundation (IBEF): India’s printing and packaging sector is expected to grow at a rate of 12% annually, driving up the domestic consumption of synthetic and natural paper dyes.

- Japan Paper Association: In 2022, Japan’s paper output exceeded 21 million tons, with decorative, inkjet, and specialty paper segments using high-performance dyes for enhanced quality.

- American Forest & Paper Association (AF&PA): The U.S. paper and wood products industry contributed USD 300 million to the economy in 2023, with a significant portion dedicated to printing and packaging that requires dye usage.

- Greenpeace: Roughly 20% of dyes used in the paper industry globally are estimated to be synthetic and non-biodegradable, spotlighting the environmental pressure on dye manufacturers to innovate.

Paper Dyes Market: Market Dynamics

Driving Factors in the Paper Dyes Market

Expansion of the Packaging Industry

The rapid growth of the global packaging sector, especially in food and beverage, e-commerce, and consumer goods, is a key driver for the paper dyes market. With increasing demand for sustainable and eco-friendly packaging, paper manufacturers are incorporating high-performance dyes to improve visual appeal and brand identity.

Paper dyes such as basic dyes, direct dyes, and pigment dyes are being utilized for coloration of corrugated boxes, cartons, and wrapping paper. The demand for functional and aesthetic paper-based packaging is directly influencing the consumption of colorants in paper production, thereby fueling market expansion and boosting innovation in dye formulation and paper surface treatment technologies.

Growing Preference for Recycled Paper

The increasing adoption of recycled paper in printing, publishing, and packaging applications is significantly propelling the demand for paper dyes. Recycled paper often requires stronger and more vibrant dyes to overcome the dull appearance caused by residual inks and fibers.

This has led to the rising use of synthetic dyes and direct dyes that enhance brightness and improve print quality. Environmental regulations encouraging recycled content have further accelerated the use of paper dye additives in the pulp and paper industry. This shift toward sustainable paper production is creating long-term growth prospects for manufacturers of colorants tailored to recycled and low-grade fibers

Restraints in the Paper Dyes Market

Stringent Environmental Regulations

Environmental concerns over dye effluents and chemical discharge from paper mills are posing significant challenges to the paper dyes market. Many dyes, especially synthetic variants and azo-based dyes, contribute to water pollution and toxicity if not treated properly. Regulatory bodies are enforcing stricter norms regarding chemical usage and wastewater management in the pulp and paper industry.

This leads to higher compliance costs and potential product bans, affecting the widespread adoption of certain dye types. The increasing demand for eco-friendly paper dyes is pushing manufacturers to reformulate products, which can be both time-consuming and cost-intensive for small players in the market.

Volatility in Raw Material Prices

Fluctuating prices of raw materials used in dye production, such as petrochemical derivatives and organic intermediates which serve as a major restraint in the paper dyes market. These cost variations affect the profitability of manufacturers, particularly those producing synthetic and acid dyes.

In addition, disruptions in the global supply chain and increased transportation costs have led to inconsistent availability of key ingredients. Such volatility impacts the pricing strategy and margins for dye suppliers, making it difficult to maintain stable business operations. As a result, end users may seek alternative solutions or reduce dye usage in favor of lower-cost, less vibrant substitutes.

Opportunities in the Paper Dyes Market

Rising Demand for Specialty Paper

The increasing consumption of specialty paper in applications like gift wrapping, labeling, security printing, and decorative printing is opening new opportunities for the paper dyes market. Specialty paper often requires customized dye solutions to achieve precise color shades, durability, and functional performance.

Manufacturers are focusing on developing high-quality direct dyes and fluorescent dyes tailored for niche applications. This segment offers lucrative prospects due to higher profit margins and lower competition. As the demand for aesthetic, functional, and tactile paper products continues to rise, suppliers of advanced colorant systems are likely to see significant growth opportunities in emerging markets.

Technological Advancements in Dye Chemistry

Innovations in dye technology, including the development of water-soluble dyes, low-VOC formulations, and biodegradable colorants, are creating new avenues in the paper dyes market. These advancements are addressing the need for sustainable solutions without compromising color fastness or vibrancy.

The integration of digital printing and inkjet-compatible paper dyes is also gaining momentum, enabling higher resolution and faster turnaround in printing applications. Manufacturers are investing in R&D to create dyes compatible with modern high-speed paper machines and environmentally compliant processes. These technology-driven innovations are unlocking opportunities for differentiation and market expansion across various paper dye applications.

Trends in the Paper Dyes Market

Shift toward Natural and Bio-Based Dyes

One of the emerging trends in the paper dyes market is the increasing preference for natural and bio-based dyes derived from plant, microbial, or waste biomass sources. As sustainability becomes a core focus for paper manufacturers, demand is rising for eco-friendly alternatives to synthetic dyes.

