Market Overview

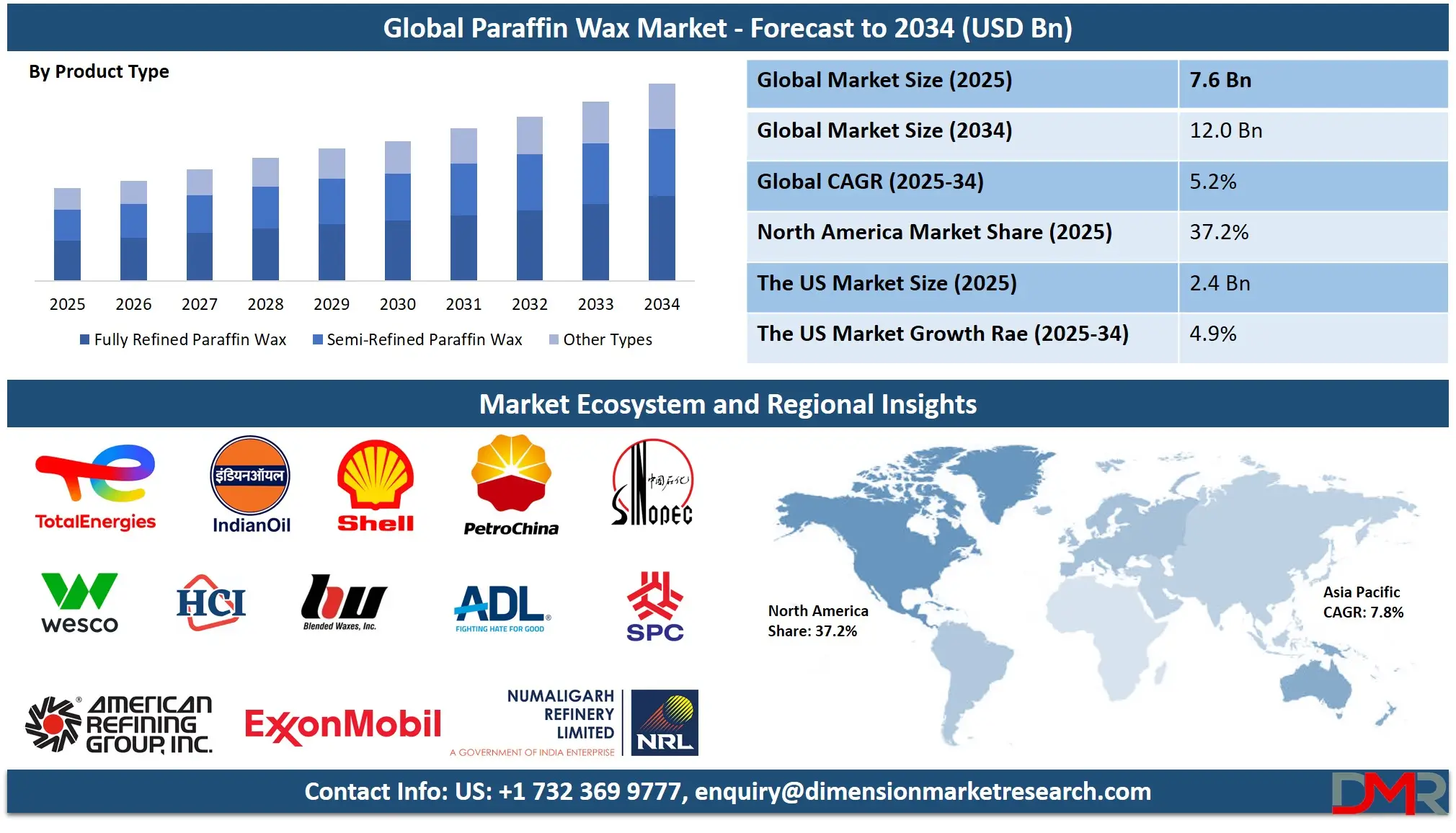

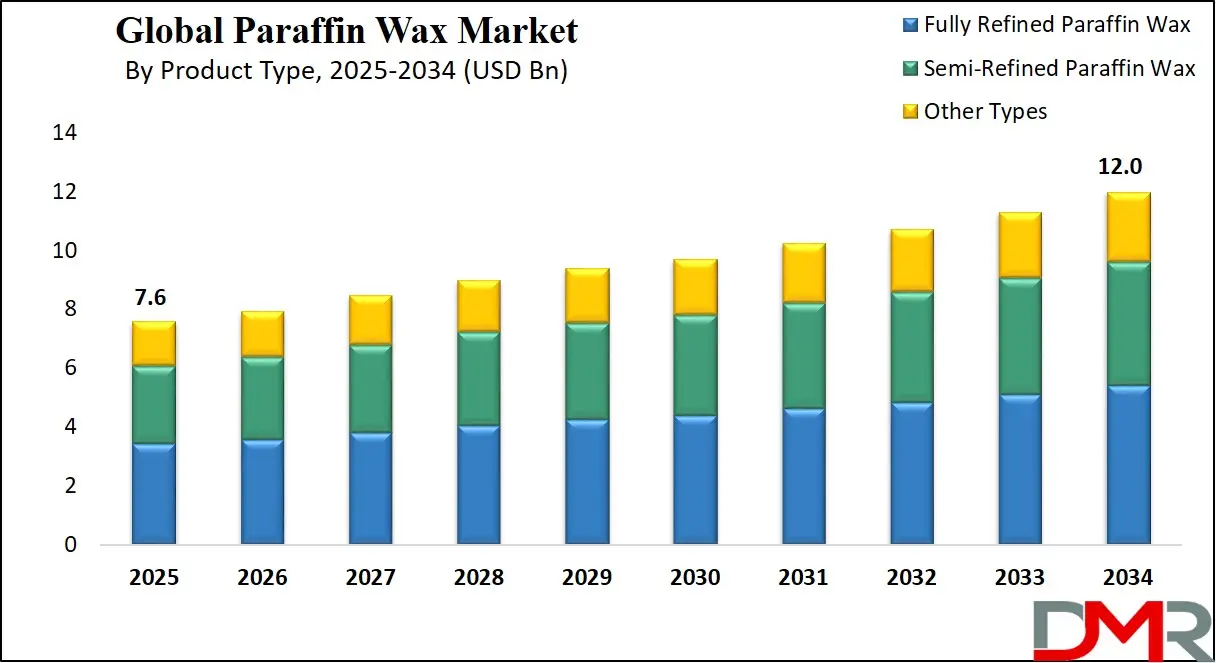

The Global Paraffin Wax Market is anticipated to reach USD 7.6 billion in 2025, driven by its widespread use in candle manufacturing, packaging, and cosmetics. The market is expected to expand at a steady compound annual growth rate (CAGR) of 5.2% from 2025 to 2034, reaching a projected value of USD 12.0 billion by 2034.

Growth is fueled by the increasing demand for cost-effective packaging solutions, rising consumption of candles for aesthetic and aromatic purposes, and the versatile applications of paraffin wax in cosmetics, personal care, and rubber industries. Additionally, expanding applications in board sizing and hot melt adhesives, coupled with the stable supply from petroleum refining, are expected to further support market expansion globally.

The global landscape for paraffin wax is characterized by its entrenched position as a versatile and economical material across multiple industries. A significant trend is the shift towards fully refined paraffin wax in high-purity applications such as cosmetics and food packaging, driven by stricter regulatory standards and consumer preference for quality. Concurrently, the candle industry remains the largest consumer, with paraffin wax favored for its excellent scent throw and burning properties.

However, the market is witnessing gradual competition from natural waxes like soy and beeswax, though paraffin's cost-effectiveness and performance ensure its continued dominance. The integration of recycled paraffin and efforts towards sustainable sourcing are also emerging, though these remain niche segments within the broader market.

The market's expansion is fueled by substantial opportunities in emerging economies, particularly in Asia Pacific, where rising disposable incomes are driving demand for candles, packaged goods, and personal care products. The packaging industry has become a major adopter, leveraging paraffin wax for its moisture resistance and sealing properties in flexible packaging and corrugated boards. Furthermore, ongoing developments in refining processes are enhancing the quality and applicability of paraffin wax, opening new avenues in specialty applications such as PVC lubrication and tire manufacturing. These innovations are poised to sustain demand despite environmental concerns and regulatory pressures.

