Market Overview

The Global

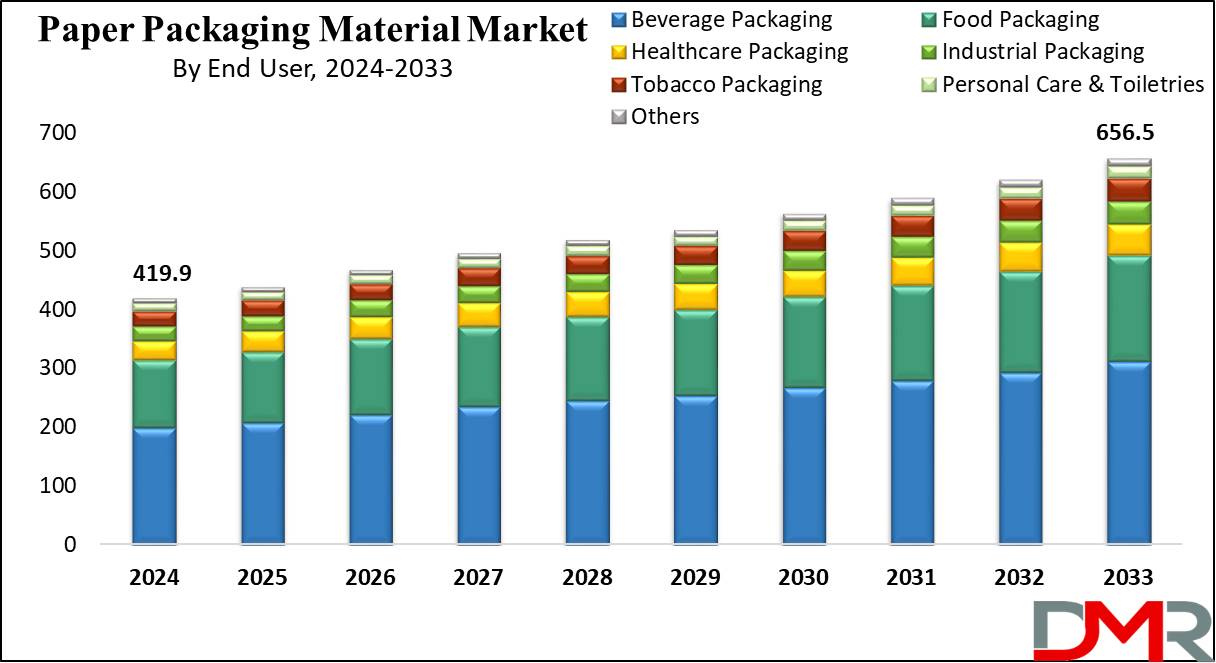

Paper Packaging Material Market size is expected to reach a value of

USD 419.9 billion in 2024, and it is further anticipated to reach a market value of

USD 656.5 billion by 2033 at a CAGR of 5.1%.

Global paper packaging material is operating more competitively in the global market, which deals with the production, supply, and application of various paper packaging materials across the globe. This market targets different sectors of end-users, for example, food and beverages, drugs and pharmaceuticals, personal care products, and electronics with various solutions like a corrugated board, carton board, liquid packaging cartons, and molded pulp. Catering for clients globally, companies in this market are bound to encounter differences in consumers’ preferences, regulations, and the economy. Economical efficiency is also an important factor, which determines the market’s demand for eco-friendly, biodegradable, reusable, and recyclable resources for packaging. Solution: This is a result of new technologies, current market conditions and trends, and the changing nature of the supply chain which poses challenges that need to be responded to and answered in the market by the players within the industry.

The following are the factors that affect the global paper packaging material market: Consumer preferences are on the rise, they want eco-friendly paper packaging material owing to sustainability needs, and most importantly the change that e-business brings to the packaging material. New rules and changes in the environment and people’s perceptions have driven the process where sustainable practices are the key, and paper packaging can be regarded as one of them taking into consideration its biodegradability and renewability. The increase in e-commerce activities has greatly impacted packaging needs hence the increased search for protective and efficient products such as (corrugated boards and paper-based packaging). Technological advancements in foils, coatings, and printing techniques are the factors that increase the opportunities of this market. The increased competition in the current world market characterized by intertangled supply systems requires efficient packaging methods. The branding and marketing significance of packaging is underlined by using inventive and good paper packaging for the touch of customers.

