Market Overview

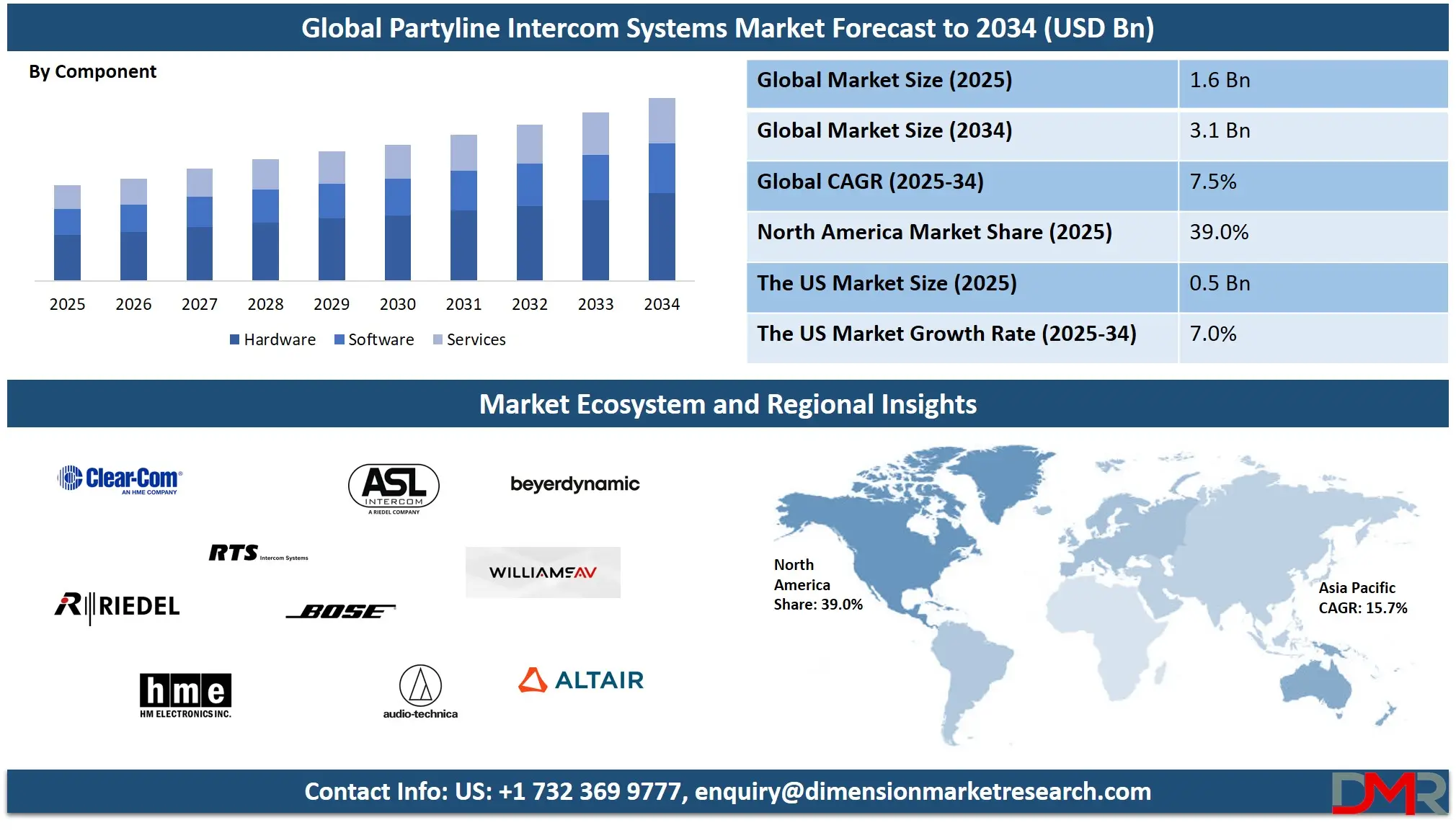

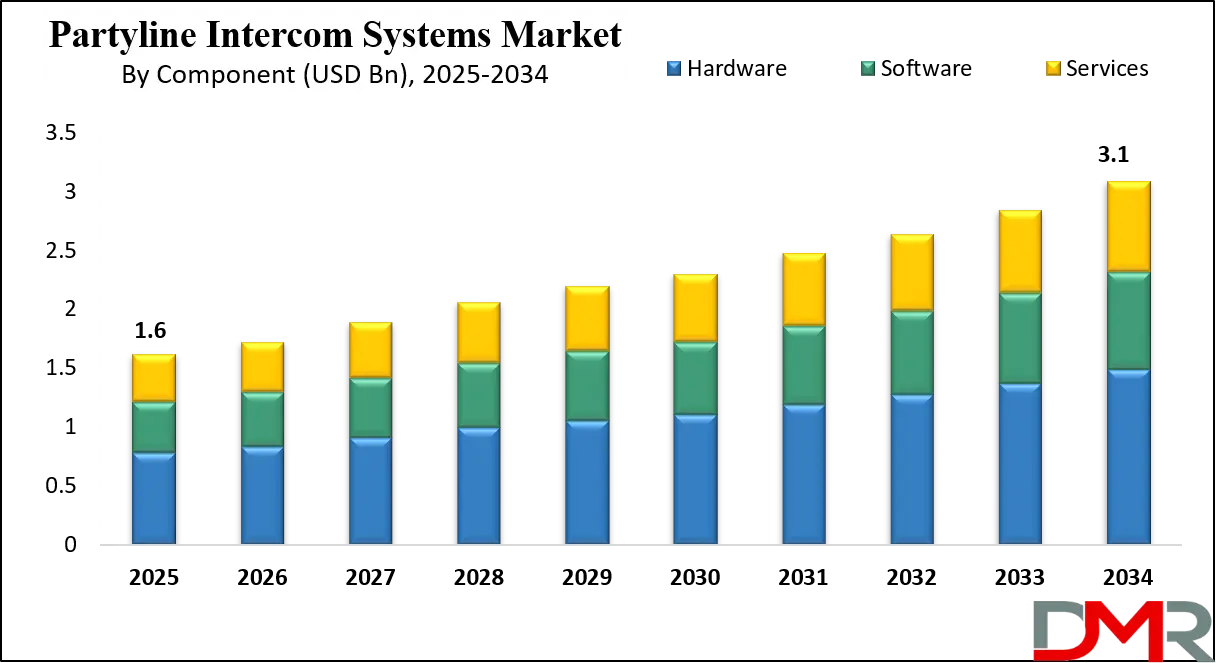

The global Partyline Intercom Systems market was valued at USD 1.6 billion in 2025 and is projected to reach USD 3.1 billion by 2034, growing at a CAGR of 7.5%, driven by rising demand for professional communication systems, broadcast intercom solutions, and real time coordination across media, live events, industrial, and security applications.

Partyline Intercom Systems are multi user communication systems that allow several participants to share a common audio channel, enabling real time, hands free voice communication within a closed network. In these systems, every connected user can hear and speak to others on the same line simultaneously, making them ideal for environments that require instant coordination and minimal latency. Partyline intercoms are widely used in broadcast studios, live events, theaters, industrial operations, and security control rooms due to their simplicity, reliability, and ease of deployment. They can be configured as wired or wireless setups and typically consist of master stations, belt packs, headsets, and control interfaces designed for continuous operational use.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global Partyline Intercom Systems market represents the worldwide demand and supply ecosystem for these communication solutions across professional, commercial, and institutional applications. The market is driven by the growing need for uninterrupted internal communication in media production, live event management, transportation hubs, and mission critical environments. Increasing investments in broadcast infrastructure, expansion of large scale entertainment venues, and rising adoption of professional communication equipment in industrial facilities are contributing to steady market growth. Technological advancements such as digital audio processing, improved wireless reliability, and integration with IP based communication networks are further enhancing system performance and scalability.

From a global perspective, the market is shaped by varying adoption patterns across regions, influenced by infrastructure maturity, regulatory standards, and industry concentration. Developed regions exhibit strong demand from established media and defense sectors, while emerging economies are witnessing increased uptake due to urbanization, expansion of public infrastructure, and growth in live entertainment and corporate facilities. The global Partyline Intercom Systems market also reflects a shift toward flexible and modular solutions that support mobility, interoperability, and long term operational efficiency, positioning it as a critical segment within the broader professional audio and communication systems industry.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Partyline Intercom Systems Market