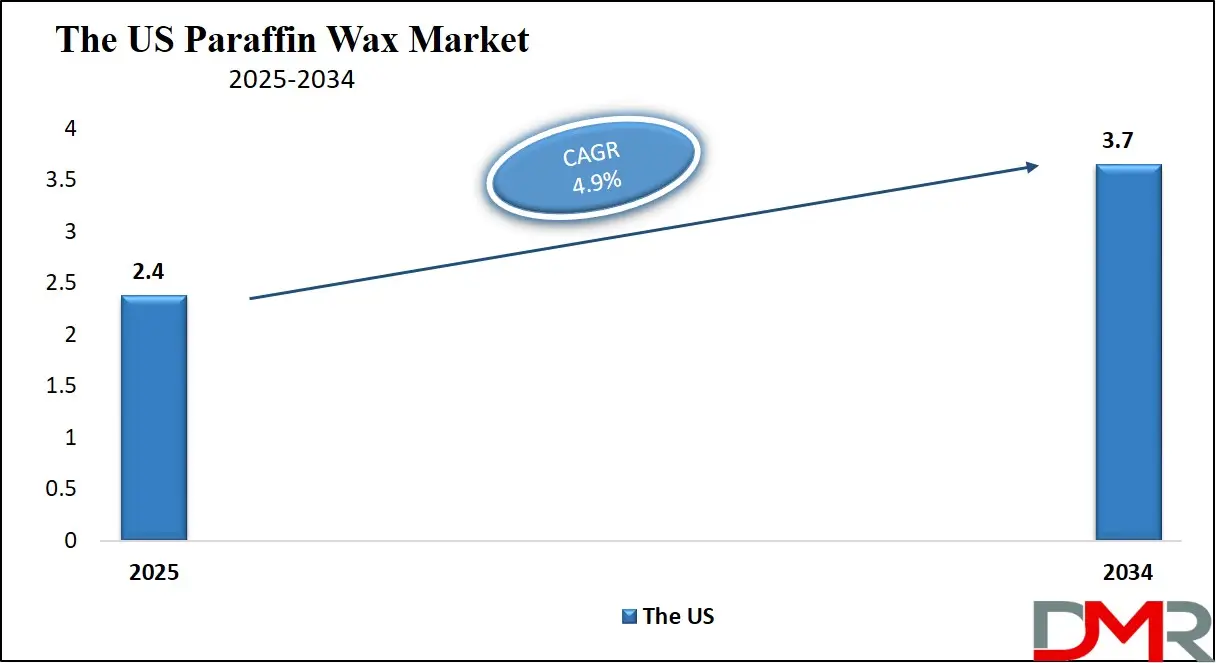

The US Paraffin Wax Market

The US Paraffin Wax Market is projected to reach USD 2.4 billion in 2025 at a compound annual growth rate of 4.9% over its forecast period.

The United States maintains a significant position in the global paraffin wax landscape, supported by well-established petroleum refining capacities and a robust industrial base. Agencies like the Environmental Protection Agency (EPA) and the Food and Drug Administration (FDA) provide regulatory oversight for applications in food contact and cosmetics, ensuring compliance with safety standards. The presence of major refiners and wax blenders ensures a steady supply of various paraffin wax grades, catering to diverse industrial needs. The country's strong manufacturing sector, particularly in candles, packaging, and adhesives, drives consistent domestic demand.

A key advantage for the U.S. market is its high per-capita consumption of candles and packaged goods, supported by cultural trends and a strong retail sector. The demand for scented and decorative candles remains robust, bolstering the paraffin wax market. Furthermore, the well-developed cosmetics and personal care industry utilizes paraffin wax in products like lip balms, creams, and lotions for its emollient properties. The industrial sector's reliance on hot melt adhesives and rubber processing also contributes to steady consumption. This diversified demand base, combined with efficient logistics and distribution networks, ensures the stability and gradual growth of the U.S. paraffin wax market.

The Europe Paraffin Wax Market

The Europe Paraffin Wax Market is estimated to be valued at USD 1.5 billion in 2025 and is further anticipated to reach USD 2.2 billion by 2034 at a CAGR of 4.0%.

The European paraffin wax ecosystem is characterized by stringent regulatory frameworks and a mature industrial base. The European Chemicals Agency (ECHA) and regulations such as REACH ensure that paraffin wax production and usage meet high environmental and safety standards. The region's strong focus on sustainability is driving interest in alternative waxes, but paraffin remains a key material due to its performance and cost efficiency. The packaging industry, particularly in Germany and France, is a major consumer, using paraffin for coating papers and boards to enhance water resistance. Support from regional policies promoting recycling and circular economy principles is influencing wax blending and reuse initiatives.

Europe's market dynamics are influenced by its advanced candle industry, where paraffin wax is valued for its superior burning qualities, despite growing niche demand for natural alternatives. The region's well-developed automotive and tire industries also utilize paraffin wax as a processing aid and anti-ozonant agent. The presence of a sophisticated cosmetics sector further drives demand for high-purity, fully refined grades. The combination of regulatory compliance, established end-use industries, and a focus on quality positions Europe as a stable and technologically advanced market for paraffin wax.

The Japan Paraffin Wax Market

The Japan Paraffin Wax Market is projected to be valued at USD 420 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 620 million in 2034 at a CAGR of 4.1%.

Japan's paraffin wax market is shaped by its highly developed and quality-conscious industrial sector. The country's stringent quality standards, enforced by authorities like the Ministry of Health, Labour and Welfare, ensure that paraffin wax used in cosmetics, food packaging, and pharmaceuticals meets strict purity requirements. Japan's advanced packaging industry relies on paraffin wax for functional coatings, while the candle market, though traditional, maintains steady demand for high-quality decorative and ceremonial candles. The presence of specialized chemical companies focusing on high-value wax blends supports market sophistication.

The demographic and industrial profile of Japan drives demand in specific applications. The aging population supports the pharmaceuticals and personal care sectors, where paraffin wax is used in ointments and lotions. The electronics packaging sector also utilizes specialized waxes for protective applications. Furthermore, Japan's focus on innovation and material science leads to the development of modified paraffin waxes for niche uses. This combination of high regulatory standards, advanced industry needs, and a focus on specialty applications positions Japan as a refined and stable market for paraffin wax.

Global Paraffin Wax Market: Key Takeaways

- Global Market Size Insights: The Global Paraffin Wax Market size is estimated to have a value of USD 7.6 billion in 2025 and is expected to reach USD 12.0 billion by the end of 2034.

- The Global Market Growth Rate: The market is growing at a CAGR of 5.2 percent over the forecasted period of 2025.

- The US Market Size Insights: The US Paraffin Wax Market is projected to be valued at USD 2.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 3.7 billion in 2034 at a CAGR of 4.9%.

- Regional Insights: North America is expected to have the largest market share in the Global Paraffin Wax Market with a share of about 37.2% in 2025.