Key Takeaways

- Market Size: The market is projected to reach a value of USD 656.5 billion by 2033 at a CAGR of 5.1% from a base value of USD 419.9 billion in 2024.

- Definition: The Paper Packaging Material Market involves the production and distribution of paper-based materials used for packaging items, focusing on sustainability, recyclability, and lowering environmental effects in comparison to plastic alternatives.

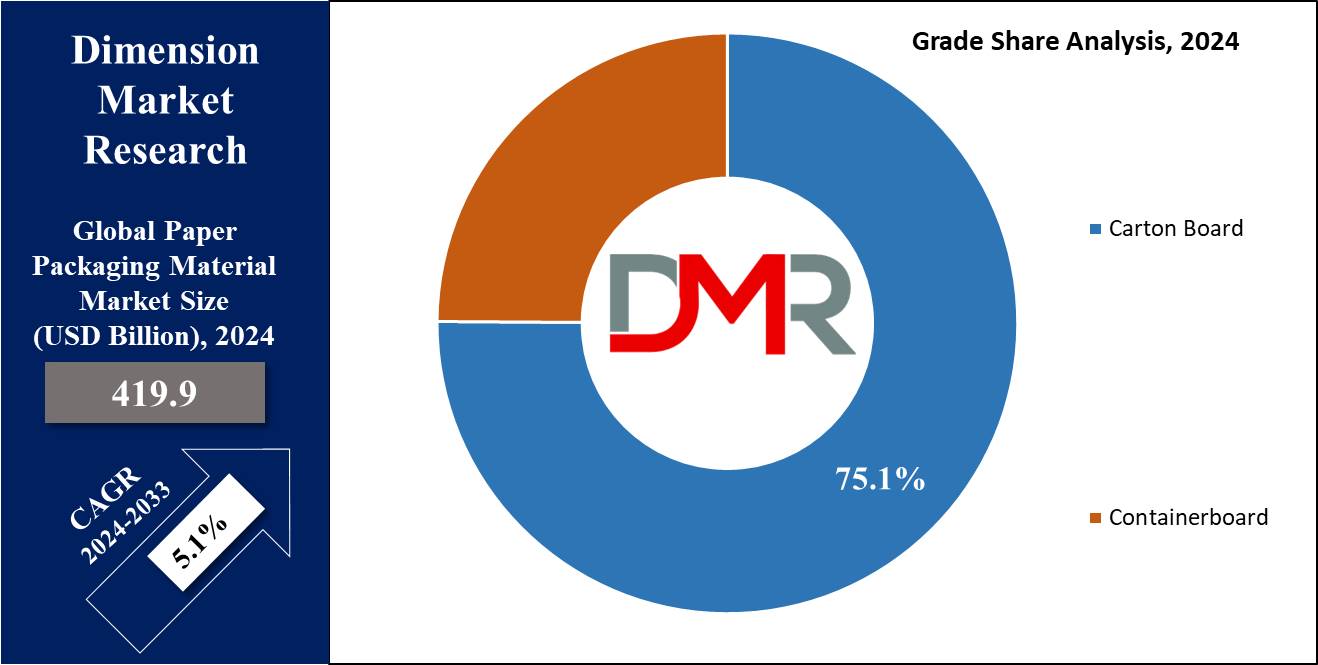

- By Grade Segment Analysis: Carton board is projected to dominate this segment based on grade as they hold 75.1% of the market share in 2024.

- By Material Segment Analysis: The corrugated board is projected to stand out as a dominant material within the global paper packaging market in 2024.

- By Product Segment Analysis: Liquid packaging cartons are projected to establish themselves as a dominant category within the global paper packaging material market based on products that dominate this segment in 2024.

- By End User Segment Analysis: Beverage packaging is projected to hold a dominant position in the global paper packaging material market as it will hold 47.3% of the market share in 2024.

- Regional Analysis: Asia Pacific is projected to stand as a dominant force in the global paper packaging material market as it will hold 47.5% of the market share in 2024.

Use Cases

- Food Packaging: Paper packaging materials are extensively used in the meals industry for gadgets like takeaway bins, bakery containers, and grocery bags, making sure hygiene and eco-friendliness.

- Retail Packaging: Retailers use paper packaging for wrapping merchandise, creating branded paper bags, and packaging apparel, selling sustainability and enhancing patron enjoyment.

- E-commerce Shipping: Online outlets rely on paper packaging substances, inclusive of corrugated containers and cushioning paper, for adequately shipping products, decreasing plastic waste, and ensuring recyclability.