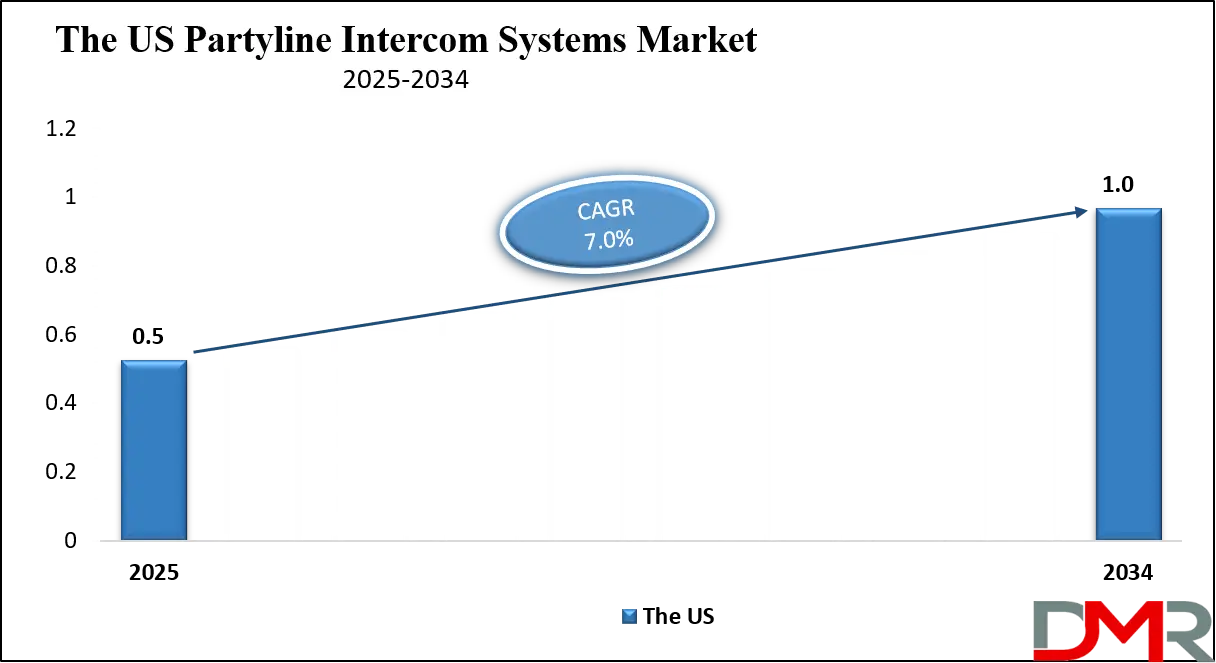

The U.S. Partyline Intercom Systems market size was valued at USD 0.5 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 1.0 billion in 2034 at a CAGR of 7.0%.

The US Partyline Intercom Systems market is characterized by strong adoption across broadcast media, live event production, defense operations, and large scale commercial facilities where real time voice communication is mission critical. The presence of a mature media and entertainment industry, including television studios, sports broadcasting networks, and event production companies, continues to drive consistent demand for professional intercom systems. High emphasis on operational reliability, low latency communication, and audio clarity has sustained the use of wired and digital partyline intercom solutions across studios and fixed installations. In addition, government agencies, public safety departments, and transportation authorities in the US rely on partyline communication systems for coordinated operations in control rooms and command centers.

Market growth in the United States is further supported by technological upgrades and replacement demand, as organizations transition from legacy analog systems to advanced digital and wireless intercom platforms. Integration with IP based communication networks, improved spectrum efficiency, and enhanced system scalability are encouraging adoption across industrial facilities and corporate environments. The increasing frequency of large live events, expansion of smart infrastructure, and growing investment in defense communication systems are also contributing to market expansion. Overall, the US Partyline Intercom Systems market reflects a stable yet innovation driven landscape, supported by strong purchasing power, established system integrators, and continuous advancements in professional audio communication technologies.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Partyline Intercom Systems Market

The Europe Partyline Intercom Systems market is projected to reach approximately 40 million USD in 2025, reflecting steady demand from key end-user segments such as broadcast and media production, live events, industrial operations, and corporate enterprises. The region’s mature media and entertainment infrastructure, including television networks, production studios, and performance venues, drives consistent adoption of wired and wireless partyline intercom solutions. Organizations in Europe increasingly rely on these systems for real-time coordination, low latency communication, and reliable audio transmission to ensure smooth operations in both permanent installations and temporary setups.

The market in Europe is further supported by ongoing technological advancements and digital transformation initiatives. Adoption of IP-based intercom platforms, cloud-enabled management systems, and wireless communication technologies is enabling users to improve scalability, flexibility, and operational efficiency. Additionally, the presence of strong system integrators and distributors helps smaller enterprises implement customized communication solutions, further boosting market growth. With a projected CAGR of 7.0%, the European market reflects a stable and innovation-driven landscape, underpinned by increasing investment in professional communication systems across multiple industries.

Japan Partyline Intercom Systems Market

The Japan Partyline Intercom Systems market is projected to reach approximately 3.6 million USD in 2025, driven by growing demand from broadcast studios, live event venues, transportation hubs, and industrial facilities. Japanese media and entertainment organizations, including television networks and production companies, rely on partyline intercom systems for real-time coordination, seamless audio transmission, and low latency communication during live broadcasts and recordings. Additionally, industries such as manufacturing and logistics are increasingly adopting these systems to ensure efficient operational communication and safety across production floors and control centers.

