Market Overview

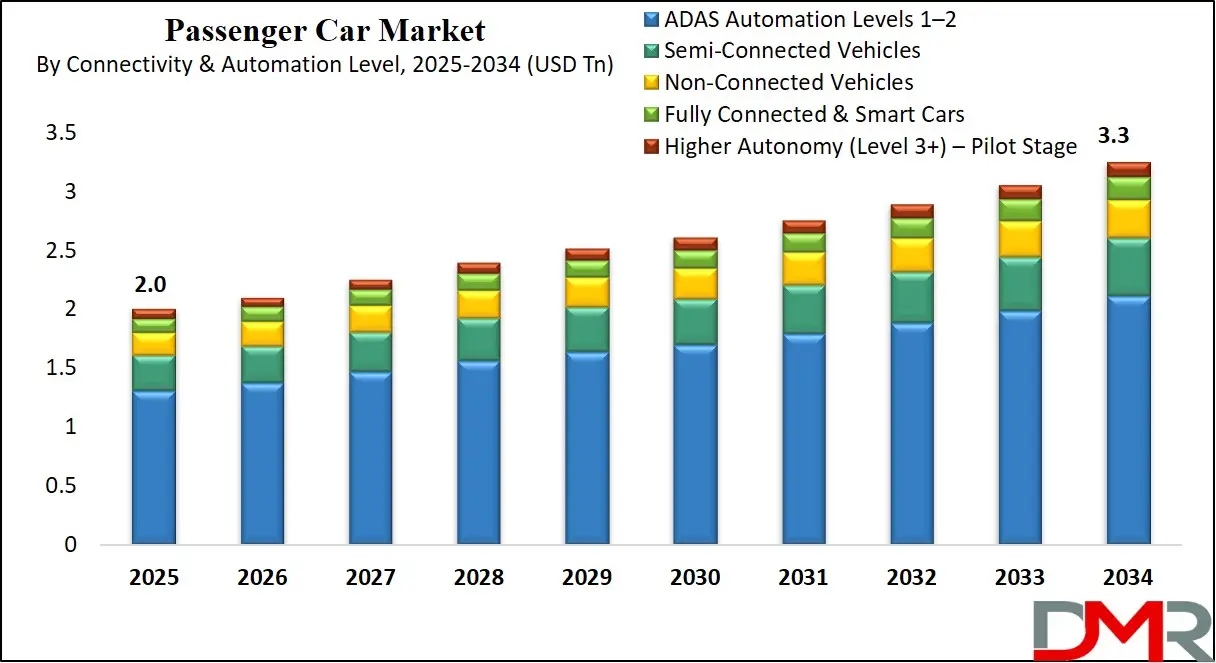

The global passenger car market is projected to reach USD 2.0 trillion in 2025 and is expected to grow to USD 3.3 trillion by 2034, registering a CAGR of 5.5%, driven by rising urban mobility demand, EV adoption, and technological advancements in automotive manufacturing.

Passenger cars are motor vehicles primarily designed for the transportation of people rather than goods. These vehicles typically accommodate up to five passengers, although some models may offer seating for up to seven or more, depending on their configuration. They are built with a focus on comfort, safety, fuel efficiency, and on-road performance, making them ideal for everyday commuting, family travel, and personal use.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Passenger cars encompass various body styles such as sedans, hatchbacks, coupes, convertibles, wagons, and sport utility vehicles (SUVs), each tailored to meet diverse consumer preferences and regional transportation needs. The segment excludes commercial vehicles, trucks, and

motorcycles, as its central objective is to provide private and fleet users with reliable mobility solutions in urban and intercity environments.

The global passenger car market represents one of the largest and most dynamic segments of the automotive industry. It encompasses the design, production, distribution, and sale of passenger vehicles across key regions, including Asia-Pacific, Europe, North America, Latin America, the Middle East, and Africa.

This market has witnessed substantial transformation driven by changing consumer lifestyles, rapid urbanization, and a growing middle class in emerging economies. Technological innovations such as advanced driver assistance systems (ADAS), digital connectivity features, and improved powertrain efficiency have become essential components in modern passenger vehicles.

Additionally, stringent emissions regulations and government incentives are influencing original equipment manufacturers (OEMs) to shift toward hybrid and electric vehicle offerings, thus reshaping global supply chains and investment strategies.

In recent years, the passenger car industry has been significantly shaped by the evolution of mobility trends, including car-sharing services, subscription-based models, and the growing role of online vehicle sales platforms. Moreover, the adoption of electric mobility and the expansion of charging infrastructure are influencing consumer buying decisions and reshaping traditional business models.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Competitive dynamics within the sector are being redefined by the rise of electric vehicle pioneers and the strategic collaborations between automotive giants and technology firms. With fluctuating raw material prices, evolving safety regulations, and growing demand for sustainable transport, the global passenger car market continues to adapt, innovate, and expand to meet the demands of an eco-conscious and digitally connected world.