- Key Players: Some of the major key players in the Global Paraffin Wax Market are ExxonMobil Corporation, Sasol Limited, PetroChina Company Limited, Sinopec Corp., Royal Dutch Shell plc, Nippon Seiro Co., Ltd., and many others.

Global Paraffin Wax Market: Use Cases

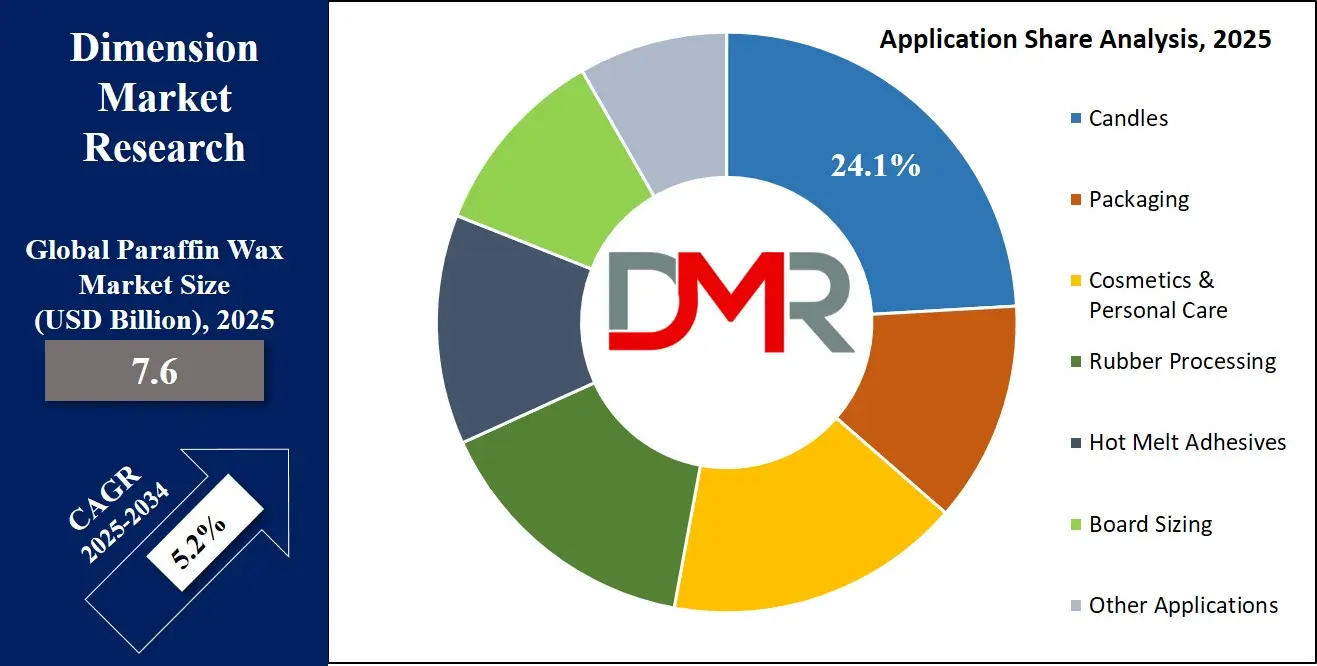

- Candle Manufacturing: Paraffin wax is the primary material for candle production due to its excellent burn quality, ability to hold fragrance and color, and cost-effectiveness, used for everything from simple tea lights to elaborate decorative candles.

- Packaging Coatings: In the packaging industry, paraffin wax is applied to papers, cartons, and corrugated boards to provide moisture resistance and durability, essential for protecting goods during storage and transportation.

- Cosmetics & Personal Care: Paraffin wax is used in creams, lip balms, and lotions for its emollient properties, forming a protective barrier on the skin to lock in moisture.

- Rubber Processing: In the rubber industry, paraffin wax is added as a processing aid and to protect finished rubber products from ozone cracking, extending their lifespan.

- Hot Melt Adhesives: Paraffin wax serves as a key component in hot melt adhesives, providing tackiness and flexibility for applications in packaging, woodworking, and product assembly.

Global Paraffin Wax Market: Stats & Facts

U.S. Energy Information Administration (EIA)

- U.S. refinery net production of waxes in 2024 was 2,159 thousand barrels.

- U.S. refinery net production of waxes in 2023 was 1,723 thousand barrels.

- Wax production increased by 25.3% from 2023 to 2024.

- EIA defines waxes (paraffin/hydrocarbon) as marketable waxes with a congealing point between 100°F and 200°F and a maximum oil content of 50 wt %.

United Nations Statistics Division (UNSD) – HS Classification

- HS heading 2712 covers “Petroleum jelly; paraffin wax, micro-crystalline petroleum wax, slack wax … other mineral waxes.”

UN COMTRADE / World Bank WITS (International Trade)

- Global exports of HS 2712 (petroleum jelly / paraffin wax family) were about USD 3.4 billion in 2023.

- Global imports of HS 2712 in 2023 totaled around USD 3.8 billion.

- For HS 271220 (“paraffin wax, containing < 0.75% oil”), China exported about USD 862.7 million in 2023.