- Cosmetic Packaging: The cosmetics enterprise uses paper packaging for product boxes, tubes, and labels, imparting a biodegradable and aesthetic opportunity to plastic, appealing to eco-conscious customers.

Market Dynamic

Trends

Growing Demand for Eco-friendly PackagingThe global paper packaging material market enjoys an abundance of dynamism and is involved in the manufacturing, trading, and consumption of numerous types of paper and paper-based products primarily for use in packaging across the world. advertised in this market are diverse end-user industries made of food and beverages,

pharmaceuticals, personal care, electronics, etc., it has versatile products like corrugated boards, carton boards, liquid packaging cartons, and molded pulp. Global players in this market have to respond to differences in consumer trends, policies of different countries, and the performance of the overall global economy.

Rise of Flexible Paper Packaging

Economical efficiency is also an important factor, which determines the market’s demand for eco-friendly, biodegradable, reusable, and recyclable resources for packaging. This is a result of new technologies, current market conditions and trends, and the changing nature of the supply chain which poses challenges that need to be responded to and answered in the market by the players within the industry.

Growth Drivers

Increased Demand for Sustainable Packaging Solutions

There are several factors that have a direct bearing on the global paper packaging material, some of which include the changing customer preferences, and trends as well as concerns for environmentally friendly products and the effects of e-commerce on this market. New rules and changes in the environment and people’s perceptions have driven the process where sustainable practices are the key, and paper packaging can be regarded as one of them taking into consideration its biodegradability and renewability.

Expansion of the E-commerce Industry

Due to a sudden increase in online shopping and home deliveries, packaging needs have changed dramatically, and there is an increasing emphasis on protective and efficient materials like corrugated boards and paper packaging. Technological advancements in foils, coatings, and printing techniques are the factors that increase the opportunities of this market. The increased competition in the current world market characterized by intertangled supply systems requires efficient packaging methods. The branding and marketing significance of packaging is underlined by using inventive and good paper packaging for the touch of customers.

Growth Opportunities

Technological Advancements in Paper Production

Advancements in technology continue to present itself as an opportunity in the paper packaging market especially in the production of papers. Today’s manufacturing technologies are facilitating the development of quality, ecological, and economical paper packaging goods. They focus on increasing the sustainability of the packing materials and the efficiency by which they can be used to pack goods, thus competing with plastic packaging. These developments are being adopted by market participants in a bid to extend their offering ranges and hence grab a greater piece of the market.

Increasing Adoption in the Food Industry

Flexible packaging and corrugated boxes in the food industry form the major consumers of paper packaging and hence are the biggest growth driving force of the market. The requirements of such aspects as safety, cleanliness, and usage of eco-friendly packing materials are making the market in this sector. Market analysis confirms that the use of paper packaging is being dictated by market trends that are by the customer’s inclination towards environmentally friendly solutions as well as by food safety issues. This trend constitutes a plethora of opportunities that may be capitalized on by various players in this market, especially where new and solely compliant packaging services are offered.

Restraints

High Costs and Limited Availability of Raw Materials

The paper packaging market is also facing the restraint of high costs and availability of raw materials that are used in the production of paper packaging materials. Paper and paper board used in packaging also demand wood pulp of which cost could be high and occasioned by shortages in supply. This challenge is further compounded by the rising consumption of eco-friendly packaging solutions since it strains available raw materials even more. All of the above factors are very detrimental to the growth of the market and can also have a direct impact on the competitive edge that paper packaging can have over others such as plastic.

Environmental Concerns Associated with Paper Production

Although paper packaging is one of the more popular types of packaging for environmental consciousness, the environment does have several drawbacks that include deforestation, and pollutant emissions during paper production. The emission of dioxin during the process of paper production especially the bleaching process is very hazardous because of its impact on the environment and the rate of health hazard. Such concerns can impact the market since the consumer and the regulatory bodies review the general effects of paper packaging on the environment. These problem areas need to be solved to ensure the sustainability of paper-based packaging systems and their adaption in the future.

Research Scope and Analysis

By Grade

Carton board is projected to dominate this segment based on grade as they hold 75.1% of the market share in 2024 and are anticipated to show subsequent growth in the upcoming period of 2024 to 2033. In the paper packaging material market, the dominance of specific grades, such as Solid Bleached Sulphate (SBS) within Carton Board and White-top Kraftliner within Containerboard, is influenced by their distinct characteristics. SBS excels in printability and visual appeal, making it a preferred choice for premium packaging, particularly in industries like cosmetics and luxury goods. Its customizable nature and association with quality contribute to its widespread adoption. On the other hand, the White-top Kraftliner in Containerboard is favored for its strength and durability, making it suitable for heavy-duty products in logistics and industrial sectors.