The US Passenger Car Market

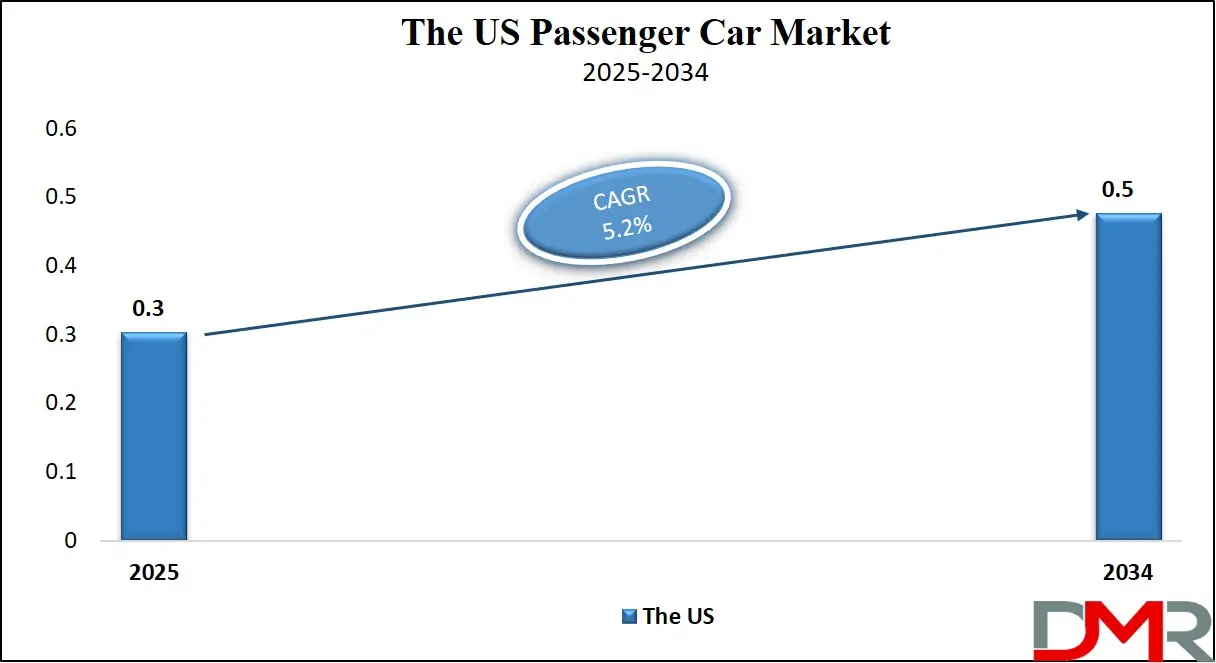

The U.S. Passenger Car Market size is projected to be valued at USD 0.3 trillion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 0.5 trillion in 2034 at a CAGR of 5.2%.

The U.S. passenger car market is a mature yet evolving segment within the broader automotive landscape, shaped by consumer behavior, regulatory policies, and shifting preferences toward advanced mobility solutions. Traditionally dominated by sedans and compact vehicles, the market has seen a significant tilt toward crossover utility vehicles (CUVs) and sport utility vehicles (SUVs) as American consumers prioritize spacious interiors, higher ride heights, and versatility.

Alongside changing tastes, U.S. automakers are responding with diversified product lines, improved infotainment systems, and enhanced fuel efficiency, all while maintaining performance and safety as core values. The widespread integration of driver-assistance technologies and digital connectivity features reflects the growing importance of tech-driven user experiences in influencing car-buying decisions.

Environmental concerns and government-led initiatives are also shaping the U.S. passenger vehicle landscape, with stricter fuel economy standards and incentives for low-emission vehicles pushing manufacturers to accelerate electrification strategies. The market is witnessing increased competition from both legacy automakers and newer electric vehicle brands, prompting innovation across powertrain technologies, lightweight materials, and manufacturing processes.

Furthermore, the rise of online car sales platforms, subscription-based ownership models, and personalized financing options is redefining traditional dealership frameworks. As the U.S. car market continues to adapt to digital disruption, sustainability demands, and evolving urban infrastructure, it remains a key arena for testing next-generation mobility solutions and setting global automotive trends.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The European Passenger Car Market

The European passenger car market is projected to reach a valuation of approximately USD 0.4 trillion in 2025, reflecting its significant role within the global automotive landscape. This market size is driven by a combination of factors, including high consumer demand for premium and electric vehicles, strict government regulations targeting reduced carbon emissions, and a well-established automotive manufacturing base.

Europe’s commitment to sustainability and environmental standards has accelerated the adoption of electric and hybrid cars, positioning the region as a key player in the transition toward greener mobility solutions. Additionally, advancements in connected car technologies, autonomous driving features, and shared mobility services are shaping consumer preferences and fueling steady growth across the region.

Over the forecast period, the European passenger car market is expected to grow at a compound annual growth rate (CAGR) of around 3.8%. This moderate yet consistent growth rate highlights the market’s resilience amidst global economic uncertainties and evolving industry dynamics. Factors such as government incentives for electric vehicle adoption, growing urbanization, and investment in smart infrastructure continue to support demand.

However, challenges, including supply chain disruptions and stringent emission norms, also influence the pace of expansion. Overall, Europe’s passenger car market maintains a balanced growth trajectory, driven by innovation, regulatory frameworks, and shifting consumer trends toward sustainable and technologically advanced vehicles.

The Japanese Passenger Car Market

The Japanese passenger car market is expected to reach a value of approximately USD 0.1 trillion in 2025, underscoring its position as a key but more mature player within the global automotive industry. Japan’s market is characterized by a strong presence of well-established automotive manufacturers known for their innovation in hybrid technology, fuel efficiency, and advanced vehicle safety features.

The country’s consumer base tends to favor reliable, compact, and technologically sophisticated vehicles, which aligns with Japan’s urban lifestyle and regulatory focus on reducing environmental impact. Additionally, Japan continues to invest heavily in research and development around autonomous driving and connected car technologies, which help maintain its competitive edge in the passenger car segment.

Despite its maturity, the Japanese passenger car market is projected to grow steadily at a compound annual growth rate (CAGR) of around 2.5% through the forecast period. This relatively moderate growth reflects both market saturation and the ongoing shift toward electrification and smart mobility solutions. Government policies supporting the adoption of hybrid and electric vehicles, along with growing consumer awareness of sustainability, are contributing to this growth.

However, demographic challenges such as an aging population and shrinking domestic demand pose constraints. Nonetheless, Japan’s continued focus on technological innovation and quality manufacturing is expected to sustain the market’s steady expansion and its significant contribution to the global passenger car industry.

Global Passenger Car Market: Key Takeaways

- Market Value: The global passenger car market size is expected to reach a value of USD 3.3 trillion by 2034 from a base value of USD 2.0 trillion in 2025 at a CAGR of 5.5%.