- In 2023, major exporters of HS 271210 included India (USD 107.97 M), Germany (USD 72.14 M), the U.S. (USD 63.62 M), and the Netherlands (USD 44.78 M).

Aggregated UN Trade (Derived from COMTRADE)

- World exports of HS 2712 were approximately USD 3.42 billion in 2023 (depending on country reporting).

- World imports of HS 2712 were roughly USD 3.81 billion in 2023.

- The top exporter countries for paraffin wax group in 2023 include China, Germany, Netherlands, South Africa, and Malaysia (based on trade-flow data).

WITS / World Bank – Detailed Trade

- COMTRADE data via WITS confirms China as a leading exporter in HS 271220 subcategory with USD 862.7 M in exports in 2023.

India (via UN Trade Data)

- India imported approximately USD 191 million worth of HS 2712 goods in 2023.

- HS 2712 imports accounted for about 0.028% of India’s total import value in 2023.

Organisation for Economic Co-operation & Development / Eurostat

- Eurostat’s energy statistics manual explicitly includes paraffin and hydrocarbon waxes within energy-product trade classifications.

- Eurostat validates intra-EU trade in waxes using trade-mirroring checks, underscoring paraffin wax’s inclusion in formal trade surveillance.

European Chemicals Agency (ECHA) / REACH

- Paraffin waxes (petroleum) are listed in ECHA/REACH registries (example EC/CAS identifier: 232-315-6, CAS 8002-74-2).

- The ECHA public registration dossiers show tonnage-band usage, hazard assessments, and commercial registrations for paraffin wax under REACH.

U.S. Environmental Protection Agency (EPA)

- EPA’s Substance Registry System lists paraffin wax (petroleum) as a distinct chemical substance.

- Paraffin wax with CAS 8002-74-2 appears on the U.S. TSCA inventory, indicating its active commercial status.

Japan: Mineral Industry (USGS / Mineral Yearbook)

- Japan had 21 petroleum refineries at the end of 2021, according to USGS data, indicating its potential capacity for wax production and refining.

Classification & Regulatory Notes

- National and international tariff schedules place paraffin wax under HS code 2712, with more granular 6-digit splits (e.g. 271210, 271220), used by statistical agencies.

Data Coverage and Caveats

- There is significant year-on-year volatility in HS 2712 trade totals in UN datasets, due to differences in country coverage, reporting, and data revisions.

Global Paraffin Wax Market: Market Dynamic

Driving Factors in the Global Paraffin Wax Market

Growth in Packaging and Candle Industries

The paraffin wax market is significantly driven by the rapid growth of the packaging sector, supported by global expansion in e-commerce, retail distribution, and food delivery ecosystems. Paraffin wax continues to be preferred for its excellent barrier properties, moisture resistance, and affordability compared to bio-based or synthetic alternatives. Additionally, the candle industry remains a major consumption segment due to rising demand for scented, decorative, and aromatherapy candles across households, spas, and wellness centers. Seasonal and festive demand further boosts consumption. Together, these industries create steady, long-term demand, reinforcing paraffin wax as a versatile and cost-efficient raw material.

Stable Supply from Petroleum Refining

Paraffin wax benefits from a predictable supply cycle as it is derived primarily as a by-product of petroleum refining. As global crude oil production stabilizes across major producing regions, refiners maintain consistent output of wax intermediates such as slack wax and scale wax. This ensures a secure and cost-effective feedstock supply for paraffin wax manufacturers. Additionally, refining expansions in Asia and the Middle East strengthen availability. Although long-term shifts toward renewable energy may impact petroleum flows, current refinery operations still support steady production levels, offering predictable supply chains and minimizing short-term volatility for downstream paraffin wax processors.

Restraints in the Global Paraffin Wax Market

Environmental and Regulatory Pressures

Growing environmental concern over fossil fuel–derived products places paraffin wax under scrutiny, particularly as industries shift toward biodegradable and sustainable materials. Regulations targeting non-biodegradable packaging, carbon emissions, and petrochemical derivatives increasingly influence purchasing decisions across cosmetics, packaging, and consumer goods sectors. Bio-based waxes such as soy, beeswax, and palm wax are gaining traction as greener substitutes, intensifying competitive pressure. Some regions are also imposing restrictions on petrochemical waste and encouraging eco-friendly labeling standards. These regulatory and environmental pressures pose challenges to long-term growth, pushing manufacturers to innovate or diversify toward cleaner wax alternatives and environmentally aligned formulations.

Volatility in Raw Material Prices

Since paraffin wax production is closely tied to crude oil refining, fluctuations in global oil prices directly influence the cost of wax feedstocks. Geopolitical tensions, OPEC+ production cuts, refinery outages, and economic uncertainty can rapidly disrupt pricing stability. This volatility creates planning difficulties for manufacturers, particularly in contract pricing, inventory management, and profit margin forecasting. Sudden cost increases ripple across downstream industries such as packaging, cosmetics, and candles, reducing competitiveness compared to stable-priced alternatives like synthetic or vegetable-based waxes. Persistent raw material instability forces businesses to adopt risk mitigation strategies, diversify supply sources, or adjust pricing models.