These natural colorants offer reduced environmental impact, low toxicity, and biodegradability, aligning with green manufacturing practices. The trend is especially prominent in premium and specialty paper segments where environmental claims and certifications are vital. Although still in early stages, bio-dyes are expected to gain traction as advancements improve their cost-efficiency and application performance in industrial-scale papermaking.

Growth in Digital and Inkjet Printing

The expansion of digital and inkjet printing in commercial and packaging sectors is influencing the demand for high-performance paper dyes. These applications require superior printability, quick drying, and vibrant color output, prompting innovations in dye formulations. Manufacturers are developing compatible colorants that ensure consistent results on a variety of paper grades, including coated and uncoated stocks.

This trend is being driven by rising demand for personalized prints, short-run packaging, and on-demand publishing. As digital printing continues to disrupt traditional paper applications, the paper dyes market is witnessing a corresponding evolution in terms of product requirements and customer preferences.

Paper Dyes Market: Research Scope and Analysis

By Form Analysis

The Liquid segment is projected to dominate the global paper dyes market by the end of 2025, accounting for 59.3% of the total market share. Liquid paper dyes are preferred due to their ease of handling, superior solubility, and consistent color distribution in various paper manufacturing processes.

Their increasing use in automated paper processing systems, particularly in high-speed production lines, enhances operational efficiency and minimizes dye wastage. Liquid formulations are widely adopted in the production of high-grade coated and packaging papers, contributing to their strong market position. Rising demand for vibrant and uniform paper coloring in commercial printing and branding applications further strengthens this segment’s dominance in the evolving paper chemicals industry.

The Powder segment is predicted to grow with the highest CAGR by the end of 2025. Powder-based paper dyes are gaining traction due to their extended shelf life, ease of transportation, and lower storage costs compared to liquid dyes.

Their adoption is accelerating in small- and medium-scale paper manufacturing units looking for economical and flexible coloring options. Additionally, powdered forms offer precise formulation control, which is critical in producing specialty and artistic papers.

Increased interest in sustainable and customized dyeing solutions for decorative and craft papers is also driving this segment. The powdered format appeals to manufacturers seeking lower carbon footprints and enhanced operational agility in the eco-conscious paper processing market.

By Type Analysis

Direct Dyes are expected to dominate the global paper dyes market by the end of 2025, securing a market share of 37.8%. These dyes are widely favored for their excellent affinity with cellulose fibers and simplified dyeing process, requiring no mordants or complex treatments.

Their cost-effectiveness and strong wash fastness make them suitable for a wide range of paper types, including tissue, newsprint, and low-grade packaging boards. The growing need for quick and uniform dyeing in bulk paper manufacturing has significantly propelled their usage. Direct dyes are particularly prominent in emerging economies where high-volume production with minimal processing costs remains a priority across the industrial and graphic paper dyeing sectors.

Reactive Dyes are anticipated to register the highest CAGR in the paper dyes market by the end of 2025. These dyes form strong covalent bonds with cellulose, resulting in excellent colorfastness and chemical resistance, making them highly suitable for premium-grade printing and coated papers.

Their expanding application in high-quality writing and specialty paper products is contributing to their rapid growth. Additionally, the rise in digital and offset printing demands high-performance paper substrates, boosting the use of reactive dyes. Their environmental compatibility and lower effluent load compared to some synthetic alternatives further enhance their attractiveness in sustainable paper manufacturing processes across developed markets.

By Origin Analysis

Synthetic paper dyes are expected to dominate the global paper dyes market by the end of 2025, accounting for 71.2% of the total market. These dyes offer a broad color spectrum, high tinctorial strength, and consistent performance in large-scale industrial operations. Their adaptability across multiple paper grades, including tissue, coated, and packaging boards, makes them a go-to choice for manufacturers.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Synthetic formulations also enable fast-drying and high-speed processing, essential in modern paper mills. Despite rising environmental concerns, ongoing innovations in low-impact synthetic dye production continue to drive demand, especially in regions with mature industrial infrastructure and high output capacities in pulp and paper processing.

The Organic segment is projected to grow with the highest CAGR by the end of 2025, driven by the increasing demand for eco-friendly and biodegradable solutions. These natural-origin dyes, often plant- or biomass-derived, are gaining attention amid tightening environmental regulations and consumer preference for sustainable practices.

Their adoption is surging in premium and artisanal paper applications, including eco-packaging, decorative stationery, and recyclable printing materials. Manufacturers are investing in organic dye innovations to meet green certification standards and appeal to environmentally conscious brands. This shift toward low-toxicity and renewable dye alternatives positions the organic segment as a key growth area in the evolving green paper chemicals landscape.