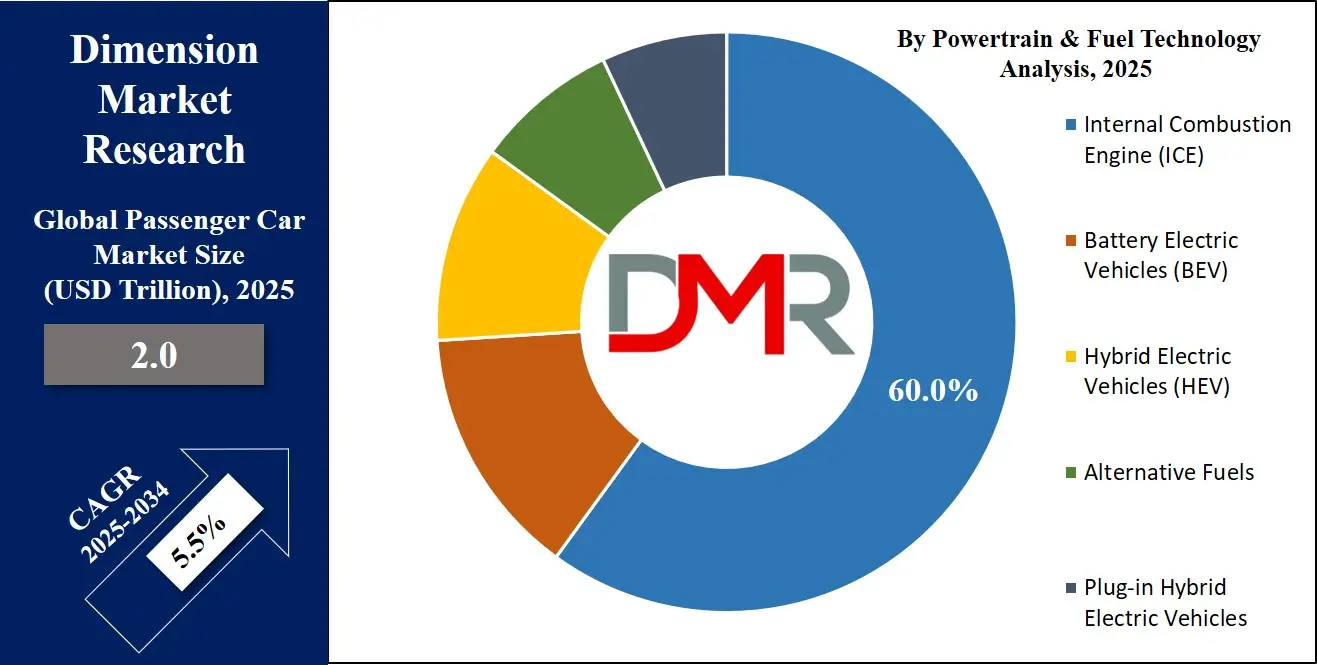

- By Powertrain & Fuel Technology Segment Analysis: Internal Combustion Engines (ICE) are poised to consolidate their dominance in the powertrain & fuel technology segment, capturing 60.0% of the total market share in 2025.

- By Vehicle Segment Analysis: SUVs are anticipated to maintain their dominance in the vehicle segment, capturing 36.0% of the total market share in 2025.

- By Drivetrain Segment Analysis: Front-Wheel Drive (FWD) layout is expected to maintain its dominance in the drivetrain segment, capturing 60.0% of the total market share in 2025.

- By Transmission Type Segment Analysis: Automatic Transmission (AT) will lead in the transmission type segment, capturing 38.0% of the market share in 2025.

- By Connectivity & Automation Level Segment Analysis: Semi-Connected Vehicles are poised to consolidate their market position in the connectivity & automation level segment, capturing 48.0% of the total market share in 2025.

- By Sales Channel Segment Analysis: Traditional Dealerships sales channels are anticipated to maintain their dominance in the sales channel segment, capturing 88.0% of the total market share in 2025.

- By Customer Type Segment Analysis: Private Individual Buyers will lead in the customer type segment, capturing 82.0% of the market share in 2025.