Market growth in Japan is supported by technological upgrades and the adoption of digital and wireless intercom solutions that offer improved mobility, flexibility, and integration with IP-based communication networks. Companies are also investing in modernizing legacy analog systems to enhance scalability and reliability for professional use. With a projected CAGR of 6.8%, the Japanese market demonstrates steady expansion, fueled by increasing deployment in media, industrial, and transportation sectors, as well as growing emphasis on operational efficiency and real-time collaboration across organizations.

Global Partyline Intercom Systems Market: Key Takeaways

- Steady Global Market Growth: The market is projected to grow from USD 1.6 billion in 2025 to USD 3.1 billion by 2034 at a CAGR of 7.5%, driven by rising demand for professional communication systems in broadcast, live events, industrial, and security applications.

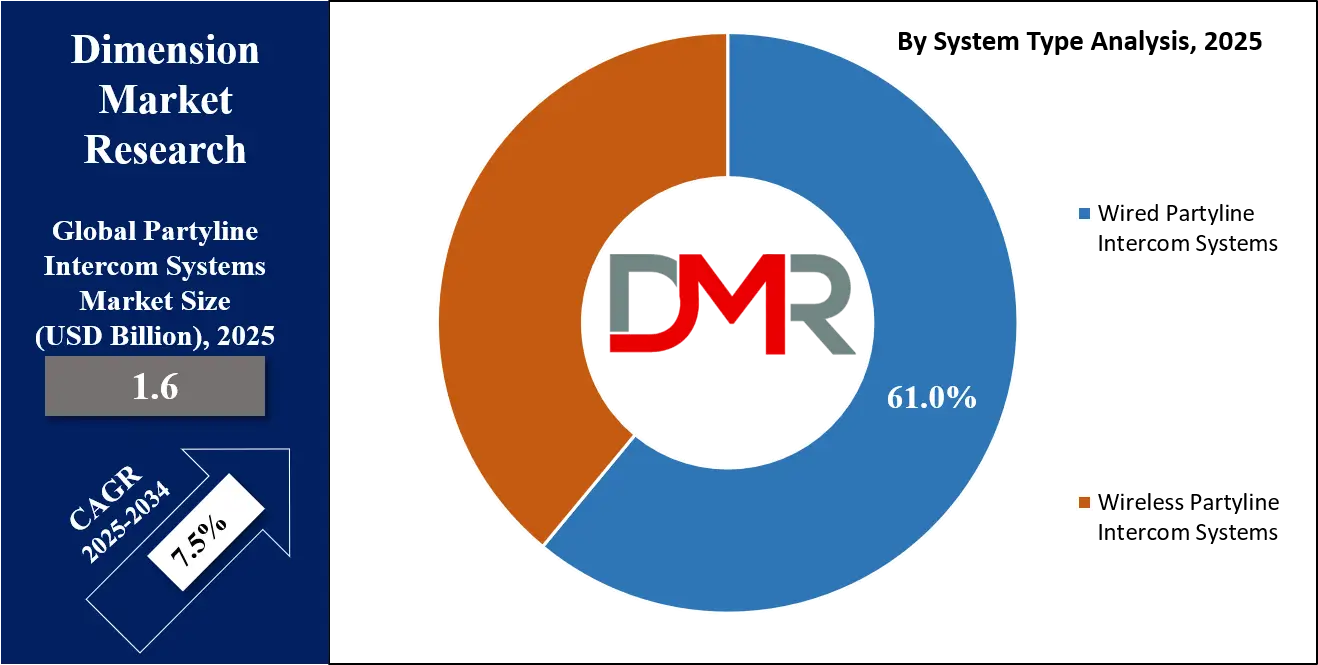

- Wired Systems Dominate, Wireless Expanding: Wired partyline intercoms lead with reliability and low latency, capturing most of the market, while wireless solutions are rapidly growing due to mobility, flexibility, and adoption in dynamic venues like concerts and live productions.

- Software and AI Integration Rising: Software platforms and AI-enabled features such as intelligent audio routing, noise suppression, and predictive diagnostics are enhancing system performance, scalability, and user experience across professional and industrial setups.

- Regional Insights: North America leads with 39% of global revenue due to mature media, defense, and corporate sectors, while Asia-Pacific shows fastest growth, driven by industrial expansion, live events, and increasing adoption of IP-based intercom platforms.