By Application Analysis

Packaging Board is forecasted to dominate the global paper dyes market by the end of 2025, with a market share of 34.5%. The growth is driven by the rising global demand for branded, colorful, and sustainable packaging across industries such as food, cosmetics, and electronics. Paper dyes enhance the aesthetic appeal and functional quality of packaging boards, supporting product differentiation.

Their use is especially vital in high-strength kraft and duplex boards where consistent color and printability are critical. As businesses shift toward paper-based alternatives to plastic, the packaging board segment remains a primary consumer of dye-based solutions to meet performance and branding needs.

The Tissues segment is expected to grow with the highest CAGR by the end of 2025. Increased demand for aesthetically appealing and personalized tissue products, such as napkins, facial tissues, and hygiene papers, is boosting the use of safe and skin-friendly dyes. The hospitality and personal care industries are key consumers driving innovation in colored and printed tissues.

Additionally, the rise of luxury and decorative tissue segments in developed markets is creating new opportunities for dye suppliers. The growing focus on biodegradable and dermatologically tested colorants further propels this segment’s expansion in the environmentally sensitive and high-compliance sectors of tissue production.

The Paper Dyes Market Report is segmented on the basis of the following:

By Form

By Type

- Direct Dyes

- Acid Dyes

- Basic Dyes

- Reactive Dyes

- Others

By Origin

By Application

- Coated Paper

- Packaging Board

- Writing & Printing

- Tissues

- Others

Regional Analysis

Region with the largest Share

North America is projected to hold the largest share of the global paper dyes market by the end of 2025, accounting for 35.6%. The region’s dominance stems from its well-established pulp and paper manufacturing industry, coupled with advanced technological integration in dye application processes.

High demand for premium packaging, printing, and coated paper in sectors like food, e-commerce, and publishing significantly fuels consumption. Moreover, stringent regulatory frameworks promote the use of high-quality, low-emission dye solutions. Key manufacturers operating in the U.S. and Canada are focusing on product innovation and sustainable practices, strengthening market maturity. Additionally, the presence of major retail brands supports continuous demand for aesthetically enhanced and functional paper products.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with Highest CAGR

Asia Pacific is expected to register the highest CAGR in the global paper dyes market by the end of 2025. Rapid industrialization, increasing urbanization, and a growing middle-class population are driving demand for packaging materials, tissue products, and printed stationery. The region is witnessing a significant expansion of the paper manufacturing sector, especially in countries like China, India, and Indonesia.

Cost-effective labor, easy access to raw materials, and government incentives for local paper production enhance regional competitiveness. Rising environmental awareness is also fostering the development of eco-friendly dye formulations. As digitalization spreads, the demand for high-quality printing paper and color-enhanced materials further accelerates the market growth across Asia Pacific.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Impact of Artificial Intelligence in the Paper Dyes Market

- AI-Driven Formulation Design: AI-driven formulation design and development accelerates innovation in the paper dyes market. Machine learning algorithms analyze chemical structures, pigment interactions, and substrate compatibility to predict optimal dye recipes. This capability reduces R&D timelines, lowers formulation costs, and enhances color accuracy and fastness across paper grades, enabling manufacturers to meet aesthetic requirements.

- Smart Manufacturing Optimization: AI-powered manufacturing systems optimize dyeing processes by analyzing real-time sensor data from coating lines and pulp machines. Predictive process control adjusts temperature, pH, and dwell time to ensure uniform color deposition. This automated optimization reduces energy consumption, minimizes chemical waste, and enhances production throughput in large-scale paper dye operations.

- Enhanced Quality Assurance: Computer vision and AI-driven inspection systems revolutionize quality assurance by detecting streaks, color inconsistencies, and coating defects at high speeds. Deep learning models trained on historical production images identify anomalies before packaging. This proactive defect detection ensures batch-to-batch consistency, reduces rework costs, and upholds stringent quality standards in paper dye manufacturing.

- Sustainability and Supply Chain Analytics: AI-driven supply chain analytics optimize raw material sourcing and demand forecasting for paper dye producers. Machine learning evaluates vendor performance, market prices, and environmental impact to recommend sustainable pigment and chemical alternatives. This strategic insight reduces carbon footprint, minimizes inventory holding costs, and supports circular economy initiatives throughout the paper dye lifecycle.

Competitive Landscape

The competitive landscape of the global paper dyes market is characterized by the presence of several key players striving to expand their market share through innovation, sustainability, and strategic partnerships.