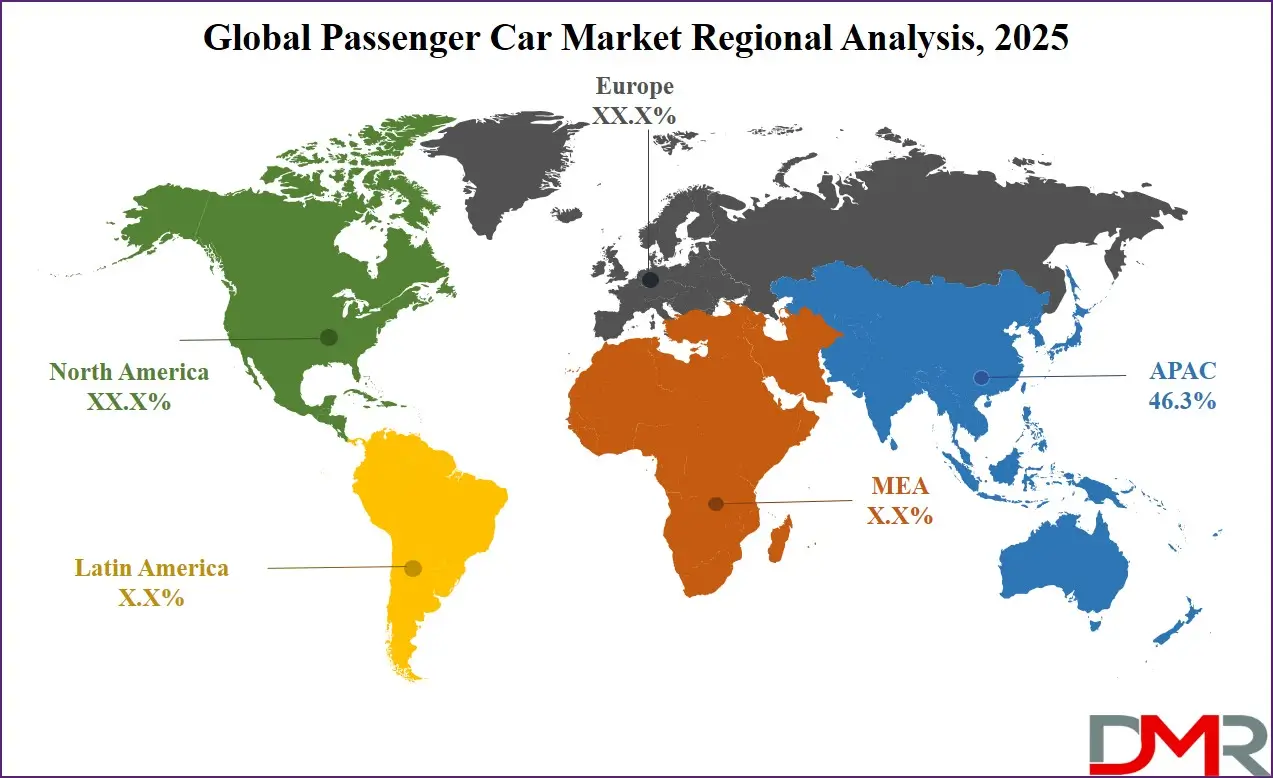

- Regional Analysis: Asia Pacific is anticipated to lead the global passenger car market landscape with 46.3% of total global market revenue in 2025.

- Key Players: Some key players in the global passenger car market are Toyota, Volkswagen, Hyundai, General Motors, Stellantis, Ford, Honda, Nissan, BMW, Mercedes-Benz, Tesla, Kia, Renault, SAIC, Geely, Tata Motors, and Other Key Players.

Global Passenger Car Market: Use Cases

- Electrification and Sustainability Adoption by OEMs: Automotive manufacturers are leveraging the global passenger car market to drive their transition toward vehicle electrification and carbon neutrality. With rising regulatory pressure and changing consumer sentiment, OEMs are launching electric vehicles (EVs) and hybrid passenger cars across multiple segments, from compact hatchbacks to full-size SUVs. This shift is not only helping reduce CO₂ emissions but also improving brand perception among environmentally conscious buyers. Global automakers like Volkswagen, Toyota, and BYD are heavily investing in EV platforms, battery innovation, and charging infrastructure to future-proof their portfolios and gain early-mover advantages. These developments are creating ripple effects across the supply chain, including battery materials, power electronics, and electric drivetrain systems.

- Integration of Connected Car Technologies for Enhanced UX: Connected car solutions have become a key differentiator in the global passenger vehicle market, reshaping how users interact with their vehicles. Automakers are integrating features such as over-the-air (OTA) updates, real-time diagnostics, voice-controlled infotainment systems, and vehicle-to-everything (V2X) communication to offer a smarter, safer, and more personalized driving experience. These advancements enable predictive maintenance, reduce downtime, and enhance customer satisfaction. OEMs and Tier-1 suppliers are forming partnerships with technology firms to develop proprietary platforms that support telematics, cloud-based analytics, and mobile integration. As a result, the passenger car becomes an extension of the user’s digital lifestyle, improving retention rates and opening new revenue streams through data-driven services.

- Fleet Optimization and Telematics for Mobility-as-a-Service (MaaS): The rise of ride-hailing, car-sharing, and subscription-based models has made fleet optimization a critical use case in the global passenger car market. Companies operating in the Mobility-as-a-Service (MaaS) space are deploying connected passenger vehicles equipped with telematics systems to monitor usage patterns, fuel consumption, driver behavior, and maintenance needs. These insights enable fleet operators to optimize route planning, reduce operational costs, and extend vehicle lifespans. Additionally, the deployment of hybrid and electric passenger cars in fleet services is helping urban mobility providers meet city-level emission targets while enhancing customer experience. This use case is particularly impactful in densely populated urban centers where congestion, sustainability, and last-mile connectivity are growing concerns.

- Advanced Safety and Autonomous Driving Applications: Passenger cars are now serving as testbeds for advanced driver-assistance systems (ADAS) and semi-autonomous driving technologies. The integration of radar, LiDAR, and camera-based systems into mid and high-end passenger vehicles is enabling features like lane-keeping assist, adaptive cruise control, and automated emergency braking. These innovations are significantly enhancing road safety while laying the groundwork for higher levels of vehicle autonomy. Major automakers such as Tesla, Mercedes-Benz, and Nissan are already piloting or offering Level 2 and Level 3 automation in select models. This technological evolution is not only boosting customer trust but also generating competitive advantage, especially in markets with tech-savvy consumers and supportive regulatory environments. As infrastructure and legislation evolve, autonomous capabilities in passenger cars will play a transformative role in the future of transportation.

Global Passenger Car Market: Stats & Facts

U.S. Department of Transportation (DOT)

- The U.S. had over 276 million registered vehicles in 2023, with passenger cars making up approximately 60% of this total.

- Annual vehicle miles traveled (VMT) in the U.S. reached 3.3 trillion miles in 2023, indicating robust passenger car usage.

- The average fuel economy for new passenger cars sold in the U.S. improved to 29.9 miles per gallon (mpg) in 2023, up from 25.4 mpg in 2010.

- In 2023, electric vehicles accounted for 8% of new passenger car registrations in the U.S., showing growing adoption.

European Environment Agency (EEA)

- Passenger cars contribute about 12% of total greenhouse gas emissions in the European Union.

- In 2023, electric and plug-in hybrid passenger cars represented 18% of all new passenger car sales in the EU.

- The average CO2 emissions for new passenger cars sold in the EU decreased to 95 grams per kilometer in 2023, down from 130 grams per kilometer in 2010.

- EU countries reported over 310 million passenger cars in operation as of 2023, making it one of the largest car fleets globally.