- Key End-Users and Applications: Media & entertainment dominate adoption, followed by corporate and industrial sectors. Critical applications include broadcast studios, live events, industrial floors, and transportation control centers requiring real-time, low-latency communication.

Global Partyline Intercom Systems Market: Use Cases

- Broadcast and Media Production: Partyline intercom systems enable real time communication among directors, camera crews, and technical teams in broadcast studios. These systems ensure smooth coordination, low latency audio, and reliable communication during live and recorded productions.

- Live Events and Theatre: In concerts and theatre productions, partyline intercom solutions support quick coordination between stage managers, lighting, and sound crews. Wireless systems are commonly used for mobility and uninterrupted backstage communication.

- Industrial and Manufacturing Operations: Industrial facilities use partyline intercom systems for hands free communication across production floors and control rooms. These systems improve safety, operational efficiency, and emergency response.

- Transportation and Infrastructure Control: Partyline intercom systems support communication in airports, rail networks, and control centers. They enable coordinated operations, incident management, and real time decision making in public infrastructure environments.

Impact of Artificial Intelligence on the global Partyline Intercom Systems market

The impact of artificial intelligence (AI) on the global Partyline Intercom Systems market is reshaping how professional communication systems operate and deliver value across industries. AI-enabled features such as noise suppression, voice recognition, and intelligent audio routing are improving clarity and reducing interference in multi-user communication environments. These enhancements allow systems to adapt in real time to complex acoustic conditions, which is especially valuable in live broadcast, theatre productions, and industrial settings where clear voice communication is critical. AI also enables predictive system diagnostics, helping organizations identify performance issues before they affect operations and reducing downtime for maintenance.

Beyond audio quality improvements, AI is accelerating the integration of partyline intercom solutions with broader IP-based communication networks and smart infrastructure platforms. Machine learning algorithms can optimize bandwidth usage, prioritize critical communication channels, and support automated channel assignment based on user roles or situational needs. In control centers, transportation hubs, and security operations, AI-driven analytics provide insights on communication patterns that improve operational coordination and emergency response. As a result, the market is evolving from traditional walkie talkie style communication toward intelligent, adaptive intercom ecosystems that enhance efficiency, reliability, and user experience across global applications.

Global Partyline Intercom Systems Market: Stats & Facts

ITU – International Telecommunication Union

- 2025 edition shows almost three‑quarters of the world’s population are now online, highlighting widespread global digital connectivity expansion.

- 2.2 billion people remain offline, primarily in low and middle income countries, underscoring connectivity gaps relevant to communications ecosystem planning.

- 5G now reaches more than half of the global population and accounts for more than one third of all mobile broadband subscriptions, illustrating global uptake of advanced communication networks.

OECD Broadband Statistics

- Share of gigabit fixed broadband subscriptions nearly tripled from 2020 to 2023, indicating rapid growth of high‑speed communication infrastructure.

- 5G was available in 37 of 38 OECD countries as of January 2024, showing broad coverage of next‑generation mobile networks.

- OECD broadband price and penetration data show sustained growth in fixed and mobile broadband adoption through 2024, forming foundational communication infrastructure.

Eurostat – European Commission

- In 2023, Eurostat’s Eurobarometer survey found that only 4 in 10 EU respondents trust information more if it is backed by statistics, reflecting communication and data perception dynamics in Europe.

- As part of statistical dissemination, Eurostat published over 651,000 followers across social media by end of 2024, indicating reach of government communication channels.

- 22,000 students from 20 EU countries participated in the European Statistics Competition (2021‑2024), illustrating official statistics outreach and education.

Global Partyline Intercom Systems Market: Market Dynamics

Global Partyline Intercom Systems Market: Driving Factors

Increasing Demand for Real Time Professional Communication

The need for instantaneous, low latency communication in sectors such as broadcast media, live events, and industrial operations is a key driver of the Partyline Intercom Systems market. Organizations require reliable intercom solutions that enable seamless coordination among production teams, control room operators, and technical staff, especially during high-stakes live productions or complex facility operations.

Growth in Broadcast and Live Entertainment Infrastructure

Expansion of television networks, streaming studios, event venues, and performance arenas globally has fueled demand for advanced communication platforms. Partyline intercom systems support these environments by providing clear audio transmission, scalable system configurations, and interoperability with other audio and communication equipment, which enhances operational efficiency and coordination.

Global Partyline Intercom Systems Market: Restraints

High Initial Investment and Installation Costs

The upfront cost of procuring professional partyline intercom systems, including hardware, cabling, and integration services, can be a financial barrier for small to medium enterprises. Installation in large venues or complex industrial facilities often requires customized setups, increasing total deployment expenditure and slowing adoption.