Leading manufacturers are focusing on developing environmentally friendly dyes, driven by rising demand for biodegradable colorants in packaging and tissue applications. Companies are also investing in advanced dyeing technologies to improve color retention, processing efficiency, and compatibility with high-speed paper machines.

Mergers and acquisitions are common as major firms aim to strengthen their global presence and access emerging markets with growing paper consumption trends. Additionally, firms are forming alliances with paper and pulp producers to offer customized solutions for specific paper grades such as coated paper, kraft board, and decorative tissue.

North America and Europe host many established players focusing on low-VOC formulations, while Asia Pacific is emerging as a hotspot for cost-effective production and innovation. Continuous R&D in synthetic dye chemistry and natural dye alternatives is enabling companies to meet both performance and sustainability demands. Key players are also prioritizing digital transformation in supply chains and product development to enhance responsiveness and cater to evolving customer needs across diverse end-use segments.

Some of the prominent players in the Global Paper Dyes Market are

- Archroma

- Atul Ltd.

- BASF SE

- DyStar Group

- Kemira Oyj

- Chromatech Incorporated

- Axyntis SAS

- Red Sun Dye Chem

- Synthesia a.s.

- Vipul Organics Ltd.

- Alliance Organics LLP

- Bhanu Dyes Pvt. Ltd.

- Kolorjet Chemicals Pvt Ltd

- Milliken & Company

- Standard Colors, Inc.

- Setaş Kimya Sanayi A.Ş.

- Organic Dyes and Pigments LLC

- Aries Dye Chem Industries

- Indo Colchem Ltd.

- Rung International Pvt. Ltd.

- Other Key Players

Recent Developments

- In March 2025, Sudarshan Chemical Industries completed the acquisition of Heubach Group’s pigments and dyes business in Germany for approximately USD 138 million. This acquisition, following a 2024 asset deal, strengthens Sudarshan’s global reach and enhances its pigment production capacity.

- In August 2024, Mondi partnered with CMC Packaging Automation in a joint venture to develop sustainable kraft paper packaging solutions. This collaboration targets the eco-conscious e-commerce market, fostering deeper integration across the sustainable packaging and paper dyes supply chain.

- In July 2024, Global Market Insights projected the paper dyes market to exceed USD 1.4 million by 2032. The forecast highlights growth driven by environmentally friendly dye technologies, increasing demand for colored papers, and rising online shopping trends.

- In March 2024, Vipul Organics secured a contract worth approximately USD 860,000 from Tamil Nadu Newsprint and Papers Limited for blue and violet dyes. The firm targets around USD 6 million in revenue from the paper dyes segment over the next three years.

- In September 2023, Archroma introduced a new line of eco-friendly dyes for paper. Concurrently, Dystar launched vivid, sustainable color solutions, and BASF expanded its specialty dyes range, signaling a major industry-wide move toward greener paper dye innovations.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 1,282.7 Bn |

| Forecast Value (2034) |

USD 1,833.9 Bn |

| CAGR (2025–2034) |

4.1% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 384.0 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Form (Liquid, Powder), By Type (Direct Dyes, Acid Dyes, Basic Dyes, Reactive Dyes, Others), By Origin (Synthetic, Organic), By Application (Coated Paper, Packaging Board, Writing & Printing, Tissues, Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Archroma, Atul Ltd., BASF SE, DyStar Group, Kemira Oyj, Chromatech Incorporated, Axyntis SAS, Red Sun Dye Chem, Synthesia a.s., Vipul Organics Ltd., Alliance Organics LLP, Bhanu Dyes Pvt. Ltd., Kolorjet Chemicals Pvt Ltd, Milliken & Company, Standard Colors, Inc., Setaş Kimya Sanayi A.Ş., Organic Dyes and Pigments LLC, Aries Dye Chem Industries, Indo Colchem Ltd., Rung International Pvt. Ltd., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Paper Dyes Market?

▾ The Global Paper Dyes Market size is estimated to have a value of USD 1,282.7 million in 2025 and is expected to reach USD 1,833.9 million by the end of 2034.

Which region accounted for the largest Global Paper Dyes Market?

▾ North America is expected to be the largest market share for the Global Paper Dyes Market with a share of about 35.6% in 2025.

Who are the key players in the Global Paper Dyes Market?

▾ Some of the major key players in the Global Paper Dyes Market are BASF SE, DyStar Group, Archroma, and many others.

What is the growth rate in the Global Paper Dyes Market?

▾ The market is growing at a CAGR of 4.1% over the forecasted period.

How big is the US Paper Dyes Market?

▾ The US Paper Dyes Market size is estimated to have a value of USD 384.0 million in 2025 and is expected to reach USD 539.7 million by the end of 2034.