China Ministry of Public Security

- China’s passenger car fleet surpassed 240 million vehicles in 2023, the largest globally.

- In 2023, new energy vehicles (NEVs), including electric and hybrid cars, accounted for 25% of new passenger car sales in China.

- China’s average vehicle ownership per 1,000 people reached 174 in 2023, up from 35 in 2010, reflecting rapid motorization.

- The government targets a 20% share of NEVs in total vehicle sales by 2025.

Japan Ministry of Land, Infrastructure, Transport and Tourism (MLIT)

- Japan’s passenger car fleet numbered approximately 78 million vehicles in 2023.

- Hybrid vehicles accounted for 40% of new passenger car registrations in 2023.

- The average age of passenger cars in Japan is 13.5 years, reflecting strong vehicle longevity.

- Fuel efficiency standards require new passenger cars to achieve at least a 20% improvement in fuel economy by 2025 compared to 2010.

India Ministry of Road Transport and Highways (MoRTH)

- India had over 35 million registered passenger cars as of 2023, with urban areas accounting for 65% of registrations.

- The annual growth rate of passenger car registrations in India was approximately 8% between 2018 and 2023.

- The government’s Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme has supported over 100,000 electric vehicle registrations since its inception.

- India aims to achieve 30% electric vehicle penetration in new passenger car sales by 2030.

UK Department for Transport (DfT)

- The UK’s passenger car fleet reached 32 million vehicles in 2023.

- Electric vehicles comprised 15% of new passenger car sales in 2023, up from 3% in 2018.

- The average CO2 emissions from new passenger cars sold in the UK declined to 94 grams per kilometer in 2023.

- The UK government has committed to banning the sale of new petrol and diesel passenger cars by 2030.

German Federal Motor Transport Authority (KBA)

- Germany recorded over 48 million passenger cars on the road in 2023.

- Diesel passenger cars accounted for 25% of the fleet in 2023, down from 40% in 2015.

- The share of battery electric passenger cars increased to 12% of new registrations in 2023.

- Average CO2 emissions from new passenger cars dropped to 92 grams per kilometer in 2023.

Australia Department of Infrastructure, Transport, Regional Development and Communications

- Australia’s passenger car fleet exceeded 15 million vehicles in 2023.

- Annual new passenger car sales were around 1.1 million units in 2023, with SUVs constituting 50% of sales.

- Electric vehicles represented 6% of new passenger car sales in 2023.

- The government has set a target for 50% of new car sales to be zero-emission vehicles by 2030.

Global Passenger Car Market: Market Dynamics

Global Passenger Car Market: Driving Factors

Surge in Electric Mobility and Fuel Efficiency Demands

The rapid adoption of electric mobility solutions is one of the most influential drivers in the global passenger car market. Increasing fuel prices, government subsidies for electric vehicles (EVs), and tightening emission regulations are encouraging both automakers and consumers to shift toward cleaner alternatives. Major manufacturers are investing in EV platforms, battery technologies, and energy-efficient drivetrains to meet rising expectations for fuel economy and environmental responsibility. This shift supports long-term sustainability goals while reducing operational costs for end-users, making electric passenger cars an attractive option.

Advancements in Automotive Safety and Infotainment Technologies

The growing consumer preference for technologically advanced vehicles has spurred the integration of features such as Advanced Driver Assistance Systems (ADAS), smart infotainment, voice control, and real-time navigation. Automakers are prioritizing safety enhancements and digital user experiences to differentiate their offerings in a highly competitive landscape. These innovations not only improve road safety and driver comfort but also support regulatory compliance, especially in regions with stringent vehicle safety standards like the European Union and North America.

Global Passenger Car Market: Restraints

High Initial Cost of Advanced Powertrains and In-Vehicle Technologies

The upfront cost of electric passenger vehicles, hybrid models, and connected car technologies remains a major barrier to widespread adoption. Although long-term savings on fuel and maintenance are often cited, many consumers, particularly in emerging markets, are deterred by the premium pricing of EVs and luxury tech features. This cost sensitivity limits penetration across lower-income segments and slows down the replacement cycle in mature markets.

Supply Chain Disruptions and Semiconductor Shortages

Global supply chain disruptions, exacerbated by geopolitical tensions and pandemic-related challenges, continue to impact the availability of essential automotive components, including semiconductors, lithium-ion batteries, and rare earth materials. These bottlenecks are leading to production delays, increased costs, and inconsistent delivery timelines, affecting both OEM output and aftermarket services. The uncertainty surrounding global logistics poses a constraint on stable market growth.

Global Passenger Car Market: Opportunities

Expansion of Connected Car Ecosystems and Digital Services

The growing deployment of connected vehicle technologies presents new revenue opportunities for automakers, software providers, and telecom companies. Features such as real-time diagnostics, over-the-air updates, remote vehicle control, and cloud-based analytics are transforming vehicles into intelligent, data-generating platforms. These services enhance customer loyalty and pave the way for subscription-based models and digital ecosystems, opening new business streams beyond traditional car sales.

Untapped Potential in Emerging Markets and Urban Commuting

Rapid urbanization and a rising middle class in regions like Southeast Asia, Latin America, and Africa are creating strong demand for affordable, compact, and fuel-efficient passenger cars. Localized production, low-cost financing options, and government incentives for personal vehicle ownership are encouraging automotive OEMs to expand their footprint in these high-growth regions. Urban commuters are seeking private transportation solutions due to inadequate public transit infrastructure, further fueling demand.

Global Passenger Car Market: Trends

Rise of Shared Mobility and Subscription-Based Car Ownership

Changing consumer preferences, especially among younger demographics, are driving a shift from traditional vehicle ownership to flexible models like car leasing, ride-sharing, and vehicle subscriptions. These alternatives offer cost-effective access to mobility without the long-term financial burden, insurance costs, or maintenance responsibilities. This trend is encouraging automakers to partner with mobility startups and create hybrid retail-leasing strategies that cater to urban and tech-savvy populations.