Opportunities in the Global Paraffin Wax Market

Expansion in Emerging Economies

Rapid urbanization, industrial expansion, and rising disposable incomes across Asia Pacific and Latin America present robust opportunities for paraffin wax applications. Growing consumer spending in candles, cosmetics, personal care, and packaged goods fuels increased wax consumption. Industrial sectors particularly construction, rubber, textiles, and coatings are also expanding, driving higher demand for paraffin-based additives. Additionally, emerging economies are increasing their refining capacities, strengthening regional supply chains and reducing dependency on imports. Favorable demographics, growing retail penetration, and a shift toward westernized lifestyle trends further contribute to long-term market potential, making developing regions high-priority targets for paraffin wax producers and exporters.

Development of Specialty and Modified Waxes

Innovation in specialty and modified paraffin wax formulations offers significant opportunity to tap into high-value segments. Techniques such as hydrogenation, blending, polymer modification, and micro-structuring create waxes with enhanced purity, stability, melting points, and performance characteristics. These advanced grades enable new applications in pharmaceuticals, high-end cosmetics, engineered packaging, industrial coatings, inks, adhesives, and PVC processing. Specialty waxes also cater to niche requirements, including odorless, food-contact-safe, or medical-grade products. As industries demand superior performance materials, manufacturers that invest in R&D and advanced refining technologies can capture premium pricing and expand their presence in innovation-driven markets.

Trends in the Global Paraffin Wax Market

Shift Towards Fully Refined Grades

The market is experiencing a notable transition toward fully refined paraffin wax, particularly for applications requiring high purity and stringent safety standards. Industries such as pharmaceuticals, personal care, cosmetics, and food packaging increasingly prefer fully refined wax due to its low oil content, clean-burning properties, and consistent quality. The rise of premium candles and therapeutic aromatherapy products has further fueled demand for high-purity grades. Additionally, international quality certifications and health regulations motivate manufacturers to adopt fully refined wax to meet global compliance requirements. This shift reflects a broader movement toward higher-value, specialized wax formulations across industrial and consumer sectors.

Sustainability and Recycling Initiatives

Sustainability is shaping the paraffin wax market as manufacturers and end-users explore recycling, waste reduction, and circular economy practices. Efforts are underway to recover and repurpose wax from industrial coatings, packaging, candle residues, and textile applications. Although still developing, closed-loop recycling systems in candle manufacturing and packaging sectors are gaining traction. Environmental regulations also encourage exploration of hybrid solutions, where paraffin is blended with biodegradable or bio-based waxes to reduce the carbon footprint. Growing consumer awareness about eco-friendly products is pushing companies to adopt sustainable sourcing strategies, invest in greener technologies, and promote environmentally responsible wax usage.

Global Paraffin Wax Market: Research Scope and Analysis

By Product Type Analysis

The Fully Refined Paraffin Wax segment is anticipated to command a substantial share of the global market due to its high purity, low oil content, and exceptional performance characteristics. Fully refined grades typically contain less than 0.5% oil, making them ideal for industries where product safety, consistency, and cleanliness are essential. These include cosmetics, pharmaceuticals, personal care, and food-contact packaging applications, where regulatory standards are increasingly strict. Its odorless, colorless, and stable nature ensures suitability for premium-grade candles, medical ointments, chewing gum bases, and food coating materials. As global consumers gravitate toward higher-quality and clean-label products, manufacturers prefer fully refined wax to meet safety certifications and international compliance requirements. The growth of the wellness and aromatherapy sectors further strengthens demand, with the premium candle industry emphasizing cleaner-burning, soot-free formulations that fully refined wax provides.

The Semi-Refined Paraffin Wax segment remains widely utilized due to its cost-effectiveness and versatility across mainstream industrial and commercial applications. With higher oil content compared to fully refined grades, semi-refined wax is suitable for candles, matches, paper coating, waterproofing materials, and textile treatments. Its affordability makes it the preferred choice for mass-market candles, especially in emerging economies where the decorative and religious candle industry is expanding rapidly. Additionally, packaging industries continue to rely on semi-refined wax for corrugated box coatings, food wraps, and industrial packaging solutions. Its balance between performance and cost positions it as a vital segment supporting large-scale consumption across global manufacturing industries.

By Application Analysis

The Candles segment represents the largest and most influential application area within the global paraffin wax market, driven by strong worldwide demand for decorative, aromatic, religious, and therapeutic candles. Paraffin wax remains the most widely used raw material in the candle industry due to its excellent burning characteristics, high fragrance retention, and ability to hold vibrant colors. The rise of aromatherapy, home fragrance trends, wellness routines, and aesthetic interior décor has significantly expanded the premium candle market. Seasonal demand surges particularly during holidays, festivals, and cultural celebrations further boost consumption. In developing economies, candles also maintain essential utility roles, supporting consistent market volume. The shift toward luxury scented candles in North America and Europe continues to reinforce paraffin wax consumption, even as alternative waxes emerge.