Integration Challenges with Legacy Systems

Many organizations still operate older communication networks and equipment that may not seamlessly integrate with newer digital or IP-based partyline solutions. Compatibility issues, system interoperability challenges, and the need for technical expertise can hinder smooth transitions and delay upgrades to modern intercom platforms.

Global Partyline Intercom Systems Market: Opportunities

Adoption of IP-Based and Cloud-Enabled Intercom Solutions

Transitioning partyline communication to IP networks and cloud platforms presents significant growth potential. These technologies offer remote access, centralized management, and scalability, enabling organizations to support distributed teams and multi-location operations with lower infrastructure complexity and enhanced flexibility.

AI and Analytics Integration for Smart Communication

Incorporating artificial intelligence, machine learning, and advanced analytics into intercom systems opens new avenues for value creation. Features such as automated noise reduction, intelligent channel allocation, and usage pattern insights can improve user experience and operational effectiveness, encouraging market expansion across diverse industries.

Global Partyline Intercom Systems Market: Trends

Shift toward Wireless and Portable Intercom Solutions

There is a growing trend toward wireless partyline systems that offer mobility, ease of deployment, and adaptability in dynamic environments such as concerts, live events, and field operations. Compact, battery-powered units with robust wireless connectivity are becoming standard choices for teams requiring flexible communication without fixed cabling.

Convergence of Intercom with Unified Communication Platforms

The integration of partyline intercom functionality into broader unified communication and collaboration ecosystems is gaining traction. This convergence allows voice intercom features to work alongside video conferencing, messaging platforms, and networked control systems, enabling users to leverage multi-channel communication within a single infrastructure.

Global Partyline Intercom Systems Market: Research Scope and Analysis

By Component Analysis

Mobile hardware is anticipated to dominate the component segment of the Partyline Intercom Systems market, accounting for approximately 48.0% of the total market share in 2025, driven by the essential role of physical communication devices in daily operations. Mobile hardware components such as belt packs, wireless headsets, portable user stations, and handheld communication units form the backbone of partyline intercom deployments across broadcast studios, live events, industrial sites, and transportation facilities.

The growing preference for mobility, hands free operation, and ruggedized equipment in dynamic environments has further increased demand for mobile intercom hardware. Additionally, frequent replacement cycles, equipment upgrades, and the need for reliable, high quality audio transmission continue to sustain strong investment in hardware components across both wired and wireless partyline systems.

Software plays a supporting yet increasingly important role within the component segment by enabling system control, configuration, and intelligent communication management. Intercom software solutions facilitate channel assignment, audio routing, user access control, and system monitoring across complex communication networks. As organizations transition toward digital and IP based intercom systems, software platforms are becoming critical for scalability, remote management, and integration with broader communication and broadcast infrastructures.

Advancements in software capabilities, including noise suppression algorithms, system diagnostics, and compatibility with unified communication platforms, are enhancing overall system performance and expanding the functional value of partyline intercom deployments across global markets.

By System Type Analysis

Mobile wired partyline intercom systems are anticipated to dominate the system type segment, capturing around 61.0% of the total market share in 2025, primarily due to their proven reliability, consistent audio quality, and resistance to signal interference. These systems are widely deployed in broadcast studios, fixed event venues, industrial facilities, and control rooms where stable, uninterrupted communication is critical to operations. Wired partyline solutions are favored for long duration use and mission critical environments because they offer low latency performance, secure communication channels, and minimal dependence on wireless spectrum conditions. Their ability to support multiple users on a shared line with predictable performance continues to make wired systems the preferred choice for permanent installations and professional applications.

Wireless partyline intercom systems represent a rapidly expanding segment within the market, driven by increasing demand for mobility, flexibility, and quick deployment. These systems are commonly adopted in live events, outdoor productions, temporary setups, and large venues where physical cabling is impractical or restrictive. Wireless partyline solutions enable real time communication across dynamic environments while reducing setup time and infrastructure complexity. Advancements in wireless technology, improved battery life, enhanced range, and better audio clarity are improving system reliability, supporting wider adoption alongside wired solutions rather than fully replacing them in professional communication environments.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Distribution Channel Analysis

Direct sales are anticipated to dominate the distribution channel segment of the Partyline Intercom Systems market, capturing approximately 46.0% of the total market share in 2025, as professional buyers often prefer purchasing directly from manufacturers for customized solutions and technical assurance. Large broadcast networks, event production companies, government agencies, and industrial operators typically engage directly with original equipment manufacturers to obtain tailored system configurations, long term service contracts, and dedicated technical support. Direct sales channels also enable manufacturers to maintain control over pricing, system design, and post sales services, which is critical for complex intercom deployments requiring integration with existing communication and audio infrastructure.