Integration of AI and Predictive Maintenance in Passenger Vehicles

Artificial intelligence (AI) is being used in predictive vehicle maintenance, smart navigation, driver behavior analysis, and real-time risk assessment. AI-enabled systems can alert drivers about potential mechanical failures before they occur, improving safety and reducing downtime. This data-driven approach is also enabling OEMs and service centers to offer customized maintenance packages and remote diagnostics, adding value to the overall ownership experience.

Global Passenger Car Market: Research Scope and Analysis

By Powertrain & Fuel Technology Analysis

Internal Combustion Engine (ICE) vehicles are expected to maintain a dominant position in the global passenger car market's powertrain and fuel technology segment, securing around 60.0% of the total market share in 2025. Despite growing environmental concerns and the push for electrification, ICE-powered cars remain prevalent due to their well-established infrastructure, lower initial cost compared to electric alternatives, and continued advancements in fuel efficiency and emissions control.

In many emerging economies, ICE vehicles are still the most practical and affordable choice for mass mobility, supported by a vast network of fueling stations and maintenance facilities. Moreover, technological improvements such as turbocharging, direct fuel injection, and hybrid integration are extending the relevance and competitiveness of internal combustion engines in the short to medium term.

At the same time, Battery Electric Vehicles (BEVs) are steadily gaining momentum as a transformative force within the passenger car segment. With zero tailpipe emissions and lower running costs, BEVs are becoming appealing to environmentally conscious consumers and fleet operators.

Government policies promoting clean energy transportation, combined with falling battery prices and expanding charging infrastructure, are accelerating BEV adoption, especially in developed markets like Europe, China, and the United States. Automakers are investing heavily in BEV development, introducing a wide range of models that cater to both premium and mass-market segments. While BEVs currently hold a smaller share compared to ICE vehicles, their growth trajectory suggests a significant shift in the market landscape over the next decade.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Vehicle Analysis

Sport Utility Vehicles (SUVs) are projected to lead the global passenger car market by vehicle type, accounting for approximately 36.0% of total market share in 2025. Their popularity stems from a blend of practicality, spacious interiors, higher ground clearance, and perceived safety, which makes them appealing to a wide range of consumers, from urban families to adventure-oriented drivers.

The growing availability of compact and subcompact SUV models has further widened their accessibility, making them a go-to choice across both developed and developing markets. Automakers are also enhancing SUVs with fuel-efficient powertrains, hybrid variants, and advanced infotainment systems, catering to changing customer demands without compromising on comfort or performance. This sustained consumer preference has positioned SUVs as a versatile and dominant force within the passenger car landscape.

Sedans, while experiencing a gradual decline in some regions, continue to hold a significant and loyal customer base within the passenger car market. Known for their balanced driving dynamics, aerodynamic design, and better fuel economy compared to larger vehicles, sedans are particularly favored by urban commuters and fleet operators. They offer a comfortable ride and ample trunk space, making them suitable for daily use as well as long-distance travel. In emerging markets, sedans remain a symbol of status and reliability, often preferred over SUVs due to their affordability and ease of maintenance.

Although their market share has been challenged by the rising trend of SUVs, sedans are being revitalized through sleek designs, hybrid variants, and technology-rich interiors that keep them relevant in a competitive automotive market.

By Drivetrain Layout Analysis

The Front-Wheel Drive (FWD) layout is expected to continue its dominance in the global passenger car market's drivetrain segment, capturing around 60.0% of the total market share in 2025. FWD vehicles are favored for their efficient use of space, lighter weight, and improved fuel economy, as the engine’s power is directly transmitted to the front wheels. This drivetrain configuration offers better traction in slippery conditions such as rain or snow, making it particularly popular in regions with diverse weather patterns.

Additionally, FWD cars tend to have lower manufacturing and maintenance costs, which appeals to both manufacturers and cost-conscious consumers. Its suitability for compact and mid-sized vehicles further reinforces its widespread adoption in urban and suburban environments where maneuverability and fuel efficiency are highly valued.

In contrast, Rear-Wheel Drive (RWD) vehicles hold a smaller but significant share of the drivetrain market, often associated with performance, handling, and driving dynamics. By transmitting power to the rear wheels, RWD layouts provide better balance and acceleration, making them the preferred choice for sports cars, luxury sedans, and larger SUVs or trucks.

This drivetrain offers improved weight distribution and greater control during high-speed driving or towing, appealing to enthusiasts and commercial users alike. While RWD vehicles generally consume more fuel and have higher production costs compared to FWD, their advantages in power delivery and stability keep them relevant in premium segments and specific geographic markets where driving performance is a priority.

By Transmission Type Analysis

Automatic Transmission (AT) is expected to lead the global passenger car market’s transmission segment, capturing around 38.0% of the market share in 2025. The growing preference for automatic vehicles is driven by the ease of use, especially in congested urban traffic conditions where frequent gear changes can be tiring. Automakers are incorporating advanced automatic transmission technologies such as continuously variable transmissions (CVT), dual-clutch transmissions (DCT), and torque converter automatics, which offer smoother gear shifts, improved fuel efficiency, and enhanced driving comfort.

The rise in demand for automatic transmissions is particularly strong in developed markets and among younger, tech-savvy consumers who prioritize convenience and a seamless driving experience. Additionally, the integration of automatic transmissions with hybrid and electric powertrains further boosts their adoption, as these systems often require sophisticated control mechanisms that manual gearboxes cannot provide.

Manual Transmission (MT), while gradually declining in global popularity, remains an important segment in certain regions and vehicle types. Manual gearboxes are favored for their lower manufacturing and maintenance costs, mechanical simplicity, and the greater control they offer to drivers, especially in performance and off-road vehicles.