Its sustainability, ease of customization for branding, and widespread use in corrugated packaging further contribute to its dominance. These preferences are shaped by the specific needs of industries, highlighting the importance of attributes such as print quality, visual appeal, strength, and sustainability in guiding the prominence of grades within the paper packaging landscape.

By Material

The corrugated board is anticipated to stand out as a dominant material within the global paper packaging market in 2024 due to various key factors and is anticipated to show significant growth in the forthcoming period of 2024 to 2033 as well. Renowned for its robust strength and durability, the corrugated design provides exceptional rigidity and resistance to compression, making it a preferred choice for safeguarding goods during transportation and handling. Its versatility allows for seamless adaptation to diverse packaging applications, from shipping boxes to retail packaging and display stands, appealing to a wide range of industries.

Notably customizable in terms of size, shape, and printing, the corrugated board offers businesses a means to meet specific product requirements and branding needs. Its lightweight nature, coupled with eco-friendliness and recyclability, makes it a cost-effective and environmentally responsible option, especially significant for the e-commerce industry. With inherent cushioning properties, supply chain efficiency, ongoing innovation, and global adoption spanning various industries, the corrugated board continues to play a vital role in the global paper packaging material market.

By Product

Liquid packaging cartons have established themselves as a dominant category within the global paper packaging material market based on products that dominate this segment in 2024. Their dominance in this segment is driven by various compelling factors like their versatility, these cartons are well-suited for a diverse range of beverages, offering convenient storage and transportation. Their lightweight nature proves cost-effective in production and logistics, making them an attractive choice for companies aiming to optimize resources. Featuring multiple layers, including paperboard and barrier films, liquid packaging cartons contribute to extended shelf life by providing effective protection against light, oxygen, and contaminants.

Embraced for their environmental sustainability, these cartons align with consumer preferences for eco-friendly alternatives, offering recyclability and supporting overall sustainability goals for beverage companies. The consumer-centric design, incorporating resealable caps and easy-to-pour spouts, enhances convenience and meets on-the-go preferences. Moreover, the unique shape and branding possibilities of liquid packaging cartons provide opportunities for brand differentiation, contributing to their widespread adoption across the global market. Technological advancements continue to enhance their functionality, ensuring they remain a preferred packaging solution for various liquid products.

By End User

Beverage packaging is anticipated to hold a dominant position in the global paper packaging material market as it holds 47.3% of the market share in 2024 and is expected to show subsequent growth in the forthcoming period of 2024 to 2033. The dominance can be driven by several key factors. The consistently high and growing consumer demand for various beverages fuels the need for efficient packaging solutions. The beverage industry's diverse packaging types, including cartons, paperboard boxes, and pouches, find versatility and flexibility in paper-based materials. Sustainability concerns play a crucial role in the growth of this market, with paper packaging being recognized as an eco-friendly alternative. Ongoing innovation in paper-based beverage packaging, including advancements in barrier coatings, addresses functionality while maintaining recyclability.

The reduced environmental impact of paper packaging, especially in comparison to single-use plastics, aligns with the global push for sustainable packaging. Stringent regulations and consumer preferences further drive beverage companies to adopt paper-based materials, enhancing their brand image associated with sustainability. The convenience and portability offered by paper-based options, coupled with their recyclability, contribute to their popularity in the beverage sector, supporting the broader shift towards a circular economy.

The Paper Packaging Material Market Report is segmented on the basis of the following

By Grade

- Carton Board

- Solid Bleached Sulphate (SBS)

- Solid Unbleached Sulphate (SUS)

- Folding Boxboard (FBB)

- Coated Recycled Board (CRB)

- Uncoated Recycled Board (URB)