The Packaging segment is another vital and fast-growing application, supported by global expansion in e-commerce, food delivery ecosystems, and industrial shipping. Paraffin wax is widely used as a moisture barrier, grease-resistant coating, and protective layer in corrugated boxes, paperboards, flexible packaging, and food-contact wraps. Its ability to enhance water resistance and structural durability makes it indispensable in agricultural packaging, frozen food transport, and bulk storage applications. As supply chains demand stronger, more durable, and cost-effective packaging solutions, paraffin wax coatings remain a practical choice. Growth in developing regions, where wax-coated packaging is commonly used for perishables and industrial goods, also contributes significantly to market expansion. Continuous innovation in wax-modified packaging materials further strengthens the segment’s long-term outlook.

The Global Paraffin Wax Market Report is segmented on the basis of the following:

By Product Type

- Fully Refined Paraffin Wax

- Semi-Refined Paraffin Wax

- Other Types

By Application

- Candles

- Packaging

- Cosmetics & Personal Care

- Rubber Processing

- Hot Melt Adhesives

- Board Sizing

- Other Applications

Impact of Artificial Intelligence in the Global Paraffin Wax Market

- AI-Driven Production Optimization: Artificial intelligence enhances paraffin wax manufacturing by optimizing refining temperatures, energy usage, and feedstock selection. AI-enabled predictive systems minimize waste, increase process efficiency, and ensure consistent product quality, enabling manufacturers to improve yields and reduce overall production costs.

- Predictive Maintenance in Refineries: AI-powered predictive maintenance systems analyze equipment performance, vibration patterns, and operational anomalies to prevent unexpected downtime. This reduces repair costs, extends machinery lifespan, and ensures uninterrupted paraffin wax production, supporting stable supply chains for industrial and commercial end users.

- AI-Based Quality Monitoring Systems: Artificial intelligence improves quality assurance by detecting impurities, analyzing oil content, and identifying inconsistencies in wax structure using automated imaging and sensors. Real-time digital monitoring ensures fully refined and semi-refined wax meet strict cosmetic, packaging, and food-grade standards.

- Enhanced Supply Chain Forecasting: AI algorithms forecast demand across candles, packaging, cosmetics, and industrial sectors with high accuracy. This helps producers optimize inventory, allocate resources effectively, manage shipping routes, and reduce logistical inefficiencies throughout the global paraffin wax supply chain.

- Sustainability and Emission Reduction Insights: AI supports sustainability by modeling carbon emissions, optimizing energy consumption, and identifying eco-friendly refining pathways. It also helps develop cleaner wax blends and improves regulatory compliance, enabling manufacturers to lower environmental footprints and align with global green initiatives.

Global Paraffin Wax Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to holds the 37.2% revenue share in the Global Paraffin Wax Market, driven by its well-established candle, packaging, cosmetics, and pharmaceutical industries. The U.S. remains the dominant contributor, supported by high consumption of scented and decorative candles, strong demand from personal care manufacturers, and robust industrial usage in rubber, coatings, and adhesives. The region benefits from steady availability of petroleum-based feedstock, advanced refining infrastructure, and stringent quality standards that favor fully refined paraffin wax.

Additionally, the growing popularity of home fragrances, aromatherapy products, and premium candle brands significantly boosts market growth. North America’s strong retail network, e-commerce adoption, and seasonal demand surges especially during holidays and festivals further strengthen its market dominance. Technological advancements in wax modification, packaging applications, and sustainable production processes also contribute to the region’s consistently high revenue share.

Region with the Highest CAGR

The Asia Pacific region is expected to register the highest CAGR in the global paraffin wax market due to rapid industrialization, expanding manufacturing bases, and rising consumer spending across emerging economies. Countries like China, India, South Korea, and Indonesia are major contributors, driven by large-scale production and consumption of candles, packaging materials, cosmetics, textiles, and rubber goods. The region benefits from abundant petroleum refining operations, enhancing raw material availability and cost competitiveness. Growing urban populations, increasing demand for packaged foods, and expansion of e-commerce logistics further accelerate wax-coated packaging applications. Additionally, cultural and religious candle usage in India and Southeast Asia supports strong domestic consumption. Asia Pacific’s dynamic export markets, low production costs, and continuous investment in specialty wax development position it as the fastest-growing region throughout the forecast period.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Paraffin Wax Market: Competitive Landscape

The Global Paraffin Wax Market is characterized by a mix of integrated petroleum refiners, specialty chemical manufacturers, and regional wax processors competing across purity grades, application-specific formulations, and long-term supply reliability. Major players such as ExxonMobil, Sinopec, PetroChina, Shell, and Sasol dominate the fully refined and semi-refined wax segments due to their large-scale refining capacities and vertically integrated operations. Their control over crude oil feedstock and advanced hydrotreating technologies allows them to consistently supply high-purity waxes to premium industries like cosmetics, pharmaceuticals, food packaging, and high-performance candles. These companies continuously invest in upgrading refining units, improving oil removal processes, and expanding automated quality control systems to enhance product consistency.