They continue to hold a strong presence in emerging markets where affordability is critical, and fuel efficiency is often achieved through skilled manual driving. Additionally, driving enthusiasts appreciate manual transmissions for the direct engagement and tactile feedback they provide. Despite the growing dominance of automatics, manual transmissions are still preferred in compact cars and certain commercial applications, preserving their relevance in the broader passenger car market.

By Connectivity & Automation Level Analysis

Semi-connected vehicles are expected to strengthen their position in the global passenger car market’s connectivity and automation segment, capturing approximately 48.0% of the total market share in 2025. These vehicles offer a balanced level of connectivity, incorporating essential features such as basic telematics, smartphone integration, and limited vehicle-to-infrastructure (V2I) communication. This allows drivers to benefit from real-time traffic updates, remote diagnostics, and over-the-air software updates without the complexities or costs associated with fully connected or autonomous vehicles.

The appeal of semi-connected vehicles lies in their ability to enhance driver convenience and safety through practical technologies while maintaining affordability for a broad consumer base. Many automakers are focusing on this segment to deliver advanced infotainment and safety features that meet regulatory requirements and customer expectations without overwhelming them with unnecessary automation.

Semi-connected vehicles typically feature driver assistance systems like adaptive cruise control, lane-keeping assistance, and basic collision warnings, which provide incremental improvements in driving safety and comfort. However, they do not offer full autonomy or extensive communication with other vehicles, making them more accessible in terms of cost and infrastructure requirements.

This segment bridges the gap between traditional vehicles and fully connected or autonomous cars, appealing to consumers who seek modern connectivity and assistance features but are not yet ready to adopt higher levels of automation. As infrastructure and technology evolve, semi-connected vehicles serve as an important transitional technology, supporting wider adoption of smarter mobility solutions globally.

By Sales Channel Analysis

Traditional dealership sales channels are expected to continue dominating the global passenger car market’s sales channel segment, capturing around 88.0% of the total market share in 2025. These dealerships offer a personalized, face-to-face buying experience that many consumers still prefer, allowing them to test drive vehicles, negotiate prices, and receive in-person consultations. Dealerships also provide after-sales services such as maintenance, financing, and warranty support, which build customer trust and loyalty.

The physical presence of dealerships in both urban and rural areas makes them accessible to a wide range of buyers, including those who may be less comfortable with digital transactions. Additionally, dealerships often play a crucial role in educating customers about new technologies and financing options, reinforcing their importance in the traditional vehicle purchasing ecosystem.

On the other hand, direct online sales are emerging as a growing alternative sales channel, leveraging digital platforms to offer a more convenient and streamlined car buying process. This channel allows consumers to browse inventories, customize vehicles, and complete purchases from the comfort of their homes, often with transparent pricing and home delivery options. Online sales are gaining traction, particularly among younger, tech-savvy buyers who value speed, ease, and contactless transactions.

Automakers and new entrants, especially electric vehicle manufacturers, are investing in direct-to-consumer online sales models to reduce reliance on dealerships and enhance profit margins. While currently holding a smaller share compared to traditional dealerships, direct online sales are poised for significant growth as digital infrastructure improves and consumer confidence in online purchases increases globally.

By Customer Type Analysis

Private individual buyers are expected to dominate the global passenger car market’s customer type segment, capturing approximately 82.0% of the market share in 2025. This segment represents everyday consumers purchasing vehicles for personal use, whether for commuting, family transportation, or leisure activities. The preference for private ownership remains strong due to the flexibility and convenience it offers, allowing individuals to control their travel schedules and routes without relying on public or shared transport.

Additionally, personal buyers often seek vehicles that match their lifestyle preferences, such as fuel efficiency, design, technology features, and brand reputation. The rise in disposable incomes in emerging markets, along with easy access to vehicle financing options, further supports the sustained demand from private buyers.

In contrast, ride-hailing and mobility services constitute a growing segment driven by the expanding popularity of shared mobility platforms and urban transportation solutions. Companies operating ride-hailing fleets, car-sharing services, and other mobility-as-a-service (MaaS) providers purchase vehicles in bulk to meet the growing demand for flexible, on-demand transport options. This segment is benefiting from urbanization, changing commuter behaviors, and a shift toward more sustainable mobility solutions.

Vehicles used in this segment often prioritize durability, low operating costs, and connectivity features that support fleet management and passenger convenience. Although ride-hailing and mobility services currently represent a smaller share of the overall customer base, their growth is expected to accelerate as cities invest in smarter transportation infrastructure and consumers embrace shared mobility options.

The Passenger Car Market Report is segmented on the basis of the following:

By Powertrain & Fuel Technology

- Internal Combustion Engine (ICE)

- Battery Electric Vehicles (BEV)

- Hybrid Electric Vehicles (HEV)

- Plug-in Hybrid Electric Vehicles (PHEV)

- Alternative Fuels

By Vehicle

- SUVs

- Sedans

- Hatchbacks

- MPVs/Minivans

- Coupes/Convertibles/Sports Cars

- Others

By Drivetrain Layout

- Front-Wheel Drive (FWD)

- Rear-Wheel Drive (RWD)

- All-Wheel Drive (AWD)

By Transmission Type

- Automatic Transmission (AT)

- Manual Transmission (MT)

- Continuously Variable Transmission (CVT)

- Dual Clutch Transmission (DCT)

By Connectivity & Automation Level

- ADAS Automation Levels 1–2

- Semi-Connected Vehicles

- Non-Connected Vehicles

- Fully Connected & Smart Cars

- Higher Autonomy (Level 3+) – Pilot Stage

By Sales Channel

- Traditional Dealerships

- Direct Online Sales

- Subscription & Leasing Models

- Fleet & Corporate Sales

By Customer Type

- Private Individual Buyers

- Ride-Hailing & Mobility Services

- Leasing & Subscription Customers

- Corporate & Government Fleets

Global Passenger Car Market: Regional Analysis

Region with the Largest Revenue Share

The Asia Pacific region is poised to dominate the global passenger car market in 2025, contributing approximately 46.3% of the total market revenue. This leadership is driven by rapid urbanization, rising disposable incomes, and expanding middle-class populations in countries such as China, India, and Southeast Asia.