- Others

- Containerboard

- White-top Kraftliner

- White Top Testliner

- Semi Chemical Fluting

By Material

- Corrugated Board

- Specialty Paper

- Box-board/Carton Board

- Kraft papers

- Molded Pulp

By Product

- Liquid Packaging Cartons

- Corrugated Cases

- Cartons & Folding Boxes

- Others

By End User

- Beverage Packaging

- Food Packaging

- Healthcare Packaging

- Industrial Packaging

- Tobacco Packaging

- Personal Care & Toiletries

- Others

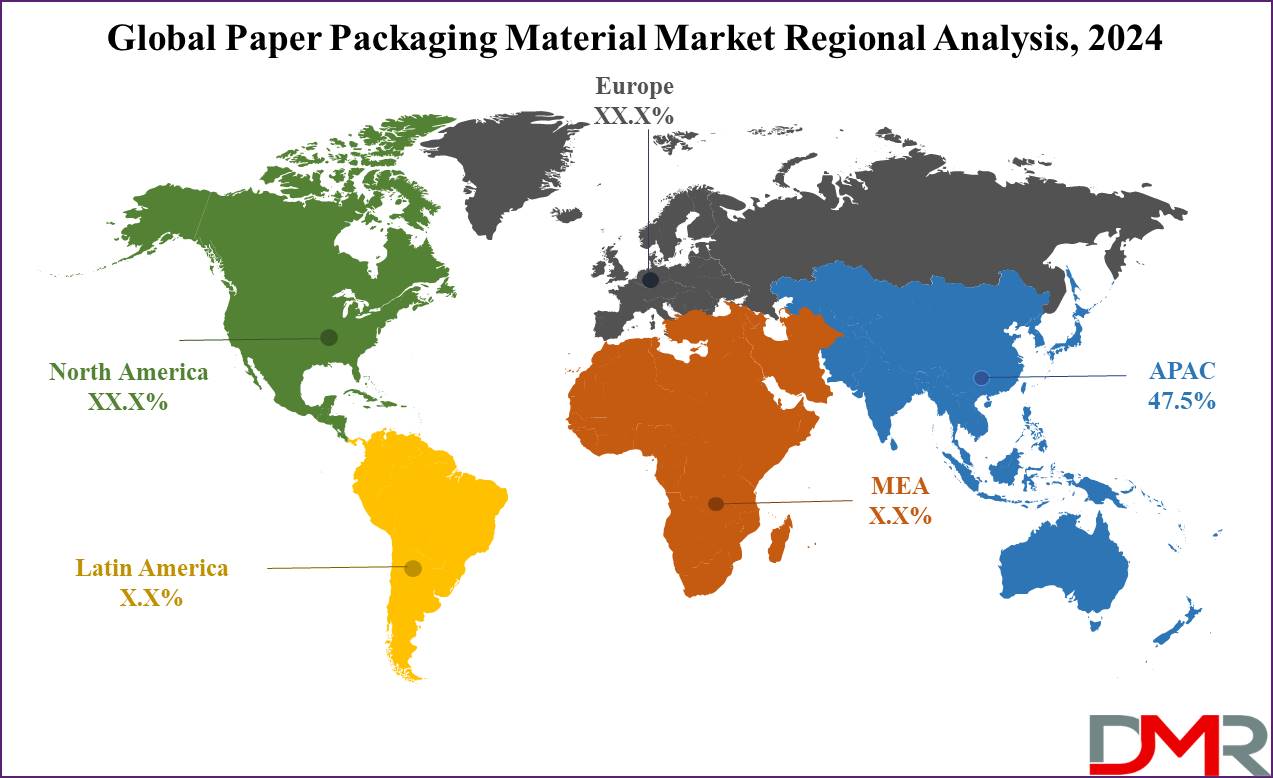

Regional Analysis

Asia Pacific is projected to stand as a dominant force in the global paper packaging material market as it

holds 47.5% of the market share in 2024 and is projected to show significant growth in the upcoming period of 2024 to 2033. The region's robust economic growth and urbanization have led to increased consumer demand for packaged goods, driving a higher need for packaging materials, including paper packaging. The sheer size of the population in Asia Pacific contributes to their elevated consumption levels, creating a substantial demand for packaging materials. The region's role as a manufacturing hub, with many multinational companies establishing facilities, has further boosted production and the demand for packaging materials.

The significant growth of e-commerce in Asia Pacific has driven a surge in demand for protective packaging solutions, including eco-friendly options like biodegradable paper packaging. Increasing environmental awareness, government initiatives promoting sustainable practices, and ongoing infrastructure investments have collectively shaped Asia Pacific’s dominance in the global paper packaging market. Key players in the industry have strategically invested and formed partnerships in the Asia Pacific to leverage the burgeoning market opportunities.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global paper packaging material market exhibits a dynamic competitive landscape shaped by key players such as International Paper Company, WestRock Company, Mondi Group, Smurfit Kappa Group, and DS Smith. These multinational companies maintain a significant market presence across diverse regions. The competitive landscape of the global paper packaging material market includes mergers and acquisitions driving industry consolidation, with large companies strategically acquiring smaller companies and new startups for expanded product offerings and market share.