Distributors and system integrators play a complementary role in the market by extending the reach of partyline intercom solutions across regional and niche customer segments. These intermediaries provide value through localized expertise, system installation, and ongoing maintenance services, particularly for small and mid-sized organizations that lack in house technical capabilities. System integrators are especially important in multi-vendor environments where partyline intercom systems must be integrated with broadcast equipment, security systems, or IP based communication networks. Their ability to deliver end to end solutions supports steady demand through indirect sales channels and strengthens market penetration across diverse application areas.

By Application Analysis

Broadcast and media production are anticipated to dominate the application segment of the Partyline Intercom Systems market, capturing approximately 40.0% of the total market share in 2025. These systems are widely used in television studios, newsrooms, film sets, and live broadcast control rooms where real time coordination between directors, camera operators, sound engineers, and technical staff is essential. The demand is driven by the need for uninterrupted communication, low latency audio, and reliable system performance to ensure smooth production workflows and minimize errors during live or recorded broadcasts. Advanced partyline intercom solutions allow multiple users to communicate simultaneously over a shared channel, supporting complex media operations and enhancing overall production efficiency.

Live events, theatre, and concerts represent another important application segment within the market, where partyline intercom systems enable backstage and event staff to coordinate effectively during performances. These systems allow stage managers, lighting crews, sound technicians, and production teams to communicate instantly, manage cues, and respond to unexpected situations in real time. Wireless and portable intercom solutions are particularly valuable in these environments as they provide mobility and flexibility for large venues or outdoor events. The ability to maintain clear and reliable communication across multiple locations within the event space enhances operational efficiency and ensures successful execution of live performances.

By End-User Analysis

Media and entertainment organizations are anticipated to dominate the end-user segment of the Partyline Intercom Systems market, capturing approximately 39.0% of the total market share in 2025. These organizations, including television networks, film production companies, event management firms, and live performance venues, rely heavily on partyline intercom systems to ensure seamless real-time communication among directors, camera operators, stage crews, and technical staff. The high demand is driven by the need for precise coordination during live broadcasts, recording sessions, and large-scale events, where even minor communication delays can disrupt operations. The systems’ ability to support multiple simultaneous users, provide clear audio, and maintain reliability under continuous use makes them indispensable in the media and entertainment sector.

Commercial and corporate enterprises form another significant end-user segment within the market, utilizing partyline intercom systems to enhance internal communication and operational efficiency across offices, factories, warehouses, and corporate campuses. These organizations implement intercom solutions to facilitate quick information sharing between departments, improve response times in large facilities, and support coordinated workflow in logistics, manufacturing, and administrative operations.

Wireless and portable intercom solutions are increasingly adopted in these environments to provide flexibility, reduce dependence on fixed cabling, and enable mobile teams to communicate effectively across different sections of the workplace. The integration of partyline systems with broader corporate communication networks further adds value by streamlining daily operations and improving overall productivity.

The Partyline Intercom Systems Market Report is segmented on the basis of the following:

By Component

- Hardware

- Master Stations

- Belt Packs

- Headsets & Handheld Units

- Power Supplies & Cabling

- Software

- System Configuration & Control Software

- Audio Routing & Channel Management Software

- Services

- Installation & Integration Services

- Maintenance & Technical Support Services

By System Type

- Wired Partyline Intercom Systems

- Analog Partyline Systems

- Digital Partyline Systems

- Wireless Partyline Intercom Systems

- RF-Based Wireless Systems

- DECT-Based Wireless Systems

By Distribution Channel

- Direct Sales

- Distributors & System Integrators

- Others

By Application

- Broadcast & Media Production

- Live Events, Theatre & Concerts

- Security & Surveillance Operations

- Industrial & Manufacturing

- Transportation & Logistics

- Military & Defense

- Others

By End-User

- Media & Entertainment Organizations

- Commercial & Corporate Enterprises

- Government & Defense Institutions

- Transportation Authorities

- Educational Institutions

- Others

Global Partyline Intercom Systems Market: Regional Analysis

Region with the Largest Revenue Share

North America is anticipated to lead the global Partyline Intercom Systems market, accounting for approximately 39.0% of total market revenue in 2025, driven by the region’s mature media and entertainment industry, extensive live event infrastructure, and advanced industrial and transportation sectors. High adoption of broadcast studios, corporate communication systems, and government facilities creates consistent demand for reliable and low latency intercom solutions.