Additionally, growing demand for both affordable and premium vehicles, integrated with growing government support for automotive manufacturing and infrastructure development, fuels market growth. The region’s expanding automotive production capabilities and consumer preference for technologically advanced, fuel-efficient vehicles further strengthen its position as the largest and fastest-growing passenger car market globally.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

The Middle East & Africa (MEA) region is expected to register the highest compound annual growth rate (CAGR) in the global passenger car market over the forecast period. This rapid growth is fueled by growing urbanization, rising disposable incomes, and expanding infrastructure development across key countries such as the United Arab Emirates, Saudi Arabia, and South Africa.

Additionally, growing consumer interest in modern vehicles equipped with advanced safety and connectivity features is driving demand. Government initiatives aimed at boosting economic diversification and improving transportation networks further support market expansion, making MEA a high-potential region for passenger car sales and innovation.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Passenger Car Market: Competitive Landscape

The global passenger car market is characterized by intense competition among leading automotive manufacturers striving to innovate and capture market share through advanced technology, sustainability, and customer-centric offerings. Major players are aggressively investing in electric vehicle development, autonomous driving capabilities, and connected car technologies to meet evolving consumer demands and regulatory requirements. Strategic collaborations, mergers, and acquisitions are common as companies aim to expand their geographic reach and product portfolios.

Additionally, competition is heightened by emerging manufacturers, particularly in the Asia Pacific region, challenging established brands with cost-effective and technologically advanced models. This dynamic landscape drives continuous improvements in vehicle performance, safety, and design, ensuring consumers benefit from a diverse range of options in both traditional internal combustion and new energy vehicles.

Some of the prominent players in the global passenger car market are:

- Toyota Motor Corporation

- Volkswagen Group

- Hyundai Motor Group

- General Motors

- Stellantis N.V.

- Ford Motor Company

- Honda Motor Co., Ltd.

- Nissan Motor Co., Ltd.

- BMW Group

- Mercedes-Benz Group AG

- Tesla, Inc.

- Kia Corporation

- Renault Group

- SAIC Motor Corporation

- Geely Auto Group

- Tata Motors (including Jaguar Land Rover)

- BYD Auto Co., Ltd.

- Subaru Corporation

- Mazda Motor Corporation

- Chang'an Automobile Group

- Other Key Players

Global Passenger Car Market: Recent Developments

Product Launches:

- June 2025: Toyota unveils two all-new SUVs for the Indian market, including a 7-seater and an electric SUV, both set to launch in 2025.

- May 2025: Volkswagen introduces the ID. Buzz electric bus, offering a spacious and sustainable travel option with a range of up to 621 miles.

Mergers & Acquisitions:

- June 2025: Akio Toyoda leads a ¥4.7 trillion ($33 billion) bid to privatize Toyota Industries, aiming to streamline governance and strengthen family control.

- May 2025: Stellantis denies rumors of a merger with Renault, with Chairman John Elkann stating, "We are not discussing any merger," at the FT Future of the Car Summit.

Funding & Investments:

- June 2025: BYD plans to nearly triple its dealership network in South Africa by next year, aiming to expand its market share in the country.

- May 2025: Tesla offers 0% financing on Model 3 and 1.99% financing on Model Y to boost sales, amid efforts to revitalize demand for its vehicles.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 2.0 T |

| Forecast Value (2034) |

USD 3.3 T |

| CAGR (2025–2034) |

5.5% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 0.3 T |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Powertrain & Fuel Technology (Internal Combustion Engine (ICE), Battery Electric Vehicles (BEV), Hybrid Electric Vehicles (HEV), Plug-in Hybrid Electric Vehicles (PHEV), and Alternative Fuels), By Vehicle (SUVs, Sedans, Hatchbacks, MPVs/Minivans, Coupes/Convertibles/Sports Cars, and Others), By Drivetrain Layout (Front-Wheel Drive (FWD), Rear-Wheel Drive (RWD), and All-Wheel Drive (AWD)), By Transmission Type (Automatic Transmission (AT), Manual Transmission (MT), Continuously Variable Transmission (CVT), and Dual Clutch Transmission (DCT)), By Connectivity & Automation Level (ADAS Automation Levels 1–2, Semi-Connected Vehicles, Non-Connected Vehicles, Fully Connected & Smart Cars, and Higher Autonomy (Level 3+) – Pilot Stage), By Sales Channel (Traditional Dealerships, Direct Online Sales, Subscription & Leasing Models, and Fleet & Corporate Sales), and By Customer Type (Private Individual Buyers, Ride-Hailing & Mobility Services, Leasing & Subscription Customers, and Corporate & Government Fleets). |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Toyota, Volkswagen, Hyundai, General Motors, Stellantis, Ford, Honda, Nissan, BMW, Mercedes-Benz, Tesla, Kia, Renault, SAIC, Geely, Tata Motors, and Other Key Players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global passenger car market?

▾ The global passenger car market size is estimated to have a value of USD 2.0 trillion in 2025 and is expected to reach USD 3.3 trillion by the end of 2034.

What is the size of the US passenger car market?

▾ The US passenger car market is projected to be valued at USD 0.3 trillion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 0.5 trillion in 2034 at a CAGR of 5.2%.

Which region accounted for the largest global passenger car market?

▾ Asia Pacific is expected to have the largest market share in the global passenger car market, with a share of about 46.3% in 2025.

Who are the key players in the global passenger car market?

▾ Some of the major key players in the global passenger car market are Toyota, Volkswagen, Hyundai, General Motors, Stellantis, Ford, Honda, Nissan, BMW, Mercedes-Benz, Tesla, Kia, Renault, SAIC, Geely, Tata Motors, and Other Key Players.

What is the growth rate of the global passenger car market?

▾ The market is growing at a CAGR of 5.5 percent over the forecasted period.