The industry prioritizes innovation and sustainability, with a focus on developing environmentally friendly and cost-effective solutions. Geographical diversity is evident in this market, with companies emphasizing regional preferences and regulations. The rise of e-commerce has prompted a shift towards packaging tailored for online retail, emphasizing product protection and enhancing the consumer unboxing experience. Sustainability initiatives, technology adoption, and regulatory compliance are critical considerations shaping the competitive strategies of key players.

Some of the prominent players in the Global Paper Packaging Material Market are

- Georgia-Pacific Corporation

- DS Smith PLC

- Holmen AB

- International Paper Company

- Hood Packaging Corporation

- OJI Holding Corporation

- MeadWestvaco Corporation

- Stora Enso Oyj

- Smurfit Kappa Group Plc

- The Mayr-Melnhof Group

- Other Key Players

Recent Development

- In January 2023, Napco National Paper Products Company showcased its cutting-edge packaging solutions, including corrugated options, at the 2022 International Dates Conference & Exhibition in January 2023. The event unfolded at the Riyadh International Convention & Exhibition Center in Saudi Arabia.

- In December 2022, WestRock Company proudly finalized the acquisition of Grupo Gondi's remaining stake for USD 970 million, inclusive of debt. This strategic move encompasses four paper mills, nine corrugated packaging facilities, and six high graphic facilities spread across Mexico. These facilities are integral to the production of sustainable packaging tailored for diverse regional end markets. The acquisition solidifies WestRock's dominant presence in the burgeoning Latin American corrugated packaging, consumer goods, paperboard, and containerboard markets.

- In September 2022, Smurfit Kappa expanded its portfolio with the acquisition of PaperBox, a packaging plant located 70 km east of Rio de Janeiro in Saquarema. This strategic move positions the company to effectively address the growing demand for sustainable and innovative packaging solutions.

- In July 2022, Mondi collaborated with Fiorini International, a leading converter and packaging company based in Italy, to innovate a recyclable paper packaging solution for a premium Italian pasta brand. This groundbreaking pasta bag not only ensures effective communication of the brand and product-related information but also boasts exceptional runnability on filling equipment. Mondi's commitment to sustainability and functionality shines through in this successful venture.

- In April 2022, Billerud completed the acquisition of Verso, a leading coated paper producer, for a total value of US$ 825 million. This strategic acquisition reinforces Billerud's presence in the virgin paper and packaging material segments, solidifying its market position.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 419.9 Bn |

| Forecast Value (2033) |

USD 656.5 Bn |

| CAGR (2024-2033) |

5.1% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Grade (Carton Board, and Containerboard), By Material (Corrugated Board, Specialty Paper, Box-board/Carton Board, Kraft papers, and Molded Pulp), By Product (Liquid Packaging Cartons, Corrugated Cases, Cartons & Folding Boxes, and Others), By End User (Beverage Packaging, Food Packaging, Healthcare Packaging, Industrial Packaging, Tobacco Packaging, Personal Care & Toiletries, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Georgia-Pacific Corporation, DS Smith PLC, Holmen AB, International Paper Company, Hood Packaging Corporation, OJI Holding Corporation, MeadWestvaco Corporation, Stora Enso Oyj, Smurfit Kappa Group Plc, The Mayr-Melnhof Group, and Other Key Players |

| Purchase Options |

HVMN Inc., Thync Global Inc., Apple Inc., Fitbit Inc., TrackmyStack, OsteoStrong, The ODIN, Thriveport LLC, Muse, Moodmetric, and Other Key Players |

Frequently Asked Questions

The Global Paper Packaging Material Market size is projected to be estimated to have a value of USD 419.9 billion in 2024 and is expected to reach USD 656.5 billion by the end of 2033.

Asia Pacific is projected to be the largest market share for the Global Paper Packaging Material Market with a share of about 47.5% in 2024.

Some major key players in the Global Paper Packaging Material Market are Georgia-Pacific Corporation, DS Smith PLC, Holmen AB, and many others.

The market is growing at a CAGR of 5.1 percent over the forecasted period.