Regional players including Hengshui Fangkun, Indian Oil Corporation, and ADL Wax focus on cost-effective production for applications such as industrial packaging, board coatings, matches, textiles, and mass-market candles. Many manufacturers are shifting toward specialty wax blends, microcrystalline wax alternatives, and modified formulations to meet evolving performance requirements in adhesives, construction materials, and rubber processing. Competition is intensifying due to the emergence of sustainable and bio-based wax producers, pushing market leaders to explore hybrid wax solutions that combine petroleum-based properties with renewable components.

Some of the prominent players in the Global Paraffin Wax Market are:

- ExxonMobil Corporation

- Sinopec (China Petroleum & Chemical Corporation)

- PetroChina Company Limited

- Royal Dutch Shell

- Sasol Limited

- TotalEnergies SE

- Indian Oil Corporation Ltd.

- ADL Wax

- Numaligarh Refinery Limited (NRL)

- Hengshui Fangkun Wax Industry

- Shanghai Petrochemical Company

- Blended Waxes, Inc.

- WAXCO International

- Sonneborn LLC

- American Refining Group

- Calumet Specialty Products Partners

- HCI Wax

- Kerax Limited

- Nippon Seiro Co., Ltd.

- Gandhar Oil Refinery India Ltd.

- Other Key Players

Recent Developments in the Global Paraffin Wax Market

- May 2024: ExxonMobil Corporation announces a USD 300 million investment to expand paraffin wax production capacity at its Singapore refinery, targeting increased Asian market demand.

- April 2024: Sasol Limited and Sinopec Corp. form a strategic collaboration to develop specialized high-melt-point paraffin wax products for the packaging and adhesives sectors.

- March 2024: The International Petrochemical Conference (IPC) in San Antonio features dedicated sessions on paraffin wax market trends and sustainability challenges.

- February 2024: PetroChina Company Limited completes acquisition of a major Indonesian paraffin wax blender, expanding its Southeast Asian distribution network.

- January 2024: The European Wax Federation hosts "Wax Forum 2024" in Brussels, focusing on regulatory compliance and bio-alternatives impacting paraffin wax markets.

- December 2023: Royal Dutch Shell plc inaugurates new paraffin wax production line at its Pernis refinery in the Netherlands, incorporating advanced purification technology.

- November 2023: Nippon Seiro Co., Ltd. launches a new range of fully refined food-grade paraffin waxes compliant with updated FDA and EU food contact regulations.

- October 2023: The "Global Wax Conference" in Dubai showcases innovations in paraffin wax applications and recycling technologies, with participation from 45 countries.

- September 2023: International Group, Inc. and Calumet Specialty Products Partners announce a joint venture to optimize paraffin wax supply chains across North American markets.

- August 2023: BASF SE introduces new modified paraffin wax formulations for hot melt adhesives, offering enhanced thermal stability and bonding performance.

- July 2023: India's Reliance Industries Limited expands paraffin wax exports to African markets, leveraging competitive pricing and strategic shipping routes.

- June 2023: The "Asian Wax Summit" in Shanghai addresses supply chain challenges and emerging opportunities in paraffin wax recycling and circular economy initiatives.

- May 2023: HollyFrontier Corporation completes modernization of its paraffin wax production facilities in Utah, increasing output efficiency by 18%.

- April 2023: A collaboration between MIT and industrial partners results in patented technology for reducing oil content in semi-refined paraffin wax, improving product quality.

- March 2023: The National Candle Association's annual exposition in Chicago highlights innovations in paraffin wax blends for enhanced fragrance retention in candles.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 7.6 Bn |

| Forecast Value (2034) |

USD 12.0 Bn |

| CAGR (2025–2034) |

5.2% |

| The US Market Size (2025) |

USD 2.4 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product Type (Fully Refined Paraffin Wax, Semi-Refined Paraffin Wax, Other Types), By Application (Candles, Packaging, Cosmetics & Personal Care, Rubber Processing, Hot Melt Adhesives, Board Sizing, Other Applications) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

ExxonMobil Corporation, Sinopec (China Petroleum & Chemical Corporation), PetroChina Company Limited, Royal Dutch Shell, Sasol Limited, TotalEnergies SE, Indian Oil Corporation Ltd., ADL Wax, Numaligarh Refinery Limited (NRL), Hengshui Fangkun Wax Industry, Shanghai Petrochemical Company, Blended Waxes Inc., WAXCO International, Sonneborn LLC, American Refining Group, Calumet Specialty Products Partners, HCI Wax, Kerax Limited, Nippon Seiro Co. Ltd., Gandhar Oil Refinery India Ltd., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Paraffin Wax Market size is estimated to have a value of USD 7.6 billion in 2025 and is expected to reach USD 12.0 billion by the end of 2034.

The market is growing at a CAGR of 5.2 percent over the forecasted period of 2025.

The US Paraffin Wax Market is projected to be valued at USD 2.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 3.7 billion in 2034 at a CAGR of 4.9%.

North America is expected to have the largest market share in the Global Paraffin Wax Market with a share of about 37.2% in 2025.

Some of the major key players in the Global Paraffin Wax Market are ExxonMobil Corporation, Sasol Limited, PetroChina Company Limited, Sinopec Corp., Royal Dutch Shell plc, Nippon Seiro Co., Ltd., and many others.