The presence of established manufacturers, strong technological innovation, and significant investment in IP-based and digital communication platforms further strengthen market growth. Additionally, North American organizations prioritize operational efficiency, safety, and real-time coordination, making partyline intercom systems an essential component of professional communication networks across multiple applications.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

The Asia Pacific region is expected to witness significant growth in the Partyline Intercom Systems market due to rapid urbanization, expanding media and entertainment infrastructure, and increasing investment in industrial and transportation facilities. Growing demand for live event production, broadcasting studios, and corporate communication systems in countries such as China, India, and Japan is driving adoption of both wired and wireless intercom solutions. Technological advancements, rising awareness of operational efficiency, and the shift toward IP-based and digital communication platforms are further fueling market expansion, positioning Asia Pacific as a high-growth region in the global partyline intercom landscape.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Partyline Intercom Systems Market: Competitive Landscape

The global Partyline Intercom Systems market is highly competitive, driven by continuous technological innovation, product differentiation, and service quality. Key players focus on developing advanced wired and wireless solutions, integrating IP-based communication, digital audio processing, and intelligent system management to meet diverse industry requirements. Competition is also shaped by strategies such as direct sales, strategic partnerships, and regional expansions to enhance market presence. Companies are increasingly investing in research and development to improve audio clarity, system reliability, scalability, and user experience, while addressing the growing demand from broadcast, live events, industrial, and transportation sectors worldwide.

Some of the prominent players in the global Partyline Intercom Systems market are:

- Clear-Com

- RTS Intercom Systems

- Riedel Communications

- HME (HM Electronics)

- ASL Intercom

- Bose Corporation

- Audio-Technica

- Beyerdynamic

- Williams Sound

- Altair

- Green-GO

- Eartec

- Telex

- Sonifex

- Datavideo

- Yamaha Corporation

- Hollyland Technology

- Pliant Technologies

- Vega Global

- Sennheiser Electronic

- Other Key Players

Global Partyline Intercom Systems Market: Recent Developments

- October 2025: A private equity firm finalized the acquisition of a long‑established broadcast equipment and wireless communications manufacturer, marking a strategic move to broaden geographic reach and invest in next‑generation broadcast solutions.

- October 2025: A major customer service platform secured a substantial USD 240 million investment aimed at accelerating strategic growth and enhancing its AI‑driven communication offerings.

- September 2025: Riedel Communications unveiled its ultra‑light Bolero Mini wireless intercom beltpack at IBC 2025, delivering high performance and maximum mobility in a compact form factor designed for broadcast and live production environments.

- September 2025: Riedel Communications completed the acquisition of hi human interface, strengthening its broadcast and production control system portfolio and expanding its scope in professional communications solutions.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 1.6 Bn |

| Forecast Value (2034) |

USD 3.1 Bn |

| CAGR (2025–2034) |

7.5% |

| The US Market Size (2025) |

USD 0.5 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Hardware, Software, Services), By System Type (Wired Partyline Intercom Systems, Wireless Partyline Intercom Systems), By Distribution Channel (Direct Sales, Distributors & System Integrators, Others), By Application (Broadcast & Media Production, Live Events, Theatre & Concerts, Security & Surveillance Operations, Industrial & Manufacturing, Transportation & Logistics, Military & Defense, Others), and By End-User (Media & Entertainment Organizations, Commercial & Corporate Enterprises, Government & Defense Institutions, Transportation Authorities, Educational Institutions, Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Clear-Com, RTS Intercom Systems, Riedel Communications, HME (HM Electronics), ASL Intercom, Bose Corporation, Audio-Technica, Beyerdynamic, Williams Sound, Altair, Green-GO, Eartec, Telex, Sonifex, Datavideo, Yamaha Corporation, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global Partyline Intercom Systems market?

▾ The global Partyline Intercom Systems market size was valued at USD 1.6 billion in 2025 and is expected to reach USD 3.1 billion by the end of 2034.

What is the size of the US Partyline Intercom Systems market?

▾ The US Partyline Intercom Systems market was valued at USD 0.5 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1.0 billion in 2034 at a CAGR of 7.0%.

Which region accounted for the largest global Partyline Intercom Systems market?

▾ North America is expected to have the largest market share in the global Partyline Intercom Systems market, with a share of about 39.0% in 2025.

Who are the key players in the global Partyline Intercom Systems market?

▾ Some of the major key players in the global Partyline Intercom Systems market are Clear-Com, RTS Intercom Systems, Riedel Communications, HME (HM Electronics), ASL Intercom, Bose Corporation, Audio-Technica, Beyerdynamic, Williams Sound, Altair, Green-GO, Eartec, Telex, Sonifex, Datavideo, Yamaha Corporation, and Others.